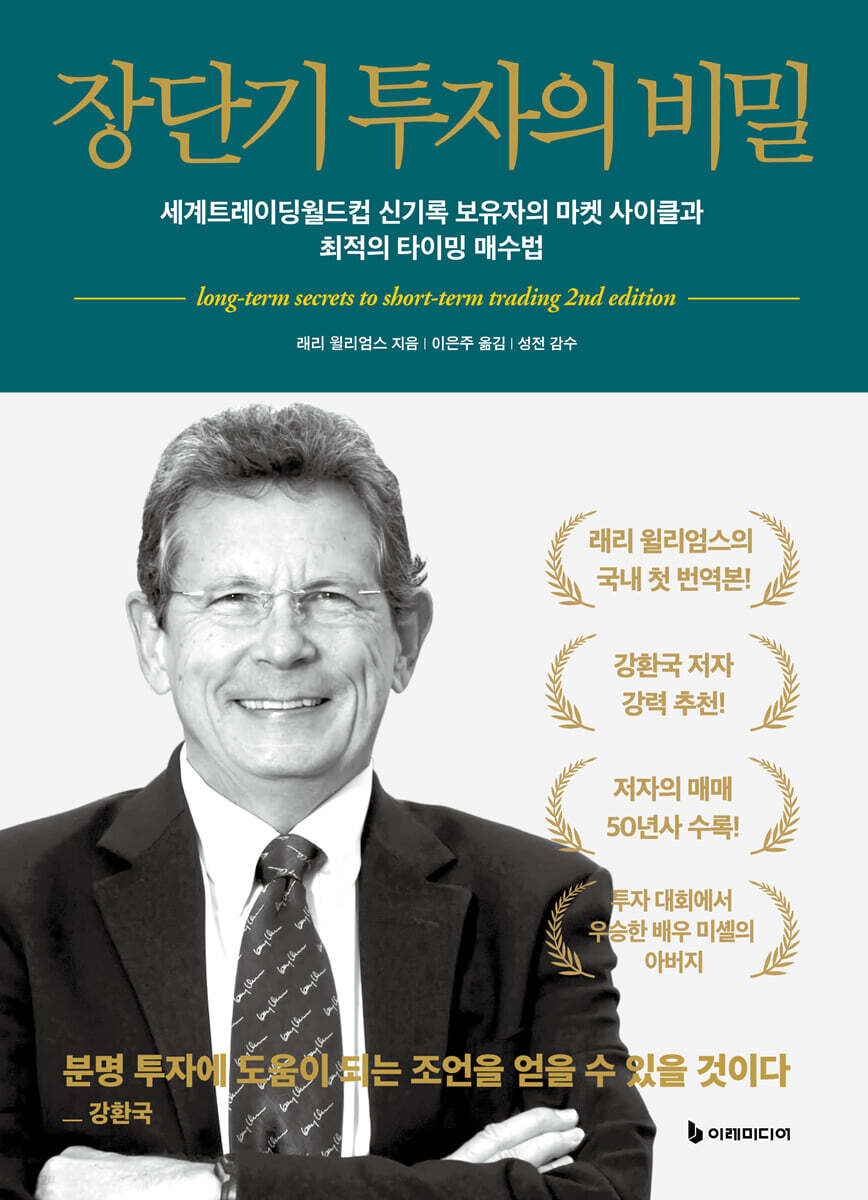

The Secret of Short-Term and Long-Term Investing

|

Description

Book Introduction

For successful investing, you need to know when to buy and sell, how much to bet,

How you manage risk is much more important.

And these techniques

You can only learn from great traders like Larry Williams.

- Kang Hwan-guk

The new world trading world cup record holder

Market Cycles and the Optimal Timing for Buying

"Secrets of Short-Term and Long-Term Investment" is the first Korean translation of Larry Williams, who is considered the greatest trader in investment history.

Larry Williams won the 1987 World Futures Trading World Cup by turning $10,000 into $1.1 million, a record that still stands.

His daughter, actress Michelle Williams, also won the World Futures Trading World Cup when she was just 17.

Her teacher was none other than her father, Larry Williams.

In addition, he created several indicators favored by technical investors, such as 'Williams %R'.

"Secrets of Short-Term and Long-Term Investment" can be said to be a book containing Larry Williams' 50-year trading secrets.

It covers in detail not only trading techniques such as volatility breakouts and profit patterns, but also how the market moves, major market cycles, indicators and analysis methods developed by the author, when to buy and when to liquidate trades, and how to minimize losses.

In addition, you can get a glimpse into his trading mindset as well as his past trading experience through articles written based on past issues of his market information magazine [Commodity Timing], and there are also a considerable number of articles offering advice to investors, such as how to break bad habits and trading strategies.

Author Kang Hwan-guk, who wrote the book's recommendation, said, "For successful investment, knowing when to buy and sell, how much to bet, and how to manage risk are much more important.

And these techniques can only be learned from great traders like Larry Williams,” he said.

If you follow the author's advice in this book, you will be well on your way to becoming a successful trader.

How you manage risk is much more important.

And these techniques

You can only learn from great traders like Larry Williams.

- Kang Hwan-guk

The new world trading world cup record holder

Market Cycles and the Optimal Timing for Buying

"Secrets of Short-Term and Long-Term Investment" is the first Korean translation of Larry Williams, who is considered the greatest trader in investment history.

Larry Williams won the 1987 World Futures Trading World Cup by turning $10,000 into $1.1 million, a record that still stands.

His daughter, actress Michelle Williams, also won the World Futures Trading World Cup when she was just 17.

Her teacher was none other than her father, Larry Williams.

In addition, he created several indicators favored by technical investors, such as 'Williams %R'.

"Secrets of Short-Term and Long-Term Investment" can be said to be a book containing Larry Williams' 50-year trading secrets.

It covers in detail not only trading techniques such as volatility breakouts and profit patterns, but also how the market moves, major market cycles, indicators and analysis methods developed by the author, when to buy and when to liquidate trades, and how to minimize losses.

In addition, you can get a glimpse into his trading mindset as well as his past trading experience through articles written based on past issues of his market information magazine [Commodity Timing], and there are also a considerable number of articles offering advice to investors, such as how to break bad habits and trading strategies.

Author Kang Hwan-guk, who wrote the book's recommendation, said, "For successful investment, knowing when to buy and sell, how much to bet, and how to manage risk are much more important.

And these techniques can only be learned from great traders like Larry Williams,” he said.

If you follow the author's advice in this book, you will be well on your way to becoming a successful trader.

- You can preview some of the book's contents.

Preview

index

Recommendation

Introduction - You are already a trader

[Chapter 1] Finding Order in the Short-Term Chaos

How I Learned the Market

Charting the market

Non-random market properties

Understanding the market pricing structure

The market price structure never changes.

Short selling pattern

Target point and trailing stop loss

Larry's request

[Chapter 2] The Function of Price and Time

Everything You Need to Know About Your Cycle

Price range change cycle

Exploiting Trends - A Second Useful Price Pattern

Larry's request

[Chapter 3] Short-Term Trading Secrets

The importance of the time element

The so-called successful trader

Proof of key facts

How to make high profits

Larry's request

[Chapter 4] Volatility Breakout: Momentum Breakout

Simple Daily Volatility Breakout

A Look at Price Volatility in the S&P 500

Distinguishing buyers and sellers using price fluctuations

result

Going one step further

Larry's request

[Chapter 5] Short-Term Trading Theory

Misconceptions about the information age

Harriman's Trading Rules

Larry's request

[Chapter 6] Getting Closer to the Truth

Random Kutner vs.

Cohen's Bias: Cohen is the Winner!

Gold TDM study

Bond TDM Study

Monthly Roadmap

Larry's request

[Chapter 7] Reading Patterns for Profitable Trading

Common elements of patterns

Questions to Ask About Market Patterns

Smash Day Pattern

How to Use the Smash Day Pattern

Specialist trap

Works on shorter time frames too

Oops! Pattern trading

S&P Oops! Trading

Larry's request

[Chapter 8] Buyer and Seller

Maximum price change

Stock index trading and GSV

Some indicators

Larry's request

[Chapter 9] Short-term trading in front of the stock market board

How to make profits by trading on the stock market day

Inflection points as indicators of trend change

3-bar high and low system

New Short-Term Trading Indicator: Willspread

Wilspread and the S&P 500 stock index

Larry's request

[Chapter 10] Special Short-Term Trading Situations

Stock index month-end trading strategy

Best or worst month for trading

Achieve better performance

Bond Market End-of-Month Trading Strategy

Specific trading cases

If there is a much better way

Selling point during the month

Larry's request

[Chapter 11] Position Liquidation Points

[Chapter 12] Considerations on Speculation

Liquidation is much more important than entry.

Three Elements of Successful Investing

Essentials regarding speculation

Larry's request

[Chapter 13] Money Management - The Key to the Kingdom

Most traders use a hit-or-miss approach.

Choose a money management method that suits you.

Good, bad, and worst examples of money management

A New Perspective on Balance Decrease and Assets

Rethinking the Ralph Way: A Breakthrough in Money Management in 2011

The mirage of the Kelly ratio

Larry's request

[Chapter 14] From Kennedy to Obama: 50 Years of Trading

What do trading and honey harvesting have in common?

Follow the fruits hanging from the lower branches

Look carefully, think more, and then act.

wooden stick subtraction game

It could get much worse

Frozen in fear

Now let's master our fears

Running, trading, and losses

It's so easy to make mistakes

Trading is not a battle, it's a war.

Memories of Fly Fishing

Face these powerful emotions: fear and greed.

Why the loss ratio is higher

A Look at Loss Trading

The biggest reason for losing trades

The most important belief related to trading

money-eating dog

Similarities Between Sports and Trading

Trend formation in stock and commodity markets

The difference between the public and the experts

Predicting the market is impossible.

The thrill of trading

The dismal reality of predictions

I just can't understand it

Face the emotions of greed and fear

The show must go on.

A boxer and a trader who were all bruised and battered

Learn how to manage losses

Coward - Out of Hell and into Heaven

The Secret of System Development and Trading

The Difference Between Profitable and Losing Traders

Larry's request

[Chapter 15] Factors That Create a Bull Market

Foundations of Logic

Trading and Logic

Materials A and B

Breaking bad habits

How to break bad habits

Stop loss and unpredictability based on amount

(Overall) Overview of My Trading Style

How my trading strategy works

Larry's request

[Chapter 16] Trading is a really difficult game to win.

Trading is like life

Are you really the right person for this job?

Homework to be solved

The Importance of a Proper Blueprint and a Master

Conclusion

Acknowledgements

Introduction - You are already a trader

[Chapter 1] Finding Order in the Short-Term Chaos

How I Learned the Market

Charting the market

Non-random market properties

Understanding the market pricing structure

The market price structure never changes.

Short selling pattern

Target point and trailing stop loss

Larry's request

[Chapter 2] The Function of Price and Time

Everything You Need to Know About Your Cycle

Price range change cycle

Exploiting Trends - A Second Useful Price Pattern

Larry's request

[Chapter 3] Short-Term Trading Secrets

The importance of the time element

The so-called successful trader

Proof of key facts

How to make high profits

Larry's request

[Chapter 4] Volatility Breakout: Momentum Breakout

Simple Daily Volatility Breakout

A Look at Price Volatility in the S&P 500

Distinguishing buyers and sellers using price fluctuations

result

Going one step further

Larry's request

[Chapter 5] Short-Term Trading Theory

Misconceptions about the information age

Harriman's Trading Rules

Larry's request

[Chapter 6] Getting Closer to the Truth

Random Kutner vs.

Cohen's Bias: Cohen is the Winner!

Gold TDM study

Bond TDM Study

Monthly Roadmap

Larry's request

[Chapter 7] Reading Patterns for Profitable Trading

Common elements of patterns

Questions to Ask About Market Patterns

Smash Day Pattern

How to Use the Smash Day Pattern

Specialist trap

Works on shorter time frames too

Oops! Pattern trading

S&P Oops! Trading

Larry's request

[Chapter 8] Buyer and Seller

Maximum price change

Stock index trading and GSV

Some indicators

Larry's request

[Chapter 9] Short-term trading in front of the stock market board

How to make profits by trading on the stock market day

Inflection points as indicators of trend change

3-bar high and low system

New Short-Term Trading Indicator: Willspread

Wilspread and the S&P 500 stock index

Larry's request

[Chapter 10] Special Short-Term Trading Situations

Stock index month-end trading strategy

Best or worst month for trading

Achieve better performance

Bond Market End-of-Month Trading Strategy

Specific trading cases

If there is a much better way

Selling point during the month

Larry's request

[Chapter 11] Position Liquidation Points

[Chapter 12] Considerations on Speculation

Liquidation is much more important than entry.

Three Elements of Successful Investing

Essentials regarding speculation

Larry's request

[Chapter 13] Money Management - The Key to the Kingdom

Most traders use a hit-or-miss approach.

Choose a money management method that suits you.

Good, bad, and worst examples of money management

A New Perspective on Balance Decrease and Assets

Rethinking the Ralph Way: A Breakthrough in Money Management in 2011

The mirage of the Kelly ratio

Larry's request

[Chapter 14] From Kennedy to Obama: 50 Years of Trading

What do trading and honey harvesting have in common?

Follow the fruits hanging from the lower branches

Look carefully, think more, and then act.

wooden stick subtraction game

It could get much worse

Frozen in fear

Now let's master our fears

Running, trading, and losses

It's so easy to make mistakes

Trading is not a battle, it's a war.

Memories of Fly Fishing

Face these powerful emotions: fear and greed.

Why the loss ratio is higher

A Look at Loss Trading

The biggest reason for losing trades

The most important belief related to trading

money-eating dog

Similarities Between Sports and Trading

Trend formation in stock and commodity markets

The difference between the public and the experts

Predicting the market is impossible.

The thrill of trading

The dismal reality of predictions

I just can't understand it

Face the emotions of greed and fear

The show must go on.

A boxer and a trader who were all bruised and battered

Learn how to manage losses

Coward - Out of Hell and into Heaven

The Secret of System Development and Trading

The Difference Between Profitable and Losing Traders

Larry's request

[Chapter 15] Factors That Create a Bull Market

Foundations of Logic

Trading and Logic

Materials A and B

Breaking bad habits

How to break bad habits

Stop loss and unpredictability based on amount

(Overall) Overview of My Trading Style

How my trading strategy works

Larry's request

[Chapter 16] Trading is a really difficult game to win.

Trading is like life

Are you really the right person for this job?

Homework to be solved

The Importance of a Proper Blueprint and a Master

Conclusion

Acknowledgements

Detailed image

Into the book

Based on my research and experience, I have developed a strong belief system that helps me.

I believe that this trade will result in a loss, and a very large loss at that (because I judged that the belief in a profit is more likely to lead to a negative outcome).

This belief is my most important prayer regarding the market.

Profitable trades can be managed in any way, but lossable trades cannot.

It goes without saying that it is not ‘profit’ but ‘loss’ that ruins a trader.

--- p.20

There is one fact that must be engraved here.

The point is that all profits come from trends.

No trend, no profit.

Trends are a function of time.

Therefore, the longer the time invested in trading, the greater the range of trend fluctuations that can be captured.

Given this relationship, short-term traders are at a clear disadvantage in terms of time.

Time is their 'enemy'.

They must exit the market at the end of the day, and there are limits to the range of trend fluctuations they can utilize.

For position traders, time is their friend, not their enemy, and they know that this is where they can profit.

--- p.104

Which came first, the chicken or the egg? Similarly, which came first, the buyer or the seller? This is the ultimate Zen question speculators must answer.

As long as there are buyers willing to buy the stock or futures contracts held by the seller, the price will not move much.

Isn't this how mutual price equilibrium is achieved? In an ideal world where everything is perfect, this kind of price equilibrium would be possible, but the real world is imperfect, and trading is largely determined by luck.

As you can see from the daily newspapers or the market information provided by your broker, prices in the real world fluctuate rapidly.

The reason for price fluctuations is not the quantity of stocks or futures contracts being bought and sold.

The amounts will eventually balance out.

The cause of price fluctuations must be sought in some form or other in the absence or gap created on the part of the seller or one of the sellers.

--- p.247

Like many professional athletes, there is another thing that martial artists do.

By watching the video footage of the previous game, you meticulously review and analyze not only your own movements but also your opponent's movements.

The same goes for trading.

It is very helpful to look back at the results of past trades and examine past market trends.

But there aren't many people who do this.

Perhaps it's because review work isn't something that traders naturally enjoy, something that gives them a thrill or an excitement.

However, it is clear that part of my success in trading stems from my diligent analysis of the market and careful review of past data.

I also believe that my failed trading experiences will serve as useful learning tools for you.

--- p.321

In this book, I have shared with you almost everything I know about the market, as well as my life experiences.

This book is a trading textbook for me, but it may not be for you.

Therefore, you need to find the part of the content I introduced that suits you and put it into practice.

Don't blindly follow what I say, but refine it yourself and come up with better concepts and new approaches.

You can consider what I have introduced here as basic trading knowledge.

I believe that this trade will result in a loss, and a very large loss at that (because I judged that the belief in a profit is more likely to lead to a negative outcome).

This belief is my most important prayer regarding the market.

Profitable trades can be managed in any way, but lossable trades cannot.

It goes without saying that it is not ‘profit’ but ‘loss’ that ruins a trader.

--- p.20

There is one fact that must be engraved here.

The point is that all profits come from trends.

No trend, no profit.

Trends are a function of time.

Therefore, the longer the time invested in trading, the greater the range of trend fluctuations that can be captured.

Given this relationship, short-term traders are at a clear disadvantage in terms of time.

Time is their 'enemy'.

They must exit the market at the end of the day, and there are limits to the range of trend fluctuations they can utilize.

For position traders, time is their friend, not their enemy, and they know that this is where they can profit.

--- p.104

Which came first, the chicken or the egg? Similarly, which came first, the buyer or the seller? This is the ultimate Zen question speculators must answer.

As long as there are buyers willing to buy the stock or futures contracts held by the seller, the price will not move much.

Isn't this how mutual price equilibrium is achieved? In an ideal world where everything is perfect, this kind of price equilibrium would be possible, but the real world is imperfect, and trading is largely determined by luck.

As you can see from the daily newspapers or the market information provided by your broker, prices in the real world fluctuate rapidly.

The reason for price fluctuations is not the quantity of stocks or futures contracts being bought and sold.

The amounts will eventually balance out.

The cause of price fluctuations must be sought in some form or other in the absence or gap created on the part of the seller or one of the sellers.

--- p.247

Like many professional athletes, there is another thing that martial artists do.

By watching the video footage of the previous game, you meticulously review and analyze not only your own movements but also your opponent's movements.

The same goes for trading.

It is very helpful to look back at the results of past trades and examine past market trends.

But there aren't many people who do this.

Perhaps it's because review work isn't something that traders naturally enjoy, something that gives them a thrill or an excitement.

However, it is clear that part of my success in trading stems from my diligent analysis of the market and careful review of past data.

I also believe that my failed trading experiences will serve as useful learning tools for you.

--- p.321

In this book, I have shared with you almost everything I know about the market, as well as my life experiences.

This book is a trading textbook for me, but it may not be for you.

Therefore, you need to find the part of the content I introduced that suits you and put it into practice.

Don't blindly follow what I say, but refine it yourself and come up with better concepts and new approaches.

You can consider what I have introduced here as basic trading knowledge.

--- p.482~483

Publisher's Review

A book containing Larry Williams' 50-year trading secrets!

The secret to her daughter, actress Michelle Williams, winning an investment competition!

I would like to talk about the achievements of Larry Williams, one of the greatest traders in investment history, through the words of author Kang Hwan-guk.

√ In 1987, Larry Williams won the World Futures Trading World Cup, turning $10,000 into $1.1 million(!).

His record has never been broken since.

√ In 1997, he coached his 17-year-old daughter, Michelle Williams, and helped her win the World Futures Trading World Cup.

Michelle later became a top-tier actress, winning a Golden Globe.

√ Successfully completed the 'Larry Williams One Million Dollar Challenge', earning $1 million by simultaneously conducting live lectures and real-time trading.

√ He created several indicators favored by technical investors, including 'Williams %R'.

Author Kang Hwan-guk said, "For successful investment, it is much more important to know when to buy and sell, how much to bet, and how to manage risk.

And these techniques can only be learned from great traders like Larry Williams,' he said.

Therefore, I would like to borrow the words of author Kang Hwan-guk once more.

“Are you ready to hear from Larry Williams now?”

The new world trading world cup record holder

Market Cycles and the Optimal Timing for Buying

Larry Williams started investing in stocks in 1962 and this book was published in 2011, so he has been investing in stocks for 50 years.

Except for 1978 and 1981—when he ran for the U.S. Senate—he devoted himself to stocks almost every day.

Meanwhile, the Internet emerged and trading systems changed as HTS became available, but Larry Williams says the stock market is still difficult and challenging, while the rules of trading haven't changed much from the past to the present.

This book, "Secrets of Short-Term and Long-Term Investment," contains Larry Williams' 50-year trading secrets that have consistently generated profits even after experiencing that transitional period.

The book covers both short-term and long-term trading.

The point of the book is in the market.

The logic is that if you go with the flow of the market, you will make a profit, and if you go against it, you will incur a loss.

Building on this logic, the author presents, in order, volatility breakouts, profit patterns, market movements, major market cycles, when to liquidate trades, and how to minimize losses.

In the process, it also destroys many common sense principles of the stock market.

√ “I believe that this trade will result in a loss, and a very large loss (because I judged that the belief in a profit is more likely to lead to a negative outcome).”

√ “If possible, choose the negative belief.

In short, believe that there is a greater chance of loss in this trade.

Then, you can protect yourself by cutting your losses at the appropriate time.”

√ “Too many trades and too many contracts can be a deadly poison that will crush a trader.”

√ “Beginner traders seem to want a foolproof formula or indicator that they can use now and in the future.

There is certainly valuable market-related information and trend indicators available.

But honestly, if it were me, I would throw away those formulas and indicators and instead embrace ‘wisdom.’

√ “Want to make a lot of money? Then learn to wait.”

In particular, the chapter we should focus on learning is Chapter 13.

The author himself said, “This is the most important part of the book, the most important part of my life, and the most valuable information I can share with you,” and Kang Hwan-guk, who wrote the recommendation for the book, recommended that those new to investing or trading start reading from Chapter 13.

The stock market is a challenging yet fascinating world.

This revised edition, written based on the original text, aims to help anyone drawn to the allure of investing better understand trading and achieve their dreams.

The author's proven indicators and analyses here will provide considerable interest to investors studying trading.

Chapters 14 and 16, which offer advice to readers by linking it to the content of his market information magazine, Commodity Timing, clearly demonstrate why he published this book.

“In this book, I have shared with you almost everything I know about the market, as well as my life experiences.

This book is a trading textbook for me, but it may not be for you.

Therefore, you need to find the part of the content I introduced that suits you and put it into practice.

“Don’t blindly follow what I say, but refine it yourself and create better concepts and new approaches.” If readers of this book follow the author’s advice, they will surely become successful traders.

The secret to her daughter, actress Michelle Williams, winning an investment competition!

I would like to talk about the achievements of Larry Williams, one of the greatest traders in investment history, through the words of author Kang Hwan-guk.

√ In 1987, Larry Williams won the World Futures Trading World Cup, turning $10,000 into $1.1 million(!).

His record has never been broken since.

√ In 1997, he coached his 17-year-old daughter, Michelle Williams, and helped her win the World Futures Trading World Cup.

Michelle later became a top-tier actress, winning a Golden Globe.

√ Successfully completed the 'Larry Williams One Million Dollar Challenge', earning $1 million by simultaneously conducting live lectures and real-time trading.

√ He created several indicators favored by technical investors, including 'Williams %R'.

Author Kang Hwan-guk said, "For successful investment, it is much more important to know when to buy and sell, how much to bet, and how to manage risk.

And these techniques can only be learned from great traders like Larry Williams,' he said.

Therefore, I would like to borrow the words of author Kang Hwan-guk once more.

“Are you ready to hear from Larry Williams now?”

The new world trading world cup record holder

Market Cycles and the Optimal Timing for Buying

Larry Williams started investing in stocks in 1962 and this book was published in 2011, so he has been investing in stocks for 50 years.

Except for 1978 and 1981—when he ran for the U.S. Senate—he devoted himself to stocks almost every day.

Meanwhile, the Internet emerged and trading systems changed as HTS became available, but Larry Williams says the stock market is still difficult and challenging, while the rules of trading haven't changed much from the past to the present.

This book, "Secrets of Short-Term and Long-Term Investment," contains Larry Williams' 50-year trading secrets that have consistently generated profits even after experiencing that transitional period.

The book covers both short-term and long-term trading.

The point of the book is in the market.

The logic is that if you go with the flow of the market, you will make a profit, and if you go against it, you will incur a loss.

Building on this logic, the author presents, in order, volatility breakouts, profit patterns, market movements, major market cycles, when to liquidate trades, and how to minimize losses.

In the process, it also destroys many common sense principles of the stock market.

√ “I believe that this trade will result in a loss, and a very large loss (because I judged that the belief in a profit is more likely to lead to a negative outcome).”

√ “If possible, choose the negative belief.

In short, believe that there is a greater chance of loss in this trade.

Then, you can protect yourself by cutting your losses at the appropriate time.”

√ “Too many trades and too many contracts can be a deadly poison that will crush a trader.”

√ “Beginner traders seem to want a foolproof formula or indicator that they can use now and in the future.

There is certainly valuable market-related information and trend indicators available.

But honestly, if it were me, I would throw away those formulas and indicators and instead embrace ‘wisdom.’

√ “Want to make a lot of money? Then learn to wait.”

In particular, the chapter we should focus on learning is Chapter 13.

The author himself said, “This is the most important part of the book, the most important part of my life, and the most valuable information I can share with you,” and Kang Hwan-guk, who wrote the recommendation for the book, recommended that those new to investing or trading start reading from Chapter 13.

The stock market is a challenging yet fascinating world.

This revised edition, written based on the original text, aims to help anyone drawn to the allure of investing better understand trading and achieve their dreams.

The author's proven indicators and analyses here will provide considerable interest to investors studying trading.

Chapters 14 and 16, which offer advice to readers by linking it to the content of his market information magazine, Commodity Timing, clearly demonstrate why he published this book.

“In this book, I have shared with you almost everything I know about the market, as well as my life experiences.

This book is a trading textbook for me, but it may not be for you.

Therefore, you need to find the part of the content I introduced that suits you and put it into practice.

“Don’t blindly follow what I say, but refine it yourself and create better concepts and new approaches.” If readers of this book follow the author’s advice, they will surely become successful traders.

GOODS SPECIFICS

- Date of issue: July 31, 2023

- Page count, weight, size: 476 pages | 804g | 170*235*24mm

- ISBN13: 9791191328936

- ISBN10: 1191328937

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)