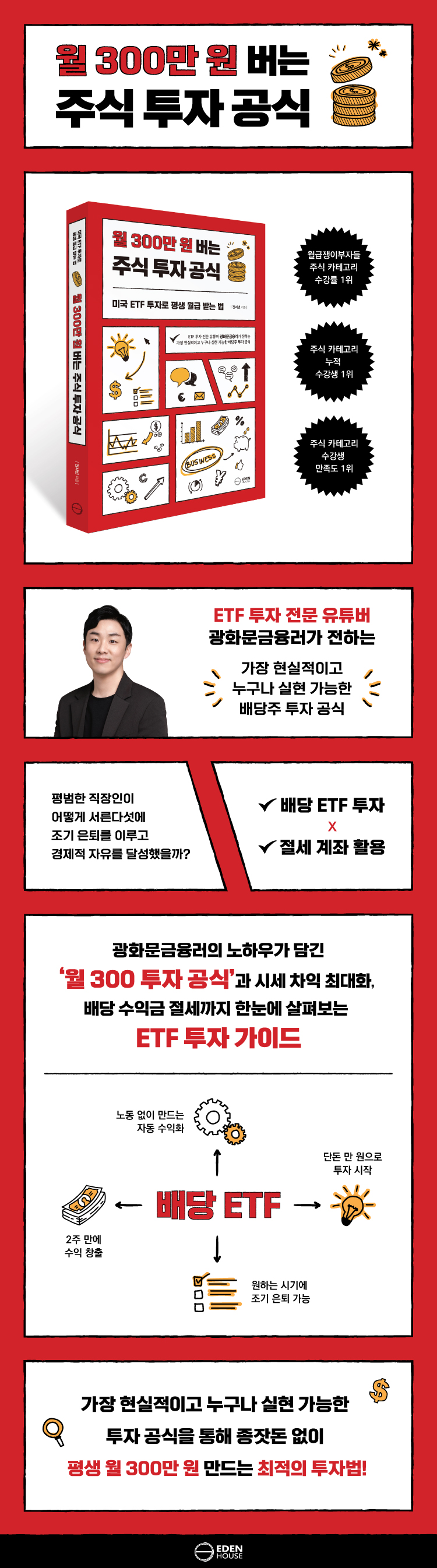

The stock investment formula that earns you 3 million won a month

|

Description

Book Introduction

The best investment method to make 3 million won per month without seed money!

ETF investment expert YouTuber Gwanghwamun Finance

The most realistic and achievable investment formula for everyone

Everything you need to know about investing in US stocks from a Gwanghwamun finance expert who started investing in stocks at 23, overcame all kinds of trials and errors, and achieved early retirement at 35.

Breaking free from the stereotype that stock investing brings low and volatile returns, we present a guide that allows anyone to achieve a monthly cash flow of 3 million won without working, even without seed money.

The author's unique "300-per-month investment formula," developed through long-term investment and continuous study, as well as the mindset that beginner investors should have, are all generously included in this book.

At the end of each chapter, we've included a vision board for effective investment, along with a practical simulation for earning 3 million won a month for life and a final investment portfolio to help you create and manage them.

It presents the optimal investment method that is realistically feasible by guiding you through the most important principles while making it easy and simple for anyone to follow.

ETF investment expert YouTuber Gwanghwamun Finance

The most realistic and achievable investment formula for everyone

Everything you need to know about investing in US stocks from a Gwanghwamun finance expert who started investing in stocks at 23, overcame all kinds of trials and errors, and achieved early retirement at 35.

Breaking free from the stereotype that stock investing brings low and volatile returns, we present a guide that allows anyone to achieve a monthly cash flow of 3 million won without working, even without seed money.

The author's unique "300-per-month investment formula," developed through long-term investment and continuous study, as well as the mindset that beginner investors should have, are all generously included in this book.

At the end of each chapter, we've included a vision board for effective investment, along with a practical simulation for earning 3 million won a month for life and a final investment portfolio to help you create and manage them.

It presents the optimal investment method that is realistically feasible by guiding you through the most important principles while making it easy and simple for anyone to follow.

- You can preview some of the book's contents.

Preview

index

prolog

Chapter 1: Why Invest in Stocks?

Gangnam Apartments vs. Stocks

Dividend stocks, the most intuitive investment asset

The Impact of Dividends on Stocks

ETF Investment That Never Fails

ETF Analysis Tools

Appendix: Creating a Vision Board for Financial Freedom

Chapter 2 Tax Savings Are More Important Than Profits

The Importance of Cash Flow

The trap of health insurance premiums

Are pension savings accounts for retirement planning?

ISA account that must be created and viewed

Completed IRP Account for Tax Savings Account

Appendix: Designing a Simulation for Earning 3 Million Won a Month for Life

Chapter 3: Investment Formula for Stable Returns

What's happening in the stock market

What if there was a stock like Gangnam Real Estate?

If you buy stocks, among these

Investment tools to help you retire early

To increase US stock returns

Appendix: Creating Your Final Investment Portfolio

Mindset Training with Gwanghwamun Financial Experts

Epilogue

Chapter 1: Why Invest in Stocks?

Gangnam Apartments vs. Stocks

Dividend stocks, the most intuitive investment asset

The Impact of Dividends on Stocks

ETF Investment That Never Fails

ETF Analysis Tools

Appendix: Creating a Vision Board for Financial Freedom

Chapter 2 Tax Savings Are More Important Than Profits

The Importance of Cash Flow

The trap of health insurance premiums

Are pension savings accounts for retirement planning?

ISA account that must be created and viewed

Completed IRP Account for Tax Savings Account

Appendix: Designing a Simulation for Earning 3 Million Won a Month for Life

Chapter 3: Investment Formula for Stable Returns

What's happening in the stock market

What if there was a stock like Gangnam Real Estate?

If you buy stocks, among these

Investment tools to help you retire early

To increase US stock returns

Appendix: Creating Your Final Investment Portfolio

Mindset Training with Gwanghwamun Financial Experts

Epilogue

Detailed image

Into the book

There is one thing to think about at this point.

It's as if real estate investment is the ultimate investment that should be pursued, while stock investment is perceived as an investment that small investors have no choice but to choose.

If the sole purpose of purchasing real estate is to own a home, then that is entirely possible.

Because everyone needs to own a home.

However, I believe that in our country, if you want to make a proper investment that produces results, you have to invest in real estate.

--- p.17

The recently announced tax reform bill includes an expansion of ISA tax benefits.

The benefits of tax-saving accounts such as pension savings accounts and ISA accounts continue to grow.

This means that going forward, there will inevitably be a larger gap in after-tax returns between investors who utilize tax-saving accounts and those who do not.

Therefore, you should learn how to use tax-saving accounts as early as possible and apply them to suit your needs.

Utilizing tax-saving accounts is no longer an option, but a necessity.

--- p.140

Most investors don't care whether the market will trend upwards over the long term.

Rather, they buy with the expectation that they will only produce a certain amount of return in the short term, or within a few months.

But contrary to my expectations, the stock price, which seemed like it would definitely rise, strangely drops significantly when I buy it.

It's almost as if someone is secretly filming my account.

And when the stock price falls like this, you end up selling.

This is because I feel like my losses will increase if I continue to hold on to it, and I feel anxious that even if I wait, it will never reach the price I bought it at.

But as evidenced by the long-term upward trend of the S&P 500 index, the S&P 500 index eventually rose.

If any of you can consistently make money with short-term investments, I wouldn't recommend investing in the S&P 500.

However, most investors will not fall into this category.

--- p.168

If there's one thing that investment masters have in common, it's that they've been investing for a long time.

Investment methods and stock selection criteria may differ.

But even as they all become old men with white hair, they continue to study investment and invest tirelessly.

Seeing someone already making a fortune through investing, I might think it's too late.

Usually you have one of two choices here.

Either give up on studying investment, or make excessive investments to try to make a quick buck.

We must neither give up on investing nor make excessive investments.

Instead, you should aim to make good investments over the long term.

--- pp.237-238

The S&P 500 graph, which I had only passed by dozens or hundreds of times, began to catch my eye.

Since I had been aiming for an average annual return of 40-50%, I didn't notice the graph of the S&P 500 index, which has a return of around 10%.

But with lower expected returns, there was no better investment than the S&P 500 Index.

At the same time, the performance of individual stock investments has also improved significantly.

I invested primarily in the S&P 500 and only invested in stocks that looked really good.

Then, stocks whose prices increased by 3 or 4 times began to appear.

If you think about it differently, you now have the luxury of waiting until the stock price increases three or four times.

It's as if real estate investment is the ultimate investment that should be pursued, while stock investment is perceived as an investment that small investors have no choice but to choose.

If the sole purpose of purchasing real estate is to own a home, then that is entirely possible.

Because everyone needs to own a home.

However, I believe that in our country, if you want to make a proper investment that produces results, you have to invest in real estate.

--- p.17

The recently announced tax reform bill includes an expansion of ISA tax benefits.

The benefits of tax-saving accounts such as pension savings accounts and ISA accounts continue to grow.

This means that going forward, there will inevitably be a larger gap in after-tax returns between investors who utilize tax-saving accounts and those who do not.

Therefore, you should learn how to use tax-saving accounts as early as possible and apply them to suit your needs.

Utilizing tax-saving accounts is no longer an option, but a necessity.

--- p.140

Most investors don't care whether the market will trend upwards over the long term.

Rather, they buy with the expectation that they will only produce a certain amount of return in the short term, or within a few months.

But contrary to my expectations, the stock price, which seemed like it would definitely rise, strangely drops significantly when I buy it.

It's almost as if someone is secretly filming my account.

And when the stock price falls like this, you end up selling.

This is because I feel like my losses will increase if I continue to hold on to it, and I feel anxious that even if I wait, it will never reach the price I bought it at.

But as evidenced by the long-term upward trend of the S&P 500 index, the S&P 500 index eventually rose.

If any of you can consistently make money with short-term investments, I wouldn't recommend investing in the S&P 500.

However, most investors will not fall into this category.

--- p.168

If there's one thing that investment masters have in common, it's that they've been investing for a long time.

Investment methods and stock selection criteria may differ.

But even as they all become old men with white hair, they continue to study investment and invest tirelessly.

Seeing someone already making a fortune through investing, I might think it's too late.

Usually you have one of two choices here.

Either give up on studying investment, or make excessive investments to try to make a quick buck.

We must neither give up on investing nor make excessive investments.

Instead, you should aim to make good investments over the long term.

--- pp.237-238

The S&P 500 graph, which I had only passed by dozens or hundreds of times, began to catch my eye.

Since I had been aiming for an average annual return of 40-50%, I didn't notice the graph of the S&P 500 index, which has a return of around 10%.

But with lower expected returns, there was no better investment than the S&P 500 Index.

At the same time, the performance of individual stock investments has also improved significantly.

I invested primarily in the S&P 500 and only invested in stocks that looked really good.

Then, stocks whose prices increased by 3 or 4 times began to appear.

If you think about it differently, you now have the luxury of waiting until the stock price increases three or four times.

--- p.274

Publisher's Review

Maximize your profits with the "300 per month investment formula" and save on taxes.

An ETF Investment Guide at a Glance

These days, the stock market is a hot topic every day due to the trend of investing in dividend ETFs, which generate stable, long-term returns, rather than investing in volatile individual stocks.

It is gaining significant attention among stock investors because it not only allows for automatic income generation without labor, but also allows for early retirement at a desired time and generates monthly cash flow through dividend payments.

The author, who achieved early retirement at the relatively young age of 35, also confesses that when he first started investing in stocks, he aimed for a bull market centered on individual stocks.

However, no individual stock has achieved high returns over the long term.

I was wondering why I, who had been studying and investing for a long time, was the only one who was making a lot of money here and there, and then I looked at the S&P 500 chart.

From then on, I started to take interest in investing in dividend stock ETFs that have been trending upward for a long time.

Although the results were a bit slow, I invested with the belief that I should 'invest in good stocks for the long term', and as a result, I achieved financial freedom faster than anyone else who started investing in stocks with me.

Afterwards, I became convinced that investing in dividend ETFs was the most reliable and stable way to generate returns, and I created my own '300 per month investment formula.'

To help many people achieve financial independence and live stable lives, he runs the YouTube channel "Statistics Major Gwanghwamun Finance Lover" and began teaching stock investment classes on "Salaryman Rich People."

From basic terminology to the principles of the stock market, various secrets for maximizing price differences, and tax-saving methods, the course was comprehensive enough for even novice stock investors to follow along with ease. As a result, the course became a hit through word of mouth.

Achieved the highest attendance rate, highest cumulative number of students, and highest student satisfaction in the stock category.

Now, let's meet the investment formula and know-how of Gwanghwamun Finance, recognized by both YouTube readers and students, in a book.

This book will satisfy both investors who have never invested in stocks before and those who want to break the cycle of failure and make a proper investment this time.

Dividend ETF investment x Tax-saving account utilization

The secret to early retirement and financial freedom for ordinary office workers!

The author cites investing in dividend ETFs and utilizing tax-saving accounts as his secrets to early retirement.

He says he was able to quickly achieve financial freedom by creating a long-term upward earnings structure through dividend ETF investments and reducing taxes, including health insurance premiums, through active use of tax-saving accounts.

It wasn't always smooth sailing to get to where I am today.

I've lost money by investing in individual stocks that boasted high returns, and I've even been so greedy that I almost lost all my wedding savings in a short period of time.

However, he continued to invest steadily, recalling the words of investment gurus such as Warren Buffett, Benjamin Graham, and Andre Kostolany, who said, “Index funds are the best choice for individual investors.”

As a result of constantly training myself to turn my doubts into certainty, I was able to create my own know-how without being swayed by the 'carders' around me.

Ultimately, investing is about the investor's attitude and perspective on life.

Money should be a means to an end, not the goal itself.

The author of this book achieved his dream goal with a monthly cash flow of 3 million won.

And I suggest that everyone become 'real investors' to live an upwardly mobile life together.

It reaches out to readers to live a proactive life by managing time, which is more valuable than money.

If you've decided to make your own investments without wavering in a world overflowing with fake news and temptations, you're now ready to make "real investments."

Let's build a system that accumulates assets together with Gwanghwamun Financial and create a virtuous cycle of happiness in life.

An ETF Investment Guide at a Glance

These days, the stock market is a hot topic every day due to the trend of investing in dividend ETFs, which generate stable, long-term returns, rather than investing in volatile individual stocks.

It is gaining significant attention among stock investors because it not only allows for automatic income generation without labor, but also allows for early retirement at a desired time and generates monthly cash flow through dividend payments.

The author, who achieved early retirement at the relatively young age of 35, also confesses that when he first started investing in stocks, he aimed for a bull market centered on individual stocks.

However, no individual stock has achieved high returns over the long term.

I was wondering why I, who had been studying and investing for a long time, was the only one who was making a lot of money here and there, and then I looked at the S&P 500 chart.

From then on, I started to take interest in investing in dividend stock ETFs that have been trending upward for a long time.

Although the results were a bit slow, I invested with the belief that I should 'invest in good stocks for the long term', and as a result, I achieved financial freedom faster than anyone else who started investing in stocks with me.

Afterwards, I became convinced that investing in dividend ETFs was the most reliable and stable way to generate returns, and I created my own '300 per month investment formula.'

To help many people achieve financial independence and live stable lives, he runs the YouTube channel "Statistics Major Gwanghwamun Finance Lover" and began teaching stock investment classes on "Salaryman Rich People."

From basic terminology to the principles of the stock market, various secrets for maximizing price differences, and tax-saving methods, the course was comprehensive enough for even novice stock investors to follow along with ease. As a result, the course became a hit through word of mouth.

Achieved the highest attendance rate, highest cumulative number of students, and highest student satisfaction in the stock category.

Now, let's meet the investment formula and know-how of Gwanghwamun Finance, recognized by both YouTube readers and students, in a book.

This book will satisfy both investors who have never invested in stocks before and those who want to break the cycle of failure and make a proper investment this time.

Dividend ETF investment x Tax-saving account utilization

The secret to early retirement and financial freedom for ordinary office workers!

The author cites investing in dividend ETFs and utilizing tax-saving accounts as his secrets to early retirement.

He says he was able to quickly achieve financial freedom by creating a long-term upward earnings structure through dividend ETF investments and reducing taxes, including health insurance premiums, through active use of tax-saving accounts.

It wasn't always smooth sailing to get to where I am today.

I've lost money by investing in individual stocks that boasted high returns, and I've even been so greedy that I almost lost all my wedding savings in a short period of time.

However, he continued to invest steadily, recalling the words of investment gurus such as Warren Buffett, Benjamin Graham, and Andre Kostolany, who said, “Index funds are the best choice for individual investors.”

As a result of constantly training myself to turn my doubts into certainty, I was able to create my own know-how without being swayed by the 'carders' around me.

Ultimately, investing is about the investor's attitude and perspective on life.

Money should be a means to an end, not the goal itself.

The author of this book achieved his dream goal with a monthly cash flow of 3 million won.

And I suggest that everyone become 'real investors' to live an upwardly mobile life together.

It reaches out to readers to live a proactive life by managing time, which is more valuable than money.

If you've decided to make your own investments without wavering in a world overflowing with fake news and temptations, you're now ready to make "real investments."

Let's build a system that accumulates assets together with Gwanghwamun Financial and create a virtuous cycle of happiness in life.

GOODS SPECIFICS

- Date of issue: October 16, 2024

- Page count, weight, size: 280 pages | 528g | 152*225*19mm

- ISBN13: 9791198564184

- ISBN10: 1198564180

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)