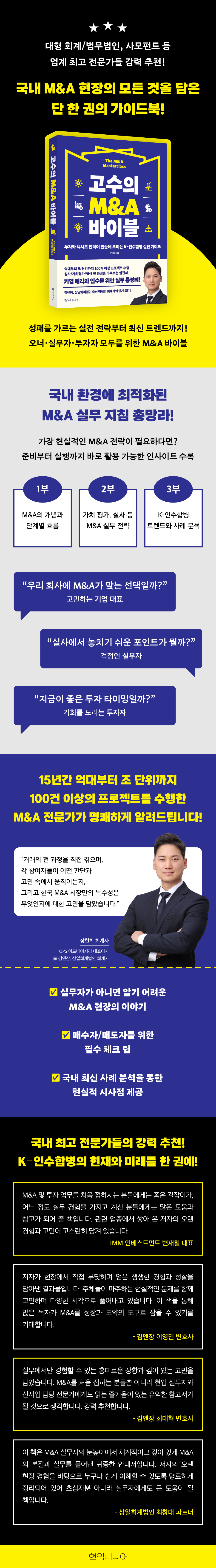

The Expert's M&A Bible

|

Description

Book Introduction

Kim & Chang, a leading domestic M&A specialist accountant from Samil Accounting Corporation

More than 100 projects ranging from hundreds of millions to trillions of won

A practical guide to K-Mergers and Acquisitions, written based on 15 years of experience!

A book highly recommended by experts from Korea's leading private equity funds and law firms!

Everything you need to know about corporate M&A practices, including deals, due diligence, and valuation!

The recent M&A market has faced difficult times due to the economic downturn and liquidity shortage.

However, the more difficult the market environment, the more crucial it is for M&A success to be determined by careful review and strategic approach.

Until now, domestic M&A has been centered around large corporations, but now we have entered an era where even mid-sized and small businesses are strategically utilizing M&A.

Especially for companies aiming for corporate growth, global expansion through overseas IPOs or cross-border M&A is now emerging as a strategy that must be considered.

Additionally, if your goal is exit or investment, you should understand the flow of the capital market and investment opportunities by examining which companies are being sold to whom, for what reasons, in the domestic M&A market.

"The Expert's M&A Bible" provides knowledge, strategies, and tips based on solid practical experience, enabling those involved in the M&A field with diverse objectives to obtain the advice they need at this point in time.

Based on the author's accumulated experience from directly executing over 100 M&A projects ranging from hundreds of millions to trillions of won over approximately 15 years, he systematically organized the entire process of mergers and acquisitions, from negotiation and due diligence to valuation, contracts, and PMI.

It specifically points out the essential points that both buyers and sellers must know from their respective perspectives, and offers practical tips on how to prepare and respond for successful deal making.

Additionally, by reflecting the structural characteristics and recent trends of the domestic M&A market, we were able to gain insight into where opportunities and risks intersect.

This book will serve as a valuable guide for business owners and practitioners preparing for M&A amidst change and uncertainty, as well as for investors seeking future investment opportunities.

More than 100 projects ranging from hundreds of millions to trillions of won

A practical guide to K-Mergers and Acquisitions, written based on 15 years of experience!

A book highly recommended by experts from Korea's leading private equity funds and law firms!

Everything you need to know about corporate M&A practices, including deals, due diligence, and valuation!

The recent M&A market has faced difficult times due to the economic downturn and liquidity shortage.

However, the more difficult the market environment, the more crucial it is for M&A success to be determined by careful review and strategic approach.

Until now, domestic M&A has been centered around large corporations, but now we have entered an era where even mid-sized and small businesses are strategically utilizing M&A.

Especially for companies aiming for corporate growth, global expansion through overseas IPOs or cross-border M&A is now emerging as a strategy that must be considered.

Additionally, if your goal is exit or investment, you should understand the flow of the capital market and investment opportunities by examining which companies are being sold to whom, for what reasons, in the domestic M&A market.

"The Expert's M&A Bible" provides knowledge, strategies, and tips based on solid practical experience, enabling those involved in the M&A field with diverse objectives to obtain the advice they need at this point in time.

Based on the author's accumulated experience from directly executing over 100 M&A projects ranging from hundreds of millions to trillions of won over approximately 15 years, he systematically organized the entire process of mergers and acquisitions, from negotiation and due diligence to valuation, contracts, and PMI.

It specifically points out the essential points that both buyers and sellers must know from their respective perspectives, and offers practical tips on how to prepare and respond for successful deal making.

Additionally, by reflecting the structural characteristics and recent trends of the domestic M&A market, we were able to gain insight into where opportunities and risks intersect.

This book will serve as a valuable guide for business owners and practitioners preparing for M&A amidst change and uncertainty, as well as for investors seeking future investment opportunities.

- You can preview some of the book's contents.

Preview

index

To begin with

Part 1: M&A from the Basics

Chapter 1: What is M&A?

Why bother buying someone else's company? - The various purposes of M&A.

There is a separate formula for each weight class.

Which company should I buy?

Should I buy a company or real estate?

Chapter 2: Five Stages of M&A, From Beginning to End

Step 1: Initial Planning

Step 2: Target Selection and Negotiation

Step 3: Due Diligence

Step 4: Contract Signing and Closing

Step 5: Post-Trade Integration

Part 2: For full-scale M&A practice

Chapter 3: Is This Company Worth Buying? - Target Company Analysis

What are your core values?

How to Build Barriers to Entry

Is the business stable?

How much influence does the representative have?

Where is the market headed?

What is the risk?

Chapter 4: How Much Is This Company Worth? - Valuation Practical Strategies

Three Methods of Valuation

Profit Structure as Read from Sales and Contribution Margin

Key indicators surrounding profits

Management premium that buys control

Real-world verification of intrinsic value

Chapter 5: 6 Tips for Sellers

Don't underestimate the selling decision.

Things to Consider When Considering Selling

First impressions are important

Use a consultant

You have to sell when it sells

Think about how to sell it at a high price.

Chapter 6: 5 Tips for Buyers

Avoid risks

Consider your exit strategy in advance.

Think about how to live cheaply

Find a good deal

Set investment criteria

Chapter 7: Completing Practical M&A Concepts

The Role of M&A Advisors

Characteristics of each type of financial investor

Private equity fund investment structure

Small-Scale M&A Model: Search Funds

Clearing Up Confusing Investment Terms

The percentage of shares that determines the rights

Pros and Cons of Listing

The importance of information collection and utilization

Understanding Key M&A Documents

Part 3: M&A Through Issues and Case Studies

Chapter 8: Understanding the Trends of the Korean M&A Market

Characteristics of Korean M&A

National Core Technologies and M&A

ESG and M&A

Maintaining listing and M&A

Global expansion and cross-border M&A

Chapter 9: Analysis of Korean M&A Cases

Naver and Kurly: A Case Study of Strategic Alliances and M&A

Analysis of Hanwha Hotels & Resorts' Acquisition of Our Home

Analysis of the Sale of CJ CheilJedang's Green Bio Business Unit

Analysis of SK D&D's Acquisition of Localstitch

In conclusion

Part 1: M&A from the Basics

Chapter 1: What is M&A?

Why bother buying someone else's company? - The various purposes of M&A.

There is a separate formula for each weight class.

Which company should I buy?

Should I buy a company or real estate?

Chapter 2: Five Stages of M&A, From Beginning to End

Step 1: Initial Planning

Step 2: Target Selection and Negotiation

Step 3: Due Diligence

Step 4: Contract Signing and Closing

Step 5: Post-Trade Integration

Part 2: For full-scale M&A practice

Chapter 3: Is This Company Worth Buying? - Target Company Analysis

What are your core values?

How to Build Barriers to Entry

Is the business stable?

How much influence does the representative have?

Where is the market headed?

What is the risk?

Chapter 4: How Much Is This Company Worth? - Valuation Practical Strategies

Three Methods of Valuation

Profit Structure as Read from Sales and Contribution Margin

Key indicators surrounding profits

Management premium that buys control

Real-world verification of intrinsic value

Chapter 5: 6 Tips for Sellers

Don't underestimate the selling decision.

Things to Consider When Considering Selling

First impressions are important

Use a consultant

You have to sell when it sells

Think about how to sell it at a high price.

Chapter 6: 5 Tips for Buyers

Avoid risks

Consider your exit strategy in advance.

Think about how to live cheaply

Find a good deal

Set investment criteria

Chapter 7: Completing Practical M&A Concepts

The Role of M&A Advisors

Characteristics of each type of financial investor

Private equity fund investment structure

Small-Scale M&A Model: Search Funds

Clearing Up Confusing Investment Terms

The percentage of shares that determines the rights

Pros and Cons of Listing

The importance of information collection and utilization

Understanding Key M&A Documents

Part 3: M&A Through Issues and Case Studies

Chapter 8: Understanding the Trends of the Korean M&A Market

Characteristics of Korean M&A

National Core Technologies and M&A

ESG and M&A

Maintaining listing and M&A

Global expansion and cross-border M&A

Chapter 9: Analysis of Korean M&A Cases

Naver and Kurly: A Case Study of Strategic Alliances and M&A

Analysis of Hanwha Hotels & Resorts' Acquisition of Our Home

Analysis of the Sale of CJ CheilJedang's Green Bio Business Unit

Analysis of SK D&D's Acquisition of Localstitch

In conclusion

Detailed image

Into the book

M&A is not simply the buying and selling of an object; it is the process of dismantling and reassembling a specific organization (company) that moves like an organic entity and interacts internally and externally.

Accordingly, it can be said that it is a rather complex process that requires thorough planning and strategic execution.

While M&As are often simple, it's important to remember that poorly prepared M&As can ultimately lead to disaster.

--- p.49, from “Chapter 2: Five Stages of M&A, From Beginning to End”

As anyone who has studied economics knows, analyzing the activities of individual companies is learned in microeconomics, not macroeconomics.

But even in M&A, there are times when the macro is more important than the micro.

When considering M&A, the most important and often overlooked thing is understanding and leveraging "macro"—the macro movements of the market.

Behind success, which cannot be explained solely by short-term financial figures or individual company capabilities, lies the larger dynamic of the market environment.

--- p.83, from “Chapter 3: Is It Okay to Buy This Company? - Target Company Analysis Method”

Moreover, due to its structural and cultural characteristics, the Korean M&A market has a very limited flow of information and is closed.

This phenomenon stems from the private nature of transactions, and information is typically transmitted through informal networks based on trust rather than through transparent information flow.

Unless it's a public offering, the mere fact that there's an intention to sell can lead to negative consequences, such as employee unrest, loss of business partners, and a weakened position compared to competitors. Therefore, sellers try to strictly control information.

Therefore, selling information itself can be considered a sensitive asset.

--- p.175, from “Chapter 8: Reading the Flow of the Korean M&A Market”

In today's corporate M&A strategies, 'cross-border M&A', or mergers and acquisitions that cross national borders, is no longer an option exclusively for certain large corporations or global companies.

For small and medium-sized enterprises (SMEs), it is becoming an essential strategy to consider as a means of global expansion or as a tool for maximizing corporate value.

Companies that previously focused on expansion within the domestic market must now simultaneously look to overseas markets to determine their growth potential and strategic direction.

Accordingly, it can be said that it is a rather complex process that requires thorough planning and strategic execution.

While M&As are often simple, it's important to remember that poorly prepared M&As can ultimately lead to disaster.

--- p.49, from “Chapter 2: Five Stages of M&A, From Beginning to End”

As anyone who has studied economics knows, analyzing the activities of individual companies is learned in microeconomics, not macroeconomics.

But even in M&A, there are times when the macro is more important than the micro.

When considering M&A, the most important and often overlooked thing is understanding and leveraging "macro"—the macro movements of the market.

Behind success, which cannot be explained solely by short-term financial figures or individual company capabilities, lies the larger dynamic of the market environment.

--- p.83, from “Chapter 3: Is It Okay to Buy This Company? - Target Company Analysis Method”

Moreover, due to its structural and cultural characteristics, the Korean M&A market has a very limited flow of information and is closed.

This phenomenon stems from the private nature of transactions, and information is typically transmitted through informal networks based on trust rather than through transparent information flow.

Unless it's a public offering, the mere fact that there's an intention to sell can lead to negative consequences, such as employee unrest, loss of business partners, and a weakened position compared to competitors. Therefore, sellers try to strictly control information.

Therefore, selling information itself can be considered a sensitive asset.

--- p.175, from “Chapter 8: Reading the Flow of the Korean M&A Market”

In today's corporate M&A strategies, 'cross-border M&A', or mergers and acquisitions that cross national borders, is no longer an option exclusively for certain large corporations or global companies.

For small and medium-sized enterprises (SMEs), it is becoming an essential strategy to consider as a means of global expansion or as a tool for maximizing corporate value.

Companies that previously focused on expansion within the domestic market must now simultaneously look to overseas markets to determine their growth potential and strategic direction.

--- p.185, from “Chapter 8: Reading the Flow of the Korean M&A Market”

Publisher's Review

Kim & Chang, an M&A specialist accountant from Samil Accounting Corporation

Everything you need to know about practical matters, based on over 15 years of field experience!

A guide covering the flow and latest trends of Korean M&A.

The domestic M&A market has recently been facing a difficult situation due to the economic downturn and shrinking liquidity.

Deal success rates have declined, and negotiations on price and terms have become more difficult.

However, in such a challenging market, thorough preparation and meticulous strategy determine the success or failure of M&A.

To grow their businesses and achieve various goals, such as IPOs and exits, that enable them to compete globally beyond the domestic market, not only large corporations but also mid-sized and small businesses need to strategically utilize M&A in ways that are different from the past.

Investors can also identify capital movements and investment opportunities by paying attention to the principles and trends of the M&A market.

Although M&A can be an attractive strategy for companies and investors, it is difficult to fully grasp the essence of M&A by looking only at the numbers and results.

Due to the structure of the domestic M&A market, which revolves around large corporations, and the limitations of sufficient disclosure of information exchanged during the transaction process, it is difficult to gain a deep understanding of the inside story unless you are an actual transaction party or an industry insider.

"The Expert's M&A Bible" delves into this very point, vividly illustrating the complex issues of the due diligence process and the risks that can easily be overlooked during contract negotiations, all directly experienced in the field.

Therefore, through this book, readers can identify and address the problems they will inevitably encounter when conducting M&A, rather than relying on textbook-style theories.

The know-how in this book, backed by solid practical experience, will help business owners, practitioners, and even investors gain more specific insights into situations and make decisions.

The author, a certified public accountant and tax accountant, is an M&A expert who has personally carried out over 100 major projects over the past 15 years at leading Korean M&A firms such as Samil Accounting Corporation, BDA Partners, and Kim & Chang, and currently at QPS Advisory.

In this book, the author draws on his experience across the entire transaction process, including negotiation, due diligence, valuation, contracts, and PMI, to thoroughly explain the fundamentals of M&A, key documents, and terminology, and provides detailed tips that would be difficult to grasp unless you are a practitioner.

Furthermore, by analyzing the structural characteristics of the domestic M&A market, recent trends, and cases, it clearly shows how to assess opportunities and risks and develop strategies in the M&A field.

Moreover, the analysis of recent cases, such as Naver and Kurly's strategic alliance and M&A, goes beyond a simple introduction and provides practical implications.

Systematic explanation optimized for the domestic market environment

Insights you can immediately apply in your work, including deals, due diligence, and valuations!

A guide for all startups aiming for an exit!

M&A is more than just a process of buying and selling a company; it is also a process of fundamentally examining the company's constitution.

Restructuring the financial structure, strengthening internal controls, and establishing a system that can operate without disruption even in the absence of a representative are all prerequisites for a successful M&A.

"The Master's M&A Bible" specifically demonstrates why this preparation process is crucial and how it makes a difference in actual transactions.

For business owners, this can be a great help as a long-term growth strategy, and for practitioners, it can be a checklist that can be used immediately in the field.

This book is divided into three parts, each of which covers in detail the key elements required to prepare and execute M&A.

Part 1 presents the concept and major trends of M&A. Part 2 analyzes and evaluates a company's value and provides practical methods for successfully leading a transaction. Part 3 presents the characteristics of the Korean M&A market and analyzes domestic cases.

What makes this book different is that it is not a foreign theory or universal case study, but a practical guide that takes into account domestic systems and environments.

Because it explains the practical context, including Korea's legal and institutional limitations and the characteristics of its business practices, it offers greater utility than other sources.

Unlike general reference books, this book will be a useful reference for those who need strategies in the Korean M&A market.

This guide is valuable not only for domestic corporations, small and medium-sized enterprises, and startups, but also for overseas investors and partners seeking to understand the Korean market.

Everything you need to know about practical matters, based on over 15 years of field experience!

A guide covering the flow and latest trends of Korean M&A.

The domestic M&A market has recently been facing a difficult situation due to the economic downturn and shrinking liquidity.

Deal success rates have declined, and negotiations on price and terms have become more difficult.

However, in such a challenging market, thorough preparation and meticulous strategy determine the success or failure of M&A.

To grow their businesses and achieve various goals, such as IPOs and exits, that enable them to compete globally beyond the domestic market, not only large corporations but also mid-sized and small businesses need to strategically utilize M&A in ways that are different from the past.

Investors can also identify capital movements and investment opportunities by paying attention to the principles and trends of the M&A market.

Although M&A can be an attractive strategy for companies and investors, it is difficult to fully grasp the essence of M&A by looking only at the numbers and results.

Due to the structure of the domestic M&A market, which revolves around large corporations, and the limitations of sufficient disclosure of information exchanged during the transaction process, it is difficult to gain a deep understanding of the inside story unless you are an actual transaction party or an industry insider.

"The Expert's M&A Bible" delves into this very point, vividly illustrating the complex issues of the due diligence process and the risks that can easily be overlooked during contract negotiations, all directly experienced in the field.

Therefore, through this book, readers can identify and address the problems they will inevitably encounter when conducting M&A, rather than relying on textbook-style theories.

The know-how in this book, backed by solid practical experience, will help business owners, practitioners, and even investors gain more specific insights into situations and make decisions.

The author, a certified public accountant and tax accountant, is an M&A expert who has personally carried out over 100 major projects over the past 15 years at leading Korean M&A firms such as Samil Accounting Corporation, BDA Partners, and Kim & Chang, and currently at QPS Advisory.

In this book, the author draws on his experience across the entire transaction process, including negotiation, due diligence, valuation, contracts, and PMI, to thoroughly explain the fundamentals of M&A, key documents, and terminology, and provides detailed tips that would be difficult to grasp unless you are a practitioner.

Furthermore, by analyzing the structural characteristics of the domestic M&A market, recent trends, and cases, it clearly shows how to assess opportunities and risks and develop strategies in the M&A field.

Moreover, the analysis of recent cases, such as Naver and Kurly's strategic alliance and M&A, goes beyond a simple introduction and provides practical implications.

Systematic explanation optimized for the domestic market environment

Insights you can immediately apply in your work, including deals, due diligence, and valuations!

A guide for all startups aiming for an exit!

M&A is more than just a process of buying and selling a company; it is also a process of fundamentally examining the company's constitution.

Restructuring the financial structure, strengthening internal controls, and establishing a system that can operate without disruption even in the absence of a representative are all prerequisites for a successful M&A.

"The Master's M&A Bible" specifically demonstrates why this preparation process is crucial and how it makes a difference in actual transactions.

For business owners, this can be a great help as a long-term growth strategy, and for practitioners, it can be a checklist that can be used immediately in the field.

This book is divided into three parts, each of which covers in detail the key elements required to prepare and execute M&A.

Part 1 presents the concept and major trends of M&A. Part 2 analyzes and evaluates a company's value and provides practical methods for successfully leading a transaction. Part 3 presents the characteristics of the Korean M&A market and analyzes domestic cases.

What makes this book different is that it is not a foreign theory or universal case study, but a practical guide that takes into account domestic systems and environments.

Because it explains the practical context, including Korea's legal and institutional limitations and the characteristics of its business practices, it offers greater utility than other sources.

Unlike general reference books, this book will be a useful reference for those who need strategies in the Korean M&A market.

This guide is valuable not only for domestic corporations, small and medium-sized enterprises, and startups, but also for overseas investors and partners seeking to understand the Korean market.

GOODS SPECIFICS

- Date of issue: October 3, 2025

- Page count, weight, size: 204 pages | 152*225*20mm

- ISBN13: 9791194793229

- ISBN10: 1194793223

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)