I learned how to become a billionaire from a giant.

|

Description

Book Introduction

★ Meta, Google, Slack… The 'Little Munger' Success Story That Captivated Silicon Valley ★

The "Follow the Giants" Strategy: Turning a Cafe Part-Timer into a Trillion Won Investor

★ Highly recommended by Bill Ackman and Morgan Housel ★

“My father, who admired giants, was poor all his life,

“I followed the giant and became a billionaire!”

What the winner of the capitalist survival game tells us

The easiest and fastest success manual

Andrew Wilkinson, who dreamed of becoming a journalist but dropped out of college after realizing the decline of legacy media.

He was just a part-timer at a cafe earning $6.50 an hour, but in about 10 years, he became the protagonist of a dramatic life reversal, discussing investments with legendary Silicon Valley investor Bill Ackman and receiving a business partner offer from investment god Charlie Munger.

How did he become a billionaire when he wasn't as highly qualified or a huge innovator as the Silicon Valley geniuses?

"I Learned How to Become a Billionaire from Giants" is a book that contains the real success story of a young billionaire who actually achieved wealth by imitating the strategies of giants such as Charlie Munger, Warren Buffett, and Steve Jobs.

He followed the advice of legendary investment gurus and entrepreneurs, not fearing failure, eliminating things he disliked, and gradually growing his assets.

His journey simultaneously shows the 'methods of making money' and 'methods of survival' that the rich never talk about.

From the founding of the design firm MetaLab, to his strategy of opposing goals to achieve freedom, to the principles of human relationships he learned from a business partner's betrayal, to the founding of the holding company Tiny and his investment experience that yielded dozens of times the profits, and finally, the story of designing a business empire with annual sales of 1 trillion won.

The incredible journey of a man who became truly rich by simply following the example of a giant contains a powerful life formula that will change not only money but also the direction of your life.

The "Follow the Giants" Strategy: Turning a Cafe Part-Timer into a Trillion Won Investor

★ Highly recommended by Bill Ackman and Morgan Housel ★

“My father, who admired giants, was poor all his life,

“I followed the giant and became a billionaire!”

What the winner of the capitalist survival game tells us

The easiest and fastest success manual

Andrew Wilkinson, who dreamed of becoming a journalist but dropped out of college after realizing the decline of legacy media.

He was just a part-timer at a cafe earning $6.50 an hour, but in about 10 years, he became the protagonist of a dramatic life reversal, discussing investments with legendary Silicon Valley investor Bill Ackman and receiving a business partner offer from investment god Charlie Munger.

How did he become a billionaire when he wasn't as highly qualified or a huge innovator as the Silicon Valley geniuses?

"I Learned How to Become a Billionaire from Giants" is a book that contains the real success story of a young billionaire who actually achieved wealth by imitating the strategies of giants such as Charlie Munger, Warren Buffett, and Steve Jobs.

He followed the advice of legendary investment gurus and entrepreneurs, not fearing failure, eliminating things he disliked, and gradually growing his assets.

His journey simultaneously shows the 'methods of making money' and 'methods of survival' that the rich never talk about.

From the founding of the design firm MetaLab, to his strategy of opposing goals to achieve freedom, to the principles of human relationships he learned from a business partner's betrayal, to the founding of the holding company Tiny and his investment experience that yielded dozens of times the profits, and finally, the story of designing a business empire with annual sales of 1 trillion won.

The incredible journey of a man who became truly rich by simply following the example of a giant contains a powerful life formula that will change not only money but also the direction of your life.

- You can preview some of the book's contents.

Preview

index

Recommendation

Chapter 1: Invited to Charlie Munger's House

My balance is at rock bottom, my dream is to be a billionaire.

Meeting our hero, Munger

Munger's surprising proposal

Chapter 2: The Secret of Wealth My Father Didn't Know

It all comes down to money

The opportunity created by my obsession with computers

It doesn't cost anything to ask.

Chapter 3: The Roller Coaster of Success and Failure

From penniless to barista

Looking at business through the eyes of a CEO

What goes up must also come down

Chapter 4 Scratch and Destroy

What I Learned from the Cat Furniture Business

The life I wanted

Chapter 5 In Search of Gold

Keep bumping into things

I use the accelerator, my business partner uses the brakes.

Chapter 6: The Risky Deal That Will Make Me a Millionaire

Most problems can be solved

A sale worth $7 million

Chapter 7: Climbing the Pleasure Wheel

Bigger planes, more expensive houses, faster cars

Business is like a parasite

Chapter 8: The World's Most Boring and Amazing Investment

Warren Buffett's Secret to Success

Chapter 9: A Relationship of Deception and Deception

The world of business is harsh

Never turn away from the truth

Chapter 10: There's no such thing as a free lunch.

Second sale decision

Chapter 11: The Shark's Wounds

Counterattack stealthily

Life is full of ups and downs

Chapter 12: Strategies for Acquiring Counter-Objectives

The beginning of investment firm Tiny

Use even failure

Chapter 13: Bill Ackman's Investment Lessons

Lunch with a Billionaire

Look for a company that's stable and long-lasting, like furniture.

Find investment opportunities in what you love

Chapter 14: The Wounds Are Deep, But Not Fatal

Allow yourself the freedom to make mistakes

The art of building a growing company

Chapter 15: The Bonfire of Money Created by Vanity

The more you have, the more things are taken away

Success and a changed daily life

Chapter 16: Becoming a Little Monger

People in the game 'Who Has More'

The life of a rich man that no one talks about

Chapter 17: She Hates Billionaires

Waitress working at a non-profit organization

Are all billionaires villains?

Chapter 18: Why We Dream of Becoming Billionaires

In order not to give in to desire

The endless anxiety that money can't solve

Chapter 19: Surviving as a Rich Man

A $500 million luxury yacht and 110,000 lives

Burn the boat to escape addiction

Chapter 20: The Unlucky One

No excuses needed

A feeling that only those born with a silver spoon in their mouths can understand

Chapter 21 Warren Buffett's Proposal

It's good for a while, but emptiness sets in.

Setting new life goals

Acknowledgements

Chapter 1: Invited to Charlie Munger's House

My balance is at rock bottom, my dream is to be a billionaire.

Meeting our hero, Munger

Munger's surprising proposal

Chapter 2: The Secret of Wealth My Father Didn't Know

It all comes down to money

The opportunity created by my obsession with computers

It doesn't cost anything to ask.

Chapter 3: The Roller Coaster of Success and Failure

From penniless to barista

Looking at business through the eyes of a CEO

What goes up must also come down

Chapter 4 Scratch and Destroy

What I Learned from the Cat Furniture Business

The life I wanted

Chapter 5 In Search of Gold

Keep bumping into things

I use the accelerator, my business partner uses the brakes.

Chapter 6: The Risky Deal That Will Make Me a Millionaire

Most problems can be solved

A sale worth $7 million

Chapter 7: Climbing the Pleasure Wheel

Bigger planes, more expensive houses, faster cars

Business is like a parasite

Chapter 8: The World's Most Boring and Amazing Investment

Warren Buffett's Secret to Success

Chapter 9: A Relationship of Deception and Deception

The world of business is harsh

Never turn away from the truth

Chapter 10: There's no such thing as a free lunch.

Second sale decision

Chapter 11: The Shark's Wounds

Counterattack stealthily

Life is full of ups and downs

Chapter 12: Strategies for Acquiring Counter-Objectives

The beginning of investment firm Tiny

Use even failure

Chapter 13: Bill Ackman's Investment Lessons

Lunch with a Billionaire

Look for a company that's stable and long-lasting, like furniture.

Find investment opportunities in what you love

Chapter 14: The Wounds Are Deep, But Not Fatal

Allow yourself the freedom to make mistakes

The art of building a growing company

Chapter 15: The Bonfire of Money Created by Vanity

The more you have, the more things are taken away

Success and a changed daily life

Chapter 16: Becoming a Little Monger

People in the game 'Who Has More'

The life of a rich man that no one talks about

Chapter 17: She Hates Billionaires

Waitress working at a non-profit organization

Are all billionaires villains?

Chapter 18: Why We Dream of Becoming Billionaires

In order not to give in to desire

The endless anxiety that money can't solve

Chapter 19: Surviving as a Rich Man

A $500 million luxury yacht and 110,000 lives

Burn the boat to escape addiction

Chapter 20: The Unlucky One

No excuses needed

A feeling that only those born with a silver spoon in their mouths can understand

Chapter 21 Warren Buffett's Proposal

It's good for a while, but emptiness sets in.

Setting new life goals

Acknowledgements

Detailed image

Into the book

One thing I've noticed over the years of observing business titans, especially those in Silicon Valley, is that while they're all smart in their own way, many of them act like they know everything.

But Munger was surprisingly different.

He was clearly a master in his areas of interest, such as investing, capitalism, science, and psychology, but he was neither assertive nor opinionated on other topics.

He even admitted humbly that he doesn't know everything about investing, saying there are areas he finds difficult to invest in.

When discussing complex topics, the most common response was a shrug and the exclamation, “That’s difficult!”

After saying this, as if admitting surrender in a discussion, he moved on to the next topic.

--- From "Chapter 1: Invited to Charlie Munger's House"

I've always thought of Stewart as a rare success story for Canadian tech companies.

He founded the photo-sharing site Flickr, sold it to Yahoo in 2005, and launched a massively multiplayer game called Glitch.

But the game failed miserably.

At the time, when he was laying off most of his staff, he emailed me and asked if we could talk.

“I’m having a really hard time,” he told me over the phone.

“But we have millions of dollars in the bank, and we want to try out the product idea we’ve envisioned,” he said, explaining his idea for a chat platform where team members could participate.

“We're thinking about calling this 'Slack.'”

--- From "Chapter 3: Roller Coaster of Success and Failure"

While most investors seek diversification, Munger calls this "deworsification" and asks:

“Why bother investing in your 100th idea?” While others were busy speculating on short-term market fluctuations and buying and selling, Munger urged investors to “buy great companies and do nothing.”

Sometimes for decades.

While Buffett maintained consistent statements and avoided unnecessary criticism, Munger was forthright in expressing his opinions on almost every issue, from economic crime to cryptocurrency.

If Buffett was a typical blues musician, Munger was an experimental jazz musician.

You never know what interesting thing he'll say next.

He was like a quote-making machine.

His sharp words were so memorable that I wanted to engrave them into my head.

--- From "Chapter 11: The Shark's Wounds"

Four years ago, Chris and I had a very expensive lunch with one of our investing heroes, Bill Ackman.

For years, he observed Ackman's activities from afar, meticulously recording every interview and email, and eventually invested millions of dollars in his publicly traded companies.

His investing style resembles Buffett's in many ways, but he prefers a more direct approach.

Ackman enjoyed working closely with the companies he invested in, often achieving surprising results.

He is best known for his investment in the Canadian Pacific Railway, which transformed Canada's most inefficient railway company into one of the most efficient, generating a whopping $2.6 billion in profits in the process.

--- From "Chapter 13 Bill Ackman's Investment Lessons"

I couldn't believe it.

To be contacted by the wise man of Omaha… … .

I dialed the number and then pressed the call connection button.

After a few beeps, a familiar voice answered.

“Nice to meet you, Andrew.

Bill praised you a lot.

“Tell me about the business you run.”

It was Warren Buffett.

He just seemed like a kind grandfather.

He oversees an empire with over 375,000 employees, over 60 businesses, and a net worth of over $100 billion, and he sat in his small office in Nebraska, looking out the window, and asked me about my life.

What on earth is going on?

People tell me not to meet my dream hero because I might be disappointed, but Buffett was everything I expected.

He listened to me intently and made proverbial remarks, just like he did on TV.

He was a real person, and he whispered in my ear.

But Munger was surprisingly different.

He was clearly a master in his areas of interest, such as investing, capitalism, science, and psychology, but he was neither assertive nor opinionated on other topics.

He even admitted humbly that he doesn't know everything about investing, saying there are areas he finds difficult to invest in.

When discussing complex topics, the most common response was a shrug and the exclamation, “That’s difficult!”

After saying this, as if admitting surrender in a discussion, he moved on to the next topic.

--- From "Chapter 1: Invited to Charlie Munger's House"

I've always thought of Stewart as a rare success story for Canadian tech companies.

He founded the photo-sharing site Flickr, sold it to Yahoo in 2005, and launched a massively multiplayer game called Glitch.

But the game failed miserably.

At the time, when he was laying off most of his staff, he emailed me and asked if we could talk.

“I’m having a really hard time,” he told me over the phone.

“But we have millions of dollars in the bank, and we want to try out the product idea we’ve envisioned,” he said, explaining his idea for a chat platform where team members could participate.

“We're thinking about calling this 'Slack.'”

--- From "Chapter 3: Roller Coaster of Success and Failure"

While most investors seek diversification, Munger calls this "deworsification" and asks:

“Why bother investing in your 100th idea?” While others were busy speculating on short-term market fluctuations and buying and selling, Munger urged investors to “buy great companies and do nothing.”

Sometimes for decades.

While Buffett maintained consistent statements and avoided unnecessary criticism, Munger was forthright in expressing his opinions on almost every issue, from economic crime to cryptocurrency.

If Buffett was a typical blues musician, Munger was an experimental jazz musician.

You never know what interesting thing he'll say next.

He was like a quote-making machine.

His sharp words were so memorable that I wanted to engrave them into my head.

--- From "Chapter 11: The Shark's Wounds"

Four years ago, Chris and I had a very expensive lunch with one of our investing heroes, Bill Ackman.

For years, he observed Ackman's activities from afar, meticulously recording every interview and email, and eventually invested millions of dollars in his publicly traded companies.

His investing style resembles Buffett's in many ways, but he prefers a more direct approach.

Ackman enjoyed working closely with the companies he invested in, often achieving surprising results.

He is best known for his investment in the Canadian Pacific Railway, which transformed Canada's most inefficient railway company into one of the most efficient, generating a whopping $2.6 billion in profits in the process.

--- From "Chapter 13 Bill Ackman's Investment Lessons"

I couldn't believe it.

To be contacted by the wise man of Omaha… … .

I dialed the number and then pressed the call connection button.

After a few beeps, a familiar voice answered.

“Nice to meet you, Andrew.

Bill praised you a lot.

“Tell me about the business you run.”

It was Warren Buffett.

He just seemed like a kind grandfather.

He oversees an empire with over 375,000 employees, over 60 businesses, and a net worth of over $100 billion, and he sat in his small office in Nebraska, looking out the window, and asked me about my life.

What on earth is going on?

People tell me not to meet my dream hero because I might be disappointed, but Buffett was everything I expected.

He listened to me intently and made proverbial remarks, just like he did on TV.

He was a real person, and he whispered in my ear.

--- From "Chapter 21 Warren Buffett's Proposal"

Publisher's Review

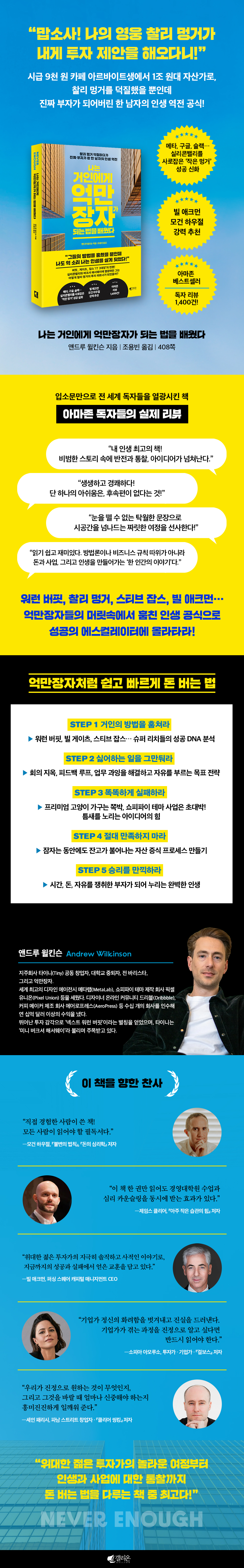

"Oh my God! I just stole their methods, and now I'm living a miserable life!"

From Cafe Worker to Billionaire: The Life Story of an Ordinary Silicon Valley "Geek"

Although they were not extremely poor, his parents always fought over money, and in the end, there was a boy who decided not to live like his father and started to quickly figure out how to make money.

A passionate young man who doesn't have any special talents but loves Bill Gates and Steve Jobs and has watched movies about them hundreds of times. Whenever a new Apple product is released, he writes a review that is at the level of a critic and even ends up having an interview with Steve Jobs.

This is the story of Andrew Wilkinson, founder of MetaLab, a design agency sought after by tech companies like Meta, YouTube, Thread, Slack, and Midjourney.

He began to consider Charlie Munger and Warren Buffett as his success mentors, and became so obsessed with them that he could recite their books and books related to Berkshire Hathaway.

Thanks to that, I was able to establish a design agency through many twists and turns, and I survived through hardships by following the numerous 'famous quotes' they left behind.

Afterwards, he established Tiny, an investment holding company following Berkshire Hathaway, and joined the ranks of 'billionaires' with assets exceeding 1 trillion won.

What's even more surprising is that he was invited to Charlie Munger's house and even received a business proposal!

His new book, Never Enough, contains his own incredible story, his strategies for success, and the lessons he learned from the giants he encountered.

It's not one of those generic self-help books that simply covers a few money-making tips or the little rules of business.

This film depicts how a penniless college dropout builds his own business empire and leaps the social ladder to become a billionaire in his 30s, a story of one man's great journey and determination to achieve wealth and fulfillment in life.

“I was just being bold because I thought I had to lose to win, but billionaires keep giving me hints!”

- The easiest and fastest success manual that turns an ordinary young man's wild dreams into reality.

How was this incredible drama possible? The strategies that made the author a billionaire can be broadly summarized in five points.

First, 'Steal the Giant's Way'.

Andrew had a long career in finance, delving into everything Silicon Valley, including computers and the latest IT technology.

He explored how rich people make money and become successful.

He reflected on the words and actions of the giants and gradually changed the course of his life.

In high school, he made money by running Macteens, a website that reported news about Apple, like any other startup. After dropping out of college, he started a design company, Metalab, and jumped into entrepreneurship like a Silicon Valley hero.

Second, ‘stop doing things you hate.’

After the meteoric success of MetaLab, Andrew had a busy life managing everything.

In particular, he had no interest in management.

So I hired my friend Mark and my bank teller Chris.

As Bill Gates said, “Let the lazy people do the hard work,” he quickly designed the company’s systems to gain freedom.

And we actively utilize the ‘opposite goal strategy’ inspired by Charlie Munger’s way of thinking of ‘thinking backwards’.

The opposite goal is to reduce the number of things you don't want to do.

“The difference between a ‘lucky rich man’ and a ‘wealth architect’ is mentality!”

The principles of smart failure, endless persistence, and a long-term vision... the essence of a billionaire mindset.

Third, ‘fail smart.’

The failure of his life-or-death cat furniture business and the massive success of his Shopify project taught Andrew the importance of diversifying his investments.

He creates new businesses targeting niche businesses.

However, the company is put in danger when it is revealed that the partner they trusted and followed is a conman after their money and company.

If you want to be successful, you need a strong mentality that can even take advantage of mistakes and failures.

After establishing a holding company called Tiny, he successfully acquired the designer community Dribble with a genuine offer, drawing on his experience of being scammed by a fraudster and failing to sell it.

Fourth, ‘Never be satisfied’ (the original title of this book is ‘Never Enough’).

If you want to make money while you sleep, you can't be satisfied until you do.

Andrew learns the importance of a long-term investment perspective during a lunch with Bill Ackman, who won the auction.

And it has acquired numerous companies, starting with the global coffee maker manufacturer AeroPress.

Following the teachings of Munger and Buffett, I invested primarily in undervalued companies with strong moats.

Andrew Wilkinson, a 'Charlie Munger fanboy' who was so poor, became a billionaire simply by stealing the methods of giants.

“A true giant is not obsessed, not impatient, and not easily moved!”

Warren Buffett himself taught us the ultimate goal of success and the values of life we must never forget.

The final strategy is to 'enjoy the victory'.

It is a true victory that not only wins money, but also wins time and freedom.

Andrew, who thought that money could make him happy, was faced with endless emptiness.

Vanity and luxury actually hinder happiness.

Charlie Munger offered him the chance to take over the business, but the excitement was short-lived.

My safety was threatened, my relationships were crumbling due to jealousy, and I had conflicts with my acquaintances.

To Andrew, who was suffering from anxiety that money could not solve, Buffett made a life-changing proposal.

The book ends with Andrew, following Buffett's suggestion, setting new life goals, acknowledging the emotions that have been plaguing him, and committing to moving forward.

This book, "I Taught Giants How to Become a Millionaire," is an autobiographical story of a young man who truly followed the success methods of giants.

It vividly and lightly depicts the changes in daily life and mindset that occur as one accumulates wealth in a short period of time, as well as insights into success and life.

The process of a man from a lower-middle-class family overcoming life-threatening poverty and overcoming lack of wealth is at first glance cathartic.

But the isolation in interpersonal relationships, moral doubts, and lack of professional satisfaction that come with gaining wealth and fame raise fundamental questions.

What are you running for, what awaits you at the end of your obsession with success and wealth?

Andrew Wilkinson uses the shark metaphor to describe the wealthy people, investors, and businessmen he meets.

He criticizes them as “robotic people who devour everything that gets in their way, people who never look back on their lives for even a moment,” saying that they are like ferocious beasts that swim forward without looking back.

And by ultimately turning the lifelong goal of becoming a billionaire upside down, it asks us what we truly want out of life.

Through his story of how he initially dreamed of becoming a shark but ultimately decided to live as a human, I hope you will discover the true formula for turning your life around, not only by gaining money, but also by gaining freedom and happiness.

From Cafe Worker to Billionaire: The Life Story of an Ordinary Silicon Valley "Geek"

Although they were not extremely poor, his parents always fought over money, and in the end, there was a boy who decided not to live like his father and started to quickly figure out how to make money.

A passionate young man who doesn't have any special talents but loves Bill Gates and Steve Jobs and has watched movies about them hundreds of times. Whenever a new Apple product is released, he writes a review that is at the level of a critic and even ends up having an interview with Steve Jobs.

This is the story of Andrew Wilkinson, founder of MetaLab, a design agency sought after by tech companies like Meta, YouTube, Thread, Slack, and Midjourney.

He began to consider Charlie Munger and Warren Buffett as his success mentors, and became so obsessed with them that he could recite their books and books related to Berkshire Hathaway.

Thanks to that, I was able to establish a design agency through many twists and turns, and I survived through hardships by following the numerous 'famous quotes' they left behind.

Afterwards, he established Tiny, an investment holding company following Berkshire Hathaway, and joined the ranks of 'billionaires' with assets exceeding 1 trillion won.

What's even more surprising is that he was invited to Charlie Munger's house and even received a business proposal!

His new book, Never Enough, contains his own incredible story, his strategies for success, and the lessons he learned from the giants he encountered.

It's not one of those generic self-help books that simply covers a few money-making tips or the little rules of business.

This film depicts how a penniless college dropout builds his own business empire and leaps the social ladder to become a billionaire in his 30s, a story of one man's great journey and determination to achieve wealth and fulfillment in life.

“I was just being bold because I thought I had to lose to win, but billionaires keep giving me hints!”

- The easiest and fastest success manual that turns an ordinary young man's wild dreams into reality.

How was this incredible drama possible? The strategies that made the author a billionaire can be broadly summarized in five points.

First, 'Steal the Giant's Way'.

Andrew had a long career in finance, delving into everything Silicon Valley, including computers and the latest IT technology.

He explored how rich people make money and become successful.

He reflected on the words and actions of the giants and gradually changed the course of his life.

In high school, he made money by running Macteens, a website that reported news about Apple, like any other startup. After dropping out of college, he started a design company, Metalab, and jumped into entrepreneurship like a Silicon Valley hero.

Second, ‘stop doing things you hate.’

After the meteoric success of MetaLab, Andrew had a busy life managing everything.

In particular, he had no interest in management.

So I hired my friend Mark and my bank teller Chris.

As Bill Gates said, “Let the lazy people do the hard work,” he quickly designed the company’s systems to gain freedom.

And we actively utilize the ‘opposite goal strategy’ inspired by Charlie Munger’s way of thinking of ‘thinking backwards’.

The opposite goal is to reduce the number of things you don't want to do.

“The difference between a ‘lucky rich man’ and a ‘wealth architect’ is mentality!”

The principles of smart failure, endless persistence, and a long-term vision... the essence of a billionaire mindset.

Third, ‘fail smart.’

The failure of his life-or-death cat furniture business and the massive success of his Shopify project taught Andrew the importance of diversifying his investments.

He creates new businesses targeting niche businesses.

However, the company is put in danger when it is revealed that the partner they trusted and followed is a conman after their money and company.

If you want to be successful, you need a strong mentality that can even take advantage of mistakes and failures.

After establishing a holding company called Tiny, he successfully acquired the designer community Dribble with a genuine offer, drawing on his experience of being scammed by a fraudster and failing to sell it.

Fourth, ‘Never be satisfied’ (the original title of this book is ‘Never Enough’).

If you want to make money while you sleep, you can't be satisfied until you do.

Andrew learns the importance of a long-term investment perspective during a lunch with Bill Ackman, who won the auction.

And it has acquired numerous companies, starting with the global coffee maker manufacturer AeroPress.

Following the teachings of Munger and Buffett, I invested primarily in undervalued companies with strong moats.

Andrew Wilkinson, a 'Charlie Munger fanboy' who was so poor, became a billionaire simply by stealing the methods of giants.

“A true giant is not obsessed, not impatient, and not easily moved!”

Warren Buffett himself taught us the ultimate goal of success and the values of life we must never forget.

The final strategy is to 'enjoy the victory'.

It is a true victory that not only wins money, but also wins time and freedom.

Andrew, who thought that money could make him happy, was faced with endless emptiness.

Vanity and luxury actually hinder happiness.

Charlie Munger offered him the chance to take over the business, but the excitement was short-lived.

My safety was threatened, my relationships were crumbling due to jealousy, and I had conflicts with my acquaintances.

To Andrew, who was suffering from anxiety that money could not solve, Buffett made a life-changing proposal.

The book ends with Andrew, following Buffett's suggestion, setting new life goals, acknowledging the emotions that have been plaguing him, and committing to moving forward.

This book, "I Taught Giants How to Become a Millionaire," is an autobiographical story of a young man who truly followed the success methods of giants.

It vividly and lightly depicts the changes in daily life and mindset that occur as one accumulates wealth in a short period of time, as well as insights into success and life.

The process of a man from a lower-middle-class family overcoming life-threatening poverty and overcoming lack of wealth is at first glance cathartic.

But the isolation in interpersonal relationships, moral doubts, and lack of professional satisfaction that come with gaining wealth and fame raise fundamental questions.

What are you running for, what awaits you at the end of your obsession with success and wealth?

Andrew Wilkinson uses the shark metaphor to describe the wealthy people, investors, and businessmen he meets.

He criticizes them as “robotic people who devour everything that gets in their way, people who never look back on their lives for even a moment,” saying that they are like ferocious beasts that swim forward without looking back.

And by ultimately turning the lifelong goal of becoming a billionaire upside down, it asks us what we truly want out of life.

Through his story of how he initially dreamed of becoming a shark but ultimately decided to live as a human, I hope you will discover the true formula for turning your life around, not only by gaining money, but also by gaining freedom and happiness.

GOODS SPECIFICS

- Date of issue: April 28, 2025

- Page count, weight, size: 408 pages | 596g | 148*220*24mm

- ISBN13: 9788901294315

- ISBN10: 8901294311

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)