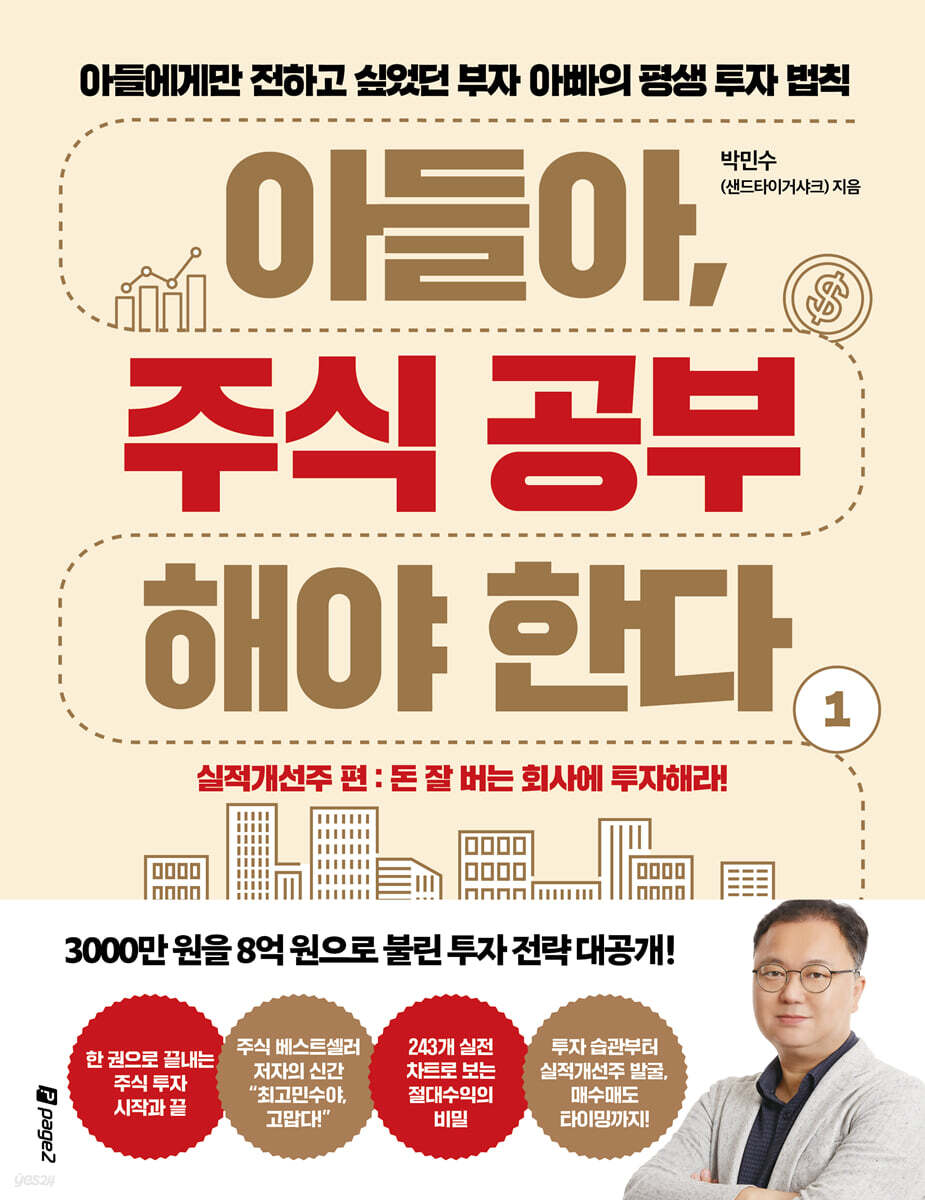

Son, you need to study stocks.

|

Description

Book Introduction

“Invest in companies that make a lot of money!” From smart investment habits to identifying and analyzing stocks with improved performance, to timing buys and sells! Don't worry, it'll all work out! A lifelong, unwavering, profit-making investment strategy revealed! Volume 1 of "Son, You Need to Study Stocks," which contains the author's 24 years of investment experience, focuses on stocks with improved performance. The reason why the stock prices in my account don't rise, why I end up cutting my losses, and why I feel uneasy constantly checking my account is because I didn't invest in stocks with improving performance. If you invest in a stock that is producing results, you can just wait for the profit to come in without worrying. The author introduces methods for identifying stocks with solid performance, tailored to the needs of even the most novice investor. He also reveals investment strategies and buy/sell timing tailored to each situation. And with over 100 real-world chart examples, it vividly demonstrates how strategies actually work in the market. Here, we explain various investment vehicles that can safely generate profits, such as dividend stocks, SPACs, REITs, and ETFs, and only provide practical information. Furthermore, the wise investment habits and philosophy that should be established before investing will serve as a proper guide for novice investors who are just starting out. “I have never lost money on an investment,” says the author, a 24-year veteran of the securities industry and an individual investor in Yeouido. He is an investment expert who consistently generates positive returns even in the current economic downturn. This book, packed with the author's investment expertise, is a whopping 500 pages long, but it will serve as a solid weapon for beginners just diving into investing to ensure they always win in the investment market. If you are an investor, I highly recommend keeping it on your bookshelf and referring to it often. You will gain a winning strategy to survive in the stock market. |

- You can preview some of the book's contents.

Preview

index

Volume 1: Performance Improvement Stocks

prolog

Chapter 1: Son, Before Investing, Prepare Your Mind

01 Why do people fail at stock investment?

02 Stock prices do not move simply.

03 Simplify your mind

04 Stock Investment is a Way of Life

Invest 5 million won as if it were 500 million won.

06 Don't invest in stocks with debt.

07 Invest with a long-term perspective

08 Choose an investment that gives you peace of mind.

09 Study and prepare like a high school senior

10 It's more important not to lose than to make big profits.

11 Let's look at the risks first

12 Forget opportunity costs

13 All information comes from diligence.

14 Don't let your heart race

15 You must know how to wait

16 Think and think again to create a story.

17 Turn the world upside down

Chapter 2: Son, Before Trading, Know the Basics

18. How to Create a Non-Face-to-Face Securities Account

19. Build basic knowledge about stock market trading.

20. Build your foundational technical analysis knowledge.

Chapter 3: Son, stock investing is about investing in performance.

21 My dad found that investing in performance is the best.

22. Don't buy loss-making companies if you don't want to lose.

One-Point Investment Lesson: How to Make Investment Decisions in 30 Seconds

23. Knowing future performance is essential to making money.

24 Ways to Find Stocks with Improving Performance

One-Point Investment Lesson: Securities Firm Report Analysis Table

One-Point Investment Lesson: Daily Investment Notes to Keep Your Mind in Focus

Check the performance of 25 growth stocks and invest.

26 Aim for the earnings announcement date

27. Sell at the peak of performance and the peak of the cyclical industry.

28 Reasons Why Equity Investment Companies Are Good Based on EV/EBITDA

29 Reasons Why Companies with High Free Cash Flow Are Good

30 Companies that Improve Performance Don't Give Up Until the End

31 My dad said he invested with the intention of not selling it for 10 years.

One-Point Investment Lesson: Stock Analysis Process for Improving Performance Based on Case Studies

32 Reasons Why Price Increases Are Good

Why You Should Look at PBR Rather Than PER

34 Companies with strong performance survive market downturns.

35 Reasons Why Companies with Consistently Raising Target Prices Are Good

36. Judge the game cycle with copper.

One-Point Investment Lesson: PMI, CPI, and PCE

37 Focus on policies promoted by the government.

38. Investing in performance keeps your psychology from being shaken.

39 I feel better when I stop short-term trading.

40 Reasons Why Preferred Stocks of Companies with Improving Performance Are Better

Chapter 4: Practical Investment Lessons from Case Studies

41 Practical Investment Lessons - ① What Matters Most: Stock Price Momentum

42 Practical Investment Lessons - ② Remember the Learning Effects of Thematic Stocks

43 Practical Investment Lessons - ③ Rising Raw Material Prices and Performance Improvement

Chapter 5: A 5-Step Stock Analysis Table that Analyzes Only the Core Stocks with Improving Performance

What is the 5-step stock analysis table for stocks with improved performance?

Step 45 Check your performance

46 Check the 2nd stage dividend

Step 3-① Key ratios to check

Step 3-② How to check the key ratio

Step 49 Check the special features of the announcement/news

Develop a 5-step investment strategy

One-Point Investment Lesson: Spend Just 10 Minutes a Day Finding Future Performance

Chapter 6: Son, how do you minimize risk with dividend stocks, ETFs, SPACs, and REITs?

51 Dividend Stocks - ① Stay Safe with Dividend Stocks

52 Dividend Stocks - ② Get High Dividend Yields

53 Dividend Stocks - ③ Hold at least 50% of your portfolio in dividend stocks.

54 Dividend Stocks - ④ Dividends increase as performance improves.

Increase safety with 55 ETFs

Definition of ETF Key Terms

One-Point Investment Lesson: Save Taxes with Pensions

One-Point Investment Lesson: Defining Futures, Options, and Witching Days

One-Point Investment Lesson: Issues to Watch Out for When Investing in ETFs

One-Point Investment Lesson: Beware of ELS, a High-Risk Product in a Bull Market

56 spec spec has less to lose

57 Ritz Ritz pays a lot of dividends

58 Son, let's invest with peace of mind.

One-Point Investment Lesson: Tax-Saving Tip 1.

Aim for income deductions by investing in over-the-counter stocks.

One-Point Investment Lesson: Tax-Saving Tip 2.

Give your overseas stock investment profits to your wife.

One-Point Investment Lesson: Tax-Saving Tip 3.

Gift stocks to your children once every ten years.

Chapter 7: Son, if you want to make money, be determined like this.

59 My father lived half his life

60 Live a long and healthy life

61 Be happy with your bucket list

62 You have to be diligent to keep your family and children from starving.

63 See the forest for the trees

64 Live as if you were 20 years away

65 Do something you are not told to do

66 Get into the habit of taking notes

67 Empty your head

68 Distinguish between your true feelings and the person you are talking to.

69 Get a hobby that pays off

70 Don't drink alcohol

71. Drops of water wear away the stone.

72 Try with a desperate heart

73 Son, never lose it

prolog

Chapter 1: Son, Before Investing, Prepare Your Mind

01 Why do people fail at stock investment?

02 Stock prices do not move simply.

03 Simplify your mind

04 Stock Investment is a Way of Life

Invest 5 million won as if it were 500 million won.

06 Don't invest in stocks with debt.

07 Invest with a long-term perspective

08 Choose an investment that gives you peace of mind.

09 Study and prepare like a high school senior

10 It's more important not to lose than to make big profits.

11 Let's look at the risks first

12 Forget opportunity costs

13 All information comes from diligence.

14 Don't let your heart race

15 You must know how to wait

16 Think and think again to create a story.

17 Turn the world upside down

Chapter 2: Son, Before Trading, Know the Basics

18. How to Create a Non-Face-to-Face Securities Account

19. Build basic knowledge about stock market trading.

20. Build your foundational technical analysis knowledge.

Chapter 3: Son, stock investing is about investing in performance.

21 My dad found that investing in performance is the best.

22. Don't buy loss-making companies if you don't want to lose.

One-Point Investment Lesson: How to Make Investment Decisions in 30 Seconds

23. Knowing future performance is essential to making money.

24 Ways to Find Stocks with Improving Performance

One-Point Investment Lesson: Securities Firm Report Analysis Table

One-Point Investment Lesson: Daily Investment Notes to Keep Your Mind in Focus

Check the performance of 25 growth stocks and invest.

26 Aim for the earnings announcement date

27. Sell at the peak of performance and the peak of the cyclical industry.

28 Reasons Why Equity Investment Companies Are Good Based on EV/EBITDA

29 Reasons Why Companies with High Free Cash Flow Are Good

30 Companies that Improve Performance Don't Give Up Until the End

31 My dad said he invested with the intention of not selling it for 10 years.

One-Point Investment Lesson: Stock Analysis Process for Improving Performance Based on Case Studies

32 Reasons Why Price Increases Are Good

Why You Should Look at PBR Rather Than PER

34 Companies with strong performance survive market downturns.

35 Reasons Why Companies with Consistently Raising Target Prices Are Good

36. Judge the game cycle with copper.

One-Point Investment Lesson: PMI, CPI, and PCE

37 Focus on policies promoted by the government.

38. Investing in performance keeps your psychology from being shaken.

39 I feel better when I stop short-term trading.

40 Reasons Why Preferred Stocks of Companies with Improving Performance Are Better

Chapter 4: Practical Investment Lessons from Case Studies

41 Practical Investment Lessons - ① What Matters Most: Stock Price Momentum

42 Practical Investment Lessons - ② Remember the Learning Effects of Thematic Stocks

43 Practical Investment Lessons - ③ Rising Raw Material Prices and Performance Improvement

Chapter 5: A 5-Step Stock Analysis Table that Analyzes Only the Core Stocks with Improving Performance

What is the 5-step stock analysis table for stocks with improved performance?

Step 45 Check your performance

46 Check the 2nd stage dividend

Step 3-① Key ratios to check

Step 3-② How to check the key ratio

Step 49 Check the special features of the announcement/news

Develop a 5-step investment strategy

One-Point Investment Lesson: Spend Just 10 Minutes a Day Finding Future Performance

Chapter 6: Son, how do you minimize risk with dividend stocks, ETFs, SPACs, and REITs?

51 Dividend Stocks - ① Stay Safe with Dividend Stocks

52 Dividend Stocks - ② Get High Dividend Yields

53 Dividend Stocks - ③ Hold at least 50% of your portfolio in dividend stocks.

54 Dividend Stocks - ④ Dividends increase as performance improves.

Increase safety with 55 ETFs

Definition of ETF Key Terms

One-Point Investment Lesson: Save Taxes with Pensions

One-Point Investment Lesson: Defining Futures, Options, and Witching Days

One-Point Investment Lesson: Issues to Watch Out for When Investing in ETFs

One-Point Investment Lesson: Beware of ELS, a High-Risk Product in a Bull Market

56 spec spec has less to lose

57 Ritz Ritz pays a lot of dividends

58 Son, let's invest with peace of mind.

One-Point Investment Lesson: Tax-Saving Tip 1.

Aim for income deductions by investing in over-the-counter stocks.

One-Point Investment Lesson: Tax-Saving Tip 2.

Give your overseas stock investment profits to your wife.

One-Point Investment Lesson: Tax-Saving Tip 3.

Gift stocks to your children once every ten years.

Chapter 7: Son, if you want to make money, be determined like this.

59 My father lived half his life

60 Live a long and healthy life

61 Be happy with your bucket list

62 You have to be diligent to keep your family and children from starving.

63 See the forest for the trees

64 Live as if you were 20 years away

65 Do something you are not told to do

66 Get into the habit of taking notes

67 Empty your head

68 Distinguish between your true feelings and the person you are talking to.

69 Get a hobby that pays off

70 Don't drink alcohol

71. Drops of water wear away the stone.

72 Try with a desperate heart

73 Son, never lose it

Detailed image

Into the book

You have to worry about it again and again to come up with a rational reason.

You have to use your brain to the fullest to find a reasonable investment appeal.

If there is a rational reason, Dad is not shaken by the sharp rise and fall of stock prices.

I need to be able to persuade myself and persuade others.

If there is no rational judgment, there is no basis for investment.

Investing roughly and moderately is no different from buying a lottery ticket.

Investing in stocks requires sufficient prior preparation and sound grounds.

If the preparation is lacking or the rationale is weak, there is a high chance of failure.

There is no difference between stock investment and my main job.

You have to work hard and do your best to succeed.

Let's do our best to prepare for stock investment.

The more effort you put in, the richer you can become.

--- p.18

Let's reduce the number of trades.

My father is an investor who trades at most 1-2 days a month.

To do this, we need to look at corporate value.

By choosing a company with good corporate value, you will no longer be an investor who makes a decision in a day or two.

It takes time to verify the performance results.

Institutions and foreigners do not make 'bulk investments' all at once.

Since it takes a considerable amount of time to buy stocks with improved performance, the daily volatility is also low.

If you look at it in the long run, it is an upward trend, so you just have to wait.

--- p.30

Investing in companies that make a lot of money is called performance improvement investing.

Since I'm making more money now than I did before, the company coffers are overflowing with money.

We only do things that help the stock price rise.

Use the excess money to make new investments or pay off debt.

It can also increase dividends for shareholders or buy back or burn treasury stock.

Because operating funds are insufficient, there is little reason to increase capital through paid-in capital increases.

There is little chance of negative news, so it is worth investing for the long term.

There is no reason to check the stock price board often.

As time passes, the PER (market capitalization divided by net income for the period) may gradually decrease due to improved performance.

The stock price is expected to rise due to the issue of undervaluation compared to performance.

If there is any loss, you can buy more at the bottom.

--- p.80

Searching for news during commuting hours is essential.

Let's also review real-time popular search terms and popular search items from time to time.

A variety of information is gathered and cross-checked, enabling precise stock selection.

Diligence is more important than any effort.

In the end, the hard-working become rich.

If you only look for what's convenient because it's annoying or you don't want to do it, you'll never have the opportunity to turn your life around.

Starting today, let's think, 'An Early Bird Catches the Money.'

--- p.120

If you sell and regret it, it calls for repurchase.

This is a stock that has already been sold for profit, but is being bought again at a high price.

Even the profit amount is added and repurchased.

The purchase price is high, so if you incur a loss, the loss rate increases.

Be careful when repurchasing sold stocks.

Just give up your foolishness and start making profits from new stocks.

Let's find and invest in stocks with better performance than existing stocks.

Stock investing is a rational business.

If you can't cut it off coolly, it won't work.

--- p.225

Interest causes a large volume of transactions, which in turn causes stock prices to rise.

The peak of interest generates more trading volume and the force retreats.

A loss of power is a sign of a loss of interest.

Since there is no interest, trading volume also decreases, and since trading volume is low, a rise in stock price is far away.

Only performance improvement is the event that can consistently maintain trading volume and stock price.

Other issues should be taken as profit-taking and left at the peak of interest.

--- p.270

The best time to give is when stock prices are low.

We aim to reduce taxes and make investment profits by buying at low prices.

We need to aim for a circuit breaker plunge.

After the circuit breaker plunge, the stock price returned to its original position.

A bear market is a perfect time to make a donation.

When the stock market plummets, there is an increase in cases where major shareholders make gifts to their children.

Because the stock price fell.

It's also a good idea to accompany them.

If it is an attractive investment opportunity, consider donating more than the tax-free amount.

Any additional 100 million won after the tax-free amount is subject to a 10% tax.

You can also consider making additional donations whenever the loss rate is -20% after the investment.

You have to use your brain to the fullest to find a reasonable investment appeal.

If there is a rational reason, Dad is not shaken by the sharp rise and fall of stock prices.

I need to be able to persuade myself and persuade others.

If there is no rational judgment, there is no basis for investment.

Investing roughly and moderately is no different from buying a lottery ticket.

Investing in stocks requires sufficient prior preparation and sound grounds.

If the preparation is lacking or the rationale is weak, there is a high chance of failure.

There is no difference between stock investment and my main job.

You have to work hard and do your best to succeed.

Let's do our best to prepare for stock investment.

The more effort you put in, the richer you can become.

--- p.18

Let's reduce the number of trades.

My father is an investor who trades at most 1-2 days a month.

To do this, we need to look at corporate value.

By choosing a company with good corporate value, you will no longer be an investor who makes a decision in a day or two.

It takes time to verify the performance results.

Institutions and foreigners do not make 'bulk investments' all at once.

Since it takes a considerable amount of time to buy stocks with improved performance, the daily volatility is also low.

If you look at it in the long run, it is an upward trend, so you just have to wait.

--- p.30

Investing in companies that make a lot of money is called performance improvement investing.

Since I'm making more money now than I did before, the company coffers are overflowing with money.

We only do things that help the stock price rise.

Use the excess money to make new investments or pay off debt.

It can also increase dividends for shareholders or buy back or burn treasury stock.

Because operating funds are insufficient, there is little reason to increase capital through paid-in capital increases.

There is little chance of negative news, so it is worth investing for the long term.

There is no reason to check the stock price board often.

As time passes, the PER (market capitalization divided by net income for the period) may gradually decrease due to improved performance.

The stock price is expected to rise due to the issue of undervaluation compared to performance.

If there is any loss, you can buy more at the bottom.

--- p.80

Searching for news during commuting hours is essential.

Let's also review real-time popular search terms and popular search items from time to time.

A variety of information is gathered and cross-checked, enabling precise stock selection.

Diligence is more important than any effort.

In the end, the hard-working become rich.

If you only look for what's convenient because it's annoying or you don't want to do it, you'll never have the opportunity to turn your life around.

Starting today, let's think, 'An Early Bird Catches the Money.'

--- p.120

If you sell and regret it, it calls for repurchase.

This is a stock that has already been sold for profit, but is being bought again at a high price.

Even the profit amount is added and repurchased.

The purchase price is high, so if you incur a loss, the loss rate increases.

Be careful when repurchasing sold stocks.

Just give up your foolishness and start making profits from new stocks.

Let's find and invest in stocks with better performance than existing stocks.

Stock investing is a rational business.

If you can't cut it off coolly, it won't work.

--- p.225

Interest causes a large volume of transactions, which in turn causes stock prices to rise.

The peak of interest generates more trading volume and the force retreats.

A loss of power is a sign of a loss of interest.

Since there is no interest, trading volume also decreases, and since trading volume is low, a rise in stock price is far away.

Only performance improvement is the event that can consistently maintain trading volume and stock price.

Other issues should be taken as profit-taking and left at the peak of interest.

--- p.270

The best time to give is when stock prices are low.

We aim to reduce taxes and make investment profits by buying at low prices.

We need to aim for a circuit breaker plunge.

After the circuit breaker plunge, the stock price returned to its original position.

A bear market is a perfect time to make a donation.

When the stock market plummets, there is an increase in cases where major shareholders make gifts to their children.

Because the stock price fell.

It's also a good idea to accompany them.

If it is an attractive investment opportunity, consider donating more than the tax-free amount.

Any additional 100 million won after the tax-free amount is subject to a 10% tax.

You can also consider making additional donations whenever the loss rate is -20% after the investment.

--- p.405

Publisher's Review

A recession is actually a good thing! Now is the time to start investing.

From the beginning to the end of your stock studies, Choi Go-min is in charge!

A comfortable investment is a real investment.

From discovering investment stocks that will rise on their own to buying and selling know-how.

The investment strategy of an investment expert who turned 30 million won into 800 million won is revealed!

Park Min-su, a bestselling author in the stock market and better known by his nicknames Sand Tiger Shark and Choi Go-min-su, has returned to us with the series, “Son, You Need to Study Stocks.”

Author Park Min-soo has recently gone beyond the stock market and created the meme "I like it, thank you" on his YouTube channel "Calm Man" with 2.1 million subscribers.

The fourth book, "Son, You Need to Study Stocks, Vol. 1 and 2," which took over a year to write and edit, is a book that stands out for its passion and sincerity, to the point that the author himself says that it contained his entire investment life.

It is a book that can be proudly said to contain the essence of the author's 20 years of investment experience as a Yeouido securities broker and individual investor.

This book, which is filled with the concerns and hopes of a father who wants his twin sons to profit from stock investment with peace of mind, contains everything about value investing that he wanted to share only with his family.

This expanded edition, which covers the previous bestseller, 『Stock Study in 5 Days Starting at Age 40』, in more depth, consists of two volumes with a total of 948 pages.

This will be an excellent textbook for those who want to study stock investment from A to Z in detail without any unnecessary information.

Volume 1 focuses on improving performance (invest in companies that are making money), and Volume 2 focuses on financial statements and disclosures (investing in detail in the company's internal workings). This book provides more specificity through 243 charts of real-world examples and investment strategies.

Author Park Min-su's books are famous for containing his own know-how and investment strategies.

It is clearly different from other books that simply list basic knowledge.

This time, you can also experience know-how and investment strategies that are uniquely yours.

Volume 1 focuses on investing in stocks with improved performance.

We've also added a significant portion of information on safe investment methods, including dividend stocks, SPACs, REITs, and ETFs.

All are attractive investment vehicles that can generate safe and steady profits.

It covers everything from basic stock investment knowledge to detailed investment mindset, real-life investment cases, and investment strategies.

Here, we also present specific practical methods, including a securities company report analysis table, daily investment notes, and a 5-step stock analysis table specifically for stocks with improving performance.

The key is to invest in companies that make a lot of money (performance improvement stocks) and companies that pay a lot of money (high dividend stocks).

Volume 2 covers key issues related to financial statements and disclosures.

Although it is a summary, it is a massive volume of over 500 pages because the content was meticulously put in.

Financial statements cover only the essentials for stock investment.

Understanding financial statements is essential for investing in stocks with improving performance.

Rather than simple accounting starting with debits and credits, it covers only the essential financial statement techniques needed for practical stock investment.

The disclosure is divided into 10 sectors, and includes sector-specific disclosure basics, investment strategies, examples of reading disclosures, and practical examples for each disclosure.

The 10 sectors of public disclosure are capital increase (capital reduction), stock-related bonds, public offerings, dividends, par value split (merger), merger, corporate division (physical division, human division), treasury stock, equity ratio, and market measures.

This book will likely be a ray of hope for investors who have suffered losses by investing without principles.

You can study specific methods for identifying attractive stocks with improving performance, identifying the right time to buy and sell, and developing in-depth investment principles and financial statement and public disclosure investment strategies.

'Son, never lose money investing in stocks' is the true message this book wants to convey.

This book is highly recommended as a textbook for readers seeking a systematic study of stock investment methodology, financial statements, and publicly disclosed investment strategies.

From the beginning to the end of your stock studies, Choi Go-min is in charge!

A comfortable investment is a real investment.

From discovering investment stocks that will rise on their own to buying and selling know-how.

The investment strategy of an investment expert who turned 30 million won into 800 million won is revealed!

Park Min-su, a bestselling author in the stock market and better known by his nicknames Sand Tiger Shark and Choi Go-min-su, has returned to us with the series, “Son, You Need to Study Stocks.”

Author Park Min-soo has recently gone beyond the stock market and created the meme "I like it, thank you" on his YouTube channel "Calm Man" with 2.1 million subscribers.

The fourth book, "Son, You Need to Study Stocks, Vol. 1 and 2," which took over a year to write and edit, is a book that stands out for its passion and sincerity, to the point that the author himself says that it contained his entire investment life.

It is a book that can be proudly said to contain the essence of the author's 20 years of investment experience as a Yeouido securities broker and individual investor.

This book, which is filled with the concerns and hopes of a father who wants his twin sons to profit from stock investment with peace of mind, contains everything about value investing that he wanted to share only with his family.

This expanded edition, which covers the previous bestseller, 『Stock Study in 5 Days Starting at Age 40』, in more depth, consists of two volumes with a total of 948 pages.

This will be an excellent textbook for those who want to study stock investment from A to Z in detail without any unnecessary information.

Volume 1 focuses on improving performance (invest in companies that are making money), and Volume 2 focuses on financial statements and disclosures (investing in detail in the company's internal workings). This book provides more specificity through 243 charts of real-world examples and investment strategies.

Author Park Min-su's books are famous for containing his own know-how and investment strategies.

It is clearly different from other books that simply list basic knowledge.

This time, you can also experience know-how and investment strategies that are uniquely yours.

Volume 1 focuses on investing in stocks with improved performance.

We've also added a significant portion of information on safe investment methods, including dividend stocks, SPACs, REITs, and ETFs.

All are attractive investment vehicles that can generate safe and steady profits.

It covers everything from basic stock investment knowledge to detailed investment mindset, real-life investment cases, and investment strategies.

Here, we also present specific practical methods, including a securities company report analysis table, daily investment notes, and a 5-step stock analysis table specifically for stocks with improving performance.

The key is to invest in companies that make a lot of money (performance improvement stocks) and companies that pay a lot of money (high dividend stocks).

Volume 2 covers key issues related to financial statements and disclosures.

Although it is a summary, it is a massive volume of over 500 pages because the content was meticulously put in.

Financial statements cover only the essentials for stock investment.

Understanding financial statements is essential for investing in stocks with improving performance.

Rather than simple accounting starting with debits and credits, it covers only the essential financial statement techniques needed for practical stock investment.

The disclosure is divided into 10 sectors, and includes sector-specific disclosure basics, investment strategies, examples of reading disclosures, and practical examples for each disclosure.

The 10 sectors of public disclosure are capital increase (capital reduction), stock-related bonds, public offerings, dividends, par value split (merger), merger, corporate division (physical division, human division), treasury stock, equity ratio, and market measures.

This book will likely be a ray of hope for investors who have suffered losses by investing without principles.

You can study specific methods for identifying attractive stocks with improving performance, identifying the right time to buy and sell, and developing in-depth investment principles and financial statement and public disclosure investment strategies.

'Son, never lose money investing in stocks' is the true message this book wants to convey.

This book is highly recommended as a textbook for readers seeking a systematic study of stock investment methodology, financial statements, and publicly disclosed investment strategies.

GOODS SPECIFICS

- Date of issue: May 10, 2023

- Page count, weight, size: 442 pages | 185*240*30mm

- ISBN13: 9791169850230

- ISBN10: 1169850235

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)