The best dividend pension investment

|

Description

Book Introduction

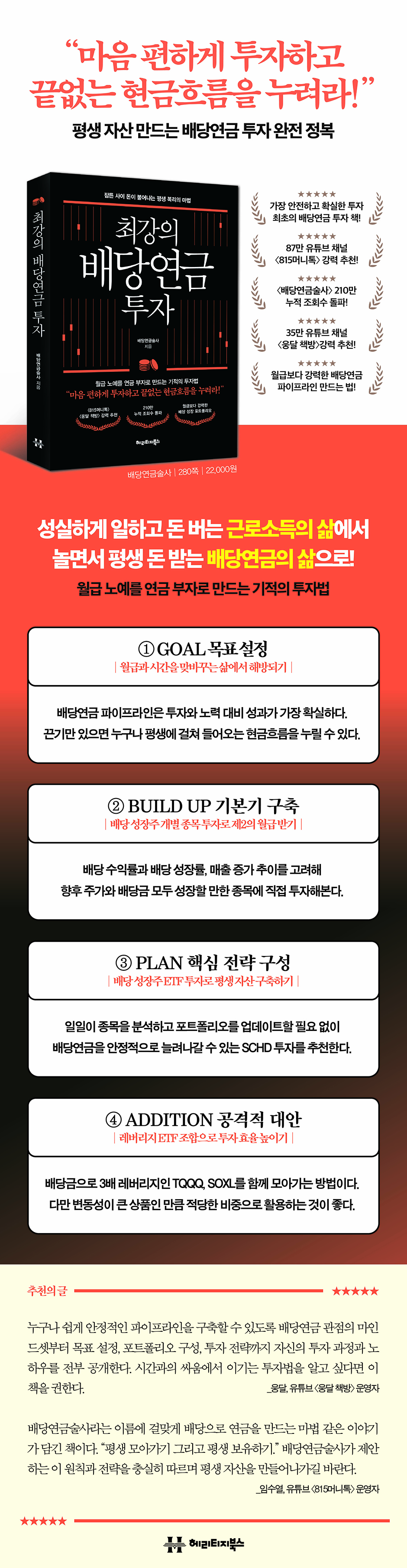

The Miracle Investment Method That Turns Wage Slaves into Pension Millionaires “Invest with peace of mind Enjoy endless cash flow!” Highly recommended YouTube channel <815 Money Talk> with 870,000 subscribers! Highly recommended YouTube channel "Ungdal Bookstore" with 350,000 subscribers! Surpassing 2.1 million cumulative views! A dividend pension pipeline stronger than your salary! The stock market is a history of repetition. As the bull market continues, the value of cash falls, and when losses are experienced in a bear market, more and more people seek out bank products that guarantee stable returns. Since no one can accurately predict the end of a rise or fall, we must prepare for it. "The Strongest Dividend Pension Investment" is the first book to cover dividend pension investment, a method for ordinary individual investors to secure profits "safely" and "surely." Dividend pension refers to creating a stable cash flow, similar to a pension, through a company's dividends. Unlike other stocks, there is no need to worry about buying and selling timing or analyze the stock anew every time. Above all, there is little stress as it is not greatly affected by stock price declines. The principles of dividend pension investment are simple. You just have to continuously increase the quantity and hold it for a long time. Therefore, it is the easiest and most comfortable investment method that anyone can succeed in if they have perseverance and patience. This book guides you through everything about dividend pension investing, from mindset to goal setting, portfolio composition, and investment strategies. The author of this book, Dividend Alchemist, actively uses his own investment experience and the process of developing through repeated successes and failures as examples. He even reveals in detail the recent portfolios of his wife (safety-oriented) and himself (growth-oriented), who have different investment tendencies. By providing direct numerical confirmation of the potential outcomes for each investment and meticulously analyzing the pros and cons, we help investors make the right choice for themselves. This book will be useful to all investors: beginners unsure of where to start, beginners just beginning their investment studies, and dividend pension investors looking to build a more robust pipeline. |

- You can preview some of the book's contents.

Preview

index

Recommendation

Prologue│A dividend pension that grows with compound interest: the first step to lifelong happiness.

Part 1: GOAL│The Beginning of Salary Independence

1.

Building a Lifetime Asset Without Money Worries

The earlier you start and the later you finish, the better

The 2040 generation is finding it difficult to trust public pensions.

Dividend Pension Pipeline to Escape Wage Slavery

2.

3 Axis for Unwavering Investment

First axis, dividend yield

Second axis, dividend growth rate

The Third Axis, the Magic of Compounding

The key is the investor's will

[TIP] The Rule of 72 to Double Your Investment

3.

Set your mindset from a dividend pension perspective

Don't leave the stock market completely

Don't be afraid of falling stock prices

We will work with companies that value trust.

[TIP] Essential Knowledge for Dividend Annuity Investment

Part 2: Building a Dividend Growth Portfolio

1.

Receive dividends continuously from individual stocks

Our family's investment turning point

Creating a timeless portfolio

A safety-oriented wife's portfolio

[TIP] View the top companies by market capitalization

2.

Overcoming the limitations of individual items

Coping with Shorter Corporate Lifespans

A dilemma you will face too

Why You Should Care About Dividend Growth ETFs

Growth-Oriented Dividend Alchemist's Portfolio

Part 3 PLAN│Investment Strategy for Assets

1.

A perfect algorithm that never fails

How to Become a Top 1% Investor in 20 Years

S&P 500 analyzed from a dividend growth perspective

Find the Best Dividend Growth ETFs

2. The charm of SCHD

Can SCHD Replace the S&P 500?

Why SCHD's Dividend Can Continue to Grow

The Power of SCHD 1-Week Accumulation

Synergy between the Korean version of SCHD and pension accounts

3. SCHD Basic Investment Strategy

What if I invest 100 million won in SCHD?

Investment Advice for New Professionals

What if I invest 500,000 won per month in SCHD?

Fixed-term investment vs. lump-sum investment

Monthly Dividend Annuity Investment Strategy Using JEPI

4.

Dividend Alchemist's Investment Principles

How to Determine a Fair Stock Price in 5 Minutes

Buying method considering exchange rate

How to check your current and future dividend pension

Absolute principles are more important than buying low.

Part 4: Addition│Adding Leverage to Dividend Annuities

1.

How to Make Dividend Annuities an Aggressive Investment

Recruit an effective striker

Use it as a safety device to prevent FOMO.

Wealth Catalysts: Leveraged ETFs

2. SCHD+TQQQ, SOXL Investment Strategy

Creating Rebalancing Principles for Risk Management

Buy TQQQ and SOXL for dividends

Turning the Windmills of Leveraged ETFs

Epilogue│The Best Investment Technique Is Not Selling

Prologue│A dividend pension that grows with compound interest: the first step to lifelong happiness.

Part 1: GOAL│The Beginning of Salary Independence

1.

Building a Lifetime Asset Without Money Worries

The earlier you start and the later you finish, the better

The 2040 generation is finding it difficult to trust public pensions.

Dividend Pension Pipeline to Escape Wage Slavery

2.

3 Axis for Unwavering Investment

First axis, dividend yield

Second axis, dividend growth rate

The Third Axis, the Magic of Compounding

The key is the investor's will

[TIP] The Rule of 72 to Double Your Investment

3.

Set your mindset from a dividend pension perspective

Don't leave the stock market completely

Don't be afraid of falling stock prices

We will work with companies that value trust.

[TIP] Essential Knowledge for Dividend Annuity Investment

Part 2: Building a Dividend Growth Portfolio

1.

Receive dividends continuously from individual stocks

Our family's investment turning point

Creating a timeless portfolio

A safety-oriented wife's portfolio

[TIP] View the top companies by market capitalization

2.

Overcoming the limitations of individual items

Coping with Shorter Corporate Lifespans

A dilemma you will face too

Why You Should Care About Dividend Growth ETFs

Growth-Oriented Dividend Alchemist's Portfolio

Part 3 PLAN│Investment Strategy for Assets

1.

A perfect algorithm that never fails

How to Become a Top 1% Investor in 20 Years

S&P 500 analyzed from a dividend growth perspective

Find the Best Dividend Growth ETFs

2. The charm of SCHD

Can SCHD Replace the S&P 500?

Why SCHD's Dividend Can Continue to Grow

The Power of SCHD 1-Week Accumulation

Synergy between the Korean version of SCHD and pension accounts

3. SCHD Basic Investment Strategy

What if I invest 100 million won in SCHD?

Investment Advice for New Professionals

What if I invest 500,000 won per month in SCHD?

Fixed-term investment vs. lump-sum investment

Monthly Dividend Annuity Investment Strategy Using JEPI

4.

Dividend Alchemist's Investment Principles

How to Determine a Fair Stock Price in 5 Minutes

Buying method considering exchange rate

How to check your current and future dividend pension

Absolute principles are more important than buying low.

Part 4: Addition│Adding Leverage to Dividend Annuities

1.

How to Make Dividend Annuities an Aggressive Investment

Recruit an effective striker

Use it as a safety device to prevent FOMO.

Wealth Catalysts: Leveraged ETFs

2. SCHD+TQQQ, SOXL Investment Strategy

Creating Rebalancing Principles for Risk Management

Buy TQQQ and SOXL for dividends

Turning the Windmills of Leveraged ETFs

Epilogue│The Best Investment Technique Is Not Selling

Detailed image

Into the book

Many people focus on finding a big bucket (a well-paying job) and holding more water (a high salary).

To accumulate wealth, you shouldn't be obsessed with the size of your bucket.

Whether it's a small bucket or a large bucket, if our lives ultimately depend on earned income, we will never be able to escape being wage slaves.

Even if it takes a long time, we need to change from directly transferring water into buckets to transferring water through pipelines.

In other words, a process is needed to convert earned income into capital income.

People who are under the illusion that their youth and salary will last forever live a life satisfied with their earned income.

But to avoid becoming a wage slave, you must build a wealth pipeline that generates cash without earned income.

--- p.32~33 From “Part 1 1: Creating Lifetime Assets Without Money Worries”

If you invested in a dividend growth stock that has steadily increased its dividend every year and received a 3% annual dividend this year, you will likely enjoy a dividend yield higher than 3% next year.

This guarantees a slightly higher dividend yield than the previous year.

However, capital gains are not as stable as dividend income.

Just because you made a 20 percent profit this year, there's no guarantee that you'll make the same profit next year.

There is a good chance that the stock price will fall by more than 20 percent next year, causing you to lose all the profits you made this year.

Simply comparing the numbers 3 and 20 may make 3 seem insignificant, but if you add the additions of 'sustainable 3' and 'temporary 20', the story changes completely.

In the long run, sustainability is far more important than the size of the numbers.

--- p.62 From “Part 1, 3: Set Your Mindset from the Perspective of Dividends”

My wife's dividend growth portfolio has shown resilience in bear markets.

Moreover, since dividends were paid out consistently regardless of the stock price decline, my wife was not shaken psychologically.

What if you had structured your portfolio primarily around non-dividend-paying growth stocks? You would have undoubtedly felt anxious, constantly checking your dwindling investment.

My wife has held 20 dividend growth stocks for over a year and has personally witnessed dividends in 2022 that are even larger than in 2021.

If you hold on to dividend growth stocks persistently, you'll see your dividend income grow, independent of the stock price movement.

--- p.96 From “Part 2, 1: Receive dividends continuously from individual stocks”

I've concluded that unless we change our investment approach, time freedom is ultimately an illusion.

We plan to gradually increase the dividend pension every year going forward.

I am confident that your sense of accomplishment and happiness will grow along with your growing dividend pension.

My current goal is to 'make 3 million won per month in dividend pension,' but it's just a symbol.

The real goal is to expand endlessly as much as possible.

Anyone can do it if they just let go of their impatience.

I too am in progress, not in completion.

--- p.126 From “Overcoming the Limitations of Individual Events, Part 2, Part 2”

Accumulative investors should invest in stocks that pay dividends so that increasing the quantity can directly lead to profits.

There is absolutely no need to worry about prolonged declines or sideways movements.

This is actually an opportunity to maximize dividend income by increasing the quantity at a low price. By accumulating SCHD in an installment plan, you can invest independently of stock price movements while maintaining control over your earnings.

Although the payment of dividends is a crucial factor in determining the success or failure of an investment plan, most investors overlook it.

--- p.196 From “Part 3, 3 SCHD Basic Investment Strategy”

Anyone can build a robust dividend pension pipeline by accumulating SCHD over time.

However, because of the obsession with making a better choice, we often hesitate and give up halfway.

At this time, if you approach purchasing from the perspective of weight adjustment rather than selection, you can invest with more peace of mind.

For example, instead of thinking dichotomously, "Should I choose between fixed-term and lump-sum investing?", ask an open question, "What proportion of fixed-term and lump-sum investing should I have?"

It also reduces the burden because you don't necessarily have to choose the better one.

--- p.240 From “Part 3, Part 4, The Dividend Alchemist’s Investment Principles”

Successful experiences give us courage, and failure experiences teach us lessons.

Investors absolutely need these two experiences.

The difference between investing directly and not investing directly is like the difference between heaven and earth.

You can never understand that feeling unless you try it.

Even things that are theoretically possible often end in failure due to psychological obstacles.

The more volatile an investment is, such as a leveraged ETF, the greater the psychological impact.

Even in the same situation, the type and magnitude of emotions felt are different for each person, so whether or not you can overcome them is something only you can know through your own judgment.

Don't be afraid of failure.

Try investing even a small amount.

As you accumulate experiences of both success and failure, you'll begin to develop an investment strategy that reflects your own tendencies. Through repeated refinement and modification, you'll gain the strength to move forward.

To accumulate wealth, you shouldn't be obsessed with the size of your bucket.

Whether it's a small bucket or a large bucket, if our lives ultimately depend on earned income, we will never be able to escape being wage slaves.

Even if it takes a long time, we need to change from directly transferring water into buckets to transferring water through pipelines.

In other words, a process is needed to convert earned income into capital income.

People who are under the illusion that their youth and salary will last forever live a life satisfied with their earned income.

But to avoid becoming a wage slave, you must build a wealth pipeline that generates cash without earned income.

--- p.32~33 From “Part 1 1: Creating Lifetime Assets Without Money Worries”

If you invested in a dividend growth stock that has steadily increased its dividend every year and received a 3% annual dividend this year, you will likely enjoy a dividend yield higher than 3% next year.

This guarantees a slightly higher dividend yield than the previous year.

However, capital gains are not as stable as dividend income.

Just because you made a 20 percent profit this year, there's no guarantee that you'll make the same profit next year.

There is a good chance that the stock price will fall by more than 20 percent next year, causing you to lose all the profits you made this year.

Simply comparing the numbers 3 and 20 may make 3 seem insignificant, but if you add the additions of 'sustainable 3' and 'temporary 20', the story changes completely.

In the long run, sustainability is far more important than the size of the numbers.

--- p.62 From “Part 1, 3: Set Your Mindset from the Perspective of Dividends”

My wife's dividend growth portfolio has shown resilience in bear markets.

Moreover, since dividends were paid out consistently regardless of the stock price decline, my wife was not shaken psychologically.

What if you had structured your portfolio primarily around non-dividend-paying growth stocks? You would have undoubtedly felt anxious, constantly checking your dwindling investment.

My wife has held 20 dividend growth stocks for over a year and has personally witnessed dividends in 2022 that are even larger than in 2021.

If you hold on to dividend growth stocks persistently, you'll see your dividend income grow, independent of the stock price movement.

--- p.96 From “Part 2, 1: Receive dividends continuously from individual stocks”

I've concluded that unless we change our investment approach, time freedom is ultimately an illusion.

We plan to gradually increase the dividend pension every year going forward.

I am confident that your sense of accomplishment and happiness will grow along with your growing dividend pension.

My current goal is to 'make 3 million won per month in dividend pension,' but it's just a symbol.

The real goal is to expand endlessly as much as possible.

Anyone can do it if they just let go of their impatience.

I too am in progress, not in completion.

--- p.126 From “Overcoming the Limitations of Individual Events, Part 2, Part 2”

Accumulative investors should invest in stocks that pay dividends so that increasing the quantity can directly lead to profits.

There is absolutely no need to worry about prolonged declines or sideways movements.

This is actually an opportunity to maximize dividend income by increasing the quantity at a low price. By accumulating SCHD in an installment plan, you can invest independently of stock price movements while maintaining control over your earnings.

Although the payment of dividends is a crucial factor in determining the success or failure of an investment plan, most investors overlook it.

--- p.196 From “Part 3, 3 SCHD Basic Investment Strategy”

Anyone can build a robust dividend pension pipeline by accumulating SCHD over time.

However, because of the obsession with making a better choice, we often hesitate and give up halfway.

At this time, if you approach purchasing from the perspective of weight adjustment rather than selection, you can invest with more peace of mind.

For example, instead of thinking dichotomously, "Should I choose between fixed-term and lump-sum investing?", ask an open question, "What proportion of fixed-term and lump-sum investing should I have?"

It also reduces the burden because you don't necessarily have to choose the better one.

--- p.240 From “Part 3, Part 4, The Dividend Alchemist’s Investment Principles”

Successful experiences give us courage, and failure experiences teach us lessons.

Investors absolutely need these two experiences.

The difference between investing directly and not investing directly is like the difference between heaven and earth.

You can never understand that feeling unless you try it.

Even things that are theoretically possible often end in failure due to psychological obstacles.

The more volatile an investment is, such as a leveraged ETF, the greater the psychological impact.

Even in the same situation, the type and magnitude of emotions felt are different for each person, so whether or not you can overcome them is something only you can know through your own judgment.

Don't be afraid of failure.

Try investing even a small amount.

As you accumulate experiences of both success and failure, you'll begin to develop an investment strategy that reflects your own tendencies. Through repeated refinement and modification, you'll gain the strength to move forward.

--- p.274~275 From "Part 4 2 SCHD+TQQQ, SOXL Investment Strategy"

Publisher's Review

“In a life of earning income by working hard and earning money,

“A life of dividend pension where you can earn money while having fun for the rest of your life!”

Growth-Oriented Investor Dividend Alchemist's Salary Independent Project

The Dividend Alchemist, who wrote this book, is a growth-oriented dividend alchemist who has been accumulating assets throughout his life with tens of thousands of subscribers through his YouTube channel, "Dividend Alchemist."

The reason he focused on 'dividend pension investment' is clear.

This is because of the ‘limits of salary (earned income)’, ‘instability of public pension’, and ‘stable retirement fund preparation’.

After buying his own home, the path to repaying his loan opened up, and he realized that he could not achieve financial freedom for the rest of his life through a routine of working hard and earning money.

Although I achieved great results, earning over 200 million won with my mother in just one year and six months through stock investment, as I continued to invest, I realized that I had no way to overcome the bear market and sideways market through my own efforts.

After going through heaven and hell, from the joy of +1400% price difference to the despair of -97.5%, I settled on dividend annuity investment, which guarantees a sure return regardless of stock price movements.

We have already established a pipeline of monthly dividend payments, and we are continuously expanding to generate a cash flow of more than 3 million won per month.

The stock market is constantly faced with unexpected crises.

You might occasionally make a big profit once or twice, but luck is something we can't control or predict.

Dividend pension investments are not like that.

You can steadily increase your profits (dividend pension) without any losses through personal effort (securing dividend amount), not luck (stock price).

If you just start, you will definitely win.

If you let go of the desire to achieve results quickly and instead make the most of the power of time, your future will become much more relaxed.

“Unaffected by stock price trends and trends of the times

Experience compound interest that grows like a snowball!”

A powerful dividend pension pipeline built with the power of time.

The process of creating a dividend pension pipeline is simple.

First, own assets (dividend stocks) that can generate cash flow (dividend pension).

Second, gradually increase the cash flow (dividend pension) generated from assets (dividend stocks).

Third and final, make sure your cash flow (dividend annuity) exceeds your monthly expenses.

Anyone can create a dividend pension pipeline by simply remembering this structure.

So how can we continuously increase the cash flow (dividend pension) flowing into the dividend pension pipeline? The author proposes the following three representative investment strategies.

? Investing in individual dividend growth stocks

This is a strategy of directly investing in stocks with the potential for growth in both stock price and dividends in the future, taking into account dividend yield, dividend growth rate, and sales growth trends.

At this time, the author says that it is important to evenly distribute sectors and include good stocks (capital stocks) that can make up for failures.

However, this alone is not enough to create a stable dividend pension pipeline.

Long-term investment is difficult in the first place due to the shortened lifespan of companies, and the psychological impact of stock price movements is significant, making it difficult to continue investing with peace of mind.

? Dividend Growth ETF Investment (SCHD)

This is a strategy to overcome the limitations of investing in individual stocks.

The author suggests SCHD (Charles Schwab's ETF product) as a solution that allows you to secure meaningful dividend pension while maintaining the advantages of the S&P 500, which regularly updates its portfolio with excellent stocks representing the United States.

Not only does it clearly show when you can receive your desired dividend pension through actual calculations, it also persuasively explains SCHD's stability and attractiveness based on various supporting data, such as dividend information summaries, dividend growth history, and annual dividend yields.

Investing in SCHD and leveraged ETFs (TQQQ, SOXL)

This is a way to make dividend pensions an aggressive investment strategy. By combining SCHD with other ETF products, the author suggests accumulating TQQQ (3x leveraged Nasdaq 100 ETF) and SOXL (3x leveraged ICE Semiconductor). By generating stable cash flow based on SCHD and increasing the holdings of TQQQ and SOXL with dividends, you can reduce risk while increasing the fun and efficiency of investing.

However, since leveraged ETFs have high volatility, it is recommended to use them effectively.

The investment methods contained in this book perfectly complement the "boring and boring" nature of dividend annuity investing, while also satisfying the expectations of those who want to achieve desired results more quickly through dividend annuity investing.

The absolute rule of dividend pension investment is “save for your entire life and hold for your entire life.”

As this is an investment method that requires a long-term perspective, you will always need to be confident that you are on the right path.

Packed with practical tips and advice, this book will be a reliable companion on your dividend pension investment journey.

Never give up and keep increasing the quantity.

And I hope you will witness with your own eyes the dividend pension growing with compound interest.

“A life of dividend pension where you can earn money while having fun for the rest of your life!”

Growth-Oriented Investor Dividend Alchemist's Salary Independent Project

The Dividend Alchemist, who wrote this book, is a growth-oriented dividend alchemist who has been accumulating assets throughout his life with tens of thousands of subscribers through his YouTube channel, "Dividend Alchemist."

The reason he focused on 'dividend pension investment' is clear.

This is because of the ‘limits of salary (earned income)’, ‘instability of public pension’, and ‘stable retirement fund preparation’.

After buying his own home, the path to repaying his loan opened up, and he realized that he could not achieve financial freedom for the rest of his life through a routine of working hard and earning money.

Although I achieved great results, earning over 200 million won with my mother in just one year and six months through stock investment, as I continued to invest, I realized that I had no way to overcome the bear market and sideways market through my own efforts.

After going through heaven and hell, from the joy of +1400% price difference to the despair of -97.5%, I settled on dividend annuity investment, which guarantees a sure return regardless of stock price movements.

We have already established a pipeline of monthly dividend payments, and we are continuously expanding to generate a cash flow of more than 3 million won per month.

The stock market is constantly faced with unexpected crises.

You might occasionally make a big profit once or twice, but luck is something we can't control or predict.

Dividend pension investments are not like that.

You can steadily increase your profits (dividend pension) without any losses through personal effort (securing dividend amount), not luck (stock price).

If you just start, you will definitely win.

If you let go of the desire to achieve results quickly and instead make the most of the power of time, your future will become much more relaxed.

“Unaffected by stock price trends and trends of the times

Experience compound interest that grows like a snowball!”

A powerful dividend pension pipeline built with the power of time.

The process of creating a dividend pension pipeline is simple.

First, own assets (dividend stocks) that can generate cash flow (dividend pension).

Second, gradually increase the cash flow (dividend pension) generated from assets (dividend stocks).

Third and final, make sure your cash flow (dividend annuity) exceeds your monthly expenses.

Anyone can create a dividend pension pipeline by simply remembering this structure.

So how can we continuously increase the cash flow (dividend pension) flowing into the dividend pension pipeline? The author proposes the following three representative investment strategies.

? Investing in individual dividend growth stocks

This is a strategy of directly investing in stocks with the potential for growth in both stock price and dividends in the future, taking into account dividend yield, dividend growth rate, and sales growth trends.

At this time, the author says that it is important to evenly distribute sectors and include good stocks (capital stocks) that can make up for failures.

However, this alone is not enough to create a stable dividend pension pipeline.

Long-term investment is difficult in the first place due to the shortened lifespan of companies, and the psychological impact of stock price movements is significant, making it difficult to continue investing with peace of mind.

? Dividend Growth ETF Investment (SCHD)

This is a strategy to overcome the limitations of investing in individual stocks.

The author suggests SCHD (Charles Schwab's ETF product) as a solution that allows you to secure meaningful dividend pension while maintaining the advantages of the S&P 500, which regularly updates its portfolio with excellent stocks representing the United States.

Not only does it clearly show when you can receive your desired dividend pension through actual calculations, it also persuasively explains SCHD's stability and attractiveness based on various supporting data, such as dividend information summaries, dividend growth history, and annual dividend yields.

Investing in SCHD and leveraged ETFs (TQQQ, SOXL)

This is a way to make dividend pensions an aggressive investment strategy. By combining SCHD with other ETF products, the author suggests accumulating TQQQ (3x leveraged Nasdaq 100 ETF) and SOXL (3x leveraged ICE Semiconductor). By generating stable cash flow based on SCHD and increasing the holdings of TQQQ and SOXL with dividends, you can reduce risk while increasing the fun and efficiency of investing.

However, since leveraged ETFs have high volatility, it is recommended to use them effectively.

The investment methods contained in this book perfectly complement the "boring and boring" nature of dividend annuity investing, while also satisfying the expectations of those who want to achieve desired results more quickly through dividend annuity investing.

The absolute rule of dividend pension investment is “save for your entire life and hold for your entire life.”

As this is an investment method that requires a long-term perspective, you will always need to be confident that you are on the right path.

Packed with practical tips and advice, this book will be a reliable companion on your dividend pension investment journey.

Never give up and keep increasing the quantity.

And I hope you will witness with your own eyes the dividend pension growing with compound interest.

GOODS SPECIFICS

- Date of issue: April 26, 2023

- Page count, weight, size: 280 pages | 150*210*20mm

- ISBN13: 9791198063670

- ISBN10: 119806367X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)