Golden Star's US Stock Dividend ETF Investment Habits

|

Description

Book Introduction

Started investing in dividends at age 43.

He was convinced that investing in US stocks, especially dividend ETFs, was the path to becoming "unwaveringly wealthy." He sold his financial products and apartments to raise initial investment funds, and has since achieved a cumulative dividend performance of 100 million won.

Currently, I receive 4 million won in dividends into my account every month.

The book explains how to quickly reinvest your investment principal, how to diversify your investments to preserve your principal even in the face of economic crises, and how to use exchange rates as leverage.

He was convinced that investing in US stocks, especially dividend ETFs, was the path to becoming "unwaveringly wealthy." He sold his financial products and apartments to raise initial investment funds, and has since achieved a cumulative dividend performance of 100 million won.

Currently, I receive 4 million won in dividends into my account every month.

The book explains how to quickly reinvest your investment principal, how to diversify your investments to preserve your principal even in the face of economic crises, and how to use exchange rates as leverage.

- You can preview some of the book's contents.

Preview

index

Golden Star's Investment History

prolog

Part 1.

Why US stocks and dividend stocks “now”?

1.

Why You Should Invest in US Stocks

2.

Why You Should Invest in Dividend Stocks

3.

How to invest in US stocks (dividend stocks) and procedures

Part 2.

Understanding US Dividend Stocks and Investing

4.

Top 5 Dividend Emperor Stocks by Market Capitalization

5.

Pros and Cons of Dividend Investing

6.

The Rule of 72: How to Verify the Effectiveness of Dividend Investing

7.

Why Exchange Rates Matter in Dividend Investing

8.

Things to check when selecting dividend stocks

9.

Systems you must know about dividend investing

10.

Start investing in dividends with just 10 million won in seed money.

11.

Four Principles Dividend Investors Should Adhere to

12.

Investment Strategies Learned from the Masters

Part 3.

Understanding Dividend Products (ETFs)

13. History of ETFs

14. Types of ETFs and Representative ETFs

15.

Top 10 US ETFs by Market Capitalization

16.

Types of Dividend ETFs and Representative ETFs - Basics

17.

Types of Dividend ETFs and Representative ETFs - Advanced Edition

18.

The emergence of ultra-high-dividend ETFs

19.

Top 10 Monthly Dividend ETFs by Market Capitalization

20.

Customized dividend ETFs by age group

21.

Golden Star Dividend ETF Investment Habits

Part 4.

Becoming a FIRE Tribe: Achieving Financial Freedom

22.

Money needed to become a Fire Tribe member

23.

A journey to prepare for the Fire Tribe

24.

Prepare my financial statements

Epilogue

prolog

Part 1.

Why US stocks and dividend stocks “now”?

1.

Why You Should Invest in US Stocks

2.

Why You Should Invest in Dividend Stocks

3.

How to invest in US stocks (dividend stocks) and procedures

Part 2.

Understanding US Dividend Stocks and Investing

4.

Top 5 Dividend Emperor Stocks by Market Capitalization

5.

Pros and Cons of Dividend Investing

6.

The Rule of 72: How to Verify the Effectiveness of Dividend Investing

7.

Why Exchange Rates Matter in Dividend Investing

8.

Things to check when selecting dividend stocks

9.

Systems you must know about dividend investing

10.

Start investing in dividends with just 10 million won in seed money.

11.

Four Principles Dividend Investors Should Adhere to

12.

Investment Strategies Learned from the Masters

Part 3.

Understanding Dividend Products (ETFs)

13. History of ETFs

14. Types of ETFs and Representative ETFs

15.

Top 10 US ETFs by Market Capitalization

16.

Types of Dividend ETFs and Representative ETFs - Basics

17.

Types of Dividend ETFs and Representative ETFs - Advanced Edition

18.

The emergence of ultra-high-dividend ETFs

19.

Top 10 Monthly Dividend ETFs by Market Capitalization

20.

Customized dividend ETFs by age group

21.

Golden Star Dividend ETF Investment Habits

Part 4.

Becoming a FIRE Tribe: Achieving Financial Freedom

22.

Money needed to become a Fire Tribe member

23.

A journey to prepare for the Fire Tribe

24.

Prepare my financial statements

Epilogue

Detailed image

Into the book

As you know, investing in US stocks means investing in the world's top companies in each sector using the US dollar, the world's most stable currency.

While Korean companies' competitiveness won't suddenly decline, given their aging population and the world's lowest birth rate, it's unclear whether Korean companies will continue to grow and share the fruits of their labor with shareholders in the next 10 or 20 years.

This is why I started investing in US stocks, especially dividend stocks.

So far, I have invested a total of 500 million won in US dividend stocks, and the period of investment is about 4 years.

In the meantime, the dividend I received was 94.35 million won.

--- p.21

I reinvest at least half or a third of the dividends I receive each month.

Dividends may arrive between 10:00 AM and 12:00 PM, or between 2:00 PM and 6:00 PM.

When dividends are paid, they are repurchased on the same day at the pre-market.

However, if you are buying a large quantity at once or buying and selling simultaneously to change your portfolio, you should trade 1 hour or 30 minutes before the regular market closes.

--- p.44

Even if dividends don't increase or stock prices don't rise, applying the Rule of 72 shows that with just a 4% dividend yield, your assets will double every 18 years.

Even if you are a coward and only reinvest 4% of the dividends each year to increase your stock holdings without investing any additional money, your assets will double in less than 10 years.

This will make a huge difference when it comes time to retire.

--- p.65

If the exchange rate of 1,100 won rises by 27% to 1,400 won, then 7 dollars will be equivalent to 9,800 won in Korean won.

That is, although the stock price fell by 30%, the value in Korean Won only fell by about 11%, from 11,000 won to 9,800 won.

In dollar terms, that's a 30% drop, but in won terms, it's an 11% drop.

This difference in investor fear is quite significant.

So, even if an economic crisis occurs and stock prices plummet, if the exchange rate rises, Korean Won investors can protect themselves from the price fluctuations.

This is called the 'cushion effect'.

--- p.71

In times of high exchange rates, such as now, when the U.S. base interest rate is high and the interest rate gap between Korea and the U.S. is large, leading to significant exchange rate fluctuations, investing in dividend stocks can be considered investing in dollars (because dividends are paid in dollars).

Exchange rates, when used wisely, act like leverage, allowing you to recover losses or, conversely, double your performance.

When investing in US stocks, it is better to convert the amount you plan to invest in advance, at least once a month, rather than converting it every time you trade.

--- p.72

Warren Buffett once said, “The stock market is a tool for moving money from the impatient to the patient.”

The biggest difference between those who make a lot of money from investing and those who don't is the patience to set investment principles and stick to them.

Investing is not a race to see who can win.

Only by enduring and enduring can you gain sufficient understanding and wisdom about the market.

--- p.93

We briefly looked at the investment thoughts of world-renowned investors such as Warren Buffett, Andre Kostolany, and Peter Lynch, and their thoughts on the stock market crash.

They all advised against trying to predict the market and instead to be patient and stay in the market for a long time.

He emphasized that when a market crash hits, ordinary investors sell their stocks and leave the market out of fear, but it is important to observe the market closely and wait rather than giving up.

--- p.105

So far, we have introduced the top 10 US ETFs by market capitalization.

What insights did you gain from this? While organizing this data, a thought suddenly occurred to me: the top 10 ETFs all employ passive, not active, strategies.

It is not an active ETF with difficult strategies such as leverage or covered calls, but a passive ETF with a low management fee of less than 0.1% and a dividend yield of 1% to 3%.

--- p.130

Looking at the top 10 monthly dividend ETFs by market capitalization, eight of them are bond ETFs.

Perhaps due to the post-COVID interest rate cuts, investment funds flowing into bond ETFs appear to be increasing.

A large market capitalization means that a lot of investment money is flowing into the market, and there is always a reason for this influx of money.

--- p.160

So far, I've shared the eight investment habits of Golden Star.

Actually, there's nothing special.

I am an ordinary investor who did not major in economics and has no experience in securities or finance.

Because I don't have a lot of relevant knowledge and experience, I'm investing humbly in safe dividend stocks and good ETFs.

In some ways, it can be said to be the investment closest to the principles.

Good investments are incredibly boring.

Don't be overly swayed by short-term results. Instead, cultivate the discernment to select good stocks, invest consistently and in a lump sum, and become a successful investor who stays in the market for a long time.

--- p.182

In 1998, three economics professors at Trinity College in the United States published a research paper that stated that if you invested 100% of your retirement funds or investments in stocks or 75% in stocks and 25% in bonds and withdrew only 4% each year, there was a more than 98% chance that your retirement funds would not be depleted for 30 years.

It is said that even though the inevitable annual inflation rate was reflected, there was no shortage of money or loss.

--- p.186

I plan to continue managing my portfolio by focusing on dividend stocks, as I always have.

So, investors who have been successful in short-term trading have been investing in dividend ETFs, which are difficult to understand, for more than five years.

I may not become rich overnight, but I want to slowly build wealth and take a leisurely stroll, like taking a walk, without being obsessed with achieving results every day.

--- p.210

For young investors just starting out or those preparing for retirement later in life, it can take years just to build up seed money for dividend investing.

In the process, most investors give up boring and dull dividend investing and try to take shortcuts by investing in volatile growth stocks or double or triple leveraged investments.

Let me reiterate: dividend investing is synonymous with time and patience.

It is a long process of investing the seed money (investment capital) saved from earned or business income in dividend stocks, and then reinvesting the dividends received every month to accumulate stocks.

This process is necessary to create a plausible cash flow.

--- p.212

It is important to gain indirect experience by creating various dividend portfolios based on dividend yields and running simulations.

Whether you have a portfolio that yields 3-4% or 9-10%, the key is to stay in the market for a long time and receive dividends.

While Korean companies' competitiveness won't suddenly decline, given their aging population and the world's lowest birth rate, it's unclear whether Korean companies will continue to grow and share the fruits of their labor with shareholders in the next 10 or 20 years.

This is why I started investing in US stocks, especially dividend stocks.

So far, I have invested a total of 500 million won in US dividend stocks, and the period of investment is about 4 years.

In the meantime, the dividend I received was 94.35 million won.

--- p.21

I reinvest at least half or a third of the dividends I receive each month.

Dividends may arrive between 10:00 AM and 12:00 PM, or between 2:00 PM and 6:00 PM.

When dividends are paid, they are repurchased on the same day at the pre-market.

However, if you are buying a large quantity at once or buying and selling simultaneously to change your portfolio, you should trade 1 hour or 30 minutes before the regular market closes.

--- p.44

Even if dividends don't increase or stock prices don't rise, applying the Rule of 72 shows that with just a 4% dividend yield, your assets will double every 18 years.

Even if you are a coward and only reinvest 4% of the dividends each year to increase your stock holdings without investing any additional money, your assets will double in less than 10 years.

This will make a huge difference when it comes time to retire.

--- p.65

If the exchange rate of 1,100 won rises by 27% to 1,400 won, then 7 dollars will be equivalent to 9,800 won in Korean won.

That is, although the stock price fell by 30%, the value in Korean Won only fell by about 11%, from 11,000 won to 9,800 won.

In dollar terms, that's a 30% drop, but in won terms, it's an 11% drop.

This difference in investor fear is quite significant.

So, even if an economic crisis occurs and stock prices plummet, if the exchange rate rises, Korean Won investors can protect themselves from the price fluctuations.

This is called the 'cushion effect'.

--- p.71

In times of high exchange rates, such as now, when the U.S. base interest rate is high and the interest rate gap between Korea and the U.S. is large, leading to significant exchange rate fluctuations, investing in dividend stocks can be considered investing in dollars (because dividends are paid in dollars).

Exchange rates, when used wisely, act like leverage, allowing you to recover losses or, conversely, double your performance.

When investing in US stocks, it is better to convert the amount you plan to invest in advance, at least once a month, rather than converting it every time you trade.

--- p.72

Warren Buffett once said, “The stock market is a tool for moving money from the impatient to the patient.”

The biggest difference between those who make a lot of money from investing and those who don't is the patience to set investment principles and stick to them.

Investing is not a race to see who can win.

Only by enduring and enduring can you gain sufficient understanding and wisdom about the market.

--- p.93

We briefly looked at the investment thoughts of world-renowned investors such as Warren Buffett, Andre Kostolany, and Peter Lynch, and their thoughts on the stock market crash.

They all advised against trying to predict the market and instead to be patient and stay in the market for a long time.

He emphasized that when a market crash hits, ordinary investors sell their stocks and leave the market out of fear, but it is important to observe the market closely and wait rather than giving up.

--- p.105

So far, we have introduced the top 10 US ETFs by market capitalization.

What insights did you gain from this? While organizing this data, a thought suddenly occurred to me: the top 10 ETFs all employ passive, not active, strategies.

It is not an active ETF with difficult strategies such as leverage or covered calls, but a passive ETF with a low management fee of less than 0.1% and a dividend yield of 1% to 3%.

--- p.130

Looking at the top 10 monthly dividend ETFs by market capitalization, eight of them are bond ETFs.

Perhaps due to the post-COVID interest rate cuts, investment funds flowing into bond ETFs appear to be increasing.

A large market capitalization means that a lot of investment money is flowing into the market, and there is always a reason for this influx of money.

--- p.160

So far, I've shared the eight investment habits of Golden Star.

Actually, there's nothing special.

I am an ordinary investor who did not major in economics and has no experience in securities or finance.

Because I don't have a lot of relevant knowledge and experience, I'm investing humbly in safe dividend stocks and good ETFs.

In some ways, it can be said to be the investment closest to the principles.

Good investments are incredibly boring.

Don't be overly swayed by short-term results. Instead, cultivate the discernment to select good stocks, invest consistently and in a lump sum, and become a successful investor who stays in the market for a long time.

--- p.182

In 1998, three economics professors at Trinity College in the United States published a research paper that stated that if you invested 100% of your retirement funds or investments in stocks or 75% in stocks and 25% in bonds and withdrew only 4% each year, there was a more than 98% chance that your retirement funds would not be depleted for 30 years.

It is said that even though the inevitable annual inflation rate was reflected, there was no shortage of money or loss.

--- p.186

I plan to continue managing my portfolio by focusing on dividend stocks, as I always have.

So, investors who have been successful in short-term trading have been investing in dividend ETFs, which are difficult to understand, for more than five years.

I may not become rich overnight, but I want to slowly build wealth and take a leisurely stroll, like taking a walk, without being obsessed with achieving results every day.

--- p.210

For young investors just starting out or those preparing for retirement later in life, it can take years just to build up seed money for dividend investing.

In the process, most investors give up boring and dull dividend investing and try to take shortcuts by investing in volatile growth stocks or double or triple leveraged investments.

Let me reiterate: dividend investing is synonymous with time and patience.

It is a long process of investing the seed money (investment capital) saved from earned or business income in dividend stocks, and then reinvesting the dividends received every month to accumulate stocks.

This process is necessary to create a plausible cash flow.

--- p.212

It is important to gain indirect experience by creating various dividend portfolios based on dividend yields and running simulations.

Whether you have a portfolio that yields 3-4% or 9-10%, the key is to stay in the market for a long time and receive dividends.

--- p.214

Publisher's Review

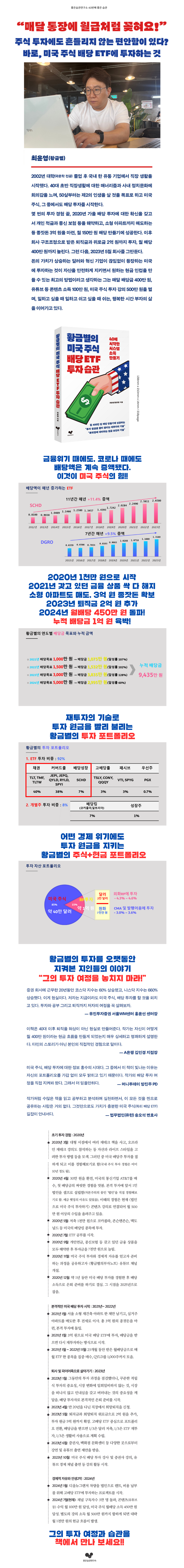

Age 43 (2020): Started investing in dividend ETFs, canceled all financial products, and secured 70 million won.

*44 years old (2021): Sell your current apartment to secure an additional 300 million won in funds.

*45 years old (2022): Focus on buying one ETF and acquire 1,000 shares of QYLD.

*Age 46 (2023): Additional investment of up to 200 million won in voluntary retirement benefits.

Monthly dividend exceeds 4 million won

*47 years old (2024): Monthly dividend of 4.5 million, content (YouTube, etc.) of 1 million, lectures of 5 million, etc.

Secure 10 million won in monthly income

There is an ordinary 40-year-old office worker with the nickname Golden Star.

He started investing in US stock dividend ETFs at the age of 43, and quickly increased his principal by reinvesting the dividends he received, securing a monthly dividend of 4 million won by the age of 46.

Then, they leave the company and become FIRE tribe members who enjoy financial freedom.

This is a story that any office worker would envy.

But he says investing like his is never difficult.

They say that anyone can invest if they just have “consistency” (habits) and agree to “get rich slowly.”

** Let's take a look at Golden Star's US stock investment habits to find out what happened to him before he received a monthly dividend of 4 million won, what he bought and sold, and how he is investing now.

Habit 1.

Gain investment experience with stable stocks

When you first start out, it's a good idea to invest in traditional value companies that have maintained a stable stock price and long-standing trust with shareholders, thereby gaining experience receiving dividends.

Traditional value stocks are better than volatile IT growth stocks.

Habit 2.

[Early Investment] Decide on Reinvestment Targets and Specific Savings Goals

I invested in QYLD, a high-dividend ETF with a monthly dividend and an annual dividend yield of over 10%.

And when I received dividends, I set a specific goal of 1,000 shares and a two-year accumulation period to reinvest them.

After successfully accumulating 1,000 shares, I am making more cash by reinvesting the monthly dividends into high-dividend ETF stocks (PGX).

Habit 3.

[Mid-term Investment] Reinvesting monthly dividends in various ETFs.

After acquiring 1,000 shares of QYLD, I reinvested them into passive ETFs and high-dividend ETFs, resulting in an additional 437 shares by June 2024.

Just as important as raising capital is reinvesting the dividends you receive.

Habit 4.

Keep 15-20% of your investment in cash to prepare for market crises.

Always keep 15% to 20% of your investment assets in cash.

When you receive dividends, in addition to reinvesting them, you set aside some cash.

This is to prepare for economic crises and market crashes that could strike at any time.

The secured cash is maintained at a ratio of approximately 5:5 or 4:6 dollars:won.

Dollars are invested in foreign currency RPs and receive interest of 4.3% to 4.6%, and Korean Won is invested in CMA accounts and issued promissory notes and receive interest of 3% to 3.6%.

Habit 5.

Hedging various taxes using individuals and corporations

We are investing in a diversified manner between individuals (2 people) and corporations (1 person).

“I plan to continue using the account in my name for dividend reinvestment.

Another family member's account also has an investment of 200 million won and receives an average monthly dividend of about $1,000 after tax.

I convert this dividend into cash and use it for my basic living expenses.

“We plan to operate with the goal of receiving dividends of up to 20 million won per person, taking into account comprehensive income tax.”

Habit 6.

Diversify your investment portfolio

My investment portfolio is comprised of 92% ETFs and 8% individual stocks. Looking at the ETFs, bond ETFs (TLT, TMF, TLTW), which I invested in anticipating interest rate cuts, account for the largest portion at 40%. Covered call ETFs like JEPI, JEPQ, QYLD, RYLD, and SPYI account for 38%, and the dividend growth ETF SCHD accounts for 7%.

Habit 7.

Build an additional 1 million won in monthly system income through reinvestment.

I am receiving 1 million won per month just from newly added stocks by reinvesting the dividends received.

The goal is to increase this amount to over 5 million won per month.

Habit 8.

Reinvest until dividends reach 30% of the principal amount.

In just over a month since the coronavirus pandemic crash, we've seen various indices, including the S&P 500, plummet by more than 30%.

The ultimate investment habit for weathering a bear market is to "reinvest honestly until you have accumulated 30% of your investment capital in dividends."

Investors who have accumulated a certain percentage of their investment principal as dividends can withstand crises by preserving their investment principal even in the event of a massive market crash.

** Age-specific ETFs recommended by Golden Star

1.

2030 Recommended Stocks: SPY, SPYG, QQQM

Although they lack investment experience, they have a long investment horizon.

Rather than investing in specific industries or themes, we recommend ETFs that track representative indices, such as SPY or QQQ.

It is a good idea to clearly set a goal of steady, long-term investment, even if it is a small amount.

2.

4050 Recommended Stocks: JEPI, SCHD, SPHD, SPYD

It's time to think about increasing your monthly cash flow.

It is time to reduce the debt-to-asset ratio and shift the portfolio from high-yield stocks to stable stocks.

Therefore, the ETFs needed by the 40-50 generation should be stocks that offer stable stock price protection and can increase cash flow with a dividend of 3% or more.

3.

60 Recommended Stocks: PFD, PFFD, PGX

We desperately need a steady cash flow, like a pension, every month.

A product that pays high dividends every month while also having a stable stock price is good.

It's best to select stocks with strong market defenses that can withstand crises and have the resilience to return to normal when the market stabilizes.

** In addition, author Hwang Geum-byeol suggested the following four principles that dividend investors should adhere to:

Principle 1.

I admit my weaknesses.

While some professional traders use mechanical methods like chart analysis to determine when to buy and sell, dividend investors can't do that.

It's important to acknowledge that you lack the trading talent to utilize advanced techniques and that you lack the information.

Principle 2.

Invest in traditional value stocks that have been proven over time.

After a few mistakes, the author says that instead of stocks with high growth potential but uncertain futures, you should choose stable stocks that you can stick with for a long time.

Investors with these characteristics are dividend investors.

Principle 3.

Don't trust anyone

It is impossible to accurately predict the future.

Anyone with even a little bit of investment experience knows this.

However, many people make investment mistakes because they are deceived by information they hear from so-called experts.

Principle 4.

Trust and follow the market

Dividend investors are afraid of risk and invest safely.

I do not invest in stocks that I am not familiar with or that have not been verified.

Invest in well-known traditional value stocks, or invest in ETFs that track market indices or dividend growth ETFs.

*44 years old (2021): Sell your current apartment to secure an additional 300 million won in funds.

*45 years old (2022): Focus on buying one ETF and acquire 1,000 shares of QYLD.

*Age 46 (2023): Additional investment of up to 200 million won in voluntary retirement benefits.

Monthly dividend exceeds 4 million won

*47 years old (2024): Monthly dividend of 4.5 million, content (YouTube, etc.) of 1 million, lectures of 5 million, etc.

Secure 10 million won in monthly income

There is an ordinary 40-year-old office worker with the nickname Golden Star.

He started investing in US stock dividend ETFs at the age of 43, and quickly increased his principal by reinvesting the dividends he received, securing a monthly dividend of 4 million won by the age of 46.

Then, they leave the company and become FIRE tribe members who enjoy financial freedom.

This is a story that any office worker would envy.

But he says investing like his is never difficult.

They say that anyone can invest if they just have “consistency” (habits) and agree to “get rich slowly.”

** Let's take a look at Golden Star's US stock investment habits to find out what happened to him before he received a monthly dividend of 4 million won, what he bought and sold, and how he is investing now.

Habit 1.

Gain investment experience with stable stocks

When you first start out, it's a good idea to invest in traditional value companies that have maintained a stable stock price and long-standing trust with shareholders, thereby gaining experience receiving dividends.

Traditional value stocks are better than volatile IT growth stocks.

Habit 2.

[Early Investment] Decide on Reinvestment Targets and Specific Savings Goals

I invested in QYLD, a high-dividend ETF with a monthly dividend and an annual dividend yield of over 10%.

And when I received dividends, I set a specific goal of 1,000 shares and a two-year accumulation period to reinvest them.

After successfully accumulating 1,000 shares, I am making more cash by reinvesting the monthly dividends into high-dividend ETF stocks (PGX).

Habit 3.

[Mid-term Investment] Reinvesting monthly dividends in various ETFs.

After acquiring 1,000 shares of QYLD, I reinvested them into passive ETFs and high-dividend ETFs, resulting in an additional 437 shares by June 2024.

Just as important as raising capital is reinvesting the dividends you receive.

Habit 4.

Keep 15-20% of your investment in cash to prepare for market crises.

Always keep 15% to 20% of your investment assets in cash.

When you receive dividends, in addition to reinvesting them, you set aside some cash.

This is to prepare for economic crises and market crashes that could strike at any time.

The secured cash is maintained at a ratio of approximately 5:5 or 4:6 dollars:won.

Dollars are invested in foreign currency RPs and receive interest of 4.3% to 4.6%, and Korean Won is invested in CMA accounts and issued promissory notes and receive interest of 3% to 3.6%.

Habit 5.

Hedging various taxes using individuals and corporations

We are investing in a diversified manner between individuals (2 people) and corporations (1 person).

“I plan to continue using the account in my name for dividend reinvestment.

Another family member's account also has an investment of 200 million won and receives an average monthly dividend of about $1,000 after tax.

I convert this dividend into cash and use it for my basic living expenses.

“We plan to operate with the goal of receiving dividends of up to 20 million won per person, taking into account comprehensive income tax.”

Habit 6.

Diversify your investment portfolio

My investment portfolio is comprised of 92% ETFs and 8% individual stocks. Looking at the ETFs, bond ETFs (TLT, TMF, TLTW), which I invested in anticipating interest rate cuts, account for the largest portion at 40%. Covered call ETFs like JEPI, JEPQ, QYLD, RYLD, and SPYI account for 38%, and the dividend growth ETF SCHD accounts for 7%.

Habit 7.

Build an additional 1 million won in monthly system income through reinvestment.

I am receiving 1 million won per month just from newly added stocks by reinvesting the dividends received.

The goal is to increase this amount to over 5 million won per month.

Habit 8.

Reinvest until dividends reach 30% of the principal amount.

In just over a month since the coronavirus pandemic crash, we've seen various indices, including the S&P 500, plummet by more than 30%.

The ultimate investment habit for weathering a bear market is to "reinvest honestly until you have accumulated 30% of your investment capital in dividends."

Investors who have accumulated a certain percentage of their investment principal as dividends can withstand crises by preserving their investment principal even in the event of a massive market crash.

** Age-specific ETFs recommended by Golden Star

1.

2030 Recommended Stocks: SPY, SPYG, QQQM

Although they lack investment experience, they have a long investment horizon.

Rather than investing in specific industries or themes, we recommend ETFs that track representative indices, such as SPY or QQQ.

It is a good idea to clearly set a goal of steady, long-term investment, even if it is a small amount.

2.

4050 Recommended Stocks: JEPI, SCHD, SPHD, SPYD

It's time to think about increasing your monthly cash flow.

It is time to reduce the debt-to-asset ratio and shift the portfolio from high-yield stocks to stable stocks.

Therefore, the ETFs needed by the 40-50 generation should be stocks that offer stable stock price protection and can increase cash flow with a dividend of 3% or more.

3.

60 Recommended Stocks: PFD, PFFD, PGX

We desperately need a steady cash flow, like a pension, every month.

A product that pays high dividends every month while also having a stable stock price is good.

It's best to select stocks with strong market defenses that can withstand crises and have the resilience to return to normal when the market stabilizes.

** In addition, author Hwang Geum-byeol suggested the following four principles that dividend investors should adhere to:

Principle 1.

I admit my weaknesses.

While some professional traders use mechanical methods like chart analysis to determine when to buy and sell, dividend investors can't do that.

It's important to acknowledge that you lack the trading talent to utilize advanced techniques and that you lack the information.

Principle 2.

Invest in traditional value stocks that have been proven over time.

After a few mistakes, the author says that instead of stocks with high growth potential but uncertain futures, you should choose stable stocks that you can stick with for a long time.

Investors with these characteristics are dividend investors.

Principle 3.

Don't trust anyone

It is impossible to accurately predict the future.

Anyone with even a little bit of investment experience knows this.

However, many people make investment mistakes because they are deceived by information they hear from so-called experts.

Principle 4.

Trust and follow the market

Dividend investors are afraid of risk and invest safely.

I do not invest in stocks that I am not familiar with or that have not been verified.

Invest in well-known traditional value stocks, or invest in ETFs that track market indices or dividend growth ETFs.

GOODS SPECIFICS

- Date of issue: August 12, 2024

- Page count, weight, size: 218 pages | 298g | 138*210*14mm

- ISBN13: 9791193639184

- ISBN10: 1193639182

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)