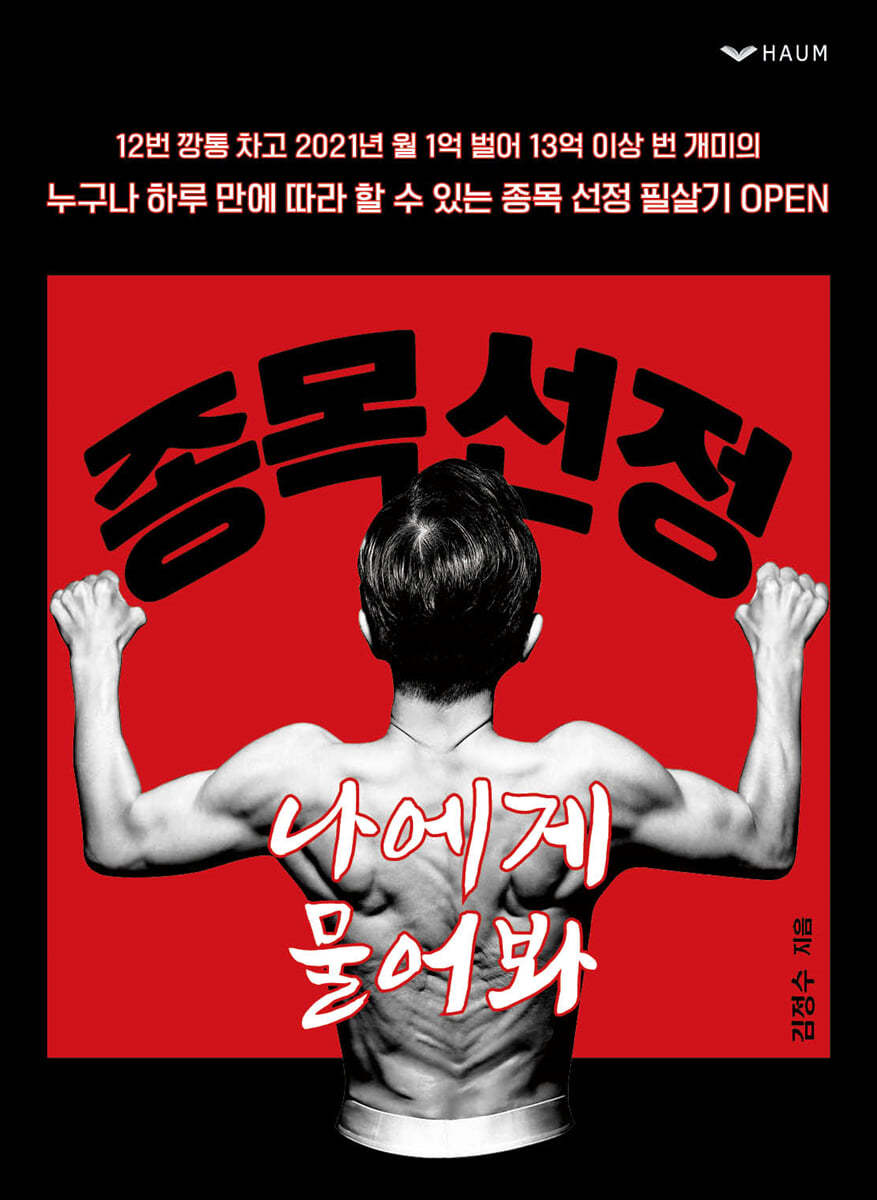

Ask me about stock selection

|

Description

Book Introduction

The author's stock trading technique, which earned an average of over 100 million won per month for 20 months, is now open! 12 Types of Stocks You Should Never Buy 12 Must-Buy Stocks The secret to selecting stocks in just one day Over eight years, 12 losses, a cumulative stop-loss of 1.1 billion won, a daily maximum of 540 million won, and a loss of 360 million won during the stock market crash due to COVID-19... However, after resuming trading in June 2020, the company achieved monthly profits and a profit of 1.3 billion won in 2021! Curious about the technique? Over 5 million charts read over 9 years, over 50,000 actual trades over 9 years, maximum daily trades of 191, over 1,000 charts read per day, 1 chart read per second! The answer is Phoenix Kim Jeong-su's "Ask Me About Stock Selection." |

- You can preview some of the book's contents.

Preview

index

Prologue: Achieving dreams and hopes at 65

Ⅰ.

Solving the ants' eternal homework of selecting a stock

1.

The pain of drying the blood of the 12th can

The History of Cans No. 12 · Commonalities in Worst-Case Situations · Pros and Cons of Using Credit and Not Using Credit · Lessons from the Stock Market Crash Due to the Coronavirus · My Prayer for Overcoming the Worst-Case Situation

2.

Lost 540 million won in one day due to poor stock selection

The index is rising, but my stocks are… · Tears of blood flowing · Prayers amidst frustration and despair · 'Dreams and hopes' that saved me · 3.

Give me a good stock · Ants who don't study · Too many investment methods to study · Human nature and psychological management · Ants' errors and trading traps

4.

Overflowing stock reading room

Ultimate responsibility for your investments lies with you. · Traces of fraud. · Limitations of winners of real-time trading competitions. · Stagnant cumulative returns. · The growing number of victims of stock reading rooms.

5.

Don't beg for stocks, stand alone

You Can Stand Alone · The Best Teacher for Standing Alone · How to Find Your Own Secret Weapon · How to Find Your Own Secret Weapon Part II · How to Find Your Own Secret Weapon Part III

6.

Optimization built on real-world experience from 5 million charts and 50,000 actual transactions.

Optimization process · Mechanical trading · Win rate · P&L ratio · Data · Statistics · Verification · Standards and principles · System

7.

A single stock selection criterion

The One Thing That Saved Papillon · Three Choices That Will Change Your Destiny · Your Secret Weapon Is the Answer · A Sheet of Paper's Difference · The Fundamentals of Stock Prices · Confidence in Stock Investment · My Mindset to Avoid Reacting Emotionally

Ⅱ.

Long bullish and long bearish candlesticks that will determine your fate

1.

Love long-term beekeeping

What is a long bullish candle? · Stock price and trading volume · Changes in trading volume of rapidly rising and powerful stocks · How to take advantage of rapidly rising and powerful stocks · Fear of entering a long bullish candle

2.

Stay away from long candlesticks

What is a long bearish candle? · A bearish candle with no trading volume and a long bearish candle · A gapped bearish candle · A long bearish candle with a long upper tail · A long bearish candle that occurs at a new high ·

Ⅲ.

Never buy stocks like this that make you lose 12 points.

1.

The essence of the stock industry

Stocks are a "bomb-throwing game." Buy "sellable stocks," not "good stocks." The fatal mistake I was forgetting.

2.

Basic concepts

Round bottom, board bottom, long candlestick

3.

Stocks you should never buy

Front bomb · Back bomb · Downhill waterfall · Downhill stairs · Downhill outer peak · Gear wheel · Multiple ledges · Multiple peaks · Multiple tails · Double peaks · Double tails · High point sideways movement

Ⅳ.

Be sure to buy stocks like this that will make you a lot of money.

Long candlestick at low point · Low point breakout · Low point suppression · Low point high play · Long candlestick at midpoint · Midpoint breakout · Midpoint suppression · Midpoint high play · Long candlestick at high point · High point breakout · High point suppression · High point high play

V.

The secret to selecting stocks that will be revealed in one day

1.

Simple screen settings

2.

Candle volume chart

Pre-war, post-war, post-war

3. STEP

Search for stocks with the highest fluctuation rate · 1st stock selection · 2nd and 3rd selection followed by final selection · Review over 1,000 charts per day, each understood in just 1 second · Animal-like feeling, intuition, and touch · How to deal with ambiguous situations · Even one a day is too many · It's not that you can't buy because there are no stocks, but because you don't have money.

4.

Buying timing

5.

Weighting, split purchase, and fund management

Weighting, Split Purchase, Fund Management

6.

A single profit realization criterion

7.

A single stop loss criterion

epilogue For higher dreams and hopes

Ⅰ.

Solving the ants' eternal homework of selecting a stock

1.

The pain of drying the blood of the 12th can

The History of Cans No. 12 · Commonalities in Worst-Case Situations · Pros and Cons of Using Credit and Not Using Credit · Lessons from the Stock Market Crash Due to the Coronavirus · My Prayer for Overcoming the Worst-Case Situation

2.

Lost 540 million won in one day due to poor stock selection

The index is rising, but my stocks are… · Tears of blood flowing · Prayers amidst frustration and despair · 'Dreams and hopes' that saved me · 3.

Give me a good stock · Ants who don't study · Too many investment methods to study · Human nature and psychological management · Ants' errors and trading traps

4.

Overflowing stock reading room

Ultimate responsibility for your investments lies with you. · Traces of fraud. · Limitations of winners of real-time trading competitions. · Stagnant cumulative returns. · The growing number of victims of stock reading rooms.

5.

Don't beg for stocks, stand alone

You Can Stand Alone · The Best Teacher for Standing Alone · How to Find Your Own Secret Weapon · How to Find Your Own Secret Weapon Part II · How to Find Your Own Secret Weapon Part III

6.

Optimization built on real-world experience from 5 million charts and 50,000 actual transactions.

Optimization process · Mechanical trading · Win rate · P&L ratio · Data · Statistics · Verification · Standards and principles · System

7.

A single stock selection criterion

The One Thing That Saved Papillon · Three Choices That Will Change Your Destiny · Your Secret Weapon Is the Answer · A Sheet of Paper's Difference · The Fundamentals of Stock Prices · Confidence in Stock Investment · My Mindset to Avoid Reacting Emotionally

Ⅱ.

Long bullish and long bearish candlesticks that will determine your fate

1.

Love long-term beekeeping

What is a long bullish candle? · Stock price and trading volume · Changes in trading volume of rapidly rising and powerful stocks · How to take advantage of rapidly rising and powerful stocks · Fear of entering a long bullish candle

2.

Stay away from long candlesticks

What is a long bearish candle? · A bearish candle with no trading volume and a long bearish candle · A gapped bearish candle · A long bearish candle with a long upper tail · A long bearish candle that occurs at a new high ·

Ⅲ.

Never buy stocks like this that make you lose 12 points.

1.

The essence of the stock industry

Stocks are a "bomb-throwing game." Buy "sellable stocks," not "good stocks." The fatal mistake I was forgetting.

2.

Basic concepts

Round bottom, board bottom, long candlestick

3.

Stocks you should never buy

Front bomb · Back bomb · Downhill waterfall · Downhill stairs · Downhill outer peak · Gear wheel · Multiple ledges · Multiple peaks · Multiple tails · Double peaks · Double tails · High point sideways movement

Ⅳ.

Be sure to buy stocks like this that will make you a lot of money.

Long candlestick at low point · Low point breakout · Low point suppression · Low point high play · Long candlestick at midpoint · Midpoint breakout · Midpoint suppression · Midpoint high play · Long candlestick at high point · High point breakout · High point suppression · High point high play

V.

The secret to selecting stocks that will be revealed in one day

1.

Simple screen settings

2.

Candle volume chart

Pre-war, post-war, post-war

3. STEP

Search for stocks with the highest fluctuation rate · 1st stock selection · 2nd and 3rd selection followed by final selection · Review over 1,000 charts per day, each understood in just 1 second · Animal-like feeling, intuition, and touch · How to deal with ambiguous situations · Even one a day is too many · It's not that you can't buy because there are no stocks, but because you don't have money.

4.

Buying timing

5.

Weighting, split purchase, and fund management

Weighting, Split Purchase, Fund Management

6.

A single profit realization criterion

7.

A single stop loss criterion

epilogue For higher dreams and hopes

Detailed image

.jpg)

Publisher's Review

Solving the ants' eternal homework: stock selection!

Even now, countless ants are wandering around looking for good stocks.

If you're feeling overwhelmed and confused by the endless stream of information pouring in from all sorts of stock broadcasts, YouTube channels, stock reading rooms, and more, I recommend putting aside your impatience and opening "Ask Me About Stock Selection."

What stands out most is the author's practical experience.

Nine years as a professional investor, over 50,000 actual trades, over 1,000 charts read per day... As much trading experience as I've had, I've also had my fair share of failures.

I broke it countless times, shed tears of blood, cut my losses, and kicked the can a whopping 12 times.

But the author now considers that can to be his 'number one possession'.

Thanks to countless trials and errors, I have finally developed my own special move and am making a lot of money.

Is it because I know better than anyone the painful times when you want to give up on everything?

The author set out to be a positive influence on the suffering ants and to share at least a part of what he had accomplished.

He revealed everything, including the account verification photo and the screen he was using.

Perhaps it's because they know how difficult it is to inspire trust in the stock market, which preys on novice investors with nothing but flashy rhetoric.

Based on his extensive experience, the author presents his techniques in a simple, concise, and highly specific manner, making them easy to understand and follow for anyone with even a passing interest in stock investment.

Also, the message about physical management and 'dreams and hopes' for successful stock investment provides greater enlightenment than any other technique.

“Never give up and achieve your dreams and hopes.” This is what the author wants to be written on his tombstone.

I hope that all readers will perfect their own 'secret technique' through 'Ask Me About Stock Selection', never give up, and ultimately achieve their 'dreams and hopes'.

Even now, countless ants are wandering around looking for good stocks.

If you're feeling overwhelmed and confused by the endless stream of information pouring in from all sorts of stock broadcasts, YouTube channels, stock reading rooms, and more, I recommend putting aside your impatience and opening "Ask Me About Stock Selection."

What stands out most is the author's practical experience.

Nine years as a professional investor, over 50,000 actual trades, over 1,000 charts read per day... As much trading experience as I've had, I've also had my fair share of failures.

I broke it countless times, shed tears of blood, cut my losses, and kicked the can a whopping 12 times.

But the author now considers that can to be his 'number one possession'.

Thanks to countless trials and errors, I have finally developed my own special move and am making a lot of money.

Is it because I know better than anyone the painful times when you want to give up on everything?

The author set out to be a positive influence on the suffering ants and to share at least a part of what he had accomplished.

He revealed everything, including the account verification photo and the screen he was using.

Perhaps it's because they know how difficult it is to inspire trust in the stock market, which preys on novice investors with nothing but flashy rhetoric.

Based on his extensive experience, the author presents his techniques in a simple, concise, and highly specific manner, making them easy to understand and follow for anyone with even a passing interest in stock investment.

Also, the message about physical management and 'dreams and hopes' for successful stock investment provides greater enlightenment than any other technique.

“Never give up and achieve your dreams and hopes.” This is what the author wants to be written on his tombstone.

I hope that all readers will perfect their own 'secret technique' through 'Ask Me About Stock Selection', never give up, and ultimately achieve their 'dreams and hopes'.

GOODS SPECIFICS

- Publication date: November 11, 2021

- Page count, weight, size: 336 pages | 866g | 188*257*20mm

- ISBN13: 9791164408580

- ISBN10: 1164408585

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)