Breakout trading strategy

|

Description

Book Introduction

- A word from MD

-

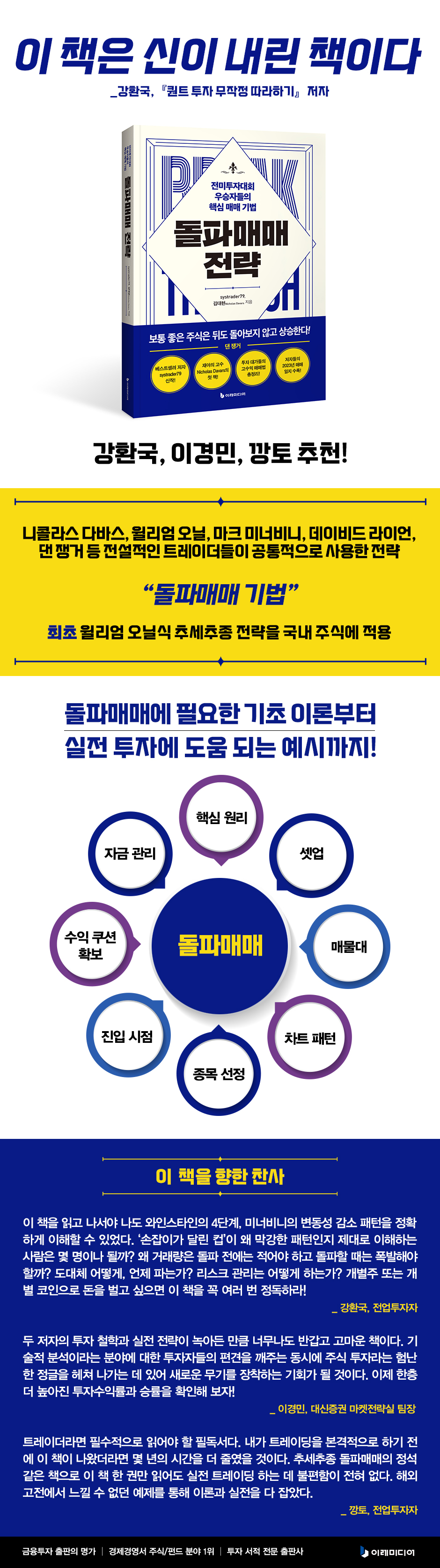

The Legendary Trader's Core StrategyThis book adapts the breakout trading techniques of legendary traders such as Nicholas Davas and William O'Neil to the domestic stock market.

It covers everything about breakout trading, from the basic principles and application methods of breakout trading techniques to topics not covered in existing investment books, providing comprehensive investment knowledge.

December 29, 2023. Economics and Management PD Kim Sang-geun

This book is a gift from God_Kang Hwan-guk

The first book to apply the most powerful strategy to the domestic stock market!

This book covers the breakout trading technique, a strategy commonly used by legendary traders such as Nicholas Davas, William O'Neill, Mark Minervini, David Ryan, and Dan Zanger.

This book covers the fundamentals of breakout trading, including the core principles of breakout trading, setup, analysis of buy and sell orders and chart patterns, stock selection, entry points, stop-loss orders, securing profit cushions, and capital management, as well as practical examples to help you with your investment.

In particular, it explains how Livermore's 'Line of Least Resistance' and William O'Neill's 'Cup with a Handle' can be applied to domestic stocks using over 100 chart examples. Although books on trend following are continuously being published in Korean bookstores, there are still no books on how to utilize them in the domestic stock market, so this part can be seen as more powerful.

The appendix contains answers to questions posed to the two authors and their trading journals for this year's blockbuster stocks.

Through this, we can also infer how to trade in the stock market, which was turbulent this year.

Additionally, the recommendation page contains an experience of applying the breakthrough trading strategy in this book to coin investment. By personally investing in the breakthrough trading strategy, author Kang Hwan-guk proved that it is possible to generate large profits in the coin market.

I confidently recommend this book not only to stock investors but also to investors investing in coins.

The first book to apply the most powerful strategy to the domestic stock market!

This book covers the breakout trading technique, a strategy commonly used by legendary traders such as Nicholas Davas, William O'Neill, Mark Minervini, David Ryan, and Dan Zanger.

This book covers the fundamentals of breakout trading, including the core principles of breakout trading, setup, analysis of buy and sell orders and chart patterns, stock selection, entry points, stop-loss orders, securing profit cushions, and capital management, as well as practical examples to help you with your investment.

In particular, it explains how Livermore's 'Line of Least Resistance' and William O'Neill's 'Cup with a Handle' can be applied to domestic stocks using over 100 chart examples. Although books on trend following are continuously being published in Korean bookstores, there are still no books on how to utilize them in the domestic stock market, so this part can be seen as more powerful.

The appendix contains answers to questions posed to the two authors and their trading journals for this year's blockbuster stocks.

Through this, we can also infer how to trade in the stock market, which was turbulent this year.

Additionally, the recommendation page contains an experience of applying the breakthrough trading strategy in this book to coin investment. By personally investing in the breakthrough trading strategy, author Kang Hwan-guk proved that it is possible to generate large profits in the coin market.

I confidently recommend this book not only to stock investors but also to investors investing in coins.

- You can preview some of the book's contents.

Preview

index

Recommendation

introduction

[Chapter 1] The Justification of Breakout Trading

Value investing vs.

Technical Analysis

Two trading methods based on technical analysis

Breakout trading is not an option, it's a necessity.

- A strategy of just dipping your toes in

Breakout Trading: Why Should You Do It?

Five Advantages of Breakout Trading

- The risks of trading with a depressed neck

[Chapter 2] Masters of Breakout Trading

Legendary part-time investor Nicholas Davas

- Are you asking me to believe you now?

- Features of Davas trading

- Setting up a Davas-style automatic trading order strategy

William O'Neil's trading method, perfected through an overwhelming amount of research.

- Buy only expensive stocks.

- Thorough, evidence-based investment

Another quant in the technical analysis world, Thomas Bulkowski

Bulkowski, who seemed close to O'Neill but wasn't.

- The most important factor in chart pattern trading

Comparing the trading methods of Davas and O'Neill

- Dabas's trading records

- O'Neill's trading record

[Chapter 3] Risk Management and Chart Setup

Breakout vs.

Pursuit purchase

Three characteristics of hand cutting

- Cutting ties is not an option, it's a necessity.

- If the market is rising, is it okay to not cut losses?

- Hand cutting is for offense, not defense.

Basic chart patterns for breakout trading

- Bar chart

- Chart settings

[Chapter 4] Buying Methods Using Patterns

The foundation of technical analysis, base

- Finding the base through the 'cup with a handle'

- Stan Weinstein's Stage Analysis

- Target base selection using step analysis

Investor sentiment and declining volatility patterns

- Why the volatility decreasing pattern occurs

- Volatility reduction pattern as seen in the chart

- Has trading volume dried up?

The Key to Pattern Trading: Relative Strength Against the Index

- The essence of Dan Zanger's trading method, which even made it into the Guinness Book of World Records for its profitability.

- Why is relative strength important compared to the index?

When to Buy: Handled Cup Pattern

- Pre-purchase checklist

- Why should trading volume dry up just before a breakout?

- Misconceptions about cups with handles

- Patterns that should not be bought: wedge handle

- Cup in Cup pattern

- W in Cup pattern

A trading method that defies human nature: the High Tight Flag pattern.

- Flat Base pattern with all criteria being weekly charts

- Low Cheat pattern created by Mark Minervini

- Another exception, the IPO pattern

- Base on Base pattern

- Formation period and trading volume are key, W pattern

- Rebasing and squats

[Chapter 5] Key Principles of Breakout Trading

Market Timing

- Mark Minervini's Progressive Betting Strategy

- Realizing profits using Sell into Strength

- Minimize market exposure (increase cash holding period)

Stock selection

- How to choose a stock to learn from Davas

- Screening Tips from Stan Weinstein

- See the trees, not the forest

- Stock analysis using 50-day highs

- Analysis of group actions within the industry

- Speculator shakeout, RS shakeout

- Daily and weekly stock selection routine

- Diversification does not protect assets.

How to sell

- How to sell in installments

- Selling using the Davas Box

- Daily trend reversal

Protect your principal!

[Chapter 6] Money Management and Loss Cutting

Hand Cut: The Key to Defense and Offense

- Loss cut function

- How to set a stop loss percentage

Progressive betting using stop loss

- How to calculate the profit cushion

- The power of progressive betting learned through Davas' trading method.

pyramiding

- Two pyramid trading methods

- How to deal with a failed breakthrough

Leading Stocks Lead the Market: How to Bet Against a Bearish Market

[Appendix] Practice is the only way to survive

How to simulate real-life situations

Answers to readers' questions

2023 Jackpot Stock Trading Journal

introduction

[Chapter 1] The Justification of Breakout Trading

Value investing vs.

Technical Analysis

Two trading methods based on technical analysis

Breakout trading is not an option, it's a necessity.

- A strategy of just dipping your toes in

Breakout Trading: Why Should You Do It?

Five Advantages of Breakout Trading

- The risks of trading with a depressed neck

[Chapter 2] Masters of Breakout Trading

Legendary part-time investor Nicholas Davas

- Are you asking me to believe you now?

- Features of Davas trading

- Setting up a Davas-style automatic trading order strategy

William O'Neil's trading method, perfected through an overwhelming amount of research.

- Buy only expensive stocks.

- Thorough, evidence-based investment

Another quant in the technical analysis world, Thomas Bulkowski

Bulkowski, who seemed close to O'Neill but wasn't.

- The most important factor in chart pattern trading

Comparing the trading methods of Davas and O'Neill

- Dabas's trading records

- O'Neill's trading record

[Chapter 3] Risk Management and Chart Setup

Breakout vs.

Pursuit purchase

Three characteristics of hand cutting

- Cutting ties is not an option, it's a necessity.

- If the market is rising, is it okay to not cut losses?

- Hand cutting is for offense, not defense.

Basic chart patterns for breakout trading

- Bar chart

- Chart settings

[Chapter 4] Buying Methods Using Patterns

The foundation of technical analysis, base

- Finding the base through the 'cup with a handle'

- Stan Weinstein's Stage Analysis

- Target base selection using step analysis

Investor sentiment and declining volatility patterns

- Why the volatility decreasing pattern occurs

- Volatility reduction pattern as seen in the chart

- Has trading volume dried up?

The Key to Pattern Trading: Relative Strength Against the Index

- The essence of Dan Zanger's trading method, which even made it into the Guinness Book of World Records for its profitability.

- Why is relative strength important compared to the index?

When to Buy: Handled Cup Pattern

- Pre-purchase checklist

- Why should trading volume dry up just before a breakout?

- Misconceptions about cups with handles

- Patterns that should not be bought: wedge handle

- Cup in Cup pattern

- W in Cup pattern

A trading method that defies human nature: the High Tight Flag pattern.

- Flat Base pattern with all criteria being weekly charts

- Low Cheat pattern created by Mark Minervini

- Another exception, the IPO pattern

- Base on Base pattern

- Formation period and trading volume are key, W pattern

- Rebasing and squats

[Chapter 5] Key Principles of Breakout Trading

Market Timing

- Mark Minervini's Progressive Betting Strategy

- Realizing profits using Sell into Strength

- Minimize market exposure (increase cash holding period)

Stock selection

- How to choose a stock to learn from Davas

- Screening Tips from Stan Weinstein

- See the trees, not the forest

- Stock analysis using 50-day highs

- Analysis of group actions within the industry

- Speculator shakeout, RS shakeout

- Daily and weekly stock selection routine

- Diversification does not protect assets.

How to sell

- How to sell in installments

- Selling using the Davas Box

- Daily trend reversal

Protect your principal!

[Chapter 6] Money Management and Loss Cutting

Hand Cut: The Key to Defense and Offense

- Loss cut function

- How to set a stop loss percentage

Progressive betting using stop loss

- How to calculate the profit cushion

- The power of progressive betting learned through Davas' trading method.

pyramiding

- Two pyramid trading methods

- How to deal with a failed breakthrough

Leading Stocks Lead the Market: How to Bet Against a Bearish Market

[Appendix] Practice is the only way to survive

How to simulate real-life situations

Answers to readers' questions

2023 Jackpot Stock Trading Journal

Detailed image

Into the book

The reason breakout trading is the best is because, as Dan Zanger puts it, "good stocks usually go up without looking back."

In many cases, stocks that rise 100%, 300%, or 500% do so without even giving room for correction.

If you wait to buy these stocks after they break out and undergo a correction, the opportunity may never come.

Livermore said that a good stock is one that makes money as soon as you buy it.

The solid 3-5% profit cushion that comes immediately after a successful breakout trade gives you the confidence to hold on until the market rises sufficiently, without panicking and selling during market corrections.

David Ryan also said, “Stocks that generate profits immediately after purchase often show the best performance.”

This is the best investment method for part-time investors who are not full-time investors.

By setting up automatic trading to buy only when the price breaks out the night before and sell when a predetermined loss limit is reached, you can focus on your work during the day.

The concentration and comfort that buying during adjustments can't provide are "special services" that only breakout trading provides.

--- p.31

Even investors who don't use technical analysis have likely heard of the cup-with-handle pattern.

The problem is that most investors misunderstand the concept of a cup with a handle.

Before diving into technical analysis, it's important to keep in mind that you should focus on how the base is formed based on the dynamics of supply and demand, rather than on how close the pattern is to a perfect cup with handles.

Let's say you're climbing Mount Everest.

No one climbs Mount Everest without stopping in one go.

So, we make camps along the way to get enough rest and build up strength to climb again.

The principle of stock price rise is the same.

No matter how good a stock is, it cannot rise 1,000% or 2,000% in a straight line.

--- p.75

In my opinion, the only safe asset is cash.

Mark Minervini is a particularly negative investor when it comes to diversification.

“Diversification does not protect investors’ assets.

“It just dilutes the profits.”

The reason for diversifying your investments is simple.

Because concentrating all your assets in one or two stocks increases your risk.

Even the best companies can have hidden problems.

But most of it can be figured out through chart analysis.

Helixmith hit its daily lower limit on September 23, 2019, the day after it announced the Phase 3 clinical trial of Engensis.

In fact, the market had been declining sharply for several months prior to the announcement.

Hanmi Pharmaceutical, which has been embroiled in controversy over its owl-based public offering, can also avoid trading through technical analysis.

If only we had followed the basic rule of 'not buying stocks whose prices are below the 200-day moving average', we could have avoided the plunge.

--- p.205

The best approach is to increase your position only when you expect a bull market after a correction, and to stop buying when you expect a bear market after a correction.

But is that as easy as it sounds? No one can accurately predict whether a correction will lead to a bull market or a bear market.

So we build up positions in the correction zone and then we get dumped when the bear market comes. We repeat this process until the correction and the bull market come.

Trend-following rewards occur in a limited period of time, about four times a year.

The compensation more than makes up for the small loss caused by waiting and cutting losses.

In many cases, stocks that rise 100%, 300%, or 500% do so without even giving room for correction.

If you wait to buy these stocks after they break out and undergo a correction, the opportunity may never come.

Livermore said that a good stock is one that makes money as soon as you buy it.

The solid 3-5% profit cushion that comes immediately after a successful breakout trade gives you the confidence to hold on until the market rises sufficiently, without panicking and selling during market corrections.

David Ryan also said, “Stocks that generate profits immediately after purchase often show the best performance.”

This is the best investment method for part-time investors who are not full-time investors.

By setting up automatic trading to buy only when the price breaks out the night before and sell when a predetermined loss limit is reached, you can focus on your work during the day.

The concentration and comfort that buying during adjustments can't provide are "special services" that only breakout trading provides.

--- p.31

Even investors who don't use technical analysis have likely heard of the cup-with-handle pattern.

The problem is that most investors misunderstand the concept of a cup with a handle.

Before diving into technical analysis, it's important to keep in mind that you should focus on how the base is formed based on the dynamics of supply and demand, rather than on how close the pattern is to a perfect cup with handles.

Let's say you're climbing Mount Everest.

No one climbs Mount Everest without stopping in one go.

So, we make camps along the way to get enough rest and build up strength to climb again.

The principle of stock price rise is the same.

No matter how good a stock is, it cannot rise 1,000% or 2,000% in a straight line.

--- p.75

In my opinion, the only safe asset is cash.

Mark Minervini is a particularly negative investor when it comes to diversification.

“Diversification does not protect investors’ assets.

“It just dilutes the profits.”

The reason for diversifying your investments is simple.

Because concentrating all your assets in one or two stocks increases your risk.

Even the best companies can have hidden problems.

But most of it can be figured out through chart analysis.

Helixmith hit its daily lower limit on September 23, 2019, the day after it announced the Phase 3 clinical trial of Engensis.

In fact, the market had been declining sharply for several months prior to the announcement.

Hanmi Pharmaceutical, which has been embroiled in controversy over its owl-based public offering, can also avoid trading through technical analysis.

If only we had followed the basic rule of 'not buying stocks whose prices are below the 200-day moving average', we could have avoided the plunge.

--- p.205

The best approach is to increase your position only when you expect a bull market after a correction, and to stop buying when you expect a bear market after a correction.

But is that as easy as it sounds? No one can accurately predict whether a correction will lead to a bull market or a bear market.

So we build up positions in the correction zone and then we get dumped when the bear market comes. We repeat this process until the correction and the bull market come.

Trend-following rewards occur in a limited period of time, about four times a year.

The compensation more than makes up for the small loss caused by waiting and cutting losses.

--- p.249

Publisher's Review

A strategy commonly used by legendary traders!

Why should I do breakout trading?

What's the core strategy shared by legendary traders like Nicolas Davas, William O'Neill, Mark Minervini, David Ryan, and Dan Zanger? It's the breakout trading technique.

The times they lived in and the stock market environment that followed were different.

Naturally, the stocks and trading periods are bound to be different.

Yet, they achieved incredible profits with one common strategy: breakout trading.

Why breakout trading? Breakout trading is actually a very simple investment technique: buying and selling according to market trends.

That's why many people still question this investment method.

'You can make money that way?' But on the contrary, it is possible.

Breakout trading techniques follow market movements, so investor subjectivity and emotions are excluded.

In a way, you can choose to buy if the price breaks through mechanically, or sell if it fails to break through and reaches the stop loss line.

Although not all traders do this, the legendary traders mentioned above and the two authors of this book tend to set their stop-loss points in advance.

This is to exclude subjectivity.

The moment you get subjective, you tend to fall into a bigger swamp because you feel bad about losing money and are worried that it will go up soon.

(The authors of this book state that they set it to automatically cut losses when a certain percentage is reached, and they also describe how to do so in the book.)

Another question arises here.

'Won't that just lead to more losses?' Of course, that could be true.

Because the main purpose of this strategy is to capture the few large profit opportunities.

This book contains various types of charts and examples scattered throughout the book.

By referring to this, you can get help to 'keep losses as small as possible and profits as large as possible'.

Strategies of National Investment Competition winners and great traders

A collection of examples of how this applies to the domestic stock market!

A trading strategy that can be applied not only to stocks but also to coins!

"Breakthrough Trading Strategy" focuses on introducing the basic principles and practical application of breakthrough trading techniques.

It mainly contains techniques for entering after a setup with high profit/loss ratio and safe, volatility reduction.

In addition, the book covers in detail the basic theories necessary for breakout trading, including setup, price and chart pattern analysis, stock selection, entry points, stop-loss orders, securing profit cushions, and capital management, as well as practical examples that can be used in real-world investing.

The appendix also contains answers to questions posed to the two authors and their trading journals of this year's blockbuster stocks.

This will help you deduce how to trade in this year's turbulent stock market.

Recently, books on trend following have been appearing in Korean bookstores, but there are still no books on how to utilize it in the domestic stock market.

This is also where the two authors focus.

That may be why I went so far as to explain, with over 100 chart examples, how Livermore's 'line of least resistance' and William O'Neill's 'cup with a handle' can be applied to domestic stocks.

And the value of this book doesn't seem to be limited to individual stocks.

The author, Kang Hwan-guk, who wrote the recommendation, read this book and applied it to Bitcoin, proving that applying it as described in the recommendation can yield significant profits.

This book has personally proven its value.

I confidently recommend this book not only to stock investors but also to investors investing in coins.

Why should I do breakout trading?

What's the core strategy shared by legendary traders like Nicolas Davas, William O'Neill, Mark Minervini, David Ryan, and Dan Zanger? It's the breakout trading technique.

The times they lived in and the stock market environment that followed were different.

Naturally, the stocks and trading periods are bound to be different.

Yet, they achieved incredible profits with one common strategy: breakout trading.

Why breakout trading? Breakout trading is actually a very simple investment technique: buying and selling according to market trends.

That's why many people still question this investment method.

'You can make money that way?' But on the contrary, it is possible.

Breakout trading techniques follow market movements, so investor subjectivity and emotions are excluded.

In a way, you can choose to buy if the price breaks through mechanically, or sell if it fails to break through and reaches the stop loss line.

Although not all traders do this, the legendary traders mentioned above and the two authors of this book tend to set their stop-loss points in advance.

This is to exclude subjectivity.

The moment you get subjective, you tend to fall into a bigger swamp because you feel bad about losing money and are worried that it will go up soon.

(The authors of this book state that they set it to automatically cut losses when a certain percentage is reached, and they also describe how to do so in the book.)

Another question arises here.

'Won't that just lead to more losses?' Of course, that could be true.

Because the main purpose of this strategy is to capture the few large profit opportunities.

This book contains various types of charts and examples scattered throughout the book.

By referring to this, you can get help to 'keep losses as small as possible and profits as large as possible'.

Strategies of National Investment Competition winners and great traders

A collection of examples of how this applies to the domestic stock market!

A trading strategy that can be applied not only to stocks but also to coins!

"Breakthrough Trading Strategy" focuses on introducing the basic principles and practical application of breakthrough trading techniques.

It mainly contains techniques for entering after a setup with high profit/loss ratio and safe, volatility reduction.

In addition, the book covers in detail the basic theories necessary for breakout trading, including setup, price and chart pattern analysis, stock selection, entry points, stop-loss orders, securing profit cushions, and capital management, as well as practical examples that can be used in real-world investing.

The appendix also contains answers to questions posed to the two authors and their trading journals of this year's blockbuster stocks.

This will help you deduce how to trade in this year's turbulent stock market.

Recently, books on trend following have been appearing in Korean bookstores, but there are still no books on how to utilize it in the domestic stock market.

This is also where the two authors focus.

That may be why I went so far as to explain, with over 100 chart examples, how Livermore's 'line of least resistance' and William O'Neill's 'cup with a handle' can be applied to domestic stocks.

And the value of this book doesn't seem to be limited to individual stocks.

The author, Kang Hwan-guk, who wrote the recommendation, read this book and applied it to Bitcoin, proving that applying it as described in the recommendation can yield significant profits.

This book has personally proven its value.

I confidently recommend this book not only to stock investors but also to investors investing in coins.

GOODS SPECIFICS

- Date of issue: January 17, 2024

- Page count, weight, size: 292 pages | 520g | 152*225*18mm

- ISBN13: 9791193394168

- ISBN10: 1193394163

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)