Bitcoin, Ethereum, and the Ultimate Winner

|

Description

Book Introduction

“DeFi is coming after Bitcoin!”

Even the Federal Reserve is paying attention during this market turmoil!

Get on board DeFi, the next revolution and the $100 trillion investment!

- Explanation of DeFi projects and various altcoins

- A detailed explanation of the cryptocurrency outlook and digital ecosystem.

- Introduction to investment methods such as interest farming and staking.

- Includes a preface by the authors to the Korean edition

It's been over a decade since Bitcoin, which shocked the world and established itself as a global asset star, finally received approval for a Bitcoin spot ETF in January 2024.

Now, a more important question is being asked across all walks of life: “Who will be Bitcoin’s successor?”

The authors of "Bitcoin, Ethereum, and the Ultimate Winner" call its successor "DeFi."

DeFi is an abbreviation for Decentralized Finance, a system that allows financial transactions to take place between individuals without the need for financial institutions.

It is a technology that is faster, more flexible, cheaper, and more transparent than traditional finance.

Tech and finance experts Stephen Boyke Sidley and Simon Dingle explain the concepts and principles of DeFi, introduce new businesses, and identify winners and losers in the coming financial revolution.

We offer various coins as well as DeFi-based projects such as Compound and Nexus Mutual.

It also describes the current state and future of the fintech industry, while also providing exit strategies for traditional banks.

This guide will be a valuable resource for readers interested in the future of cryptocurrencies and virtual assets, businesspeople working in finance or interested in trends, and investors contemplating which assets will be valuable in the future.

Even the Federal Reserve is paying attention during this market turmoil!

Get on board DeFi, the next revolution and the $100 trillion investment!

- Explanation of DeFi projects and various altcoins

- A detailed explanation of the cryptocurrency outlook and digital ecosystem.

- Introduction to investment methods such as interest farming and staking.

- Includes a preface by the authors to the Korean edition

It's been over a decade since Bitcoin, which shocked the world and established itself as a global asset star, finally received approval for a Bitcoin spot ETF in January 2024.

Now, a more important question is being asked across all walks of life: “Who will be Bitcoin’s successor?”

The authors of "Bitcoin, Ethereum, and the Ultimate Winner" call its successor "DeFi."

DeFi is an abbreviation for Decentralized Finance, a system that allows financial transactions to take place between individuals without the need for financial institutions.

It is a technology that is faster, more flexible, cheaper, and more transparent than traditional finance.

Tech and finance experts Stephen Boyke Sidley and Simon Dingle explain the concepts and principles of DeFi, introduce new businesses, and identify winners and losers in the coming financial revolution.

We offer various coins as well as DeFi-based projects such as Compound and Nexus Mutual.

It also describes the current state and future of the fintech industry, while also providing exit strategies for traditional banks.

This guide will be a valuable resource for readers interested in the future of cryptocurrencies and virtual assets, businesspeople working in finance or interested in trends, and investors contemplating which assets will be valuable in the future.

- You can preview some of the book's contents.

Preview

index

Recommendation

A timeline of major cryptocurrency-related events

To Korean readers

Entering

CHAPTER 1: Defi is Coming

CHAPTER 2: It's a matter of trust above all else.

CHAPTER 3: Cryptocurrency Legends: Bitcoin and Ethereum

CHAPTER 4: Democratizing Finance Led by DeFi

CHAPTER 5 Traditional Banks vs. DeFi

CHAPTER 6 Financing through ICOs

CHAPTER 7 Stablecoins Pegged to the Dollar

CHAPTER 8 Compounds Dealing with Deposits and Loans

CHAPTER 9: Yield Farming and Fantastic Returns

CHAPTER 10: Uniswap, the World's Largest Decentralized Exchange

CHAPTER 11 $100 Trillion Smart Contract

CHAPTER 12: Innovative Insurance Services, Nexus Mutual

CHAPTER 13 Ethereum and Killer Apps

CHAPTER 14 DERIVATIVES AND CRYPTOMATOLOGIES

CHAPTER 15 NFTs and DeFi Projects

CHAPTER 16: The Weird Pie Project: A Brilliant Idea

CHAPTER 17 DeFi Risks

CHAPTER 18 Wyoming's Fintech Sandbox

CHAPTER 19 Fintech and Neobanks

CHAPTER 20: Cryptocurrency Mining and the Energy Debate

CHAPTER 21 Exit Strategies of Traditional Banks

CHAPTER 22: CENTRAL BANKING AND STABLECOINS

CHAPTER 23 The Future of DeFi

In conclusion

Regarding some issues

Acknowledgements

A timeline of major cryptocurrency-related events

To Korean readers

Entering

CHAPTER 1: Defi is Coming

CHAPTER 2: It's a matter of trust above all else.

CHAPTER 3: Cryptocurrency Legends: Bitcoin and Ethereum

CHAPTER 4: Democratizing Finance Led by DeFi

CHAPTER 5 Traditional Banks vs. DeFi

CHAPTER 6 Financing through ICOs

CHAPTER 7 Stablecoins Pegged to the Dollar

CHAPTER 8 Compounds Dealing with Deposits and Loans

CHAPTER 9: Yield Farming and Fantastic Returns

CHAPTER 10: Uniswap, the World's Largest Decentralized Exchange

CHAPTER 11 $100 Trillion Smart Contract

CHAPTER 12: Innovative Insurance Services, Nexus Mutual

CHAPTER 13 Ethereum and Killer Apps

CHAPTER 14 DERIVATIVES AND CRYPTOMATOLOGIES

CHAPTER 15 NFTs and DeFi Projects

CHAPTER 16: The Weird Pie Project: A Brilliant Idea

CHAPTER 17 DeFi Risks

CHAPTER 18 Wyoming's Fintech Sandbox

CHAPTER 19 Fintech and Neobanks

CHAPTER 20: Cryptocurrency Mining and the Energy Debate

CHAPTER 21 Exit Strategies of Traditional Banks

CHAPTER 22: CENTRAL BANKING AND STABLECOINS

CHAPTER 23 The Future of DeFi

In conclusion

Regarding some issues

Acknowledgements

Detailed image

Into the book

The financial institutions where we entrust our precious assets feel more and more unfamiliar with each passing day.

Their brands and tellers may know something, but the financial products they sell us are becoming increasingly complex and incomprehensible.

And financial institutions are becoming increasingly monopolistic.

It's not because there's no competition, but because it's difficult for customers to switch their primary bank.

If you're someone who has a lot of savings accounts, checking accounts, credit cards, and mortgage loans at one bank, wouldn't you be hesitant to open a new bank?

This situation leads us to the term “trustlessness,” one of the core pillars of DeFi.

And that leads us to another often misunderstood DeFi term: decentralization.

A trustless economic system is one in which participants do not need to trust anyone.

There is no need for that at all.

Anyone who created the system, used it, or abused it.

This applies to most of the DeFi projects we will discuss.

Trustless architectures are designed around worst-case scenarios, such as everyone deceiving each other.

Even the system itself does not need to be trusted.

---From "CHAPTER 2: It's a matter of trust above all else"

When discussing DeFi, one thing that cannot be left out is Bitcoin.

Because Bitcoin is the progenitor of DeFi.

However, despite Bitcoin's relatively young existence, there are already so many records, myths, claims, and analyses about it that we only want to discuss the parts that illuminate the path to DeFi.

The landmark white paper "Bitcoin: A Peer-to-Peer Electronic Cash System" published by Bitcoin creator Satoshi Nakamoto in 2008 served as a catalyst for a small group of cryptocurrency enthusiasts, including Satoshi himself, to develop the Bitcoin blockchain.

Satoshi attempted to solve several problems with real-world currencies through his white paper and the blockchain software it described.

The most important issue was the "double spending" problem, which had been a stumbling block since the 1970s when people began to contemplate developing digital currencies.

---From "CHAPTER 3: The Legend of Cryptocurrency, Bitcoin and Ethereum"

Currently, many DeFi projects are competing with banks in the areas of deposits and interest rates.

The best known of these projects is Yearn.

In its early stages, Yeon's work involved scouring the DeFi world for projects that needed crypto capital for lending, trading, or other uses, and that paid interest to attract it.

The kite sniffs around looking for the best liquidity provider, and you, the depositor, receive the best interest in return for providing liquidity until the kite finds a better provider.

This new service, called "yield farming," is completely impossible in traditional finance.

Because of the lock-in and complicated administrative procedures.

---From "CHAPTER 4: Democratization of Finance Led by DeFi"

Some of them became rich as their market capitalization soared.

There were also TrumpCoin and PutinCoin, both cryptocurrencies that also attracted some investment.

Celebrities were no help at this time.

Many of them were promoting new ICOs, feeling the adrenaline rush of receiving free tokens, without even clearly understanding what they were selling.

Now, as evidenced by Elon Musk's tweet endorsing Dogecoin in 2021, it's celebrities who are moving the market.

---From "CHAPTER 6 Financing through ICO"

Real-world derivatives worth $1,000 trillion are flocking to DeFi.

DeFi is the perfect tool for performing complex calculations on complex financial products like derivatives.

Billions of cryptocurrency derivatives already circulate around the Ethereum blockchain through projects like Synthetix.

It may not be $1,000 trillion yet, but it's growing rapidly.

For this amount of money, it's better to trust the data.

---From "CHAPTER 11: The Quadrillion Dollar Smart Contract"

The WeirdPie project, which will be explained next, is, in a word, a 'lottery that cannot lose money.'

There are several such projects, and I'd like to introduce PoolTogether.

The concept is simple.

Clients put money into one of several pools, whether it's a DAI pool, a USDT pool, or a Tether pool, in exchange for POOL tokens that grant them governance rights.

Then, PoolTogether invests the collected customer money in external DeFi projects that pay interest, like Compound.

The interest accumulated in the pool is put up as a prize and paid out to lucky token holders randomly selected by the system.

While PoolTogether itself is a protocol, external developers can design various lotteries within the system.

Developers can be creative and come up with different reward and prize strategies as long as they follow the established rules.

And of course, the full tokens given to those who bet on the lottery can be freely traded on various DEXs.

---From "CHAPTER 16: The Weird Pie Project, a Collection of Ingenious Ideas"

To further clarify the relationship between fintech and DeFi, let's talk about fintech expert Will Beeson.

Bison became famous for founding and successfully running a neobank.

Neobanks are very similar to traditional banks, except that they don't have offline branches.

The services offered by neobanks are based on PC and mobile phone interfaces that feel modern and sometimes uniquely designed.

As a Chartered Financial Accountant (CFA), Beeson had been working as a banker at Citibank and TradeFi before, as he proudly puts it at the top of his LinkedIn page, he “got fed up with the banking industry and felt the need to do something about it.”

After leaving the banking industry, he served as an advisor to various technology-driven startup banks, and helped found two neobanks, Alika and Bella, in the UK and the US, respectively.

---From "CHAPTER 19 Fintech and Neobanks"

We firmly believe that we are at the cutting edge of innovation.

It's as innovative as the "big" new technology ecosystem that has relied on a combination of microprocessors, software, and the Internet for success since the 1970s.

It feels like a mystery that people don't know about DeFi, maybe because we're so far ahead in the cycle.

But even so, it is truly amazing.

If you take a quick look at some DeFi projects, for example, you'll quickly realize that the DeFi deposit interest rates are much higher than any deposit interest rate offered by TradeFi.

Their brands and tellers may know something, but the financial products they sell us are becoming increasingly complex and incomprehensible.

And financial institutions are becoming increasingly monopolistic.

It's not because there's no competition, but because it's difficult for customers to switch their primary bank.

If you're someone who has a lot of savings accounts, checking accounts, credit cards, and mortgage loans at one bank, wouldn't you be hesitant to open a new bank?

This situation leads us to the term “trustlessness,” one of the core pillars of DeFi.

And that leads us to another often misunderstood DeFi term: decentralization.

A trustless economic system is one in which participants do not need to trust anyone.

There is no need for that at all.

Anyone who created the system, used it, or abused it.

This applies to most of the DeFi projects we will discuss.

Trustless architectures are designed around worst-case scenarios, such as everyone deceiving each other.

Even the system itself does not need to be trusted.

---From "CHAPTER 2: It's a matter of trust above all else"

When discussing DeFi, one thing that cannot be left out is Bitcoin.

Because Bitcoin is the progenitor of DeFi.

However, despite Bitcoin's relatively young existence, there are already so many records, myths, claims, and analyses about it that we only want to discuss the parts that illuminate the path to DeFi.

The landmark white paper "Bitcoin: A Peer-to-Peer Electronic Cash System" published by Bitcoin creator Satoshi Nakamoto in 2008 served as a catalyst for a small group of cryptocurrency enthusiasts, including Satoshi himself, to develop the Bitcoin blockchain.

Satoshi attempted to solve several problems with real-world currencies through his white paper and the blockchain software it described.

The most important issue was the "double spending" problem, which had been a stumbling block since the 1970s when people began to contemplate developing digital currencies.

---From "CHAPTER 3: The Legend of Cryptocurrency, Bitcoin and Ethereum"

Currently, many DeFi projects are competing with banks in the areas of deposits and interest rates.

The best known of these projects is Yearn.

In its early stages, Yeon's work involved scouring the DeFi world for projects that needed crypto capital for lending, trading, or other uses, and that paid interest to attract it.

The kite sniffs around looking for the best liquidity provider, and you, the depositor, receive the best interest in return for providing liquidity until the kite finds a better provider.

This new service, called "yield farming," is completely impossible in traditional finance.

Because of the lock-in and complicated administrative procedures.

---From "CHAPTER 4: Democratization of Finance Led by DeFi"

Some of them became rich as their market capitalization soared.

There were also TrumpCoin and PutinCoin, both cryptocurrencies that also attracted some investment.

Celebrities were no help at this time.

Many of them were promoting new ICOs, feeling the adrenaline rush of receiving free tokens, without even clearly understanding what they were selling.

Now, as evidenced by Elon Musk's tweet endorsing Dogecoin in 2021, it's celebrities who are moving the market.

---From "CHAPTER 6 Financing through ICO"

Real-world derivatives worth $1,000 trillion are flocking to DeFi.

DeFi is the perfect tool for performing complex calculations on complex financial products like derivatives.

Billions of cryptocurrency derivatives already circulate around the Ethereum blockchain through projects like Synthetix.

It may not be $1,000 trillion yet, but it's growing rapidly.

For this amount of money, it's better to trust the data.

---From "CHAPTER 11: The Quadrillion Dollar Smart Contract"

The WeirdPie project, which will be explained next, is, in a word, a 'lottery that cannot lose money.'

There are several such projects, and I'd like to introduce PoolTogether.

The concept is simple.

Clients put money into one of several pools, whether it's a DAI pool, a USDT pool, or a Tether pool, in exchange for POOL tokens that grant them governance rights.

Then, PoolTogether invests the collected customer money in external DeFi projects that pay interest, like Compound.

The interest accumulated in the pool is put up as a prize and paid out to lucky token holders randomly selected by the system.

While PoolTogether itself is a protocol, external developers can design various lotteries within the system.

Developers can be creative and come up with different reward and prize strategies as long as they follow the established rules.

And of course, the full tokens given to those who bet on the lottery can be freely traded on various DEXs.

---From "CHAPTER 16: The Weird Pie Project, a Collection of Ingenious Ideas"

To further clarify the relationship between fintech and DeFi, let's talk about fintech expert Will Beeson.

Bison became famous for founding and successfully running a neobank.

Neobanks are very similar to traditional banks, except that they don't have offline branches.

The services offered by neobanks are based on PC and mobile phone interfaces that feel modern and sometimes uniquely designed.

As a Chartered Financial Accountant (CFA), Beeson had been working as a banker at Citibank and TradeFi before, as he proudly puts it at the top of his LinkedIn page, he “got fed up with the banking industry and felt the need to do something about it.”

After leaving the banking industry, he served as an advisor to various technology-driven startup banks, and helped found two neobanks, Alika and Bella, in the UK and the US, respectively.

---From "CHAPTER 19 Fintech and Neobanks"

We firmly believe that we are at the cutting edge of innovation.

It's as innovative as the "big" new technology ecosystem that has relied on a combination of microprocessors, software, and the Internet for success since the 1970s.

It feels like a mystery that people don't know about DeFi, maybe because we're so far ahead in the cycle.

But even so, it is truly amazing.

If you take a quick look at some DeFi projects, for example, you'll quickly realize that the DeFi deposit interest rates are much higher than any deposit interest rate offered by TradeFi.

---From "CHAPTER 23: The Future of Defi"

Publisher's Review

The Next Big Thing Beyond Bitcoin and Ethereum

Pay attention to DeFi!

★Amazon Reader Reviews

“A clear explanation of the impact of blockchain and Web 3.0.” _Robi*

“A book filled with essential common sense in a changing world!” _James Whyl*

“This book makes understanding Bitcoin and blockchain much easier.” _Mark Morri*

“A clear explanation of cryptocurrencies, allowing us to anticipate the coming financial revolution.” _Pelica*

In these times when it is difficult to predict even an inch ahead,

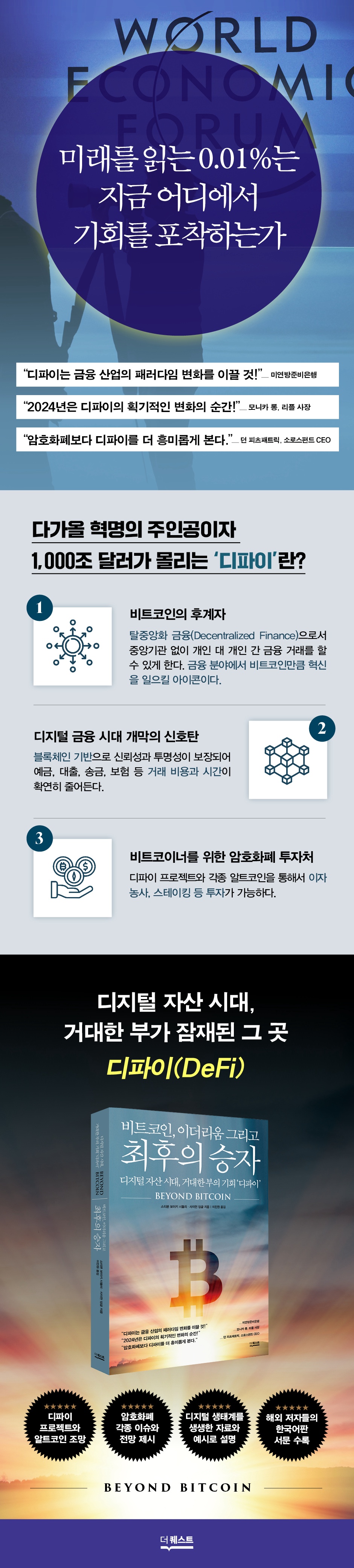

The 0.01% who can see the future find opportunities in DeFi.

With the era of low growth, geopolitical risks still present, and global stock markets fluctuating due to technological changes, market turmoil is intensifying year after year.

In this era where we must predict the future and discover new opportunities, what are experts focusing on? There's one word that experts unanimously recommend paying attention to.

It's DeFi.

DeFi, short for Decentralized Finance, allows financial transactions between individuals without intermediaries, and is characterized by being faster and more reliable than the existing financial system.

The Federal Reserve Bank of the United States predicted that DeFi could lead to a paradigm shift in the financial industry, and renowned venture capital firm Andreessen Horowitz showed great interest in a DeFi project called Compound.

Also, Don Fitzpatrick, CEO of Soros Funds, is looking at DeFi along with cryptocurrencies with great interest.

Ripple CEO Monica Long also said that 2024 will be the year of DeFi innovation.

In this way, key market players are paying attention to DeFi.

Everything from DeFi's concept to its risks and prospects!

A must-read book to get rich quicker than others!

"Bitcoin, Ethereum, and the Ultimate Winner" is a book that explores the potential opportunities of DeFi from A to Z.

In fact, to truly understand DeFi, you need to understand various new technologies such as blockchain, cryptocurrency, and NFTs and their relationships.

Understanding the tangled digital ecosystem is not easy.

However, the authors, who have worked in various tech companies, including cryptocurrency companies, explain the concept of DeFi, its risks, prospects, and its role in the digital ecosystem in an easily understandable manner.

For example, when explaining a DeFi project called 'Nexus Mutual', the founder's concerns were addressed, the process he went through to grow the business, and similar projects are explained in a storytelling format.

In addition, we will delve into various altcoins, the prospects for Bitcoin and Ethereum, new businesses in the cryptocurrency sector unknown to the general public, and risks.

This book, which examines not only DeFi but also the ecosystem surrounding it, meticulously presents a macroscopic outlook and analysis of the future beyond Bitcoin, much like its original title, "Beyond Bitcoin."

The authors argue that DeFi will usher in a financial revolution that goes beyond fintech, as it is a fast, low-cost, and secure technology.

It is also said that DeFi will usher in a so-called "bankless era," where the public will not need to go through central banks or other platforms.

He also argues that there is a possibility that cryptocurrencies will become a true future asset.

In particular, the authors compare DeFi to the internet and smartphones.

The current position of DeFi is similar to that of the Internet in the 1990s and smartphones in the 2000s and 2010s.

If AI is at the forefront of the recent technological revolution, DeFi is at the forefront of the financial revolution.

History doesn't repeat itself, but its flow does.

Just as various technologies have transformed our world, decentralized finance (DeFi) will do the same in the near future.

Pay attention to DeFi!

★Amazon Reader Reviews

“A clear explanation of the impact of blockchain and Web 3.0.” _Robi*

“A book filled with essential common sense in a changing world!” _James Whyl*

“This book makes understanding Bitcoin and blockchain much easier.” _Mark Morri*

“A clear explanation of cryptocurrencies, allowing us to anticipate the coming financial revolution.” _Pelica*

In these times when it is difficult to predict even an inch ahead,

The 0.01% who can see the future find opportunities in DeFi.

With the era of low growth, geopolitical risks still present, and global stock markets fluctuating due to technological changes, market turmoil is intensifying year after year.

In this era where we must predict the future and discover new opportunities, what are experts focusing on? There's one word that experts unanimously recommend paying attention to.

It's DeFi.

DeFi, short for Decentralized Finance, allows financial transactions between individuals without intermediaries, and is characterized by being faster and more reliable than the existing financial system.

The Federal Reserve Bank of the United States predicted that DeFi could lead to a paradigm shift in the financial industry, and renowned venture capital firm Andreessen Horowitz showed great interest in a DeFi project called Compound.

Also, Don Fitzpatrick, CEO of Soros Funds, is looking at DeFi along with cryptocurrencies with great interest.

Ripple CEO Monica Long also said that 2024 will be the year of DeFi innovation.

In this way, key market players are paying attention to DeFi.

Everything from DeFi's concept to its risks and prospects!

A must-read book to get rich quicker than others!

"Bitcoin, Ethereum, and the Ultimate Winner" is a book that explores the potential opportunities of DeFi from A to Z.

In fact, to truly understand DeFi, you need to understand various new technologies such as blockchain, cryptocurrency, and NFTs and their relationships.

Understanding the tangled digital ecosystem is not easy.

However, the authors, who have worked in various tech companies, including cryptocurrency companies, explain the concept of DeFi, its risks, prospects, and its role in the digital ecosystem in an easily understandable manner.

For example, when explaining a DeFi project called 'Nexus Mutual', the founder's concerns were addressed, the process he went through to grow the business, and similar projects are explained in a storytelling format.

In addition, we will delve into various altcoins, the prospects for Bitcoin and Ethereum, new businesses in the cryptocurrency sector unknown to the general public, and risks.

This book, which examines not only DeFi but also the ecosystem surrounding it, meticulously presents a macroscopic outlook and analysis of the future beyond Bitcoin, much like its original title, "Beyond Bitcoin."

The authors argue that DeFi will usher in a financial revolution that goes beyond fintech, as it is a fast, low-cost, and secure technology.

It is also said that DeFi will usher in a so-called "bankless era," where the public will not need to go through central banks or other platforms.

He also argues that there is a possibility that cryptocurrencies will become a true future asset.

In particular, the authors compare DeFi to the internet and smartphones.

The current position of DeFi is similar to that of the Internet in the 1990s and smartphones in the 2000s and 2010s.

If AI is at the forefront of the recent technological revolution, DeFi is at the forefront of the financial revolution.

History doesn't repeat itself, but its flow does.

Just as various technologies have transformed our world, decentralized finance (DeFi) will do the same in the near future.

GOODS SPECIFICS

- Date of issue: February 23, 2024

- Page count, weight, size: 340 pages | 510g | 152*220*22mm

- ISBN13: 9791140708420

- ISBN10: 1140708422

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)