Warren Buffett's Next Door: Sook-hyang's Stock Investment Story (Special Edition)

|

Description

Book Introduction

Revealed! [Sukhyang's Investment Journal, 2020-2025]

Reborn with a new sense

《Warren Buffett next door, Sookhyang's stock investment story》!

★★★★★ Detailed disclosure of stock and fund returns for 2020-2025

★★★★★ A 40-Year Investment Record from a Value Investing Master and Stock Expert

★★★★★ Timeless investment principles proven by returns and results

How Investment Guru Beats the Market in Chaos

40 years of investment experience, a look at real investment cases

The unwavering investment principles of Sookhyang, a true value investor of our time!

The book "Warren Buffett Next Door, Sukhyang's Stock Investment Story," which contains the investment methods of the master of value investing, "Warren Buffett Next Door, Sukhyang," has been reborn in a new form.

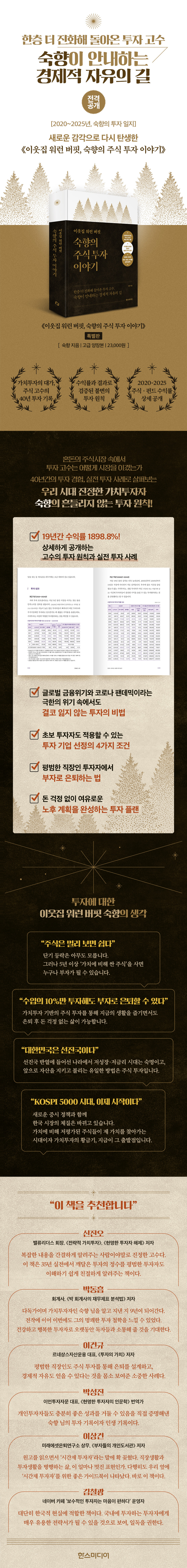

《(Special Edition) Warren Buffett Next Door, Sook-hyang's Stock Investment Story》 is a book that includes the author Sook-hyang's detailed investment diary and analysis for the past 5 years (2020-2024) and the past 19 years (2006-2024) in 《Warren Buffett Next Door, Sook-hyang's Stock Investment Story》 published in 2020, and is refined with a new sensibility.

The returns on stocks and funds he revealed in the preface to the special edition are astonishing.

Sukhyang's investment funds have shown a return of 88.6% (annual compound return of 13.5%) over the past five years, and 1898.8% (annual compound return of 17.1%) over the 19 years from 2006 to 2024.

Assuming the initial investment was 100 million won, it has grown to 1.999 billion won.

Considering that this period was marked by extreme crises, including the global financial crisis and the COVID-19 pandemic, his value investing shines even brighter.

In particular, the fund (Sukhyang) that operates with an investment principal of 500 million won and an 18-year operating period from October 1, 2021 to September 30, 2039, had a return of 99.5%, and the principal of 500 million won increased to 998 million won as of the end of September 2025.

It can be said that he personally demonstrated the true value of value investing.

The author's point through this disclosure of investment records is clear.

Anyone who believes in the true power of value investing and puts it into practice can achieve financial freedom.

The author says that anyone can retire rich by spending 90% of their income on living expenses and investing only 10%.

By setting aside just 10% of your income to prepare for the future, you can enjoy your present life and live a worry-free life after retirement.

To this end, author Sook-hyang introduces the correct understanding and practical methods of stock investment in an easy-to-understand manner through her own investment records in “Warren Buffett Next Door, Sook-hyang’s Stock Investment Story.”

Reborn with a new sense

《Warren Buffett next door, Sookhyang's stock investment story》!

★★★★★ Detailed disclosure of stock and fund returns for 2020-2025

★★★★★ A 40-Year Investment Record from a Value Investing Master and Stock Expert

★★★★★ Timeless investment principles proven by returns and results

How Investment Guru Beats the Market in Chaos

40 years of investment experience, a look at real investment cases

The unwavering investment principles of Sookhyang, a true value investor of our time!

The book "Warren Buffett Next Door, Sukhyang's Stock Investment Story," which contains the investment methods of the master of value investing, "Warren Buffett Next Door, Sukhyang," has been reborn in a new form.

《(Special Edition) Warren Buffett Next Door, Sook-hyang's Stock Investment Story》 is a book that includes the author Sook-hyang's detailed investment diary and analysis for the past 5 years (2020-2024) and the past 19 years (2006-2024) in 《Warren Buffett Next Door, Sook-hyang's Stock Investment Story》 published in 2020, and is refined with a new sensibility.

The returns on stocks and funds he revealed in the preface to the special edition are astonishing.

Sukhyang's investment funds have shown a return of 88.6% (annual compound return of 13.5%) over the past five years, and 1898.8% (annual compound return of 17.1%) over the 19 years from 2006 to 2024.

Assuming the initial investment was 100 million won, it has grown to 1.999 billion won.

Considering that this period was marked by extreme crises, including the global financial crisis and the COVID-19 pandemic, his value investing shines even brighter.

In particular, the fund (Sukhyang) that operates with an investment principal of 500 million won and an 18-year operating period from October 1, 2021 to September 30, 2039, had a return of 99.5%, and the principal of 500 million won increased to 998 million won as of the end of September 2025.

It can be said that he personally demonstrated the true value of value investing.

The author's point through this disclosure of investment records is clear.

Anyone who believes in the true power of value investing and puts it into practice can achieve financial freedom.

The author says that anyone can retire rich by spending 90% of their income on living expenses and investing only 10%.

By setting aside just 10% of your income to prepare for the future, you can enjoy your present life and live a worry-free life after retirement.

To this end, author Sook-hyang introduces the correct understanding and practical methods of stock investment in an easy-to-understand manner through her own investment records in “Warren Buffett Next Door, Sook-hyang’s Stock Investment Story.”

- You can preview some of the book's contents.

Preview

Detailed image

Into the book

The most important thing I emphasized while writing the book was that investing in stocks is essential for a worry-free life after retirement. Specifically, I explained that you can create a portfolio of stocks that are cheap compared to their value by using four investment indicators.

The current government's policy to normalize our stock market is once again proving the effectiveness of the investment method I've been using, as it increases the likelihood that undervalued stocks will regain their value.

And I believe that its effectiveness will be even stronger in the coming era of the KOSPI 5000 index.

--- From “[Special Edition] Preface: Sookhyang’s Investment Journal, 2020-2025”

The ultimate goal of this book is to prepare you for the time when you will have to live off of capital income after your labor income ceases, and to suggest ways to create a life of freedom that entails financial freedom regardless of retirement.

In my experience, it is possible to invest in stocks based on value investing.

--- From "Prologue: How Investor Experience Becomes an Asset"

By retiring this year, I've naturally become a full-time investor, but by sharing my investing experience as a working professional, I hope to demonstrate that even part-time investors (to use Peter Lynch's term) can achieve satisfactory returns from stock investing.

Ultimately, retirement life, which is supposed to be lived on capital income, should be free from money problems.

I wanted to tell you that investing in stocks is a great tool.

--- From "Prologue: How Investor Experience Becomes an Asset"

The purpose of investing is to obtain the highest possible return without losing the principal.

There are many investment options that immediately come to mind, such as bank deposits, real estate, bonds, and gold, but I am confident that stock investment has provided the highest long-term returns and will continue to do so.

This is proven by statistical figures from past investment data, and is a conclusion drawn from the performance of many successful investors and my own experience.

--- From "Chapter 3 Introduction to Investment"

I set my stock investment target return at twice the bank's regular deposit interest rate.

This level of return can be easily achieved without investing a lot of time or thorough analysis.

Setting achievable goals allows you to invest without being overly ambitious, i.e., without speculating.

--- From "Chapter 3 Introduction to Investment"

The saying that nothing in life is free is true, and it's a maxim we should always keep in mind, especially when it comes to investing.

So, what we need to do is to use our own abilities and efforts to find stocks that are cheap compared to their value.

--- From "Chapter 4 General Trading"

There is a stock market adage that says not to catch a falling knife, but I don't accept this adage because I believe that no one can predict when a falling stock price will bounce back.

Rather, since the stock price of the stock I wanted to buy has fallen significantly, I am buying it little by little.

The more the stock price falls, the greater the margin of safety, so they follow, whether it's the basement, the second floor, or any other floor.

If you run out of cash to buy, you have no choice but to stop buying.

The word leverage does not exist in the dictionary of a sound investor.

--- From "Chapter 5 Trading - Buying"

If the stock price is at the bottom, but the company's value continues to increase and the company pays more in dividends than interest on deposits, I would like to hold the stock until the stock price reaches a price that matches its intrinsic value.

It's often said that selling is more difficult than buying, but if you've made a profit and sold, you'll never regret it.

We need to have the mindset and attitude that the person who bought the stock I sold should also profit.

--- From "Chapter 7 Trading - Selling"

I believe that while it's important to prepare for a comfortable life after retirement, it's also important to enjoy each day.

I think the best way to prepare for retirement is to save and invest 10% of your income, as suggested in George Clayton's book, "The Richest Man is Babylon."

--- From "Chapter 10 Investment Plan to Complete Your Retirement Plan"

For those of you who, like me, don't like learning directly from others, the study method I'd like to recommend is (the only one I know) reading, that is, reading books.

They say that books contain all the world's knowledge, and there are many excellent books that can help you improve your skills and qualifications as a stock investor.

To become a successful investor, you need to read a lot of books that contain the experiences of great investors.

The book teaches everything about investing, including the investment philosophies of the masters, how to make profits from investing, and the ideal attitude for an investor.

--- From "Chapter 12: Books Make Great Investors"

Lastly, this is the life I aspire to lead, but I hope that investing in stocks is not solely about making money, but rather about being free from money.

Money is just a means to live the life you want, and the goal of life is to live each day happily and wonderfully.

The current government's policy to normalize our stock market is once again proving the effectiveness of the investment method I've been using, as it increases the likelihood that undervalued stocks will regain their value.

And I believe that its effectiveness will be even stronger in the coming era of the KOSPI 5000 index.

--- From “[Special Edition] Preface: Sookhyang’s Investment Journal, 2020-2025”

The ultimate goal of this book is to prepare you for the time when you will have to live off of capital income after your labor income ceases, and to suggest ways to create a life of freedom that entails financial freedom regardless of retirement.

In my experience, it is possible to invest in stocks based on value investing.

--- From "Prologue: How Investor Experience Becomes an Asset"

By retiring this year, I've naturally become a full-time investor, but by sharing my investing experience as a working professional, I hope to demonstrate that even part-time investors (to use Peter Lynch's term) can achieve satisfactory returns from stock investing.

Ultimately, retirement life, which is supposed to be lived on capital income, should be free from money problems.

I wanted to tell you that investing in stocks is a great tool.

--- From "Prologue: How Investor Experience Becomes an Asset"

The purpose of investing is to obtain the highest possible return without losing the principal.

There are many investment options that immediately come to mind, such as bank deposits, real estate, bonds, and gold, but I am confident that stock investment has provided the highest long-term returns and will continue to do so.

This is proven by statistical figures from past investment data, and is a conclusion drawn from the performance of many successful investors and my own experience.

--- From "Chapter 3 Introduction to Investment"

I set my stock investment target return at twice the bank's regular deposit interest rate.

This level of return can be easily achieved without investing a lot of time or thorough analysis.

Setting achievable goals allows you to invest without being overly ambitious, i.e., without speculating.

--- From "Chapter 3 Introduction to Investment"

The saying that nothing in life is free is true, and it's a maxim we should always keep in mind, especially when it comes to investing.

So, what we need to do is to use our own abilities and efforts to find stocks that are cheap compared to their value.

--- From "Chapter 4 General Trading"

There is a stock market adage that says not to catch a falling knife, but I don't accept this adage because I believe that no one can predict when a falling stock price will bounce back.

Rather, since the stock price of the stock I wanted to buy has fallen significantly, I am buying it little by little.

The more the stock price falls, the greater the margin of safety, so they follow, whether it's the basement, the second floor, or any other floor.

If you run out of cash to buy, you have no choice but to stop buying.

The word leverage does not exist in the dictionary of a sound investor.

--- From "Chapter 5 Trading - Buying"

If the stock price is at the bottom, but the company's value continues to increase and the company pays more in dividends than interest on deposits, I would like to hold the stock until the stock price reaches a price that matches its intrinsic value.

It's often said that selling is more difficult than buying, but if you've made a profit and sold, you'll never regret it.

We need to have the mindset and attitude that the person who bought the stock I sold should also profit.

--- From "Chapter 7 Trading - Selling"

I believe that while it's important to prepare for a comfortable life after retirement, it's also important to enjoy each day.

I think the best way to prepare for retirement is to save and invest 10% of your income, as suggested in George Clayton's book, "The Richest Man is Babylon."

--- From "Chapter 10 Investment Plan to Complete Your Retirement Plan"

For those of you who, like me, don't like learning directly from others, the study method I'd like to recommend is (the only one I know) reading, that is, reading books.

They say that books contain all the world's knowledge, and there are many excellent books that can help you improve your skills and qualifications as a stock investor.

To become a successful investor, you need to read a lot of books that contain the experiences of great investors.

The book teaches everything about investing, including the investment philosophies of the masters, how to make profits from investing, and the ideal attitude for an investor.

--- From "Chapter 12: Books Make Great Investors"

Lastly, this is the life I aspire to lead, but I hope that investing in stocks is not solely about making money, but rather about being free from money.

Money is just a means to live the life you want, and the goal of life is to live each day happily and wonderfully.

--- From "Epilogue: Retired Investors Become Permanent Professional Investors"

Publisher's Review

The investment expert returns, even more evolved.

The Path to Economic Freedom Guided by Sookhyang

How can an ordinary office worker retire rich through investing?

Simple yet safe value investing is the answer!

The name 'Sukhyang' is not unfamiliar to those who frequently visit stock investment cafes.

He has been sharing his investment portfolio and book reviews in stock-related communities for a long time, and his friendly yet persuasive writing has become a hot topic among members.

《Warren Buffett Next Door, Sook-hyang's Stock Investment Story》 is a book that meticulously organizes Sook-hyang's unique investment principles that have enabled her to beat the market with high returns, along with practical investment cases that have been revealed so far.

He first disclosed the investment performance and returns of the past period through the special edition preface.

Sukhyang's investment funds have shown a return of 88.6% (annual compound return of 13.5%) over the past five years, and 1898.8% (annual compound return of 17.1%) over the 19 years from 2006 to 2024.

Assuming the initial investment was 100 million won, it has grown to 1.999 billion won.

Considering that this period was marked by extreme crises, including the global financial crisis and the COVID-19 pandemic, his value investing shines even brighter.

In particular, the fund (Sukhyang) that operates with an investment principal of 500 million won and an 18-year operating period from October 1, 2021 to September 30, 2039, had a return of 99.5%, and the principal of 500 million won increased to 998 million won as of the end of September 2025.

It can be said that he personally demonstrated the true value of value investing.

Value investing is an investment method proven by investment legends such as Benjamin Graham and Warren Buffett, and is based on calculating intrinsic value (the fundamental value of a company).

The author states that the ultimate purpose of investing is to "prepare for the time when one must live off capital income after labor income ceases, and to create a life of freedom accompanied by economic freedom," and that this is possible through stock investment based on value investing.

In particular, Sook-hyang wanted to emphasize through her book that even ordinary office workers and self-employed individuals can create satisfactory returns by focusing on their main job and utilizing a short period of time without having to spend a lot of time investing in stocks.

According to the author, this is also possible through value investing.

Things beginner investors must know

Revealing "Investment Principles Proven Through 40 Years of Investment Experience."

The author introduces his own investment principles, thoroughly tested through 40 years of investment experience, and elaborates on the "four criteria to consider when selecting a company to invest in."

(1) PER 10 or less: the lower the better

(2) PBR 1 or lower: The lower the better.

(3) The higher the dividend yield, the better, as it is higher than the bank's regular deposit interest rate.

(4) Cash-only company: The more cash, the better.

The author explains that by constructing a portfolio of companies that meet the four criteria above, you can not only avoid losses but also achieve returns that surpass the average stock market return and even exceed bank interest rates.

This is a must-know guide for inexperienced beginner investors, and it also provides a convenient way for investors who find it cumbersome to analyze each company individually.

And I also explained in detail how to calculate 'intrinsic value', the basis of value investing, which is also one of the questions I have received frequently from readers.

In particular, the author kindly explains how to calculate intrinsic value and apply it to investment, using examples of stocks in which he has actually invested over the past several years.

This will provide an opportunity for investors who are unfamiliar with corporate analysis to resolve their questions and improve their investment skills.

Additionally, when selecting companies to invest in, Sook-hyang introduces a "stock analysis table" format, concisely organized in her own unique way. This will also be valuable information for less experienced investors.

To make an investment that doesn't lose, you need to be patient and know how to wait.

At this time, reading the philosophy of the great fighters is the best remedy.

The author offers his own clear principles on topics that investors are likely to ponder at least once, such as timing buys and sells, setting target returns, cash allocation, and the number of stocks to hold in a portfolio.

Among these, what the author emphasizes is the importance of reading.

An investment method based on value investing requires patience and the ability to wait for a long time, and reading books containing the lessons of the masters can be a great help in that process.

Of course, reading is the best way to improve your investment skills, as you can indirectly acquire the proven investment methods and wisdom of the masters.

In fact, Sook-hyang is a voracious reader and avid reader, and she has carefully selected and introduced 104 books that she recommends to investors.

Furthermore, this book is richly quoting sentences that encapsulate the investment philosophies of the masters, allowing readers to access their voices without spending too much time.

By the time this book was written, the author had finished his long career as a part-time investor and had transitioned into a full-time investor.

And as I had planned for a long time, I was able to enjoy a worry-free retirement thanks to investment returns and dividends.

His realistic retirement plan, which he actually implemented, will be a valuable reference for anyone who longs for financial freedom.

The author emphasized, “It is important to prepare for a comfortable life after retirement, but you should also enjoy each day you live.” He added, “Excessive investment not only makes you anxious and prevents you from living a happy life, but an impatient mind that acts against reason leads you down the path of failure, so the most important virtue in investing is a relaxed mindset.”

The lessons that Sookhyang imparts are not limited to investment.

I hope this book will be an important companion on your path to financial freedom.

About investment

Warren Buffett's thoughts on the neighbor's house

Stocks are easy when you look at them from a long-term perspective.

No one knows the short-term ups and downs.

However, anyone can become rich by buying 'cheap stocks compared to their value' for more than five years.

"You can retire rich by investing just 10% of your income."

Value investing allows you to enjoy your current life while also living a worry-free life after retirement.

“South Korea is a developed country.”

In a country that has joined the ranks of advanced nations, an era of low growth and low interest rates is inevitable, and the only way to protect assets and thrive in the future is through stock investment.

The KOSPI 5000 Era Has Just Beginned

The constitution of the Korean market is changing along with the new stock market policy.

This is the golden age of value investing, an era where undervalued stocks are finding their true value. Now is the starting point.

The Path to Economic Freedom Guided by Sookhyang

How can an ordinary office worker retire rich through investing?

Simple yet safe value investing is the answer!

The name 'Sukhyang' is not unfamiliar to those who frequently visit stock investment cafes.

He has been sharing his investment portfolio and book reviews in stock-related communities for a long time, and his friendly yet persuasive writing has become a hot topic among members.

《Warren Buffett Next Door, Sook-hyang's Stock Investment Story》 is a book that meticulously organizes Sook-hyang's unique investment principles that have enabled her to beat the market with high returns, along with practical investment cases that have been revealed so far.

He first disclosed the investment performance and returns of the past period through the special edition preface.

Sukhyang's investment funds have shown a return of 88.6% (annual compound return of 13.5%) over the past five years, and 1898.8% (annual compound return of 17.1%) over the 19 years from 2006 to 2024.

Assuming the initial investment was 100 million won, it has grown to 1.999 billion won.

Considering that this period was marked by extreme crises, including the global financial crisis and the COVID-19 pandemic, his value investing shines even brighter.

In particular, the fund (Sukhyang) that operates with an investment principal of 500 million won and an 18-year operating period from October 1, 2021 to September 30, 2039, had a return of 99.5%, and the principal of 500 million won increased to 998 million won as of the end of September 2025.

It can be said that he personally demonstrated the true value of value investing.

Value investing is an investment method proven by investment legends such as Benjamin Graham and Warren Buffett, and is based on calculating intrinsic value (the fundamental value of a company).

The author states that the ultimate purpose of investing is to "prepare for the time when one must live off capital income after labor income ceases, and to create a life of freedom accompanied by economic freedom," and that this is possible through stock investment based on value investing.

In particular, Sook-hyang wanted to emphasize through her book that even ordinary office workers and self-employed individuals can create satisfactory returns by focusing on their main job and utilizing a short period of time without having to spend a lot of time investing in stocks.

According to the author, this is also possible through value investing.

Things beginner investors must know

Revealing "Investment Principles Proven Through 40 Years of Investment Experience."

The author introduces his own investment principles, thoroughly tested through 40 years of investment experience, and elaborates on the "four criteria to consider when selecting a company to invest in."

(1) PER 10 or less: the lower the better

(2) PBR 1 or lower: The lower the better.

(3) The higher the dividend yield, the better, as it is higher than the bank's regular deposit interest rate.

(4) Cash-only company: The more cash, the better.

The author explains that by constructing a portfolio of companies that meet the four criteria above, you can not only avoid losses but also achieve returns that surpass the average stock market return and even exceed bank interest rates.

This is a must-know guide for inexperienced beginner investors, and it also provides a convenient way for investors who find it cumbersome to analyze each company individually.

And I also explained in detail how to calculate 'intrinsic value', the basis of value investing, which is also one of the questions I have received frequently from readers.

In particular, the author kindly explains how to calculate intrinsic value and apply it to investment, using examples of stocks in which he has actually invested over the past several years.

This will provide an opportunity for investors who are unfamiliar with corporate analysis to resolve their questions and improve their investment skills.

Additionally, when selecting companies to invest in, Sook-hyang introduces a "stock analysis table" format, concisely organized in her own unique way. This will also be valuable information for less experienced investors.

To make an investment that doesn't lose, you need to be patient and know how to wait.

At this time, reading the philosophy of the great fighters is the best remedy.

The author offers his own clear principles on topics that investors are likely to ponder at least once, such as timing buys and sells, setting target returns, cash allocation, and the number of stocks to hold in a portfolio.

Among these, what the author emphasizes is the importance of reading.

An investment method based on value investing requires patience and the ability to wait for a long time, and reading books containing the lessons of the masters can be a great help in that process.

Of course, reading is the best way to improve your investment skills, as you can indirectly acquire the proven investment methods and wisdom of the masters.

In fact, Sook-hyang is a voracious reader and avid reader, and she has carefully selected and introduced 104 books that she recommends to investors.

Furthermore, this book is richly quoting sentences that encapsulate the investment philosophies of the masters, allowing readers to access their voices without spending too much time.

By the time this book was written, the author had finished his long career as a part-time investor and had transitioned into a full-time investor.

And as I had planned for a long time, I was able to enjoy a worry-free retirement thanks to investment returns and dividends.

His realistic retirement plan, which he actually implemented, will be a valuable reference for anyone who longs for financial freedom.

The author emphasized, “It is important to prepare for a comfortable life after retirement, but you should also enjoy each day you live.” He added, “Excessive investment not only makes you anxious and prevents you from living a happy life, but an impatient mind that acts against reason leads you down the path of failure, so the most important virtue in investing is a relaxed mindset.”

The lessons that Sookhyang imparts are not limited to investment.

I hope this book will be an important companion on your path to financial freedom.

About investment

Warren Buffett's thoughts on the neighbor's house

Stocks are easy when you look at them from a long-term perspective.

No one knows the short-term ups and downs.

However, anyone can become rich by buying 'cheap stocks compared to their value' for more than five years.

"You can retire rich by investing just 10% of your income."

Value investing allows you to enjoy your current life while also living a worry-free life after retirement.

“South Korea is a developed country.”

In a country that has joined the ranks of advanced nations, an era of low growth and low interest rates is inevitable, and the only way to protect assets and thrive in the future is through stock investment.

The KOSPI 5000 Era Has Just Beginned

The constitution of the Korean market is changing along with the new stock market policy.

This is the golden age of value investing, an era where undervalued stocks are finding their true value. Now is the starting point.

GOODS SPECIFICS

- Date of issue: November 4, 2025

- Format: Hardcover book binding method guide

- Page count, weight, size: 376 pages | 710g | 145*205*26mm

- ISBN13: 9791194777656

- ISBN10: 1194777651

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)