Complete ETF investment in 7 days

|

Description

Book Introduction

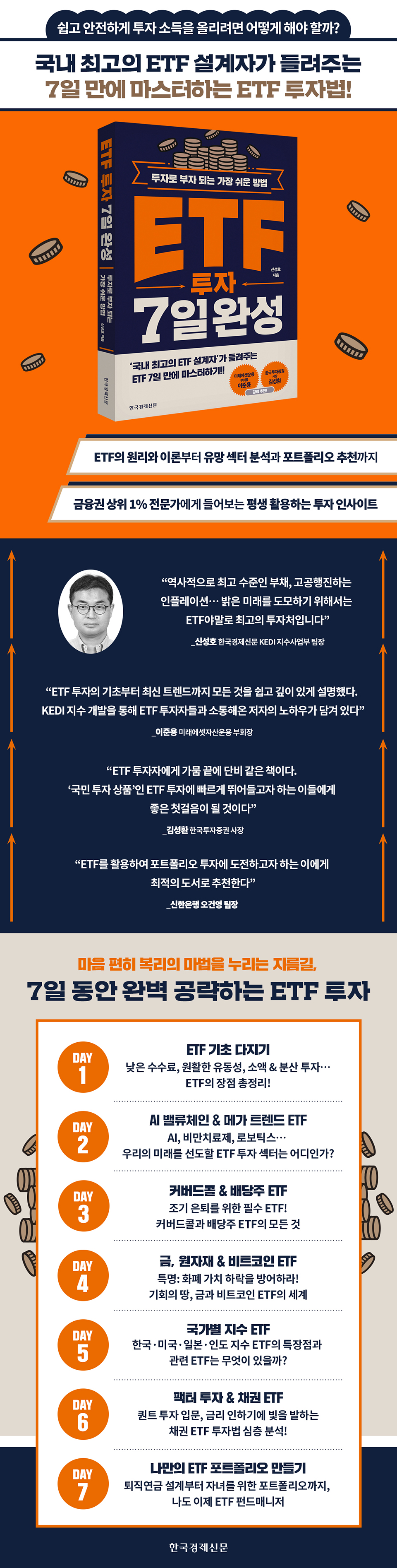

The best ETF designer in Korea tells you

Master ETF investment in just 7 days!

This book provides an easy-to-understand and in-depth explanation of everything from the basics of ETF investing to the latest trends. It also captures the author's expertise in communicating with ETF investors through the development of the KEDI index.

Lee Jun-yong, Vice Chairman of Mirae Asset Global Investments

This book is like a drop of rain after a drought for ETF investors.

This will be a good first step for those who want to quickly jump into ETF investment, a 'national investment product.'

Kim Seong-hwan, President of Korea Investment & Securities

· Strongly recommended by Oh Geon-yeong, Team Leader of the WM Promotion Department at Shinhan Bank

· ETF textbook that teaches both principles and practical investment methods.

· Includes high-growth, high-dividend, core industries, and factor investments.

The author, who has worked as a fund manager for 12 years and has accumulated expertise in everything from investment product strategies to ETF index development, offers a comprehensive introduction to ETF investing. He provides a comprehensive and easy-to-understand overview of ETF composition, types, taxes and fees, specific investment sectors, portfolio construction methods, and the characteristics of index ETFs by country.

ETFs, often called "the most innovative financial product of the past century," are suitable for long-term investment because they offer significant diversification, less volatility than individual stocks, and lower fees.

Just as the saying goes, "Don't try to find a needle in a haystack; buy the whole haystack," ETFs maximize the return on an investor's effort.

This book is not difficult to understand, as dozens of diagrams and graphs help with intuitive understanding.

It features concise and easy-to-understand explanations, easy-to-read diagrams, and a well-structured structure. From Day 1 to Day 7, it's designed to provide a deep understanding of ETFs over the course of a week, allowing you to acquire a lifelong investment strategy in a short period of time.

At the end of the chapter, a special corner titled 'ETF Jump Up' was placed.

We cover a variety of topics, including ETFs that many Koreans invest in, ETFs built around interesting stories, and ETFs with high distribution rates.

This book is designed to help even readers with little investment knowledge learn basic theories, apply them in practice, and develop their skills. It can be considered a textbook on ETFs.

The book is deeply covered in theory and principles, making it appealing even to readers with extensive investment experience.

If you're curious about how to consistently achieve high returns over the long term, rather than high-risk, high-return short-term gains, this book is for you.

Master ETF investment in just 7 days!

This book provides an easy-to-understand and in-depth explanation of everything from the basics of ETF investing to the latest trends. It also captures the author's expertise in communicating with ETF investors through the development of the KEDI index.

Lee Jun-yong, Vice Chairman of Mirae Asset Global Investments

This book is like a drop of rain after a drought for ETF investors.

This will be a good first step for those who want to quickly jump into ETF investment, a 'national investment product.'

Kim Seong-hwan, President of Korea Investment & Securities

· Strongly recommended by Oh Geon-yeong, Team Leader of the WM Promotion Department at Shinhan Bank

· ETF textbook that teaches both principles and practical investment methods.

· Includes high-growth, high-dividend, core industries, and factor investments.

The author, who has worked as a fund manager for 12 years and has accumulated expertise in everything from investment product strategies to ETF index development, offers a comprehensive introduction to ETF investing. He provides a comprehensive and easy-to-understand overview of ETF composition, types, taxes and fees, specific investment sectors, portfolio construction methods, and the characteristics of index ETFs by country.

ETFs, often called "the most innovative financial product of the past century," are suitable for long-term investment because they offer significant diversification, less volatility than individual stocks, and lower fees.

Just as the saying goes, "Don't try to find a needle in a haystack; buy the whole haystack," ETFs maximize the return on an investor's effort.

This book is not difficult to understand, as dozens of diagrams and graphs help with intuitive understanding.

It features concise and easy-to-understand explanations, easy-to-read diagrams, and a well-structured structure. From Day 1 to Day 7, it's designed to provide a deep understanding of ETFs over the course of a week, allowing you to acquire a lifelong investment strategy in a short period of time.

At the end of the chapter, a special corner titled 'ETF Jump Up' was placed.

We cover a variety of topics, including ETFs that many Koreans invest in, ETFs built around interesting stories, and ETFs with high distribution rates.

This book is designed to help even readers with little investment knowledge learn basic theories, apply them in practice, and develop their skills. It can be considered a textbook on ETFs.

The book is deeply covered in theory and principles, making it appealing even to readers with extensive investment experience.

If you're curious about how to consistently achieve high returns over the long term, rather than high-risk, high-return short-term gains, this book is for you.

- You can preview some of the book's contents.

Preview

index

prolog

ETF Investment Guide for Comfortable and Stable Asset Management

DAY 1. Build Your ETF Fundamentals

01 Why ETFs?

02 Preliminary knowledge to help you invest in ETFs

03 Principles for Portfolio Composition of Basic Indices

04 Passive and Active

05 ETFs that hedge exchange rates and ETFs that do not hedge

06 Taxes and Fees

07 PR (Price-to-earnings ratio) and TR (Total return)

08 Leverage and Inverse

ETF Jump Up - ETN Trading

DAY 2. AI Value Chain & Mega Trend ETF

01 Understanding the AI Value Chain

02 AI Semiconductors that Will Lead the Future

03 Software at the top of the AI value chain

04 A Sustainable Future, AI Infrastructure, and Nuclear Energy

05 On-Device AI: The Center of Innovation

06 Average annual growth of 30%, obesity treatment

07 Next-Generation Bio, Cell Genetics, and AI

08 Tesla and Tesla ETF

09 True Clean Energy, Hydrogen

10 Advanced Technology Orchestra, Robotics

11 K-Defense Industry, South Korea's Mega Trend

12 If Genesis surpasses Volkswagen

13 Bank Stock ETFs Leading Value Up

DAY 3.

Covered Call & Dividend ETFs

01 Structure of Options and Covered Calls

02 S&P 500 Covered Call JEPI and JEPQ

03 Target Premium Covered Call ETF

04 Covered Call ETFs are structurally different from ELS.

05 Domestic Dividend Stock ETFs by Type

06 US Dividend Aristocrats & Dividend King ETFs

07 REITs and infrastructure where business conditions are important

ETF Jump-Up - High-Distribution ETFs

DAY 4.

Gold, Commodities & Bitcoin ETFs

01 What is the difference between a gift and a present?

02 Crisis-Resistant Gold ETF

03 Crude oil, palladium, copper, agricultural products

04 Bitcoin & Ethereum Spot ETFs

ETF Jump Up - ETFs with Money-Making Stories

DAY 5.

Country Index ETFs

01 Korea KOSPI and KOSDAQ

02 US S&P 500 and Nasdaq

03 Japan Nikkei 225 and semiconductors

04 India Nifty50 and group stocks, consumer goods

ETF Jump-Up: Trends in Overseas Stock & ETF Investments by Domestic Investors

DAY 6.

Factor Investing & Bond ETFs

01 Growth Factor Investment

02 Value Factor Investing

03 Low-Volatility Factor Investment

04 Interest rates, bond prices, and credit ratings

05 Duration and Short-Term Finance

06 Bond Investment Strategy

07 Short-term and long-term spreads

08 US 30-Year Treasury Covered Call

09 The world's most convenient ETF investment, maturity-matched

DAY 7.

Create your own ETF portfolio

01 Let's start by understanding the system.

02 Pension Investments Tailored to Your Life Cycle, TDF

03 My Retirement Pension TDF

04 If you can tolerate short-term declines

05 If you want to sleep well while receiving dividends

06 If you need a monthly allowance, the gift of compound interest

07 If you want to give your children dreams and stability

ETF Jumpup - A Complete Guide to ETFs Listed in the US Market

ETF Investment Guide for Comfortable and Stable Asset Management

DAY 1. Build Your ETF Fundamentals

01 Why ETFs?

02 Preliminary knowledge to help you invest in ETFs

03 Principles for Portfolio Composition of Basic Indices

04 Passive and Active

05 ETFs that hedge exchange rates and ETFs that do not hedge

06 Taxes and Fees

07 PR (Price-to-earnings ratio) and TR (Total return)

08 Leverage and Inverse

ETF Jump Up - ETN Trading

DAY 2. AI Value Chain & Mega Trend ETF

01 Understanding the AI Value Chain

02 AI Semiconductors that Will Lead the Future

03 Software at the top of the AI value chain

04 A Sustainable Future, AI Infrastructure, and Nuclear Energy

05 On-Device AI: The Center of Innovation

06 Average annual growth of 30%, obesity treatment

07 Next-Generation Bio, Cell Genetics, and AI

08 Tesla and Tesla ETF

09 True Clean Energy, Hydrogen

10 Advanced Technology Orchestra, Robotics

11 K-Defense Industry, South Korea's Mega Trend

12 If Genesis surpasses Volkswagen

13 Bank Stock ETFs Leading Value Up

DAY 3.

Covered Call & Dividend ETFs

01 Structure of Options and Covered Calls

02 S&P 500 Covered Call JEPI and JEPQ

03 Target Premium Covered Call ETF

04 Covered Call ETFs are structurally different from ELS.

05 Domestic Dividend Stock ETFs by Type

06 US Dividend Aristocrats & Dividend King ETFs

07 REITs and infrastructure where business conditions are important

ETF Jump-Up - High-Distribution ETFs

DAY 4.

Gold, Commodities & Bitcoin ETFs

01 What is the difference between a gift and a present?

02 Crisis-Resistant Gold ETF

03 Crude oil, palladium, copper, agricultural products

04 Bitcoin & Ethereum Spot ETFs

ETF Jump Up - ETFs with Money-Making Stories

DAY 5.

Country Index ETFs

01 Korea KOSPI and KOSDAQ

02 US S&P 500 and Nasdaq

03 Japan Nikkei 225 and semiconductors

04 India Nifty50 and group stocks, consumer goods

ETF Jump-Up: Trends in Overseas Stock & ETF Investments by Domestic Investors

DAY 6.

Factor Investing & Bond ETFs

01 Growth Factor Investment

02 Value Factor Investing

03 Low-Volatility Factor Investment

04 Interest rates, bond prices, and credit ratings

05 Duration and Short-Term Finance

06 Bond Investment Strategy

07 Short-term and long-term spreads

08 US 30-Year Treasury Covered Call

09 The world's most convenient ETF investment, maturity-matched

DAY 7.

Create your own ETF portfolio

01 Let's start by understanding the system.

02 Pension Investments Tailored to Your Life Cycle, TDF

03 My Retirement Pension TDF

04 If you can tolerate short-term declines

05 If you want to sleep well while receiving dividends

06 If you need a monthly allowance, the gift of compound interest

07 If you want to give your children dreams and stability

ETF Jumpup - A Complete Guide to ETFs Listed in the US Market

Detailed image

Into the book

For those looking for hassle-free, easy, and stable investments, ETFs are the best option.

ETFs are considered the most innovative financial product of the past century. Simply open a brokerage account and trade them as easily as stocks, and you can check the underlying stocks at any time.

You can diversify your investments with small amounts and invest in stocks in US markets with different operating hours.

However, even with ETFs, you ultimately have to make choices. You have to decide whether to buy an AI-related ETF, a bond ETF, or the trendy monthly dividend ETF.

--- From the "Prologue"

By purchasing one share of an ETF, you can enjoy the diversification effect of purchasing all the stocks contained in the ETF at the same time in proportion.

Also, general funds only disclose the stocks held one or two months ago, so I have no idea what stocks my fund is currently investing in.

However, ETFs can be viewed daily in the form of PDF (Portfolio Deposit File, composition details) on the Korea Exchange (KRX) information data system, asset management company ETF homepages, or HTS (Home Trading System).

--- From "Why ETFs"

At the top of the AI value chain is software.

Ultimately, it has to lead to a service that consumers use.

However, profit growth is still concentrated in semiconductors, as tech companies that need to provide services must first build the infrastructure.

As the infrastructure is established and services begin to be offered, profit growth will spread to software service companies.

The representative software company is Microsoft, with the ticker 'MSFT'.

First of all, it is the largest investor in OpenAI, the creator of the generative AI Chat GPT.

And it is a company that provides Windows to computers around the world and competes for the 1st and 2nd place in market capitalization in the United States, with approximately 360 million customers using MS Office 365, including Word, Excel, and PowerPoint.

--- From "AI Software"

The robotics industry is an orchestra of cutting-edge technologies.

It is a comprehensive art that leads to cognition, judgment, and action.

Camera sensors for image detection, Lidar, which measures distances by shooting lasers and measuring the speed of their reflections, and Simultaneous Localization and Mapping (SLAM) technology, which allows robots to estimate and recognize their own location and simultaneously create a map, perform cognitive functions similar to human eyes or ears. AI makes decisions based on learned data.

And the drive motor and reducer make it move.

It is a comprehensive art form that combines cutting-edge technologies such as sensors, AI, and precision machinery.

Robot companies can also be divided into several categories.

Companies that manufacture large industrial automation machines include Japan's Fanuc and Keyence, and Switzerland's ABB.

And the representative company that manufactures collaborative robots that look like small arms is Denmark's Universal Robots.

Next are Korea's Doosan Robotics, Rainbow Robotics, and Robotis.

--- From "Robotics"

Domestically listed ETFs with raw materials as underlying assets include crude oil (especially West Texas Intermediate (WTI)) futures ETFs and copper, palladium, and agricultural products ETFs.

Although the price cycle differs depending on the demand source for each raw material, it is generally inversely proportional to the quote currency, the US dollar.

When the dollar strengthens, the quote currency strengthens, so the prices of raw materials fall relatively.

Of course, if the dollar's strength is due to economic recovery rather than relative strength due to tight monetary policy, industrial raw materials prices may rise despite the strength of the quote currency.

--- From "Crude Oil, Palladium, Copper, and Agricultural Products"

Comparing the period returns, there are differences by period, but it shows a superior return than KOSPI.

The unfortunate thing is that, excluding 'KODEX Growth', the net assets are less than 10 billion.

This is because Korean investors are more interested in popular themes in the market than in investment products based on numerical fundamentals.

However, for long-term returns, it seems necessary to utilize factor-based investments that exclude emotions.

--- From "Growth Factor Investment"

There are children's funds, but no children's ETFs.

Some parents open securities accounts for their children and put Samsung Electronics stock in them.

Recently, I have received consultations from people who want to hold stocks in American big tech companies.

By teaching their young children about the capital market and buying them stocks in big tech companies that are driving change in the world, we embody the hopes of parents who want their children to live better lives in a better world.

But putting all that hope into one stock can be an investment that only makes your heart flutter.

Businesses are changing, competition is accelerating, and the future is uncertain.

Nevertheless, technology will continue to advance and research for a better life will continue.

The method is an ETF that has specific criteria and direction and diversifies investments into various stocks.

This is because changes in the industry are reflected through rebalancing while keeping in line with the direction of research, development, and technological advancement.

ETFs are considered the most innovative financial product of the past century. Simply open a brokerage account and trade them as easily as stocks, and you can check the underlying stocks at any time.

You can diversify your investments with small amounts and invest in stocks in US markets with different operating hours.

However, even with ETFs, you ultimately have to make choices. You have to decide whether to buy an AI-related ETF, a bond ETF, or the trendy monthly dividend ETF.

--- From the "Prologue"

By purchasing one share of an ETF, you can enjoy the diversification effect of purchasing all the stocks contained in the ETF at the same time in proportion.

Also, general funds only disclose the stocks held one or two months ago, so I have no idea what stocks my fund is currently investing in.

However, ETFs can be viewed daily in the form of PDF (Portfolio Deposit File, composition details) on the Korea Exchange (KRX) information data system, asset management company ETF homepages, or HTS (Home Trading System).

--- From "Why ETFs"

At the top of the AI value chain is software.

Ultimately, it has to lead to a service that consumers use.

However, profit growth is still concentrated in semiconductors, as tech companies that need to provide services must first build the infrastructure.

As the infrastructure is established and services begin to be offered, profit growth will spread to software service companies.

The representative software company is Microsoft, with the ticker 'MSFT'.

First of all, it is the largest investor in OpenAI, the creator of the generative AI Chat GPT.

And it is a company that provides Windows to computers around the world and competes for the 1st and 2nd place in market capitalization in the United States, with approximately 360 million customers using MS Office 365, including Word, Excel, and PowerPoint.

--- From "AI Software"

The robotics industry is an orchestra of cutting-edge technologies.

It is a comprehensive art that leads to cognition, judgment, and action.

Camera sensors for image detection, Lidar, which measures distances by shooting lasers and measuring the speed of their reflections, and Simultaneous Localization and Mapping (SLAM) technology, which allows robots to estimate and recognize their own location and simultaneously create a map, perform cognitive functions similar to human eyes or ears. AI makes decisions based on learned data.

And the drive motor and reducer make it move.

It is a comprehensive art form that combines cutting-edge technologies such as sensors, AI, and precision machinery.

Robot companies can also be divided into several categories.

Companies that manufacture large industrial automation machines include Japan's Fanuc and Keyence, and Switzerland's ABB.

And the representative company that manufactures collaborative robots that look like small arms is Denmark's Universal Robots.

Next are Korea's Doosan Robotics, Rainbow Robotics, and Robotis.

--- From "Robotics"

Domestically listed ETFs with raw materials as underlying assets include crude oil (especially West Texas Intermediate (WTI)) futures ETFs and copper, palladium, and agricultural products ETFs.

Although the price cycle differs depending on the demand source for each raw material, it is generally inversely proportional to the quote currency, the US dollar.

When the dollar strengthens, the quote currency strengthens, so the prices of raw materials fall relatively.

Of course, if the dollar's strength is due to economic recovery rather than relative strength due to tight monetary policy, industrial raw materials prices may rise despite the strength of the quote currency.

--- From "Crude Oil, Palladium, Copper, and Agricultural Products"

Comparing the period returns, there are differences by period, but it shows a superior return than KOSPI.

The unfortunate thing is that, excluding 'KODEX Growth', the net assets are less than 10 billion.

This is because Korean investors are more interested in popular themes in the market than in investment products based on numerical fundamentals.

However, for long-term returns, it seems necessary to utilize factor-based investments that exclude emotions.

--- From "Growth Factor Investment"

There are children's funds, but no children's ETFs.

Some parents open securities accounts for their children and put Samsung Electronics stock in them.

Recently, I have received consultations from people who want to hold stocks in American big tech companies.

By teaching their young children about the capital market and buying them stocks in big tech companies that are driving change in the world, we embody the hopes of parents who want their children to live better lives in a better world.

But putting all that hope into one stock can be an investment that only makes your heart flutter.

Businesses are changing, competition is accelerating, and the future is uncertain.

Nevertheless, technology will continue to advance and research for a better life will continue.

The method is an ETF that has specific criteria and direction and diversifies investments into various stocks.

This is because changes in the industry are reflected through rebalancing while keeping in line with the direction of research, development, and technological advancement.

--- From "If you want to give your children dreams and stability"

Publisher's Review

Anyone who has ever invested in stocks will tell you that investing is difficult.

This is because individual stocks are highly volatile, companies' movements are difficult to closely examine, and they are constantly exposed to various variables.

However, if you invest in ETFs, which are considered "the most innovative financial products of the past century," the situation changes 180 degrees. ETFs diversify investments across various stocks at a set ratio, have low fees, and offer abundant liquidity thanks to a "liquidity provider" system.

This is why the number of people investing in ETFs, which have emerged as an attractive investment destination, is increasing significantly, and why related products are springing up like mushrooms.

Diversification, low fees, volatility management, sector-wide exposure, and abundant liquidity…

If you're an individual investor, be sure to take advantage of the outstanding benefits of ETF investment!

The author provides helpful guidance on everything from the principles and theory of ETF composition to the characteristics of individual products and even recommends portfolios by sector and situation.

You can learn everything about ETFs in one book in 7 days.

Rather than simply providing information on the characteristics of individual ETFs, it also provides information on the related industry as a whole, helping investors gain a three-dimensional perspective on their investment targets.

We'll take a closer look at the recently popular covered call products and monthly dividend ETFs in one chapter.

This is especially noteworthy for readers hoping to retire early by leveraging diverse dividend stocks.

“What are the unique advantages of country-specific index ETFs?”

“Why are JEPI and JEPQ, which pay high dividends, so popular?”

Country-specific index ETFs, such as the S&P500, Nikkei225, and Nifty50, are known as the most popular and stable investment vehicles.

However, few people invest with a proper understanding of the characteristics and advantages of each index ETF.

Carefully studying the weighting and investment points by industry can help increase your returns.

The S&P 500 covered call ETFs 'JEPI' and 'JEPQ', which have attracted much attention for their high dividend yields, are famous.

However, there are clear limitations, such as limited stock price increases, so it would be safe to study the principles and theory of covered calls before investing.

From portfolios for children to retirement portfolios

We recommend the optimal ETF portfolio!

We recommend optimal portfolios for a variety of investor situations: aggressive investors who can withstand short-term declines, conservative investors who prefer a low-volatility portfolio, and those seeking a monthly allowance in the form of dividends.

A robust portfolio that carefully considers the weighting and interconnectedness of each product is highly effective.

The reason I introduced specific products in detail above was to help readers create their own portfolios.

If you master the art of building a retirement portfolio that will make retirement a less daunting prospect, you can become a seasoned investor who finds investing effortless. We hope this book, which covers everything about ETFs, will help you embark on the path to successful investing.

This is because individual stocks are highly volatile, companies' movements are difficult to closely examine, and they are constantly exposed to various variables.

However, if you invest in ETFs, which are considered "the most innovative financial products of the past century," the situation changes 180 degrees. ETFs diversify investments across various stocks at a set ratio, have low fees, and offer abundant liquidity thanks to a "liquidity provider" system.

This is why the number of people investing in ETFs, which have emerged as an attractive investment destination, is increasing significantly, and why related products are springing up like mushrooms.

Diversification, low fees, volatility management, sector-wide exposure, and abundant liquidity…

If you're an individual investor, be sure to take advantage of the outstanding benefits of ETF investment!

The author provides helpful guidance on everything from the principles and theory of ETF composition to the characteristics of individual products and even recommends portfolios by sector and situation.

You can learn everything about ETFs in one book in 7 days.

Rather than simply providing information on the characteristics of individual ETFs, it also provides information on the related industry as a whole, helping investors gain a three-dimensional perspective on their investment targets.

We'll take a closer look at the recently popular covered call products and monthly dividend ETFs in one chapter.

This is especially noteworthy for readers hoping to retire early by leveraging diverse dividend stocks.

“What are the unique advantages of country-specific index ETFs?”

“Why are JEPI and JEPQ, which pay high dividends, so popular?”

Country-specific index ETFs, such as the S&P500, Nikkei225, and Nifty50, are known as the most popular and stable investment vehicles.

However, few people invest with a proper understanding of the characteristics and advantages of each index ETF.

Carefully studying the weighting and investment points by industry can help increase your returns.

The S&P 500 covered call ETFs 'JEPI' and 'JEPQ', which have attracted much attention for their high dividend yields, are famous.

However, there are clear limitations, such as limited stock price increases, so it would be safe to study the principles and theory of covered calls before investing.

From portfolios for children to retirement portfolios

We recommend the optimal ETF portfolio!

We recommend optimal portfolios for a variety of investor situations: aggressive investors who can withstand short-term declines, conservative investors who prefer a low-volatility portfolio, and those seeking a monthly allowance in the form of dividends.

A robust portfolio that carefully considers the weighting and interconnectedness of each product is highly effective.

The reason I introduced specific products in detail above was to help readers create their own portfolios.

If you master the art of building a retirement portfolio that will make retirement a less daunting prospect, you can become a seasoned investor who finds investing effortless. We hope this book, which covers everything about ETFs, will help you embark on the path to successful investing.

GOODS SPECIFICS

- Date of issue: December 19, 2024

- Page count, weight, size: 290 pages | 510g | 145*225*18mm

- ISBN13: 9788947549905

- ISBN10: 8947549908

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)