Strategic value investing

|

Description

Book Introduction

The late Chairman Shin Jin-oh has rewritten his immortal masterpiece!

Revised edition released with updated information and latest strategies

A revised edition of the late Chairman Shin Jin-oh's famous book, "Strategic Value Investing," has been published.

First published in 2009, this book covers all investment concepts and techniques, including value investing, growth investing, and dividend investing. It has been evaluated as the only "classic investment book" in Korea.

This revised edition was published by analyst Lee Sang-min, who updated the data and updated the techniques after Chairman Shin Jin-oh passed away in 2022.

Since the publication of the original edition, investment strategies that had lost their effectiveness during the 2008 financial crisis and the COVID-19 crisis have been cut out, and newly developed investment strategies have been added.

These days, the Korean stock market is considered to be entering a period of transformation.

This book shines even brighter in these times, offering investment methodologies applicable regardless of time or market.

If you want to develop the ability to view the stock market in a three-dimensional way, this is a must-read.

Revised edition released with updated information and latest strategies

A revised edition of the late Chairman Shin Jin-oh's famous book, "Strategic Value Investing," has been published.

First published in 2009, this book covers all investment concepts and techniques, including value investing, growth investing, and dividend investing. It has been evaluated as the only "classic investment book" in Korea.

This revised edition was published by analyst Lee Sang-min, who updated the data and updated the techniques after Chairman Shin Jin-oh passed away in 2022.

Since the publication of the original edition, investment strategies that had lost their effectiveness during the 2008 financial crisis and the COVID-19 crisis have been cut out, and newly developed investment strategies have been added.

These days, the Korean stock market is considered to be entering a period of transformation.

This book shines even brighter in these times, offering investment methodologies applicable regardless of time or market.

If you want to develop the ability to view the stock market in a three-dimensional way, this is a must-read.

- You can preview some of the book's contents.

Preview

index

Recommendation

Preface to the Revised Edition

Old edition preface

Chapter 1 Understanding Stock Investment

1-1 Things Investors Should Do

1-2 Macroeconomic Indicators and Investment Timing

1-3 Fundamental and Technical Analysis

How are 1-4 stocks formed?

Beta coefficient for calculating sensitivity 1-5

Easier weight adjustment than selecting 1-6 stocks

Chapter 2 Beta Investment Strategy

2-1 Entering the Beta Investment Strategy

2-2 Buy-and-hold method: Hold unconditionally

2-3 Fixed-Rate Investment Method: Unifying the Weighting of Stocks and Bonds

In-depth ① What is forward analysis?

2-4 Variable Rate Investment Method: The Opposite Position of the Buy-Hold Method

2-5 Trend Investing Method: Enjoying the Uptrend and Avoiding the Downtrend

In-Depth ② Trend Investment Method vs. Anti-Trend Investment Method

2-6 Fixed-Rate Trend Trading: The Benefits of Strategic Diversification

2-7 Fixed-sum investment method: Maintain a constant valuation of the stocks held

2-8 Increased Investment Method: When Principal Protection is Needed

2-9 Investment Stopping Method: Sell if it goes against your strategy

2-10 Step Down: The stepwise proportion increases as you go down.

2-11 Fixed-Amount Savings Plan: Splitting Your Salary and Investing

2-12 Absolute Momentum Strategy: Understanding the Strength of a Trend

2-13 Incremental Accumulation: Accumulation amount adjusted according to stock price fluctuations

2-14 Pyramiding: Trend-following investment that increases positions.

2-15 Hedging: Insuring Against Market Declines

2-16 Asset Allocation: Mitigating Risk with U.S. Treasury Investments

2-17 Accumulated Pyramid: Synthesis of Investment Methods

2-18 Leveraged Investment: Diversify your strategy by increasing your investment amount.

2-19 Comparison and Application of Investment Strategies

Chapter 3 Alpha Investment Strategy

3-1 Entering the Alpha Investment Strategy

3-2 Value Investing: Buy when low, sell when high

In-Depth ③ Is value investing dead?

3-3 Momentum Investment: Buy when it rises, sell when it falls.

3-4 Quality Investment: Excellent business performance and financial structure

3-5 Dividend Investment: Reliable and Stable Asset Growth

3-6 Low Volatility Investments: Increased Returns Through Risk Reduction

3-7 Growth Investment: Investing in promising companies

3-8 Portfolio: Don't put all your eggs in one basket

In-Depth ④ Concentrated investment vs. diversified investment: What is the optimal number of stocks?

3-9 Diversification: Offsetting the Risk of Individual Stocks

3-10 Diversification: Fixed-Rate Investment Method Between Stocks

3-11 Core & Satellite: Risky investments with small seeds

3-12 Market Capitalization Weighting: The higher the market capitalization, the greater the weighting.

3-13 Indicator Weighting: Trading by Moving Average

3-14 Equal weight: Equal weight of holdings for each stock

3-15 Momentum Weighting: Increase the weighting of rising stocks.

3-16 Weighting factor: Calculate the weight by squaring

3-17 Value Weighting: Focus on investing in stocks with high intrinsic value.

Static and dynamic synthesis of 3-18 items

3-19 Value Weighting②: Selection of Excellent Companies Based on Intrinsic Value

Chapter 4: The Three-Party Strategy

Entering the 4-1 set-up strategy

4-2 How much will we need for our retirement?

4-3 Income Growth Rate and Investment Scenarios

4-4 Is debt investing a reasonable investment method?

4-5 Is Samsung Electronics the Ark of Salvation?

4-6 Practical Theta Self-Strategy

Chapter 5 Strategic Value Investing

5-1 Entering strategic value investing

5-2 Strategy ①: Equal Weight + Fixed Rate Investment Method

5-3 Strategy ②: Equal Weight + Fixed-Rate Investment Method + Hedge Transactions

Strategy 5-4 ③: Value-weighted + Fixed-Rate Investment Method

5-5 Strategy ④: Value-weighted + Fixed-Rate Investment Method + Hedge Transactions

Strategy 5-6: Momentum Weighting + Absolute Momentum + US Stocks

5-7 Strategy ⑥: Value-weighted + Absolute Momentum + Theta Equity Strategy

Strategy 5-8⑦: 7:3 + Core & Satellite + Theta Self Strategy

In conclusion

Preface to the Revised Edition

Old edition preface

Chapter 1 Understanding Stock Investment

1-1 Things Investors Should Do

1-2 Macroeconomic Indicators and Investment Timing

1-3 Fundamental and Technical Analysis

How are 1-4 stocks formed?

Beta coefficient for calculating sensitivity 1-5

Easier weight adjustment than selecting 1-6 stocks

Chapter 2 Beta Investment Strategy

2-1 Entering the Beta Investment Strategy

2-2 Buy-and-hold method: Hold unconditionally

2-3 Fixed-Rate Investment Method: Unifying the Weighting of Stocks and Bonds

In-depth ① What is forward analysis?

2-4 Variable Rate Investment Method: The Opposite Position of the Buy-Hold Method

2-5 Trend Investing Method: Enjoying the Uptrend and Avoiding the Downtrend

In-Depth ② Trend Investment Method vs. Anti-Trend Investment Method

2-6 Fixed-Rate Trend Trading: The Benefits of Strategic Diversification

2-7 Fixed-sum investment method: Maintain a constant valuation of the stocks held

2-8 Increased Investment Method: When Principal Protection is Needed

2-9 Investment Stopping Method: Sell if it goes against your strategy

2-10 Step Down: The stepwise proportion increases as you go down.

2-11 Fixed-Amount Savings Plan: Splitting Your Salary and Investing

2-12 Absolute Momentum Strategy: Understanding the Strength of a Trend

2-13 Incremental Accumulation: Accumulation amount adjusted according to stock price fluctuations

2-14 Pyramiding: Trend-following investment that increases positions.

2-15 Hedging: Insuring Against Market Declines

2-16 Asset Allocation: Mitigating Risk with U.S. Treasury Investments

2-17 Accumulated Pyramid: Synthesis of Investment Methods

2-18 Leveraged Investment: Diversify your strategy by increasing your investment amount.

2-19 Comparison and Application of Investment Strategies

Chapter 3 Alpha Investment Strategy

3-1 Entering the Alpha Investment Strategy

3-2 Value Investing: Buy when low, sell when high

In-Depth ③ Is value investing dead?

3-3 Momentum Investment: Buy when it rises, sell when it falls.

3-4 Quality Investment: Excellent business performance and financial structure

3-5 Dividend Investment: Reliable and Stable Asset Growth

3-6 Low Volatility Investments: Increased Returns Through Risk Reduction

3-7 Growth Investment: Investing in promising companies

3-8 Portfolio: Don't put all your eggs in one basket

In-Depth ④ Concentrated investment vs. diversified investment: What is the optimal number of stocks?

3-9 Diversification: Offsetting the Risk of Individual Stocks

3-10 Diversification: Fixed-Rate Investment Method Between Stocks

3-11 Core & Satellite: Risky investments with small seeds

3-12 Market Capitalization Weighting: The higher the market capitalization, the greater the weighting.

3-13 Indicator Weighting: Trading by Moving Average

3-14 Equal weight: Equal weight of holdings for each stock

3-15 Momentum Weighting: Increase the weighting of rising stocks.

3-16 Weighting factor: Calculate the weight by squaring

3-17 Value Weighting: Focus on investing in stocks with high intrinsic value.

Static and dynamic synthesis of 3-18 items

3-19 Value Weighting②: Selection of Excellent Companies Based on Intrinsic Value

Chapter 4: The Three-Party Strategy

Entering the 4-1 set-up strategy

4-2 How much will we need for our retirement?

4-3 Income Growth Rate and Investment Scenarios

4-4 Is debt investing a reasonable investment method?

4-5 Is Samsung Electronics the Ark of Salvation?

4-6 Practical Theta Self-Strategy

Chapter 5 Strategic Value Investing

5-1 Entering strategic value investing

5-2 Strategy ①: Equal Weight + Fixed Rate Investment Method

5-3 Strategy ②: Equal Weight + Fixed-Rate Investment Method + Hedge Transactions

Strategy 5-4 ③: Value-weighted + Fixed-Rate Investment Method

5-5 Strategy ④: Value-weighted + Fixed-Rate Investment Method + Hedge Transactions

Strategy 5-6: Momentum Weighting + Absolute Momentum + US Stocks

5-7 Strategy ⑥: Value-weighted + Absolute Momentum + Theta Equity Strategy

Strategy 5-8⑦: 7:3 + Core & Satellite + Theta Self Strategy

In conclusion

Detailed image

Into the book

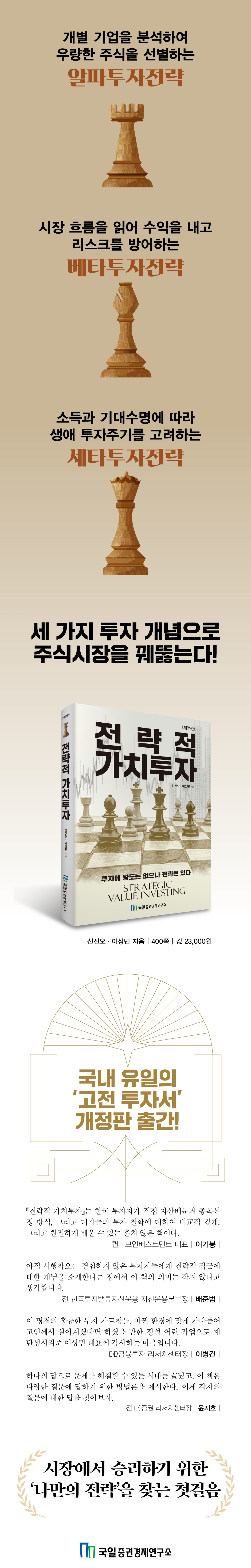

This book is largely divided into three parts: beta investment strategy, alpha investment strategy, and theta investment strategy.

First of all, 'beta investment strategy' refers to an investment methodology that protects against market risk or maximizes profits according to market trends.

'Alpha investment strategy' is a stock selection methodology that selects superior companies within the same theme.

In the old version, it was expressed as a 'value investment strategy', but in the revised version, it was named an alpha investment strategy because the value investment strategy ultimately analyzes individual corporate factors, which can be said to be the first element (α) of stock prices.

The 'three-stage investment strategy' is an investment strategy based on life cycles, and is not covered in detail in the previous edition.

This is an investment strategy that comprehensively considers the investor's lifetime income, initial capital, inflation, retirement funds, and life expectancy. It is a strategy that individual investors must be familiar with, even if they do not adopt it.

---From the "Preface to the Revised Edition"

Stock price movements can be analyzed from various perspectives, some of which are widely known.

The first is the ‘movement of the stock price just before’.

After testing various figures and exploring which figure had the highest correlation with stock prices, interestingly enough, the most important figure in determining the direction of stock prices was the 'previous stock price movement'.

In other words, if the stock price rose just before, it can be predicted that the stock price will rise again this time, and this possibility is more likely to be correct than any other indicator that reasonably explains the stock price movement, such as corporate performance or economic indicators.

---From "Chapter 1 Understanding Stock Investment"

In his book, "3 Questions to Beat the Market," Ken Fisher points out that investors put too much effort and attention into stock selection, but neglect to consider the proportion of their stock holdings.

When building an investment portfolio, the biggest consideration is deciding how much stock to hold.

Ken Fisher stated that asset allocation considerations such as stocks, bonds, and cash account for 70% of overall investment performance.

---From "Chapter 2 Beta Investment Strategy"

Understanding the 'value of a stock' ultimately leads to understanding the 'value of a company.'

While the value of a stock is influenced by factors other than the company's value, such as market sentiment, no investor would disagree that the company's value is the most influential factor.

To properly judge a company's value, you must be more knowledgeable about the company's circumstances than its executives and employees.

Just as a doctor who performs a comprehensive examination knows a patient's body better than the patient himself, investors should be more knowledgeable about the company's affairs than its internal members.

In fact, in industrial settings, there are cases where business managers come to analysts to learn about the specific circumstances of their companies.

---From "Chapter 3 Alpha Investment Strategy"

We often hear that we should enjoy the benefits of welfare from a young age.

Then, in the case of a 9th grade civil servant, if the lifetime income is discounted to present value, it comes to approximately 620 million won.

Then, it is necessary to ask whether it is really beneficial to take out a loan of 120 to 150 million won, which is 20 to 30% of one's lifetime income, when one is just starting out in society and invest it.

In theory, if the loan interest rate is 5% and the investment return is 9%, we can make a profit of 4% per year (investment return 9% - loan interest 5%).

Therefore, if you invest by discounting the expected future income to the present value as a 'debt investment', it is equivalent to securing an additional 4% return on investment each year, and if this profit is accumulated through compound interest for 30 years, it makes a big difference.

---From "Chapter 4: The Three Self-Strategies"

According to what we've seen in our alpha investment strategy, if it's difficult to compare the intrinsic value of a portfolio comprised of multiple stocks, simply maintaining equal weightings can yield surprisingly high investment returns.

Furthermore, as we have seen in our beta investment strategy, simply maintaining a certain proportion of stocks and cash, without using complex techniques, can have a significant improvement effect.

Select at least five blue-chip stocks with a very low risk of default, then invest equally in each stock.

And keep the stock investment ratio among the total investment assets at 50%.

This shouldn't be too complicated or difficult.

First of all, 'beta investment strategy' refers to an investment methodology that protects against market risk or maximizes profits according to market trends.

'Alpha investment strategy' is a stock selection methodology that selects superior companies within the same theme.

In the old version, it was expressed as a 'value investment strategy', but in the revised version, it was named an alpha investment strategy because the value investment strategy ultimately analyzes individual corporate factors, which can be said to be the first element (α) of stock prices.

The 'three-stage investment strategy' is an investment strategy based on life cycles, and is not covered in detail in the previous edition.

This is an investment strategy that comprehensively considers the investor's lifetime income, initial capital, inflation, retirement funds, and life expectancy. It is a strategy that individual investors must be familiar with, even if they do not adopt it.

---From the "Preface to the Revised Edition"

Stock price movements can be analyzed from various perspectives, some of which are widely known.

The first is the ‘movement of the stock price just before’.

After testing various figures and exploring which figure had the highest correlation with stock prices, interestingly enough, the most important figure in determining the direction of stock prices was the 'previous stock price movement'.

In other words, if the stock price rose just before, it can be predicted that the stock price will rise again this time, and this possibility is more likely to be correct than any other indicator that reasonably explains the stock price movement, such as corporate performance or economic indicators.

---From "Chapter 1 Understanding Stock Investment"

In his book, "3 Questions to Beat the Market," Ken Fisher points out that investors put too much effort and attention into stock selection, but neglect to consider the proportion of their stock holdings.

When building an investment portfolio, the biggest consideration is deciding how much stock to hold.

Ken Fisher stated that asset allocation considerations such as stocks, bonds, and cash account for 70% of overall investment performance.

---From "Chapter 2 Beta Investment Strategy"

Understanding the 'value of a stock' ultimately leads to understanding the 'value of a company.'

While the value of a stock is influenced by factors other than the company's value, such as market sentiment, no investor would disagree that the company's value is the most influential factor.

To properly judge a company's value, you must be more knowledgeable about the company's circumstances than its executives and employees.

Just as a doctor who performs a comprehensive examination knows a patient's body better than the patient himself, investors should be more knowledgeable about the company's affairs than its internal members.

In fact, in industrial settings, there are cases where business managers come to analysts to learn about the specific circumstances of their companies.

---From "Chapter 3 Alpha Investment Strategy"

We often hear that we should enjoy the benefits of welfare from a young age.

Then, in the case of a 9th grade civil servant, if the lifetime income is discounted to present value, it comes to approximately 620 million won.

Then, it is necessary to ask whether it is really beneficial to take out a loan of 120 to 150 million won, which is 20 to 30% of one's lifetime income, when one is just starting out in society and invest it.

In theory, if the loan interest rate is 5% and the investment return is 9%, we can make a profit of 4% per year (investment return 9% - loan interest 5%).

Therefore, if you invest by discounting the expected future income to the present value as a 'debt investment', it is equivalent to securing an additional 4% return on investment each year, and if this profit is accumulated through compound interest for 30 years, it makes a big difference.

---From "Chapter 4: The Three Self-Strategies"

According to what we've seen in our alpha investment strategy, if it's difficult to compare the intrinsic value of a portfolio comprised of multiple stocks, simply maintaining equal weightings can yield surprisingly high investment returns.

Furthermore, as we have seen in our beta investment strategy, simply maintaining a certain proportion of stocks and cash, without using complex techniques, can have a significant improvement effect.

Select at least five blue-chip stocks with a very low risk of default, then invest equally in each stock.

And keep the stock investment ratio among the total investment assets at 50%.

This shouldn't be too complicated or difficult.

---From "Chapter 5 Strategic Value Investment"

Publisher's Review

“Investing is about taking risks!”

A must-read that covers all three risks of stock investing.

The author emphasizes that to succeed in stock investment, you must deal well with the 'three risks'.

First, there is the unsystematic risk that arises from the management situation of the company being invested in; second, there is the market risk that affects the entire market, such as the Great Depression, the IMF foreign exchange crisis, and the U.S. subprime mortgage crisis; and third, there is the "life risk" that arises from having to achieve the desired investment performance within a limited time called life.

And, as investment strategies to deal with these three risks, we propose alpha investment strategy, beta investment strategy, and theta investment strategy.

This book introduces all the concepts of stock investment within the categories of three investment strategies.

This structure provides a systematic understanding of what makes up and how the world of investing, once perceived as complex and difficult, works.

Through this book, readers will not only learn how to make profits, but also gain a deeper understanding of risk management, the essence of investing.

This book is the ultimate guide to understanding the complex world of investing and providing all the knowledge you need to become a successful player.

A must-read that covers all three risks of stock investing.

The author emphasizes that to succeed in stock investment, you must deal well with the 'three risks'.

First, there is the unsystematic risk that arises from the management situation of the company being invested in; second, there is the market risk that affects the entire market, such as the Great Depression, the IMF foreign exchange crisis, and the U.S. subprime mortgage crisis; and third, there is the "life risk" that arises from having to achieve the desired investment performance within a limited time called life.

And, as investment strategies to deal with these three risks, we propose alpha investment strategy, beta investment strategy, and theta investment strategy.

This book introduces all the concepts of stock investment within the categories of three investment strategies.

This structure provides a systematic understanding of what makes up and how the world of investing, once perceived as complex and difficult, works.

Through this book, readers will not only learn how to make profits, but also gain a deeper understanding of risk management, the essence of investing.

This book is the ultimate guide to understanding the complex world of investing and providing all the knowledge you need to become a successful player.

GOODS SPECIFICS

- Date of issue: September 15, 2025

- Page count, weight, size: 400 pages | 153*225*30mm

- ISBN13: 9788957822289

- ISBN10: 8957822283

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)