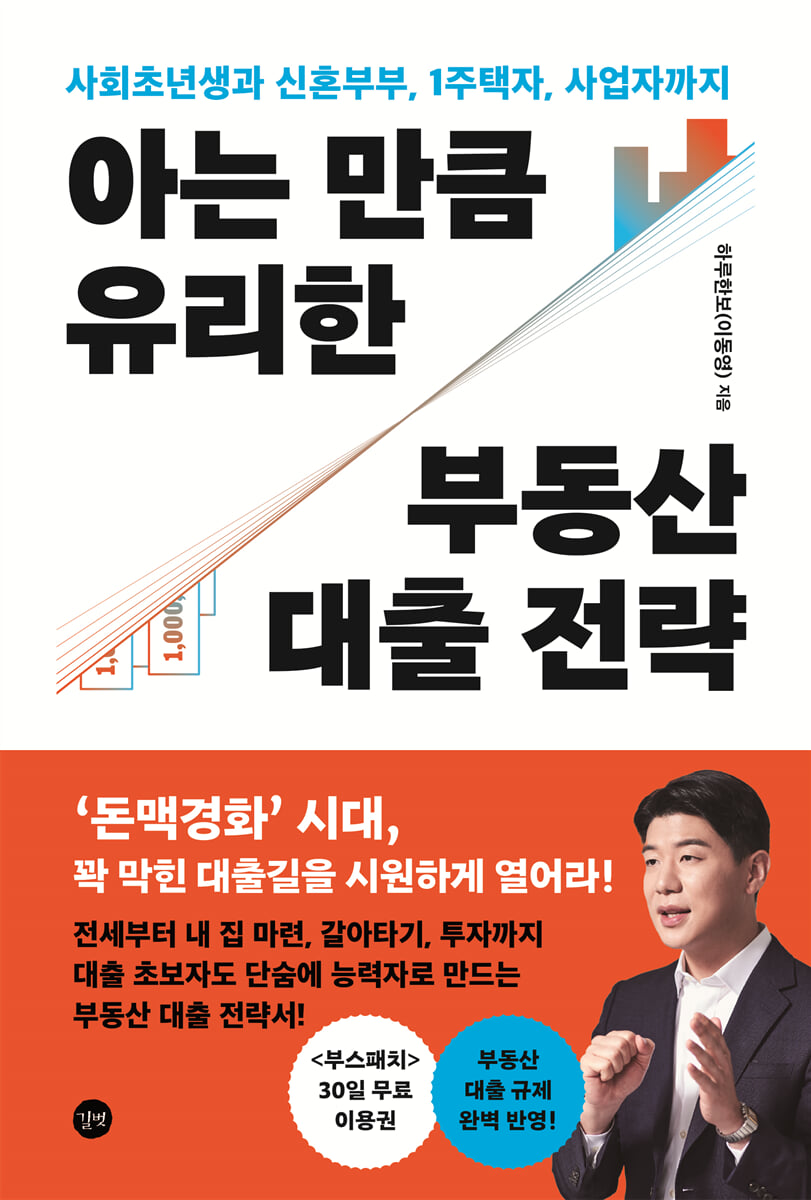

Real estate loan strategies that are as advantageous as your knowledge

|

Description

Book Introduction

“I want to get a loan, but I’m scared and feel discouraged for no reason….”

"Do I really need to study for a loan? Isn't it going to come out as planned anyway?"

Many people have vague fears and prejudices about loans.

When I visited the bank to open a savings account, my shoulders were always so confident, but when the purpose of the visit was to get a loan consultation, they started to shrink.

Some people also question whether it is necessary to study the lending system, which operates according to rules and regulations.

Why does the mere mention of loans automatically lead to a "乙" (eul)? And why should we study them? The answer is simple.

Because I don't know about loans.

In the same situation and under the same conditions, some people are rejected for a loan, while others are easily approved.

When it comes to loans, knowledge is power.

"Do I really need to study for a loan? Isn't it going to come out as planned anyway?"

Many people have vague fears and prejudices about loans.

When I visited the bank to open a savings account, my shoulders were always so confident, but when the purpose of the visit was to get a loan consultation, they started to shrink.

Some people also question whether it is necessary to study the lending system, which operates according to rules and regulations.

Why does the mere mention of loans automatically lead to a "乙" (eul)? And why should we study them? The answer is simple.

Because I don't know about loans.

In the same situation and under the same conditions, some people are rejected for a loan, while others are easily approved.

When it comes to loans, knowledge is power.

- You can preview some of the book's contents.

Preview

index

[Opening remarks]

A Simple, Powerful Secret: If You Want to Succeed, Borrow It

----------------------------------------------

Chapter 1: The Power of Loans

----------------------------------------------

01 A loan that helped me take a step forward

[Tip] Using Insurance Policy Loans

02 The feeling of defeat that came with lottery subscription

[Tip] Mortgage Insurance and Air Defense

03 The shortcut to loans

04 To avoid falling behind

05 Money is debt

06 The Relationship Between Loans and Real Estate

07 Even if the interest rate is high or low, you will eventually get a loan

[Loan Consultation Case] High Interest Rates Repaying a Kindness

----------------------------------------------

Chapter 2: Minimum Loan Knowledge

----------------------------------------------

08 Going over basic terminology

[Tip] The Difference Between Loans and Borrowing

09 Types of Loans

10. Utilization of secondary financial institutions and guarantee institutions

[Tip] Loan from your main bank?

[Tip] How to Use Loan Counselor Properly

11 Is face-to-face or remote meeting more advantageous?

12 Variable and fixed interest rates

13 How will the loan proceed?

[Tip] Income Evaluation Criteria for Office Workers and Business Owners

14. Planning Your Finances

[Loan Consultation Case] Why You Need an Expert

----------------------------------------------

Chapter 3: LTV, DTI, and DSR: Determining Loan Limits

----------------------------------------------

15 Understanding LTV, DTI, and DSR

[Tip] Calculating the Weighted Average Interest Rate

[Tip] Understanding the DSR Debt Calculation Method

16 Loan rates vary depending on the situation

[Tip] Regulated and unregulated areas

Calculating DSR using Site 17

18 Three Ways to Avoid DSR

19 Stress-Free DSR

20 Reasons Why Governments Regulate Lending

[Loan Consultation Case] Knowledge is Power

----------------------------------------------

Chapter 4: Loan Knowledge for Newlyweds and Newlyweds:

From renting to buying your own home

----------------------------------------------

21 Loan policies that are more advantageous for younger people

22. A mortgage loan policy that creates seed money

23 Housing and Urban Development Corporation's 4 major rental loans

[Tip] Differences between HF and HUG warranties

[Tip] Are you a homeowner but not a homeowner?

24. Deposit Return Guarantee to Protect Your Precious Money

25 Mortgage Loan Products for Home Purchase

[Tip] What's the Difference Between Insurance Companies' Mortgage Loan Products?

26 Case Studies on How to Use Home Mortgage Loans

27 Loan Points to Know When Winning a Subscription

28 Marriage Registration: Should I or Should I Not?

29 Similar but different pre-sale rights balance loan

30 Loan Utilization Tips Only Professionals Know

[Tip] Why do income standards for the Bokgeumjari loan follow the business processing standards?

[Tip] Can loans be transferred?

31 Tips for Buyers of Pre-Owned Apartments and High-Income Earners

[Loan Consultation Case] Loan First, Deposit Later is Definitely Possible

----------------------------------------------

Chapter 5: More Important Loan Knowledge for Homeowners:

From transfer to additional purchase

----------------------------------------------

32 The taste of familiarity is scary

33 Six Things to Consider Before Switching

34 Strategies for You Who Don't Even Have a Deposit

35 Strategies for Maintaining a Temporary Second Home

36 Strategies to Overcome LTV

[Tip] If you are making additional purchases in other areas

37 Strategies for Returning Insufficient Deposit

38 Loan Refinancing Strategies

[Tip] Can I keep the loan as is and change the purpose?

39 Tips for Single-Home Owners Preparing to Invest and Start a Business

[Loan Consultation Case] The prepared person seizes the opportunity.

----------------------------------------------

Chapter 6 Loan Knowledge for Business Owners:

From raising business funds to investing

----------------------------------------------

40 Business Loan Utilization Strategies

41 If you dream of starting a real estate rental business

[Tip] Setting up RTI for rent-free

42 Synergy between Auctions and Loans

[Tip] Auction Balance Loan Process

[Tip] How to Get a Loan for the Auction Balance

Become a building owner with 100 million to 200 million won

44 How to Invest in Officetels

[Tip] Investing in Knowledge Industry Centers

45. Utilizing low-interest, unsecured policy funds

46 Ways to Increase the Income Recognition Amount for Business Owners and Freelancers

47 You absolutely must have this one

[Loan Consultation Case] Investing in an Apartment as a Corporate Business

----------------------------------------------

Chapter 7: The Art of Negotiation: Getting the Bank on Your Side

----------------------------------------------

Let's first understand the composition of the 48 interest rates.

[Tip] Side Deals and Breaking Sales

49 Tips for Getting a Loan Approval

[Tip] How to Find a Banker Who Will Actively Help You with Your Loan

50 When a financial institution requests additional information

51 How to Get a Silent Employee to Move After a Consultation

52 There's a timing to interest rate negotiations.

53. Using the Right to Request an Interest Rate Reduction

54 The Power to Make the Impossible Possible

[Loan Consultation Case] There's No Giving Up

A Simple, Powerful Secret: If You Want to Succeed, Borrow It

----------------------------------------------

Chapter 1: The Power of Loans

----------------------------------------------

01 A loan that helped me take a step forward

[Tip] Using Insurance Policy Loans

02 The feeling of defeat that came with lottery subscription

[Tip] Mortgage Insurance and Air Defense

03 The shortcut to loans

04 To avoid falling behind

05 Money is debt

06 The Relationship Between Loans and Real Estate

07 Even if the interest rate is high or low, you will eventually get a loan

[Loan Consultation Case] High Interest Rates Repaying a Kindness

----------------------------------------------

Chapter 2: Minimum Loan Knowledge

----------------------------------------------

08 Going over basic terminology

[Tip] The Difference Between Loans and Borrowing

09 Types of Loans

10. Utilization of secondary financial institutions and guarantee institutions

[Tip] Loan from your main bank?

[Tip] How to Use Loan Counselor Properly

11 Is face-to-face or remote meeting more advantageous?

12 Variable and fixed interest rates

13 How will the loan proceed?

[Tip] Income Evaluation Criteria for Office Workers and Business Owners

14. Planning Your Finances

[Loan Consultation Case] Why You Need an Expert

----------------------------------------------

Chapter 3: LTV, DTI, and DSR: Determining Loan Limits

----------------------------------------------

15 Understanding LTV, DTI, and DSR

[Tip] Calculating the Weighted Average Interest Rate

[Tip] Understanding the DSR Debt Calculation Method

16 Loan rates vary depending on the situation

[Tip] Regulated and unregulated areas

Calculating DSR using Site 17

18 Three Ways to Avoid DSR

19 Stress-Free DSR

20 Reasons Why Governments Regulate Lending

[Loan Consultation Case] Knowledge is Power

----------------------------------------------

Chapter 4: Loan Knowledge for Newlyweds and Newlyweds:

From renting to buying your own home

----------------------------------------------

21 Loan policies that are more advantageous for younger people

22. A mortgage loan policy that creates seed money

23 Housing and Urban Development Corporation's 4 major rental loans

[Tip] Differences between HF and HUG warranties

[Tip] Are you a homeowner but not a homeowner?

24. Deposit Return Guarantee to Protect Your Precious Money

25 Mortgage Loan Products for Home Purchase

[Tip] What's the Difference Between Insurance Companies' Mortgage Loan Products?

26 Case Studies on How to Use Home Mortgage Loans

27 Loan Points to Know When Winning a Subscription

28 Marriage Registration: Should I or Should I Not?

29 Similar but different pre-sale rights balance loan

30 Loan Utilization Tips Only Professionals Know

[Tip] Why do income standards for the Bokgeumjari loan follow the business processing standards?

[Tip] Can loans be transferred?

31 Tips for Buyers of Pre-Owned Apartments and High-Income Earners

[Loan Consultation Case] Loan First, Deposit Later is Definitely Possible

----------------------------------------------

Chapter 5: More Important Loan Knowledge for Homeowners:

From transfer to additional purchase

----------------------------------------------

32 The taste of familiarity is scary

33 Six Things to Consider Before Switching

34 Strategies for You Who Don't Even Have a Deposit

35 Strategies for Maintaining a Temporary Second Home

36 Strategies to Overcome LTV

[Tip] If you are making additional purchases in other areas

37 Strategies for Returning Insufficient Deposit

38 Loan Refinancing Strategies

[Tip] Can I keep the loan as is and change the purpose?

39 Tips for Single-Home Owners Preparing to Invest and Start a Business

[Loan Consultation Case] The prepared person seizes the opportunity.

----------------------------------------------

Chapter 6 Loan Knowledge for Business Owners:

From raising business funds to investing

----------------------------------------------

40 Business Loan Utilization Strategies

41 If you dream of starting a real estate rental business

[Tip] Setting up RTI for rent-free

42 Synergy between Auctions and Loans

[Tip] Auction Balance Loan Process

[Tip] How to Get a Loan for the Auction Balance

Become a building owner with 100 million to 200 million won

44 How to Invest in Officetels

[Tip] Investing in Knowledge Industry Centers

45. Utilizing low-interest, unsecured policy funds

46 Ways to Increase the Income Recognition Amount for Business Owners and Freelancers

47 You absolutely must have this one

[Loan Consultation Case] Investing in an Apartment as a Corporate Business

----------------------------------------------

Chapter 7: The Art of Negotiation: Getting the Bank on Your Side

----------------------------------------------

Let's first understand the composition of the 48 interest rates.

[Tip] Side Deals and Breaking Sales

49 Tips for Getting a Loan Approval

[Tip] How to Find a Banker Who Will Actively Help You with Your Loan

50 When a financial institution requests additional information

51 How to Get a Silent Employee to Move After a Consultation

52 There's a timing to interest rate negotiations.

53. Using the Right to Request an Interest Rate Reduction

54 The Power to Make the Impossible Possible

[Loan Consultation Case] There's No Giving Up

Detailed image

.jpg)

Publisher's Review

Don't talk about real estate without mentioning loans!

The absolute gateway to real estate is loans!

There's a lot of talk about a real estate bubble and a bear market, but in South Korea, a "real estate republic" where most assets are invested in real estate, anyone who wants to survive has no choice but to take an interest in real estate.

Even those who say real estate is over now say that 'housing' is essential.

There are countless different ways to invest in real estate.

Anyone can enter the real estate market through small investments, auctions, subscriptions, etc., depending on economic trends and individual circumstances.

However, there is a hurdle that must be overcome in order to 'complete' the investment.

It's a loan.

Occasionally, you'll see articles about people buying real estate with 100% cash and no loans, but such cases are extremely rare.

Most people, whether they want to or not, end up facing a wall called a loan.

For those just starting out in society, there are loan products tailored to each stage of life, including a jeonse loan, a mortgage loan for newlyweds to purchase a home, a loan for the balance of the auction, and a business loan.

And these loans have terms and conditions, including repayment methods and interest rates, that last for a short period of two years or a long period of 30 or 40 years.

That's why the initial setup is important.

There is a loan that is right for me.

There is no right answer, but there is a strategy.

To find the right product for your situation among the numerous products and set up terms that are favorable to you, basic knowledge about loans is essential.

① After acquiring a solid understanding of basic knowledge such as LTV, DTI, DSR, and fixed/floating interest rates,

② Let’s look at loan strategies tailored to each individual: young adults, newlyweds, single-home owners, and investors.

③ Lastly, loan negotiation skills with banks,

A practical guide that covers the entire process of lending from start to finish has been published.

《The More You Know, the More Beneficial Real Estate Loan Strategies》 is a collection of strategies that have been proven effective by Haruhanbo (Lee Dong-young), a loan expert with extensive experience in both the lending departments of commercial banks and the financial consulting market, through consulting on hundreds of loans.

Loans are the lever for building wealth.

But to someone who doesn't know, it's just a 'stick'.

Successful people didn't achieve success solely through their assets or cash.

Because I knew how to get the money I needed when I needed it.

Without capital, no matter how good your idea is, how much talent you have, or how much passion you have, you can't make it happen.

In times like these, a loan becomes a powerful lever that can change your life.

It doesn't matter if the interest rate is high or low.

Now is the time to study loans.

We need to study lending to seize opportunities when interest rates are low and to exploit regulatory loopholes when rates are high.

There are no bad loans in the world.

A loan is just a 'tool'.

For those with planning and management skills, loans are always an opportunity.

80% of people know that loans are important, but they don't study.

If you are opening this book, you are already in the top 20%.

I hope this book will be an opportunity to change the fear of borrowing into 'confidence'.

The absolute gateway to real estate is loans!

There's a lot of talk about a real estate bubble and a bear market, but in South Korea, a "real estate republic" where most assets are invested in real estate, anyone who wants to survive has no choice but to take an interest in real estate.

Even those who say real estate is over now say that 'housing' is essential.

There are countless different ways to invest in real estate.

Anyone can enter the real estate market through small investments, auctions, subscriptions, etc., depending on economic trends and individual circumstances.

However, there is a hurdle that must be overcome in order to 'complete' the investment.

It's a loan.

Occasionally, you'll see articles about people buying real estate with 100% cash and no loans, but such cases are extremely rare.

Most people, whether they want to or not, end up facing a wall called a loan.

For those just starting out in society, there are loan products tailored to each stage of life, including a jeonse loan, a mortgage loan for newlyweds to purchase a home, a loan for the balance of the auction, and a business loan.

And these loans have terms and conditions, including repayment methods and interest rates, that last for a short period of two years or a long period of 30 or 40 years.

That's why the initial setup is important.

There is a loan that is right for me.

There is no right answer, but there is a strategy.

To find the right product for your situation among the numerous products and set up terms that are favorable to you, basic knowledge about loans is essential.

① After acquiring a solid understanding of basic knowledge such as LTV, DTI, DSR, and fixed/floating interest rates,

② Let’s look at loan strategies tailored to each individual: young adults, newlyweds, single-home owners, and investors.

③ Lastly, loan negotiation skills with banks,

A practical guide that covers the entire process of lending from start to finish has been published.

《The More You Know, the More Beneficial Real Estate Loan Strategies》 is a collection of strategies that have been proven effective by Haruhanbo (Lee Dong-young), a loan expert with extensive experience in both the lending departments of commercial banks and the financial consulting market, through consulting on hundreds of loans.

Loans are the lever for building wealth.

But to someone who doesn't know, it's just a 'stick'.

Successful people didn't achieve success solely through their assets or cash.

Because I knew how to get the money I needed when I needed it.

Without capital, no matter how good your idea is, how much talent you have, or how much passion you have, you can't make it happen.

In times like these, a loan becomes a powerful lever that can change your life.

It doesn't matter if the interest rate is high or low.

Now is the time to study loans.

We need to study lending to seize opportunities when interest rates are low and to exploit regulatory loopholes when rates are high.

There are no bad loans in the world.

A loan is just a 'tool'.

For those with planning and management skills, loans are always an opportunity.

80% of people know that loans are important, but they don't study.

If you are opening this book, you are already in the top 20%.

I hope this book will be an opportunity to change the fear of borrowing into 'confidence'.

GOODS SPECIFICS

- Date of issue: September 26, 2025

- Page count, weight, size: 372 pages | 680g | 152*225*22mm

- ISBN13: 9791140715787

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)