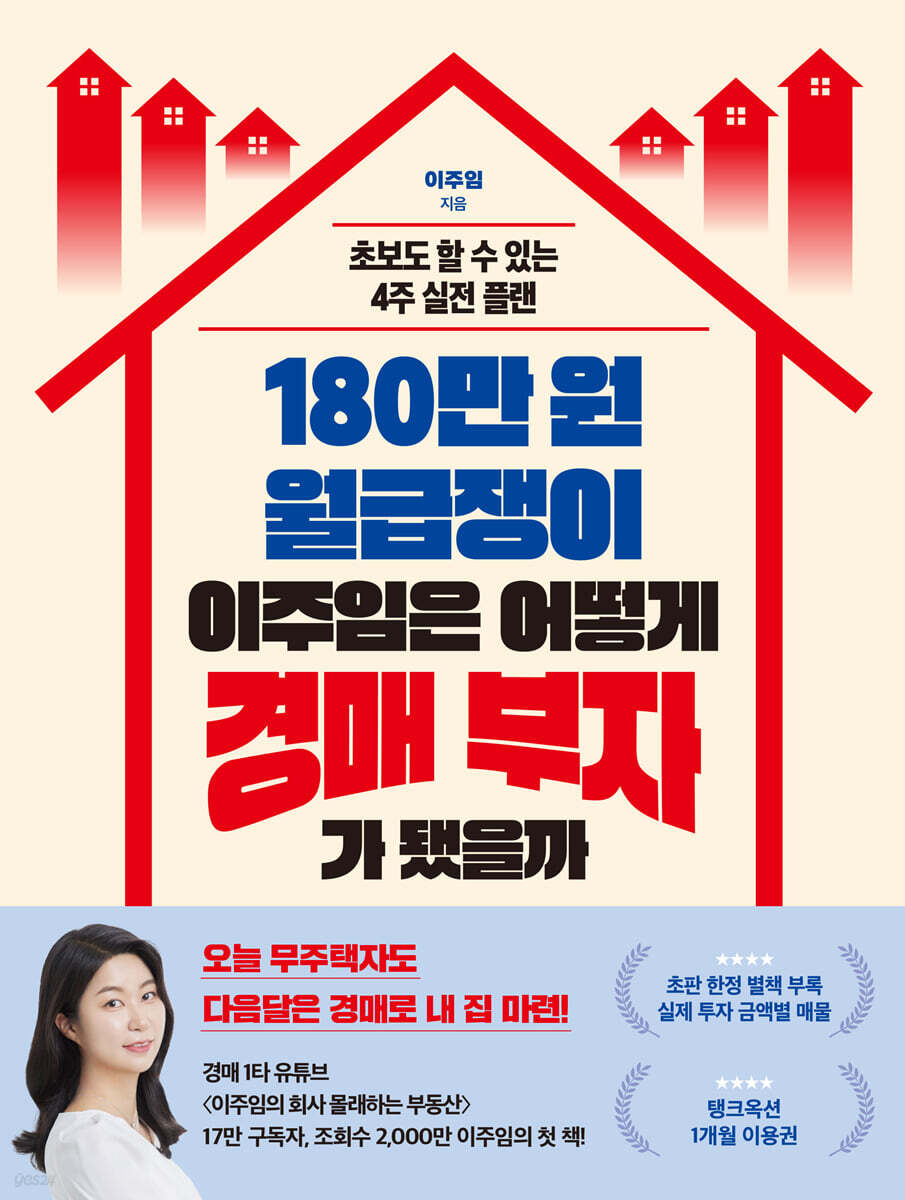

How did Lee Ju-im, a 1.8 million won salaryman, become a millionaire through auctions?

|

Description

Book Introduction

South Korea's No. 1 Auction YouTube Channel "Lee Ju-im's Secret Real Estate Deal"

170,000 subscribers, 20 million views, Lee Ju-im's first book!

Starting from a monthly salary of 1.8 million won and owning 13 houses

How to auction and make a profit

A broke 20-something, graduated from a local university, earning 1.8 million won a month.

The author started out in society with disadvantages in making money, let alone good 'specs'.

“If I save my entire salary like this, will I ever be able to own a house of my own?” Faced with this question, the author needed a new breakthrough and found the answer in auctions.

He has accumulated assets by winning the bids for houses one by one at auctions, and now owns 13 houses.

How is this possible? Through her channel, "Lee Joo-im's Secret Real Estate," author Lee Joo-im shares her experiences of accumulating assets and the trials and errors she faced, making auctions easier to understand for those just starting out in real estate. Each video garnered an explosive response, garnering over a million views.

He has surpassed 100,000 subscribers in just one year and is currently approaching 180,000, growing into the best auction YouTuber in Korea.

This book contains the author's success stories, know-how, and investment methods not revealed on YouTube or in previous lectures.

The author strongly believes that those who are new to real estate, or who know the importance of financial investment but lack the courage to take the plunge, should first consider auctions.

To make auctions easily accessible to beginner investors, we explain auction terminology and rights analysis, and explain the investment process in four weeks to reduce trial and error and increase the probability of success.

It covers the entire auction process from start to finish, detailing how to secure your own home and how to profit from price differences through short-term trading.

170,000 subscribers, 20 million views, Lee Ju-im's first book!

Starting from a monthly salary of 1.8 million won and owning 13 houses

How to auction and make a profit

A broke 20-something, graduated from a local university, earning 1.8 million won a month.

The author started out in society with disadvantages in making money, let alone good 'specs'.

“If I save my entire salary like this, will I ever be able to own a house of my own?” Faced with this question, the author needed a new breakthrough and found the answer in auctions.

He has accumulated assets by winning the bids for houses one by one at auctions, and now owns 13 houses.

How is this possible? Through her channel, "Lee Joo-im's Secret Real Estate," author Lee Joo-im shares her experiences of accumulating assets and the trials and errors she faced, making auctions easier to understand for those just starting out in real estate. Each video garnered an explosive response, garnering over a million views.

He has surpassed 100,000 subscribers in just one year and is currently approaching 180,000, growing into the best auction YouTuber in Korea.

This book contains the author's success stories, know-how, and investment methods not revealed on YouTube or in previous lectures.

The author strongly believes that those who are new to real estate, or who know the importance of financial investment but lack the courage to take the plunge, should first consider auctions.

To make auctions easily accessible to beginner investors, we explain auction terminology and rights analysis, and explain the investment process in four weeks to reduce trial and error and increase the probability of success.

It covers the entire auction process from start to finish, detailing how to secure your own home and how to profit from price differences through short-term trading.

- You can preview some of the book's contents.

Preview

index

To begin with: A crisis for some, an opportunity for others

Part 1 [Concept] Auction Started with a Monthly Salary of 1.8 Million Won

Chapter 1: Why Auctions Are a Must for Real Estate Beginners

01.

Start auctioning in your 20s

02.

How did a salaried worker earning 1.8 million won invest?

03.

The power of auctions that are cheaper than quick sales

04.

Learn more about auctions

05.

Auction Cycle at a Glance

★ Auction terms to know in advance

Part 2 [Basics] The Time When Complex Auctions Become Easy

Chapter 2 (Week 1) Searching for Items and Calculating Bids

01.

How much do I need to start an auction?

02.

How to find auction items quickly and easily

03.

Three prices to consider when calculating your bid

04.

The bid price is lower than the quick sale price

★ Week 1 Summary

Chapter 3 (Week 2) Even a complete beginner in auctions can master rights analysis in just one week.

01.

Rights Analysis: The Key to Success or Failure in Auction Investments

02.

Finding the right to cancellation based on the certificate of registration details

03.

Analysis of rights when there is a tenant

04.

The most important document in rights analysis is the 'Sale Item Specification'.

05.

Order of distribution by creditor

06.

Distribution to small tenants

07.

Property for which the Housing and Urban Guarantee Corporation has given up its right to object

08.

Understanding the current tax without any obstacles

09.

Complete rights analysis in 10 seconds

★ Week 2 Summary

Part 3 [Practical] A 2-Week Strategy to Increase Your Success Rate

Chapter 4 (Week 3) When you go to the forest, just remember this.

01.

Apartment and Villa Auctions: From Environmental Analysis to Brightness Hints

02.

To preview the inside of the house

03.

Redevelopment/Reconstruction Auction Items: Additional Contributions and Violation of Building Regulations

★ Week 3 Summary

Chapter 5 (Week 4) How to Make Bidding and Bid Equal

01.

From arrival at the auction court to submission of bid envelope

02.

How to write a bid form and what to prepare for bidding

03.

The moment of winning the bid has finally arrived

04.

Is brightness really that difficult?

05.

Method of eviction based on the tenant's resistance

06.

Application for extradition order, application for compulsory execution, and compulsory execution

★ Week 4 Summary

Part 4 [Usage] Auction Formula for Changing the Size of Wealth

Chapter 6: How to Make Money as Fast as Possible

01.

Increase the value of your home with just the interior design

02.

Get the brokerage manager on your side

03.

Various ways to increase profits after winning an auction

04.

Make a profit from an item that has been accepted by the successful bidder

supplement.

Answers to your concerns for successful investing

In conclusion: The auction should start as soon as possible.

Part 1 [Concept] Auction Started with a Monthly Salary of 1.8 Million Won

Chapter 1: Why Auctions Are a Must for Real Estate Beginners

01.

Start auctioning in your 20s

02.

How did a salaried worker earning 1.8 million won invest?

03.

The power of auctions that are cheaper than quick sales

04.

Learn more about auctions

05.

Auction Cycle at a Glance

★ Auction terms to know in advance

Part 2 [Basics] The Time When Complex Auctions Become Easy

Chapter 2 (Week 1) Searching for Items and Calculating Bids

01.

How much do I need to start an auction?

02.

How to find auction items quickly and easily

03.

Three prices to consider when calculating your bid

04.

The bid price is lower than the quick sale price

★ Week 1 Summary

Chapter 3 (Week 2) Even a complete beginner in auctions can master rights analysis in just one week.

01.

Rights Analysis: The Key to Success or Failure in Auction Investments

02.

Finding the right to cancellation based on the certificate of registration details

03.

Analysis of rights when there is a tenant

04.

The most important document in rights analysis is the 'Sale Item Specification'.

05.

Order of distribution by creditor

06.

Distribution to small tenants

07.

Property for which the Housing and Urban Guarantee Corporation has given up its right to object

08.

Understanding the current tax without any obstacles

09.

Complete rights analysis in 10 seconds

★ Week 2 Summary

Part 3 [Practical] A 2-Week Strategy to Increase Your Success Rate

Chapter 4 (Week 3) When you go to the forest, just remember this.

01.

Apartment and Villa Auctions: From Environmental Analysis to Brightness Hints

02.

To preview the inside of the house

03.

Redevelopment/Reconstruction Auction Items: Additional Contributions and Violation of Building Regulations

★ Week 3 Summary

Chapter 5 (Week 4) How to Make Bidding and Bid Equal

01.

From arrival at the auction court to submission of bid envelope

02.

How to write a bid form and what to prepare for bidding

03.

The moment of winning the bid has finally arrived

04.

Is brightness really that difficult?

05.

Method of eviction based on the tenant's resistance

06.

Application for extradition order, application for compulsory execution, and compulsory execution

★ Week 4 Summary

Part 4 [Usage] Auction Formula for Changing the Size of Wealth

Chapter 6: How to Make Money as Fast as Possible

01.

Increase the value of your home with just the interior design

02.

Get the brokerage manager on your side

03.

Various ways to increase profits after winning an auction

04.

Make a profit from an item that has been accepted by the successful bidder

supplement.

Answers to your concerns for successful investing

In conclusion: The auction should start as soon as possible.

Detailed image

Into the book

When I went to the forest to check the market price before bidding on this villa, the real estate agent said that it could be sold for 160 million won.

That's why I bid.

After finishing the search, I went back to the real estate agency that had kindly answered my questions.

Last time, I told the owner, “I’ll win the bid!” and left, but this time, I went in saying, “I won the bid!”

He congratulated me sincerely.

The owner said the market price was 160 million won, but when I looked it up online, I found that 170 million won would be a good price.

So I asked the manager to list the property for 170 million won.

But a month has passed and there has been no news.

The customer said he came and went several times, but no one asked to write a contract.

So, I asked for the manager's understanding in advance and told him that I would distribute the property to other brokerage offices as well.

The place where the contract was finally signed was the first place where I had offered it to alone, and the sales contract was drawn up after 4 months.

--- From "Chapter 1: Starting Auctions in Your 20s"

Typical costs include acquisition tax, registration fee, legal fee, title fee, interior design fee, transfer tax, and brokerage fee.

Acquisition tax is levied at 1-3%, 8%, or 12% depending on the number of houses.

Registration fees and legal fees vary depending on the successful bid amount, title fees vary depending on how the title process is conducted, and interior design fees vary depending on the condition of the house.

And the transfer tax is legally set at a certain amount depending on how much profit was made and the brokerage fee is set at what price it was sold for.

Let me introduce a case study from a student.

This student won the bid for a villa in Seoul for 180 million won just 10 days after starting the study.

And as soon as I paid the balance, I wrote up a sales contract, and the selling price was 220 million won.

In other words, the transfer amount (selling price - buying price) is 40 million won.

Let's look at net profit.

Acquisition tax was 1.98 million won, registration fee and legal fee were approximately 1 million won, interior design fee was 1 million won, transfer tax was 4.74 million won, and brokerage fee was 880,000 won when selling.

So the final profit is 30.4 million won.

Since it was an empty house, there was no separate cost for lighting, and since the house was clean, only the painting was done, so the interior design cost was relatively low.

This is a case where a short-term sale was planned from the beginning, the costs were roughly calculated, and the bid was strategically won.

--- From "Chapter 2 (Week 1) Searching for Items and Calculating Bid Prices"

When you start investing in real estate, one thing you can't skip is forestry.

However, the method of investing is slightly different depending on what kind of item you are investing in and what kind of plan you have.

For example, if you're looking for an undervalued apartment for a long-term investment, you'll need to explore all the areas you're interested in.

If you are interested in area A, go to areas B and C, which have similar price ranges, and find out the characteristics of the most expensive apartments.

Most will have good school districts, be close to subway stations, or be in newer apartments, but you may also find other advantages.

Based on that information, we find apartments with similar characteristics in Area A.

If an apartment has the characteristics of a B or C area apartment but is cheaper, it can be judged that the apartment in area A is still undervalued.

Long-term apartment investment is done by finding things like this.

--- From "Chapter 4 (Week 3) When you go to the forest, just remember this"

The more you know about loans, the better.

Auction balance loans are mainly provided by secondary financial institutions, but it is not the case that primary financial institutions do not handle them at all, so visit as many primary and secondary financial institutions as possible to find out more.

Loan limits and interest rates vary slightly from bank to bank, so you can choose a loan product that suits your situation.

If you have a small amount of actual investment, a product with a higher interest rate but with a higher loan amount would be better. If you have a certain amount of investment, a product with a lower interest rate would be more advantageous.

And if you are planning to sell in the short term or pay the balance and then immediately rent it out, you should also check whether there is a prepayment fee as you will have to repay the principal 3-4 months after receiving the loan.

--- From "Chapter 5 (Week 4) How to Make Bidding and Blindness Equal"

This is the case of a student in his 60s who won the bid for a villa in Gyeonggi-do.

It was sold for 158.99 million won after being sold for 192 million won after interior decoration, making a profit of approximately 30 million won.

This house was also a mess when I checked inside after the light was turned on, to the point where I wondered how anyone could live there.

When seeing a scene like this, the successful bidder becomes worried and thinks, 'Oh, I think I made a mistake in bidding.'

But this house that was in such a mess became a new house after being repaired and decorated.

And as soon as the repairs are done, we can find a tenant, recover our investment, and invest in the next auction property.

--- From "Chapter 6: How to Make Money as Fast as Possible"

The third case is a villa in Guro-gu, Seoul.

The student who won the bid for this villa initially planned to bid on a villa that was close to a subway station and built less than 10 years ago.

However, since it was a good property in anyone's eyes, the competition seemed fierce and the winning bid seemed to be high, so I happened to find this villa while looking at properties being held at the same court on the same day and placed a bid.

The villa I was initially planning to bid on was similar in age to the one I was looking to buy, but it had the disadvantage of being far from the subway station.

Instead, there was a bus stop right in front.

The student who won the bid for 180.1 million won stopped by the brokerage office first, and the manager said that a buyer was waiting.

So, after the transfer of ownership, we made simple repairs to the interior of the house and immediately signed a sales contract for 220 million won.

The difference was about 40 million won, and the net profit was 27 million won.

That's why I bid.

After finishing the search, I went back to the real estate agency that had kindly answered my questions.

Last time, I told the owner, “I’ll win the bid!” and left, but this time, I went in saying, “I won the bid!”

He congratulated me sincerely.

The owner said the market price was 160 million won, but when I looked it up online, I found that 170 million won would be a good price.

So I asked the manager to list the property for 170 million won.

But a month has passed and there has been no news.

The customer said he came and went several times, but no one asked to write a contract.

So, I asked for the manager's understanding in advance and told him that I would distribute the property to other brokerage offices as well.

The place where the contract was finally signed was the first place where I had offered it to alone, and the sales contract was drawn up after 4 months.

--- From "Chapter 1: Starting Auctions in Your 20s"

Typical costs include acquisition tax, registration fee, legal fee, title fee, interior design fee, transfer tax, and brokerage fee.

Acquisition tax is levied at 1-3%, 8%, or 12% depending on the number of houses.

Registration fees and legal fees vary depending on the successful bid amount, title fees vary depending on how the title process is conducted, and interior design fees vary depending on the condition of the house.

And the transfer tax is legally set at a certain amount depending on how much profit was made and the brokerage fee is set at what price it was sold for.

Let me introduce a case study from a student.

This student won the bid for a villa in Seoul for 180 million won just 10 days after starting the study.

And as soon as I paid the balance, I wrote up a sales contract, and the selling price was 220 million won.

In other words, the transfer amount (selling price - buying price) is 40 million won.

Let's look at net profit.

Acquisition tax was 1.98 million won, registration fee and legal fee were approximately 1 million won, interior design fee was 1 million won, transfer tax was 4.74 million won, and brokerage fee was 880,000 won when selling.

So the final profit is 30.4 million won.

Since it was an empty house, there was no separate cost for lighting, and since the house was clean, only the painting was done, so the interior design cost was relatively low.

This is a case where a short-term sale was planned from the beginning, the costs were roughly calculated, and the bid was strategically won.

--- From "Chapter 2 (Week 1) Searching for Items and Calculating Bid Prices"

When you start investing in real estate, one thing you can't skip is forestry.

However, the method of investing is slightly different depending on what kind of item you are investing in and what kind of plan you have.

For example, if you're looking for an undervalued apartment for a long-term investment, you'll need to explore all the areas you're interested in.

If you are interested in area A, go to areas B and C, which have similar price ranges, and find out the characteristics of the most expensive apartments.

Most will have good school districts, be close to subway stations, or be in newer apartments, but you may also find other advantages.

Based on that information, we find apartments with similar characteristics in Area A.

If an apartment has the characteristics of a B or C area apartment but is cheaper, it can be judged that the apartment in area A is still undervalued.

Long-term apartment investment is done by finding things like this.

--- From "Chapter 4 (Week 3) When you go to the forest, just remember this"

The more you know about loans, the better.

Auction balance loans are mainly provided by secondary financial institutions, but it is not the case that primary financial institutions do not handle them at all, so visit as many primary and secondary financial institutions as possible to find out more.

Loan limits and interest rates vary slightly from bank to bank, so you can choose a loan product that suits your situation.

If you have a small amount of actual investment, a product with a higher interest rate but with a higher loan amount would be better. If you have a certain amount of investment, a product with a lower interest rate would be more advantageous.

And if you are planning to sell in the short term or pay the balance and then immediately rent it out, you should also check whether there is a prepayment fee as you will have to repay the principal 3-4 months after receiving the loan.

--- From "Chapter 5 (Week 4) How to Make Bidding and Blindness Equal"

This is the case of a student in his 60s who won the bid for a villa in Gyeonggi-do.

It was sold for 158.99 million won after being sold for 192 million won after interior decoration, making a profit of approximately 30 million won.

This house was also a mess when I checked inside after the light was turned on, to the point where I wondered how anyone could live there.

When seeing a scene like this, the successful bidder becomes worried and thinks, 'Oh, I think I made a mistake in bidding.'

But this house that was in such a mess became a new house after being repaired and decorated.

And as soon as the repairs are done, we can find a tenant, recover our investment, and invest in the next auction property.

--- From "Chapter 6: How to Make Money as Fast as Possible"

The third case is a villa in Guro-gu, Seoul.

The student who won the bid for this villa initially planned to bid on a villa that was close to a subway station and built less than 10 years ago.

However, since it was a good property in anyone's eyes, the competition seemed fierce and the winning bid seemed to be high, so I happened to find this villa while looking at properties being held at the same court on the same day and placed a bid.

The villa I was initially planning to bid on was similar in age to the one I was looking to buy, but it had the disadvantage of being far from the subway station.

Instead, there was a bus stop right in front.

The student who won the bid for 180.1 million won stopped by the brokerage office first, and the manager said that a buyer was waiting.

So, after the transfer of ownership, we made simple repairs to the interior of the house and immediately signed a sales contract for 220 million won.

The difference was about 40 million won, and the net profit was 27 million won.

--- From "Chapter 6: How to Make Money as Fast as Possible"

Publisher's Review

Today I'm homeless, but next month I'll have a house through an auction.

Master Auctions with a 4-Week Practical Plan

Real estate investors are naturally interested in auctions, but more often than not, they are afraid to get started.

It is not easy to readily participate in an auction due to the burden of having to drag someone out, the anxiety that the house being auctioned will not be in good condition, and the fear that if you win the bid hastily, it may be sold for more than the market price.

However, the author makes a somewhat provocative suggestion to readers who are new to real estate: start with auctions.

This is because the relevant laws rarely change, and if you know the right method, you can buy a house for less than a quick sale.

In fact, she also purchased several houses starting from auctions, even though she only received a monthly salary of 1.8 million won, and she wrote about her experiences and know-how in this book.

Part 1 covers the basics of auctions and the mindset beginners should have.

The author helps readers overcome their fear of auctions by sharing examples ranging from their first experience bidding to successfully negotiating with tenants and finalizing the contract after winning the bid.

This article demonstrates that by properly utilizing the characteristics of auctions, which are often put up for sale due to financial difficulties, it can provide an opportunity to purchase a home at a lower price than a quick sale, and convinces even beginner investors that it is a realistic and safe method.

Parts 2 and 3 present a step-by-step practical method through a 4-week practical plan so that even beginners in auctions can buy a house within a month.

The first week covers how to search for auction items and calculate bid prices, while the second week covers how to analyze rights and determine the legal status of an item.

Specifically, you'll learn how to use free and paid sites to obtain auction information, strategies for setting bids lower than the asking price, and pricing criteria to consider when bidding.

The third and fourth weeks cover various situations and problems that may arise at auction sites.

It explains in detail situations that you may encounter in real life, such as things to look out for during the forestry process, how to achieve smooth lighting, and a step-by-step process for profiting from the difference in market price after the auction.

A compilation of various success stories and profit-making methods.

A Profitable Investment Book for Auction Beginners

The final part 4 covers how to maximize your profits by leveraging the properties you win.

The author goes beyond simply achieving a successful auction, and presents specific strategies for increasing the value of a home through interior design and completing a sale in a short period of time.

There are also ways to generate rental income or make additional profits through resale.

The author's case studies of how he transformed run-down homes into profitable assets at minimal cost, and those of people from young adults to those preparing for retirement, are invaluable in providing a glimpse into the potential of auctions.

The positions of the working moms, students preparing for retirement, and young adults appearing in this book are not much different from those of the readers.

And when you see how they make small profits, you will realize that even a beginner in real estate can do it if they know how.

For those who are afraid to start investing, and for those who dream of investing but are hesitant to take the first step, this book will provide powerful motivation and practical guidance.

It is not simply a success story, but the process of growth through trial and error itself will be a great inspiration to readers.

Master Auctions with a 4-Week Practical Plan

Real estate investors are naturally interested in auctions, but more often than not, they are afraid to get started.

It is not easy to readily participate in an auction due to the burden of having to drag someone out, the anxiety that the house being auctioned will not be in good condition, and the fear that if you win the bid hastily, it may be sold for more than the market price.

However, the author makes a somewhat provocative suggestion to readers who are new to real estate: start with auctions.

This is because the relevant laws rarely change, and if you know the right method, you can buy a house for less than a quick sale.

In fact, she also purchased several houses starting from auctions, even though she only received a monthly salary of 1.8 million won, and she wrote about her experiences and know-how in this book.

Part 1 covers the basics of auctions and the mindset beginners should have.

The author helps readers overcome their fear of auctions by sharing examples ranging from their first experience bidding to successfully negotiating with tenants and finalizing the contract after winning the bid.

This article demonstrates that by properly utilizing the characteristics of auctions, which are often put up for sale due to financial difficulties, it can provide an opportunity to purchase a home at a lower price than a quick sale, and convinces even beginner investors that it is a realistic and safe method.

Parts 2 and 3 present a step-by-step practical method through a 4-week practical plan so that even beginners in auctions can buy a house within a month.

The first week covers how to search for auction items and calculate bid prices, while the second week covers how to analyze rights and determine the legal status of an item.

Specifically, you'll learn how to use free and paid sites to obtain auction information, strategies for setting bids lower than the asking price, and pricing criteria to consider when bidding.

The third and fourth weeks cover various situations and problems that may arise at auction sites.

It explains in detail situations that you may encounter in real life, such as things to look out for during the forestry process, how to achieve smooth lighting, and a step-by-step process for profiting from the difference in market price after the auction.

A compilation of various success stories and profit-making methods.

A Profitable Investment Book for Auction Beginners

The final part 4 covers how to maximize your profits by leveraging the properties you win.

The author goes beyond simply achieving a successful auction, and presents specific strategies for increasing the value of a home through interior design and completing a sale in a short period of time.

There are also ways to generate rental income or make additional profits through resale.

The author's case studies of how he transformed run-down homes into profitable assets at minimal cost, and those of people from young adults to those preparing for retirement, are invaluable in providing a glimpse into the potential of auctions.

The positions of the working moms, students preparing for retirement, and young adults appearing in this book are not much different from those of the readers.

And when you see how they make small profits, you will realize that even a beginner in real estate can do it if they know how.

For those who are afraid to start investing, and for those who dream of investing but are hesitant to take the first step, this book will provide powerful motivation and practical guidance.

It is not simply a success story, but the process of growth through trial and error itself will be a great inspiration to readers.

GOODS SPECIFICS

- Date of issue: January 24, 2025

- Page count, weight, size: 308 pages | 700g | 170*225*20mm

- ISBN13: 9788947549943

- ISBN10: 8947549940

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)