How to read economic indicators carefully

|

Description

Book Introduction

“If you understand economic indicators, you can go a little faster and a little deeper. “We can glimpse the future that lies ahead of us.” Why are the rich always one step ahead of others? How to Read the Flow of Money, Economy, and Wealth Hidden in Economic Indicators It shows the economic trends of individuals, businesses, households, and countries in detail. Predicting the future with 12 economic indicators How Kim Young-ik, a macroeconomics guru, interprets the future Learn the art of quick and easy future prediction by carefully studying 12 economic indicators! Professor Kim Young-ik, a leading figure in Korean macroeconomics, has published a new, revised edition of "How to Read Economic Indicators," a long-time bestseller since its publication in 2018. "How to Read Economic Indicators," which covers how to use economic indicators around us to predict the future, has been well-received by businesspeople, corporate leaders, investors, and even those just starting out in society and job seekers who want to understand the economy more deeply and apply it to their real-world applications. It is particularly significant in that it is the favorite book of Professor Kim Young-ik, known as Korea's "Dr. Doom," who has clearly predicted and warned of the global economic crisis that has been freezing since the COVID-19 pandemic. This is because it contains the most fundamental data and analytical methods that the author has used for decades to analyze the economy and predict the future. One of the unique values of this latest revised edition of "How to Read Economic Indicators" is that it meticulously reflects and explains key economic indicators that have fluctuated during the COVID-19 pandemic. Analyzing economic indicators such as export and import trends, GDP, employment, interest rates, and exchange rates over the past few years, when unprecedented levels of liquidity were supplied, holds invaluable value. Because it is a look at the seeds of the future that will come to us. Economic indicators contain the coming flow of wealth. Through 『How to Read Economic Indicators』, you will be able to discover the trend more easily and clearly. |

- You can preview some of the book's contents.

Preview

index

Preface _ Economic indicators reveal the imminent flow of wealth.

Chapter 1: What is a Business Cycle and How Does It Work?: Business Cycles and Factors That Drive Economic Fluctuations

01 Competition and Business Cycle

02 How the game works

03 How do market fluctuations occur?

04 What Makes Up Economic Indicators

Chapter 2: Current Economic Situation of Households and Businesses: Industrial Activity Trends

01 What are industrial activity trends?

02 Production trends in manufacturing and service industries

03 Judging the current economy with the inventory ratio index

04 Another indicator for judging the game, the coincident index cyclical fluctuation

05 Leading indicator cyclical fluctuations that forecast the upcoming economy

Chapter 3: Economic Trends Over Time: Gross Domestic Product

01 What is GDP?

02 Measurement of GDP from the Expenditure Perspective

03 Announcement of GDP

04 Other National Income-Related Indicators You Should Know

05 The difference between potential GDP and actual GDP, the output gap

06 Korea's economic growth rate is expected to fall below the average of advanced economies.

Chapter 4: Navigating the Trade Market: Import and Export Trends

01 Monthly export and import trends: the most important indicator for understanding the Korean economy.

02 Export trends by product to understand the business conditions by industry

03 Regional export trends that provide a glimpse into the global economic landscape

04 Where are you making money?: Regional trade balance

05 Export indicators reveal the future of the Korean economy.

Chapter 5: Business and Individual Perceptions of the Economy: Business and Consumer Survey Index

01 Business Survey Index, which shows the perceived business conditions of companies

02 Consumer Sentiment Index that measures household consumption sentiment

03 Economic sentiment index that measures public sentiment on the economic situation

Chapter 6: Global Concerns for the Future: Employment

01 What Employment Trends Mean

02 Unemployment and employment rates that show the health of the economy

03 How many jobs were created in which industries: Employment by industry

04 How many jobs did each occupation create? Employment by occupation

Chapter 7: Household and Corporate Economic Weather Vanes: Prices

01 What is the Price Index?

02 Consumer Price Index, the level of prices perceived by households

03 Core price index, excluding food and energy

04 Price Index and Economics

05 Two things prices should avoid: inflation and deflation.

Chapter 8: The Lifeblood of the National Economy: Currency

01 Currency and Economic Stories

02 How much money is in circulation: monetary indicators

03 How well money is circulating: Money multiplier

04 Currency from a demand perspective

Chapter 9 The Price of Passing On Current Consumption to the Future: Interest Rates

01 What is interest rate?

02 Types of Interest Rates You Must Know

03 Fisher's equation for estimating a country's optimal nominal interest rate

04 Bond yields and bond prices move in opposite directions.

05 The relationship between currency and interest rates that fluctuate in opposite directions

06 Predicting the Future Economy with the Yield Curve

07 The Dangerous Structure of Interest Rates: Losing Money If You Don't Know

Chapter 10 Household and Corporate Health Indicators: The Circulation of Money

01 What is the circulation of funds and how is it structured?

02 Cash Flow Statement at a Glance

03 How does each economic entity procure and manage funds?

04 Understanding Financial Assets and Liabilities by Economic Entity

05 Application of various cash flow

Chapter 11: Supply and Demand for Foreign Currency: Exchange Rates

01 The interesting economics of exchange rates

02 Various exchange rates used to measure the equilibrium exchange rate

03 Exchange Rates Around the World: Differing by Country

Chapter 12: Flow of Foreign Transactions: Balance of Payments

01 What is the Balance of Payments?

02 Presentation of Current Account and Financial Account Statistics through Case Studies

Chapter 13 Government Revenue and Expenditure Activities: Finance

01 What is Finance?

02 The Story of Revenues, Expenditures, and a Balanced Budget

03 What is national debt and how is the indicator used?

Appendix _ Key Macroeconomic Indicators in Korea at a Glance

Chapter 1: What is a Business Cycle and How Does It Work?: Business Cycles and Factors That Drive Economic Fluctuations

01 Competition and Business Cycle

02 How the game works

03 How do market fluctuations occur?

04 What Makes Up Economic Indicators

Chapter 2: Current Economic Situation of Households and Businesses: Industrial Activity Trends

01 What are industrial activity trends?

02 Production trends in manufacturing and service industries

03 Judging the current economy with the inventory ratio index

04 Another indicator for judging the game, the coincident index cyclical fluctuation

05 Leading indicator cyclical fluctuations that forecast the upcoming economy

Chapter 3: Economic Trends Over Time: Gross Domestic Product

01 What is GDP?

02 Measurement of GDP from the Expenditure Perspective

03 Announcement of GDP

04 Other National Income-Related Indicators You Should Know

05 The difference between potential GDP and actual GDP, the output gap

06 Korea's economic growth rate is expected to fall below the average of advanced economies.

Chapter 4: Navigating the Trade Market: Import and Export Trends

01 Monthly export and import trends: the most important indicator for understanding the Korean economy.

02 Export trends by product to understand the business conditions by industry

03 Regional export trends that provide a glimpse into the global economic landscape

04 Where are you making money?: Regional trade balance

05 Export indicators reveal the future of the Korean economy.

Chapter 5: Business and Individual Perceptions of the Economy: Business and Consumer Survey Index

01 Business Survey Index, which shows the perceived business conditions of companies

02 Consumer Sentiment Index that measures household consumption sentiment

03 Economic sentiment index that measures public sentiment on the economic situation

Chapter 6: Global Concerns for the Future: Employment

01 What Employment Trends Mean

02 Unemployment and employment rates that show the health of the economy

03 How many jobs were created in which industries: Employment by industry

04 How many jobs did each occupation create? Employment by occupation

Chapter 7: Household and Corporate Economic Weather Vanes: Prices

01 What is the Price Index?

02 Consumer Price Index, the level of prices perceived by households

03 Core price index, excluding food and energy

04 Price Index and Economics

05 Two things prices should avoid: inflation and deflation.

Chapter 8: The Lifeblood of the National Economy: Currency

01 Currency and Economic Stories

02 How much money is in circulation: monetary indicators

03 How well money is circulating: Money multiplier

04 Currency from a demand perspective

Chapter 9 The Price of Passing On Current Consumption to the Future: Interest Rates

01 What is interest rate?

02 Types of Interest Rates You Must Know

03 Fisher's equation for estimating a country's optimal nominal interest rate

04 Bond yields and bond prices move in opposite directions.

05 The relationship between currency and interest rates that fluctuate in opposite directions

06 Predicting the Future Economy with the Yield Curve

07 The Dangerous Structure of Interest Rates: Losing Money If You Don't Know

Chapter 10 Household and Corporate Health Indicators: The Circulation of Money

01 What is the circulation of funds and how is it structured?

02 Cash Flow Statement at a Glance

03 How does each economic entity procure and manage funds?

04 Understanding Financial Assets and Liabilities by Economic Entity

05 Application of various cash flow

Chapter 11: Supply and Demand for Foreign Currency: Exchange Rates

01 The interesting economics of exchange rates

02 Various exchange rates used to measure the equilibrium exchange rate

03 Exchange Rates Around the World: Differing by Country

Chapter 12: Flow of Foreign Transactions: Balance of Payments

01 What is the Balance of Payments?

02 Presentation of Current Account and Financial Account Statistics through Case Studies

Chapter 13 Government Revenue and Expenditure Activities: Finance

01 What is Finance?

02 The Story of Revenues, Expenditures, and a Balanced Budget

03 What is national debt and how is the indicator used?

Appendix _ Key Macroeconomic Indicators in Korea at a Glance

Detailed image

Into the book

I worked as an economist at a securities firm's research center and a private economic research institute for 25 years.

Then, starting seven years ago, I began extending my role as an economist with students at Sogang University's Graduate School of Economics.

I wanted to connect students who primarily study economic theory with the real world of the economy, so I created a course called "Macroeconomic Indicator Analysis," which I've been teaching for 14 consecutive semesters.

This course provides students with an overview of how key economic indicators published by the National Statistical Office, the Bank of Korea, and other institutions are compiled, how they are connected to economic theory, and how to use these indicators to diagnose the current economic situation and forecast the future economy.

Additionally, we share knowledge in the same way as financial professionals in the training course called ‘Financial Market Analysis’ at the Korea Financial Training Institute.

This book is based on the contents of these lectures.

For this reason, I believe that it has sufficient practical necessity and utility, no less than any other book.

---From the "Preface"

Economy refers to the overall level of activity of the national economy.

Simply put, it indicates how actively the economy is moving.

The phrase 'good economy' means that the level of activity in production and consumption is high.

In other words, they produce a lot and consume a lot.

Naturally, the movement of money also becomes more active.

Conversely, a bad economy means that production and consumption are shrinking and the flow of money is blocked.

Let's explain the game using a student analogy.

Saying that the economy is doing well is like saying that a student is working hard at the activity called 'studying'.

You can only know how good or bad a student's grades are by looking at his or her report card.

However, you can tell whether you are studying hard or not, and people around you can also feel it.

The same goes for Gyeonggi-do.

You can feel firsthand whether economic activity is active or not.

Just as a student who studies hard is more likely to get good grades, when the economy is doing well, the economy itself is more likely to do well.

---From "Chapter 1: What is a Business Cycle and How Does It Work: Business Cycle and Factors of Business Fluctuations"

The economy is formed through the specific actions and organic interactions of individuals and groups participating in economic activities.

Individuals or groups that engage in economic activities are called 'economic entities', and can be broadly divided into households, businesses, governments, and foreign countries.

Among these, the role of households, which are primarily responsible for consumption, and companies, which are primarily responsible for production, is significant.

Therefore, examining the current situation of households and businesses is an effective tool for understanding the state of the economy.

A useful indicator is industrial activity trends.

At the end of every month, Statistics Korea announces industrial activity trends for the previous month.

This shows how much of the goods our country's companies produced and sold (shipments) and how much is left (inventory).

It also provides statistics on household consumption and corporate investment trends.

And by creating a comprehensive economic index, we can forecast not only the current but also the future economy.

---From "Chapter 2 Current Economic Situation of Households and Businesses: Industrial Activity Trends"

The Korean economy is highly dependent on trade.

In other words, since exports and imports have a significant impact on the economy, export and import trends are very important indicators for understanding the Korean economy.

To understand export and import trends, you can refer to the “Monthly Export and Import Trends” published monthly by the Ministry of Trade, Industry and Energy.

---From "Chapter 4: Navigation in the Trade Market: Import and Export Trends"

We live in constant conflict with prices in our daily lives.

In order to carry out economic activities, we have to buy something, and prices determine the price of the products and services we buy.

We often hear stories in the media about households struggling financially due to rising college tuition, transportation fares like bus and subway fares, and public utility bills like gas.

Additionally, interviews with housewives who are afraid to go grocery shopping because of rising food prices are a regular feature on TV news.

But prices don't just affect households.

Companies cannot help but be sensitive to the prices of raw materials they purchase for production.

And rising prices are also a direct cause of rising labor costs.

In this way, prices affect all sectors of the national economy, including household consumption and corporate production.

---From "Chapter 7: The Weather Vane of Household and Corporate Economy: Prices"

People cannot hold only as much money as they need.

Sometimes you have money to spare and sometimes you don't have enough.

If you have any money left over, deposit it in the bank or lend it to someone else.

When you're short on money, you may borrow from others.

A person who borrows money must pay a fee for borrowing the money over a certain period of time, and this fee is called 'interest'.

The proportion of this interest in the principal, that is, the ratio of interest to principal, is called the 'interest rate' or 'interest rate'.

In other words, the interest rate is the ratio of the interest amount to the principal that the demander of funds pays to the supplier in return for borrowing funds in the financial market.

---From "Chapter 9: The Price of Passing Current Consumption to the Future: Interest Rates"

Exchange rates, like other commodities, are determined by supply and demand in the foreign exchange market.

If our export companies do well in exports and earn a lot of dollars and supply them to the foreign exchange market, the value of the dollar will fall and the value of the won will rise.

The won/dollar exchange rate is falling.

Conversely, if our importers buy dollars in the foreign exchange market to import goods or services, the demand for dollars will increase and the exchange rate will rise.

Therefore, the balance of payments has the most important influence on exchange rate determination.

If the balance of payments is in surplus, it means that the supply of dollars in our foreign exchange market is greater than the demand, so the value of the dollar falls and the value of the won rises relatively.

Then, starting seven years ago, I began extending my role as an economist with students at Sogang University's Graduate School of Economics.

I wanted to connect students who primarily study economic theory with the real world of the economy, so I created a course called "Macroeconomic Indicator Analysis," which I've been teaching for 14 consecutive semesters.

This course provides students with an overview of how key economic indicators published by the National Statistical Office, the Bank of Korea, and other institutions are compiled, how they are connected to economic theory, and how to use these indicators to diagnose the current economic situation and forecast the future economy.

Additionally, we share knowledge in the same way as financial professionals in the training course called ‘Financial Market Analysis’ at the Korea Financial Training Institute.

This book is based on the contents of these lectures.

For this reason, I believe that it has sufficient practical necessity and utility, no less than any other book.

---From the "Preface"

Economy refers to the overall level of activity of the national economy.

Simply put, it indicates how actively the economy is moving.

The phrase 'good economy' means that the level of activity in production and consumption is high.

In other words, they produce a lot and consume a lot.

Naturally, the movement of money also becomes more active.

Conversely, a bad economy means that production and consumption are shrinking and the flow of money is blocked.

Let's explain the game using a student analogy.

Saying that the economy is doing well is like saying that a student is working hard at the activity called 'studying'.

You can only know how good or bad a student's grades are by looking at his or her report card.

However, you can tell whether you are studying hard or not, and people around you can also feel it.

The same goes for Gyeonggi-do.

You can feel firsthand whether economic activity is active or not.

Just as a student who studies hard is more likely to get good grades, when the economy is doing well, the economy itself is more likely to do well.

---From "Chapter 1: What is a Business Cycle and How Does It Work: Business Cycle and Factors of Business Fluctuations"

The economy is formed through the specific actions and organic interactions of individuals and groups participating in economic activities.

Individuals or groups that engage in economic activities are called 'economic entities', and can be broadly divided into households, businesses, governments, and foreign countries.

Among these, the role of households, which are primarily responsible for consumption, and companies, which are primarily responsible for production, is significant.

Therefore, examining the current situation of households and businesses is an effective tool for understanding the state of the economy.

A useful indicator is industrial activity trends.

At the end of every month, Statistics Korea announces industrial activity trends for the previous month.

This shows how much of the goods our country's companies produced and sold (shipments) and how much is left (inventory).

It also provides statistics on household consumption and corporate investment trends.

And by creating a comprehensive economic index, we can forecast not only the current but also the future economy.

---From "Chapter 2 Current Economic Situation of Households and Businesses: Industrial Activity Trends"

The Korean economy is highly dependent on trade.

In other words, since exports and imports have a significant impact on the economy, export and import trends are very important indicators for understanding the Korean economy.

To understand export and import trends, you can refer to the “Monthly Export and Import Trends” published monthly by the Ministry of Trade, Industry and Energy.

---From "Chapter 4: Navigation in the Trade Market: Import and Export Trends"

We live in constant conflict with prices in our daily lives.

In order to carry out economic activities, we have to buy something, and prices determine the price of the products and services we buy.

We often hear stories in the media about households struggling financially due to rising college tuition, transportation fares like bus and subway fares, and public utility bills like gas.

Additionally, interviews with housewives who are afraid to go grocery shopping because of rising food prices are a regular feature on TV news.

But prices don't just affect households.

Companies cannot help but be sensitive to the prices of raw materials they purchase for production.

And rising prices are also a direct cause of rising labor costs.

In this way, prices affect all sectors of the national economy, including household consumption and corporate production.

---From "Chapter 7: The Weather Vane of Household and Corporate Economy: Prices"

People cannot hold only as much money as they need.

Sometimes you have money to spare and sometimes you don't have enough.

If you have any money left over, deposit it in the bank or lend it to someone else.

When you're short on money, you may borrow from others.

A person who borrows money must pay a fee for borrowing the money over a certain period of time, and this fee is called 'interest'.

The proportion of this interest in the principal, that is, the ratio of interest to principal, is called the 'interest rate' or 'interest rate'.

In other words, the interest rate is the ratio of the interest amount to the principal that the demander of funds pays to the supplier in return for borrowing funds in the financial market.

---From "Chapter 9: The Price of Passing Current Consumption to the Future: Interest Rates"

Exchange rates, like other commodities, are determined by supply and demand in the foreign exchange market.

If our export companies do well in exports and earn a lot of dollars and supply them to the foreign exchange market, the value of the dollar will fall and the value of the won will rise.

The won/dollar exchange rate is falling.

Conversely, if our importers buy dollars in the foreign exchange market to import goods or services, the demand for dollars will increase and the exchange rate will rise.

Therefore, the balance of payments has the most important influence on exchange rate determination.

If the balance of payments is in surplus, it means that the supply of dollars in our foreign exchange market is greater than the demand, so the value of the dollar falls and the value of the won rises relatively.

---From "Chapter 11 Demand and Supply for Foreign Currency: Exchange Rates"

Publisher's Review

They are always one step ahead

How can we glimpse the future of wealth even in a crisis?

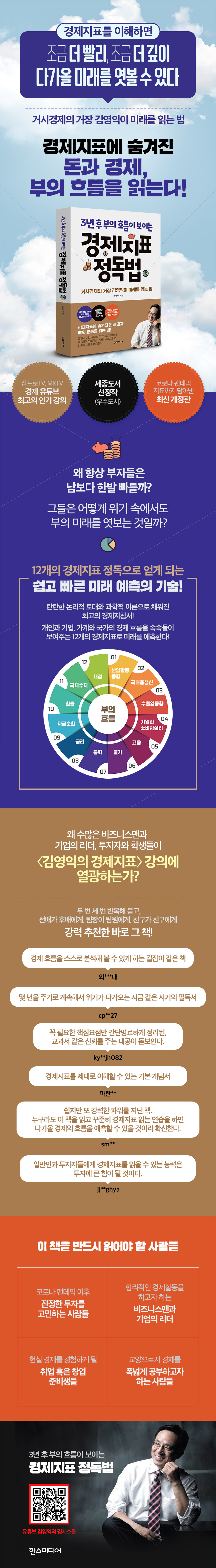

Why are the rich always one step ahead of others? How do they grasp the flow of wealth so well? It's difficult to simply attribute it to vague luck or intuition, but is there some secret to foreseeing the future?

"How to Read Economic Indicators" introduces a method for predicting the future one step ahead by using various economic indicators commonly encountered around us.

Based on the "Economic Indicator Lecture," a renowned and highly popular course taught by Sogang University and the Korea Institute of Finance, this book introduces 12 economic indicators presented by various organizations, including Statistics Korea and the Bank of Korea, and explains how to understand future economic and financial trends through them.

It explains how key economic indicators are compiled and how they are linked to economic theory, and presents methods for diagnosing the current economic situation and forecasting the future economy based on these indicators.

Filled with a solid logical foundation and scientific theories, the applications of this book are endless.

For businessmen and corporate leaders, it serves as a key tool for rational economic activity. For those seeking high-yield financial investments with limited resources, it serves as a reliable compass providing direction. For students contemplating employment or starting a business, or those planning to retire, it serves as a vivid medium through which they can experience the real economy.

There is no economy that cannot be predicted even an inch ahead.

There are numerous indicators around us that predict the future economy that will soon come.

Because it shows it vividly.

Only those who glimpse this a little faster and a little deeper

I have just been given the opportunity to become financially free and rich.

The IMF foreign exchange crisis of 1997 and the global financial crisis of 2008 brought suffering to many, but conversely, they were also times when a large number of wealthy people with tens or hundreds of billions of won emerged.

As if they had foreseen the coming of a massive economic crisis, they liquidated their assets ahead of time and boldly invested at the right time to realize their wealth.

The same goes for the unprecedented coronavirus pandemic.

While it brought great suffering to many, it was also a time of opportunity for others to seize great wealth they never dreamed of.

While such a major economic transformation may seem to come without warning, the signs are clearly visible ahead of time in numerous economic indicators.

By examining employment trends that actually show the job index, industrial activity trends that show the current economic situation of households and businesses, and export and import trends that can be considered as navigation for the trade market, it is easy to predict the economic situation 2-3 years from now.

Moreover, it costs nothing to view these economic indicators.

Because most institutions make it available for free.

While it may not be true that all wealthy people utilize these economic indicators, it is essential for the wise wealthy, who do not rely solely on luck, to objectively and rationally understand economic trends.

Beyond simply accumulating wealth on a personal level, understanding economic indicators also provides a significant advantage for businesses in developing business plans and managing mid- to long-term risks.

This is essential common sense not only for those who are self-employed or considering starting a business, but also for students preparing to enter society.

It is truly a 'treasure trove of wisdom' that will help you develop insight into the economy.

By understanding the basic concepts based on the economic indicators introduced in this book and consistently updating the data, you will naturally be able to see the future economic trends.

Then, you will understand the major trends in the economy and financial markets, and you will be able to make wise decisions, including investments.

It may feel a bit more challenging than existing books on economics, but in an era where the domestic and international economic environment changes rapidly, understanding this much will be of great help in properly diagnosing and forecasting our economy and financial markets.

Kim Young-ik, a giant in South Korea's macroeconomics, says,

How to Read the Future Economy Ahead of Us

The author of this book, Professor Kim Young-ik of Sogang University, once gained fame as a legendary "pincer" analyst by predicting the stock price crash just before the 9/11 terrorist attacks and the subsequent rebound, the stock price decline in May 2004, and the stock price rise in 2005, based on his own "stock price prediction indicator."

The 2015 financial crisis originating in China also garnered attention as it was accurately predicted in the book “The Future 3 Years Later,” published a year earlier.

The author, known as Korea's Dr. Doom, consistently warned of the imminent arrival of an unprecedented economic crisis even after 2020, a year marked by a global stock market frenzy. His predictions and outlook have undoubtedly come true this time around.

"How to Read Economic Indicators" is a book that contains the author's own economic forecasting techniques as an economics professor, professional analyst, and economist.

Why are college students and young professionals preparing for employment so enthusiastic about this course?

The most popular lecture selected by Sogang University and the Korea Institute of Finance!

I listened to it two or three times, and it was the very lecture that seniors recommended to juniors and friends recommended to friends!

Acquiring an 'eye for economics' is not an easy task.

Especially in these times when the domestic and international economic environment changes rapidly at every moment, ‘economic sense ahead of others’ is a powerful weapon that cannot be replaced by anything else.

This is precisely why the author's lecture "Economic Indicators," which formed the basis of this book, is receiving an explosive response from young college students preparing for employment and businesspeople just entering the workforce.

This is because it cultivates an 'eye for economics' that can only be acquired through direct experience over a long period of time.

This is because, of course, seniors strongly recommend lectures to juniors, team leaders to team members, and friends to friends, not to mention listening to the same lectures two or three times.

How can we glimpse the future of wealth even in a crisis?

Why are the rich always one step ahead of others? How do they grasp the flow of wealth so well? It's difficult to simply attribute it to vague luck or intuition, but is there some secret to foreseeing the future?

"How to Read Economic Indicators" introduces a method for predicting the future one step ahead by using various economic indicators commonly encountered around us.

Based on the "Economic Indicator Lecture," a renowned and highly popular course taught by Sogang University and the Korea Institute of Finance, this book introduces 12 economic indicators presented by various organizations, including Statistics Korea and the Bank of Korea, and explains how to understand future economic and financial trends through them.

It explains how key economic indicators are compiled and how they are linked to economic theory, and presents methods for diagnosing the current economic situation and forecasting the future economy based on these indicators.

Filled with a solid logical foundation and scientific theories, the applications of this book are endless.

For businessmen and corporate leaders, it serves as a key tool for rational economic activity. For those seeking high-yield financial investments with limited resources, it serves as a reliable compass providing direction. For students contemplating employment or starting a business, or those planning to retire, it serves as a vivid medium through which they can experience the real economy.

There is no economy that cannot be predicted even an inch ahead.

There are numerous indicators around us that predict the future economy that will soon come.

Because it shows it vividly.

Only those who glimpse this a little faster and a little deeper

I have just been given the opportunity to become financially free and rich.

The IMF foreign exchange crisis of 1997 and the global financial crisis of 2008 brought suffering to many, but conversely, they were also times when a large number of wealthy people with tens or hundreds of billions of won emerged.

As if they had foreseen the coming of a massive economic crisis, they liquidated their assets ahead of time and boldly invested at the right time to realize their wealth.

The same goes for the unprecedented coronavirus pandemic.

While it brought great suffering to many, it was also a time of opportunity for others to seize great wealth they never dreamed of.

While such a major economic transformation may seem to come without warning, the signs are clearly visible ahead of time in numerous economic indicators.

By examining employment trends that actually show the job index, industrial activity trends that show the current economic situation of households and businesses, and export and import trends that can be considered as navigation for the trade market, it is easy to predict the economic situation 2-3 years from now.

Moreover, it costs nothing to view these economic indicators.

Because most institutions make it available for free.

While it may not be true that all wealthy people utilize these economic indicators, it is essential for the wise wealthy, who do not rely solely on luck, to objectively and rationally understand economic trends.

Beyond simply accumulating wealth on a personal level, understanding economic indicators also provides a significant advantage for businesses in developing business plans and managing mid- to long-term risks.

This is essential common sense not only for those who are self-employed or considering starting a business, but also for students preparing to enter society.

It is truly a 'treasure trove of wisdom' that will help you develop insight into the economy.

By understanding the basic concepts based on the economic indicators introduced in this book and consistently updating the data, you will naturally be able to see the future economic trends.

Then, you will understand the major trends in the economy and financial markets, and you will be able to make wise decisions, including investments.

It may feel a bit more challenging than existing books on economics, but in an era where the domestic and international economic environment changes rapidly, understanding this much will be of great help in properly diagnosing and forecasting our economy and financial markets.

Kim Young-ik, a giant in South Korea's macroeconomics, says,

How to Read the Future Economy Ahead of Us

The author of this book, Professor Kim Young-ik of Sogang University, once gained fame as a legendary "pincer" analyst by predicting the stock price crash just before the 9/11 terrorist attacks and the subsequent rebound, the stock price decline in May 2004, and the stock price rise in 2005, based on his own "stock price prediction indicator."

The 2015 financial crisis originating in China also garnered attention as it was accurately predicted in the book “The Future 3 Years Later,” published a year earlier.

The author, known as Korea's Dr. Doom, consistently warned of the imminent arrival of an unprecedented economic crisis even after 2020, a year marked by a global stock market frenzy. His predictions and outlook have undoubtedly come true this time around.

"How to Read Economic Indicators" is a book that contains the author's own economic forecasting techniques as an economics professor, professional analyst, and economist.

Why are college students and young professionals preparing for employment so enthusiastic about this course?

The most popular lecture selected by Sogang University and the Korea Institute of Finance!

I listened to it two or three times, and it was the very lecture that seniors recommended to juniors and friends recommended to friends!

Acquiring an 'eye for economics' is not an easy task.

Especially in these times when the domestic and international economic environment changes rapidly at every moment, ‘economic sense ahead of others’ is a powerful weapon that cannot be replaced by anything else.

This is precisely why the author's lecture "Economic Indicators," which formed the basis of this book, is receiving an explosive response from young college students preparing for employment and businesspeople just entering the workforce.

This is because it cultivates an 'eye for economics' that can only be acquired through direct experience over a long period of time.

This is because, of course, seniors strongly recommend lectures to juniors, team leaders to team members, and friends to friends, not to mention listening to the same lectures two or three times.

GOODS SPECIFICS

- Publication date: August 25, 2022

- Page count, weight, size: 348 pages | 596g | 150*215*21mm

- ISBN13: 9791160078411

- ISBN10: 1160078416

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)