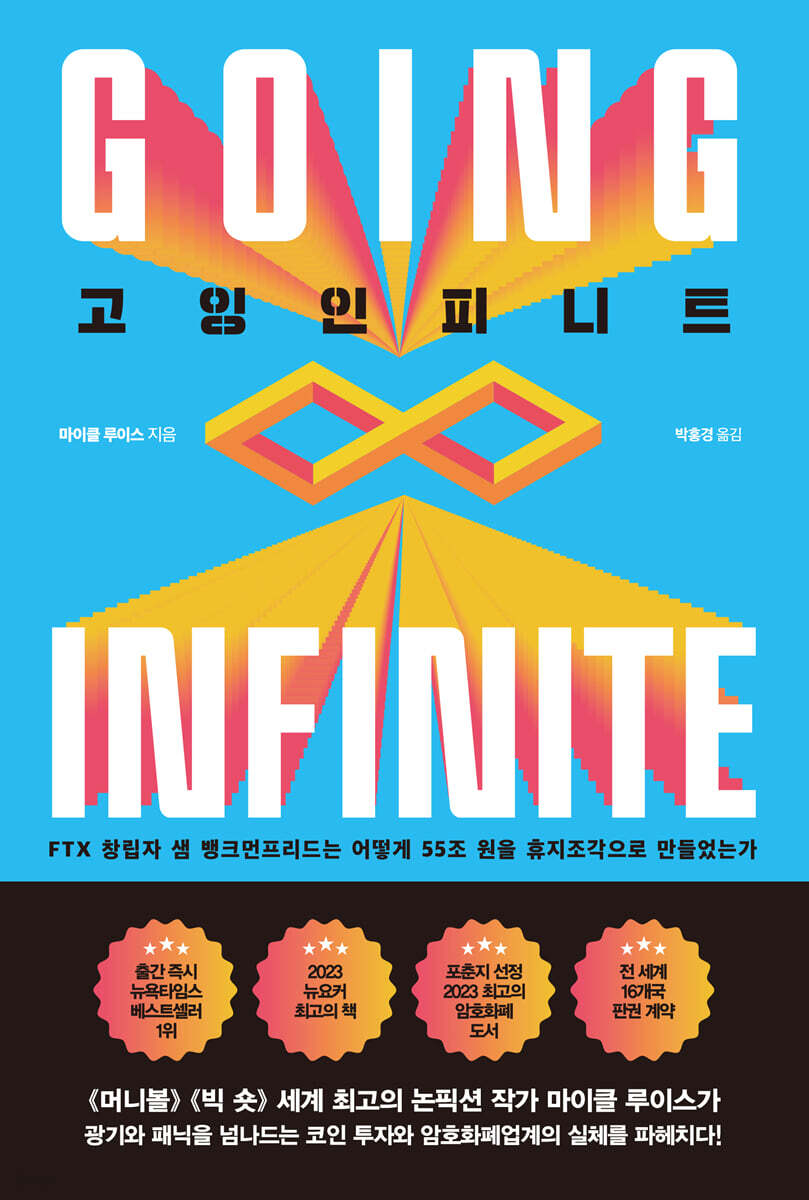

Going Infinite

|

Description

Book Introduction

Michael Lewis, the world's best non-fiction writer of 『Moneyball』 and 『The Big Short』 Uncovering the reality of the cryptocurrency industry, teetering between madness and panic! *** #1 New York Times Bestseller upon publication*** *** New Yorker Best Books of 2023 *** *** Fortune's Best Cryptocurrency Books of 2023 *** *** Worldwide distribution rights contract in 16 countries *** Michael Lewis, the world's greatest non-fiction writer, has published a book, "Going Infinite," which delves into the biggest financial fraud case in history, more dramatic than a movie, and the problematic figure at the center of it, Sam Bankman-Fried. The sudden bankruptcy of FTX, the world's second-largest cryptocurrency exchange with a corporate value exceeding 55 trillion won (as of 2021), shocked people around the world and significantly impacted the cryptocurrency industry, sparking a "crypto winter." Before that, FTX founder Sam Bankman-Fried was hailed as the world's youngest billionaire and a cryptocurrency genius. He was also a global celebrity, with CEOs of major corporations, world leaders, and celebrities eager to become close to him. What on earth happened from his meteoric rise to his precipitous fall? It was by chance that Michael Lewis, known as a financial journalist and master of economic non-fiction, including “Moneyball” and “The Big Short,” interviewed Sam Bankman-Fried. Michael Lewis, who had previously been bombarded with requests from readers to read his work on cryptocurrency, said he hadn't been particularly interested, and hadn't even paid attention to FTX founder Sam Bankman-Fried. Then, by chance, you meet a distracted billionaire wearing cargo shorts and baggy white socks. When Michael Lewis first met Sam Bankman-Fried, he was considered the king of cryptocurrencies and one of the fastest-growing wealthiest people in human history. It wasn't just because he was incredibly wealthy that Michael Lewis became interested in Sam. When Sam boldly announces his plan to solve threats to humanity such as nuclear war, epidemics, and artificial intelligence attacks, the author is deeply intrigued and tells him, "I'll see how far you'll go." And for over a year, Michael has been following Sam up close and personal with him. Sam vividly documents in his book how he amassed a fortune of $22.5 billion amidst the frenzied rise of FTX, and the madness and panic that saw it all go down to zero in just 10 days. In the United States, the book was published the day before Sam Bankman-Fried's trial, attracting enormous public attention. And after the trial, Michael Lewis wrote an additional epilogue about Sam, as he thought of him. The Korean edition, published in July 2024, is the first in the world to include the sequel. |

- You can preview some of the book's contents.

Preview

index

introduction

Part 1

Chapter 1 Yep

Chapter 2 Santa Claus

Chapter 3: Metagame

Chapter 4: Human Development

Part 2

Chapter 5: Thought Experiments on 'Rice'

Chapter 6: False Love

Chapter 7 Organizational Chart

Part 3

Chapter 8: The Dragon's Treasure House

Chapter 9 Evaporation

Chapter 10 Manfred

Chapter 11: Serum of Truth

closing

Epilogue

Acknowledgements

Part 1

Chapter 1 Yep

Chapter 2 Santa Claus

Chapter 3: Metagame

Chapter 4: Human Development

Part 2

Chapter 5: Thought Experiments on 'Rice'

Chapter 6: False Love

Chapter 7 Organizational Chart

Part 3

Chapter 8: The Dragon's Treasure House

Chapter 9 Evaporation

Chapter 10 Manfred

Chapter 11: Serum of Truth

closing

Epilogue

Acknowledgements

Detailed image

Into the book

In November 2021, Forbes estimated Sam's net worth at $22.5 billion, placing him one place below Rupert Murdoch and one place above Laurene Powell Jobs.

The $22.5 billion valuation followed the $40 billion valuation of FTX, a cryptocurrency exchange, by a global venture capital firm.

Sam owned 60 percent of FTX, which is 60 percent of $40 billion, which is $24 billion.

In Forbes' 40-year history of tracking the wealth of the wealthy, Sam was something of an outlier.

“Sam has become one of the wealthiest people on the Forbes list, which is unprecedented,” Peterson-Wedon said. “While there were grounds to estimate his net worth much higher, we wanted to be as conservative as possible.”

Sam's estimated net worth was so reliable that Forbes executives wondered if he might be interested in acquiring the media company.

--- From "Chapter 1 Yep"

There is a tug-of-war between the financial markets and the people who work in them.

After people create the market, the market creates the people.

The market that will affect Sam Bankman-Fried has been reshaping itself over the past few decades towards lessening the impact of sound.

The 2008 financial crisis was not entirely to blame, but it certainly played a part.

Investment banks like Goldman Sachs and Morgan Stanley, once the most exciting trading risk-takers, have become crude in their investment style and subject to strict regulation.

They were forced to play the same monotonous role that the big Wall Street commercial banks used to play.

Accordingly, the center of trading activities shifted to the private trading industry, which was shrouded in mystery.

--- From "Chapter 4: The Development of Humanity"

From the beginning, the transaction was conducted in a state of chaos.

Most of the money I made in my first two months came from just two trades.

The frenzied rise in demand for Bitcoin has led to a bizarre distortion in the global cryptocurrency market.

In December 2017, South Korean retail speculators pushed the price of Bitcoin to 20 percent higher than on US exchanges, and the gap sometimes widened further.

If someone could simultaneously sell cryptocurrency in Korea and buy it outside of Korea, it would be an opportunity to reap huge profits.

But it wasn't as simple as it sounds.

--- From "Chapter 5: Thought Experiments on 'Rice'"

Much of what happened in Sam's world happened without the usual checks and balances in place.

Others in the outside world found it particularly difficult to voice their discontent.

The transaction funds appeared to be solely related to Sam's pocket.

So why shouldn't Sam invest as he pleases? Yet, throughout human history, it's rare for someone in their 20s to invest such a large sum of money without being significantly constrained by mature managers or the prevailing corporate regulations.

Sam said, "It's unclear whether we should have a real board of directors," but added, "We created a three-member board because without one, we'd be looked at with suspicion."

Sam said this shortly after the aforementioned Twitter meeting, but couldn't remember the other two people's names.

“The composition may have changed.

A major requirement of the job is that you don't mind signing DocuSign documents at 3 a.m.

“DocuSign signing is my main job.”

--- From "Chapter 8: The Dragon's Treasure House"

Even weeks after FTX's collapse, the Orchid Penthouse still had the aura of a crime scene, with display cases smashed and items stolen.

Each bedroom was left in the same condition as when the owner left.

The room preserved not only personal belongings but also the state of mind at the time.

Caroline's room was a mess, a mess from the excitement of going on vacation with her new boyfriend.

Clothes that I decided not to pack were strewn across the bed.

Nishad's room was spotlessly clean.

Since I had been working hard to convince them to leave the Bahamas, I had time to get things organized, like a hotel room waiting to be checked in.

Gary's room, which Sam came to use, had a special and complex story.

Three bags full of luggage were left in the corner.

Gary decided to pack his bags and left.

But not all the luggage was packed.

Clothes to be washed were still strewn around the room.

On the desk, there was a half-eaten packet of fried noodles.

The toothbrush was still on the sink.

It seemed like he was getting ready to leave, but then changed his mind and stayed a few more days before leaving.

It seemed like he had decided not to go, but then changed his mind and packed his bags as quickly as possible.

The $22.5 billion valuation followed the $40 billion valuation of FTX, a cryptocurrency exchange, by a global venture capital firm.

Sam owned 60 percent of FTX, which is 60 percent of $40 billion, which is $24 billion.

In Forbes' 40-year history of tracking the wealth of the wealthy, Sam was something of an outlier.

“Sam has become one of the wealthiest people on the Forbes list, which is unprecedented,” Peterson-Wedon said. “While there were grounds to estimate his net worth much higher, we wanted to be as conservative as possible.”

Sam's estimated net worth was so reliable that Forbes executives wondered if he might be interested in acquiring the media company.

--- From "Chapter 1 Yep"

There is a tug-of-war between the financial markets and the people who work in them.

After people create the market, the market creates the people.

The market that will affect Sam Bankman-Fried has been reshaping itself over the past few decades towards lessening the impact of sound.

The 2008 financial crisis was not entirely to blame, but it certainly played a part.

Investment banks like Goldman Sachs and Morgan Stanley, once the most exciting trading risk-takers, have become crude in their investment style and subject to strict regulation.

They were forced to play the same monotonous role that the big Wall Street commercial banks used to play.

Accordingly, the center of trading activities shifted to the private trading industry, which was shrouded in mystery.

--- From "Chapter 4: The Development of Humanity"

From the beginning, the transaction was conducted in a state of chaos.

Most of the money I made in my first two months came from just two trades.

The frenzied rise in demand for Bitcoin has led to a bizarre distortion in the global cryptocurrency market.

In December 2017, South Korean retail speculators pushed the price of Bitcoin to 20 percent higher than on US exchanges, and the gap sometimes widened further.

If someone could simultaneously sell cryptocurrency in Korea and buy it outside of Korea, it would be an opportunity to reap huge profits.

But it wasn't as simple as it sounds.

--- From "Chapter 5: Thought Experiments on 'Rice'"

Much of what happened in Sam's world happened without the usual checks and balances in place.

Others in the outside world found it particularly difficult to voice their discontent.

The transaction funds appeared to be solely related to Sam's pocket.

So why shouldn't Sam invest as he pleases? Yet, throughout human history, it's rare for someone in their 20s to invest such a large sum of money without being significantly constrained by mature managers or the prevailing corporate regulations.

Sam said, "It's unclear whether we should have a real board of directors," but added, "We created a three-member board because without one, we'd be looked at with suspicion."

Sam said this shortly after the aforementioned Twitter meeting, but couldn't remember the other two people's names.

“The composition may have changed.

A major requirement of the job is that you don't mind signing DocuSign documents at 3 a.m.

“DocuSign signing is my main job.”

--- From "Chapter 8: The Dragon's Treasure House"

Even weeks after FTX's collapse, the Orchid Penthouse still had the aura of a crime scene, with display cases smashed and items stolen.

Each bedroom was left in the same condition as when the owner left.

The room preserved not only personal belongings but also the state of mind at the time.

Caroline's room was a mess, a mess from the excitement of going on vacation with her new boyfriend.

Clothes that I decided not to pack were strewn across the bed.

Nishad's room was spotlessly clean.

Since I had been working hard to convince them to leave the Bahamas, I had time to get things organized, like a hotel room waiting to be checked in.

Gary's room, which Sam came to use, had a special and complex story.

Three bags full of luggage were left in the corner.

Gary decided to pack his bags and left.

But not all the luggage was packed.

Clothes to be washed were still strewn around the room.

On the desk, there was a half-eaten packet of fried noodles.

The toothbrush was still on the sink.

It seemed like he was getting ready to leave, but then changed his mind and stayed a few more days before leaving.

It seemed like he had decided not to go, but then changed his mind and packed his bags as quickly as possible.

--- From "Chapter 9 Manfred"

Publisher's Review

A true story more dramatic than a movie,

A $5 million film rights contract was already signed before writing!

According to Forbes, Sam Bankman-Fried is not only the richest person in the world under the age of 30, but he is also expected to go down in history as the person who accumulated wealth at the fastest rate.

The speed at which he amassed his wealth was comparable to that of Mark Zuckerberg, founder of Facebook (now Meta).

Additionally, the leaders of the US Republican and Democratic parties sought Sam's support and attention.

The heads of the big Wall Street banks were curious about Sam, and the major venture capital firms in Silicon Valley wanted to invest in him.

American sports star Tom Brady spent time with Sam, and world-renowned singer-songwriter Taylor Swift negotiated a deal to promote Sam's cryptocurrency exchange.

Basketball player Shaquille O'Neal dreamed of working with Sam to solve the homeless problem in the Bahamas, and actor Orlando Bloom offered Sam a role in a movie.

Michael Lewis, a top nonfiction writer, decided to write a biography about Sam simply out of curiosity about the character and where he would end up.

And a year later, Sam is arrested for the largest financial fraud in history.

What on earth happened?

The largest financial fraud in history,

Invite readers to the jury box for that case!

This book is a fascinating account of Sam Bankman-Fried's extraordinary childhood, adolescence, and the roller coaster ride of his life, from his departure from his first company to his rise to become one of the world's richest men, to his arrest.

The author says he never expected the book to influence the verdict of Sam, who was arrested on charges of embezzling $10 billion in client deposits.

As I was the one who covered Sam from the closest distance, I was worried that other media outlets might excerpt and distort the contents of this book.

But anyway, he said he felt that through this book, readers would be able to reach a more precise verdict rather than simply deciding Sam was 'guilty' or 'not guilty.'

This book contains detailed information about Sam that ordinary jurors would never have access to.

Still, not all readers of this book will reach the same verdict.

According to the author, the charm of the story lies in the fact that each reader reaches a different conclusion.

This case was too complex to be a binary decision.

What did Sam Bankman-Fried know, when, and how? What did he intentionally do with client deposits, and why? Everyone will draw different lessons from this complex case, which will leave everyone confused even if they read the same book.

What will the readers of this book decide?

A $5 million film rights contract was already signed before writing!

According to Forbes, Sam Bankman-Fried is not only the richest person in the world under the age of 30, but he is also expected to go down in history as the person who accumulated wealth at the fastest rate.

The speed at which he amassed his wealth was comparable to that of Mark Zuckerberg, founder of Facebook (now Meta).

Additionally, the leaders of the US Republican and Democratic parties sought Sam's support and attention.

The heads of the big Wall Street banks were curious about Sam, and the major venture capital firms in Silicon Valley wanted to invest in him.

American sports star Tom Brady spent time with Sam, and world-renowned singer-songwriter Taylor Swift negotiated a deal to promote Sam's cryptocurrency exchange.

Basketball player Shaquille O'Neal dreamed of working with Sam to solve the homeless problem in the Bahamas, and actor Orlando Bloom offered Sam a role in a movie.

Michael Lewis, a top nonfiction writer, decided to write a biography about Sam simply out of curiosity about the character and where he would end up.

And a year later, Sam is arrested for the largest financial fraud in history.

What on earth happened?

The largest financial fraud in history,

Invite readers to the jury box for that case!

This book is a fascinating account of Sam Bankman-Fried's extraordinary childhood, adolescence, and the roller coaster ride of his life, from his departure from his first company to his rise to become one of the world's richest men, to his arrest.

The author says he never expected the book to influence the verdict of Sam, who was arrested on charges of embezzling $10 billion in client deposits.

As I was the one who covered Sam from the closest distance, I was worried that other media outlets might excerpt and distort the contents of this book.

But anyway, he said he felt that through this book, readers would be able to reach a more precise verdict rather than simply deciding Sam was 'guilty' or 'not guilty.'

This book contains detailed information about Sam that ordinary jurors would never have access to.

Still, not all readers of this book will reach the same verdict.

According to the author, the charm of the story lies in the fact that each reader reaches a different conclusion.

This case was too complex to be a binary decision.

What did Sam Bankman-Fried know, when, and how? What did he intentionally do with client deposits, and why? Everyone will draw different lessons from this complex case, which will leave everyone confused even if they read the same book.

What will the readers of this book decide?

GOODS SPECIFICS

- Date of issue: July 25, 2024

- Page count, weight, size: 400 pages | 818g | 160*232*28mm

- ISBN13: 9788927813224

- ISBN10: 8927813227

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)