The pulse of the new chart

|

Description

Book Introduction

No. 1 in stock chart analysis

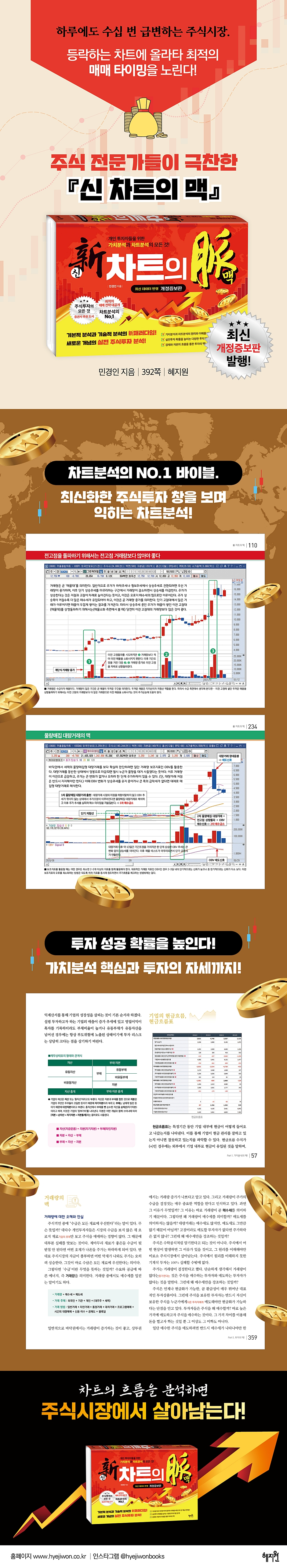

The book "The Pulse of the New Chart," highly praised by stock experts, has been revised and expanded for the first time in eight years!

With many people taking a keen interest in stock investment following the COVID-19 pandemic, "The Pulse of the New Chart," which became a reverse bestseller, has returned with the latest chart data.

Along with the growing interest in stock investment, 『The Pulse of the New Chart』, which has received rave reviews from many experts for accurately grasping the core of value analysis and chart analysis, covers everything about chart analysis.

Based on the latest stock chart windows of various companies, we will carefully explain the secrets to timing your purchases by looking back at the chart flow.

In addition, it explains only the core of value analysis, an important element in stock investment along with chart analysis, and also touches on the secrets of rapidly rising stocks, secrets for day traders, and the fundamentals of investment.

This is a must-read for beginners in the stock market, and for intermediate and advanced investors, it will broaden their perspective on existing stock investments.

The book "The Pulse of the New Chart," highly praised by stock experts, has been revised and expanded for the first time in eight years!

With many people taking a keen interest in stock investment following the COVID-19 pandemic, "The Pulse of the New Chart," which became a reverse bestseller, has returned with the latest chart data.

Along with the growing interest in stock investment, 『The Pulse of the New Chart』, which has received rave reviews from many experts for accurately grasping the core of value analysis and chart analysis, covers everything about chart analysis.

Based on the latest stock chart windows of various companies, we will carefully explain the secrets to timing your purchases by looking back at the chart flow.

In addition, it explains only the core of value analysis, an important element in stock investment along with chart analysis, and also touches on the secrets of rapidly rising stocks, secrets for day traders, and the fundamentals of investment.

This is a must-read for beginners in the stock market, and for intermediate and advanced investors, it will broaden their perspective on existing stock investments.

- You can preview some of the book's contents.

Preview

index

prolog

capitalist stock market

listed company

The sorrow of expulsion, delisting

Basic conditions for stock selection

PART 01 The pulse of value analysis

The concept of value analysis

1.

The pulse of economic analysis!

capitalist business cycle

Growth indicator, gross domestic product (GDP)

Trade indicators, exchange rates

Funding indicators, interest rates

Liquidity indicators, money supply

The Shadow of Quantitative Easing: The Liquidity Trap

Oil prices and raw materials

Prices and inflation

The KOSPI index, a barometer of the domestic economy

America's power, the dollar

The Dow Jones Industrial Average, a barometer of the global stock market

2.

The pulse of industry (sector) analysis!

Red Ocean vs. Blue Ocean

Industrial Life Cycle

Intrinsic value vs. growth value

Government policies and themes

economies of scale

3.

The pulse of corporate analysis!

Primary criterion for corporate value

Corporate growth potential, income statement

Corporate stability, financial statements (balance sheet)

Corporate cash flow, cash flow statement

Present value of the company, earnings per share (EPS)

Corporate earnings value, price-to-earnings ratio (PER)

Corporate asset value, price-to-book ratio (PBR)

Corporate management value, return on equity (ROE)

Corporate cash flow, EV/EBITDA

Corporate risk, debt ratio

The heart of a company, operating profit

Corporate value, market capitalization

The influence of the major shareholder (CEO)

The importance of major shareholder tendencies and stakes

Typical unexpected misfortunes: embezzlement and breach of trust

The Light and Shadow of Value Analysis

PART 02 The pulse of chart analysis

Concept of chart analysis

1.

The pulse of stock price candles (candlestick charts)!

The three major indicators on the chart

Basic structure of candlestick charts

Basic candlestick model

Basic candlestick patterns

Basic candle formation

Short-term stock price trends can be viewed through minute charts.

The upper tail of the candlestick represents selling forces, and the lower tail represents buying forces.

The body of the candle indicates the strength of the buying and selling forces.

A long bullish candlestick at the bottom is a buy signal.

A long candlestick with a bullish trend is a sell signal.

Trend breakout long candlestick

Hope Circuit

Cheating bee candles

Reversal candle

Investor sentiment regarding candle tail length

A bearish candlestick with a high tail indicates a decline the next day.

A rising candle near the bottom signals a trend reversal.

The Secret of the Rising Candlestick

Increase the probability of a deceptive (rising) candlestick

Black three soldiers in Sangtuwon = Sell signal

Bottom Red Three Soldiers = Buy Signal

Stock price trends, weekly and monthly charts

2.

Trading volume and selling price!

Candles are lagging, volume is leading

Volume is the chart

General theory of stock price and trading volume changes

Trading volume increases when an uptrend is imminent.

Ideal volume for rising stock prices, step-like volume

Irregular bulk trading has significant short-term aftereffects.

To break through the all-time high, it is best to have more trading volume than the all-time high.

If the previous low is not supported after a large transaction, discard it.

Bulk trading

Risks of small and medium-sized stocks with low capital

Risk of bad stocks, low-priced stocks, and neglected stocks

Bulk purchase transactions

Target stocks with increasing trading volume at the bottom → decreasing → increasing.

Ideal volume buying point

Watch the 5 days from the bottom of the trading volume.

Watch for volume increases from the weekly volume bottom.

Look for a tricky bearish candlestick (rising bearish candlestick) in the trading volume.

The inseparable relationship between trading volume and selling price

Trading volume must increase to break through the selling point.

Wisdom in utilizing the property

Volume is volatility, not price

3.

The pulse of the moving average!

Basic concepts of moving averages

Moving Average Default

Granville's Law

Index charts represent the overall market trend.

Moving averages are a benchmark for investment sentiment.

Golden Cross = regular arrangement

Dead Cross = Reverse arrangement

When the medium-term moving average is in a downtrend, the short-term moving average trend rebound is short-lived.

When the medium-term moving average is in an upward trend, a decline in the short-term moving average is likely to be a bearish trend.

General rules for moving average crossings

The gap between the stock price and the moving average, the degree of divergence (divergence rate)

Moving average = Buy line = Support line = Resistance line

The 5-day inflection point is a buy signal

5-Day Inflection Point Trading Precautions

Trading the 5-day moving average in a gentle upward trend

5-day inflection point after moving average convergence

5-day turning point of deception

Don't be quick to bite just because the moving averages are converging.

20-day moving average = supply and demand line = power line

20-day moving average pressure point trading

Increase your odds in stocks where the 20-day moving average is still alive.

4.

The pulse of trends and patterns!

Stock price direction (flow), trend

Trendline types

Draw a trend line

Setting a trend

Trend line buy signal

Trend line sell signal

Trendline Confidence Analysis

Trend line buying point

Using the central trend line

Breakthrough of resistance line → support line

Deviation from support line → resistance line

The pulse of box trading

The core of trend trading

The concept of pattern analysis

V-shaped (outer sole) pattern

Watch for stocks with increasing trading volume during a market decline.

A sample of a surge-type stock, the N-shaped pattern

Joy after boredom, the inverted L-shaped pattern

W-shaped (double bottom) pattern, with successive highs

Buying even if it means selling your house, triple bottom pattern

Tamp the floor several times, multi-floor pattern

Gentle uptrend, round bottom pattern

A sharp rise followed by a sharp decline, an inverted V-shaped (outer candle) pattern

Can't surpass the previous high, M-shaped (double top, double peak) pattern

Check the high point three times and then exit, a three-bar pattern

Gentle downtrend, circular top pattern

The final direction is important, the triangle (triangular convergence) pattern.

Same trend line direction, wedge pattern

Indicates a correction phase, flag-shaped pattern

Indicates a downtrend, an expanding (inverted triangle) pattern

Indicates a stagnant zone, a rectangular (box) pattern

Head & Shoulders Pattern

5.

The pulse of auxiliary indicators!

Divergence

A representative trading volume indicator, OBV (On Balance Volume)

Trend reversal signal, OBV divergence

Limitations of the OBV indicator

Volume Ratio (VR)

Volume strength indicators, Positive Volume Index (PVI), Negative Volume Index (NVI)

Moving Average Convergence & Divergence (MACD) indicator

MACD Oscillator

Investor Sentiment Indicator, Stochastics

An uptrend is always overheated

A downtrend is always a recession

How to Use Fast, Slow Stochastic

Moving average momentum indicator, Sonar (Sonar momentum chart)

Fundamentals, Momentum

Relative Strength Index (RSI)

Directional Movement Indicator (DMI)

Trend confirmation indicator, ADX (Average Directional Movement Index)

Exponential moving average change rate, Trix (Triple Exponential smoothed moving average)

Investor sentiment, investment sentiment line

Volatility indicator, Bollinger Bands

Separation indicator, envelope

mesh chart

Three-line conversion diagram

Ichimoku Kinko Hyo

Foreign-institutional-individual shareholding ratio

The Light and Shadow of Chart Analysis

PART 03 The pulse of investment methods

High Risk High Return

Power Stock (Rising Stock) Report

Stock price rise (surge) momentum

General conditions for a sudden rise

Tips for predicting a sharp rise in stock prices

The chart of the powerful stock is pretty.

Short candlesticks are better for rising stocks.

Short-term purchase and bulk trading

The pulse of bulk buying and bulk trading

Yangbong-type bulk purchase transaction

Negative candlestick-type bulk purchase transaction

Bulk buying transactions typically occur one to two months before a sharp rise.

Include large-volume long candlesticks in your interest zone.

Beware of bulk trading

The Truth and Lies of Bulk Trading at the Bottom

The law of trading volume for rapidly rising stocks

Changes in initial trading volume of rapidly rising stocks

Ideal surge volume pattern

Yang-Yin-Yang surge pattern

Jeongbae-ryeol surge pattern

Reverse array surge pattern

Experts focus on reverse arrangements rather than regular arrangements.

Technical rebound, retracement formula

Limit surge based on number of listed and free-floating shares

Conditions and Limits of a Rapid Rise Based on Market Capitalization

The purpose of suppressing rising stocks

Buying pressure points for rising stocks

Price adjustment vs. period adjustment

Always beware of deceptive pressure.

Conditions for breaking through the previous high

A three-time push from a high point is likely to lead to a downtrend.

A Study on Reversion and Repression

Key Points in Push-Pull Trading

Be wary of stocks that surge with a surge in trading volume.

Stocks that plummet as trading volume surges may see a significant rebound.

Beware of sudden drops when trading volume surges

High-priced play pattern

High-priced games, meaningful numbers

Sell signal for rising stocks

Selling pressure on rising stocks

30-minute trading signals for rapidly rising stocks

Use the minute charts of rising stocks to understand the intentions of the powers that be.

Setting detailed moving averages helps with short-term responses.

Catch up to the upper limit 1

Catch the upper limit 2

Catch the upper limit - Catch a strong upper limit

Catch the upper limit - Use minute candles

Chasing the Upper Limit - Beware of Fraudulent Upper Limits

The upper limit of distressed, managed, and ultra-low-priced stocks poses significant risks.

Don't try, limit trading

Traditional investment technique, Sakeda strategy

Check the bottom and target the buying point.

3-Yin (Yin) candlestick short-term trading

Bulk trading of power's quantity

Trade primarily stocks with well-managed power.

Chart analysis is about reading and responding to trends.

Basic concept of gap

Types and characteristics of gaps

Short-term trading is a general gap

Chasing trade is a breakout gap

A gap filled in a short-term upward trend is a warning signal.

Mac that increases investment probability through chart analysis

Performance doesn't betray stock price.

The pulse of using auxiliary indicators

Ignoring the charts can have disastrous consequences.

Elliot is dead

Trading patterns of experts and beginners

Find your own trading technique

PART 04 Charting for Day Traders

Day traders prioritize charts.

Day Trading Stock Selection

Be sensitive to index movements in short-term trading.

Day trading trading time zone

Setting Day Trading Moving Averages

Look at the support (resistance) lines, trends, and trading volume.

The Pulse of Day Trading Minute Charts 1

The Pulse of Day Trading Minute Charts 2

The 3 Pulses of Day Trading Minute Charts

Scalpers risk their lives on 1-minute charts.

Swing Trading (Swing Trading) Minute Chart Pulse 1

Pulse of Swing Trading Minute Chart 2

The 3 Pulses of Swing Trading Minute Charts

Box Rights (period adjustment) Strategy

How to conquer the reverse arrangement of the spur

Predicting and targeting the pressure points of rising stocks

How to target short-term trading at the upper limit

How to conquer rising candlesticks and high price play

How to conquer the triple bottom of the minute chart

How to conquer the general gap

The Risks of Gap Buying

The short-term power's short-term watermill method

Risk minimization principle: 〈Purchase price = Stop loss price〉

Maximizing Profitability: Take-Profit Price = Purchase Price

A corporate crisis can strike in an instant.

Even if you laugh and cry at public announcements and news, information is asymmetric.

The core of chart analysis: candlesticks, volume, moving averages, and trend lines.

Day Trading Basics

PART 05 The pulse of investment

The core of value analysis

Debt issuance, bond issuance

Paid capital increase, free capital increase

Major shareholder stock collateral loan reverse sale

Delisting messenger, the most paid

The Light and Shadow of Paid Capital Increase

Capital erosion and depreciation

The pulse of candlestick charts

Pulse of trading volume

The pulse of chart analysis

Look at the economic trends and index trends!

Choose stocks that fit your investment style!

At least some corporate analysis is essential!

Analyze public notices and news!

Watch trends and volume!

Attack the buying point!

Fly like a butterfly, sting like a bee!

Run faster than a hungry lion!

capitalist stock market

listed company

The sorrow of expulsion, delisting

Basic conditions for stock selection

PART 01 The pulse of value analysis

The concept of value analysis

1.

The pulse of economic analysis!

capitalist business cycle

Growth indicator, gross domestic product (GDP)

Trade indicators, exchange rates

Funding indicators, interest rates

Liquidity indicators, money supply

The Shadow of Quantitative Easing: The Liquidity Trap

Oil prices and raw materials

Prices and inflation

The KOSPI index, a barometer of the domestic economy

America's power, the dollar

The Dow Jones Industrial Average, a barometer of the global stock market

2.

The pulse of industry (sector) analysis!

Red Ocean vs. Blue Ocean

Industrial Life Cycle

Intrinsic value vs. growth value

Government policies and themes

economies of scale

3.

The pulse of corporate analysis!

Primary criterion for corporate value

Corporate growth potential, income statement

Corporate stability, financial statements (balance sheet)

Corporate cash flow, cash flow statement

Present value of the company, earnings per share (EPS)

Corporate earnings value, price-to-earnings ratio (PER)

Corporate asset value, price-to-book ratio (PBR)

Corporate management value, return on equity (ROE)

Corporate cash flow, EV/EBITDA

Corporate risk, debt ratio

The heart of a company, operating profit

Corporate value, market capitalization

The influence of the major shareholder (CEO)

The importance of major shareholder tendencies and stakes

Typical unexpected misfortunes: embezzlement and breach of trust

The Light and Shadow of Value Analysis

PART 02 The pulse of chart analysis

Concept of chart analysis

1.

The pulse of stock price candles (candlestick charts)!

The three major indicators on the chart

Basic structure of candlestick charts

Basic candlestick model

Basic candlestick patterns

Basic candle formation

Short-term stock price trends can be viewed through minute charts.

The upper tail of the candlestick represents selling forces, and the lower tail represents buying forces.

The body of the candle indicates the strength of the buying and selling forces.

A long bullish candlestick at the bottom is a buy signal.

A long candlestick with a bullish trend is a sell signal.

Trend breakout long candlestick

Hope Circuit

Cheating bee candles

Reversal candle

Investor sentiment regarding candle tail length

A bearish candlestick with a high tail indicates a decline the next day.

A rising candle near the bottom signals a trend reversal.

The Secret of the Rising Candlestick

Increase the probability of a deceptive (rising) candlestick

Black three soldiers in Sangtuwon = Sell signal

Bottom Red Three Soldiers = Buy Signal

Stock price trends, weekly and monthly charts

2.

Trading volume and selling price!

Candles are lagging, volume is leading

Volume is the chart

General theory of stock price and trading volume changes

Trading volume increases when an uptrend is imminent.

Ideal volume for rising stock prices, step-like volume

Irregular bulk trading has significant short-term aftereffects.

To break through the all-time high, it is best to have more trading volume than the all-time high.

If the previous low is not supported after a large transaction, discard it.

Bulk trading

Risks of small and medium-sized stocks with low capital

Risk of bad stocks, low-priced stocks, and neglected stocks

Bulk purchase transactions

Target stocks with increasing trading volume at the bottom → decreasing → increasing.

Ideal volume buying point

Watch the 5 days from the bottom of the trading volume.

Watch for volume increases from the weekly volume bottom.

Look for a tricky bearish candlestick (rising bearish candlestick) in the trading volume.

The inseparable relationship between trading volume and selling price

Trading volume must increase to break through the selling point.

Wisdom in utilizing the property

Volume is volatility, not price

3.

The pulse of the moving average!

Basic concepts of moving averages

Moving Average Default

Granville's Law

Index charts represent the overall market trend.

Moving averages are a benchmark for investment sentiment.

Golden Cross = regular arrangement

Dead Cross = Reverse arrangement

When the medium-term moving average is in a downtrend, the short-term moving average trend rebound is short-lived.

When the medium-term moving average is in an upward trend, a decline in the short-term moving average is likely to be a bearish trend.

General rules for moving average crossings

The gap between the stock price and the moving average, the degree of divergence (divergence rate)

Moving average = Buy line = Support line = Resistance line

The 5-day inflection point is a buy signal

5-Day Inflection Point Trading Precautions

Trading the 5-day moving average in a gentle upward trend

5-day inflection point after moving average convergence

5-day turning point of deception

Don't be quick to bite just because the moving averages are converging.

20-day moving average = supply and demand line = power line

20-day moving average pressure point trading

Increase your odds in stocks where the 20-day moving average is still alive.

4.

The pulse of trends and patterns!

Stock price direction (flow), trend

Trendline types

Draw a trend line

Setting a trend

Trend line buy signal

Trend line sell signal

Trendline Confidence Analysis

Trend line buying point

Using the central trend line

Breakthrough of resistance line → support line

Deviation from support line → resistance line

The pulse of box trading

The core of trend trading

The concept of pattern analysis

V-shaped (outer sole) pattern

Watch for stocks with increasing trading volume during a market decline.

A sample of a surge-type stock, the N-shaped pattern

Joy after boredom, the inverted L-shaped pattern

W-shaped (double bottom) pattern, with successive highs

Buying even if it means selling your house, triple bottom pattern

Tamp the floor several times, multi-floor pattern

Gentle uptrend, round bottom pattern

A sharp rise followed by a sharp decline, an inverted V-shaped (outer candle) pattern

Can't surpass the previous high, M-shaped (double top, double peak) pattern

Check the high point three times and then exit, a three-bar pattern

Gentle downtrend, circular top pattern

The final direction is important, the triangle (triangular convergence) pattern.

Same trend line direction, wedge pattern

Indicates a correction phase, flag-shaped pattern

Indicates a downtrend, an expanding (inverted triangle) pattern

Indicates a stagnant zone, a rectangular (box) pattern

Head & Shoulders Pattern

5.

The pulse of auxiliary indicators!

Divergence

A representative trading volume indicator, OBV (On Balance Volume)

Trend reversal signal, OBV divergence

Limitations of the OBV indicator

Volume Ratio (VR)

Volume strength indicators, Positive Volume Index (PVI), Negative Volume Index (NVI)

Moving Average Convergence & Divergence (MACD) indicator

MACD Oscillator

Investor Sentiment Indicator, Stochastics

An uptrend is always overheated

A downtrend is always a recession

How to Use Fast, Slow Stochastic

Moving average momentum indicator, Sonar (Sonar momentum chart)

Fundamentals, Momentum

Relative Strength Index (RSI)

Directional Movement Indicator (DMI)

Trend confirmation indicator, ADX (Average Directional Movement Index)

Exponential moving average change rate, Trix (Triple Exponential smoothed moving average)

Investor sentiment, investment sentiment line

Volatility indicator, Bollinger Bands

Separation indicator, envelope

mesh chart

Three-line conversion diagram

Ichimoku Kinko Hyo

Foreign-institutional-individual shareholding ratio

The Light and Shadow of Chart Analysis

PART 03 The pulse of investment methods

High Risk High Return

Power Stock (Rising Stock) Report

Stock price rise (surge) momentum

General conditions for a sudden rise

Tips for predicting a sharp rise in stock prices

The chart of the powerful stock is pretty.

Short candlesticks are better for rising stocks.

Short-term purchase and bulk trading

The pulse of bulk buying and bulk trading

Yangbong-type bulk purchase transaction

Negative candlestick-type bulk purchase transaction

Bulk buying transactions typically occur one to two months before a sharp rise.

Include large-volume long candlesticks in your interest zone.

Beware of bulk trading

The Truth and Lies of Bulk Trading at the Bottom

The law of trading volume for rapidly rising stocks

Changes in initial trading volume of rapidly rising stocks

Ideal surge volume pattern

Yang-Yin-Yang surge pattern

Jeongbae-ryeol surge pattern

Reverse array surge pattern

Experts focus on reverse arrangements rather than regular arrangements.

Technical rebound, retracement formula

Limit surge based on number of listed and free-floating shares

Conditions and Limits of a Rapid Rise Based on Market Capitalization

The purpose of suppressing rising stocks

Buying pressure points for rising stocks

Price adjustment vs. period adjustment

Always beware of deceptive pressure.

Conditions for breaking through the previous high

A three-time push from a high point is likely to lead to a downtrend.

A Study on Reversion and Repression

Key Points in Push-Pull Trading

Be wary of stocks that surge with a surge in trading volume.

Stocks that plummet as trading volume surges may see a significant rebound.

Beware of sudden drops when trading volume surges

High-priced play pattern

High-priced games, meaningful numbers

Sell signal for rising stocks

Selling pressure on rising stocks

30-minute trading signals for rapidly rising stocks

Use the minute charts of rising stocks to understand the intentions of the powers that be.

Setting detailed moving averages helps with short-term responses.

Catch up to the upper limit 1

Catch the upper limit 2

Catch the upper limit - Catch a strong upper limit

Catch the upper limit - Use minute candles

Chasing the Upper Limit - Beware of Fraudulent Upper Limits

The upper limit of distressed, managed, and ultra-low-priced stocks poses significant risks.

Don't try, limit trading

Traditional investment technique, Sakeda strategy

Check the bottom and target the buying point.

3-Yin (Yin) candlestick short-term trading

Bulk trading of power's quantity

Trade primarily stocks with well-managed power.

Chart analysis is about reading and responding to trends.

Basic concept of gap

Types and characteristics of gaps

Short-term trading is a general gap

Chasing trade is a breakout gap

A gap filled in a short-term upward trend is a warning signal.

Mac that increases investment probability through chart analysis

Performance doesn't betray stock price.

The pulse of using auxiliary indicators

Ignoring the charts can have disastrous consequences.

Elliot is dead

Trading patterns of experts and beginners

Find your own trading technique

PART 04 Charting for Day Traders

Day traders prioritize charts.

Day Trading Stock Selection

Be sensitive to index movements in short-term trading.

Day trading trading time zone

Setting Day Trading Moving Averages

Look at the support (resistance) lines, trends, and trading volume.

The Pulse of Day Trading Minute Charts 1

The Pulse of Day Trading Minute Charts 2

The 3 Pulses of Day Trading Minute Charts

Scalpers risk their lives on 1-minute charts.

Swing Trading (Swing Trading) Minute Chart Pulse 1

Pulse of Swing Trading Minute Chart 2

The 3 Pulses of Swing Trading Minute Charts

Box Rights (period adjustment) Strategy

How to conquer the reverse arrangement of the spur

Predicting and targeting the pressure points of rising stocks

How to target short-term trading at the upper limit

How to conquer rising candlesticks and high price play

How to conquer the triple bottom of the minute chart

How to conquer the general gap

The Risks of Gap Buying

The short-term power's short-term watermill method

Risk minimization principle: 〈Purchase price = Stop loss price〉

Maximizing Profitability: Take-Profit Price = Purchase Price

A corporate crisis can strike in an instant.

Even if you laugh and cry at public announcements and news, information is asymmetric.

The core of chart analysis: candlesticks, volume, moving averages, and trend lines.

Day Trading Basics

PART 05 The pulse of investment

The core of value analysis

Debt issuance, bond issuance

Paid capital increase, free capital increase

Major shareholder stock collateral loan reverse sale

Delisting messenger, the most paid

The Light and Shadow of Paid Capital Increase

Capital erosion and depreciation

The pulse of candlestick charts

Pulse of trading volume

The pulse of chart analysis

Look at the economic trends and index trends!

Choose stocks that fit your investment style!

At least some corporate analysis is essential!

Analyze public notices and news!

Watch trends and volume!

Attack the buying point!

Fly like a butterfly, sting like a bee!

Run faster than a hungry lion!

Detailed image

Publisher's Review

Understanding the pulse of value analysis and chart analysis! The #1 book on chart analysis that grasps the pulse of money.

The revised and expanded edition of "The Pulse of the New Chart," armed with the latest stock window!

With the stock investment craze sparked by the Donghak Ant Movement, stock investment has now become a reliable means of financial investment that anyone can try.

However, many retail investors do not know the appropriate trading timing and repeat the mistake of buying at the previous high and selling at the previous low.

If you buy because it seems to be rising sharply with a bullish candle, a gap down appears the next day, and if you sell out of fear of a bearish market, it rises again with a bullish candle the next day as if nothing had happened.

In this way, the stock market mercilessly steals money from individuals who do not have proper information.

Covers everything about chart analysis, predicting the future using past chart data.

The book "The Pulse of the New Chart," which serves as a guide to chart analysis and value analysis for these investors, has been revised and expanded.

This book teaches you how to time your trades by analyzing actual chart windows.

Starting with the basic forms of positive and negative candlesticks, we have carefully organized various chart shapes, methods for analyzing trading volume and buying and selling prices, moving averages and trend lines, and how to use auxiliary indicators.

It is also a useful book for beginners and intermediate traders, as it covers a wide range of topics, including how to ride the rising tide and charting techniques for day traders.

Surviving the stock market by complementing chart analysis and value analysis.

Chart analysis and value analysis are complementary analytical techniques.

The book also provides detailed information on the core of value analysis.

Through value analysis, we predict the value and prospects of a company, and through chart analysis, we predict rises and falls based on past trends.

There is no right answer in stock investing.

But you can reduce the chances of failure.

This book will be the way to reduce that probability.

The book is largely divided into five sections.

1.

The pulse of value analysis: First, we examine the capitalist economy and the flow of capital. Next, we explain in detail what value is and how it should be evaluated, along with industry analysis and methods for determining corporate value based on financial statements.

2.

The pulse of chart analysis: Chart analysis, also known as technical analysis, is like the minimum weapon needed to survive in the battlefield called the stock market.

The core of chart analysis can be summarized as trends and supply and demand.

We covered everything from beginning to end of technical analysis, from trend and supply/demand analysis to determining trading timing.

3.

The pulse of investment methods: Trading techniques based on chart analysis are not fixed as quickly as the times change.

However, if you look at the big picture of chart analysis, you can see that the basic flow is the same now as it was then.

Therefore, rather than blindly memorizing various investment techniques and trading methods like mathematical formulas, I hope you will make an effort to integrate your own experience and know-how based on the basic chart concepts and various investment techniques described in this book.

4.

Charting for Day Traders: Introducing basic day trading techniques and tips focused on short-term trading.

We also introduce trading tips for scalpers and swing trading, as well as various short-term investment techniques.

5.

The Pulse of Investment: Explains what individual investors should be aware of when investing in stocks and how to mitigate the investment risks.

In addition, it covers in detail the principles of investment, the core of chart analysis, and practical investment tips.

The revised and expanded edition of "The Pulse of the New Chart," armed with the latest stock window!

With the stock investment craze sparked by the Donghak Ant Movement, stock investment has now become a reliable means of financial investment that anyone can try.

However, many retail investors do not know the appropriate trading timing and repeat the mistake of buying at the previous high and selling at the previous low.

If you buy because it seems to be rising sharply with a bullish candle, a gap down appears the next day, and if you sell out of fear of a bearish market, it rises again with a bullish candle the next day as if nothing had happened.

In this way, the stock market mercilessly steals money from individuals who do not have proper information.

Covers everything about chart analysis, predicting the future using past chart data.

The book "The Pulse of the New Chart," which serves as a guide to chart analysis and value analysis for these investors, has been revised and expanded.

This book teaches you how to time your trades by analyzing actual chart windows.

Starting with the basic forms of positive and negative candlesticks, we have carefully organized various chart shapes, methods for analyzing trading volume and buying and selling prices, moving averages and trend lines, and how to use auxiliary indicators.

It is also a useful book for beginners and intermediate traders, as it covers a wide range of topics, including how to ride the rising tide and charting techniques for day traders.

Surviving the stock market by complementing chart analysis and value analysis.

Chart analysis and value analysis are complementary analytical techniques.

The book also provides detailed information on the core of value analysis.

Through value analysis, we predict the value and prospects of a company, and through chart analysis, we predict rises and falls based on past trends.

There is no right answer in stock investing.

But you can reduce the chances of failure.

This book will be the way to reduce that probability.

The book is largely divided into five sections.

1.

The pulse of value analysis: First, we examine the capitalist economy and the flow of capital. Next, we explain in detail what value is and how it should be evaluated, along with industry analysis and methods for determining corporate value based on financial statements.

2.

The pulse of chart analysis: Chart analysis, also known as technical analysis, is like the minimum weapon needed to survive in the battlefield called the stock market.

The core of chart analysis can be summarized as trends and supply and demand.

We covered everything from beginning to end of technical analysis, from trend and supply/demand analysis to determining trading timing.

3.

The pulse of investment methods: Trading techniques based on chart analysis are not fixed as quickly as the times change.

However, if you look at the big picture of chart analysis, you can see that the basic flow is the same now as it was then.

Therefore, rather than blindly memorizing various investment techniques and trading methods like mathematical formulas, I hope you will make an effort to integrate your own experience and know-how based on the basic chart concepts and various investment techniques described in this book.

4.

Charting for Day Traders: Introducing basic day trading techniques and tips focused on short-term trading.

We also introduce trading tips for scalpers and swing trading, as well as various short-term investment techniques.

5.

The Pulse of Investment: Explains what individual investors should be aware of when investing in stocks and how to mitigate the investment risks.

In addition, it covers in detail the principles of investment, the core of chart analysis, and practical investment tips.

GOODS SPECIFICS

- Publication date: August 25, 2022

- Format: Hardcover book binding method guide

- Page count, weight, size: 392 pages | 1,146g | 258*188*28mm

- ISBN13: 9791167640208

- ISBN10: 1167640209

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)