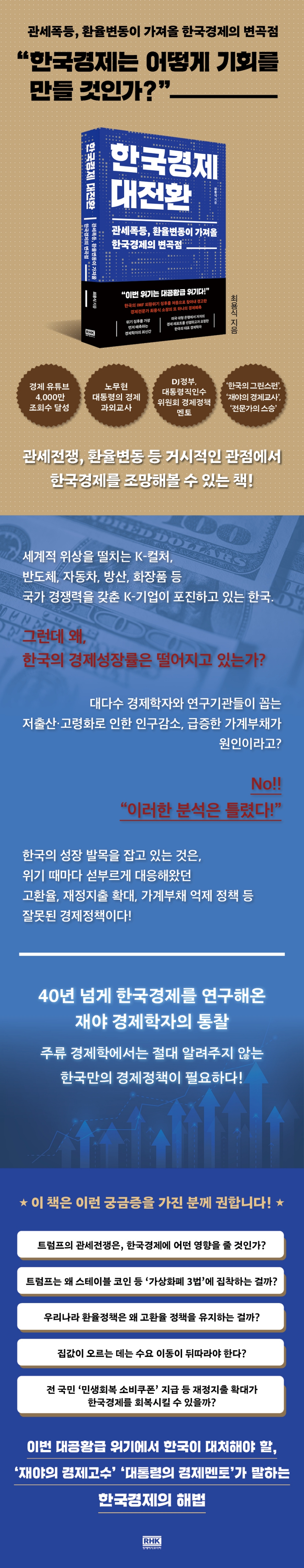

A major transformation of the Korean economy

|

Description

Book Introduction

★Economic YouTube Channel Reaches 40 Million Views! ★Another Crisis Signal from the Economist Who First Warned the IMF Crisis: "This Crisis is on a Level with the Great Depression!"

Signs of a crisis are now surfacing, accelerated by tariff hikes and exchange rate fluctuations.

Why is Trump so obsessed with enacting the "Three Cryptocurrency Laws," including stablecoins? Can issuing "People's Livelihood Recovery Consumption Coupons" to all citizens revitalize the Korean economy? From the true motive behind Trump's tariff obsession to how the Korean economy will cope with the crisis, now is a turning point for the Korean economy! This Korean economic strategy book contains a sharp economic analysis by Director Choi Yong-sik, the "President's Economic Mentor," who first identified and warned of the IMF foreign exchange crisis! A Korean economic forecast book that helps you understand the economy from a macro perspective!

Signs of a crisis are now surfacing, accelerated by tariff hikes and exchange rate fluctuations.

Why is Trump so obsessed with enacting the "Three Cryptocurrency Laws," including stablecoins? Can issuing "People's Livelihood Recovery Consumption Coupons" to all citizens revitalize the Korean economy? From the true motive behind Trump's tariff obsession to how the Korean economy will cope with the crisis, now is a turning point for the Korean economy! This Korean economic strategy book contains a sharp economic analysis by Director Choi Yong-sik, the "President's Economic Mentor," who first identified and warned of the IMF foreign exchange crisis! A Korean economic forecast book that helps you understand the economy from a macro perspective!

- You can preview some of the book's contents.

Preview

index

Prologue: Something More Fearsome Than a Trade War Is Coming

Chapter 1: The Trade War: The Trump Risk

Trump's crazy sword dance

History Proves the Failure of Protectionism

Trump's sudden policy shift

Could Trump's tariff war be the trigger for a financial crisis?

Why do financial crises recur?

The beginning of hidden danger

Signs of a bubble burst in the U.S. stock market

Signs of crisis are also visible in China, Japan, and the European Union.

Chapter 2: Weaponization of Tariffs and Dollar Hegemony

America's political and economic hegemony is being challenged

Why Trump Is Obsessed with Tariffs

The U.S. Current Account Deficit and the Exchange Rate Problem: The Inside Story of the 2010 Currency Dispute

The 'Yen' Shock: The Currency Dispute That Rocked 2013

Behind the trade disruption

Peter Navarro, architect of the tariff war

The Limits of the US's High Interest Rates and Strong Dollar Policy

Chapter 3: What Happens When You Ignore the Exchange Rate

Exchange rates influence the flow of a country's economy.

Exchange rates also cause credit crunches and economic surges.

Domestic demand is more important than exports

Increase transparency in exchange rate policy

To increase the dynamism of our economy

How are exchange rates determined?

Factors affecting the capital account

The impact of exchange rate fluctuations on competitiveness

Exchange rates and the rise and fall of nations

Chapter 4: What Japan, at a standstill, taught us

Japan's 30-year long recession

The collapse of the bubble economy that led to Japan's downfall

The reality brought about by repeated failed policies

The large current account surplus is the decisive cause.

Japan's fiscal policy did more harm than good

Chapter 5: Success and Failure of the Korean Economy

Why is Korea experiencing persistent economic difficulties?

Ideology is useless in reviving the economy.

Learning from the failures of past governments

Chapter 6: The Stock Market, Stock Investment, and the Trade War

Stock Market and K-Economics

Long-term cycle of the stock market

The Credit Destruction Principle as Seen in the Hanbo Bankruptcy

For successful stock investment

Trade war and the stock market

Stablecoin?

Epilogue: For a Better Future for the Korean Economy

Appendix Rewriting Economics

Chapter 1: The Trade War: The Trump Risk

Trump's crazy sword dance

History Proves the Failure of Protectionism

Trump's sudden policy shift

Could Trump's tariff war be the trigger for a financial crisis?

Why do financial crises recur?

The beginning of hidden danger

Signs of a bubble burst in the U.S. stock market

Signs of crisis are also visible in China, Japan, and the European Union.

Chapter 2: Weaponization of Tariffs and Dollar Hegemony

America's political and economic hegemony is being challenged

Why Trump Is Obsessed with Tariffs

The U.S. Current Account Deficit and the Exchange Rate Problem: The Inside Story of the 2010 Currency Dispute

The 'Yen' Shock: The Currency Dispute That Rocked 2013

Behind the trade disruption

Peter Navarro, architect of the tariff war

The Limits of the US's High Interest Rates and Strong Dollar Policy

Chapter 3: What Happens When You Ignore the Exchange Rate

Exchange rates influence the flow of a country's economy.

Exchange rates also cause credit crunches and economic surges.

Domestic demand is more important than exports

Increase transparency in exchange rate policy

To increase the dynamism of our economy

How are exchange rates determined?

Factors affecting the capital account

The impact of exchange rate fluctuations on competitiveness

Exchange rates and the rise and fall of nations

Chapter 4: What Japan, at a standstill, taught us

Japan's 30-year long recession

The collapse of the bubble economy that led to Japan's downfall

The reality brought about by repeated failed policies

The large current account surplus is the decisive cause.

Japan's fiscal policy did more harm than good

Chapter 5: Success and Failure of the Korean Economy

Why is Korea experiencing persistent economic difficulties?

Ideology is useless in reviving the economy.

Learning from the failures of past governments

Chapter 6: The Stock Market, Stock Investment, and the Trade War

Stock Market and K-Economics

Long-term cycle of the stock market

The Credit Destruction Principle as Seen in the Hanbo Bankruptcy

For successful stock investment

Trade war and the stock market

Stablecoin?

Epilogue: For a Better Future for the Korean Economy

Appendix Rewriting Economics

Detailed image

Into the book

In particular, it is a very serious problem that the U.S. tariff war is acting as a detonator that can trigger a financial crisis.

If a global financial crisis occurs, there is a high possibility that an economic crisis on the level of the Great Depression will occur.

This is because it occurs when a financial crisis and a tariff war overlap, just like the Great Depression of the 1930s.

In fact, the aftermath of the Great Depression at the time caused a devastating economic disaster around the world for over a decade.

--- p.6

The US Federal Reserve, having confirmed that a recession had begun in the first quarter of 2022, suddenly began implementing high interest rates and a strong dollar policy in March.

Normally, the base rate has been adjusted by 0.25%, but suddenly it was raised by 0.75% and then again by 0.5%.

At that time, the Federal Reserve insisted that high interest rates and a strong dollar policy were policy tools to alleviate price instability.

But this was a ploy to hide the real intention.

--- p.91

Our country's export dependence is reported to be close to 50% of GDP.

Our government believes so too.

But this analysis is wrong.

If export dependence is this high, it would have been normal for the 2008 growth rate to exceed 15%.

This is because the export growth rate converted into our currency at the time reached 34%.

But the actual growth rate was only 2.8%.

…Why was the government's belief wrong? Because exports are a measure of trade volume, and GDP is the total value added.

To compare these two, either transaction amount or added value must be converted into one and the standards must be aligned.

--- p.116

Immediately after the Roh Moo-hyun administration took office, the issue of household debt emerged as a social issue.

Household debt was a serious problem that could have a major impact on our economy.

I foresaw this situation coming, and around the end of 2002, I wrote a report on the household debt problem and handed it over directly to Roh Moo-hyun.

The key point was that if he takes power in the future, he should never touch the household debt issue.

--- p.215

So why is our country's growth rate declining year after year? It's because our government's economic policies continue to fail.

What economic policies have failed to keep the growth rate low? Among economic policies, the one that has led to the most critical failure is the "high exchange rate policy."

Policymakers emphasize that a rising exchange rate will increase exports and improve the domestic economy, but this is incorrect.

In cases where the current account is in surplus, when the exchange rate rises, exports actually decrease in the medium to long term and the growth rate also falls.

It is difficult to find counter-examples.

If a global financial crisis occurs, there is a high possibility that an economic crisis on the level of the Great Depression will occur.

This is because it occurs when a financial crisis and a tariff war overlap, just like the Great Depression of the 1930s.

In fact, the aftermath of the Great Depression at the time caused a devastating economic disaster around the world for over a decade.

--- p.6

The US Federal Reserve, having confirmed that a recession had begun in the first quarter of 2022, suddenly began implementing high interest rates and a strong dollar policy in March.

Normally, the base rate has been adjusted by 0.25%, but suddenly it was raised by 0.75% and then again by 0.5%.

At that time, the Federal Reserve insisted that high interest rates and a strong dollar policy were policy tools to alleviate price instability.

But this was a ploy to hide the real intention.

--- p.91

Our country's export dependence is reported to be close to 50% of GDP.

Our government believes so too.

But this analysis is wrong.

If export dependence is this high, it would have been normal for the 2008 growth rate to exceed 15%.

This is because the export growth rate converted into our currency at the time reached 34%.

But the actual growth rate was only 2.8%.

…Why was the government's belief wrong? Because exports are a measure of trade volume, and GDP is the total value added.

To compare these two, either transaction amount or added value must be converted into one and the standards must be aligned.

--- p.116

Immediately after the Roh Moo-hyun administration took office, the issue of household debt emerged as a social issue.

Household debt was a serious problem that could have a major impact on our economy.

I foresaw this situation coming, and around the end of 2002, I wrote a report on the household debt problem and handed it over directly to Roh Moo-hyun.

The key point was that if he takes power in the future, he should never touch the household debt issue.

--- p.215

So why is our country's growth rate declining year after year? It's because our government's economic policies continue to fail.

What economic policies have failed to keep the growth rate low? Among economic policies, the one that has led to the most critical failure is the "high exchange rate policy."

Policymakers emphasize that a rising exchange rate will increase exports and improve the domestic economy, but this is incorrect.

In cases where the current account is in surplus, when the exchange rate rises, exports actually decrease in the medium to long term and the growth rate also falls.

It is difficult to find counter-examples.

--- p.270

Publisher's Review

A Great Depression-level crisis accelerated by tariff hikes and exchange rate fluctuations.

“How will the Korean economy create opportunities?”

★ Economic YouTube channel reaches 40 million views

★ President Roh Moo-hyun's economic tutor

★ DJ government, Presidential Transition Committee economic policy mentor

★ 'Korea's Greenspan', 'Economics Teacher in the Field', 'Expert's Teacher'

An economist who has studied the Korean economy for over 40 years

Watch out for the warning siren

As of early this year, Korea's economic growth rate announced by major institutions was in the 1.8% range.

Now, after the second quarter, it has been revised downward to 0.8%.

The Korean economy faces a gloomy future with 0% growth.

This year in particular, with the inauguration of the second Trump administration, the global chaos and uncertainty caused by the tariff war are growing, and Korea is also facing chaos due to the president's impeachment and re-election.

Governments around the world are taking policy responses.

South Korea is also making every effort to revive its economy, including by issuing "livelihood recovery consumption coupons" to all citizens.

Externally, Korea's K-culture is currently gaining recognition around the world, and many K-companies representing Korea, such as semiconductors, automobiles, defense, and cosmetics, are globally competitive.

But despite Korea's industrial competitiveness and cultural foundation, why does its economic growth rate continue to decline? Most economic experts point to the rapidly declining birth rate and aging population, which are reducing Korea's productivity.

In addition, it is said that household debt at a dangerous level is a factor that lowers the potential growth rate.

The author of this book, “The Great Transformation of the Korean Economy,” strongly says “NO” to this.

Choi Yong-sik, known as the "economic expert in the field," says that rapid population decline and rapidly increasing household debt are not the core problems of the Korean economy.

This is because Ireland has the highest GDP per capita even though its population has been halved, and if statistics are properly reflected, our country's household debt is not at a dangerous level.

So what is the fundamental problem? The author emphasizes, "The problem with the Korean economy is the failure of economic policy."

The hasty judgments made by our government and economic experts whenever rumors of an economic crisis emerge are holding back the Korean economy.

Choi Yong-sik, director of the 21st Century Economics Research Institute, appeared on an economic YouTube channel and garnered a heated response, garnering 40 million cumulative views, with his statement, “The world is on the verge of a great depression!” “Stocks, real estate, gold—everything is going to be in shambles!” “Trust me!”

He is the only economist who predicted Korea's IMF economic crisis and the 2008 financial crisis.

We established an economic research institute and provided reports containing economic diagnoses and forecasts to our membership, but a large American bank even requested that we release the report in advance to them.

However, the author, who says that his pride as a Korean economist could never allow this, was known as an “economics teacher in the field” while working as an economic policy mentor for the Presidential Transition Committee at the time of the launch of the People’s Government and as an economics tutor for President Roh Moo-hyun during the Participatory Government.

He is once again sounding the warning siren, saying that the signs of crisis brought about by the tariff hike and exchange rate fluctuation triggered by Trump this time are "an unprecedented crisis, a crisis on par with the Great Depression."

This crisis, which is expected to be a new turning point for the Korean economy, is causing this crisis, and what and how should we respond? This book presents an economic strategy for Korea, a developed nation, presented by an economist who has studied the Korean economy for over 40 years.

It boldly suggests the reality of the Korean economy and solutions that conventional economics fails to reveal.

"Something scarier than a tariff war is coming."

Triggering the financial crisis

In January 2025, President Trump took office and immediately launched an aggressive tariff war against the world, issuing dozens of executive orders.

What will be the future consequences of the tariff war and policy volatility unleashed by Trump? Many economic experts predict that the tariff war initiated by the United States will have a tragic ending.

The reason is clear.

Because ‘protectionism’ such as a tariff war would deal a blow to the global economy and bring disaster to the U.S. economy.

Economist Choi Yong-sik, who is quicker than anyone to detect signs of an economic crisis, points out that the outbreak of the tariff war while the U.S. Federal Reserve is barely preventing a financial crisis is a more serious problem.

They also warn that the level of the crisis is 'Great Depression-level'.

Will Trump's tariff war truly serve as the detonator that triggers a financial crisis, as the author predicts? Director Choi Yong-sik argues that the US economy will ultimately fall into a vicious cycle of "reduced material production."

In such a case, the stock market would be on the verge of collapse, the operating results of American companies would deteriorate significantly, and the same would apply to financial institutions.

Then, a financial crisis could erupt if a deposit run occurs at a financial institution or a redemption of financial products occurs.

If a financial crisis like this occurs, the financial crisis in the United States will immediately spread throughout the world.

Our country's economy will also find it difficult to avoid the blow.

So, how far has the crisis reached? The author argues that the US current account deficit is, in fact, on the verge of reaching a dangerous level, rising from 2.1% of GDP in 2019 to 3.9% of GDP in 2024.

A crisis is about to rise above the water!

Why Trump Is Obsessed with Tariffs

"A tariff war is a currency war."

Historically, tariff wars have not only never been successful, but have also repeatedly caused serious instability in financial markets.

So why doesn't President Trump give up the tariff war? This book argues that the true purpose of the tariff war lies elsewhere.

In fact, the hidden purpose was revealed in April 2025 when a report written by Steve Miran, chairman of the White House Council of Economic Advisers, in November 2024 was belatedly revealed.

That is, by detonating a tariff bomb on a country manipulating its exchange rate, we will induce that country's exchange rate to fall!

China and Japan are cited as representative currency manipulators.

The U.S. government has also designated our country as a 'currency monitoring country.'

The United States believes that our government is manipulating the exchange rate.

This book examines the hidden economic intentions and behaviors of each country, including the intensifying currency dispute between the United States and China, Japan's increasing exchange rate while keeping an eye on neighboring countries, and the United States' willingness to wage a tariff war to maintain its dollar hegemony.

“Now is the turning point that will change the Korean economy’s exchange rate policy!”

It's time to heed the warnings of an economist who has studied the Korean economy for over 40 years.

How should the Korean economy navigate the ongoing trade war and the resulting global economic crisis? "The Great Transformation of the Korean Economy" begins by examining the economic growth rates of successive Korean administrations.

The average growth rate has continued to decline with each change in government: 5.7% under the Kim Dae-jung administration, 4.7% under the Roh Moo-hyun administration, 3.4% under the Lee Myung-bak administration, 3.2% under the Park Geun-hye administration, 2.6% under the Moon Jae-in administration, and 2.0% under the Yoon Seok-yeol administration.

No government has been able to reverse the decline in growth.

What is the reason?

Economists and economic research institutes usually analyze that Korea's potential growth rate has fallen.

They often cite the rapidly progressing problems of low birth rates and aging population, as well as the increasing household debt, as reasons.

However, Director Choi Yong-sik says that these factors are not insurmountable problems.

Wrong analysis leads to wrong response.

The author has presented a diagnosis based on his experience working directly in the government as an economic mentor to the president and over 40 years of economic research as an independent economist.

“The problem with the Korean economy is the failure of economic policy!”

Let's look at an anecdote about a government policy proposal he made as President Roh Moo-hyun's economic mentor.

The author suggested that President Roh Moo-hyun and the participatory government change their policy direction, urging them to never touch the household debt problem.

However, he confessed that it was not easy to abandon familiar policies and implement new ones, and that his own advice was ultimately not accepted.

Among them, the proposal he had made regarding the “exchange rate” was reflected, and the author wrote about the situation at the time as follows.

Fortunately, one economic policy of the Roh Moo-hyun administration was successful and played a role in alleviating the economic crisis.

It is an economic policy that allows the exchange rate to fall gradually due to market functions.

This policy was also one I advised.

This policy was implemented as I recommended, despite fierce resistance from the bureaucracy.

As a result, the exchange rate fell from 1,326 won at the end of 2001 to 1,200 won at the end of 2002, and has continued to fall further since then.

In October 2007, it fell to 899 won at one point.

Even though the exchange rate continued to fall (economics explains that in this case, exports decrease), our country's exports have consistently recorded a high growth rate, as shown in the table above.

Rather, export growth rates were much higher than at other times and were sustained for a longer period.

The current account surplus also grew every year.

(pp218~219)

Most economists and policymakers argue that since our country's exports account for nearly half of its GDP, a rise in the exchange rate will increase exports and improve the domestic economy.

But the author strongly says “NO.”

This view is wrong.

Because exports are total sales and GDP is total value added.

If we match that standard, exports will not even reach 10% of GDP.

On the other hand, he claims that domestic demand exceeds 90% of GDP.

Therefore, the author emphasizes that a gradual decline in the exchange rate is essential for the continued growth of the Korean economy.

In addition, they say that the fact that statistics on the increase in household debt in our country, which is at a serious risk level, are being manipulated is even more serious.

The problem is that it doesn't adhere to established standards. According to the standards published in accordance with the IMF's statistical manual, Korea's household debt ratio falls below 90%.

The author criticizes Korea's economic experts and policymakers for remaining trapped in a "wall of thinking" while still following Japan's failed exchange rate policy.

“Now abandon failed economic policies!”

This book emphasizes that it is time to abandon the policies that Korea has previously pursued, such as high exchange rates, increased fiscal spending, lower interest rates, and suppression of household debt, and to build an advanced economy with its own unique economic strategy.

It examines the impact of the current crisis on the Korean economy, provides insight into why the economic policies of past governments have repeatedly failed during each crisis, and presents solutions unique to the future Korean economy.

The strategies for the Korean economy contained in this book are filled with the sharp economic diagnoses, in-depth economic forecasts, and insights that develop the logic of an economist who has studied the Korean economy for over 40 years.

This book provides a keen insight into the future of the Korean economy, something that conventional economics has not been able to provide.

“How will the Korean economy create opportunities?”

★ Economic YouTube channel reaches 40 million views

★ President Roh Moo-hyun's economic tutor

★ DJ government, Presidential Transition Committee economic policy mentor

★ 'Korea's Greenspan', 'Economics Teacher in the Field', 'Expert's Teacher'

An economist who has studied the Korean economy for over 40 years

Watch out for the warning siren

As of early this year, Korea's economic growth rate announced by major institutions was in the 1.8% range.

Now, after the second quarter, it has been revised downward to 0.8%.

The Korean economy faces a gloomy future with 0% growth.

This year in particular, with the inauguration of the second Trump administration, the global chaos and uncertainty caused by the tariff war are growing, and Korea is also facing chaos due to the president's impeachment and re-election.

Governments around the world are taking policy responses.

South Korea is also making every effort to revive its economy, including by issuing "livelihood recovery consumption coupons" to all citizens.

Externally, Korea's K-culture is currently gaining recognition around the world, and many K-companies representing Korea, such as semiconductors, automobiles, defense, and cosmetics, are globally competitive.

But despite Korea's industrial competitiveness and cultural foundation, why does its economic growth rate continue to decline? Most economic experts point to the rapidly declining birth rate and aging population, which are reducing Korea's productivity.

In addition, it is said that household debt at a dangerous level is a factor that lowers the potential growth rate.

The author of this book, “The Great Transformation of the Korean Economy,” strongly says “NO” to this.

Choi Yong-sik, known as the "economic expert in the field," says that rapid population decline and rapidly increasing household debt are not the core problems of the Korean economy.

This is because Ireland has the highest GDP per capita even though its population has been halved, and if statistics are properly reflected, our country's household debt is not at a dangerous level.

So what is the fundamental problem? The author emphasizes, "The problem with the Korean economy is the failure of economic policy."

The hasty judgments made by our government and economic experts whenever rumors of an economic crisis emerge are holding back the Korean economy.

Choi Yong-sik, director of the 21st Century Economics Research Institute, appeared on an economic YouTube channel and garnered a heated response, garnering 40 million cumulative views, with his statement, “The world is on the verge of a great depression!” “Stocks, real estate, gold—everything is going to be in shambles!” “Trust me!”

He is the only economist who predicted Korea's IMF economic crisis and the 2008 financial crisis.

We established an economic research institute and provided reports containing economic diagnoses and forecasts to our membership, but a large American bank even requested that we release the report in advance to them.

However, the author, who says that his pride as a Korean economist could never allow this, was known as an “economics teacher in the field” while working as an economic policy mentor for the Presidential Transition Committee at the time of the launch of the People’s Government and as an economics tutor for President Roh Moo-hyun during the Participatory Government.

He is once again sounding the warning siren, saying that the signs of crisis brought about by the tariff hike and exchange rate fluctuation triggered by Trump this time are "an unprecedented crisis, a crisis on par with the Great Depression."

This crisis, which is expected to be a new turning point for the Korean economy, is causing this crisis, and what and how should we respond? This book presents an economic strategy for Korea, a developed nation, presented by an economist who has studied the Korean economy for over 40 years.

It boldly suggests the reality of the Korean economy and solutions that conventional economics fails to reveal.

"Something scarier than a tariff war is coming."

Triggering the financial crisis

In January 2025, President Trump took office and immediately launched an aggressive tariff war against the world, issuing dozens of executive orders.

What will be the future consequences of the tariff war and policy volatility unleashed by Trump? Many economic experts predict that the tariff war initiated by the United States will have a tragic ending.

The reason is clear.

Because ‘protectionism’ such as a tariff war would deal a blow to the global economy and bring disaster to the U.S. economy.

Economist Choi Yong-sik, who is quicker than anyone to detect signs of an economic crisis, points out that the outbreak of the tariff war while the U.S. Federal Reserve is barely preventing a financial crisis is a more serious problem.

They also warn that the level of the crisis is 'Great Depression-level'.

Will Trump's tariff war truly serve as the detonator that triggers a financial crisis, as the author predicts? Director Choi Yong-sik argues that the US economy will ultimately fall into a vicious cycle of "reduced material production."

In such a case, the stock market would be on the verge of collapse, the operating results of American companies would deteriorate significantly, and the same would apply to financial institutions.

Then, a financial crisis could erupt if a deposit run occurs at a financial institution or a redemption of financial products occurs.

If a financial crisis like this occurs, the financial crisis in the United States will immediately spread throughout the world.

Our country's economy will also find it difficult to avoid the blow.

So, how far has the crisis reached? The author argues that the US current account deficit is, in fact, on the verge of reaching a dangerous level, rising from 2.1% of GDP in 2019 to 3.9% of GDP in 2024.

A crisis is about to rise above the water!

Why Trump Is Obsessed with Tariffs

"A tariff war is a currency war."

Historically, tariff wars have not only never been successful, but have also repeatedly caused serious instability in financial markets.

So why doesn't President Trump give up the tariff war? This book argues that the true purpose of the tariff war lies elsewhere.

In fact, the hidden purpose was revealed in April 2025 when a report written by Steve Miran, chairman of the White House Council of Economic Advisers, in November 2024 was belatedly revealed.

That is, by detonating a tariff bomb on a country manipulating its exchange rate, we will induce that country's exchange rate to fall!

China and Japan are cited as representative currency manipulators.

The U.S. government has also designated our country as a 'currency monitoring country.'

The United States believes that our government is manipulating the exchange rate.

This book examines the hidden economic intentions and behaviors of each country, including the intensifying currency dispute between the United States and China, Japan's increasing exchange rate while keeping an eye on neighboring countries, and the United States' willingness to wage a tariff war to maintain its dollar hegemony.

“Now is the turning point that will change the Korean economy’s exchange rate policy!”

It's time to heed the warnings of an economist who has studied the Korean economy for over 40 years.

How should the Korean economy navigate the ongoing trade war and the resulting global economic crisis? "The Great Transformation of the Korean Economy" begins by examining the economic growth rates of successive Korean administrations.

The average growth rate has continued to decline with each change in government: 5.7% under the Kim Dae-jung administration, 4.7% under the Roh Moo-hyun administration, 3.4% under the Lee Myung-bak administration, 3.2% under the Park Geun-hye administration, 2.6% under the Moon Jae-in administration, and 2.0% under the Yoon Seok-yeol administration.

No government has been able to reverse the decline in growth.

What is the reason?

Economists and economic research institutes usually analyze that Korea's potential growth rate has fallen.

They often cite the rapidly progressing problems of low birth rates and aging population, as well as the increasing household debt, as reasons.

However, Director Choi Yong-sik says that these factors are not insurmountable problems.

Wrong analysis leads to wrong response.

The author has presented a diagnosis based on his experience working directly in the government as an economic mentor to the president and over 40 years of economic research as an independent economist.

“The problem with the Korean economy is the failure of economic policy!”

Let's look at an anecdote about a government policy proposal he made as President Roh Moo-hyun's economic mentor.

The author suggested that President Roh Moo-hyun and the participatory government change their policy direction, urging them to never touch the household debt problem.

However, he confessed that it was not easy to abandon familiar policies and implement new ones, and that his own advice was ultimately not accepted.

Among them, the proposal he had made regarding the “exchange rate” was reflected, and the author wrote about the situation at the time as follows.

Fortunately, one economic policy of the Roh Moo-hyun administration was successful and played a role in alleviating the economic crisis.

It is an economic policy that allows the exchange rate to fall gradually due to market functions.

This policy was also one I advised.

This policy was implemented as I recommended, despite fierce resistance from the bureaucracy.

As a result, the exchange rate fell from 1,326 won at the end of 2001 to 1,200 won at the end of 2002, and has continued to fall further since then.

In October 2007, it fell to 899 won at one point.

Even though the exchange rate continued to fall (economics explains that in this case, exports decrease), our country's exports have consistently recorded a high growth rate, as shown in the table above.

Rather, export growth rates were much higher than at other times and were sustained for a longer period.

The current account surplus also grew every year.

(pp218~219)

Most economists and policymakers argue that since our country's exports account for nearly half of its GDP, a rise in the exchange rate will increase exports and improve the domestic economy.

But the author strongly says “NO.”

This view is wrong.

Because exports are total sales and GDP is total value added.

If we match that standard, exports will not even reach 10% of GDP.

On the other hand, he claims that domestic demand exceeds 90% of GDP.

Therefore, the author emphasizes that a gradual decline in the exchange rate is essential for the continued growth of the Korean economy.

In addition, they say that the fact that statistics on the increase in household debt in our country, which is at a serious risk level, are being manipulated is even more serious.

The problem is that it doesn't adhere to established standards. According to the standards published in accordance with the IMF's statistical manual, Korea's household debt ratio falls below 90%.

The author criticizes Korea's economic experts and policymakers for remaining trapped in a "wall of thinking" while still following Japan's failed exchange rate policy.

“Now abandon failed economic policies!”

This book emphasizes that it is time to abandon the policies that Korea has previously pursued, such as high exchange rates, increased fiscal spending, lower interest rates, and suppression of household debt, and to build an advanced economy with its own unique economic strategy.

It examines the impact of the current crisis on the Korean economy, provides insight into why the economic policies of past governments have repeatedly failed during each crisis, and presents solutions unique to the future Korean economy.

The strategies for the Korean economy contained in this book are filled with the sharp economic diagnoses, in-depth economic forecasts, and insights that develop the logic of an economist who has studied the Korean economy for over 40 years.

This book provides a keen insight into the future of the Korean economy, something that conventional economics has not been able to provide.

GOODS SPECIFICS

- Date of issue: August 20, 2025

- Page count, weight, size: 332 pages | 584g | 152*225*20mm

- ISBN13: 9788925573199

- ISBN10: 8925573199

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)