I almost ended up working without knowing anything about accounting!

|

Description

Book Introduction

Considered by many readers as a “life accounting book”

"I almost worked without knowing accounting!"

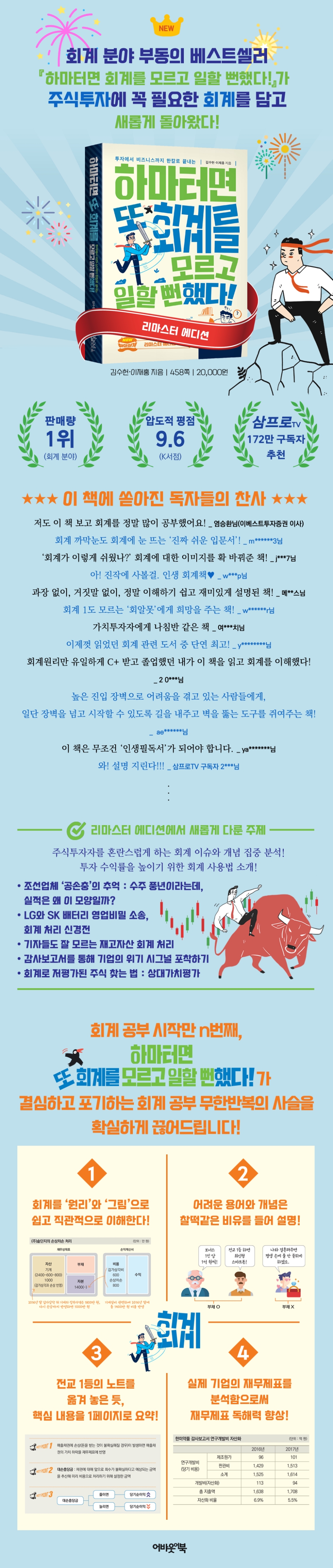

We're back with a fresh take on accounting essentials for stock investing!

***

Let's break the endless cycle of studying accounting, deciding to give up, and then giving up!

***

A perennial bestseller since its publication in 2018! Praised by readers as "the accounting book of my life," "Why did I only just discover it now?", and "a truly easy and fun accounting book," "I almost went to work without knowing accounting!" has returned with a fresh take on the essential accounting for stock investors.

The new edition, which has been expanded by about 90 pages, has been supplemented with accounting stories tailored to stock investors, such as the story of an investor who threw away stocks because he did not know the unique accounting characteristics of the contract-based business, the issue of accounting for inventory assets that even reporters often misunderstand and publish incorrect analysis articles, the different accounting treatments of LG and SK over a 1 trillion won settlement, how to detect corporate crisis signals through audit reports, and finding undervalued stocks through accounting.

If you are blind to accounting, your worries will deepen as your years of work experience increase.

Because companies record and report everything through accounting.

No matter what company you work for or what job you have, accounting knowledge is essential.

Because accounting has such a wide influence in the business world, it's one of the qualifications that can differentiate you from other job seekers.

In recent years, the stock investment craze has been so strong that many people have started investing in stocks.

However, many investors who invested without preparation, gripped by the anxiety that they might become 'sudden beggars' if things continued this way, experienced failure.

To increase your investment success rate, you need to analyze a company's financial statements, and accounting is the essential knowledge you need for this.

Many people who start studying accounting end up opening and closing several accounting books with different titles for years.

The reason why you are stuck in the same place no matter how much you study accounting is not because you lack the ability to study.

Because I haven't found a proper, authentic introduction.

An accessible and user-friendly introduction to accounting, proven by countless readers! This upgraded edition accurately highlights the practical uses of accounting! "I Almost Got to Work Without Knowing Accounting Again!" will surely break the cycle of endlessly repetitive accounting studies that you resolve and then give up.

"I almost worked without knowing accounting!"

We're back with a fresh take on accounting essentials for stock investing!

***

Let's break the endless cycle of studying accounting, deciding to give up, and then giving up!

***

A perennial bestseller since its publication in 2018! Praised by readers as "the accounting book of my life," "Why did I only just discover it now?", and "a truly easy and fun accounting book," "I almost went to work without knowing accounting!" has returned with a fresh take on the essential accounting for stock investors.

The new edition, which has been expanded by about 90 pages, has been supplemented with accounting stories tailored to stock investors, such as the story of an investor who threw away stocks because he did not know the unique accounting characteristics of the contract-based business, the issue of accounting for inventory assets that even reporters often misunderstand and publish incorrect analysis articles, the different accounting treatments of LG and SK over a 1 trillion won settlement, how to detect corporate crisis signals through audit reports, and finding undervalued stocks through accounting.

If you are blind to accounting, your worries will deepen as your years of work experience increase.

Because companies record and report everything through accounting.

No matter what company you work for or what job you have, accounting knowledge is essential.

Because accounting has such a wide influence in the business world, it's one of the qualifications that can differentiate you from other job seekers.

In recent years, the stock investment craze has been so strong that many people have started investing in stocks.

However, many investors who invested without preparation, gripped by the anxiety that they might become 'sudden beggars' if things continued this way, experienced failure.

To increase your investment success rate, you need to analyze a company's financial statements, and accounting is the essential knowledge you need for this.

Many people who start studying accounting end up opening and closing several accounting books with different titles for years.

The reason why you are stuck in the same place no matter how much you study accounting is not because you lack the ability to study.

Because I haven't found a proper, authentic introduction.

An accessible and user-friendly introduction to accounting, proven by countless readers! This upgraded edition accurately highlights the practical uses of accounting! "I Almost Got to Work Without Knowing Accounting Again!" will surely break the cycle of endlessly repetitive accounting studies that you resolve and then give up.

- You can preview some of the book's contents.

Preview

index

· Remastered Edition Preface: We'll break the endless cycle of starting to study accounting, deciding to start for the nth time, and then giving up!

· Preface: It's not your fault that you're stuck no matter how much you study accounting!

· Prologue: Why Accounting Doesn't Have "Principles" or "Introduction"

[Special Exploration] I almost invested in stocks without knowing accounting!

· Memories of the shipbuilding company 'Gongsun Chung': They say there's a bumper year for orders, but why are the results like this?

LG and SK's battery trade secret lawsuit and accounting war

· Inventory accounting treatment that even reporters are not familiar with

· Identifying corporate crisis signals through audit reports

· How to Find Undervalued Stocks Based on Accounting: Relative Valuation

Lesson 1.

Capital and debt marry to create assets!

· Even if you grow cabbage, you still need accounting.

· The first change in financial statements is the change from non-operating assets (cash) to operating assets (machinery and equipment).

· Net assets (capital) belong to shareholders

Lesson 2.

The single formula that governs all accounting processes: the accounting identity.

· Why Selling a Rice Cooker Increases Your Assets and Capital

· Cost execution, whether cash or credit, reduces capital the same.

· If I borrow money from a bank to buy a machine, what happens to my assets, liabilities, and equity?

Lesson 3.

The balance sheet and income statement are one body.

· Distinguishing between profitable and non-profitable transactions

· The 'Retained Earnings within Capital' wallet, where the finalized profits and losses go.

Lesson 4.

Profit and Loss Statement Steps 1 and 2: Gross Profit and Operating Profit

· Revenue is money earned, profit is money left over.

· The profit and loss calculation process neatly summarized in one picture

· What is the difference between manufacturing cost and cost of goods sold?

· Step 1 of the Income Statement: Calculating Gross Profit

· Step 2 of the Income Statement: Calculating Operating Profit

[Critical Accounting] Are my labor costs manufacturing costs or selling and general administrative costs?

Lesson 5.

Income Statement Steps 3 and 4: Pretax Income and Net Income

· The relationship between lottery winnings and non-operating income and expenses

· The $1 borrowed from Michael returned as a foreign exchange loss.

· Steps 3 and 4 of the income statement: Net income for the period is calculated by subtracting corporate tax expenses from pre-tax income.

· Retained earnings show the company's history.

[Crucial Accounting Knowledge] Retained Earnings: The Wallet That Collects Net Income

Lesson 6.

Real-World Analysis: Uncovering the Income Statements of Seven Companies

· Income statement, which is written off when closing the books, and balance sheet, which is accumulated

· If the cost of sales is low, will the operating profit margin be high?

Samsung SDI, a technology leader, spends half of its sales and administrative expenses on research and development.

[Crucial Accounting Knowledge] A Side Dish Better Than the Main Dish: Financial Statement Notes

· Daewon Pharmaceutical focuses on selling, general, and administrative expenses rather than cost of sales.

· "Please fix the lowest-bid system," Hyundai Rotem's appeal.

· Hotel Shilla Duty Free Shop Profitability and Rent Depend on Its Rent

[Crucial Accounting Knowledge] Coupang's Sales Growth Illusion: Focusing on Rocket Delivery

· Gaming companies face stagnation in commission payments exceeding salaries.

Lesson 7.

Digging into a Real-World Financial Statement

· The financial statements of Vice President Kim, whose entire asset is a house.

· A critical period of time that divides 'flow' and 'non-flow': one year

· LG Chem: Tangible assets are a source of profit.

· As Hotel Shilla's duty-free business grows, which assets will become more important?

LG Display has a lot of "good debt."

Lesson 8.

When purchasing machinery and equipment, when and how should the costs be recorded? The principles of depreciation.

· A company's accounting books that even a mother who has kept a household account book her entire life cannot understand

· Machinery and equipment that becomes useful after depreciation is over

Lesson 9.

Merciless impairment accounting for intangible assets that are worthless

· It is difficult to even get the principal back from Manager Kang's car.

· How are impairment losses reflected in financial statements?

Interplex sheds tears over depreciation

[Crucial Accounting Knowledge] A Frequent Customer for Manufacturing Companies' Tangible Assets: "Assets Under Construction."

· Korea Iron and Steel, which suffered from impairment losses despite increased sales

Lesson 10.

Accounting for intangible assets that work hard even when they are not visible

· Turtle Brand Kwangdong Pharmaceutical acquires Solpyo!

· Reflecting the Shuck Shuck Burger trademark usage fee in financial statements

· Why should Solpyo trademark fees be processed until the production of Weiqingshu?

Lesson 11.

Development costs are not expenses but assets?

· Why is Hyundai Motor, which spent 2.5 trillion won on research and development, only recording 1.8 trillion won as expenses?

· Differences in the accounting treatment of R&D expenses between Celltrion and Hanmi Pharmaceutical

Genexine revised its financial statements in response to the Financial Supervisory Service's warning.

· Accounting methods when development does not even cover the investment cost

Lesson 12.

Money given in advance (advance payment) is an asset, money received in advance (receipt) is a liability.

· Understanding the assets and liabilities of advance payments through the transactions between the fish-shaped bread vendor and the flour vendor.

Apple's cash-strapped strategy: prepayments

· The transformation of advance payment revenue: A graphical look at advance payment accounting.

· Duo, a matchmaking agency, promised to arrange a meeting and received money as debt.

Crucial Accounting Knowledge: Why does "cash-rich" Samsung Electronics have so much short-term debt?

Lesson 13: Understanding Accounting Principles with Balanced Equations

· Birds fly with their left and right wings!

· Why the left-right balance equation must be maintained

Lesson 14.

What are the intangible assets that only news agencies and entertainment agencies have?

SK Telecom's 2.17 trillion won worth of spoils

· Understanding the "left-right balance principle" through frequency asset accounting

· How did KT reflect the unusable frequency usage rights in its financial statements?

· The exclusive contract fee for a celebrity is an intangible asset of the agency.

· Is the exclusive contract fee expense (amortization) considered cost of sales or selling, general and administrative expenses?

Lesson 15.

"I don't think I'll be able to collect my payments", accounts receivable impaired

· If you think you will lose money, use 'bad debt allowance' and 'bad debt depreciation expense'

· What is the difference between local supermarkets and businesses in accounting for credit?

· How do I estimate the amount of money I will owe?

· If you receive money that you thought was owed, how will you record it in your financial statements?

Lesson 16.

Debts and liabilities, even if you don't know exactly how much to give to whom and when

· Is the promise made when proposing a debt or not?

· The performance bonus promised by the boss is a debt!

· What changes will there be in the financial statements of a food company that suffered a food poisoning incident?

· The story of Kia Motors, which handled 1 trillion won in expenses in one go.

· Warranty repair obligations are also liabilities!

Analysis of provisions appearing in Kia Motors' financial statements

· Peace Engineering, which suffered greatly from sales warranty liabilities

Lesson 17.

The magic of net income exceeding sales

· Even for the same investment stocks, accounting treatment varies.

· How did you run your business so that your net income is greater than your sales?

[Crucial Accounting Knowledge] How did Bithumb reflect the Bitcoin fees it received in its financial statements?

Lesson 18.

Complete Mastery of Equity Method Accounting

· What happens when Sotdanji Co., Ltd. purchases a 30% stake in Yongsan Mart Co., Ltd.

· Why should I include other companies' profits in my financial statements?

· Bident, which applies the equity method to Bithumb, posts a huge net profit despite an operating loss.

· Where is Yuhan Corporation's equity method subsidiary?

Lesson 19.

Mergers and acquisitions, goodwill

· Mr. Kim Moo-sik, who is trying to take over a chicken restaurant, knows only one thing and not two!

· I paid a premium, so why is it considered an asset and not an expense?

· The 'book value' and 'fair value (actual value)' of net assets are different!

[Crucial Accounting Knowledge] What is the difference between acquisitions and mergers?

Lesson 20.

How to calculate enterprise value and goodwill?

· There is no listed company with the same market capitalization and net assets!

· How do you evaluate the value of an unlisted company?

· The amount paid in excess of the net asset value is goodwill.

· Why Samsung Electronics acquired 4.45 trillion won in goodwill.

Lotte Shopping faces the challenge of losing its goodwill while expanding its territory.

· Futures of acquisitions and mergers, bargain purchase profits

Lesson 21.

Understanding the Cash Flow Statement to Identify a Doomed Company

· When do I record sales when selling goods on credit?

· Accrual accounting that faithfully matches revenues and expenses

· Prepaid insurance premiums are divided into expenses and assets.

· Profit is 'money left over on the books', not actual cash!

· Unpaid expenses, unpaid revenue

· An increase in assets is a cash outflow, and an increase in liabilities is a cash inflow.

Lesson 22.

Practical Analysis: Understanding Sales, Investment, and Financial Cash Flow

· Three branches of cash flow

· Slow collection of accounts receivable and rapid depletion of operating cash as inventory piles up

· Find cash flow from investing activities

· Find cash flow from financing activities

· The most ideal cash flow

· Why did a company that had been generating billions in profits suddenly collapse?

· There is quality in profit too!

Lesson 23.

Company Comprehensive Health Checkup: Financial Ratio Analysis Basics

· Can you view financial statements in just one second?

· In what order should I look at the financial statements?

· Is operating profit or net income more important?

[Crucial Accounting Knowledge] The order in which venture capitalists view income statements is the exact opposite of what accountants do.

Lesson 24.

Financial Ratio Analysis 1: Diagnosing Profitability and Growth Potential with the Income Statement

· Income statement that requires reading long-term trends

· Profitability, the first factor determining corporate value

· Why doesn't profit growth keep pace with sales growth?

Lesson 25.

Basics of Financial Statement Analysis

· The financial statements are viewed in the order of capital assets and liabilities!

· Capital surplus and retained earnings

[Crucial Accounting Knowledge] How to Identify a Company with Continued Losses at a Glance: Capital Erosion

· Let's distinguish between debt that pays interest and debt that doesn't!

Lesson 26.

Financial Ratio Analysis 2: Diagnosing Stability with the Balance Sheet

· Liquidity, the power that enables a company to survive without going bankrupt

· You can also see growth potential through the financial statements!

Lesson 27.

Financial Ratio Analysis 3: How quickly do you sell and how quickly do you recover?

· Cross-analysis of financial statements and income statements

· Baek Jong-won's tips that can be applied to businesses too!

· Three major turnover indicators that evaluate a company's activity

· Sell quickly, inventory turnover ratio

· The longer the inventory turnover period, the more severe the 'cash thirst' becomes.

· What the accounts receivable turnover ratio and turnover period tell us

· The sales cycle is the final step in evaluating a company!

· Cash flow rate, cash generation cycle

· Preface: It's not your fault that you're stuck no matter how much you study accounting!

· Prologue: Why Accounting Doesn't Have "Principles" or "Introduction"

[Special Exploration] I almost invested in stocks without knowing accounting!

· Memories of the shipbuilding company 'Gongsun Chung': They say there's a bumper year for orders, but why are the results like this?

LG and SK's battery trade secret lawsuit and accounting war

· Inventory accounting treatment that even reporters are not familiar with

· Identifying corporate crisis signals through audit reports

· How to Find Undervalued Stocks Based on Accounting: Relative Valuation

Lesson 1.

Capital and debt marry to create assets!

· Even if you grow cabbage, you still need accounting.

· The first change in financial statements is the change from non-operating assets (cash) to operating assets (machinery and equipment).

· Net assets (capital) belong to shareholders

Lesson 2.

The single formula that governs all accounting processes: the accounting identity.

· Why Selling a Rice Cooker Increases Your Assets and Capital

· Cost execution, whether cash or credit, reduces capital the same.

· If I borrow money from a bank to buy a machine, what happens to my assets, liabilities, and equity?

Lesson 3.

The balance sheet and income statement are one body.

· Distinguishing between profitable and non-profitable transactions

· The 'Retained Earnings within Capital' wallet, where the finalized profits and losses go.

Lesson 4.

Profit and Loss Statement Steps 1 and 2: Gross Profit and Operating Profit

· Revenue is money earned, profit is money left over.

· The profit and loss calculation process neatly summarized in one picture

· What is the difference between manufacturing cost and cost of goods sold?

· Step 1 of the Income Statement: Calculating Gross Profit

· Step 2 of the Income Statement: Calculating Operating Profit

[Critical Accounting] Are my labor costs manufacturing costs or selling and general administrative costs?

Lesson 5.

Income Statement Steps 3 and 4: Pretax Income and Net Income

· The relationship between lottery winnings and non-operating income and expenses

· The $1 borrowed from Michael returned as a foreign exchange loss.

· Steps 3 and 4 of the income statement: Net income for the period is calculated by subtracting corporate tax expenses from pre-tax income.

· Retained earnings show the company's history.

[Crucial Accounting Knowledge] Retained Earnings: The Wallet That Collects Net Income

Lesson 6.

Real-World Analysis: Uncovering the Income Statements of Seven Companies

· Income statement, which is written off when closing the books, and balance sheet, which is accumulated

· If the cost of sales is low, will the operating profit margin be high?

Samsung SDI, a technology leader, spends half of its sales and administrative expenses on research and development.

[Crucial Accounting Knowledge] A Side Dish Better Than the Main Dish: Financial Statement Notes

· Daewon Pharmaceutical focuses on selling, general, and administrative expenses rather than cost of sales.

· "Please fix the lowest-bid system," Hyundai Rotem's appeal.

· Hotel Shilla Duty Free Shop Profitability and Rent Depend on Its Rent

[Crucial Accounting Knowledge] Coupang's Sales Growth Illusion: Focusing on Rocket Delivery

· Gaming companies face stagnation in commission payments exceeding salaries.

Lesson 7.

Digging into a Real-World Financial Statement

· The financial statements of Vice President Kim, whose entire asset is a house.

· A critical period of time that divides 'flow' and 'non-flow': one year

· LG Chem: Tangible assets are a source of profit.

· As Hotel Shilla's duty-free business grows, which assets will become more important?

LG Display has a lot of "good debt."

Lesson 8.

When purchasing machinery and equipment, when and how should the costs be recorded? The principles of depreciation.

· A company's accounting books that even a mother who has kept a household account book her entire life cannot understand

· Machinery and equipment that becomes useful after depreciation is over

Lesson 9.

Merciless impairment accounting for intangible assets that are worthless

· It is difficult to even get the principal back from Manager Kang's car.

· How are impairment losses reflected in financial statements?

Interplex sheds tears over depreciation

[Crucial Accounting Knowledge] A Frequent Customer for Manufacturing Companies' Tangible Assets: "Assets Under Construction."

· Korea Iron and Steel, which suffered from impairment losses despite increased sales

Lesson 10.

Accounting for intangible assets that work hard even when they are not visible

· Turtle Brand Kwangdong Pharmaceutical acquires Solpyo!

· Reflecting the Shuck Shuck Burger trademark usage fee in financial statements

· Why should Solpyo trademark fees be processed until the production of Weiqingshu?

Lesson 11.

Development costs are not expenses but assets?

· Why is Hyundai Motor, which spent 2.5 trillion won on research and development, only recording 1.8 trillion won as expenses?

· Differences in the accounting treatment of R&D expenses between Celltrion and Hanmi Pharmaceutical

Genexine revised its financial statements in response to the Financial Supervisory Service's warning.

· Accounting methods when development does not even cover the investment cost

Lesson 12.

Money given in advance (advance payment) is an asset, money received in advance (receipt) is a liability.

· Understanding the assets and liabilities of advance payments through the transactions between the fish-shaped bread vendor and the flour vendor.

Apple's cash-strapped strategy: prepayments

· The transformation of advance payment revenue: A graphical look at advance payment accounting.

· Duo, a matchmaking agency, promised to arrange a meeting and received money as debt.

Crucial Accounting Knowledge: Why does "cash-rich" Samsung Electronics have so much short-term debt?

Lesson 13: Understanding Accounting Principles with Balanced Equations

· Birds fly with their left and right wings!

· Why the left-right balance equation must be maintained

Lesson 14.

What are the intangible assets that only news agencies and entertainment agencies have?

SK Telecom's 2.17 trillion won worth of spoils

· Understanding the "left-right balance principle" through frequency asset accounting

· How did KT reflect the unusable frequency usage rights in its financial statements?

· The exclusive contract fee for a celebrity is an intangible asset of the agency.

· Is the exclusive contract fee expense (amortization) considered cost of sales or selling, general and administrative expenses?

Lesson 15.

"I don't think I'll be able to collect my payments", accounts receivable impaired

· If you think you will lose money, use 'bad debt allowance' and 'bad debt depreciation expense'

· What is the difference between local supermarkets and businesses in accounting for credit?

· How do I estimate the amount of money I will owe?

· If you receive money that you thought was owed, how will you record it in your financial statements?

Lesson 16.

Debts and liabilities, even if you don't know exactly how much to give to whom and when

· Is the promise made when proposing a debt or not?

· The performance bonus promised by the boss is a debt!

· What changes will there be in the financial statements of a food company that suffered a food poisoning incident?

· The story of Kia Motors, which handled 1 trillion won in expenses in one go.

· Warranty repair obligations are also liabilities!

Analysis of provisions appearing in Kia Motors' financial statements

· Peace Engineering, which suffered greatly from sales warranty liabilities

Lesson 17.

The magic of net income exceeding sales

· Even for the same investment stocks, accounting treatment varies.

· How did you run your business so that your net income is greater than your sales?

[Crucial Accounting Knowledge] How did Bithumb reflect the Bitcoin fees it received in its financial statements?

Lesson 18.

Complete Mastery of Equity Method Accounting

· What happens when Sotdanji Co., Ltd. purchases a 30% stake in Yongsan Mart Co., Ltd.

· Why should I include other companies' profits in my financial statements?

· Bident, which applies the equity method to Bithumb, posts a huge net profit despite an operating loss.

· Where is Yuhan Corporation's equity method subsidiary?

Lesson 19.

Mergers and acquisitions, goodwill

· Mr. Kim Moo-sik, who is trying to take over a chicken restaurant, knows only one thing and not two!

· I paid a premium, so why is it considered an asset and not an expense?

· The 'book value' and 'fair value (actual value)' of net assets are different!

[Crucial Accounting Knowledge] What is the difference between acquisitions and mergers?

Lesson 20.

How to calculate enterprise value and goodwill?

· There is no listed company with the same market capitalization and net assets!

· How do you evaluate the value of an unlisted company?

· The amount paid in excess of the net asset value is goodwill.

· Why Samsung Electronics acquired 4.45 trillion won in goodwill.

Lotte Shopping faces the challenge of losing its goodwill while expanding its territory.

· Futures of acquisitions and mergers, bargain purchase profits

Lesson 21.

Understanding the Cash Flow Statement to Identify a Doomed Company

· When do I record sales when selling goods on credit?

· Accrual accounting that faithfully matches revenues and expenses

· Prepaid insurance premiums are divided into expenses and assets.

· Profit is 'money left over on the books', not actual cash!

· Unpaid expenses, unpaid revenue

· An increase in assets is a cash outflow, and an increase in liabilities is a cash inflow.

Lesson 22.

Practical Analysis: Understanding Sales, Investment, and Financial Cash Flow

· Three branches of cash flow

· Slow collection of accounts receivable and rapid depletion of operating cash as inventory piles up

· Find cash flow from investing activities

· Find cash flow from financing activities

· The most ideal cash flow

· Why did a company that had been generating billions in profits suddenly collapse?

· There is quality in profit too!

Lesson 23.

Company Comprehensive Health Checkup: Financial Ratio Analysis Basics

· Can you view financial statements in just one second?

· In what order should I look at the financial statements?

· Is operating profit or net income more important?

[Crucial Accounting Knowledge] The order in which venture capitalists view income statements is the exact opposite of what accountants do.

Lesson 24.

Financial Ratio Analysis 1: Diagnosing Profitability and Growth Potential with the Income Statement

· Income statement that requires reading long-term trends

· Profitability, the first factor determining corporate value

· Why doesn't profit growth keep pace with sales growth?

Lesson 25.

Basics of Financial Statement Analysis

· The financial statements are viewed in the order of capital assets and liabilities!

· Capital surplus and retained earnings

[Crucial Accounting Knowledge] How to Identify a Company with Continued Losses at a Glance: Capital Erosion

· Let's distinguish between debt that pays interest and debt that doesn't!

Lesson 26.

Financial Ratio Analysis 2: Diagnosing Stability with the Balance Sheet

· Liquidity, the power that enables a company to survive without going bankrupt

· You can also see growth potential through the financial statements!

Lesson 27.

Financial Ratio Analysis 3: How quickly do you sell and how quickly do you recover?

· Cross-analysis of financial statements and income statements

· Baek Jong-won's tips that can be applied to businesses too!

· Three major turnover indicators that evaluate a company's activity

· Sell quickly, inventory turnover ratio

· The longer the inventory turnover period, the more severe the 'cash thirst' becomes.

· What the accounts receivable turnover ratio and turnover period tell us

· The sales cycle is the final step in evaluating a company!

· Cash flow rate, cash generation cycle

Detailed image

Publisher's Review

* I'm just starting to study accounting for the nth time.

Let's break the endless cycle of deciding and giving up!

If you are blind to accounting, your worries will deepen as your years of work experience increase.

Because companies record and report everything through accounting.

No matter what company you work for or what job you have, accounting knowledge is essential.

Because accounting has such a wide influence in the business world, it's one of the qualifications that can differentiate you from other job seekers.

In recent years, the stock investment craze has been so strong that many people have started investing in stocks.

However, many investors who invested without preparation, gripped by the anxiety that they might become 'sudden beggars' if things continued this way, experienced failure.

To increase your investment success rate, you need to analyze a company's financial statements, and accounting is the essential knowledge you need for this.

A perennial bestseller since its publication in 2018! Praised by readers as "the accounting book of my life," "Why did I only just discover it now?", and "a truly easy and fun accounting book," "I almost went to work without knowing accounting!" has returned with a fresh take on the essential accounting for stock investors.

The new edition, which has been expanded by about 90 pages, has been supplemented with accounting stories tailored to stock investors, such as the story of an investor who threw away stocks because he did not know the unique accounting characteristics of the contract-based business, the issue of accounting for inventory assets that even reporters often misunderstand and publish incorrect analysis articles, the different accounting treatments of LG and SK over a 1 trillion won settlement, how to detect corporate crisis signals through audit reports, and finding undervalued stocks through accounting.

Many people who start studying accounting end up opening and closing several accounting books with different titles for years.

The reason why you are stuck in the same place no matter how much you study accounting is not because you lack the ability to study.

Because I haven't found a proper, authentic introduction.

An accessible and user-friendly introduction to accounting, proven by countless readers! This upgraded edition accurately highlights the practical uses of accounting! "I Almost Got to Work Without Knowing Accounting Again!" will surely break the cycle of endlessly repetitive accounting studies that you resolve and then give up.

* The shortcut to conquering accounting, the 'principle', intuitively understood through pictures!

· The shortcut to conquering accounting lies in principles!

In any academic discipline, books for beginners are usually titled 'Principles' or 'Introduction'.

However, introductory accounting books are titled 'Principles'.

Why is that? Because accounting becomes easier once you understand the principles.

The principles you need to know to master accounting are neither too numerous nor too difficult.

Accounting starts from the simple principle of 'Assets = Liabilities + Capital'.

This principle, called the 'accounting identity', governs all accounting processes.

This book demonstrates how basic accounting principles, such as accounting identities, can be applied in various situations, thereby solidifying your fundamental understanding of accounting.

· Learn accounting principles with intuitive illustrations!

All of a company's activities are expressed numerically in financial statements.

For those unfamiliar with accounting notations, financial statements, expressed solely in numbers, can seem difficult and abstract.

This book provides a pictorial explanation of all accounting processes and results.

By following the diagram, you can naturally understand not only accounting principles but also their relationship with financial statements.

No matter how complex the accounting process is, it can be explained with just two pictures.

A diagram showing assets, liabilities, and equity in the financial statements and income and expenses in the income statement.

· Explain accounting terms and concepts that sound like alien language using perfect analogies!

Most accounting terms, such as 'depreciation', 'impairment loss', and 'allowance for bad debts', are combinations of abstract words that are not commonly used in everyday life.

Let's take the concept of 'debt' as an example.

In accounting, a liability is an obligation that must be repaid in the future using money or resources owned by the company.

For an obligation to become a liability, it must be specifically and objectively measurable in value.

It's clearly Korean, but it feels like I'm reading a foreign language.

How about this explanation? A man proposes to his lover, saying, "If you marry me, I'll never let you get your hands dirty again."

Is a man's promise a debt or not? The expression "don't let your hands get wet" implies a promise not to cause trouble, but the obligations contained in the promise are abstract in nature and impossible to measure objectively.

So, it's not debt! This book uses striking analogies and examples to explain difficult accounting terms and concepts in an easy-to-understand manner.

· Content diet tailored to beginners' level!

Many accounting books explain from the perspective of the preparer of accounting information.

As such, it contains a lot of information that is unnecessary to know when reading and interpreting financial statements, such as balances, debits, and credits.

This book aims to 'improve financial statement reading skills' and explains accounting from the perspective of financial statement users.

At the beginning of my accounting studies, I boldly eliminated any content that was obviously going to cause overload.

On the other hand, the core principles and concepts that form the backbone of accounting are explained with different examples until they are imprinted in the mind.

· Read the flow of management with the latest accounting issues!

The issues facing companies are reflected numerically in their financial statements.

This book shows how the latest accounting issues are reflected in corporate financial statements, thereby enhancing financial statement reading skills, including the reason why the stock prices of bio companies that had been running at full speed for years all plummeted when issues arose about the accounting treatment of development costs; the stagnation of commissions paid out more than salaries in NCSoft's financial statements; the reason why Kia Motors suddenly incurred a cost of 1 trillion won; the surprising financial statements of Bithumb where net income for the period is greater than sales; and the reason why Samsung Electronics, a "cash rich" company, has short-term borrowings exceeding 12 trillion won.

For job seekers, knowing accounting means the ultimate qualification that opens the narrow door to employment. For office workers, it means the competitiveness that increases work efficiency and accelerates promotions. For investors, it means gaining insight into the market.

This book will help you find many opportunities that you almost lost.

Let's break the endless cycle of deciding and giving up!

If you are blind to accounting, your worries will deepen as your years of work experience increase.

Because companies record and report everything through accounting.

No matter what company you work for or what job you have, accounting knowledge is essential.

Because accounting has such a wide influence in the business world, it's one of the qualifications that can differentiate you from other job seekers.

In recent years, the stock investment craze has been so strong that many people have started investing in stocks.

However, many investors who invested without preparation, gripped by the anxiety that they might become 'sudden beggars' if things continued this way, experienced failure.

To increase your investment success rate, you need to analyze a company's financial statements, and accounting is the essential knowledge you need for this.

A perennial bestseller since its publication in 2018! Praised by readers as "the accounting book of my life," "Why did I only just discover it now?", and "a truly easy and fun accounting book," "I almost went to work without knowing accounting!" has returned with a fresh take on the essential accounting for stock investors.

The new edition, which has been expanded by about 90 pages, has been supplemented with accounting stories tailored to stock investors, such as the story of an investor who threw away stocks because he did not know the unique accounting characteristics of the contract-based business, the issue of accounting for inventory assets that even reporters often misunderstand and publish incorrect analysis articles, the different accounting treatments of LG and SK over a 1 trillion won settlement, how to detect corporate crisis signals through audit reports, and finding undervalued stocks through accounting.

Many people who start studying accounting end up opening and closing several accounting books with different titles for years.

The reason why you are stuck in the same place no matter how much you study accounting is not because you lack the ability to study.

Because I haven't found a proper, authentic introduction.

An accessible and user-friendly introduction to accounting, proven by countless readers! This upgraded edition accurately highlights the practical uses of accounting! "I Almost Got to Work Without Knowing Accounting Again!" will surely break the cycle of endlessly repetitive accounting studies that you resolve and then give up.

* The shortcut to conquering accounting, the 'principle', intuitively understood through pictures!

· The shortcut to conquering accounting lies in principles!

In any academic discipline, books for beginners are usually titled 'Principles' or 'Introduction'.

However, introductory accounting books are titled 'Principles'.

Why is that? Because accounting becomes easier once you understand the principles.

The principles you need to know to master accounting are neither too numerous nor too difficult.

Accounting starts from the simple principle of 'Assets = Liabilities + Capital'.

This principle, called the 'accounting identity', governs all accounting processes.

This book demonstrates how basic accounting principles, such as accounting identities, can be applied in various situations, thereby solidifying your fundamental understanding of accounting.

· Learn accounting principles with intuitive illustrations!

All of a company's activities are expressed numerically in financial statements.

For those unfamiliar with accounting notations, financial statements, expressed solely in numbers, can seem difficult and abstract.

This book provides a pictorial explanation of all accounting processes and results.

By following the diagram, you can naturally understand not only accounting principles but also their relationship with financial statements.

No matter how complex the accounting process is, it can be explained with just two pictures.

A diagram showing assets, liabilities, and equity in the financial statements and income and expenses in the income statement.

· Explain accounting terms and concepts that sound like alien language using perfect analogies!

Most accounting terms, such as 'depreciation', 'impairment loss', and 'allowance for bad debts', are combinations of abstract words that are not commonly used in everyday life.

Let's take the concept of 'debt' as an example.

In accounting, a liability is an obligation that must be repaid in the future using money or resources owned by the company.

For an obligation to become a liability, it must be specifically and objectively measurable in value.

It's clearly Korean, but it feels like I'm reading a foreign language.

How about this explanation? A man proposes to his lover, saying, "If you marry me, I'll never let you get your hands dirty again."

Is a man's promise a debt or not? The expression "don't let your hands get wet" implies a promise not to cause trouble, but the obligations contained in the promise are abstract in nature and impossible to measure objectively.

So, it's not debt! This book uses striking analogies and examples to explain difficult accounting terms and concepts in an easy-to-understand manner.

· Content diet tailored to beginners' level!

Many accounting books explain from the perspective of the preparer of accounting information.

As such, it contains a lot of information that is unnecessary to know when reading and interpreting financial statements, such as balances, debits, and credits.

This book aims to 'improve financial statement reading skills' and explains accounting from the perspective of financial statement users.

At the beginning of my accounting studies, I boldly eliminated any content that was obviously going to cause overload.

On the other hand, the core principles and concepts that form the backbone of accounting are explained with different examples until they are imprinted in the mind.

· Read the flow of management with the latest accounting issues!

The issues facing companies are reflected numerically in their financial statements.

This book shows how the latest accounting issues are reflected in corporate financial statements, thereby enhancing financial statement reading skills, including the reason why the stock prices of bio companies that had been running at full speed for years all plummeted when issues arose about the accounting treatment of development costs; the stagnation of commissions paid out more than salaries in NCSoft's financial statements; the reason why Kia Motors suddenly incurred a cost of 1 trillion won; the surprising financial statements of Bithumb where net income for the period is greater than sales; and the reason why Samsung Electronics, a "cash rich" company, has short-term borrowings exceeding 12 trillion won.

For job seekers, knowing accounting means the ultimate qualification that opens the narrow door to employment. For office workers, it means the competitiveness that increases work efficiency and accelerates promotions. For investors, it means gaining insight into the market.

This book will help you find many opportunities that you almost lost.

GOODS SPECIFICS

- Publication date: November 29, 2022

- Page count, weight, size: 458 pages | 782g | 150*210*26mm

- ISBN13: 9791192229164

- ISBN10: 1192229169

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)