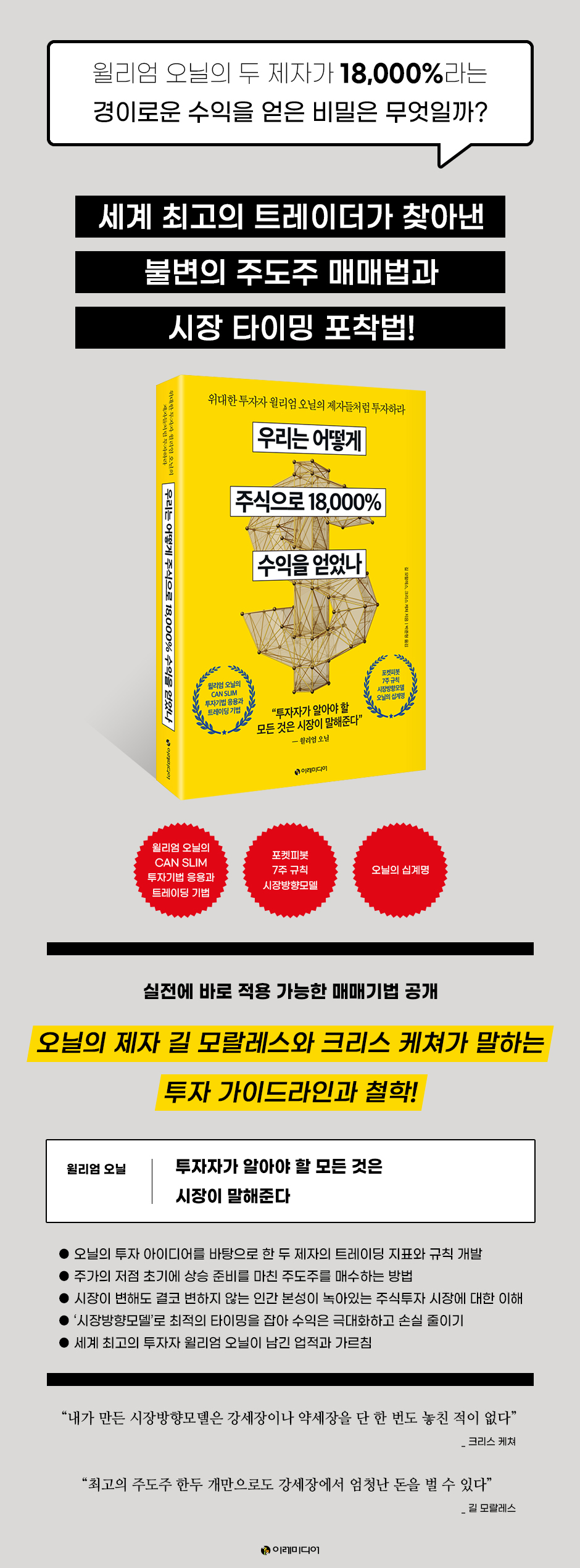

How We Gained 18,000% in Stocks

|

Description

Book Introduction

How did William O'Neil's two disciples achieve a staggering 18,000% return?

The world's best traders have discovered timeless stock trading strategies and how to spot market timing. William O'Neil is a legendary investor who became the youngest member of the New York Stock Exchange at the age of thirty. He is considered a master of growth stock investing, developing the CANSLIM trading method that combines fundamental and technical analysis to invest in volatile and rising stocks. Gil Morales and Chris Kacher, who learned about investing from him, developed their own trading indicators and rules based on O'Neil's investment ideas, achieving an astonishing total return of over 18,000%. They created detailed rules for O'Neill's investment method and devised their own rules using the signals sent by the market. For example, while general investors have a habit of buying when the stock price breaks through the low point and rises, they have figured out a way to buy leading stocks that are ready to rise in the early stages of the stock price low point. |

- You can preview some of the book's contents.

Preview

index

Chapter 1: O'Neill's Investment Techniques

Excellent investment techniques are developed over generations.

Prepare, study, and practice

Don't buy cheap stocks, buy expensive stocks.

Stop water riding!

Cut your losses as quickly as possible.

Sell slowly in a rising market: Wait until the stock price has risen sufficiently.

Concentrated investment

Support from top stocks and institutional investors

chart patterns

Livermore's Pivotal Point vs.

O'Neill's pivot point

Timing the Market: Knowing When to Enter and When to Exit

Emotions and Predictions

Expert opinions, news, and information

Overtrading

O'Neill's Investment Method: Fundamental Analysis + Technical Analysis

conclusion

Chapter 2: How Chris Kacher Achieved an 18,000% Return

Step into the investment market

1996: Making Money with Y2K Stocks

1997: Making Money Despite the Asian Financial Crisis

1998: Investor Discouragement

1999: The stock market bubble is growing.

2000: The market bubble finally bursts.

2001: Lessons from Short Selling

From 2002 to Now: The Jagged Sideways Market and the Birth of the Pocket Pivot

Chapter 3: How Gil Morales Achieved an 11,000% Return

Early failures become a blessing in disguise

Rocket-like stock price rise

Entering the 1,000% yield range

Oracle Bubble

Patience and a cautious eye

All obstacles disappear

Verisign, like seasoning in soup

Endure without thinking

Sell at the high point

Themes in Success Stories

The Secret Ingredients for Success

Chapter 4 Failure is the mother of success

What we need is courage, persistence and patience.

To succeed, you must let go of your pride.

Learn from our mistakes

Problem, situation, solution

conclusion

Chapter 5: The Secrets of Trading

Dr.

K's Lab: The Excellence of Pocket Pivot

Pocket Pivot's characteristics

Defining Pocket Pivot Buy Points

Pocket Pivots and Traditional Breakout Buying Points

Buy from Pocket

Hunting from the ground with Pocket Pivot

Persistent Pocket Pivot: Utilizing the 10-Day Moving Average

Pocket Pivots that are incomplete or should be avoided

Using the moving average as a selling standard

Dr.

K's Lab: Buying When Leading Stocks Gap Up

Selling techniques using the 10-day and 50-day moving averages

Investing requires mobilizing all your skills.

conclusion

Chapter 6: How to Ride the Bear Market Wave

Short selling timing techniques

Golden Rule of Short Selling

Short selling pattern

Rocket stock short selling

conclusion

Chapter 7 Dr.

K's market direction model

Market timing

Chart example

Stealing the Secrets of the Market Direction Model

Timing Model FAQ

conclusion

Chapter 8: O'Neill's Ten Commandments

misunderstanding

Survive without pride

1.

Never be swayed

2.

Don't trade in fear

3.

Keep your enemies closer than your friends

4.

Never stop learning and improving

5.

Never talk about your own stocks

6.

Don't be too fond of the best position

7.

First, look at the weekly chart.

Next, look at the daily chart.

Ignore the intraday charts

8.

Find the best stocks.

Next, find a way to buy big.

9.

Always be careful when sleeping with someone.

10.

Always be crazy focused

conclusion

Chapter 9 In O'Neill's Trenches

1997~1998

1999~2000

2001-2002, the worst bear market

2003-2005, bull market

conclusion

Chapter 10: Investing is Life, Life is Investment

Ed Seykota: Technology for Every Trader in the World

Eckhart Tolle: Live in the Moment

Esther Hicks: The Law of Attraction

Jack Canfield: The Struggle to Optimize the Individual

Psychological Checklist: Questions to Ask Yourself

Commonalities

conclusion

Appendix: Dr.

50 Recommended Investment Books by K

Excellent investment techniques are developed over generations.

Prepare, study, and practice

Don't buy cheap stocks, buy expensive stocks.

Stop water riding!

Cut your losses as quickly as possible.

Sell slowly in a rising market: Wait until the stock price has risen sufficiently.

Concentrated investment

Support from top stocks and institutional investors

chart patterns

Livermore's Pivotal Point vs.

O'Neill's pivot point

Timing the Market: Knowing When to Enter and When to Exit

Emotions and Predictions

Expert opinions, news, and information

Overtrading

O'Neill's Investment Method: Fundamental Analysis + Technical Analysis

conclusion

Chapter 2: How Chris Kacher Achieved an 18,000% Return

Step into the investment market

1996: Making Money with Y2K Stocks

1997: Making Money Despite the Asian Financial Crisis

1998: Investor Discouragement

1999: The stock market bubble is growing.

2000: The market bubble finally bursts.

2001: Lessons from Short Selling

From 2002 to Now: The Jagged Sideways Market and the Birth of the Pocket Pivot

Chapter 3: How Gil Morales Achieved an 11,000% Return

Early failures become a blessing in disguise

Rocket-like stock price rise

Entering the 1,000% yield range

Oracle Bubble

Patience and a cautious eye

All obstacles disappear

Verisign, like seasoning in soup

Endure without thinking

Sell at the high point

Themes in Success Stories

The Secret Ingredients for Success

Chapter 4 Failure is the mother of success

What we need is courage, persistence and patience.

To succeed, you must let go of your pride.

Learn from our mistakes

Problem, situation, solution

conclusion

Chapter 5: The Secrets of Trading

Dr.

K's Lab: The Excellence of Pocket Pivot

Pocket Pivot's characteristics

Defining Pocket Pivot Buy Points

Pocket Pivots and Traditional Breakout Buying Points

Buy from Pocket

Hunting from the ground with Pocket Pivot

Persistent Pocket Pivot: Utilizing the 10-Day Moving Average

Pocket Pivots that are incomplete or should be avoided

Using the moving average as a selling standard

Dr.

K's Lab: Buying When Leading Stocks Gap Up

Selling techniques using the 10-day and 50-day moving averages

Investing requires mobilizing all your skills.

conclusion

Chapter 6: How to Ride the Bear Market Wave

Short selling timing techniques

Golden Rule of Short Selling

Short selling pattern

Rocket stock short selling

conclusion

Chapter 7 Dr.

K's market direction model

Market timing

Chart example

Stealing the Secrets of the Market Direction Model

Timing Model FAQ

conclusion

Chapter 8: O'Neill's Ten Commandments

misunderstanding

Survive without pride

1.

Never be swayed

2.

Don't trade in fear

3.

Keep your enemies closer than your friends

4.

Never stop learning and improving

5.

Never talk about your own stocks

6.

Don't be too fond of the best position

7.

First, look at the weekly chart.

Next, look at the daily chart.

Ignore the intraday charts

8.

Find the best stocks.

Next, find a way to buy big.

9.

Always be careful when sleeping with someone.

10.

Always be crazy focused

conclusion

Chapter 9 In O'Neill's Trenches

1997~1998

1999~2000

2001-2002, the worst bear market

2003-2005, bull market

conclusion

Chapter 10: Investing is Life, Life is Investment

Ed Seykota: Technology for Every Trader in the World

Eckhart Tolle: Live in the Moment

Esther Hicks: The Law of Attraction

Jack Canfield: The Struggle to Optimize the Individual

Psychological Checklist: Questions to Ask Yourself

Commonalities

conclusion

Appendix: Dr.

50 Recommended Investment Books by K

Detailed image

Publisher's Review

Learn stock investing from the world's best traders!

Learn how to spot the best buy signals and even master the selling rules of top traders.

William J. O'Neill and the William O'Neill Company

It would be a golden opportunity for stock investors to make money if they could learn how to trade from the world's best traders (O'Neil+Co., Inc.).

In particular, O'Neill's CAN SLIM investment method is famous for creating great wealth by utilizing both individual and institutional investors.

The practice of focusing on a few stocks by considering factors such as corporate fundamentals, chart patterns, market trends, and sector cycles has significantly influenced the trading practices of many investors to this day.

His disciples, Dr. Gil Morales and Dr. Chris Kacher, spent decades observing the markets while working at William O'Neil Company, further developing O'Neil's principles and investing themselves, creating their own practical, detailed rules.

Dr. Chris Kacher used both fundamental and technical analysis when buying stocks, and relied on technical analysis when selling.

In particular, Pocket Pivot is a signal that can be used to capture and utilize optimal buying opportunities with low risk by detecting buying and purchasing signals from institutional investors before a specific stock breaks through its low or consolidation phase and begins to rise.

It was perfectly applicable to the market from the 1970s to the 1990s, and is known to be a very useful trading method even in the recent market.

Another useful feature of Pocket Pivot is its ability to identify buying opportunities for small-cap stocks with low trading volume, liquidity, and low stock prices, making them difficult to invest in. Furthermore, these trading ideas provide readily available insights for current market participants.

Another notable strength of this book is that it covers in detail not only buying but also selling rules.

It can be of great help to current investors, as it provides a glimpse into the technical and psychological foundations of how to maximize profits.

Market Timing - The Art of Trading with Just One or Two Leading Stocks at the Optimal Time

Don't miss out on investment opportunities by identifying the right mid-term market direction!

Anyone who has the skills to determine the most ideal buying and selling times when investing in stocks will inevitably make a profit.

But systematically designing a model that tells us the 'optimal' time is a whole other problem.

Although it should be based on a rational and logical system, many timing models on the market tend to rely too much on past data.

Recently, there has been a growing number of services that claim to provide accurate stock investment timing based on artificial intelligence algorithms. However, most of these services are based on unknown data and lack logical explanations.

However, if used correctly, a proper market timing model can play a role in maximizing profits and minimizing losses.

Gil Morales and Chris Kacher also credit the market direction model as the reason they were able to participate in the market and record huge profits.

In other words, it is very important to predict the mid- to long-term market direction and then make investments.

In particular, he says, being able to capture the direction of a bull market and invest in the best leading stocks can be a way to dramatically increase returns.

Even an experienced investor like William O'Neil can sometimes fail in the markets.

O'Neill is unrivaled in discerning the intrinsic quality of a stock, but he sometimes struggles.

Therefore, strictly adhering to statistically proven rules based on major market indices and trading volume can also be a key investment method.

In other words, readers can gain a sufficient understanding of the market timing methods introduced in this book and use them as a foundation for developing an objective perspective to create their own timing model.

Lessons from failure and the laws of psychological investing from legendary traders.

William O'Neil is arguably the most accomplished survivor in the world of investment banking, having survived for over 50 years.

As someone who has overcome all kinds of difficulties and persevered, I have personally witnessed and experienced countless cases of investment success and failure.

In particular, it is said that investors who have a dangerous mentality and are unable to control their money are at risk of ultimately self-destructing.

In the world of investing, we must learn how much psychological factors influence trading and how to deal with them.

"How We Made 18,000% Returns on Stocks" not only includes the trading rules that O'Neil emphasizes, but also includes "O'Neil's Ten Commandments," providing an opportunity to solidify the psychological aspects of trading in addition to the rules.

Moreover, even traders who have achieved historic returns have experienced numerous failures, and they detail their failures in this book.

That is, it helps market investors control their psychology and behavior by revealing their failures.

-Never be swayed

-Don't trade in fear.

-Keep your enemies closer than your friends.

-Never stop learning and improving.

-Never talk about your own stocks.

-Don't be too happy about being in the best position.

-Look at the weekly chart first.

Next, look at the daily chart.

Ignore the intraday charts

-Find the best stocks.

Next, find a way to buy big.

-Always be careful when sleeping with someone.

-Always be crazy focused

Learn how to spot the best buy signals and even master the selling rules of top traders.

William J. O'Neill and the William O'Neill Company

It would be a golden opportunity for stock investors to make money if they could learn how to trade from the world's best traders (O'Neil+Co., Inc.).

In particular, O'Neill's CAN SLIM investment method is famous for creating great wealth by utilizing both individual and institutional investors.

The practice of focusing on a few stocks by considering factors such as corporate fundamentals, chart patterns, market trends, and sector cycles has significantly influenced the trading practices of many investors to this day.

His disciples, Dr. Gil Morales and Dr. Chris Kacher, spent decades observing the markets while working at William O'Neil Company, further developing O'Neil's principles and investing themselves, creating their own practical, detailed rules.

Dr. Chris Kacher used both fundamental and technical analysis when buying stocks, and relied on technical analysis when selling.

In particular, Pocket Pivot is a signal that can be used to capture and utilize optimal buying opportunities with low risk by detecting buying and purchasing signals from institutional investors before a specific stock breaks through its low or consolidation phase and begins to rise.

It was perfectly applicable to the market from the 1970s to the 1990s, and is known to be a very useful trading method even in the recent market.

Another useful feature of Pocket Pivot is its ability to identify buying opportunities for small-cap stocks with low trading volume, liquidity, and low stock prices, making them difficult to invest in. Furthermore, these trading ideas provide readily available insights for current market participants.

Another notable strength of this book is that it covers in detail not only buying but also selling rules.

It can be of great help to current investors, as it provides a glimpse into the technical and psychological foundations of how to maximize profits.

Market Timing - The Art of Trading with Just One or Two Leading Stocks at the Optimal Time

Don't miss out on investment opportunities by identifying the right mid-term market direction!

Anyone who has the skills to determine the most ideal buying and selling times when investing in stocks will inevitably make a profit.

But systematically designing a model that tells us the 'optimal' time is a whole other problem.

Although it should be based on a rational and logical system, many timing models on the market tend to rely too much on past data.

Recently, there has been a growing number of services that claim to provide accurate stock investment timing based on artificial intelligence algorithms. However, most of these services are based on unknown data and lack logical explanations.

However, if used correctly, a proper market timing model can play a role in maximizing profits and minimizing losses.

Gil Morales and Chris Kacher also credit the market direction model as the reason they were able to participate in the market and record huge profits.

In other words, it is very important to predict the mid- to long-term market direction and then make investments.

In particular, he says, being able to capture the direction of a bull market and invest in the best leading stocks can be a way to dramatically increase returns.

Even an experienced investor like William O'Neil can sometimes fail in the markets.

O'Neill is unrivaled in discerning the intrinsic quality of a stock, but he sometimes struggles.

Therefore, strictly adhering to statistically proven rules based on major market indices and trading volume can also be a key investment method.

In other words, readers can gain a sufficient understanding of the market timing methods introduced in this book and use them as a foundation for developing an objective perspective to create their own timing model.

Lessons from failure and the laws of psychological investing from legendary traders.

William O'Neil is arguably the most accomplished survivor in the world of investment banking, having survived for over 50 years.

As someone who has overcome all kinds of difficulties and persevered, I have personally witnessed and experienced countless cases of investment success and failure.

In particular, it is said that investors who have a dangerous mentality and are unable to control their money are at risk of ultimately self-destructing.

In the world of investing, we must learn how much psychological factors influence trading and how to deal with them.

"How We Made 18,000% Returns on Stocks" not only includes the trading rules that O'Neil emphasizes, but also includes "O'Neil's Ten Commandments," providing an opportunity to solidify the psychological aspects of trading in addition to the rules.

Moreover, even traders who have achieved historic returns have experienced numerous failures, and they detail their failures in this book.

That is, it helps market investors control their psychology and behavior by revealing their failures.

-Never be swayed

-Don't trade in fear.

-Keep your enemies closer than your friends.

-Never stop learning and improving.

-Never talk about your own stocks.

-Don't be too happy about being in the best position.

-Look at the weekly chart first.

Next, look at the daily chart.

Ignore the intraday charts

-Find the best stocks.

Next, find a way to buy big.

-Always be careful when sleeping with someone.

-Always be crazy focused

GOODS SPECIFICS

- Date of issue: September 3, 2020

- Page count, weight, size: 488 pages | 828g | 176*248*30mm

- ISBN13: 9791188279845

- ISBN10: 118827984X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)