Investment Meets Evolution

|

Description

Book Introduction

“Reading this book changed my investing approach.

“It was a huge home run that changed the mindset of investors like me.”

Rave reviews from legendary investor Mohnish Pabrai

Average annual return of 20.3% over 16 years from 2017 to 2023

The path to investment and life wisdom discovered through the principles of evolution.

This book is a record of an investor who overcame the financial crisis and the COVID-19 crisis, focusing solely on Indian stocks from 2007 to 2023 and achieving an average annual return of 20.3%. He found wisdom about investing, wealth, and even the core issues of life in evolutionary biology, that is, the survival and prosperity of species.

Why should investors, and we all, heed the message of evolutionary biology? Building wealth through investing and living life is a long-term process that requires a long-term perspective and a broad perspective. Species evolution is the epitome of such a long-term process.

The wisdom gleaned from evolution, on the one hand, breathes life into stale words, and on the other, it shatters common sense in investment.

The idea that you should avoid big risks and buy quality stocks at reasonable prices seems so obvious, outdated, and abstract that it feels meaningless.

But when we examine the experiences of businesses and industries through the insights gained from research on things like bumblebees, silver foxes, sea urchins, and E. coli, that obvious saying takes on a new meaning, and we come to understand the specific criteria and methods for making good decisions.

The argument that economic news or executive interviews are nothing more than noise in investing, or that if you bought a good stock at a good price, you "shouldn't sell," is counterintuitive.

However, the logic that unfolds through research on guppies, finches, snails, rabbits, and various business data is so powerful that it convinced legendary investor Mohnish Pabrai.

“It was a huge home run that changed the mindset of investors like me.”

Rave reviews from legendary investor Mohnish Pabrai

Average annual return of 20.3% over 16 years from 2017 to 2023

The path to investment and life wisdom discovered through the principles of evolution.

This book is a record of an investor who overcame the financial crisis and the COVID-19 crisis, focusing solely on Indian stocks from 2007 to 2023 and achieving an average annual return of 20.3%. He found wisdom about investing, wealth, and even the core issues of life in evolutionary biology, that is, the survival and prosperity of species.

Why should investors, and we all, heed the message of evolutionary biology? Building wealth through investing and living life is a long-term process that requires a long-term perspective and a broad perspective. Species evolution is the epitome of such a long-term process.

The wisdom gleaned from evolution, on the one hand, breathes life into stale words, and on the other, it shatters common sense in investment.

The idea that you should avoid big risks and buy quality stocks at reasonable prices seems so obvious, outdated, and abstract that it feels meaningless.

But when we examine the experiences of businesses and industries through the insights gained from research on things like bumblebees, silver foxes, sea urchins, and E. coli, that obvious saying takes on a new meaning, and we come to understand the specific criteria and methods for making good decisions.

The argument that economic news or executive interviews are nothing more than noise in investing, or that if you bought a good stock at a good price, you "shouldn't sell," is counterintuitive.

However, the logic that unfolds through research on guppies, finches, snails, rabbits, and various business data is so powerful that it convinced legendary investor Mohnish Pabrai.

- You can preview some of the book's contents.

Preview

index

Entering

Part 1: Avoiding Major Risks

Part 2: Buying Quality Stocks at Fair Prices

Chapter 1: Pumpkin Bees: A Story of Survival

The two paths before us | The path of evolution | Warren Buffett's two investment principles | Great investors are great rejecters | How we avoid big risks | How will we miss out on Tesla?

Chapter 2: Silver Fox Talks About Stock Selection

So where to start? | Single selection criteria and evolutionary chains | Choosing historical ROCE brings with it many others | There are no guarantees in investing.

Chapter 3: Sea Urchins, Speaking of Resilience

McKinsey's Mystery | Life is Incredibly Resilient | The Evolution of Evolvability | You Have to Be Resilient to Evolve | Leaders Fall from Fail

Chapter 4: Dung Beetles: Corporate Analysis

How vs. Why | Why You Shouldn't Focus on Proximate Causes | The Pain and Benefits of Headlines

Chapter 5: Darwin on Valuation

The Hidden Reason for Their Poor Performance | Thomas Huxley's Lament | The Mystery Hidden in the Peacock's Tail | We Are One | We Study Corporate History | Necessary Conditions Are Not Sufficient

Chapter 6: E. coli, Speaking of Patterns

The Amazing Anole Lizard | Convergent Evolution Is Everywhere | We Don't Invest in Individual Companies | Kahneman's External Perspective and Convergence | Practical Ways to Apply the Principle of Convergence | It's Not as Simple as You Think | Lessons from E. coli

Chapter 7: Guppy Talks Investment Information

The Blessings and Perils of Signals | The Handicap Principle Lights the Way | Dishonest Signals | Honest Signals and How to Interpret Them | Anthony Bolton's Mistake

Part 3: Don't be lazy, be incredibly lazy.

Chapter 8: Finch, Talking about Buying and Selling

What about Fed rates, Chinese ports, and German regulators? | Constant upheaval is mind-boggling | Kurten's surprising discovery | The Grants and Kurten observe the pace of evolution | The Grant-Kurten buy-sell principle | Why and when to sell | A lot has changed in 60 years.

Is that really true?

Chapter 9: The Snail, Speaking of Waiting

Absence of evidence is evidence of absence | Stagnation is the default for businesses | Stock price fluctuations are not a corporate discipline | Capitalize on rare discipline

Chapter 10: The Rabbit and the Welfare

Darwin, the Unrecognized Mathematical Genius | Rabbits Invade Australia | More Reasons We Don't Sell | Answers to Expected Objections

Coming out, the bee speaks of victory

Acknowledgements

Americas

Part 1: Avoiding Major Risks

Part 2: Buying Quality Stocks at Fair Prices

Chapter 1: Pumpkin Bees: A Story of Survival

The two paths before us | The path of evolution | Warren Buffett's two investment principles | Great investors are great rejecters | How we avoid big risks | How will we miss out on Tesla?

Chapter 2: Silver Fox Talks About Stock Selection

So where to start? | Single selection criteria and evolutionary chains | Choosing historical ROCE brings with it many others | There are no guarantees in investing.

Chapter 3: Sea Urchins, Speaking of Resilience

McKinsey's Mystery | Life is Incredibly Resilient | The Evolution of Evolvability | You Have to Be Resilient to Evolve | Leaders Fall from Fail

Chapter 4: Dung Beetles: Corporate Analysis

How vs. Why | Why You Shouldn't Focus on Proximate Causes | The Pain and Benefits of Headlines

Chapter 5: Darwin on Valuation

The Hidden Reason for Their Poor Performance | Thomas Huxley's Lament | The Mystery Hidden in the Peacock's Tail | We Are One | We Study Corporate History | Necessary Conditions Are Not Sufficient

Chapter 6: E. coli, Speaking of Patterns

The Amazing Anole Lizard | Convergent Evolution Is Everywhere | We Don't Invest in Individual Companies | Kahneman's External Perspective and Convergence | Practical Ways to Apply the Principle of Convergence | It's Not as Simple as You Think | Lessons from E. coli

Chapter 7: Guppy Talks Investment Information

The Blessings and Perils of Signals | The Handicap Principle Lights the Way | Dishonest Signals | Honest Signals and How to Interpret Them | Anthony Bolton's Mistake

Part 3: Don't be lazy, be incredibly lazy.

Chapter 8: Finch, Talking about Buying and Selling

What about Fed rates, Chinese ports, and German regulators? | Constant upheaval is mind-boggling | Kurten's surprising discovery | The Grants and Kurten observe the pace of evolution | The Grant-Kurten buy-sell principle | Why and when to sell | A lot has changed in 60 years.

Is that really true?

Chapter 9: The Snail, Speaking of Waiting

Absence of evidence is evidence of absence | Stagnation is the default for businesses | Stock price fluctuations are not a corporate discipline | Capitalize on rare discipline

Chapter 10: The Rabbit and the Welfare

Darwin, the Unrecognized Mathematical Genius | Rabbits Invade Australia | More Reasons We Don't Sell | Answers to Expected Objections

Coming out, the bee speaks of victory

Acknowledgements

Americas

Detailed image

Publisher's Review

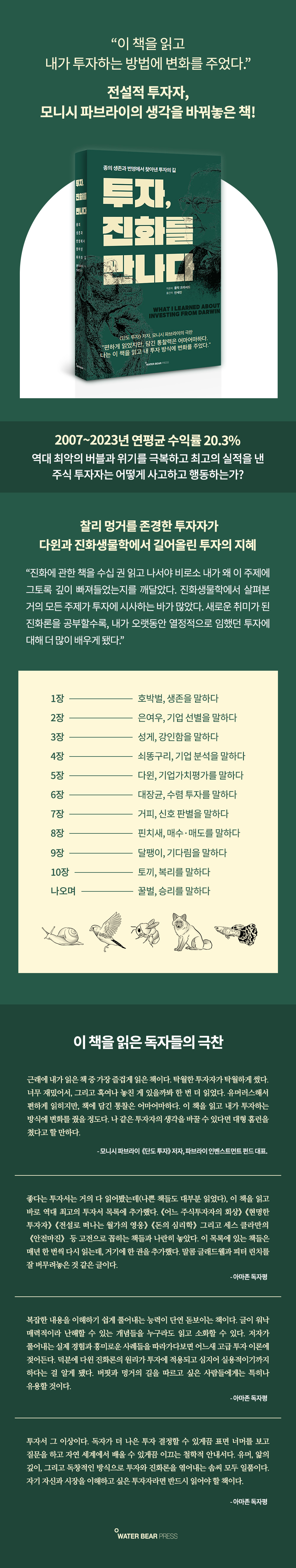

“Reading this book changed the way I invest.”

Legendary investor Mohnish Pabrai's mindset shifts

Mohnish Pabrai, a renowned investment guru, was asked to recommend a book as a final recommendation during a conversation on an investment podcast.

He was also known as a voracious reader, and when asked, he mentioned "Investing Meets Evolution," written by an unfamiliar Indian investor named Pulag Prasad.

It wasn't just a simple recommendation.

“It’s the most enjoyable book I’ve read in a while,” he said. “It’s changed the way I invest.”

Mohnish Pabrai is one of the world's greatest investors, having proven himself with incredible results over the past 25 years, so it was a great compliment to hear that someone's story had changed his investing approach.

“This is the most enjoyable book I’ve read in recent times.

A brilliant investor writes brilliantly.

It was so interesting, I read it again just in case I missed something.

It's humorous and easy to read, but the insights contained in the book are immense.

Reading this book has changed the way I invest.

“If I can change the mindset of investors like me, I’ll have hit a home run.”

Everyone who has read this book has unanimously praised it, calling it "the best investment book I've ever read."

Some noted the author's writing style, saying, "It's like a good mix of Malcolm Gladwell and Peter Lynch," and "It's more than just an investment book.

Some are impressed by the depth of the content, saying, “It is a philosophical guide that leads readers to look beyond the surface, ask questions, and learn from the natural world.”

Even one particle physics doctor confessed, “My hero used to be Einstein, but I wavered on whether I should change it to Darwin.”

Investors who admire Charlie Munger

Finding Investment Insights in Evolutionary Psychology

Who taught the author of this book, who has the inner strength to persuade legendary investors, about investing? One of them was Charlie Munger (and Warren Buffett).

He wanted to learn about Charlie Munger's investments by reading the annual meeting minutes of Wesco Financial, where he was chairman.

Another one, rather unexpectedly, is Darwin and evolutionary biology.

The author was inspired to study Darwin and evolutionary biology by Charlie Munger.

After seeing him recommend Richard Dawkins' The Selfish Gene in the 2000 Wesco Financial Annual Meeting Proceedings, I rushed to the bookstore to buy it. Since then, I have been so engrossed in evolutionary biology that I have read not only popular books but also graduate school textbooks and academic papers.

However, evolutionary biology, which he began reading as a hobby, influenced the author's investments and his entire life.

Investing is a long-term process that takes place over a long period of time, and I came to the conclusion that “evolutionary biology is the epitome of a long-term process.”

“The more I studied evolution, the more I learned about investing, something I've been passionate about for a long time.”

The investment wisdom the author drew from evolution was not complicated.

1) Avoid big risks.

2) Buy quality stocks at reasonable prices.

3) Don't be lazy.

Be incredibly lazy.

There were three of them.

All three of these sentences seem to make little sense.

The first two are too obvious, vague, and outdated to be useful, and the last one goes against common sense in investing.

However, the author examines the preceding two sentences from an evolutionary perspective, giving them new meaning and providing practical investment guidance.

And the last sentence is a persuasive argument that examines the history of evolution and business.

The author founded Nalanda Capital in 2007 based on his investment philosophy and methodology outlined in this book.

He transparently discloses his current portfolio and past purchases and sales on his website, which is proof that he is following the methods outlined in this book.

The fund delivered an average annual return of 20.3% between 2007 and 2023, a period that spanned the worst of the financial crisis and the COVID-19 pandemic.

A wise investor risks his life.

The principles of evolution followed by all surviving species

Professional investors will get upset if you say, “Investors don’t take investing seriously.”

Many people working in the securities industry are extremely busy, have to deal with difficult clients, are frequently on business trips and in meetings, and are under tremendous stress due to concerns about performance.

Yet, the author, who knows all this, says, “The problem with our investment industry is that we don’t take investing seriously.”

Why is that?

Before answering that question, let's take a look at the natural world, where people struggle fiercely to survive and thrive.

How have living things evolved to survive to this day? Let's look at the red deer as an example.

Female deer live in groups called harems, and male deer, armed with large antlers, compete by 'fighting' for exclusive mating rights to a particular harem.

However, these fights rarely escalate into actual physical fights.

The deer first compete for dominance by roaring loudly at each other.

If the opponent still does not back down, it tramples on the surrounding vegetation and shakes its horns to threaten them.

These 'shows' often determine the winner, and only about 5% of stags suffer permanent injuries as a result of actual physical fights during mating season.

Red deer compete in ways that reduce the risk of injury or death, even if it means giving up the sweet opportunity of exclusive mating rights.

This is not just a story about red deer.

Whether you look at the predatory cheetah, the behavior of the bumblebee, or the evolutionary direction of the willow tree, they are all similar.

In the long history of life, there have been few instances where beings that exposed themselves to more risk for greater gain survived and thrived.

Conversely, there are countless examples of people who have achieved remarkable success by giving up potentially sweet opportunities and focusing on avoiding life-threatening risks.

This provides an important lesson for long-term investors.

More important than finding good investments is filtering out bad ones.

That's why Warren Buffett made "never lose money" the first rule of investing.

Investing 'with your life on the line' like living things in the natural world is the basis of successful investing.

Charlie Munger's Insights on Avoiding Tragedy

How to Analyze Investment Information from Goofy

In 2015, Valeant, a pharmaceutical company run by Mike Pearson, attracted a lot of attention.

This was because the market value, which was $5 billion in 2010, grew to nearly $90 billion in just five years through a strategy of acquiring pharmaceutical companies, strictly managing costs, and raising product prices.

Well-known investment firms such as Bill Ackman's Pershing Square, Sequoia, and ValueAct have invested in Valeant and are self-proclaimed fans of Mike Pearson.

But Charlie Munger was the opposite.

He viewed Valeant's business practices of raising prices after acquiring a life-saving drug manufacturer as unethical and predicted that the company would soon fail catastrophically, so Berkshire Hathaway did not invest in Valeant.

In April 2015, Valeant's largest shareholder, Bill Ackman, suggested that Charlie Munger meet with Mike Pearson, but Munger declined.

By mid-2016, Valiant's enterprise value had fallen by 90%.

Bill Ackman lost $3 billion.

Why didn't the experts leading the world's top investment firms see the same problem Munger did?

Biologist Amotz Zahavi's "handicap principle" can help us understand this.

In the natural world, countless signals occur, many of which deceive natural enemies, the opposite sex, or prey for survival and reproduction.

So how can we distinguish between "honest signals" and those that are not? Zahavi argued, through the handicap principle, that if 1) the cost of signal generation is high and an expensive signal does not match a cheap signal, then it is an "honest signal."

For example, the red and colorful patterns of male guppies are an honest signal.

Female guppies are more attracted to male guppies with redder and more colorful patterns, as this red pigment requires a significant amount of other vital resources that poorly nourished male guppies cannot replicate.

The author says this handicap principle is a good criterion for distinguishing which investment information to trust.

Corporate press releases, interviews with executives, and face-to-face meetings with executives are all signs of dishonesty.

This doesn't mean that managers are frauds.

However, it doesn't cost much to write and speak in a way that investors will like.

This is especially true if the management is attractive.

So what are the signals of honesty in the business world? The author suggests past operational and financial performance, as well as industry reputation.

It is easy to write that this level of profit will be made in the future, but it is not easy to produce a record of actually making this level of profit in the past few years.

The reputation of customers or partners who have used a company's products and services is extremely difficult to manipulate these days.

These two are expensive signals to generate.

Bill Ackman believed that he could learn the truth by hearing directly from executives.

Many investors today think similarly.

But the power of a competent and attractive management team is formidable.

You have to recognize that it's a cheap signal and decide not to take it seriously in the first place.

And we need to focus on honest signals.

Charlie Munger's wisdom lies in not responding to Bill Ackman's offer to meet Mike Pearson in person.

The mountains and rivers do not change as much as you think.

The Principles of Stock Selling as Told by Finch and Bear

Back in 2015, the American Enterprise Institute published an article on its website titled:

“The Fortune 500 in 1955 and 2015: Only 12% Remain Thanks to Creative Destruction Driving Economic Prosperity” A comparison of the Fortune 500 companies in 1955 and 2015 showed that only 61 companies (12%) survived in the 60 years, and listed the 61 companies.

This is not surprising.

They say that mountains and rivers change in 10 years, and with 'creative destruction' occurring frequently in modern capitalism, it's only natural that most of the world's best companies would change in 60 years.

The author questions this obvious common sense.

Because this common sense has been broken in evolutionary biology.

Common sense would suggest that if you observe a living organism for a short period of time, less evolution should occur, and if you observe it for a long period of time, more evolution should occur.

However, the opposite is true, according to the research of the Grants and Kurten couples, who studied finches and bears, respectively.

In the short term, many changes occur, but in the long term, as many of these changes are repeated, the number of meaningful changes actually decreases.

Is the corporate world any different? Let's take a closer look at the American Enterprise Institute survey results above.

First of all, 11 companies were omitted from the survey, so the actual number of surviving companies was 72.

And the list of surviving companies does not include acquired companies like Gillette, which is still a strong and performing company despite its acquisition.

Including these companies brings the number of surviving companies to 73.

Of the remaining companies, 63 have gone bankrupt and are now firmly out of business, but there are still some that are still good companies that didn't make the Fortune 500.

An example is the power management company Eaton.

Although it was listed on the Fortune 500 for 58 years before being removed in 2014, it remains an industry leader.

The author estimates that there are approximately 60 to 75 companies that are still considered good companies despite being excluded from the Fortune 500.

Adding all of this together, this means that 40-45% of the 205-220 excellent companies remained excellent companies even after 60 years.

Is this truly such a small number that "selling at the right time" is a wise investment? The author uses various data, including this one, to demonstrate that while many things seem to happen in individual companies and industries over a short period of five years or less, there's little change over a longer period of ten years or more.

So, the argument goes, if you buy the stock of a good company at a reasonable price, it's best to hold it for as long as possible, unless there are signs that the company is going under.

Mohnish Pabrai, one of the world's top investors, admits that this argument, while quite different from his previous thinking, is persuasive and has changed his investment approach.

Cutting through the complex world of investing with simple evolutionary principles.

The Path to Success Learned from Bees

In addition to the stories introduced above, this book weaves together various evolutionary biology studies and business cases across ten chapters, exploring and finding answers to key questions that arise when investing in stocks.

By following fascinating evolutionary biology stories like bumblebees, silver foxes, sea urchins, and viruses, as well as diverse business cases like Toys "R" Us, Walmart, L'Oréal, and IBM, you'll find a way to easily understand investment issues that can sometimes seem too complex.

As you read the book, you will naturally come to understand how to view investing and life from a long-term perspective of 10 years or more, rather than just the few months or years immediately before your eyes.

So this book is both a practical investment book and a philosophical guide.

The book ends with the story of the bees.

How do bees solve the crucial problem of choosing a home? They do it by dancing a figure-eight dance.

After going around to several places, when you find the place you think is the best, you dance hard, and when your colleagues who come to see you dance hard with you as a sign of agreement, the place that gets the most support will be decided naturally.

It is about solving a task that seems complex and difficult by repeating a simple but rational process.

The author says he tries to emulate the life of a bee to achieve successful investing and a happy life.

That is, once you have decided on a reasonable process after much deliberation, you must repeat it faithfully.

And then he says this:

It doesn't take a genius to establish that investing in great management teams running great companies leads to long-term success.

But how many people can put this theory into practice every day, year after year? It is important to find a reasonable and accurate investment theory.

But more important than that is practicing it faithfully every day.

Legendary investor Mohnish Pabrai's mindset shifts

Mohnish Pabrai, a renowned investment guru, was asked to recommend a book as a final recommendation during a conversation on an investment podcast.

He was also known as a voracious reader, and when asked, he mentioned "Investing Meets Evolution," written by an unfamiliar Indian investor named Pulag Prasad.

It wasn't just a simple recommendation.

“It’s the most enjoyable book I’ve read in a while,” he said. “It’s changed the way I invest.”

Mohnish Pabrai is one of the world's greatest investors, having proven himself with incredible results over the past 25 years, so it was a great compliment to hear that someone's story had changed his investing approach.

“This is the most enjoyable book I’ve read in recent times.

A brilliant investor writes brilliantly.

It was so interesting, I read it again just in case I missed something.

It's humorous and easy to read, but the insights contained in the book are immense.

Reading this book has changed the way I invest.

“If I can change the mindset of investors like me, I’ll have hit a home run.”

Everyone who has read this book has unanimously praised it, calling it "the best investment book I've ever read."

Some noted the author's writing style, saying, "It's like a good mix of Malcolm Gladwell and Peter Lynch," and "It's more than just an investment book.

Some are impressed by the depth of the content, saying, “It is a philosophical guide that leads readers to look beyond the surface, ask questions, and learn from the natural world.”

Even one particle physics doctor confessed, “My hero used to be Einstein, but I wavered on whether I should change it to Darwin.”

Investors who admire Charlie Munger

Finding Investment Insights in Evolutionary Psychology

Who taught the author of this book, who has the inner strength to persuade legendary investors, about investing? One of them was Charlie Munger (and Warren Buffett).

He wanted to learn about Charlie Munger's investments by reading the annual meeting minutes of Wesco Financial, where he was chairman.

Another one, rather unexpectedly, is Darwin and evolutionary biology.

The author was inspired to study Darwin and evolutionary biology by Charlie Munger.

After seeing him recommend Richard Dawkins' The Selfish Gene in the 2000 Wesco Financial Annual Meeting Proceedings, I rushed to the bookstore to buy it. Since then, I have been so engrossed in evolutionary biology that I have read not only popular books but also graduate school textbooks and academic papers.

However, evolutionary biology, which he began reading as a hobby, influenced the author's investments and his entire life.

Investing is a long-term process that takes place over a long period of time, and I came to the conclusion that “evolutionary biology is the epitome of a long-term process.”

“The more I studied evolution, the more I learned about investing, something I've been passionate about for a long time.”

The investment wisdom the author drew from evolution was not complicated.

1) Avoid big risks.

2) Buy quality stocks at reasonable prices.

3) Don't be lazy.

Be incredibly lazy.

There were three of them.

All three of these sentences seem to make little sense.

The first two are too obvious, vague, and outdated to be useful, and the last one goes against common sense in investing.

However, the author examines the preceding two sentences from an evolutionary perspective, giving them new meaning and providing practical investment guidance.

And the last sentence is a persuasive argument that examines the history of evolution and business.

The author founded Nalanda Capital in 2007 based on his investment philosophy and methodology outlined in this book.

He transparently discloses his current portfolio and past purchases and sales on his website, which is proof that he is following the methods outlined in this book.

The fund delivered an average annual return of 20.3% between 2007 and 2023, a period that spanned the worst of the financial crisis and the COVID-19 pandemic.

A wise investor risks his life.

The principles of evolution followed by all surviving species

Professional investors will get upset if you say, “Investors don’t take investing seriously.”

Many people working in the securities industry are extremely busy, have to deal with difficult clients, are frequently on business trips and in meetings, and are under tremendous stress due to concerns about performance.

Yet, the author, who knows all this, says, “The problem with our investment industry is that we don’t take investing seriously.”

Why is that?

Before answering that question, let's take a look at the natural world, where people struggle fiercely to survive and thrive.

How have living things evolved to survive to this day? Let's look at the red deer as an example.

Female deer live in groups called harems, and male deer, armed with large antlers, compete by 'fighting' for exclusive mating rights to a particular harem.

However, these fights rarely escalate into actual physical fights.

The deer first compete for dominance by roaring loudly at each other.

If the opponent still does not back down, it tramples on the surrounding vegetation and shakes its horns to threaten them.

These 'shows' often determine the winner, and only about 5% of stags suffer permanent injuries as a result of actual physical fights during mating season.

Red deer compete in ways that reduce the risk of injury or death, even if it means giving up the sweet opportunity of exclusive mating rights.

This is not just a story about red deer.

Whether you look at the predatory cheetah, the behavior of the bumblebee, or the evolutionary direction of the willow tree, they are all similar.

In the long history of life, there have been few instances where beings that exposed themselves to more risk for greater gain survived and thrived.

Conversely, there are countless examples of people who have achieved remarkable success by giving up potentially sweet opportunities and focusing on avoiding life-threatening risks.

This provides an important lesson for long-term investors.

More important than finding good investments is filtering out bad ones.

That's why Warren Buffett made "never lose money" the first rule of investing.

Investing 'with your life on the line' like living things in the natural world is the basis of successful investing.

Charlie Munger's Insights on Avoiding Tragedy

How to Analyze Investment Information from Goofy

In 2015, Valeant, a pharmaceutical company run by Mike Pearson, attracted a lot of attention.

This was because the market value, which was $5 billion in 2010, grew to nearly $90 billion in just five years through a strategy of acquiring pharmaceutical companies, strictly managing costs, and raising product prices.

Well-known investment firms such as Bill Ackman's Pershing Square, Sequoia, and ValueAct have invested in Valeant and are self-proclaimed fans of Mike Pearson.

But Charlie Munger was the opposite.

He viewed Valeant's business practices of raising prices after acquiring a life-saving drug manufacturer as unethical and predicted that the company would soon fail catastrophically, so Berkshire Hathaway did not invest in Valeant.

In April 2015, Valeant's largest shareholder, Bill Ackman, suggested that Charlie Munger meet with Mike Pearson, but Munger declined.

By mid-2016, Valiant's enterprise value had fallen by 90%.

Bill Ackman lost $3 billion.

Why didn't the experts leading the world's top investment firms see the same problem Munger did?

Biologist Amotz Zahavi's "handicap principle" can help us understand this.

In the natural world, countless signals occur, many of which deceive natural enemies, the opposite sex, or prey for survival and reproduction.

So how can we distinguish between "honest signals" and those that are not? Zahavi argued, through the handicap principle, that if 1) the cost of signal generation is high and an expensive signal does not match a cheap signal, then it is an "honest signal."

For example, the red and colorful patterns of male guppies are an honest signal.

Female guppies are more attracted to male guppies with redder and more colorful patterns, as this red pigment requires a significant amount of other vital resources that poorly nourished male guppies cannot replicate.

The author says this handicap principle is a good criterion for distinguishing which investment information to trust.

Corporate press releases, interviews with executives, and face-to-face meetings with executives are all signs of dishonesty.

This doesn't mean that managers are frauds.

However, it doesn't cost much to write and speak in a way that investors will like.

This is especially true if the management is attractive.

So what are the signals of honesty in the business world? The author suggests past operational and financial performance, as well as industry reputation.

It is easy to write that this level of profit will be made in the future, but it is not easy to produce a record of actually making this level of profit in the past few years.

The reputation of customers or partners who have used a company's products and services is extremely difficult to manipulate these days.

These two are expensive signals to generate.

Bill Ackman believed that he could learn the truth by hearing directly from executives.

Many investors today think similarly.

But the power of a competent and attractive management team is formidable.

You have to recognize that it's a cheap signal and decide not to take it seriously in the first place.

And we need to focus on honest signals.

Charlie Munger's wisdom lies in not responding to Bill Ackman's offer to meet Mike Pearson in person.

The mountains and rivers do not change as much as you think.

The Principles of Stock Selling as Told by Finch and Bear

Back in 2015, the American Enterprise Institute published an article on its website titled:

“The Fortune 500 in 1955 and 2015: Only 12% Remain Thanks to Creative Destruction Driving Economic Prosperity” A comparison of the Fortune 500 companies in 1955 and 2015 showed that only 61 companies (12%) survived in the 60 years, and listed the 61 companies.

This is not surprising.

They say that mountains and rivers change in 10 years, and with 'creative destruction' occurring frequently in modern capitalism, it's only natural that most of the world's best companies would change in 60 years.

The author questions this obvious common sense.

Because this common sense has been broken in evolutionary biology.

Common sense would suggest that if you observe a living organism for a short period of time, less evolution should occur, and if you observe it for a long period of time, more evolution should occur.

However, the opposite is true, according to the research of the Grants and Kurten couples, who studied finches and bears, respectively.

In the short term, many changes occur, but in the long term, as many of these changes are repeated, the number of meaningful changes actually decreases.

Is the corporate world any different? Let's take a closer look at the American Enterprise Institute survey results above.

First of all, 11 companies were omitted from the survey, so the actual number of surviving companies was 72.

And the list of surviving companies does not include acquired companies like Gillette, which is still a strong and performing company despite its acquisition.

Including these companies brings the number of surviving companies to 73.

Of the remaining companies, 63 have gone bankrupt and are now firmly out of business, but there are still some that are still good companies that didn't make the Fortune 500.

An example is the power management company Eaton.

Although it was listed on the Fortune 500 for 58 years before being removed in 2014, it remains an industry leader.

The author estimates that there are approximately 60 to 75 companies that are still considered good companies despite being excluded from the Fortune 500.

Adding all of this together, this means that 40-45% of the 205-220 excellent companies remained excellent companies even after 60 years.

Is this truly such a small number that "selling at the right time" is a wise investment? The author uses various data, including this one, to demonstrate that while many things seem to happen in individual companies and industries over a short period of five years or less, there's little change over a longer period of ten years or more.

So, the argument goes, if you buy the stock of a good company at a reasonable price, it's best to hold it for as long as possible, unless there are signs that the company is going under.

Mohnish Pabrai, one of the world's top investors, admits that this argument, while quite different from his previous thinking, is persuasive and has changed his investment approach.

Cutting through the complex world of investing with simple evolutionary principles.

The Path to Success Learned from Bees

In addition to the stories introduced above, this book weaves together various evolutionary biology studies and business cases across ten chapters, exploring and finding answers to key questions that arise when investing in stocks.

By following fascinating evolutionary biology stories like bumblebees, silver foxes, sea urchins, and viruses, as well as diverse business cases like Toys "R" Us, Walmart, L'Oréal, and IBM, you'll find a way to easily understand investment issues that can sometimes seem too complex.

As you read the book, you will naturally come to understand how to view investing and life from a long-term perspective of 10 years or more, rather than just the few months or years immediately before your eyes.

So this book is both a practical investment book and a philosophical guide.

The book ends with the story of the bees.

How do bees solve the crucial problem of choosing a home? They do it by dancing a figure-eight dance.

After going around to several places, when you find the place you think is the best, you dance hard, and when your colleagues who come to see you dance hard with you as a sign of agreement, the place that gets the most support will be decided naturally.

It is about solving a task that seems complex and difficult by repeating a simple but rational process.

The author says he tries to emulate the life of a bee to achieve successful investing and a happy life.

That is, once you have decided on a reasonable process after much deliberation, you must repeat it faithfully.

And then he says this:

It doesn't take a genius to establish that investing in great management teams running great companies leads to long-term success.

But how many people can put this theory into practice every day, year after year? It is important to find a reasonable and accurate investment theory.

But more important than that is practicing it faithfully every day.

GOODS SPECIFICS

- Date of issue: February 10, 2025

- Page count, weight, size: 560 pages | 638g | 140*220*26mm

- ISBN13: 9791191484304

- ISBN10: 1191484300

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)