The basics of short-term cryptocurrency trading

|

Description

Book Introduction

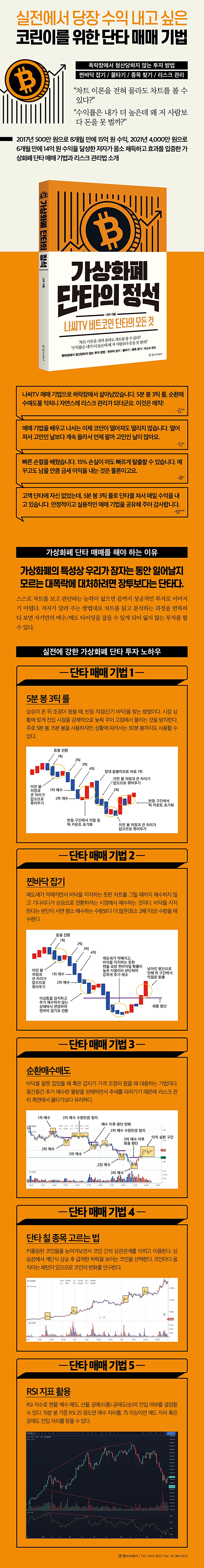

“Can you read charts without knowing anything about chart theory?” “My rate of return is higher, so why can’t I make more money than that person?” In 2017, 5 million won was used to generate 1.5 billion won in profits in 8 months. 1.4 billion won in profit in 6 months from 40 million won in 2021 The author has personally experienced and proven the effectiveness Introduction to short-term cryptocurrency trading techniques and risk management methods. Why You Should Short-Term Trade Cryptocurrency Even if you buy virtual currency at the same time, the results can be very different. Even though my rate of return is higher, other people make a lot more money. Why? The author entered the cryptocurrency market in 2017 with 5 million won, mastered his own trading techniques, and achieved 1.5 billion won in profits in just eight months before leaving the market. While writing this book, I returned to the coin market in January 2021 with 40 million won and achieved a profit of 1.4 billion won in just 6 months. The author believes that, given the nature of cryptocurrencies, short-term investments are more appropriate than long-term ones to prepare for a potential crash that could occur while we sleep. So, this book explains how to trade virtual currency in the short term. In this book, the author shares valuable lessons learned through his own experiences investing in cryptocurrencies, both through success and failure. No matter how good the market is, if you don't establish your own standards, you could fail in an instant. Therefore, the author recommends that Corin study this book from the beginning and practice trading only with small amounts until you have sufficient trading experience. By repeating the process of reading and analyzing charts as instructed by the author, you will be able to determine your own buying and selling timing, allowing you to make investments without losing money. |

- You can preview some of the book's contents.

Preview

index

prolog

Chapter 1: The Basics You Need to Know Before Getting Started with Bitcoin

Which exchange should I use?

How do we know the trading volume of exchanges around the world?

What is the difference between spot and futures trading?

Why are prices on domestic and foreign exchanges different?

How do I deposit money into an overseas exchange?

Where should I start learning about Bitcoin?

Chapter 2: I Jumped into the Coin Market Without Knowing Anything About Investment

Getting started with Bitcoin

Day 3 of Bitcoin: Experiencing a Crash

Get into short-term trading

Daegu Bank? Strategic? What's that? Poloniex/Bittrex Opens Eyes to Overseas Exchanges

I have a high rate of return, so why don't I earn less than that person?

Awaken to the benefits and experience their effects

Chapter 3: How to Study Complex Charts Easily

Can you read charts without knowing any theory?

How should I study charts?

How to predict short-term direction when trading short-term

Chapter 4 Short-Term Trading Technique 1: The 5-Minute 3-Tick Rule

What is the 5-minute candlestick 3-tick rule?

Basic Rules of the 5-Minute 3-Tick Rule

When should I buy within a candle?

When should I use 5-minute and 15-minute candlesticks?

When does a positive candle appear between negative candles?

When is a long candle compared to the previous candle considered 1 tick?

What should I do if there is a continuous decline after entering the 3-tick range?

Chapter 5: Short-Term Trading Technique 2: Catching the Bottom

What is a steamed bottom catch?

Basic rules for catching the steamed bottom

Can't we look at the bottom with a 1-minute candle from the beginning?

What would be an appropriate purchase amount?

I thought it was a steamed bun, but what if it wasn't?

Chapter 6 Short-Term Trading Technique 3: Rotating Buys and Sells

What is circular buying and selling?

Basic rules for circular buying and selling

Why does the principal continue to decrease when I make circular purchases?

Example of circular sale

Is there no way to calculate profit and loss from Upbit's circular trading?

When selling in circulation, should I do it by amount or quantity?

What to do if there is no rebound?

Chapter 7 Short-Term Trading Technique 4: How to Pick Stocks for Short-Term Trading

How to find correlations between coins

Pick a coin that shows a steep decline after a step-by-step rise.

How to find and identify the characteristics that exist in each coin

Read the market trends and quickly catch the movements of coins that change depending on the market.

Chapter 8: Short-Term Trading Technique 5: Using the RSI Indicator

What is RSI?

Detection of overbought and oversold levels

Divergence Trading Strategy Using RSI

Chapter 9: Asset Management and Risk Management: More Important Than Trading Techniques

How to Stably Operate Spot and Futures Seeds

How to reinvest your profits

How to Respond When Bitten by a Job Coin

Chapter 10 How do you know a bear market is coming?

What are the signs of a decline?

Community Posts

Bitcoin Futures Chart (Binance)

Altcoin chart and Korean Premium (Upbit)

Trading volume

Chapter 11: How to Survive a Sudden Market Crash

Patterns of people liquidated in a crash

How to Respond to a Crash

Chapter 12: How to Respond to a Persistently Downward Market

What should I do when the decline continues for a long time?

Chapter 1: The Basics You Need to Know Before Getting Started with Bitcoin

Which exchange should I use?

How do we know the trading volume of exchanges around the world?

What is the difference between spot and futures trading?

Why are prices on domestic and foreign exchanges different?

How do I deposit money into an overseas exchange?

Where should I start learning about Bitcoin?

Chapter 2: I Jumped into the Coin Market Without Knowing Anything About Investment

Getting started with Bitcoin

Day 3 of Bitcoin: Experiencing a Crash

Get into short-term trading

Daegu Bank? Strategic? What's that? Poloniex/Bittrex Opens Eyes to Overseas Exchanges

I have a high rate of return, so why don't I earn less than that person?

Awaken to the benefits and experience their effects

Chapter 3: How to Study Complex Charts Easily

Can you read charts without knowing any theory?

How should I study charts?

How to predict short-term direction when trading short-term

Chapter 4 Short-Term Trading Technique 1: The 5-Minute 3-Tick Rule

What is the 5-minute candlestick 3-tick rule?

Basic Rules of the 5-Minute 3-Tick Rule

When should I buy within a candle?

When should I use 5-minute and 15-minute candlesticks?

When does a positive candle appear between negative candles?

When is a long candle compared to the previous candle considered 1 tick?

What should I do if there is a continuous decline after entering the 3-tick range?

Chapter 5: Short-Term Trading Technique 2: Catching the Bottom

What is a steamed bottom catch?

Basic rules for catching the steamed bottom

Can't we look at the bottom with a 1-minute candle from the beginning?

What would be an appropriate purchase amount?

I thought it was a steamed bun, but what if it wasn't?

Chapter 6 Short-Term Trading Technique 3: Rotating Buys and Sells

What is circular buying and selling?

Basic rules for circular buying and selling

Why does the principal continue to decrease when I make circular purchases?

Example of circular sale

Is there no way to calculate profit and loss from Upbit's circular trading?

When selling in circulation, should I do it by amount or quantity?

What to do if there is no rebound?

Chapter 7 Short-Term Trading Technique 4: How to Pick Stocks for Short-Term Trading

How to find correlations between coins

Pick a coin that shows a steep decline after a step-by-step rise.

How to find and identify the characteristics that exist in each coin

Read the market trends and quickly catch the movements of coins that change depending on the market.

Chapter 8: Short-Term Trading Technique 5: Using the RSI Indicator

What is RSI?

Detection of overbought and oversold levels

Divergence Trading Strategy Using RSI

Chapter 9: Asset Management and Risk Management: More Important Than Trading Techniques

How to Stably Operate Spot and Futures Seeds

How to reinvest your profits

How to Respond When Bitten by a Job Coin

Chapter 10 How do you know a bear market is coming?

What are the signs of a decline?

Community Posts

Bitcoin Futures Chart (Binance)

Altcoin chart and Korean Premium (Upbit)

Trading volume

Chapter 11: How to Survive a Sudden Market Crash

Patterns of people liquidated in a crash

How to Respond to a Crash

Chapter 12: How to Respond to a Persistently Downward Market

What should I do when the decline continues for a long time?

Detailed image

Publisher's Review

Why You Should Short-Term Trade Cryptocurrency

Even if you buy virtual currency at the same time, the results can be very different.

Even though my rate of return is higher, other people make a lot more money.

Why? The author entered the cryptocurrency market in 2017 with 5 million won, mastered his own trading techniques, and achieved 1.5 billion won in profits in just eight months before leaving the market.

While writing this book, I returned to the coin market in January 2021 with 40 million won, and achieved a profit of 1.4 billion won in just six months.

The author believes that, given the nature of cryptocurrencies, short-term investments are more appropriate than long-term ones to prepare for a potential crash that could occur while we sleep.

So, this book explains how to trade virtual currency in the short term.

In this book, the author shares valuable lessons learned through his own successes and failures while investing in cryptocurrency.

No matter how good the market is, if you don't establish your own standards, you could fail in an instant. Therefore, the author recommends that Corin study this book from the beginning and practice trading only with small amounts until you have sufficient trading experience.

By repeating the process of reading and analyzing charts as instructed by the author, you will be able to determine your own buying and selling timing, allowing you to make investments without losing money.

The Basics of Bitcoin Study: How to Read Charts

If you are new to coins, you are likely to be intimidated by the complex theories and chart patterns and give up on studying charts.

The theory and charts may seem complicated at first glance, but there is no need to be intimidated, as they are ultimately made by collecting past data, finding similarities, and creating a single formula.

If you look at the charts every day, observe the patterns, and become familiar with them, at some point you will start to see familiar chart shapes one by one, and the direction of the next candle will naturally come to mind.

This book aims to develop the ability to analyze charts on your own and find good times to buy and sell.

Because without the ability to read and judge charts on your own, it is difficult to make a successful investment until the end.

The author details how to quickly identify organically changing patterns through example charts.

Even if the same pattern is shown, it can rise or fall depending on the market sentiment at the time, so you can develop the ability to respond to charts that change according to the situation.

Once you learn how to read charts, you can read the overall flow of a coin by looking at charts of various time periods and predict short-term directions, thereby increasing your hit rate.

Risk management essential for short-term cryptocurrency trading

For stable and successful investment, a strategy of 'betting boldly when the market is good and operating conservatively while holding cash and waiting when the market is bad' is necessary.

But most beginners operate the same way regardless of whether the market is good or bad.

As a result, even if you make money in a rising market, there are many cases where you cannot protect that money in a falling market.

The end goal of investing is ultimately profit realization and risk management.

In the coin market, even if you make a lot of money, it means nothing if you can't use it, and if you lose big even once, you can lose everything.

That is why it is important to appropriately withdraw your profits to reduce risk.

This book introduces risk management methods that can occur when investing in virtual currency, such as how to escape from a short-term bottom (riding the wave), how to respond to a continuously falling market, how to deal with an unexpected trend deviation, and how to respond when bitten by a junk coin.

Even beginners can achieve successful results without fail by investing in virtual currency while studying step by step without being impatient with the ups and downs.

-I survived the bear market using Nassi TV trading techniques.

Once I learned the 5-minute candlestick 3-tick rule and circular buying and selling, I was able to manage risk naturally.

This is magic! -Kim**

-After learning trading techniques, I no longer feel nervous when the coin falls.

There are more days when I worry about when to sell because it keeps rising than days when I worry about when it falls.

-step*

-I learned how to cut off my hands quickly.

Even if you lose 15%, you can escape quickly.

It is not only that you will quickly make a profit, but you will also have some left over.

-Ryu*

-I wasn't confident in high-stakes short-term trading, but I'm making profits every day by trading short-term using the 5-minute candlestick 3-tick rule.

Thank you for sharing your reliable and practical trading techniques.

-room***

Even if you buy virtual currency at the same time, the results can be very different.

Even though my rate of return is higher, other people make a lot more money.

Why? The author entered the cryptocurrency market in 2017 with 5 million won, mastered his own trading techniques, and achieved 1.5 billion won in profits in just eight months before leaving the market.

While writing this book, I returned to the coin market in January 2021 with 40 million won, and achieved a profit of 1.4 billion won in just six months.

The author believes that, given the nature of cryptocurrencies, short-term investments are more appropriate than long-term ones to prepare for a potential crash that could occur while we sleep.

So, this book explains how to trade virtual currency in the short term.

In this book, the author shares valuable lessons learned through his own successes and failures while investing in cryptocurrency.

No matter how good the market is, if you don't establish your own standards, you could fail in an instant. Therefore, the author recommends that Corin study this book from the beginning and practice trading only with small amounts until you have sufficient trading experience.

By repeating the process of reading and analyzing charts as instructed by the author, you will be able to determine your own buying and selling timing, allowing you to make investments without losing money.

The Basics of Bitcoin Study: How to Read Charts

If you are new to coins, you are likely to be intimidated by the complex theories and chart patterns and give up on studying charts.

The theory and charts may seem complicated at first glance, but there is no need to be intimidated, as they are ultimately made by collecting past data, finding similarities, and creating a single formula.

If you look at the charts every day, observe the patterns, and become familiar with them, at some point you will start to see familiar chart shapes one by one, and the direction of the next candle will naturally come to mind.

This book aims to develop the ability to analyze charts on your own and find good times to buy and sell.

Because without the ability to read and judge charts on your own, it is difficult to make a successful investment until the end.

The author details how to quickly identify organically changing patterns through example charts.

Even if the same pattern is shown, it can rise or fall depending on the market sentiment at the time, so you can develop the ability to respond to charts that change according to the situation.

Once you learn how to read charts, you can read the overall flow of a coin by looking at charts of various time periods and predict short-term directions, thereby increasing your hit rate.

Risk management essential for short-term cryptocurrency trading

For stable and successful investment, a strategy of 'betting boldly when the market is good and operating conservatively while holding cash and waiting when the market is bad' is necessary.

But most beginners operate the same way regardless of whether the market is good or bad.

As a result, even if you make money in a rising market, there are many cases where you cannot protect that money in a falling market.

The end goal of investing is ultimately profit realization and risk management.

In the coin market, even if you make a lot of money, it means nothing if you can't use it, and if you lose big even once, you can lose everything.

That is why it is important to appropriately withdraw your profits to reduce risk.

This book introduces risk management methods that can occur when investing in virtual currency, such as how to escape from a short-term bottom (riding the wave), how to respond to a continuously falling market, how to deal with an unexpected trend deviation, and how to respond when bitten by a junk coin.

Even beginners can achieve successful results without fail by investing in virtual currency while studying step by step without being impatient with the ups and downs.

-I survived the bear market using Nassi TV trading techniques.

Once I learned the 5-minute candlestick 3-tick rule and circular buying and selling, I was able to manage risk naturally.

This is magic! -Kim**

-After learning trading techniques, I no longer feel nervous when the coin falls.

There are more days when I worry about when to sell because it keeps rising than days when I worry about when it falls.

-step*

-I learned how to cut off my hands quickly.

Even if you lose 15%, you can escape quickly.

It is not only that you will quickly make a profit, but you will also have some left over.

-Ryu*

-I wasn't confident in high-stakes short-term trading, but I'm making profits every day by trading short-term using the 5-minute candlestick 3-tick rule.

Thank you for sharing your reliable and practical trading techniques.

-room***

GOODS SPECIFICS

- Date of issue: September 8, 2021

- Page count, weight, size: 209 pages | 406g | 152*225*15mm

- ISBN13: 9788965183365

- ISBN10: 8965183367

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)