I am a first time real estate salesperson.

|

Description

Book Introduction

From tax exemptions to double-entry bookkeeping, inventory assets, and loans

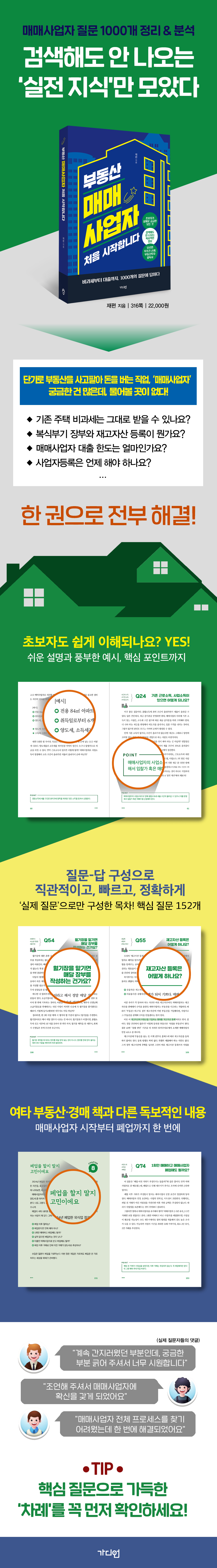

Answering 1,000 Questions from Real Estate Agents

High interest rates and a sluggish real estate market.

These days, with so many properties being auctioned, many people are trying their hand at becoming real estate agents.

But no matter how much I search on Naver or YouTube, there is no place that provides information about the trading business.

For beginners who are at a loss as to where to start, "Beginner Real Estate Sales Business" has been published.

The author collected and analyzed 1,000 questions from real estate investors, selecting 152 of the most frequently asked and most essential core questions and organizing them in a "question-and-answer" format.

Beginning with the basic concepts of a real estate business, it covers everything a real estate business needs, including business registration, taxes, double-entry bookkeeping, inventory assets, expense processing, individuals/corporations, the four major insurances, and even loans, the most pressing topic.

In particular, it helps beginner traders reduce mistakes and run successful businesses by providing detailed explanations of potentially confusing information, such as things to watch out for when registering a business, common mistakes made when filing taxes, and things to keep in mind when trading.

For those just starting out in the real estate business, "Getting Started in Real Estate" will be an essential guide.

Answering 1,000 Questions from Real Estate Agents

High interest rates and a sluggish real estate market.

These days, with so many properties being auctioned, many people are trying their hand at becoming real estate agents.

But no matter how much I search on Naver or YouTube, there is no place that provides information about the trading business.

For beginners who are at a loss as to where to start, "Beginner Real Estate Sales Business" has been published.

The author collected and analyzed 1,000 questions from real estate investors, selecting 152 of the most frequently asked and most essential core questions and organizing them in a "question-and-answer" format.

Beginning with the basic concepts of a real estate business, it covers everything a real estate business needs, including business registration, taxes, double-entry bookkeeping, inventory assets, expense processing, individuals/corporations, the four major insurances, and even loans, the most pressing topic.

In particular, it helps beginner traders reduce mistakes and run successful businesses by providing detailed explanations of potentially confusing information, such as things to watch out for when registering a business, common mistakes made when filing taxes, and things to keep in mind when trading.

For those just starting out in the real estate business, "Getting Started in Real Estate" will be an essential guide.

- You can preview some of the book's contents.

Preview

index

Prologue Why aren't there any books that properly teach traders how to trade?

[PART 1: Most Frequently Asked Questions]

CHAPTER 1 What on earth is a broker?

Q1 Why is individual short-term selling not recommended?

Q2 What kind of real estate do real estate agents buy and sell?

Q3 Are there any taxes that I need to be aware of depending on the type of real estate?

CHAPTER 2 The Power of Converting Capital Gains Tax into Income Tax

Q4 You're saying I don't have to pay the transfer tax?

Q5 Why can a trader pay income tax?

CHAPTER 3 The Power to Turn Multiple Homeowners into Single Homeowners

Q6 Are commercial housing units excluded from all housing unit counts?

Q7 Is it necessary to sell commercial housing through a real estate agent?

CHAPTER 4 The Power of Expense-Based Taxes

Q8 What is the difference between a business owner and an employee?

Q9 How does expense processing reduce taxes?

Q10 Why do businesses provide these benefits?

CHAPTER 5 I don't understand the concepts of individual, trader, and corporation.

Q11: What is the difference between an individual and a corporation?

Q12: What is the difference between an individual and a business?

Q13 Please tell me the basic process for a trader.

Q14 When should I use the individual and business names respectively?

Q15 If I sell as a real estate agent, do I need to notify the real estate agent in advance?

CHAPTER 6: The Emergence of the Presumed Trader

Q16 Are there any risks for the considered trader?

Q17 Why are there so few considered dealers?

Q18 Is there any way to avoid being considered a broker?

[PART 2: Taxes for Traders]

CHAPTER 1: Understanding Transfer Tax

Q19 What is the transfer tax rate based on the holding period?

Q20 How do I receive the exemption from transfer tax?

Q21 Is there any way to be tax-exempt without residing in a regulated area?

Q22 Are there any advantages for individuals over traders?

CHAPTER 2: I'm curious about the world where comprehensive income tax is paid.

Q23 How are the comprehensive income tax rate brackets determined?

Q24 What happens if I have existing earned income or business income?

Q25 When do I pay my comprehensive income tax?

CHAPTER 3 Do retailers also have to pay VAT?

Q26 We already know about VAT

Q27 When is VAT charged?

Q28 When is the VAT payment/refund period?

Q29 Can individuals also receive a VAT refund?

Q30 How much VAT does a seller pay?

Q31 When do I have to pay VAT and when do I not have to?

Q32 If I sell real estate to an individual as a real estate agent, who pays VAT and how?

Q33 When selling a large-sized house, do I need to specify a 10% VAT in the contract?

Q34 Is there any way to eliminate VAT?

Q35 Do I have to pay an additional 10% VAT and issue a cash receipt?

Q36 If a taxable business only trades VAT-exempt items, does it need to report no sales?

*VAT key points for beginner traders!

CHAPTER 4 Do real estate agents receive discounts on acquisition and property taxes?

Q37 How much acquisition tax must a real estate agent pay?

Q38 How is the number of houses subject to acquisition tax calculated?

Q39 Can a real estate sales business receive the same acquisition tax benefits as an individual?

Q40 Do real estate agents also receive a discount on property taxes?

Q41 What about houses with a public notice price of 100 million won or less?

Q42 When is the tax-exempt housing holding period calculated?

[PART 3: The Real Estate Agent's Secret You Missed]

CHAPTER 1 For Traders, Reporting Is Not the End

Q43 Please explain the 'Comprehensive Judgment' criteria in more detail.

Q44 Is it mandatory to buy and sell 1-2 houses a year?

Q45 Is it possible that I may not be recognized as a trading business operator?

Q46 Are there cases where acquisition is not for trading purposes?

Q47 Can I sell the gifted real estate as a real estate agent?

Q48 Is it not allowed for houses completed after redevelopment or reconstruction?

Q49 Can subscription rights be sold to a real estate agent?

CHAPTER 2: Knowing Your Accounts is a Must for Business

Please tell me what the Q50 length is

Q51 Do I have to wear a helmet?

Q52 Do I have to prepare the ledger every month?

Q53 When should I start using ledgers?

Q54 If I entrust the monthly ledger, will I have to prepare the ledger every month?

Q55 How do I register inventory assets?

Q56 Can a house included in the tangible assets be recognized as a house for sale?

Q57 How do I exclude the number of houses?

Q58 Can I sell a commercial house under my personal name and receive a tax exemption on the transfer tax?

CHAPTER 3: Tell me about expense processing items and precautions.

Q59 Why do I need to process expenses?

Q60 What items can a seller deduct as expenses?

Q61 Can I process expenses incurred prior to business registration?

Q62 Which is better, for income deduction or for proof of expenditure?

Q63 Are there any points to be aware of when processing expenses?

Q64 Do I need to write a cost processing special clause when selling?

CHAPTER 4 Businesses Don't Have to Fear Losses?

Q65 What is the difference between personal damages and business damages?

Q66 How do I receive a comprehensive income tax refund?

CHAPTER 5 Do I really need to open a business account (card)?

Q67 Is there a requirement to report a business account?

CHAPTER 6 How much is an appropriate amount for tax accounting and legal fees?

Q68 Do you have any tips for choosing a good legal advisor or tax accountant?

Q69 What documents should I provide to a tax accountant when I entrust my accounting to him?

CHAPTER 7 Can I rent out my house to a real estate agent?

Q70 When does the tax authority determine that a property is being used for rental purposes?

Q71 If I rent out a house to a real estate agent, do I have to pay a rental fee?

Q72 Do I not need to report rental income?

CHAPTER 8 I'm wondering whether to close my business or not.

Q73 Can I close my business after receiving a loan from a retail business?

Q74 Can I close my business after making just one transaction?

Q75 If I never win a bid, should I close my business?

Q76 Is it over just by reporting the closure of the business?

CHAPTER 9: Please tell me about the corporate sales business.

Q77 What is the difference between a corporate salesperson and an individual salesperson?

Q78 Is it true that corporate taxes have been increased for small corporations?

Q79 Is the vehicle expense processing limit reduced for corporate sales business operators?

Q80 Are there any advantages to investing in a corporate brokerage?

CHAPTER 10 Can I run a real estate business even if I already own a house?

Q81 Can I process my existing home as a sales business?

Q82 Do I have to sell my existing home to a real estate agent?

Q83 Can I still receive tax exemption for my existing home after registering as a sales business operator?

Q84 Do I have to actually live in my existing home to sell it tax-free?

[PART 4 I started this without even knowing this]

CHAPTER 1 What are the different types of self-employed individuals?

Q85 What are duty-exempt businesses and taxable businesses?

Q86 What is the difference between general taxpayers and simplified taxpayers?

Q87 Can a sales business operator also be subject to simplified taxation?

Q88 What should I do if I have an existing business location?

Q89 Which is more advantageous for a sales business operator, a taxable business operator or a tax-exempt business operator?

Q90 Can I register a business in advance before buying or selling?

Q91 Do retailers also need to issue tax invoices?

Q92 When and how do I file a VAT return?

Q93 How do I report my business status?

Q94 What should I do if I move from my business registration address?

CHAPTER 2 Isn't the business registration process complicated?

Q95 What should I enter as the business code?

Q96 If I only register a residential building code, can I not handle commercial buildings?

Q97 Where should I set up my business?

Q98 Do I have to submit a business plan?

CHAPTER 3 I'm curious about the timing of business registration.

Q99 When is it best to register as a sales business?

Q100 Is there any loss if I register a business in advance without any performance?

Q101 Are there any benefits to registering as a business in advance?

CHAPTER 4 Can office workers also be traders?

Q102 If I apply for a business, won't my workplace find out?

Q103 What if there is a clause prohibiting concurrent employment?

CHAPTER 5 How do health insurance premiums change?

Q104 Please let me know starting with the employees.

Q105 When will health insurance premiums increase?

Q106 Please tell me how much my insurance premium will increase.

Q107 Why don't my health insurance premiums go up if I sell real estate as an individual?

Q108 When will a dependent be converted to a local subscriber?

Q109 Are there any tips for reducing health insurance premiums?

Q110 Can I find out about changes in health insurance premiums at work?

CHAPTER 6 I'm afraid that the national pension increase will be a loss.

Q111 Please let me know starting with business subscribers.

Q112 How much does a local subscriber, not a business subscriber, pay in national pension?

Q113 Can I use a corporation, just like with health insurance?

*National Pension Key Summary for Beginner Traders!

Q114 Why should local subscribers and business owners be cautious?

Q115 How long will the changed payment amount last?

Q116 How is the National Pension Service handled for other pension subscribers?

Q117 Can I find out about changes to my national pension at work?

CHAPTER 7 Why should traders be wary of comparative taxation?

Q118 Please provide details on the transfer tax surcharge.

Q119 Are subscription rights always subject to comparative taxation?

CHAPTER 8 How is the preliminary report different from the transfer tax report?

Q120 When is the deadline for submitting the expected report?

Q121 What should the expected tax rate be?

Q122 Can expenses be processed even in a scheduled report?

Q123 What should I do if I sell multiple items in one year?

Q124 What happens if I buy and sell in different years?

Q125 So the transfer tax is actually a preliminary report?

Q126 What if I made a mistake in my expected return declaration and ended up paying more?

CHAPTER 9 I was selected for the Honest Reporter Award, but isn't that something to celebrate?

Q127 What are the criteria for selecting targets for honest reporting?

Q128 What changes if I am selected as a target for honest reporting?

[PART 5: Just now learning about loans for real estate agents]

CHAPTER 1 Can I receive a business loan and sell it under my personal name?

Q129 Can I get a personal loan if I am a trader?

Q130 Which bank is best for getting a loan?

Q131 I want to check and bid on a loan in advance, but there's no place to tell me.

CHAPTER 2: Please provide accurate loan limits for traders.

Q132 What exactly is an auction fund loan?

Q133 How is the personal loan limit calculated?

Q134 What are the differences between business loans?

Q135 Can I get a business loan even if my income is 0 won?

Q136 Isn't it true that business loans are only available 3 months after business registration?

Q137 If I take out a business loan, will it affect my existing home?

Q138 Do I need to register inventory assets to receive a business loan?

Q139 What are the pros and cons of trust loans?

Q140 Please give me some loan tips

CHAPTER 3 Should I register as a salesperson under the name of someone with high or low income?

Q141 Is it possible to change the name of a trading business?

Q142 What happens if I sell a jointly owned apartment?

Q143 Does the business name have to be my own?

Q144 Can a sales business operator also be a joint business operator?

Q145 I'm curious about the various situations of joint ownership.

Q146 Can housewives also be business owners?

[PART 6: Practical Calculations! Individuals vs. Traders]

*Basic capital gains tax rate and comprehensive income tax rate brackets

Q147 Practical Example ①: One transaction per year

Q148 Practical Example ②: Two Transactions per Year

Q149 Practical Example ③: Buying this year and selling next year

Q150 Practical Example ④: Calculating with Cost Processing

[PART 7: Do Markets Need Forecasts?]

Q151 Why are experts always wrong?

Q152 So what should we do?

The story of the epilogue reorganization

[PART 1: Most Frequently Asked Questions]

CHAPTER 1 What on earth is a broker?

Q1 Why is individual short-term selling not recommended?

Q2 What kind of real estate do real estate agents buy and sell?

Q3 Are there any taxes that I need to be aware of depending on the type of real estate?

CHAPTER 2 The Power of Converting Capital Gains Tax into Income Tax

Q4 You're saying I don't have to pay the transfer tax?

Q5 Why can a trader pay income tax?

CHAPTER 3 The Power to Turn Multiple Homeowners into Single Homeowners

Q6 Are commercial housing units excluded from all housing unit counts?

Q7 Is it necessary to sell commercial housing through a real estate agent?

CHAPTER 4 The Power of Expense-Based Taxes

Q8 What is the difference between a business owner and an employee?

Q9 How does expense processing reduce taxes?

Q10 Why do businesses provide these benefits?

CHAPTER 5 I don't understand the concepts of individual, trader, and corporation.

Q11: What is the difference between an individual and a corporation?

Q12: What is the difference between an individual and a business?

Q13 Please tell me the basic process for a trader.

Q14 When should I use the individual and business names respectively?

Q15 If I sell as a real estate agent, do I need to notify the real estate agent in advance?

CHAPTER 6: The Emergence of the Presumed Trader

Q16 Are there any risks for the considered trader?

Q17 Why are there so few considered dealers?

Q18 Is there any way to avoid being considered a broker?

[PART 2: Taxes for Traders]

CHAPTER 1: Understanding Transfer Tax

Q19 What is the transfer tax rate based on the holding period?

Q20 How do I receive the exemption from transfer tax?

Q21 Is there any way to be tax-exempt without residing in a regulated area?

Q22 Are there any advantages for individuals over traders?

CHAPTER 2: I'm curious about the world where comprehensive income tax is paid.

Q23 How are the comprehensive income tax rate brackets determined?

Q24 What happens if I have existing earned income or business income?

Q25 When do I pay my comprehensive income tax?

CHAPTER 3 Do retailers also have to pay VAT?

Q26 We already know about VAT

Q27 When is VAT charged?

Q28 When is the VAT payment/refund period?

Q29 Can individuals also receive a VAT refund?

Q30 How much VAT does a seller pay?

Q31 When do I have to pay VAT and when do I not have to?

Q32 If I sell real estate to an individual as a real estate agent, who pays VAT and how?

Q33 When selling a large-sized house, do I need to specify a 10% VAT in the contract?

Q34 Is there any way to eliminate VAT?

Q35 Do I have to pay an additional 10% VAT and issue a cash receipt?

Q36 If a taxable business only trades VAT-exempt items, does it need to report no sales?

*VAT key points for beginner traders!

CHAPTER 4 Do real estate agents receive discounts on acquisition and property taxes?

Q37 How much acquisition tax must a real estate agent pay?

Q38 How is the number of houses subject to acquisition tax calculated?

Q39 Can a real estate sales business receive the same acquisition tax benefits as an individual?

Q40 Do real estate agents also receive a discount on property taxes?

Q41 What about houses with a public notice price of 100 million won or less?

Q42 When is the tax-exempt housing holding period calculated?

[PART 3: The Real Estate Agent's Secret You Missed]

CHAPTER 1 For Traders, Reporting Is Not the End

Q43 Please explain the 'Comprehensive Judgment' criteria in more detail.

Q44 Is it mandatory to buy and sell 1-2 houses a year?

Q45 Is it possible that I may not be recognized as a trading business operator?

Q46 Are there cases where acquisition is not for trading purposes?

Q47 Can I sell the gifted real estate as a real estate agent?

Q48 Is it not allowed for houses completed after redevelopment or reconstruction?

Q49 Can subscription rights be sold to a real estate agent?

CHAPTER 2: Knowing Your Accounts is a Must for Business

Please tell me what the Q50 length is

Q51 Do I have to wear a helmet?

Q52 Do I have to prepare the ledger every month?

Q53 When should I start using ledgers?

Q54 If I entrust the monthly ledger, will I have to prepare the ledger every month?

Q55 How do I register inventory assets?

Q56 Can a house included in the tangible assets be recognized as a house for sale?

Q57 How do I exclude the number of houses?

Q58 Can I sell a commercial house under my personal name and receive a tax exemption on the transfer tax?

CHAPTER 3: Tell me about expense processing items and precautions.

Q59 Why do I need to process expenses?

Q60 What items can a seller deduct as expenses?

Q61 Can I process expenses incurred prior to business registration?

Q62 Which is better, for income deduction or for proof of expenditure?

Q63 Are there any points to be aware of when processing expenses?

Q64 Do I need to write a cost processing special clause when selling?

CHAPTER 4 Businesses Don't Have to Fear Losses?

Q65 What is the difference between personal damages and business damages?

Q66 How do I receive a comprehensive income tax refund?

CHAPTER 5 Do I really need to open a business account (card)?

Q67 Is there a requirement to report a business account?

CHAPTER 6 How much is an appropriate amount for tax accounting and legal fees?

Q68 Do you have any tips for choosing a good legal advisor or tax accountant?

Q69 What documents should I provide to a tax accountant when I entrust my accounting to him?

CHAPTER 7 Can I rent out my house to a real estate agent?

Q70 When does the tax authority determine that a property is being used for rental purposes?

Q71 If I rent out a house to a real estate agent, do I have to pay a rental fee?

Q72 Do I not need to report rental income?

CHAPTER 8 I'm wondering whether to close my business or not.

Q73 Can I close my business after receiving a loan from a retail business?

Q74 Can I close my business after making just one transaction?

Q75 If I never win a bid, should I close my business?

Q76 Is it over just by reporting the closure of the business?

CHAPTER 9: Please tell me about the corporate sales business.

Q77 What is the difference between a corporate salesperson and an individual salesperson?

Q78 Is it true that corporate taxes have been increased for small corporations?

Q79 Is the vehicle expense processing limit reduced for corporate sales business operators?

Q80 Are there any advantages to investing in a corporate brokerage?

CHAPTER 10 Can I run a real estate business even if I already own a house?

Q81 Can I process my existing home as a sales business?

Q82 Do I have to sell my existing home to a real estate agent?

Q83 Can I still receive tax exemption for my existing home after registering as a sales business operator?

Q84 Do I have to actually live in my existing home to sell it tax-free?

[PART 4 I started this without even knowing this]

CHAPTER 1 What are the different types of self-employed individuals?

Q85 What are duty-exempt businesses and taxable businesses?

Q86 What is the difference between general taxpayers and simplified taxpayers?

Q87 Can a sales business operator also be subject to simplified taxation?

Q88 What should I do if I have an existing business location?

Q89 Which is more advantageous for a sales business operator, a taxable business operator or a tax-exempt business operator?

Q90 Can I register a business in advance before buying or selling?

Q91 Do retailers also need to issue tax invoices?

Q92 When and how do I file a VAT return?

Q93 How do I report my business status?

Q94 What should I do if I move from my business registration address?

CHAPTER 2 Isn't the business registration process complicated?

Q95 What should I enter as the business code?

Q96 If I only register a residential building code, can I not handle commercial buildings?

Q97 Where should I set up my business?

Q98 Do I have to submit a business plan?

CHAPTER 3 I'm curious about the timing of business registration.

Q99 When is it best to register as a sales business?

Q100 Is there any loss if I register a business in advance without any performance?

Q101 Are there any benefits to registering as a business in advance?

CHAPTER 4 Can office workers also be traders?

Q102 If I apply for a business, won't my workplace find out?

Q103 What if there is a clause prohibiting concurrent employment?

CHAPTER 5 How do health insurance premiums change?

Q104 Please let me know starting with the employees.

Q105 When will health insurance premiums increase?

Q106 Please tell me how much my insurance premium will increase.

Q107 Why don't my health insurance premiums go up if I sell real estate as an individual?

Q108 When will a dependent be converted to a local subscriber?

Q109 Are there any tips for reducing health insurance premiums?

Q110 Can I find out about changes in health insurance premiums at work?

CHAPTER 6 I'm afraid that the national pension increase will be a loss.

Q111 Please let me know starting with business subscribers.

Q112 How much does a local subscriber, not a business subscriber, pay in national pension?

Q113 Can I use a corporation, just like with health insurance?

*National Pension Key Summary for Beginner Traders!

Q114 Why should local subscribers and business owners be cautious?

Q115 How long will the changed payment amount last?

Q116 How is the National Pension Service handled for other pension subscribers?

Q117 Can I find out about changes to my national pension at work?

CHAPTER 7 Why should traders be wary of comparative taxation?

Q118 Please provide details on the transfer tax surcharge.

Q119 Are subscription rights always subject to comparative taxation?

CHAPTER 8 How is the preliminary report different from the transfer tax report?

Q120 When is the deadline for submitting the expected report?

Q121 What should the expected tax rate be?

Q122 Can expenses be processed even in a scheduled report?

Q123 What should I do if I sell multiple items in one year?

Q124 What happens if I buy and sell in different years?

Q125 So the transfer tax is actually a preliminary report?

Q126 What if I made a mistake in my expected return declaration and ended up paying more?

CHAPTER 9 I was selected for the Honest Reporter Award, but isn't that something to celebrate?

Q127 What are the criteria for selecting targets for honest reporting?

Q128 What changes if I am selected as a target for honest reporting?

[PART 5: Just now learning about loans for real estate agents]

CHAPTER 1 Can I receive a business loan and sell it under my personal name?

Q129 Can I get a personal loan if I am a trader?

Q130 Which bank is best for getting a loan?

Q131 I want to check and bid on a loan in advance, but there's no place to tell me.

CHAPTER 2: Please provide accurate loan limits for traders.

Q132 What exactly is an auction fund loan?

Q133 How is the personal loan limit calculated?

Q134 What are the differences between business loans?

Q135 Can I get a business loan even if my income is 0 won?

Q136 Isn't it true that business loans are only available 3 months after business registration?

Q137 If I take out a business loan, will it affect my existing home?

Q138 Do I need to register inventory assets to receive a business loan?

Q139 What are the pros and cons of trust loans?

Q140 Please give me some loan tips

CHAPTER 3 Should I register as a salesperson under the name of someone with high or low income?

Q141 Is it possible to change the name of a trading business?

Q142 What happens if I sell a jointly owned apartment?

Q143 Does the business name have to be my own?

Q144 Can a sales business operator also be a joint business operator?

Q145 I'm curious about the various situations of joint ownership.

Q146 Can housewives also be business owners?

[PART 6: Practical Calculations! Individuals vs. Traders]

*Basic capital gains tax rate and comprehensive income tax rate brackets

Q147 Practical Example ①: One transaction per year

Q148 Practical Example ②: Two Transactions per Year

Q149 Practical Example ③: Buying this year and selling next year

Q150 Practical Example ④: Calculating with Cost Processing

[PART 7: Do Markets Need Forecasts?]

Q151 Why are experts always wrong?

Q152 So what should we do?

The story of the epilogue reorganization

Detailed image

Into the book

The burden of comprehensive real estate tax is enormous for multiple homeowners.

Not only is the acquisition tax higher, but as a multi-homeowner, you also get less loans.

However, due to the transfer tax, you cannot sell it right away and must hold it for at least two years.

In short, I'm just being tossed around.

This has the power to instantly turn even multi-homeowners into single-homeowners, making it an inventory asset for real estate agents.

Inventory assets are 'commercial housing' registered by a real estate agent as a house to buy and sell.

A house registered as a real estate agent's inventory asset is excluded from the number of houses when selling another house to an individual.

Even multi-homeowners can benefit from the transfer tax exemption.

It's groundbreaking.

Quickly get rid of troublesome properties to make money and save on property taxes.

--- p.26, from “CHAPTER 3 The Power to Change Multiple Homeowners into Single Homeowners”

'Accounting' is the act of a business recording sales and expenses in a ledger.

Entrusting the bookkeeping means that you are entrusting the task of preparing the books to a tax accountant or accountant, and the bookkeeping fee is the cost of preparing the books.

What is a ledger? Simply put, it's a ledger for recording your allowance.

Recording income and expenses with dates.

You can think of the ledger that a business owner uses to enter their allowance as a ledger.

Track the flow of money coming in and going out through ledgers.

The ledger can be used to determine whether a business is in the black or in the red.

There are two types of ledgers.

Simple ledger and double-entry ledger.

Simple ledger is a common household account book format that even individuals can use with just a little bit of familiarity.

Double-entry bookkeeping is called 'double-entry bookkeeping' for practical convenience, and is a formal accounting record that uses debits and credits.

It requires specialized knowledge and is difficult for an individual to do on their own.

Usually, traders do not use simple ledgers, but double-entry ledgers.

This is because one of the requirements for being recognized as a trading business operator is to handle inventory assets.

'Inventory assets', which are very important in determining whether a property is 'commercially used', appear only in double-entry bookkeeping.

--- p.102, from “Please tell me what the Q50 captain is”

In February 2025, we were selling our house and talking to the buyer about various things.

The buyer also did not have enough financial resources, so he boldly sold his own house and took the property we sold in a hurry.

I asked the buyer if he had held it for two years, and he said that he would have to pay a lot of capital gains tax if he sold it before that.

The words, 'Aha, I can use a broker!' rose to the top of my lungs.

But I couldn't tell you.

Even if you already know the dealer, it was difficult to use them.

Moreover, the buyer who got our urgent sale was a newlywed couple, and their expressions were very bright.

I didn't have the courage to say, 'You guys, if you don't do this, you'll lose out.'

‘Next time you make a short sale, please use a broker…’ I secretly wished the couple happiness.

Therefore, if you want to utilize a real estate agent, register your business at the appropriate time and, if possible, build up a track record in advance.

--- p.165-166, from “Q81 Can I process an existing home as a sales business?”

What is my answer to the question, "When is the best time to register as a real estate agent?"

I recommend registering your business after the purchase contract and before paying the balance.

If you are an auction investor, the balance of the winning bid will be transferred after the successful bid.

The reason is simple.

This is because registering a business, acquiring real estate, and adding it to inventory assets is a clean way to proceed with business.

However, if you are receiving a business loan, you must register your business beforehand.

This is because the loan requirements for business operators are a business registration certificate and collateral real estate.

--- p.204-205, from “Q99 When is it best to register as a sales business?”

There is absolutely no disadvantage to a business owner taking out a personal loan.

You can also handle all expenses as is.

For us who have started a business, we now have another option besides personal loans: business loans.

The name under which the property is sold has absolutely nothing to do with the type of loan taken out.

There is no problem with putting up a business and taking out a personal loan.

If you're wondering which loan to get, the right answer is 'choose the one that's most advantageous.'

Whether you are taking out a personal loan or a business loan, you should choose the loan with the most favorable terms (interest rate, grace period, loan term, early repayment fee).

You can take out a business loan and convert it into a personal loan, or vice versa.

Not only is the acquisition tax higher, but as a multi-homeowner, you also get less loans.

However, due to the transfer tax, you cannot sell it right away and must hold it for at least two years.

In short, I'm just being tossed around.

This has the power to instantly turn even multi-homeowners into single-homeowners, making it an inventory asset for real estate agents.

Inventory assets are 'commercial housing' registered by a real estate agent as a house to buy and sell.

A house registered as a real estate agent's inventory asset is excluded from the number of houses when selling another house to an individual.

Even multi-homeowners can benefit from the transfer tax exemption.

It's groundbreaking.

Quickly get rid of troublesome properties to make money and save on property taxes.

--- p.26, from “CHAPTER 3 The Power to Change Multiple Homeowners into Single Homeowners”

'Accounting' is the act of a business recording sales and expenses in a ledger.

Entrusting the bookkeeping means that you are entrusting the task of preparing the books to a tax accountant or accountant, and the bookkeeping fee is the cost of preparing the books.

What is a ledger? Simply put, it's a ledger for recording your allowance.

Recording income and expenses with dates.

You can think of the ledger that a business owner uses to enter their allowance as a ledger.

Track the flow of money coming in and going out through ledgers.

The ledger can be used to determine whether a business is in the black or in the red.

There are two types of ledgers.

Simple ledger and double-entry ledger.

Simple ledger is a common household account book format that even individuals can use with just a little bit of familiarity.

Double-entry bookkeeping is called 'double-entry bookkeeping' for practical convenience, and is a formal accounting record that uses debits and credits.

It requires specialized knowledge and is difficult for an individual to do on their own.

Usually, traders do not use simple ledgers, but double-entry ledgers.

This is because one of the requirements for being recognized as a trading business operator is to handle inventory assets.

'Inventory assets', which are very important in determining whether a property is 'commercially used', appear only in double-entry bookkeeping.

--- p.102, from “Please tell me what the Q50 captain is”

In February 2025, we were selling our house and talking to the buyer about various things.

The buyer also did not have enough financial resources, so he boldly sold his own house and took the property we sold in a hurry.

I asked the buyer if he had held it for two years, and he said that he would have to pay a lot of capital gains tax if he sold it before that.

The words, 'Aha, I can use a broker!' rose to the top of my lungs.

But I couldn't tell you.

Even if you already know the dealer, it was difficult to use them.

Moreover, the buyer who got our urgent sale was a newlywed couple, and their expressions were very bright.

I didn't have the courage to say, 'You guys, if you don't do this, you'll lose out.'

‘Next time you make a short sale, please use a broker…’ I secretly wished the couple happiness.

Therefore, if you want to utilize a real estate agent, register your business at the appropriate time and, if possible, build up a track record in advance.

--- p.165-166, from “Q81 Can I process an existing home as a sales business?”

What is my answer to the question, "When is the best time to register as a real estate agent?"

I recommend registering your business after the purchase contract and before paying the balance.

If you are an auction investor, the balance of the winning bid will be transferred after the successful bid.

The reason is simple.

This is because registering a business, acquiring real estate, and adding it to inventory assets is a clean way to proceed with business.

However, if you are receiving a business loan, you must register your business beforehand.

This is because the loan requirements for business operators are a business registration certificate and collateral real estate.

--- p.204-205, from “Q99 When is it best to register as a sales business?”

There is absolutely no disadvantage to a business owner taking out a personal loan.

You can also handle all expenses as is.

For us who have started a business, we now have another option besides personal loans: business loans.

The name under which the property is sold has absolutely nothing to do with the type of loan taken out.

There is no problem with putting up a business and taking out a personal loan.

If you're wondering which loan to get, the right answer is 'choose the one that's most advantageous.'

Whether you are taking out a personal loan or a business loan, you should choose the loan with the most favorable terms (interest rate, grace period, loan term, early repayment fee).

You can take out a business loan and convert it into a personal loan, or vice versa.

--- p.255, from “Q129 Can I get a personal loan if I am a salesperson?”

Publisher's Review

"Unrivaled information that can't be found even through a search."

Contains only what is 'really' necessary for traders!

A real estate agent is someone who makes money by buying and selling real estate in the short term.

Some people may be hearing about it for the first time, while others may have heard about it in passing in the real estate community.

They say, 'We need a real estate agent to lower the transfer tax,' but I can't find any information on what exactly that is or how to get started.

Even if you find the information, it's difficult to understand what it means.

There is someone who has thrown down the gauntlet to the 'trader', which is like an uncharted sea.

Just reorganize the writers.

He started studying real estate, using his painful experience of losing tens of millions of won in stocks and going through a divorce crisis as a stepping stone.

As time passed and I gained confidence, I participated in the auction.

You're lucky enough to win the bid on a house, but then you get stuck at the next stage.

The real trader.

The auction was a success, but the seller blocked it.

I can't just sit back and watch this wall.

It's literally like 'heading into the ground'.

YouTube, blogs, cafes, books… .

I even called the tax office and got scolded by the civil servant in charge.

Still, it wasn't a wasted effort, as I gradually learned what a real estate agent is and how to utilize it.

Information was gradually accumulated on everything from business registration laws, recognition requirements, tax strategies, bookkeeping, corporations, and loans.

In this way, I successfully bought 4 houses and sold 3 houses in one year.

Achieving a total of 1.2 billion won in sales raises curiosity.

'I wonder if there are people who are struggling like me?' To relieve my boredom, I post something on an online cafe.

“Questions from traders are accepted.”

But then the comments started pouring in.

“What happens to my existing home if I register as a real estate agent?”

“Can I also claim expenses for money spent before registering my business?”

“Can I run a trading business without being caught by the company?”

“I submitted a bid, but I never won a single bid.

“Should I close down the business?”

“Are salespeople also exempt from the tax on one house per household?”

The Q&A started like that and there were over 1,000 questions.

At this point, I'm starting to get curious again.

"Shall we organize this vast data?" We categorize the questions by frequency and topic, and carefully select 152 representative questions.

The book that was created that way is “Real Estate Sales Business Beginner”.

"Getting Started in the Real Estate Business" is not a book that simply lists and explains difficult and complex tax laws.

We've compiled only the essentials for traders and introduce them with abundant examples, easy explanations, and a friendly writing style.

‘Intuitive and concise answers’ is the spirit this book pursues.

A Q&A book for real estate agents, compiled from thousands of questions and answers that you won't find on the internet.

Contains only what is 'really' necessary for traders!

A real estate agent is someone who makes money by buying and selling real estate in the short term.

Some people may be hearing about it for the first time, while others may have heard about it in passing in the real estate community.

They say, 'We need a real estate agent to lower the transfer tax,' but I can't find any information on what exactly that is or how to get started.

Even if you find the information, it's difficult to understand what it means.

There is someone who has thrown down the gauntlet to the 'trader', which is like an uncharted sea.

Just reorganize the writers.

He started studying real estate, using his painful experience of losing tens of millions of won in stocks and going through a divorce crisis as a stepping stone.

As time passed and I gained confidence, I participated in the auction.

You're lucky enough to win the bid on a house, but then you get stuck at the next stage.

The real trader.

The auction was a success, but the seller blocked it.

I can't just sit back and watch this wall.

It's literally like 'heading into the ground'.

YouTube, blogs, cafes, books… .

I even called the tax office and got scolded by the civil servant in charge.

Still, it wasn't a wasted effort, as I gradually learned what a real estate agent is and how to utilize it.

Information was gradually accumulated on everything from business registration laws, recognition requirements, tax strategies, bookkeeping, corporations, and loans.

In this way, I successfully bought 4 houses and sold 3 houses in one year.

Achieving a total of 1.2 billion won in sales raises curiosity.

'I wonder if there are people who are struggling like me?' To relieve my boredom, I post something on an online cafe.

“Questions from traders are accepted.”

But then the comments started pouring in.

“What happens to my existing home if I register as a real estate agent?”

“Can I also claim expenses for money spent before registering my business?”

“Can I run a trading business without being caught by the company?”

“I submitted a bid, but I never won a single bid.

“Should I close down the business?”

“Are salespeople also exempt from the tax on one house per household?”

The Q&A started like that and there were over 1,000 questions.

At this point, I'm starting to get curious again.

"Shall we organize this vast data?" We categorize the questions by frequency and topic, and carefully select 152 representative questions.

The book that was created that way is “Real Estate Sales Business Beginner”.

"Getting Started in the Real Estate Business" is not a book that simply lists and explains difficult and complex tax laws.

We've compiled only the essentials for traders and introduce them with abundant examples, easy explanations, and a friendly writing style.

‘Intuitive and concise answers’ is the spirit this book pursues.

A Q&A book for real estate agents, compiled from thousands of questions and answers that you won't find on the internet.

GOODS SPECIFICS

- Date of issue: May 2, 2025

- Page count, weight, size: 316 pages | 476g | 152*225*20mm

- ISBN13: 9791167781529

- ISBN10: 116778152X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)