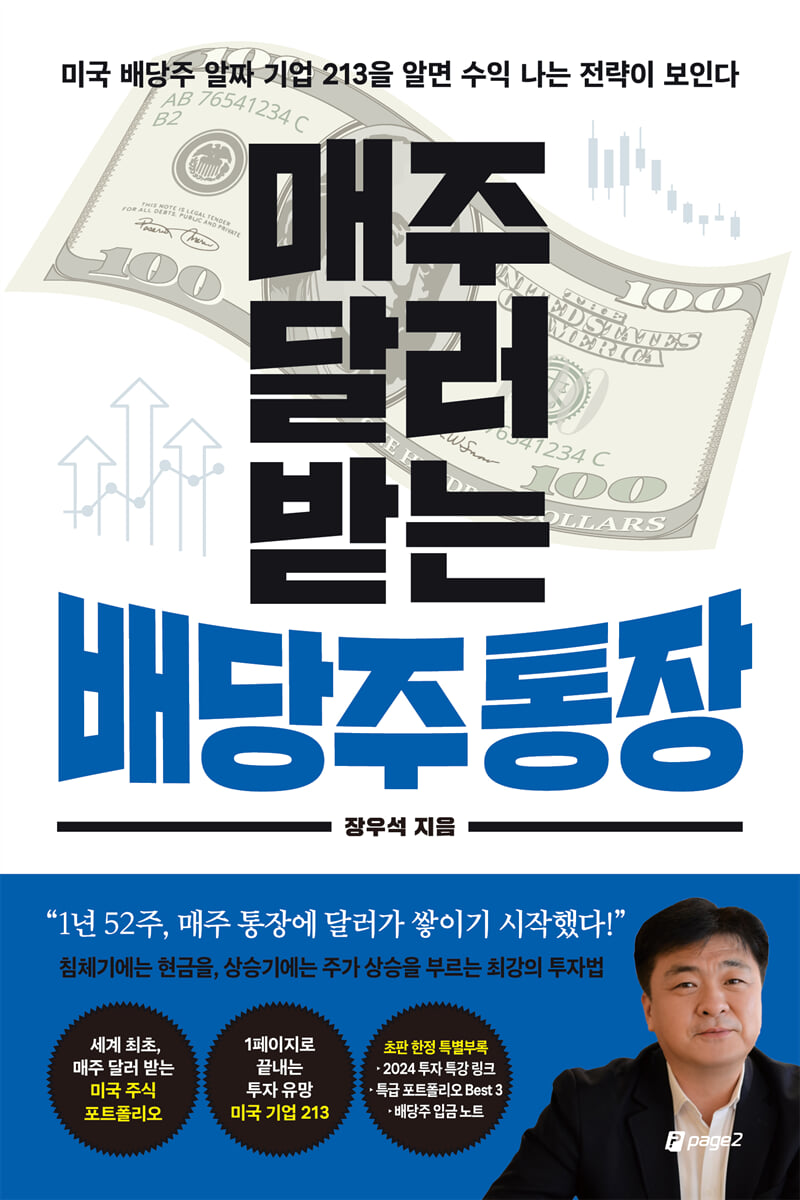

Dividend account that receives dollars every week

|

Description

Book Introduction

"For 52 weeks a year, dollars started piling up in my account every week."

The most powerful investment strategy: cash in a recession and stock price increases in a boom.

* The winning strategy for US dividend investment from Woo-seok Jang, aka "Jang Bi-dia," a popular figure who predicted the sharp rise and fall of Nvidia.

* Create your own portfolio that receives dollars every week from 213 companies!

There is nothing more enjoyable than seeing money pile up in your bank account every week.

Anyone can make that dream a reality by investing in U.S. dividend stocks.

Unlike domestic stocks, the US has a high rate of returning profits to shareholders and a high level of awareness of dividends, so many companies pay dividends quarterly.

Unlike domestic stocks, they are not affected by themes and generate steady profits, so people seeking stable investments for retirement savings are recently turning their attention to U.S. dividend stocks.

This book provides basic knowledge for investors new to U.S. dividend stocks, as well as practical strategies for creating a portfolio that receives weekly dollar deposits.

And by introducing 213 profitable dividend-generating companies with vivid comments from author Jang Woo-seok, it helps you build a successful portfolio and even rebalance it throughout the entire process.

This is a helpful book for anyone who is new to investing in US dividend stocks or is already investing but is struggling to generate effective returns.

The most powerful investment strategy: cash in a recession and stock price increases in a boom.

* The winning strategy for US dividend investment from Woo-seok Jang, aka "Jang Bi-dia," a popular figure who predicted the sharp rise and fall of Nvidia.

* Create your own portfolio that receives dollars every week from 213 companies!

There is nothing more enjoyable than seeing money pile up in your bank account every week.

Anyone can make that dream a reality by investing in U.S. dividend stocks.

Unlike domestic stocks, the US has a high rate of returning profits to shareholders and a high level of awareness of dividends, so many companies pay dividends quarterly.

Unlike domestic stocks, they are not affected by themes and generate steady profits, so people seeking stable investments for retirement savings are recently turning their attention to U.S. dividend stocks.

This book provides basic knowledge for investors new to U.S. dividend stocks, as well as practical strategies for creating a portfolio that receives weekly dollar deposits.

And by introducing 213 profitable dividend-generating companies with vivid comments from author Jang Woo-seok, it helps you build a successful portfolio and even rebalance it throughout the entire process.

This is a helpful book for anyone who is new to investing in US dividend stocks or is already investing but is struggling to generate effective returns.

- You can preview some of the book's contents.

Preview

index

[Introduction] Earning as much as your salary through dividend stocks is no longer a dream!

Part 1: Why Dividend Stocks?

Why I became interested in dividend stock investing

The positive function of dividends

Why should you pay attention to US dividend stocks?

Complete Guide to Dividend Stock Basics

Don't fall into the trap of high dividend yields!

Are there nobles and kings among dividend stocks?

When it comes to taxes, you only need to know about capital gains tax and dividend tax.

Misconceptions and Truths About Dividend Stocks

The magic of a dividend portfolio that lets you experience the power of compound interest at 200%.

Key Elements of Dividend Investing

Websites to Bookmark Before Investing

Invest only in industries that are performing well.

The three key elements of a portfolio that receives weekly dividends

Part 3: Practice! Creating a portfolio that receives weekly dividends

Tips for weekly dividends

Sample portfolio with weekly dividend payments

Part 4: List of 213 Companies Paying Dividends Every Week

Part 1: Why Dividend Stocks?

Why I became interested in dividend stock investing

The positive function of dividends

Why should you pay attention to US dividend stocks?

Complete Guide to Dividend Stock Basics

Don't fall into the trap of high dividend yields!

Are there nobles and kings among dividend stocks?

When it comes to taxes, you only need to know about capital gains tax and dividend tax.

Misconceptions and Truths About Dividend Stocks

The magic of a dividend portfolio that lets you experience the power of compound interest at 200%.

Key Elements of Dividend Investing

Websites to Bookmark Before Investing

Invest only in industries that are performing well.

The three key elements of a portfolio that receives weekly dividends

Part 3: Practice! Creating a portfolio that receives weekly dividends

Tips for weekly dividends

Sample portfolio with weekly dividend payments

Part 4: List of 213 Companies Paying Dividends Every Week

Detailed image

.jpg)

Into the book

Dividend investing is, in a word, a battle against time.

Here, time means 'time', not 'timing'.

It is almost impossible to time an accident and sell correctly.

But even elementary school students should learn how to reinvest dividends from investments made with spare money.

Whenever I give a dividend seminar, I always end it with this story:

“Think of investing in American dividends as investing in a building owner who owns a huge building.

The building won't disappear unless I destroy it.

Dividend investing doesn't matter if there's a market crisis or if I lose money, as long as I don't sell the stocks.

Even during a recession, if you choose the right stocks and invest wisely, you will always receive dividends.

My investment strategy is timeless.

“This is the charm and appeal of dividend investing.”

--- p.19~20

I believe in the long-term value of dividend investing, not the dividends themselves.

When many people think of dividend investing, they are only interested in how much return they can generate annually.

Of course, I also consider returns important, but I believe the purpose of dividend stocks is to make investing in them fun and enjoyable, and to make long-term investments without getting bored.

--- p.27

When the stock price falls, the thought of selling will not leave your mind.

Every time that happens, I get a weekly dividend notification from the securities firm.

I was trying to sell, but I got a text message.

I'm thinking about selling again next week, but I get another dividend text.

If this kind of thing is repeated for 52 weeks, over a year, you will soon realize that you have become a long-term investor.

--- p.30

This portfolio, which I created and which pays weekly dividends, consists of 16 individual stocks and 1 ETF.

Looking at the portfolio, the dividend schedule from January to March is repeated continuously from April to December.

Most U.S. stocks typically pay quarterly dividends, so when building a portfolio, it's good to remember that by setting dividends for January, February, and March, you've essentially set dividends for the remaining nine months.

--- p.123

As corporate situations constantly change, the dividend situations, yields, and projected returns of the 213 companies introduced in this book will also change.

Although it's unfortunate that the physical limitations of a paper book prevent it from covering all of these points, I hope this book will serve as a valuable seed and source of nourishment for those seeking to build a dividend stock portfolio.

I sincerely hope that through this book, you will realize the allure of dividend stocks, discover previously unknown dividend-paying companies, and build a portfolio that will last a lifetime.

Here, time means 'time', not 'timing'.

It is almost impossible to time an accident and sell correctly.

But even elementary school students should learn how to reinvest dividends from investments made with spare money.

Whenever I give a dividend seminar, I always end it with this story:

“Think of investing in American dividends as investing in a building owner who owns a huge building.

The building won't disappear unless I destroy it.

Dividend investing doesn't matter if there's a market crisis or if I lose money, as long as I don't sell the stocks.

Even during a recession, if you choose the right stocks and invest wisely, you will always receive dividends.

My investment strategy is timeless.

“This is the charm and appeal of dividend investing.”

--- p.19~20

I believe in the long-term value of dividend investing, not the dividends themselves.

When many people think of dividend investing, they are only interested in how much return they can generate annually.

Of course, I also consider returns important, but I believe the purpose of dividend stocks is to make investing in them fun and enjoyable, and to make long-term investments without getting bored.

--- p.27

When the stock price falls, the thought of selling will not leave your mind.

Every time that happens, I get a weekly dividend notification from the securities firm.

I was trying to sell, but I got a text message.

I'm thinking about selling again next week, but I get another dividend text.

If this kind of thing is repeated for 52 weeks, over a year, you will soon realize that you have become a long-term investor.

--- p.30

This portfolio, which I created and which pays weekly dividends, consists of 16 individual stocks and 1 ETF.

Looking at the portfolio, the dividend schedule from January to March is repeated continuously from April to December.

Most U.S. stocks typically pay quarterly dividends, so when building a portfolio, it's good to remember that by setting dividends for January, February, and March, you've essentially set dividends for the remaining nine months.

--- p.123

As corporate situations constantly change, the dividend situations, yields, and projected returns of the 213 companies introduced in this book will also change.

Although it's unfortunate that the physical limitations of a paper book prevent it from covering all of these points, I hope this book will serve as a valuable seed and source of nourishment for those seeking to build a dividend stock portfolio.

I sincerely hope that through this book, you will realize the allure of dividend stocks, discover previously unknown dividend-paying companies, and build a portfolio that will last a lifetime.

--- p.123

Publisher's Review

Investors' vivid testimonials about Jang Woo-seok, the top mentor in U.S. stocks.

“I trusted you, teacher, and bought and held Nvidia stocks, and the returns have been over 100%.”

Five years ago, when investors were focused on manufacturers like Tesla and Apple, there was someone who quietly focused on Nvidia's value and future.

It was Jang Woo-seok, the number one mentor in US stocks and the operator of the YouTube channel “Crazy about US Stocks” with 155,000 subscribers.

He introduced Nvidia to people by predicting the future that AI would change, and earned the nickname 'Equipmentia'.

Now, his prediction has come true, and Nvidia is on a tear, rising at breakneck speed to become the world's most valuable company.

His unique insight into businesses and the market shines through in his new book, "Dividend Stock Account that Earns Dollars Every Week."

Author Jang Woo-seok says that American dividend stocks, which are good even when the market is in a slump and even better when the market is rising, are the investment method we need now, and he wrote this book so that everyone can become a little more familiar with American dividend stocks.

An account that receives money every week is every salaried worker's dream.

In this book, the author introduces how to build a portfolio that brings in dollars every week to make that dream a reality.

This portfolio is an unbeatable investment method that kills three birds with one stone: weekly incoming dollar income, exchange rate gains when exchanging currency, and price differences that can be earned when selling stocks in the future.

This book explains 213 stocks that make this possible, with vivid comments from an American business expert. With just one copy, you can complete a lifelong investment strategy.

How to Build a Dividend Portfolio That Even Ordinary Salaried Workers Can Follow

“Get your money deposited every week while you sleep!”

Many people wonder if creating a portfolio that receives dollars every week requires finding and buying 52 companies for 52 weeks of the year.

The United States has a high level of awareness of dividends, so many companies pay dividends quarterly.

In this case, if you clearly decide on a company for 1 to 3 months, it will be repeated quarterly, so you can easily create a portfolio that receives dollars every week.

There is also the question of whether investing in companies with high dividend yields will be the end of it.

No, it isn't.

As a company's growth stops, its dividend yield also increases.

If you want to secure a decent dividend income along with the company's growth potential for future capital gains, there are several things to consider besides the dividend yield.

This book also reveals all of these dividend investment strategies that beginners often overlook.

If you consistently invest in a portfolio you've built, your investment will accumulate every month, and if you reinvest dividends, you can automatically earn a return equivalent to your monthly salary in the future through the compound interest effect.

Whether you're a stability-oriented investor aiming for principal protection, a 30-something office worker dreaming of becoming a FIRE Tribe member, or even managing your retirement pension, all can be achieved with US dividend stocks.

“I trusted you, teacher, and bought and held Nvidia stocks, and the returns have been over 100%.”

Five years ago, when investors were focused on manufacturers like Tesla and Apple, there was someone who quietly focused on Nvidia's value and future.

It was Jang Woo-seok, the number one mentor in US stocks and the operator of the YouTube channel “Crazy about US Stocks” with 155,000 subscribers.

He introduced Nvidia to people by predicting the future that AI would change, and earned the nickname 'Equipmentia'.

Now, his prediction has come true, and Nvidia is on a tear, rising at breakneck speed to become the world's most valuable company.

His unique insight into businesses and the market shines through in his new book, "Dividend Stock Account that Earns Dollars Every Week."

Author Jang Woo-seok says that American dividend stocks, which are good even when the market is in a slump and even better when the market is rising, are the investment method we need now, and he wrote this book so that everyone can become a little more familiar with American dividend stocks.

An account that receives money every week is every salaried worker's dream.

In this book, the author introduces how to build a portfolio that brings in dollars every week to make that dream a reality.

This portfolio is an unbeatable investment method that kills three birds with one stone: weekly incoming dollar income, exchange rate gains when exchanging currency, and price differences that can be earned when selling stocks in the future.

This book explains 213 stocks that make this possible, with vivid comments from an American business expert. With just one copy, you can complete a lifelong investment strategy.

How to Build a Dividend Portfolio That Even Ordinary Salaried Workers Can Follow

“Get your money deposited every week while you sleep!”

Many people wonder if creating a portfolio that receives dollars every week requires finding and buying 52 companies for 52 weeks of the year.

The United States has a high level of awareness of dividends, so many companies pay dividends quarterly.

In this case, if you clearly decide on a company for 1 to 3 months, it will be repeated quarterly, so you can easily create a portfolio that receives dollars every week.

There is also the question of whether investing in companies with high dividend yields will be the end of it.

No, it isn't.

As a company's growth stops, its dividend yield also increases.

If you want to secure a decent dividend income along with the company's growth potential for future capital gains, there are several things to consider besides the dividend yield.

This book also reveals all of these dividend investment strategies that beginners often overlook.

If you consistently invest in a portfolio you've built, your investment will accumulate every month, and if you reinvest dividends, you can automatically earn a return equivalent to your monthly salary in the future through the compound interest effect.

Whether you're a stability-oriented investor aiming for principal protection, a 30-something office worker dreaming of becoming a FIRE Tribe member, or even managing your retirement pension, all can be achieved with US dividend stocks.

GOODS SPECIFICS

- Date of issue: March 27, 2024

- Page count, weight, size: 364 pages | 600g | 148*210*21mm

- ISBN13: 9791169850704

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)