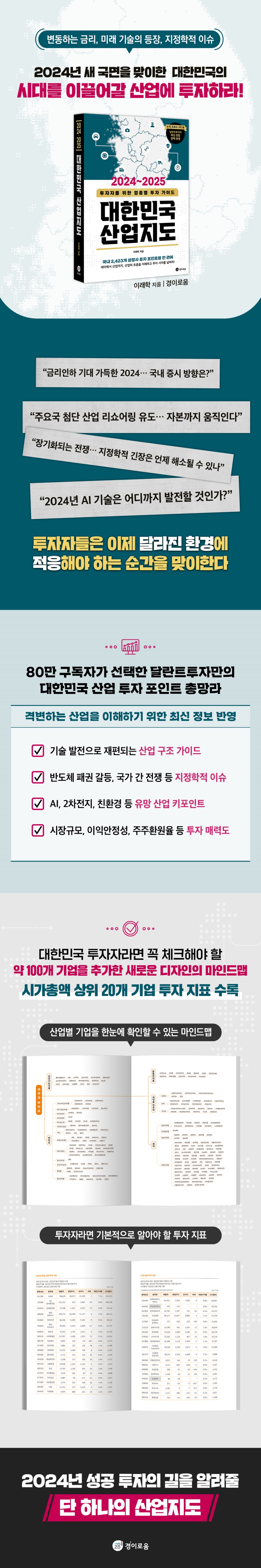

2024~2025 Korea Industrial Map

|

Description

Book Introduction

- A word from MD

-

Seize the investment opportunity!Author Lee Rae-hak, who runs 'Dallantu Investment' with 830,000 subscribers, organized 2,423 domestic listed companies into 27 industries and 179 sub-sectors.

It provides a clear overview of companies, sectors, and industries, making it easier for investors to make informed decisions.

It also includes various investment tips through investment points and attractiveness.

February 2, 2024. Economics and Management PD Kim Sang-geun

Fluctuating interest rates, shifting technological trends, and growing new industries.

The volatile stock market enters a new phase in 2023!

Investment opportunities to emerge among 2,423 companies, which is an increase from last year.

Find investment opportunities across all Korean industries in a single industrial map!

The historically high interest rate policy of the United States, which had been shaking up the asset market, is beginning to change.

Despite a global stock market downturn in 2023, investors seeking opportunities amidst crisis are listening closely to more issues, studying new technologies and industries, and identifying promising investment opportunities.

And finally, a new South Korean industrial map has been published, serving as a landmark to identify the companies poised to become "ten-baggers" in the stock market as it enters a new phase in 2024.

Future capital gathers in industries that are recognized for their potential value and technological prowess.

And when investors invest in these industries, they can make huge profits.

Industries that will lead the future can be identified based on various industry news and electronic disclosure data, but most investors are unable to decipher the flow of money amidst the vast amount of data.

So, following 2023, this book contains only the investment information that investors investing in Korean industries need to know.

It covers recent issues such as Chat GPT and secondary batteries, and includes information on 2,423 companies, an increase from last year, and a new radial graph that allows you to check the investment attractiveness of each industry.

The author, who has been running the YouTube channel "Dallant Investment" since 2019 and providing industry-specific investment tips to investors, says, "The third greatest upheaval in history is coming."

To invest in the new era, you need to be able to identify key points from the overflow of investment information.

This book, which can be viewed as a compendium of Korean industrial investment, will hopefully serve as a milestone on the road to successful investment over the next two years.

The volatile stock market enters a new phase in 2023!

Investment opportunities to emerge among 2,423 companies, which is an increase from last year.

Find investment opportunities across all Korean industries in a single industrial map!

The historically high interest rate policy of the United States, which had been shaking up the asset market, is beginning to change.

Despite a global stock market downturn in 2023, investors seeking opportunities amidst crisis are listening closely to more issues, studying new technologies and industries, and identifying promising investment opportunities.

And finally, a new South Korean industrial map has been published, serving as a landmark to identify the companies poised to become "ten-baggers" in the stock market as it enters a new phase in 2024.

Future capital gathers in industries that are recognized for their potential value and technological prowess.

And when investors invest in these industries, they can make huge profits.

Industries that will lead the future can be identified based on various industry news and electronic disclosure data, but most investors are unable to decipher the flow of money amidst the vast amount of data.

So, following 2023, this book contains only the investment information that investors investing in Korean industries need to know.

It covers recent issues such as Chat GPT and secondary batteries, and includes information on 2,423 companies, an increase from last year, and a new radial graph that allows you to check the investment attractiveness of each industry.

The author, who has been running the YouTube channel "Dallant Investment" since 2019 and providing industry-specific investment tips to investors, says, "The third greatest upheaval in history is coming."

To invest in the new era, you need to be able to identify key points from the overflow of investment information.

This book, which can be viewed as a compendium of Korean industrial investment, will hopefully serve as a milestone on the road to successful investment over the next two years.

- You can preview some of the book's contents.

Preview

index

Author's Note

Chapter 1: Infrastructure and Consumer Essentials

energy

Finance

communication

medical devices

Pharmaceuticals and Bio

Chapter 2 Basic Materials and Industrial Goods

Oil and Chemicals

steel and minerals

Shipbuilding and Transportation

Construction and Plants

machine

Chapter 3 IT

semiconductor

display

Mobile devices and cameras

IT services

Internet

Chapter 4 Consumer Goods 1

Food and beverage

Fashion

circulation

Other consumer goods

Chapter 5 Consumer Goods 2

cosmetics

Leisure

Media

game

Chapter 6 Consumer Goods 3

electronic devices

secondary battery

Automotive Appendix - Holding Company

Chapter 1: Infrastructure and Consumer Essentials

energy

Finance

communication

medical devices

Pharmaceuticals and Bio

Chapter 2 Basic Materials and Industrial Goods

Oil and Chemicals

steel and minerals

Shipbuilding and Transportation

Construction and Plants

machine

Chapter 3 IT

semiconductor

display

Mobile devices and cameras

IT services

Internet

Chapter 4 Consumer Goods 1

Food and beverage

Fashion

circulation

Other consumer goods

Chapter 5 Consumer Goods 2

cosmetics

Leisure

Media

game

Chapter 6 Consumer Goods 3

electronic devices

secondary battery

Automotive Appendix - Holding Company

Detailed image

Into the book

The global reshoring trend is also stimulating demand for electricity infrastructure.

As the hegemonic war between the United States and China intensified, the world became more bloc-oriented, and this led to a reshoring trend in which developed countries rushed to establish production facilities in their own countries.

Representative examples include the US Semiconductor Support Act and the Inflation Reduction Act.

--- p.22~23

The imaging diagnostic equipment and medical imaging market is expected to experience rapid growth in the diagnostic field, intertwined with AI. This is because AI medical imaging software can replace doctors in this field.

According to BIS Research, a leading technology research firm, oncology is expected to account for 45.7% of the total market in AI imaging diagnostics by 2029.

--- p.85

The Yoon Seok-yeol administration plans to supply a total of 2.7 million units from 2023 to 2027.

A total of 1.58 million households will be supplied in the metropolitan area, including downtown areas, areas near subway stations, and third-generation new cities.

However, the supply performance based on permits from January to August 2023 is only about 213,000 units, which means that the achievement rate is not even half yet.

The actual government supply plan is subject to change depending on real estate market conditions and political issues, so it is important to closely monitor whether it will actually be implemented.

--- p.190~191

The United States announced that it would enact the Semiconductor Support Act and invest approximately $52.7 billion in securing semiconductor facilities and research and development in the future.

Of this, approximately $39 billion is subsidies related to facility investment.

Companies investing in semiconductor manufacturing facilities in the United States may receive benefits from the U.S. government in the form of subsidies, loans, or loan guarantees.

Accordingly, Taiwan's TSMC and Samsung Electronics are building foundry factories in the United States.

--- p.244

The other consumer goods industry, including household goods, furniture, education, and toys, is centered on domestic demand and thus has a low growth rate.

Since the export volume is small, the market size is also small.

However, since repeated consumption occurs and it is not greatly affected by economic conditions, profit stability is high.

Some companies are striving to return shareholder value based on stable profits.

--- p.346

Korea's music exports are on a sharp upward trend.

According to the Ministry of Trade, Industry and Energy, exports in the first half of 2023 reached approximately $132.93 million, continuing their growth. This growth is the result of BTS's continued solo activities, despite the suspension of group activities, and the continued work of diverse artists like Stray Kids and TXT.

--- p.406~408

There are a total of 53 companies in the secondary battery industry, accounting for 9.5% of the stock market.

The market capitalization ratio is large compared to the number of companies.

In particular, it accounts for a larger proportion than the automobile market, which is a front-runner market, thanks to the growth potential of the secondary battery industry and the position of domestic companies.

Because LG Energy Solution, Samsung SDI, and SK On are leaders in the global secondary battery market, the valuation premiums given to them in the stock market are also significant.

As the hegemonic war between the United States and China intensified, the world became more bloc-oriented, and this led to a reshoring trend in which developed countries rushed to establish production facilities in their own countries.

Representative examples include the US Semiconductor Support Act and the Inflation Reduction Act.

--- p.22~23

The imaging diagnostic equipment and medical imaging market is expected to experience rapid growth in the diagnostic field, intertwined with AI. This is because AI medical imaging software can replace doctors in this field.

According to BIS Research, a leading technology research firm, oncology is expected to account for 45.7% of the total market in AI imaging diagnostics by 2029.

--- p.85

The Yoon Seok-yeol administration plans to supply a total of 2.7 million units from 2023 to 2027.

A total of 1.58 million households will be supplied in the metropolitan area, including downtown areas, areas near subway stations, and third-generation new cities.

However, the supply performance based on permits from January to August 2023 is only about 213,000 units, which means that the achievement rate is not even half yet.

The actual government supply plan is subject to change depending on real estate market conditions and political issues, so it is important to closely monitor whether it will actually be implemented.

--- p.190~191

The United States announced that it would enact the Semiconductor Support Act and invest approximately $52.7 billion in securing semiconductor facilities and research and development in the future.

Of this, approximately $39 billion is subsidies related to facility investment.

Companies investing in semiconductor manufacturing facilities in the United States may receive benefits from the U.S. government in the form of subsidies, loans, or loan guarantees.

Accordingly, Taiwan's TSMC and Samsung Electronics are building foundry factories in the United States.

--- p.244

The other consumer goods industry, including household goods, furniture, education, and toys, is centered on domestic demand and thus has a low growth rate.

Since the export volume is small, the market size is also small.

However, since repeated consumption occurs and it is not greatly affected by economic conditions, profit stability is high.

Some companies are striving to return shareholder value based on stable profits.

--- p.346

Korea's music exports are on a sharp upward trend.

According to the Ministry of Trade, Industry and Energy, exports in the first half of 2023 reached approximately $132.93 million, continuing their growth. This growth is the result of BTS's continued solo activities, despite the suspension of group activities, and the continued work of diverse artists like Stray Kids and TXT.

--- p.406~408

There are a total of 53 companies in the secondary battery industry, accounting for 9.5% of the stock market.

The market capitalization ratio is large compared to the number of companies.

In particular, it accounts for a larger proportion than the automobile market, which is a front-runner market, thanks to the growth potential of the secondary battery industry and the position of domestic companies.

Because LG Energy Solution, Samsung SDI, and SK On are leaders in the global secondary battery market, the valuation premiums given to them in the stock market are also significant.

--- p.458

Publisher's Review

Changed industrial outlook and new investment points,

The Korean Industrial Investment Formula That Covers All of This

No investor invests in a company without a reason.

Starting with checking stock price trends, we analyze market size and prospects, and even confirm the company's progress and business stability.

Investing is more likely to be successful when you take the time to clarify your reasons for investing.

This is the secret to generating reliable returns through investment, and it is why the author has put so much effort into this map of Korean industry.

A flood of issues are emerging that will shake up the stock market in 2024, including the US-China semiconductor hegemony battle and the Russia-Ukraine war.

The author has categorized the changing technological trends and new industrial prospects that investors must know into 'Infrastructure and Essential Consumer Goods,' 'Basic Materials and Industrial Goods,' 'IT,' and 'Consumer Goods.'

The Infrastructure and Consumer Essentials section includes updated content on the energy supply chain reorganized by the Russia-Ukraine War and Novo Nordisk's Vigovi, a revolutionary anti-obesity drug. The Basic Materials and Industrial Goods section includes new content on aerospace companies and the shift in the construction market driven by Saudi Arabia's NEOM project. The IT and Consumer Goods section includes AI technology trends that fueled the stock market's most exciting year in 2023 and key information on secondary batteries, helping readers understand the megatrends that will drive the market going forward.

It is not easy for ordinary investors to find only the key information in a lake of information.

The South Korean Industrial Map is a guidebook that helps investors, who cannot sift through countless business reports and economic articles, understand the South Korean market.

If you carefully read this book, which returns after a year with new content, and establish your own investment principles, you will be able to achieve successful investment in the stock market that will usher in a new era in 2024.

The Korean Industrial Investment Formula That Covers All of This

No investor invests in a company without a reason.

Starting with checking stock price trends, we analyze market size and prospects, and even confirm the company's progress and business stability.

Investing is more likely to be successful when you take the time to clarify your reasons for investing.

This is the secret to generating reliable returns through investment, and it is why the author has put so much effort into this map of Korean industry.

A flood of issues are emerging that will shake up the stock market in 2024, including the US-China semiconductor hegemony battle and the Russia-Ukraine war.

The author has categorized the changing technological trends and new industrial prospects that investors must know into 'Infrastructure and Essential Consumer Goods,' 'Basic Materials and Industrial Goods,' 'IT,' and 'Consumer Goods.'

The Infrastructure and Consumer Essentials section includes updated content on the energy supply chain reorganized by the Russia-Ukraine War and Novo Nordisk's Vigovi, a revolutionary anti-obesity drug. The Basic Materials and Industrial Goods section includes new content on aerospace companies and the shift in the construction market driven by Saudi Arabia's NEOM project. The IT and Consumer Goods section includes AI technology trends that fueled the stock market's most exciting year in 2023 and key information on secondary batteries, helping readers understand the megatrends that will drive the market going forward.

It is not easy for ordinary investors to find only the key information in a lake of information.

The South Korean Industrial Map is a guidebook that helps investors, who cannot sift through countless business reports and economic articles, understand the South Korean market.

If you carefully read this book, which returns after a year with new content, and establish your own investment principles, you will be able to achieve successful investment in the stock market that will usher in a new era in 2024.

GOODS SPECIFICS

- Date of issue: January 17, 2024

- Page count, weight, size: 512 pages | 172*240*35mm

- ISBN13: 9791192445618

- ISBN10: 1192445619

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)