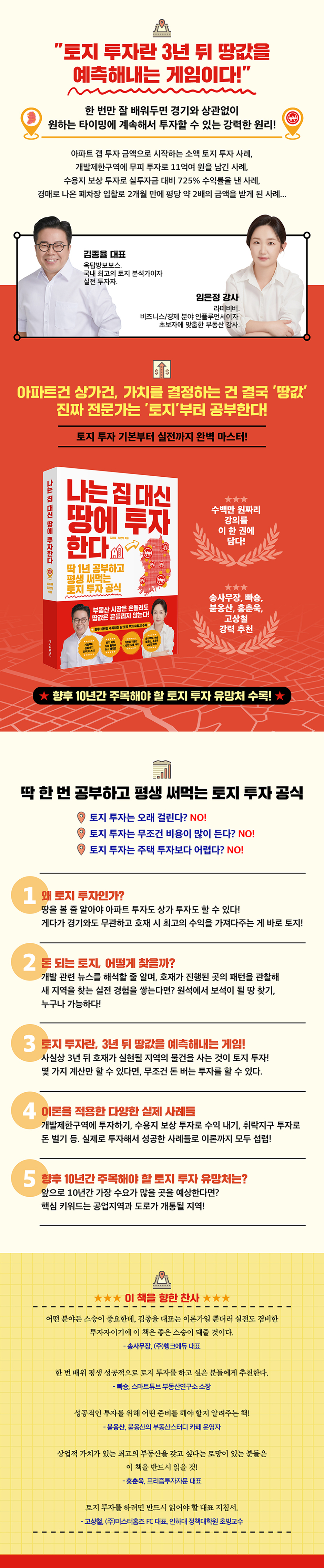

I invest in land instead of houses.

|

Description

Book Introduction

Whether it's an apartment or a commercial building, what ultimately determines value is the price of the land!

A true expert starts by studying the 'land'!

The practical sense of the best land investment analyst, Attic Boss Kim Jong-yul.

And the detailed explanation by Latte Beaver Im Eun-jeong that will help you build a solid foundation!

* Strongly recommended by Song Sa-mu-jang, Ppa-song, Bu-ong-san, Hong Chun-wook, and Go Sang-cheol *

Kim Jong-yul and Lim Eun-jeong, recognized as Korea's leading land instructors, have published a master textbook on land investment that can be utilized by anyone from beginners to experts.

This book is called “I Invest in Land Instead of Houses.”

Any real estate investor wants an investment that generates consistent returns regardless of market conditions.

In particular, investments that are free from government policies, regulations, and market conditions, and that can generate large profits, are good.

What is that? It's land investment.

In fact, most of the wealthy people use land to achieve explosive growth in assets, aka quantum leaps, and everyone knows that the truly wealthy are the "land rich."

Even though apartment prices have risen significantly over the past few years, they haven't risen by more than 5 to 10 times.

However, land has development potential, and if you time your buying and selling well, its value can easily rise 5 to 10 times.

So why can't I easily invest? Land investment is too difficult and seems like it would require a lot of seed money.

Moreover, they believe it will take a long time to become profitable.

Is this true? The authors of this book argue that we need to start by dispelling this preconception.

And although it is not an easy task for a beginner who knows nothing to start right away, I can confidently say that anyone can make more than expected profits from land investment in a short period of time if they study hard enough.

This book was co-written by author Jong-Yul Kim, a renowned lecturer in the land field and a successful investor, and Eun-Jeong Lim, who has lectured in various communities to help beginners who are struggling with land investment.

Author Kim Jong-yul, known not only as a theorist but also as a practical investor, primarily talks about powerful investment skills that can be learned once and used for a lifetime, and he also reveals a significant number of success stories not found in any other book.

From successful investment cases in areas of interest to investors, such as semi-industrial areas or development-restricted zones, to investment cases that generated profits with small amounts comparable to the amount invested in apartment gaps, this field is full of surprising cases for anyone who has studied it even once.

And author Im Eun-jeong explains everything from difficult methods for beginner investors to light public offering investment in the easiest way possible so that anyone can easily approach it.

Thus, this book can be called the bible of land investment, covering everything from the basics to application, with Kim Jong-yul's practical investment sense and instructor Im Eun-jeong's friendly theoretical explanations.

A true expert starts by studying the 'land'!

The practical sense of the best land investment analyst, Attic Boss Kim Jong-yul.

And the detailed explanation by Latte Beaver Im Eun-jeong that will help you build a solid foundation!

* Strongly recommended by Song Sa-mu-jang, Ppa-song, Bu-ong-san, Hong Chun-wook, and Go Sang-cheol *

Kim Jong-yul and Lim Eun-jeong, recognized as Korea's leading land instructors, have published a master textbook on land investment that can be utilized by anyone from beginners to experts.

This book is called “I Invest in Land Instead of Houses.”

Any real estate investor wants an investment that generates consistent returns regardless of market conditions.

In particular, investments that are free from government policies, regulations, and market conditions, and that can generate large profits, are good.

What is that? It's land investment.

In fact, most of the wealthy people use land to achieve explosive growth in assets, aka quantum leaps, and everyone knows that the truly wealthy are the "land rich."

Even though apartment prices have risen significantly over the past few years, they haven't risen by more than 5 to 10 times.

However, land has development potential, and if you time your buying and selling well, its value can easily rise 5 to 10 times.

So why can't I easily invest? Land investment is too difficult and seems like it would require a lot of seed money.

Moreover, they believe it will take a long time to become profitable.

Is this true? The authors of this book argue that we need to start by dispelling this preconception.

And although it is not an easy task for a beginner who knows nothing to start right away, I can confidently say that anyone can make more than expected profits from land investment in a short period of time if they study hard enough.

This book was co-written by author Jong-Yul Kim, a renowned lecturer in the land field and a successful investor, and Eun-Jeong Lim, who has lectured in various communities to help beginners who are struggling with land investment.

Author Kim Jong-yul, known not only as a theorist but also as a practical investor, primarily talks about powerful investment skills that can be learned once and used for a lifetime, and he also reveals a significant number of success stories not found in any other book.

From successful investment cases in areas of interest to investors, such as semi-industrial areas or development-restricted zones, to investment cases that generated profits with small amounts comparable to the amount invested in apartment gaps, this field is full of surprising cases for anyone who has studied it even once.

And author Im Eun-jeong explains everything from difficult methods for beginner investors to light public offering investment in the easiest way possible so that anyone can easily approach it.

Thus, this book can be called the bible of land investment, covering everything from the basics to application, with Kim Jong-yul's practical investment sense and instructor Im Eun-jeong's friendly theoretical explanations.

- You can preview some of the book's contents.

Preview

index

Prologue: Why I'm Writing a Book with Professor Im Eun-jeong

For those who are new to land investment_ Everyone is a beginner when they first start out.

Chapter 1: Why Should We Care About Land Now?

Want to change your life through real estate investing?

Why Land Investment is Difficult

Good land for investment vs.

bad land

Study land for just one year and use it for the rest of your life.

Is there any cheap and good land?

Three Types of Land Investment

Small-scale land investment starting with the apartment gap investment amount

Chapter 2: How to find profitable land?

Land investment is a game of predicting land prices three years from now.

How to Read a Land Use Plan to Determine Land Class 1

How to Read a Land Use Plan to Determine Land Class (Part 2)

Why land use zones are more important than land designation

There's a separate way to read development-related news.

Where can I find profitable development information?

Finding the land that will turn a gem from a rough stone

When is the best time to enter the investment market?

Chapter 3: Land Investment: Know This

A few techniques you absolutely must know

The ultimate plan called Earth Unit Plan

Building and road laws that you will lose out on if you don't know them

Money flows along the road

Is the land over which a road passes less valuable?

Land that rises and land that does not rise when a highway IC opens

Is it near the subway or near the bus stop?

Easy land surveying in the corner of your room

Even buildings need sunlight to grow.

If you want to know more about the land, check the public ledger.

Investing in farmland and mountainous areas is profitable only if you know how to do it.

What happens if you don't farm your land?

The key to farmland investment is targeting areas where agricultural promotion zones are being lifted.

Increasing land value through development permits

Investment tips tailored to your specific area

When the market changes, these investments

When the knowledge industry center opens, investment in semi-industrial areas will be

The commercial district will change when the knowledge industry center is built?

Chapter 4: Land: How to Live Better Than Others

Auctions and public auctions are accessible to novice land investors.

When buying or selling land through a certified real estate agent

How to find out land prices

How to get a good land loan

Good sites and apps to use when investing in land

Chapter 5: Land Investment Explained Through Various Case Studies

The basics of investing in development-restricted areas

Copy, the type is always similar

Make money by investing in residential areas

How to Make Money with Land Compensation Investments

The investment method of experts that beginners don't know

Promising land investment areas to watch for over the next 10 years

Factories are a must-have investment destination

Recent investment cases in promising land investment areas

Epilogue: Let's face it: Investing is hard.

For a winning investment, the foundation of real estate is land.

For those who are new to land investment_ Everyone is a beginner when they first start out.

Chapter 1: Why Should We Care About Land Now?

Want to change your life through real estate investing?

Why Land Investment is Difficult

Good land for investment vs.

bad land

Study land for just one year and use it for the rest of your life.

Is there any cheap and good land?

Three Types of Land Investment

Small-scale land investment starting with the apartment gap investment amount

Chapter 2: How to find profitable land?

Land investment is a game of predicting land prices three years from now.

How to Read a Land Use Plan to Determine Land Class 1

How to Read a Land Use Plan to Determine Land Class (Part 2)

Why land use zones are more important than land designation

There's a separate way to read development-related news.

Where can I find profitable development information?

Finding the land that will turn a gem from a rough stone

When is the best time to enter the investment market?

Chapter 3: Land Investment: Know This

A few techniques you absolutely must know

The ultimate plan called Earth Unit Plan

Building and road laws that you will lose out on if you don't know them

Money flows along the road

Is the land over which a road passes less valuable?

Land that rises and land that does not rise when a highway IC opens

Is it near the subway or near the bus stop?

Easy land surveying in the corner of your room

Even buildings need sunlight to grow.

If you want to know more about the land, check the public ledger.

Investing in farmland and mountainous areas is profitable only if you know how to do it.

What happens if you don't farm your land?

The key to farmland investment is targeting areas where agricultural promotion zones are being lifted.

Increasing land value through development permits

Investment tips tailored to your specific area

When the market changes, these investments

When the knowledge industry center opens, investment in semi-industrial areas will be

The commercial district will change when the knowledge industry center is built?

Chapter 4: Land: How to Live Better Than Others

Auctions and public auctions are accessible to novice land investors.

When buying or selling land through a certified real estate agent

How to find out land prices

How to get a good land loan

Good sites and apps to use when investing in land

Chapter 5: Land Investment Explained Through Various Case Studies

The basics of investing in development-restricted areas

Copy, the type is always similar

Make money by investing in residential areas

How to Make Money with Land Compensation Investments

The investment method of experts that beginners don't know

Promising land investment areas to watch for over the next 10 years

Factories are a must-have investment destination

Recent investment cases in promising land investment areas

Epilogue: Let's face it: Investing is hard.

For a winning investment, the foundation of real estate is land.

Detailed image

Into the book

There is no such thing as cheap, good land, but there are certainly ways to buy good land cheaply.

The ultimate goal of studying land investment is to learn how to buy good land cheaply.

As with other real estate, especially when it comes to land, you need to think about the timing of the sale and who will buy your property from the moment you purchase it.

Land is usually considered a long-term investment.

I think that land is not easy to sell because I did not give enough consideration to selling when buying.

If you think about when to sell and who to buy beforehand, land can be a good short-term investment.

For land to be easy to sell, it must have value above all else.

If the following conditions are met, it can be said to be more valuable land.

---From "Is there cheap and good land?"

When investing in land, there are many cases where analyzing the news well leads to greater profits than studying theories of construction.

This is exactly the case.

For a long time, Icheon was a place where there was a strong feeling that 'something was not right'.

But around the time of the bidding in 2019, I started to feel like 'this is going to work out'.

I expected that by 2022, three years after winning the bid in 2019, the apartment building framework would be clearly visible from the outside, and that the partial urban development project around Icheon Station would have made some progress, allowing the apartment building to take shape.

If that happens, it seems obvious that development projects in the area will become active and the value of the land will rise.

At the time of the bidding in 2019, compensation had just begun, but the market was still in a slump, and items were constantly being auctioned off.

The student who asked me the question was fortunate enough to win the bid by a narrow margin, and the market atmosphere changed faster than expected.

Less than a year after winning the bid, sales offers began pouring in.

When the item I bought for 750,000 won per person became 1,150,000 won, the student asked me how much I should sell it for, and I answered like this.

---From "Small-scale land investment starting with apartment gap investment funds"

I deliberately avoided theoretical details when explaining this case.

The term "special development promotion zone" was used to describe the situation in which development was in progress, but other than that, no land use designation or zoning was mentioned.

This does not mean that zoning is not important.

Zoning is always important.

However, I wanted to show that successful investments can be made with small amounts of money by simply paying attention to the timing of positive developments in stagnant areas.

So, I explained it by emphasizing the past when progress was slow and the period when development was in progress.

Land investment is often thought to require a lot of money and time, but this is not necessarily the case.

In my case, I rarely buy land and leave it uncultivated for more than three years.

---From "Small-scale land investment starting with apartment gap investment funds"

As such, all the lands we are interested in as investment destinations are places with good prospects.

This means that there is news that something is coming, whether it is a railroad, a road, an industrial complex, or a residential area.

Calculate how much the land will be worth after three years from now.

That's pretty much all there is to land investing.

If you can do this calculation well, investing in land is easy.

Also, because you don't know this principle, it becomes difficult to invest even if you learn the method.

Even if you have studied the construction method thoroughly, if you are not confident in estimating the price of the planned management area in front of the IC (interchange), wouldn't it be impossible to buy land even when the IC construction is in full swing?

I am not saying that there is no need for a method.

This means that you must study the law as the law and the news as the news in advance.

---From "Land Investment is a Game of Predicting Land Prices 3 Years Later"

Whether or not development activities that affect the value of land can be carried out is determined by the land use zone, not the land designation.

Even if the land designation is forest, if the intended use area is a 2nd class general residential area, you can build an apartment.

Therefore, the first thing to check when looking at a land use plan is the land use area.

To quickly develop your land-use perspective, let's look at the land use plan near your home.

By keeping in mind the land use plans for already developed land and looking for land with similar land use plans, you can determine which land has a high potential for future development.

---From "Why the use area is more important than the designation"

Truly lucrative developments can be identified by carefully reading between the lines of the news. The key is whether both the administrative plan and the project implementer are present.

If you consistently read news in the areas you're interested in, you'll begin to get a feel for when and where to invest.

I also think that if I had kept an eye on Daejang District since 2005 and purchased it after seeing the 2016 implementation plan announcement, it would have been a successful investment.

Of course, land prices will be more expensive than they were in the early days when most people were unaware of development information.

However, considering the uncertainty of development projects and the accompanying mental anguish, the secret to successful investment is to purchase when development is certain, even if the price has risen.

---From "There is a separate way to read development-related news"

As the saying goes, "History is a beacon illuminating the future," the best way to invest in land is to carefully analyze past success stories and gain early access to areas likely to be developed in a similar manner in the future.

Just as Cinderella transformed from a sullen maiden to an elegant lady after meeting her fairy godmother, let's look for land investment opportunities in places where old, outdated semi-industrial areas are transforming into splendid business districts filled with knowledge industry centers.

The ultimate goal of studying land investment is to learn how to buy good land cheaply.

As with other real estate, especially when it comes to land, you need to think about the timing of the sale and who will buy your property from the moment you purchase it.

Land is usually considered a long-term investment.

I think that land is not easy to sell because I did not give enough consideration to selling when buying.

If you think about when to sell and who to buy beforehand, land can be a good short-term investment.

For land to be easy to sell, it must have value above all else.

If the following conditions are met, it can be said to be more valuable land.

---From "Is there cheap and good land?"

When investing in land, there are many cases where analyzing the news well leads to greater profits than studying theories of construction.

This is exactly the case.

For a long time, Icheon was a place where there was a strong feeling that 'something was not right'.

But around the time of the bidding in 2019, I started to feel like 'this is going to work out'.

I expected that by 2022, three years after winning the bid in 2019, the apartment building framework would be clearly visible from the outside, and that the partial urban development project around Icheon Station would have made some progress, allowing the apartment building to take shape.

If that happens, it seems obvious that development projects in the area will become active and the value of the land will rise.

At the time of the bidding in 2019, compensation had just begun, but the market was still in a slump, and items were constantly being auctioned off.

The student who asked me the question was fortunate enough to win the bid by a narrow margin, and the market atmosphere changed faster than expected.

Less than a year after winning the bid, sales offers began pouring in.

When the item I bought for 750,000 won per person became 1,150,000 won, the student asked me how much I should sell it for, and I answered like this.

---From "Small-scale land investment starting with apartment gap investment funds"

I deliberately avoided theoretical details when explaining this case.

The term "special development promotion zone" was used to describe the situation in which development was in progress, but other than that, no land use designation or zoning was mentioned.

This does not mean that zoning is not important.

Zoning is always important.

However, I wanted to show that successful investments can be made with small amounts of money by simply paying attention to the timing of positive developments in stagnant areas.

So, I explained it by emphasizing the past when progress was slow and the period when development was in progress.

Land investment is often thought to require a lot of money and time, but this is not necessarily the case.

In my case, I rarely buy land and leave it uncultivated for more than three years.

---From "Small-scale land investment starting with apartment gap investment funds"

As such, all the lands we are interested in as investment destinations are places with good prospects.

This means that there is news that something is coming, whether it is a railroad, a road, an industrial complex, or a residential area.

Calculate how much the land will be worth after three years from now.

That's pretty much all there is to land investing.

If you can do this calculation well, investing in land is easy.

Also, because you don't know this principle, it becomes difficult to invest even if you learn the method.

Even if you have studied the construction method thoroughly, if you are not confident in estimating the price of the planned management area in front of the IC (interchange), wouldn't it be impossible to buy land even when the IC construction is in full swing?

I am not saying that there is no need for a method.

This means that you must study the law as the law and the news as the news in advance.

---From "Land Investment is a Game of Predicting Land Prices 3 Years Later"

Whether or not development activities that affect the value of land can be carried out is determined by the land use zone, not the land designation.

Even if the land designation is forest, if the intended use area is a 2nd class general residential area, you can build an apartment.

Therefore, the first thing to check when looking at a land use plan is the land use area.

To quickly develop your land-use perspective, let's look at the land use plan near your home.

By keeping in mind the land use plans for already developed land and looking for land with similar land use plans, you can determine which land has a high potential for future development.

---From "Why the use area is more important than the designation"

Truly lucrative developments can be identified by carefully reading between the lines of the news. The key is whether both the administrative plan and the project implementer are present.

If you consistently read news in the areas you're interested in, you'll begin to get a feel for when and where to invest.

I also think that if I had kept an eye on Daejang District since 2005 and purchased it after seeing the 2016 implementation plan announcement, it would have been a successful investment.

Of course, land prices will be more expensive than they were in the early days when most people were unaware of development information.

However, considering the uncertainty of development projects and the accompanying mental anguish, the secret to successful investment is to purchase when development is certain, even if the price has risen.

---From "There is a separate way to read development-related news"

As the saying goes, "History is a beacon illuminating the future," the best way to invest in land is to carefully analyze past success stories and gain early access to areas likely to be developed in a similar manner in the future.

Just as Cinderella transformed from a sullen maiden to an elegant lady after meeting her fairy godmother, let's look for land investment opportunities in places where old, outdated semi-industrial areas are transforming into splendid business districts filled with knowledge industry centers.

---From "Promising Land Investment Areas to Watch Over the Next 10 Years"

Publisher's Review

"Land investment is a game of predicting the land price three years from now!"

If you learn it well just once, it doesn't matter what the game is like.

A powerful principle that allows you to continue investing whenever you want!

Small-scale land investment case starting with apartment gap investment amount,

A case where 1 billion won was saved through investment in a development restriction zone.

A case where a 725% return on the actual investment was achieved through compensation investment in a water treatment plant.

A case of earning nearly double the profit in just two months by bidding on a junkyard car that was put up for auction…

Can we really succeed by investing in land rather than apartments or commercial buildings? They say the truly wealthy are those with land wealth, but could that really be my story? It's a daunting prospect.

When I see people who have become rich through land, I feel envious and think, "Should I invest too?" However, investing in land is very difficult and seems like it would require a lot of seed money.

The new book, “I Invest in Land Instead of Houses,” deals with exactly that “land investment.”

Author Kim Jong-yul and instructor Lim Eun-jeong, two of Korea's top land analysis instructors, inspire us to think, "Maybe I can try land investment, something we thought we couldn't do."

If you properly learn from author Im Eun-jeong's detailed and friendly explanations and author Kim Jong-yul's practical and diverse investment case studies,

This book covers land, a blue ocean of real estate investment, and is sure to captivate readers with its easy-to-understand explanations tailored to beginners' perspectives and real-world investment examples rarely found in any other book.

First, author Im Eun-jeong, taking advantage of her experience lecturing beginners in various communities, provides the easiest-to-understand explanations of the construction methods and buying and selling methods that are often considered barriers to entry when studying land.

And, true to his renowned reputation, author Kim Jong-yul provides fascinating explanations of land investment theories based on his own investment experiences.

This book generously discloses a variety of cases the author has actually experienced, including cases of small-scale land investments through auctions in areas just emerging from stagnation, cases of investments in development-restricted areas (commonly known as green belts), cases of investments in residential areas, and cases of profits made through compensation investments for land acquired through acquisition.

This will provide readers with a vivid guide to how experts in this field approach land investment.

This book also details promising land investment areas to watch for over the next 10 years.

The key words are ‘industrial area’ and ‘area where roads will be opened.’

The authors advise that particular attention should be paid to industrial areas in the metropolitan area and areas where highway interchanges are about to open.

This is information that anyone embarking on the path of land investment should not miss.

Life-changing land investments,

If you can learn it in a year, wouldn't it be worth a try?

The authors recommend that if you are investing, you should now look at land as well as houses.

In fact, apartments have a very low barrier to entry for investment, but competition is constantly increasing, and external factors such as interest rates, taxes, and government permits play a significant role, making it difficult to estimate the appropriate price.

On the other hand, land has difficult terminology and difficult theories, but if you study hard for just one year, you can invest regardless of market conditions. It is a blue ocean that not just anyone can enter, so competition is weak, and there is plenty of land that will show sufficient price differences in the future.

The important thing is the will to learn properly about investing.

The authors argue that no matter how difficult land investment may be, there is nothing that cannot be studied, and that with the knowledge and passion of today's investors, they will be able to acquire the necessary knowledge.

The way to become rich is simple.

You just have to invest consistently.

The secret is to increase the size of your assets by repeating the strategy of buying when assets are undervalued and selling when prices rise.

As of 2023, the residential real estate market is experiencing a price correction along with a transaction cliff.

So what about the land market? Areas with potential for development, including the metropolitan area, are continuing to rise.

If you want to make money through real estate investing, why not take a look at land investment now?

The authors estimate that the study period will be approximately one year.

If you learn it well just once, you can use it as a powerful weapon that allows you to continue investing at the desired timing throughout your life, regardless of the economy.

It may feel unfamiliar and difficult at first, but if you keep doing it one by one, it will become possible.

This book will serve as a strong light on the path of land investors.

If you learn it well just once, it doesn't matter what the game is like.

A powerful principle that allows you to continue investing whenever you want!

Small-scale land investment case starting with apartment gap investment amount,

A case where 1 billion won was saved through investment in a development restriction zone.

A case where a 725% return on the actual investment was achieved through compensation investment in a water treatment plant.

A case of earning nearly double the profit in just two months by bidding on a junkyard car that was put up for auction…

Can we really succeed by investing in land rather than apartments or commercial buildings? They say the truly wealthy are those with land wealth, but could that really be my story? It's a daunting prospect.

When I see people who have become rich through land, I feel envious and think, "Should I invest too?" However, investing in land is very difficult and seems like it would require a lot of seed money.

The new book, “I Invest in Land Instead of Houses,” deals with exactly that “land investment.”

Author Kim Jong-yul and instructor Lim Eun-jeong, two of Korea's top land analysis instructors, inspire us to think, "Maybe I can try land investment, something we thought we couldn't do."

If you properly learn from author Im Eun-jeong's detailed and friendly explanations and author Kim Jong-yul's practical and diverse investment case studies,

This book covers land, a blue ocean of real estate investment, and is sure to captivate readers with its easy-to-understand explanations tailored to beginners' perspectives and real-world investment examples rarely found in any other book.

First, author Im Eun-jeong, taking advantage of her experience lecturing beginners in various communities, provides the easiest-to-understand explanations of the construction methods and buying and selling methods that are often considered barriers to entry when studying land.

And, true to his renowned reputation, author Kim Jong-yul provides fascinating explanations of land investment theories based on his own investment experiences.

This book generously discloses a variety of cases the author has actually experienced, including cases of small-scale land investments through auctions in areas just emerging from stagnation, cases of investments in development-restricted areas (commonly known as green belts), cases of investments in residential areas, and cases of profits made through compensation investments for land acquired through acquisition.

This will provide readers with a vivid guide to how experts in this field approach land investment.

This book also details promising land investment areas to watch for over the next 10 years.

The key words are ‘industrial area’ and ‘area where roads will be opened.’

The authors advise that particular attention should be paid to industrial areas in the metropolitan area and areas where highway interchanges are about to open.

This is information that anyone embarking on the path of land investment should not miss.

Life-changing land investments,

If you can learn it in a year, wouldn't it be worth a try?

The authors recommend that if you are investing, you should now look at land as well as houses.

In fact, apartments have a very low barrier to entry for investment, but competition is constantly increasing, and external factors such as interest rates, taxes, and government permits play a significant role, making it difficult to estimate the appropriate price.

On the other hand, land has difficult terminology and difficult theories, but if you study hard for just one year, you can invest regardless of market conditions. It is a blue ocean that not just anyone can enter, so competition is weak, and there is plenty of land that will show sufficient price differences in the future.

The important thing is the will to learn properly about investing.

The authors argue that no matter how difficult land investment may be, there is nothing that cannot be studied, and that with the knowledge and passion of today's investors, they will be able to acquire the necessary knowledge.

The way to become rich is simple.

You just have to invest consistently.

The secret is to increase the size of your assets by repeating the strategy of buying when assets are undervalued and selling when prices rise.

As of 2023, the residential real estate market is experiencing a price correction along with a transaction cliff.

So what about the land market? Areas with potential for development, including the metropolitan area, are continuing to rise.

If you want to make money through real estate investing, why not take a look at land investment now?

The authors estimate that the study period will be approximately one year.

If you learn it well just once, you can use it as a powerful weapon that allows you to continue investing at the desired timing throughout your life, regardless of the economy.

It may feel unfamiliar and difficult at first, but if you keep doing it one by one, it will become possible.

This book will serve as a strong light on the path of land investors.

GOODS SPECIFICS

- Date of issue: March 31, 2023

- Pages, weight, size: 356 pages | 706g | 170*225*22mm

- ISBN13: 9788947548885

- ISBN10: 894754888X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)