I get free Starbucks coffee every day thanks to dividend investing.

|

Description

Book Introduction

“One well-grown dividend stock can become a never-ending source of money!”

The secret to receiving a salary until you die from Dividend King Super TV is revealed! A Miraculous Dividend Investing Guide for Beginners The YouTube channel 'SupeTV', which has gained the trust of beginner and intermediate stock investors with its quick market trend analysis and meticulous investment knowledge, is a member of the FIRE tribe who has successfully achieved financial freedom by investing in Korean and US stocks for many years. As an individual investor, I studied the countless failures and successes I experienced to build a solid wealth pipeline. I've compiled the best dividend investment strategies for steady income with low risk. I've compiled the results and practical know-how in "I Drink Starbucks Coffee for Free Every Day with Dividend Investing." This book is designed to provide a solid investment mindset for those studying economics and investing in stocks to escape the daily grind of corporate life. It also provides comprehensive investment knowledge and insights, including how to identify expected investment returns and risks, analyze corporate information, find ETFs tailored to individual investment tendencies, and manage portfolios. It is densely structured so that you can follow along for 30 days. This book covers everything from investment terminology to useful websites, allowing even novice investors new to stock investing to create a master plan for earning a second salary for half their life. |

- You can preview some of the book's contents.

Preview

index

Prologue | A Rich Life with Dividends

[DAY 01] Transparent lines that control the puppet

[DAY 02] How to Live a Better Life for Free

[DAY 03] The Easiest Path from Economic Poverty to Freedom

[DAY 04] Why I Have No Choice But to Choose Dividend Investing

[DAY 05] My Future Determined by Dividends

[DAY 06] Dividend Reinvestment at a Crossroads

[DAY 07] The Dividend King Who Survived 50 Years

[DAY 08] What is the safest monthly dividend strategy?

[DAY 09] Dividend Growth Stocks That Grow Better Than Bamboo

[DAY 10] How to Earn Rent by Investing in US Real Estate

[DAY 11] Dividend time flows differently

[DAY 12] Korean dividend-paying companies finally appear.

[DAY 13] ETF Investment: Easy Start with Small Amounts

[DAY 14] US Representative S&P 500 ETF

[DAY 15] Dividend ETFs That Grow Faster Than My Salary

[DAY 16] Treating the monthly bill as a dividend

[DAY 17] ETF Comprehensive Futures Set

[DAY 18] US Dividend ETFs Available for Investing in Korea

[DAY 19] Three High-Dividend ETFs Representing Korea

[Midterm Summary] Dividend Stock Summary

[DAY 20] Deciding in one minute and feeling anxious for a year?

[DAY 21] Five of my favorite things to save you time

[DAY 22] What happens when you invest 1 million won a month in dividend stocks?

[DAY 23] Invest in Dividend Companies with High Brand Value

[DAY 24] Previewing High-Dividend vs. Dividend Growth with 100 Million Won

[DAY 25] How much do I need to save to be financially free?

[DAY 26] One thing anyone can do, but not everyone can do

[DAY 27] Everything You'll Ever Need to Know About Taxes

[DAY 28] Why are we so passionate about pension savings?

[DAY 29] A Two-Track Strategy to Change Your Life

[DAY 30] Want to get into the passing lane?

Appendix | Dividend Royals, Dividend Aristocrats, and Dividend Growth Stocks

[DAY 01] Transparent lines that control the puppet

[DAY 02] How to Live a Better Life for Free

[DAY 03] The Easiest Path from Economic Poverty to Freedom

[DAY 04] Why I Have No Choice But to Choose Dividend Investing

[DAY 05] My Future Determined by Dividends

[DAY 06] Dividend Reinvestment at a Crossroads

[DAY 07] The Dividend King Who Survived 50 Years

[DAY 08] What is the safest monthly dividend strategy?

[DAY 09] Dividend Growth Stocks That Grow Better Than Bamboo

[DAY 10] How to Earn Rent by Investing in US Real Estate

[DAY 11] Dividend time flows differently

[DAY 12] Korean dividend-paying companies finally appear.

[DAY 13] ETF Investment: Easy Start with Small Amounts

[DAY 14] US Representative S&P 500 ETF

[DAY 15] Dividend ETFs That Grow Faster Than My Salary

[DAY 16] Treating the monthly bill as a dividend

[DAY 17] ETF Comprehensive Futures Set

[DAY 18] US Dividend ETFs Available for Investing in Korea

[DAY 19] Three High-Dividend ETFs Representing Korea

[Midterm Summary] Dividend Stock Summary

[DAY 20] Deciding in one minute and feeling anxious for a year?

[DAY 21] Five of my favorite things to save you time

[DAY 22] What happens when you invest 1 million won a month in dividend stocks?

[DAY 23] Invest in Dividend Companies with High Brand Value

[DAY 24] Previewing High-Dividend vs. Dividend Growth with 100 Million Won

[DAY 25] How much do I need to save to be financially free?

[DAY 26] One thing anyone can do, but not everyone can do

[DAY 27] Everything You'll Ever Need to Know About Taxes

[DAY 28] Why are we so passionate about pension savings?

[DAY 29] A Two-Track Strategy to Change Your Life

[DAY 30] Want to get into the passing lane?

Appendix | Dividend Royals, Dividend Aristocrats, and Dividend Growth Stocks

Detailed image

Into the book

Most of the inconveniences we experience in life or things we have to do but don't want to do can be solved with money.

To live a slightly better life, a happier and more satisfying life, you ultimately need money.

They say money isn't everything, but there are many worries and anxieties that money can solve.

Earning a lot of money is good, but what's more important is creating a structure that allows money to come in steadily.

--- p.11

What would be 100% automatic profit? This is where we need to break the mold.

Everything we've talked about so far has been 'earned income'.

What we need to do is find another source of income, and that is ‘financial income.’

I have to make money work for me so that money can make money for me.

Unfortunately, the school we attended introduced various career paths to earned income, but did not teach us about the path to financial income.

It is correct to earn money through earned income and then expand to financial income, but many people are so intoxicated by the sweet taste of their salary that they cannot move forward and end up staying put.

--- p.34~35

Coca-Cola's average annual dividend growth rate over the past 10 years is 5.64%.

First, let's calculate assuming that you consume the dividends without reinvesting them.

If you currently invest 100 million won, you will receive a quarterly dividend of 637,500 won (dividend rate: 3%).

And one year later, the quarterly dividend will increase by 5.64% to 673,500 won.

That is, it rose by 36,000 won per quarter.

The dividend is paid out in an amount of about ten thousand won per month, which may feel like less than you thought.

However, after 10 years, the quarterly dividend increases to 1,044,600 won, after 20 years to 1,808,100 won, and after 30 years to 3,129,700 won.

This is the result of Coca-Cola's hard work, increasing sales and profits and steadily increasing dividends to shareholders, even though no additional money was invested from the original 100 million won.

The joy of increasing dividends comes gradually, so you have to watch it over a long period of time to feel the reward.

Even if you don't reinvest your dividends, you will experience compounding effects thanks to the dividend growth rate.

--- p.60

Five companies were introduced each from the dividend royalty and noble stocks.

What would be a good approach for investing based on 10 companies? If you want to create a structure where you receive monthly dividends, like a salary, it's best to check the dividend payment months of the 10 companies and organize them so they don't overlap.

Let's create a monthly dividend structure by investing 100 million won in three dividend stocks.

Since dividends are usually paid quarterly, they are divided into three groups (January, April, July, October/February, May, September, November/March, June, September, December). Let's select one company for each group.

--- p.89

When considering dividend investing and researching various ETFs, you will often come across products with particularly high dividend yields.

Representative examples include JEPI, QYLD, and XYLD, with dividend rates of around 9-12%.

Just as there is no such thing as a free lunch in life, if the odds are high, be suspicious.

From a corporate perspective, maintaining a dividend yield of over 10% and continuously paying dividends is not an easy task.

So, to compensate for this, asset management companies use a covered call strategy.

A covered call is a method of selling a call option derived from a stock while purchasing the stock.

Simply put, it is called a covered call because when the stock price falls, a call option is sold to cover the decline.

It is a structure that profits from the volatility caused by rises and falls, just as stocks do not rise or fall every day.

To live a slightly better life, a happier and more satisfying life, you ultimately need money.

They say money isn't everything, but there are many worries and anxieties that money can solve.

Earning a lot of money is good, but what's more important is creating a structure that allows money to come in steadily.

--- p.11

What would be 100% automatic profit? This is where we need to break the mold.

Everything we've talked about so far has been 'earned income'.

What we need to do is find another source of income, and that is ‘financial income.’

I have to make money work for me so that money can make money for me.

Unfortunately, the school we attended introduced various career paths to earned income, but did not teach us about the path to financial income.

It is correct to earn money through earned income and then expand to financial income, but many people are so intoxicated by the sweet taste of their salary that they cannot move forward and end up staying put.

--- p.34~35

Coca-Cola's average annual dividend growth rate over the past 10 years is 5.64%.

First, let's calculate assuming that you consume the dividends without reinvesting them.

If you currently invest 100 million won, you will receive a quarterly dividend of 637,500 won (dividend rate: 3%).

And one year later, the quarterly dividend will increase by 5.64% to 673,500 won.

That is, it rose by 36,000 won per quarter.

The dividend is paid out in an amount of about ten thousand won per month, which may feel like less than you thought.

However, after 10 years, the quarterly dividend increases to 1,044,600 won, after 20 years to 1,808,100 won, and after 30 years to 3,129,700 won.

This is the result of Coca-Cola's hard work, increasing sales and profits and steadily increasing dividends to shareholders, even though no additional money was invested from the original 100 million won.

The joy of increasing dividends comes gradually, so you have to watch it over a long period of time to feel the reward.

Even if you don't reinvest your dividends, you will experience compounding effects thanks to the dividend growth rate.

--- p.60

Five companies were introduced each from the dividend royalty and noble stocks.

What would be a good approach for investing based on 10 companies? If you want to create a structure where you receive monthly dividends, like a salary, it's best to check the dividend payment months of the 10 companies and organize them so they don't overlap.

Let's create a monthly dividend structure by investing 100 million won in three dividend stocks.

Since dividends are usually paid quarterly, they are divided into three groups (January, April, July, October/February, May, September, November/March, June, September, December). Let's select one company for each group.

--- p.89

When considering dividend investing and researching various ETFs, you will often come across products with particularly high dividend yields.

Representative examples include JEPI, QYLD, and XYLD, with dividend rates of around 9-12%.

Just as there is no such thing as a free lunch in life, if the odds are high, be suspicious.

From a corporate perspective, maintaining a dividend yield of over 10% and continuously paying dividends is not an easy task.

So, to compensate for this, asset management companies use a covered call strategy.

A covered call is a method of selling a call option derived from a stock while purchasing the stock.

Simply put, it is called a covered call because when the stock price falls, a call option is sold to cover the decline.

It is a structure that profits from the volatility caused by rises and falls, just as stocks do not rise or fall every day.

--- p.165

Publisher's Review

The savior of 350,000 beginner stock investors, revealed by YouTuber SupeTV

The Miraculous Dividend Pipeline Strategy Guide: Earning 5 Million Won a Month for Life

Dividend investing may feel psychologically more comfortable because it is not greatly affected by stock price declines. However, the contrasting reality for dividend investors is that while some accumulate dividends every year, others experience the frustrating experience of seeing their dividends decline and even their assets go into the red.

Song Min-seop, who has been running the YouTube channel "Supe TV" for four years since 2019, emphasizes, "Don't be fooled by sweet promises of high dividends. You need to know exactly what to look for and invest in."

"I drink Starbucks coffee for free every day through dividend investing" was written for people who were interested in stocks but were unable to invest because they found it difficult to get started or were afraid of losses, people who want to be able to discern investment information that affects profits, and beginner investors who want to establish their own investment identity and proactively buy and sell.

We've compiled the investment content that subscribers have found particularly enthusiastic and helpful among the investment content previously released on 'Supe TV', and updated it with the latest information. We've also honestly revealed the core principles of investment and secrets to success that we couldn't reveal before.

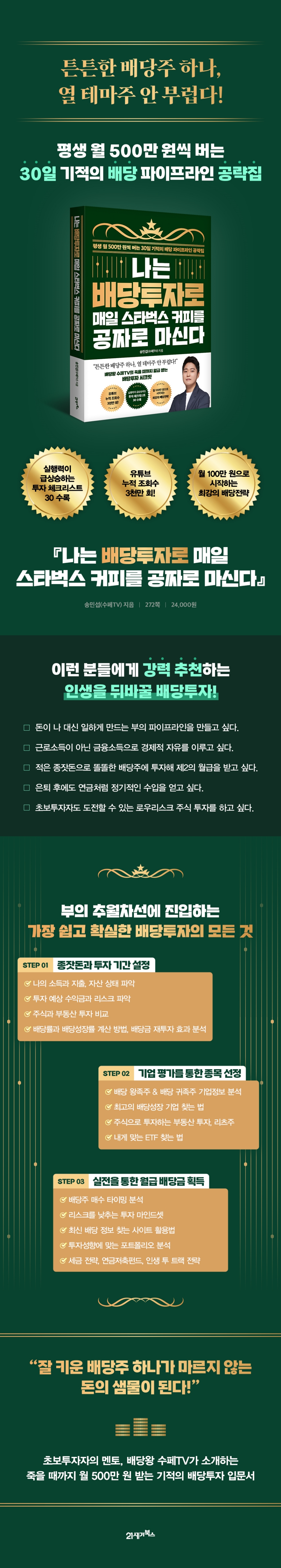

If you want to earn a little extra each month, even if it's just the cost of a coffee, or if you want a solid pipeline of steady income even after retirement, this book will teach you everything from the basics to practical application strategies, and meticulous and detailed practices. This book will help you embark on a new life of investing that will consistently fuel your investment drive.

Boost your potential investing power with this 30-day step-by-step guide and investment checklist!

A dividend investment roadmap that is unaffected by stock price movements and shines over time.

This book helps you learn dividend investment techniques over a 30-day course.

'DAY 01~06' is the first step of dividend investment, and it explains 'setting seed money and investment period' considering personal income, expenses, and asset status.

By comparing the pros and cons of stock and real estate investments, analyzing dividend yields and dividend growth calculations, and the effects of dividend reinvestment, you can understand what you need to gain and what you need to prepare before investing in dividends.

'DAY 07~19' is the second stage of dividend investing, and we will delve into 'stock selection through corporate evaluation.'

We analyze the corporate information of dividend royalty and dividend aristocrat stocks that have consistently increased their dividends, and reveal tips for finding the best stocks.

We also introduce REITs and various ETFs that allow you to invest in real estate through stocks, helping you lead a proactive and independent investment lifestyle.

'DAY 20~30' is the final third stage of dividend investing, and the goal is to 'earn monthly dividends through practice.'

We delve into everything from buying timing to how to use sites to find the latest dividend information, tax strategies, and even the power of compound interest and inflation, which drive long-term investing.

Since successful investing begins with understanding your income and expenses, we've included an investment checklist for each date to help investors grasp the concept of financial management.

If you organize your income-expenditure-asset-investment situation on a checklist and enter your earned income and financial income, you will be able to set realistic financial goals that fit your financial situation and understand your investment tendencies.

We've also prepared a checklist related to your working life and retirement planning to help you learn and practice dividend investing and revisit any mistakes you might have made along the way.

By completing this book, you'll be able to solidify your own investment strategy and confidently draw a roadmap to wealth. By the time you've completed it, you'll be able to analyze additional corporate information, organize your own portfolio, and formulate a dividend investment strategy.

The Miraculous Dividend Pipeline Strategy Guide: Earning 5 Million Won a Month for Life

Dividend investing may feel psychologically more comfortable because it is not greatly affected by stock price declines. However, the contrasting reality for dividend investors is that while some accumulate dividends every year, others experience the frustrating experience of seeing their dividends decline and even their assets go into the red.

Song Min-seop, who has been running the YouTube channel "Supe TV" for four years since 2019, emphasizes, "Don't be fooled by sweet promises of high dividends. You need to know exactly what to look for and invest in."

"I drink Starbucks coffee for free every day through dividend investing" was written for people who were interested in stocks but were unable to invest because they found it difficult to get started or were afraid of losses, people who want to be able to discern investment information that affects profits, and beginner investors who want to establish their own investment identity and proactively buy and sell.

We've compiled the investment content that subscribers have found particularly enthusiastic and helpful among the investment content previously released on 'Supe TV', and updated it with the latest information. We've also honestly revealed the core principles of investment and secrets to success that we couldn't reveal before.

If you want to earn a little extra each month, even if it's just the cost of a coffee, or if you want a solid pipeline of steady income even after retirement, this book will teach you everything from the basics to practical application strategies, and meticulous and detailed practices. This book will help you embark on a new life of investing that will consistently fuel your investment drive.

Boost your potential investing power with this 30-day step-by-step guide and investment checklist!

A dividend investment roadmap that is unaffected by stock price movements and shines over time.

This book helps you learn dividend investment techniques over a 30-day course.

'DAY 01~06' is the first step of dividend investment, and it explains 'setting seed money and investment period' considering personal income, expenses, and asset status.

By comparing the pros and cons of stock and real estate investments, analyzing dividend yields and dividend growth calculations, and the effects of dividend reinvestment, you can understand what you need to gain and what you need to prepare before investing in dividends.

'DAY 07~19' is the second stage of dividend investing, and we will delve into 'stock selection through corporate evaluation.'

We analyze the corporate information of dividend royalty and dividend aristocrat stocks that have consistently increased their dividends, and reveal tips for finding the best stocks.

We also introduce REITs and various ETFs that allow you to invest in real estate through stocks, helping you lead a proactive and independent investment lifestyle.

'DAY 20~30' is the final third stage of dividend investing, and the goal is to 'earn monthly dividends through practice.'

We delve into everything from buying timing to how to use sites to find the latest dividend information, tax strategies, and even the power of compound interest and inflation, which drive long-term investing.

Since successful investing begins with understanding your income and expenses, we've included an investment checklist for each date to help investors grasp the concept of financial management.

If you organize your income-expenditure-asset-investment situation on a checklist and enter your earned income and financial income, you will be able to set realistic financial goals that fit your financial situation and understand your investment tendencies.

We've also prepared a checklist related to your working life and retirement planning to help you learn and practice dividend investing and revisit any mistakes you might have made along the way.

By completing this book, you'll be able to solidify your own investment strategy and confidently draw a roadmap to wealth. By the time you've completed it, you'll be able to analyze additional corporate information, organize your own portfolio, and formulate a dividend investment strategy.

GOODS SPECIFICS

- Date of issue: December 6, 2023

- Page count, weight, size: 272 pages | 170*235*20mm

- ISBN13: 9791171171989

- ISBN10: 1171171986

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)