Capitalism that capital doesn't speak of

|

Description

Book Introduction

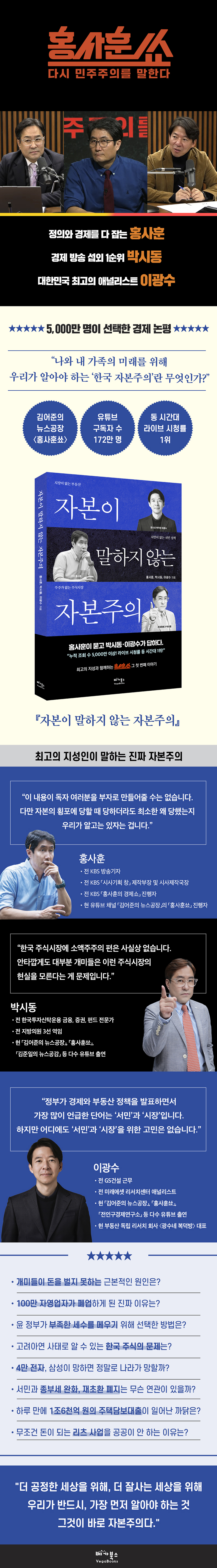

Over 50 million cumulative views! Ranked #1 in live viewership in its time slot! Meet the "Hong Sa-hun Show" with the best intellect in book form! Hong Sa-hoon asks, Park Si-dong and Lee Kwang-soo answer, and the true face of capitalism! With 1.69 million YouTube subscribers, "Kim Eo-jun's Humility is Hard News Factory"'s main program, "Hong Sa-hoon Show," has finally been published as a book! The high-quality economic talk show, chosen by 50 million people, has been released. Hong Sa-hoon, a reporter who covers both economics and justice; Park Si-dong, the economic commentator who is most sought after by the media; and Lee Gwang-soo, the CEO of Gwangsoo's Bokdeokbang, the best analyst and top real estate expert selected by the Korea Economic Daily. Three of the world's top intellectuals come together to uncover the true state of South Korea's economy. Capital never gives up its interests easily. Their true intentions are hidden in the words ‘common people’ and ‘market.’ Policies for the common people and the market sometimes seem to be really for our benefit. But if we look inside, we can see that the insidious vested interests of capital are deeply hidden in every corner of the policy. The country is becoming sick in real time because of the chronic diseases of Korean capitalism that capital has secretly suppressed without revealing. The Korean stock market is experiencing an unprecedented downturn, the Korea discount that is eating away at our economy, household loans that increased by about 1.6 trillion won in one day on August 31, 2024, the Korean stock market where retail investors are completely excluded from consideration, 17 real 'economic stories' about Korea that everyone should know but no one talks about. It tells the hidden truth about the distorted capitalism that we didn't know. What is the 'Korean capitalism' that we really need to know for the future of myself and my family? |

- You can preview some of the book's contents.

Preview

index

introduction

Part 1 | The Real Korean Stock Market: What Capital Doesn't Say

1.

Six Reasons Why Ants Can't Make Money

Problem One: Directors Don't Serve Shareholders

Second problem: The law always sides with controlling shareholders.

Third problem: Even the National Pension Service isn't on the people's side.

Fourth question: Is the physical division a stock market or a fraud market?

Fifth Problem: Management Premium, Only Minority Shareholders Benefit

Problem Six: "Ghost Shares" That Destroy Corporate Value

There is no market for ants

2.

I'll revise the Commercial Act and abolish the crime of breach of trust.

Amending the Commercial Act? It's my company, so who can control it?

More responsibility? Just don't take responsibility!

The First Deal in Business: The Principles of Business Judgment

The business world's second deal: abolishing the breach of trust law.

The Chaebols' Secret Service: Poison Pill

Piercing a Crack with a Needle: Differential Voting Rights Shares

The Chairman's Absolute Ring: Hwanggeumju

Can't we just revise the Commercial Act?

3.

Should we get a taste of the Financial Supervisory Service? Doosan, the devil's merger ratio

Striking the Back of the Head for Minority Shareholders ① Creating a New Corporation

Striking the Back of the Head for Minority Shareholders ② Merging Listed and Unlisted Companies

③ The timing of the merger is at the discretion of the major shareholder.

Do you think shareholders know shit?

The miracle of a three-fold increase in shares

The Financial Supervisory Service: "If insufficient, we will request unlimited corrections."

The Financial Supervisory Service: "Insufficient explanation of fair value."

Want to taste ants? Stock purchase warrants

4.

The self-employed are all dying, and we're entering an era where 1 million businesses will close.

Three years into the administration, how long will we continue to blame the previous administration?

If you can't think of anything, at least apply for the People's Livelihood Recovery Support Fund.

The government's small business measures: whereabouts of 25 trillion won

15 trillion won in construction investment, blatantly raising housing prices

The main idea behind the inheritance tax reform

In an era of 1 million business closures, fundamental solutions are needed.

The government is unable to address the soaring burden of delivery costs.

5.

A clever way to fill the tax gap: circulating the foreign exchange reserve fund.

Discretionary spending is at 0%, and the government has given up on economic stimulus.

Compliance with fiscal rules: a blatant lie

They don't give local government money, and instead use up foreign exchange reserves.

The foreign exchange reserve fund was used arbitrarily, and the budget was reduced to avoid repayment.

The Key to Unlocking the Economy: The Private Sector, Trust Only You

6.

The True Face of the Korea Discount: Seen Through the Korea Zinc Incident

Belly button over belly, Korea Zinc over Youngpoong

MBK Partners joins the fray, Korea Zinc, you're mine!

Korea Zinc, ask and get double!

Ants bursting in a whale fight

The Other Side of the Money War: Korea Discount

7.

Sambu Construction's stock price manipulation revealed in a single KakaoTalk message

The rise and fall of Sambu Construction

A single KakaoTalk message: "Check with Sambu tomorrow."

Sambu Construction's stock price chart looks strange to anyone.

Why is Sambu Construction in Ukraine?

Lime, Sambu Construction, and Deutsche Motors stock manipulation family

Suspicion of Sambu Construction's largest shareholder's involvement in stock price manipulation

How did Sambu Construction meet with the Ukrainian Presidential Office?

8.

Divorce costs 1.9 trillion won, SK in crisis

SK Group, the second-largest conglomerate in the world, is struggling.

SK Group Escapes Crisis ① Great Unity Through Merger

SK Group's Escape from Crisis ② Cashing Out Investment Assets

1.9 trillion won, a heartbreaking divorce

9.

40,000 Electronics: If Samsung fails, will the country fail?

Samsung in crisis: What's the problem?

Samsung's memory semiconductors, once a powerhouse, are now being held back by a massive gap.

Samsung wants to excel in the foundry business, but the problem lies in technology and trust.

Samsung in crisis: what is the solution?

If Samsung fails, will the country fail? Or maybe it will survive?

Chronic problems within Samsung: bureaucratization and factionalism

How Samsung Survives ① Run it well!

How Samsung Survived ② Quantum Jump

Samsung's Rising Chinese Semiconductor Industry: A Rise in the Ranks

Astronomical semiconductor subsidies around the world, what about Korea?

Samsung Electronics buys back its own shares for the first time in seven years.

The Real Reason Samsung's Share Buybacks: A Choice for the Owners

Samsung's urgent complaints remain, but the cause remains unknown.

Hong Sa-hoon's Reporter's Notebook ①

Part 2 | The Real Korean Real Estate Market: What Capital Doesn't Say

1.

A Model for Tax Cuts for the Rich: Inheritance Tax Reform

What kind of commoner inherits 3 billion won?

Child deduction of up to 500 million won

5 million people flocked to the lottery subscription

2.

Deja Vu 2009: The Key to Housing Prices: Sales Volume

Will house prices rise if the housing supply decreases?

Signs of a Crash: Increased Selling Volume

The Key to Housing Prices in the Metropolitan Area: Effective Demand

3.

Soaring Housing Prices: Abolishing the Private Land Price Cap

The construction industry is not manufacturing.

Sharing profits rather than lottery subscriptions

4.

No Law for the Common People: Reducing the Inheritance Tax and Abolishing Reinstatement

Why is the Democratic Party talking about easing the inheritance tax?

4,951 people, 0.01%, will receive comprehensive real estate tax relief

The excess profit recovery system for reconstruction projects must be maintained unconditionally.

5.

Soaring Housing Prices in the Seoul Metropolitan Area: August 8 Real Estate Measures

Greenbelt Development: A Feast for the Big Shots

Government-led housing supply

The government plans to stabilize housing prices through supply in 10 years.

No more candy, just giveaways and redevelopment

Mortgage loans increase by 5 trillion won every month

Soaring Seoul, Declining Provinces

Real Estate Market and Politics

Key Real Estate Reforms: Market Fluctuations and Housing Welfare

Real Estate Reform: Perhaps the Last Chance

6.

Real estate PF rollover, record-breaking household debt

Real Estate PF Policy: Leaving the Blame to the Private Sector

Household Debt Soars: A Clear Policy Failure

Does increased lending lead to increased marriages and childbirths?

The government's rubber-band lending policy

Real estate must be sold to make money.

A chaotic administration, a bank that is in disarray

Growing household debt and a crippling domestic economy

7.

Why can't the government do it? Private REIT business.

Private enterprise rental housing: the gateway to privatization of public works projects

Who is the culprit? Who benefits?

From private to public, policies for the homeless

8.

So when are you buying a house?

Have house prices stabilized?

Why is trading volume decreasing?

What is a stable leverage ratio?

What policies does the government pursue?

Selling volume determines home prices.

Correlation between interest rates and house prices

Understand the statistics properly

Two Characteristics of Real Estate: Use Value and Effective Demand Limits

Homes that others want: Transaction turnover, high investment ratio

Real Estate Market Outlook for 2025

Buying a home, not when, but how

Hong Sa-hoon's Reporter's Notebook ②

Part 1 | The Real Korean Stock Market: What Capital Doesn't Say

1.

Six Reasons Why Ants Can't Make Money

Problem One: Directors Don't Serve Shareholders

Second problem: The law always sides with controlling shareholders.

Third problem: Even the National Pension Service isn't on the people's side.

Fourth question: Is the physical division a stock market or a fraud market?

Fifth Problem: Management Premium, Only Minority Shareholders Benefit

Problem Six: "Ghost Shares" That Destroy Corporate Value

There is no market for ants

2.

I'll revise the Commercial Act and abolish the crime of breach of trust.

Amending the Commercial Act? It's my company, so who can control it?

More responsibility? Just don't take responsibility!

The First Deal in Business: The Principles of Business Judgment

The business world's second deal: abolishing the breach of trust law.

The Chaebols' Secret Service: Poison Pill

Piercing a Crack with a Needle: Differential Voting Rights Shares

The Chairman's Absolute Ring: Hwanggeumju

Can't we just revise the Commercial Act?

3.

Should we get a taste of the Financial Supervisory Service? Doosan, the devil's merger ratio

Striking the Back of the Head for Minority Shareholders ① Creating a New Corporation

Striking the Back of the Head for Minority Shareholders ② Merging Listed and Unlisted Companies

③ The timing of the merger is at the discretion of the major shareholder.

Do you think shareholders know shit?

The miracle of a three-fold increase in shares

The Financial Supervisory Service: "If insufficient, we will request unlimited corrections."

The Financial Supervisory Service: "Insufficient explanation of fair value."

Want to taste ants? Stock purchase warrants

4.

The self-employed are all dying, and we're entering an era where 1 million businesses will close.

Three years into the administration, how long will we continue to blame the previous administration?

If you can't think of anything, at least apply for the People's Livelihood Recovery Support Fund.

The government's small business measures: whereabouts of 25 trillion won

15 trillion won in construction investment, blatantly raising housing prices

The main idea behind the inheritance tax reform

In an era of 1 million business closures, fundamental solutions are needed.

The government is unable to address the soaring burden of delivery costs.

5.

A clever way to fill the tax gap: circulating the foreign exchange reserve fund.

Discretionary spending is at 0%, and the government has given up on economic stimulus.

Compliance with fiscal rules: a blatant lie

They don't give local government money, and instead use up foreign exchange reserves.

The foreign exchange reserve fund was used arbitrarily, and the budget was reduced to avoid repayment.

The Key to Unlocking the Economy: The Private Sector, Trust Only You

6.

The True Face of the Korea Discount: Seen Through the Korea Zinc Incident

Belly button over belly, Korea Zinc over Youngpoong

MBK Partners joins the fray, Korea Zinc, you're mine!

Korea Zinc, ask and get double!

Ants bursting in a whale fight

The Other Side of the Money War: Korea Discount

7.

Sambu Construction's stock price manipulation revealed in a single KakaoTalk message

The rise and fall of Sambu Construction

A single KakaoTalk message: "Check with Sambu tomorrow."

Sambu Construction's stock price chart looks strange to anyone.

Why is Sambu Construction in Ukraine?

Lime, Sambu Construction, and Deutsche Motors stock manipulation family

Suspicion of Sambu Construction's largest shareholder's involvement in stock price manipulation

How did Sambu Construction meet with the Ukrainian Presidential Office?

8.

Divorce costs 1.9 trillion won, SK in crisis

SK Group, the second-largest conglomerate in the world, is struggling.

SK Group Escapes Crisis ① Great Unity Through Merger

SK Group's Escape from Crisis ② Cashing Out Investment Assets

1.9 trillion won, a heartbreaking divorce

9.

40,000 Electronics: If Samsung fails, will the country fail?

Samsung in crisis: What's the problem?

Samsung's memory semiconductors, once a powerhouse, are now being held back by a massive gap.

Samsung wants to excel in the foundry business, but the problem lies in technology and trust.

Samsung in crisis: what is the solution?

If Samsung fails, will the country fail? Or maybe it will survive?

Chronic problems within Samsung: bureaucratization and factionalism

How Samsung Survives ① Run it well!

How Samsung Survived ② Quantum Jump

Samsung's Rising Chinese Semiconductor Industry: A Rise in the Ranks

Astronomical semiconductor subsidies around the world, what about Korea?

Samsung Electronics buys back its own shares for the first time in seven years.

The Real Reason Samsung's Share Buybacks: A Choice for the Owners

Samsung's urgent complaints remain, but the cause remains unknown.

Hong Sa-hoon's Reporter's Notebook ①

Part 2 | The Real Korean Real Estate Market: What Capital Doesn't Say

1.

A Model for Tax Cuts for the Rich: Inheritance Tax Reform

What kind of commoner inherits 3 billion won?

Child deduction of up to 500 million won

5 million people flocked to the lottery subscription

2.

Deja Vu 2009: The Key to Housing Prices: Sales Volume

Will house prices rise if the housing supply decreases?

Signs of a Crash: Increased Selling Volume

The Key to Housing Prices in the Metropolitan Area: Effective Demand

3.

Soaring Housing Prices: Abolishing the Private Land Price Cap

The construction industry is not manufacturing.

Sharing profits rather than lottery subscriptions

4.

No Law for the Common People: Reducing the Inheritance Tax and Abolishing Reinstatement

Why is the Democratic Party talking about easing the inheritance tax?

4,951 people, 0.01%, will receive comprehensive real estate tax relief

The excess profit recovery system for reconstruction projects must be maintained unconditionally.

5.

Soaring Housing Prices in the Seoul Metropolitan Area: August 8 Real Estate Measures

Greenbelt Development: A Feast for the Big Shots

Government-led housing supply

The government plans to stabilize housing prices through supply in 10 years.

No more candy, just giveaways and redevelopment

Mortgage loans increase by 5 trillion won every month

Soaring Seoul, Declining Provinces

Real Estate Market and Politics

Key Real Estate Reforms: Market Fluctuations and Housing Welfare

Real Estate Reform: Perhaps the Last Chance

6.

Real estate PF rollover, record-breaking household debt

Real Estate PF Policy: Leaving the Blame to the Private Sector

Household Debt Soars: A Clear Policy Failure

Does increased lending lead to increased marriages and childbirths?

The government's rubber-band lending policy

Real estate must be sold to make money.

A chaotic administration, a bank that is in disarray

Growing household debt and a crippling domestic economy

7.

Why can't the government do it? Private REIT business.

Private enterprise rental housing: the gateway to privatization of public works projects

Who is the culprit? Who benefits?

From private to public, policies for the homeless

8.

So when are you buying a house?

Have house prices stabilized?

Why is trading volume decreasing?

What is a stable leverage ratio?

What policies does the government pursue?

Selling volume determines home prices.

Correlation between interest rates and house prices

Understand the statistics properly

Two Characteristics of Real Estate: Use Value and Effective Demand Limits

Homes that others want: Transaction turnover, high investment ratio

Real Estate Market Outlook for 2025

Buying a home, not when, but how

Hong Sa-hoon's Reporter's Notebook ②

Detailed image

Into the book

Recently, there has been a movement throughout society to revise this tilted commercial law.

But we all know from experience that those with vested interests and power do not easily give up their jobs.

Financial authorities are also saying that instead of allowing the amendment to the Commercial Act, the crime of breach of trust by executives should be abolished.

This means that we should not punish theft at all in order to reduce theft.

Capital has no intention of making any concessions.

Even if it is the same commercial law, its meaning can be completely different depending on whose position it reflects.

Whether the future society will be inclusive or exploitative depends on the direction of this law.

--- From the "Preface"

In the end, what I've said so far is that there is virtually no support for minority shareholders in the Korean stock market.

Problems are rampant across the market, including boards of directors, laws and regulations, national pensions, spin-offs, management premiums, and phantom treasury stocks.

What was expected from the government's corporate value-up project was a solution to the above problem.

However, these core issues were not addressed at all and only formalities were mentioned.

This is exactly what the government should have been talking about.

--- From "Six Reasons Why Ants Can't Make Money"

There are people who are in favor of revising the Commercial Act and there are people who are against it.

The most common opposing opinion is the business.

Wouldn't companies be thinking, "No matter how much we oppose it, the 22nd National Assembly has an overwhelming Democratic Party majority, so the Commercial Act amendment can really be pushed through?" Given this situation, would they simply shout, "We oppose the Commercial Act amendment!"? If they believe it might pass even with their opposition, they'd naturally prepare a Plan B.

--- From "I will revise the Commercial Act and abolish the crime of breach of trust"

Money must be transferred from the foreign exchange reserve fund to the public fund, and then transferred from the public fund to the general budget.

In this way, the government spent 20 trillion won of the foreign exchange reserve fund as budget.

They said they would run it without borrowing money, but they didn't give out subsidies and withdrew foreign exchange reserves to last a year.

I even used up my postal insurance savings.

It's like they've really taken out the liver of a flea.

--- From "A Secret to Filling the Tax Shortage: Turning Over the Foreign Exchange Fund"

The battle for management rights between Korea Zinc and Youngpoong in 2024 was a hot topic in the Korean stock market.

First, let's start with something provocative for fun. When SM, Kakao, and Hive came together to wage a war of attrition, it was a huge topic of conversation, wasn't it? At the time, the total amount involved was less than 1 trillion won.

There is a money war going on right now over a company called Korea Zinc, and it is a war worth approximately 3 trillion won.

A real money battle between conglomerates has begun in the stock market.

--- From "The True Face of the Korea Discount as Seen Through the Korea Zinc Incident"

On November 14, 2024, Samsung Electronics' stock price fell to 49,900 won.

The '40,000 electrons' that was once a joke has become a reality.

It has been two years since Chairman Lee Jae-yong took over management of Samsung.

These words are constantly being said in the market these days.

"Samsung, the number one conglomerate in our country, is in real trouble!" This crisis is no small matter.

To conclude, it is because there is substance.

--- From "40,000 Electronics: If Samsung goes bankrupt, will the country go bankrupt?"

When the government diagnoses our country's real estate, there is this stereotype.

“Housing prices are rising because there is a housing shortage.” Fundamentally, the housing shortage cannot be solved.

Have you ever had a house full of people? So, you shouldn't try to solve the problem by supplying it.

The reason why house prices fluctuate is actually because of demand.

So, the key to stabilizing housing prices is how to address demand.

--- From "Surge in Housing Prices in the Metropolitan Area, August 8 Real Estate Measures"

South Korea's GDP growth rate recorded a negative figure in the second quarter as well.

The impact of the weak domestic market is enormous.

Domestic demand accounts for 49% of our country's GDP as of 2023.

Domestic demand is incredibly important.

One thing we must not keep in mind is that we should not think of South Korea as an export-oriented country.

Now that globalization is breaking down, exports cannot be as successful as before.

The United States is also poised to further strengthen protectionism in the future, and China is also pursuing its own protectionist policies.

--- From "Real Estate PF Rollback, Household Loans of All Time"

That is why REITs must be operated as public REITs led by the government, not privately.

Only then can ordinary citizens participate in Ritz and receive proper benefits.

There's no way the government doesn't know that.

The government has left a structure in place that could increase the burden on tenants.

This itself may have some purpose.

--- From "Why can't the government do it? Private REIT business"

The real estate market in 2025 is likely to see decreasing demand and increasing short-term supply.

In particular, it is predicted that owners who own apartments for investment purposes will sell a lot of their properties.

Real estate must be sold unconditionally to realize profits.

So, for investors, the timing of selling is more important than the timing of buying.

So when do investors sell their apartments?

But we all know from experience that those with vested interests and power do not easily give up their jobs.

Financial authorities are also saying that instead of allowing the amendment to the Commercial Act, the crime of breach of trust by executives should be abolished.

This means that we should not punish theft at all in order to reduce theft.

Capital has no intention of making any concessions.

Even if it is the same commercial law, its meaning can be completely different depending on whose position it reflects.

Whether the future society will be inclusive or exploitative depends on the direction of this law.

--- From the "Preface"

In the end, what I've said so far is that there is virtually no support for minority shareholders in the Korean stock market.

Problems are rampant across the market, including boards of directors, laws and regulations, national pensions, spin-offs, management premiums, and phantom treasury stocks.

What was expected from the government's corporate value-up project was a solution to the above problem.

However, these core issues were not addressed at all and only formalities were mentioned.

This is exactly what the government should have been talking about.

--- From "Six Reasons Why Ants Can't Make Money"

There are people who are in favor of revising the Commercial Act and there are people who are against it.

The most common opposing opinion is the business.

Wouldn't companies be thinking, "No matter how much we oppose it, the 22nd National Assembly has an overwhelming Democratic Party majority, so the Commercial Act amendment can really be pushed through?" Given this situation, would they simply shout, "We oppose the Commercial Act amendment!"? If they believe it might pass even with their opposition, they'd naturally prepare a Plan B.

--- From "I will revise the Commercial Act and abolish the crime of breach of trust"

Money must be transferred from the foreign exchange reserve fund to the public fund, and then transferred from the public fund to the general budget.

In this way, the government spent 20 trillion won of the foreign exchange reserve fund as budget.

They said they would run it without borrowing money, but they didn't give out subsidies and withdrew foreign exchange reserves to last a year.

I even used up my postal insurance savings.

It's like they've really taken out the liver of a flea.

--- From "A Secret to Filling the Tax Shortage: Turning Over the Foreign Exchange Fund"

The battle for management rights between Korea Zinc and Youngpoong in 2024 was a hot topic in the Korean stock market.

First, let's start with something provocative for fun. When SM, Kakao, and Hive came together to wage a war of attrition, it was a huge topic of conversation, wasn't it? At the time, the total amount involved was less than 1 trillion won.

There is a money war going on right now over a company called Korea Zinc, and it is a war worth approximately 3 trillion won.

A real money battle between conglomerates has begun in the stock market.

--- From "The True Face of the Korea Discount as Seen Through the Korea Zinc Incident"

On November 14, 2024, Samsung Electronics' stock price fell to 49,900 won.

The '40,000 electrons' that was once a joke has become a reality.

It has been two years since Chairman Lee Jae-yong took over management of Samsung.

These words are constantly being said in the market these days.

"Samsung, the number one conglomerate in our country, is in real trouble!" This crisis is no small matter.

To conclude, it is because there is substance.

--- From "40,000 Electronics: If Samsung goes bankrupt, will the country go bankrupt?"

When the government diagnoses our country's real estate, there is this stereotype.

“Housing prices are rising because there is a housing shortage.” Fundamentally, the housing shortage cannot be solved.

Have you ever had a house full of people? So, you shouldn't try to solve the problem by supplying it.

The reason why house prices fluctuate is actually because of demand.

So, the key to stabilizing housing prices is how to address demand.

--- From "Surge in Housing Prices in the Metropolitan Area, August 8 Real Estate Measures"

South Korea's GDP growth rate recorded a negative figure in the second quarter as well.

The impact of the weak domestic market is enormous.

Domestic demand accounts for 49% of our country's GDP as of 2023.

Domestic demand is incredibly important.

One thing we must not keep in mind is that we should not think of South Korea as an export-oriented country.

Now that globalization is breaking down, exports cannot be as successful as before.

The United States is also poised to further strengthen protectionism in the future, and China is also pursuing its own protectionist policies.

--- From "Real Estate PF Rollback, Household Loans of All Time"

That is why REITs must be operated as public REITs led by the government, not privately.

Only then can ordinary citizens participate in Ritz and receive proper benefits.

There's no way the government doesn't know that.

The government has left a structure in place that could increase the burden on tenants.

This itself may have some purpose.

--- From "Why can't the government do it? Private REIT business"

The real estate market in 2025 is likely to see decreasing demand and increasing short-term supply.

In particular, it is predicted that owners who own apartments for investment purposes will sell a lot of their properties.

Real estate must be sold unconditionally to realize profits.

So, for investors, the timing of selling is more important than the timing of buying.

So when do investors sell their apartments?

--- From "So when are you buying a house?"

Publisher's Review

An economy in ruins, a society in chaos, and a crumbling democracy.

South Korea regresses to the 1980s, leaving the entire nation in a state of "uncertain emergency."

For a fairer world, for a better world

The first thing we must know

That's capitalism.

Only those who know the truth will survive.

Korea's capital market is blatantly advantageous only to vested capital.

The capital market law itself, which constitutes the market, is like that.

The absurd exploitation of capital, such as splitting up companies and splitting them into physical units, is clearly an act of greed that is beyond anyone's comprehension.

But if you look at it from a legal standpoint, they are all legal.

The same goes for tax policy.

While labor income is taxed without any special treatment, capital income is taxed with lenient standards for all sorts of reasons.

The reason is simple.

Because capital has the power to make such laws.

What Capital Doesn't Say About the Korean Stock Market

The Truth About Capitalism: It Threatens My Happiness and My Family's Future

“Why can’t we be rich?”

If we were to point out the problems in the Korean stock market, there would be no end to them.

The commercial law that has not changed for decades, the merger ratio of Doosan Bobcat and Doosan Robotics, the Korea discount revealed in the Korea Zinc incident, suspicions of stock price manipulation at Sambu Construction, the 40,000 Electronics that is just around the corner, SK that needs 1.9 trillion won for the divorce cost of the CEO, an era where 1 million self-employed people are going out of business, the government trying to cover the insufficient tax revenue with the Foreign Exchange Stabilization Fund, etc., etc. There are a thousand problems that threaten the Korean economy.

What is the real problem with capitalism that's eating away at Korea? Only by understanding the truth about Korean capitalism can we discern what threatens our happiness and our families' futures, and then determine how to address the problem.

Korean real estate policies that are ruining the market

What's happening in Korea, where I live now and will live in the future.

“Why doesn’t my debt decrease no matter how much I pay it?”

The current average price of an apartment in Seoul is about 1.3 billion won.

When purchasing a home, real demanders naturally need a loan.

If you calculate the mortgage interest rate as 4%, you will have to pay 3 million won to the bank in interest every month.

In this way, to live in Seoul, one month's salary is needed as bank interest.

The era has arrived where ordinary citizens cannot even afford to maintain an apartment in Seoul.

In this situation, the government is pouring out policies for various real estate cartels.

The reason why the already dead local ecosystem is completely destroyed and only real estate prices in Seoul are skyrocketing is because of the relaxation of the comprehensive real estate tax, the abolition of the re-exchange, the abolition of the upper limit on the sale price, the reform of the inheritance tax, the shifting of real estate PF to household loans, green belt development, and private REIT business.

A stock market without shareholders, real estate without a market

Policies for the common people without the common people: Anarchy in the Republic of Korea

Small shareholders, the homeless, and the common people.

There is no country for them.

The fundamental causes of the Korea discount, including directors who only care about the company, skewed laws and systems, physical divisions, management premiums, and phantom treasury stocks, have remained unresolved for decades.

The government is resolving the unprecedented real estate PF through policy loans and private debt.

The government's announced policy for the common people includes a tax reform plan for those who inherit more than 3 billion won.

Can we just leave this deformed capitalism that is eating away at our future as it is?

At the very least, we need to know why we are suffering so that we can stop the tyranny of capital and gather the strength to solve the problem.

Only by understanding the true face of Korean capitalism can we create a fairer and better world.

How should distorted Korean capitalism change? Let's prepare for the coming crisis with "Capitalism Unspoken," the first book of "Hong Sa-hoon Show," a series featuring leading intellectuals!

South Korea regresses to the 1980s, leaving the entire nation in a state of "uncertain emergency."

For a fairer world, for a better world

The first thing we must know

That's capitalism.

Only those who know the truth will survive.

Korea's capital market is blatantly advantageous only to vested capital.

The capital market law itself, which constitutes the market, is like that.

The absurd exploitation of capital, such as splitting up companies and splitting them into physical units, is clearly an act of greed that is beyond anyone's comprehension.

But if you look at it from a legal standpoint, they are all legal.

The same goes for tax policy.

While labor income is taxed without any special treatment, capital income is taxed with lenient standards for all sorts of reasons.

The reason is simple.

Because capital has the power to make such laws.

What Capital Doesn't Say About the Korean Stock Market

The Truth About Capitalism: It Threatens My Happiness and My Family's Future

“Why can’t we be rich?”

If we were to point out the problems in the Korean stock market, there would be no end to them.

The commercial law that has not changed for decades, the merger ratio of Doosan Bobcat and Doosan Robotics, the Korea discount revealed in the Korea Zinc incident, suspicions of stock price manipulation at Sambu Construction, the 40,000 Electronics that is just around the corner, SK that needs 1.9 trillion won for the divorce cost of the CEO, an era where 1 million self-employed people are going out of business, the government trying to cover the insufficient tax revenue with the Foreign Exchange Stabilization Fund, etc., etc. There are a thousand problems that threaten the Korean economy.

What is the real problem with capitalism that's eating away at Korea? Only by understanding the truth about Korean capitalism can we discern what threatens our happiness and our families' futures, and then determine how to address the problem.

Korean real estate policies that are ruining the market

What's happening in Korea, where I live now and will live in the future.

“Why doesn’t my debt decrease no matter how much I pay it?”

The current average price of an apartment in Seoul is about 1.3 billion won.

When purchasing a home, real demanders naturally need a loan.

If you calculate the mortgage interest rate as 4%, you will have to pay 3 million won to the bank in interest every month.

In this way, to live in Seoul, one month's salary is needed as bank interest.

The era has arrived where ordinary citizens cannot even afford to maintain an apartment in Seoul.

In this situation, the government is pouring out policies for various real estate cartels.

The reason why the already dead local ecosystem is completely destroyed and only real estate prices in Seoul are skyrocketing is because of the relaxation of the comprehensive real estate tax, the abolition of the re-exchange, the abolition of the upper limit on the sale price, the reform of the inheritance tax, the shifting of real estate PF to household loans, green belt development, and private REIT business.

A stock market without shareholders, real estate without a market

Policies for the common people without the common people: Anarchy in the Republic of Korea

Small shareholders, the homeless, and the common people.

There is no country for them.

The fundamental causes of the Korea discount, including directors who only care about the company, skewed laws and systems, physical divisions, management premiums, and phantom treasury stocks, have remained unresolved for decades.

The government is resolving the unprecedented real estate PF through policy loans and private debt.

The government's announced policy for the common people includes a tax reform plan for those who inherit more than 3 billion won.

Can we just leave this deformed capitalism that is eating away at our future as it is?

At the very least, we need to know why we are suffering so that we can stop the tyranny of capital and gather the strength to solve the problem.

Only by understanding the true face of Korean capitalism can we create a fairer and better world.

How should distorted Korean capitalism change? Let's prepare for the coming crisis with "Capitalism Unspoken," the first book of "Hong Sa-hoon Show," a series featuring leading intellectuals!

GOODS SPECIFICS

- Date of issue: January 2, 2025

- Page count, weight, size: 260 pages | 474g | 152*225*18mm

- ISBN13: 9791192488523

- ISBN10: 1192488520

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)