Eventually you end up buying an apartment.

|

Description

Book Introduction

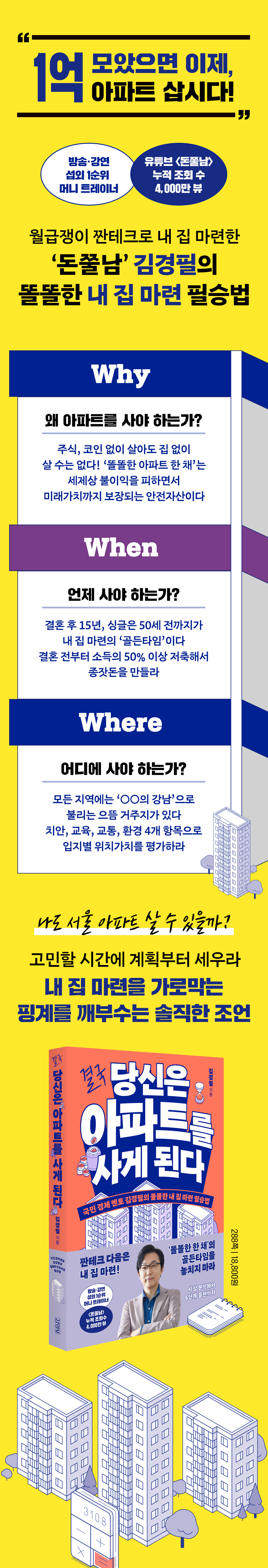

"Now that we've saved 100 million won, let's buy an apartment."

Money Trainer Kim Kyung-pil's

A surefire way to own a smart home that will ease your lifelong financial worries.

Money trainer Kim Kyung-pil has stepped forward to help those who cannot even try to buy a home due to strong real estate control policies and apartment prices that are breaking new records every day.

He has presented hard-hitting diagnoses and practical solutions on various TV shows and YouTube channels, including “High-End Salt Struggler” and “Save Me Holmes,” and he shows the way to realize the dream of owning a home, which anyone who saves money has thought about at least once.

It is packed with practical homeownership plans and know-how based on the author's own experience and the cases of actual homebuyers, as well as the economics of housing prices.

Are you saying you can't buy a home because housing prices are so high? No, you can't buy a home without giving up your current lifestyle.

Should I really buy a house? Yes, owning a home is the safest way to protect your hard-earned money.

The most practical financial roadmap for everyone: those in their 20s and 30s wondering whether to buy a home, those in their 30s and 40s trying to figure out where to start, and those in their 40s and 50s looking to take things to the next level, whether they should move to a better home.

Money Trainer Kim Kyung-pil's

A surefire way to own a smart home that will ease your lifelong financial worries.

Money trainer Kim Kyung-pil has stepped forward to help those who cannot even try to buy a home due to strong real estate control policies and apartment prices that are breaking new records every day.

He has presented hard-hitting diagnoses and practical solutions on various TV shows and YouTube channels, including “High-End Salt Struggler” and “Save Me Holmes,” and he shows the way to realize the dream of owning a home, which anyone who saves money has thought about at least once.

It is packed with practical homeownership plans and know-how based on the author's own experience and the cases of actual homebuyers, as well as the economics of housing prices.

Are you saying you can't buy a home because housing prices are so high? No, you can't buy a home without giving up your current lifestyle.

Should I really buy a house? Yes, owning a home is the safest way to protect your hard-earned money.

The most practical financial roadmap for everyone: those in their 20s and 30s wondering whether to buy a home, those in their 30s and 40s trying to figure out where to start, and those in their 40s and 50s looking to take things to the next level, whether they should move to a better home.

- You can preview some of the book's contents.

Preview

index

Preface: Why This Book Was Published

Chapter 1.

When it comes to buying a home, choose a "smart apartment."

1.

Smart apartments, why are they so important?

2.

Self-made millionaires choose apartments over stocks.

3.

The secret to the 'surpassing' returns of a single smart home

4.

Housing prices are moving from polarization to hyperpolarization.

5.

Four Conditions for the Local "Gangnam" That's Sprung Up Everywhere

6.

Seoul's representative prime residential areas, Yeouido and Gangnam

7.

The phenomenon of apartment crowding is ultimately due to the desire for safety.

8.

A growing number of high-income households are eyeing Gangnam.

Chapter 2.

Knowing the price of a home reveals the path to owning one.

1.

What makes up a house price?

2.

Understanding the trends in jeonse and monthly rents can help you predict future apartment prices.

3.

Newly built Gangnam Han River view, another name for luxury

4.

Ultra-high-end apartments are a guaranteed gourmet restaurant.

5.

The era of disappearing middle risk and middle return

6.

Why price increases vary across regions

7.

Smart Apartment, how long will the price go up?

8. If you don't understand BTS's popularity, give up on investing.

Chapter 3.

Smart Apartment: Saying you can't afford it is just an excuse.

1.

Did the author of the best-selling book on financial management actually succeed in financial management?

2.

Is it true that people can't buy a house because house prices have gone up so much?

3.

Is it okay to tie up all your assets in one apartment?

4.

How much can two people save together?

5.

What are the 'five enemies' that interfere with the preparation of a smart house?

Chapter 4.

6 Plans for a Smart Apartment

1.

Buy your own home within 15 years of marriage, or by 50 if you're single.

2.

Create financial goals before you get married.

3.

Draw the big picture of area, size, and shape early.

4.

The basic seed money is regular savings.

5.

Don't buy a house with cash

6.

Build a stepping stone with subscription savings

Chapter 5.

Practical tips for buying a home

1.

How much loan should I get to buy something without any problems?

2.

Analysis of asking prices, market prices, actual transaction prices, and urgent sales prices

3.

Why You Should Befriend Your Real Estate Agent

4.

Even if you can't catch a quick sale, you shouldn't buy it too expensively.

5.

No regrets about selling your feet: A 6-step execution process

Appendix_Useful Sites to Know

Chapter 1.

When it comes to buying a home, choose a "smart apartment."

1.

Smart apartments, why are they so important?

2.

Self-made millionaires choose apartments over stocks.

3.

The secret to the 'surpassing' returns of a single smart home

4.

Housing prices are moving from polarization to hyperpolarization.

5.

Four Conditions for the Local "Gangnam" That's Sprung Up Everywhere

6.

Seoul's representative prime residential areas, Yeouido and Gangnam

7.

The phenomenon of apartment crowding is ultimately due to the desire for safety.

8.

A growing number of high-income households are eyeing Gangnam.

Chapter 2.

Knowing the price of a home reveals the path to owning one.

1.

What makes up a house price?

2.

Understanding the trends in jeonse and monthly rents can help you predict future apartment prices.

3.

Newly built Gangnam Han River view, another name for luxury

4.

Ultra-high-end apartments are a guaranteed gourmet restaurant.

5.

The era of disappearing middle risk and middle return

6.

Why price increases vary across regions

7.

Smart Apartment, how long will the price go up?

8. If you don't understand BTS's popularity, give up on investing.

Chapter 3.

Smart Apartment: Saying you can't afford it is just an excuse.

1.

Did the author of the best-selling book on financial management actually succeed in financial management?

2.

Is it true that people can't buy a house because house prices have gone up so much?

3.

Is it okay to tie up all your assets in one apartment?

4.

How much can two people save together?

5.

What are the 'five enemies' that interfere with the preparation of a smart house?

Chapter 4.

6 Plans for a Smart Apartment

1.

Buy your own home within 15 years of marriage, or by 50 if you're single.

2.

Create financial goals before you get married.

3.

Draw the big picture of area, size, and shape early.

4.

The basic seed money is regular savings.

5.

Don't buy a house with cash

6.

Build a stepping stone with subscription savings

Chapter 5.

Practical tips for buying a home

1.

How much loan should I get to buy something without any problems?

2.

Analysis of asking prices, market prices, actual transaction prices, and urgent sales prices

3.

Why You Should Befriend Your Real Estate Agent

4.

Even if you can't catch a quick sale, you shouldn't buy it too expensively.

5.

No regrets about selling your feet: A 6-step execution process

Appendix_Useful Sites to Know

Detailed image

Into the book

Why have I endured for twenty years, carrying that cross-like house on my shoulders, refusing to give up? I asked myself.

The answer that came from within me was simple.

“Because it’s home.”

“Because this is the house I live in.”

If it weren't for the house, would I have been able to keep this much money for this long?

--- p.36

Housing prices are relative.

Even if the price of our apartment goes up by 50 million won, if the price of the apartment across the street goes up by 100 million won, our apartment's price will go down by 50 million won.

Even if there is good news in our region, if there is relatively better news in other regions, we cannot see that the value of our region has increased.

--- p.92

If it is classified as a safe asset in the market, its price will continue to rise endlessly, and if its safety is even slightly questioned, it will repeatedly fall endlessly.

It seems like the saying, 'Only those who can do it will do it' fits perfectly.

We are now living in an era where middle risk-middle return is completely disappearing.

--- p.138

Everyone who heard the story of my home purchase remembers only that bold decision to buy an apartment in Gangnam.

What really mattered was not the judgment but the strong saving power to save 310 million won.

Without it, I wouldn't have even been able to attempt this type of investment.

--- p.174

So, what's the appropriate cost for a car? While opinions vary, the following principles are essential for achieving the goal of owning a smart car in the metropolitan area on time.

The cost of a vehicle, i.e. transportation costs, should be appropriately 5% of household income, and in special cases, it is desirable that it does not exceed 7%.

--- p.200

In fact, she hated loans, so at first she insisted that she would not buy a house until she had at least 80% of the house's value as a down payment.

If I hadn't borrowed 60% of the house's value back then, the house would have become unaffordable with the money I had saved so far.

There is something you must remember here.

The fact is that borrowing money from others can be a good loan or a bad debt depending on its nature.

--- p.240

Since a place with a good location inevitably has a higher average price increase rate, if you receive the same level of loan with the same capital, the smaller the target balance, the more advantageous it is to live in a better location.

So, when a person without a home buys their first home, it is a good decision for the future to buy one that is around 20 pyeong rather than one that is over 30 pyeong.

Recently, if you look at YouTube, you will see provocative titles like “30 pyeong is over now” that make it seem like the popularity of 30 pyeong apartments will decline, but I don’t think that’s necessarily the case.

However, if you buy your first home in the 30 pyeong range, it can be an obstacle to moving to a higher location with limited capital.

The answer that came from within me was simple.

“Because it’s home.”

“Because this is the house I live in.”

If it weren't for the house, would I have been able to keep this much money for this long?

--- p.36

Housing prices are relative.

Even if the price of our apartment goes up by 50 million won, if the price of the apartment across the street goes up by 100 million won, our apartment's price will go down by 50 million won.

Even if there is good news in our region, if there is relatively better news in other regions, we cannot see that the value of our region has increased.

--- p.92

If it is classified as a safe asset in the market, its price will continue to rise endlessly, and if its safety is even slightly questioned, it will repeatedly fall endlessly.

It seems like the saying, 'Only those who can do it will do it' fits perfectly.

We are now living in an era where middle risk-middle return is completely disappearing.

--- p.138

Everyone who heard the story of my home purchase remembers only that bold decision to buy an apartment in Gangnam.

What really mattered was not the judgment but the strong saving power to save 310 million won.

Without it, I wouldn't have even been able to attempt this type of investment.

--- p.174

So, what's the appropriate cost for a car? While opinions vary, the following principles are essential for achieving the goal of owning a smart car in the metropolitan area on time.

The cost of a vehicle, i.e. transportation costs, should be appropriately 5% of household income, and in special cases, it is desirable that it does not exceed 7%.

--- p.200

In fact, she hated loans, so at first she insisted that she would not buy a house until she had at least 80% of the house's value as a down payment.

If I hadn't borrowed 60% of the house's value back then, the house would have become unaffordable with the money I had saved so far.

There is something you must remember here.

The fact is that borrowing money from others can be a good loan or a bad debt depending on its nature.

--- p.240

Since a place with a good location inevitably has a higher average price increase rate, if you receive the same level of loan with the same capital, the smaller the target balance, the more advantageous it is to live in a better location.

So, when a person without a home buys their first home, it is a good decision for the future to buy one that is around 20 pyeong rather than one that is over 30 pyeong.

Recently, if you look at YouTube, you will see provocative titles like “30 pyeong is over now” that make it seem like the popularity of 30 pyeong apartments will decline, but I don’t think that’s necessarily the case.

However, if you buy your first home in the 30 pyeong range, it can be an obstacle to moving to a higher location with limited capital.

--- p.251

Publisher's Review

Money Trainer Kim Kyung-pil's

The Surefire Way to Buy a Smart Home That Will Ease Your Lifetime Financial Worries

"Now that we've saved 100 million won, let's buy an apartment."

Buying a house is an investment of money that you have worked hard to save throughout your life.

For those who cannot even try to buy a home due to the strong real estate control policy and apartment prices that are breaking new records every day, money trainer Kim Kyung-pil has stepped forward.

“There is a barrier to entry when it comes to buying a home, namely the initial capital.

But wouldn't it be tempting to cross that barrier if you knew exactly what awaited you beyond it?

Kim Kyung-pil, who has provided hard-hitting diagnoses and practical solutions to those who want to make money through various broadcasts such as “High-End Salt Struggler” and “Help Me, Holmes” and YouTube, has now gone one step further in “You Will Buy an Apartment in the End” to show the way to realize the dream of owning a home that anyone who saves money has thought about at least once.

The author saved 1.24 million won out of his 1.55 million won monthly salary when he was a young adult and took out a loan to move into an apartment in Gangnam before he turned 40.

He had to move out of his home twice to pay off his mortgage, but that decision turned out to be one of his most successful financial decisions.

However, the era where “any apartment you buy will go up in price is over.

“If you gather your soul and buy it anywhere, you will be ruined.”

He offers cool advice to those who want to buy an apartment among their homes, and a smart one among their apartments.

Are you saying you can't buy a home because housing prices are so high? No, you can't buy a home without giving up your current lifestyle.

Should I really buy a house? Yes, owning a home is the safest way to protect your hard-earned money.

Gangnam apartments that went from 700 million won to 2.8 billion won are no longer someone else's story.

"You'll Buy an Apartment in the End" is packed with homebuying plans and know-how based on the author's own experience and the cases of actual buyers, including the factors that determine home prices and how to develop an eye for finding a good apartment.

The most practical financial roadmap for everyone: those in their 20s and 30s wondering whether to buy a home, those in their 30s and 40s trying to figure out where to start, and those in their 40s and 50s looking to take things to the next level, whether they should move to a better home.

In an era where everyone is heading to the 'upscale Gangnam', where is my home?

From the economics of housing prices to practical tips for owning a home.

· Why Smart Apartments Matter: The "Extraordinary" Returns Chosen by Self-Made Millionaires

It's a loss to rent a house.

Even if you don't buy a house, you'll still have to spend about 60% of the house price on housing costs, such as the deposit, and invest the remaining assets elsewhere to generate a return greater than the increase in house price each time.

But that is nearly impossible.

One smart apartment guarantees returns that are greater than the returns of a typical stock investment and two average apartments.

In Korea, no tax is paid on income generated from one house per household up to a transfer price of 1.2 billion won. Even if the house is expensive and is over 1.2 billion won, if it is held for more than 10 years, 80% of the excess amount is deducted from the transfer income.

A smart apartment with a high purpose of actual residence is like a blue chip that guarantees future value while avoiding tax disadvantages.

What is a smart apartment, and how do you know which one is right for you? Identify the right price and focus on location.

The price of a house is determined by its use value and investment value, and location value, one of the use values, is the most important of the core.

In other words, a smart apartment is a small to medium-sized apartment with excellent location value in a preferred area.

Like '-ridan-gil' across the country, each region has a prime residential area (Gangnam) that is good for living and investing.

Neither elasticity nor balance is important.

You should set a financial goal and choose the area with the highest location value within your living area.

Security, education, transportation, and nature are the most important criteria for choosing a prime residential area.

· How to Make a Smart Apartment Yours: From Savings Planning to Execution

Although the population is declining, life expectancy and active years are increasing, so the author says that people should start planning for home ownership now rather than waiting for housing prices to fall.

Young adults entering society must save 40-50% of their income to create seed money, and must build up their financial resources through dual-income families for up to 15 years after marriage.

Since single people have relatively lower incomes, they should buy their own home by the age of 50 (15 years before retirement age).

The author also provides detailed information on how much a loan is appropriate for your income level, the differences between asking price, market price, actual transaction price, and quick sale price, and how to avoid houses that are overpriced beyond their value.

The author's six-step approach guarantees a regret-free forestry experience.

Gangnam apartments worth 700 million to 2.8 billion won - does that still sound like someone else's story?

Excuses only prolong the period of homelessness.

Still hesitating to buy a home? Buying a smart home is a race against time.

Income, housing prices, and living expenses are all rising rapidly, but housing prices and living expenses are rising faster than income.

Therefore, for those without a home, the key to accelerating home ownership is how little money they invest in housing in the early stages of marriage, especially before their children start school.

Want to live in a slightly nicer place? Too much debt is just a hindrance to a smart home.

Don't have money to buy a house? Start by checking your car maintenance costs relative to your income.

Worried about tying up your money? It's better to focus on apartments than diversifying your assets without sufficient information.

As long as you think of your home as a consumer good rather than an asset, and as long as you think you'll save more after you have children or your income rises, the day you own a home will be far away.

The Surefire Way to Buy a Smart Home That Will Ease Your Lifetime Financial Worries

"Now that we've saved 100 million won, let's buy an apartment."

Buying a house is an investment of money that you have worked hard to save throughout your life.

For those who cannot even try to buy a home due to the strong real estate control policy and apartment prices that are breaking new records every day, money trainer Kim Kyung-pil has stepped forward.

“There is a barrier to entry when it comes to buying a home, namely the initial capital.

But wouldn't it be tempting to cross that barrier if you knew exactly what awaited you beyond it?

Kim Kyung-pil, who has provided hard-hitting diagnoses and practical solutions to those who want to make money through various broadcasts such as “High-End Salt Struggler” and “Help Me, Holmes” and YouTube, has now gone one step further in “You Will Buy an Apartment in the End” to show the way to realize the dream of owning a home that anyone who saves money has thought about at least once.

The author saved 1.24 million won out of his 1.55 million won monthly salary when he was a young adult and took out a loan to move into an apartment in Gangnam before he turned 40.

He had to move out of his home twice to pay off his mortgage, but that decision turned out to be one of his most successful financial decisions.

However, the era where “any apartment you buy will go up in price is over.

“If you gather your soul and buy it anywhere, you will be ruined.”

He offers cool advice to those who want to buy an apartment among their homes, and a smart one among their apartments.

Are you saying you can't buy a home because housing prices are so high? No, you can't buy a home without giving up your current lifestyle.

Should I really buy a house? Yes, owning a home is the safest way to protect your hard-earned money.

Gangnam apartments that went from 700 million won to 2.8 billion won are no longer someone else's story.

"You'll Buy an Apartment in the End" is packed with homebuying plans and know-how based on the author's own experience and the cases of actual buyers, including the factors that determine home prices and how to develop an eye for finding a good apartment.

The most practical financial roadmap for everyone: those in their 20s and 30s wondering whether to buy a home, those in their 30s and 40s trying to figure out where to start, and those in their 40s and 50s looking to take things to the next level, whether they should move to a better home.

In an era where everyone is heading to the 'upscale Gangnam', where is my home?

From the economics of housing prices to practical tips for owning a home.

· Why Smart Apartments Matter: The "Extraordinary" Returns Chosen by Self-Made Millionaires

It's a loss to rent a house.

Even if you don't buy a house, you'll still have to spend about 60% of the house price on housing costs, such as the deposit, and invest the remaining assets elsewhere to generate a return greater than the increase in house price each time.

But that is nearly impossible.

One smart apartment guarantees returns that are greater than the returns of a typical stock investment and two average apartments.

In Korea, no tax is paid on income generated from one house per household up to a transfer price of 1.2 billion won. Even if the house is expensive and is over 1.2 billion won, if it is held for more than 10 years, 80% of the excess amount is deducted from the transfer income.

A smart apartment with a high purpose of actual residence is like a blue chip that guarantees future value while avoiding tax disadvantages.

What is a smart apartment, and how do you know which one is right for you? Identify the right price and focus on location.

The price of a house is determined by its use value and investment value, and location value, one of the use values, is the most important of the core.

In other words, a smart apartment is a small to medium-sized apartment with excellent location value in a preferred area.

Like '-ridan-gil' across the country, each region has a prime residential area (Gangnam) that is good for living and investing.

Neither elasticity nor balance is important.

You should set a financial goal and choose the area with the highest location value within your living area.

Security, education, transportation, and nature are the most important criteria for choosing a prime residential area.

· How to Make a Smart Apartment Yours: From Savings Planning to Execution

Although the population is declining, life expectancy and active years are increasing, so the author says that people should start planning for home ownership now rather than waiting for housing prices to fall.

Young adults entering society must save 40-50% of their income to create seed money, and must build up their financial resources through dual-income families for up to 15 years after marriage.

Since single people have relatively lower incomes, they should buy their own home by the age of 50 (15 years before retirement age).

The author also provides detailed information on how much a loan is appropriate for your income level, the differences between asking price, market price, actual transaction price, and quick sale price, and how to avoid houses that are overpriced beyond their value.

The author's six-step approach guarantees a regret-free forestry experience.

Gangnam apartments worth 700 million to 2.8 billion won - does that still sound like someone else's story?

Excuses only prolong the period of homelessness.

Still hesitating to buy a home? Buying a smart home is a race against time.

Income, housing prices, and living expenses are all rising rapidly, but housing prices and living expenses are rising faster than income.

Therefore, for those without a home, the key to accelerating home ownership is how little money they invest in housing in the early stages of marriage, especially before their children start school.

Want to live in a slightly nicer place? Too much debt is just a hindrance to a smart home.

Don't have money to buy a house? Start by checking your car maintenance costs relative to your income.

Worried about tying up your money? It's better to focus on apartments than diversifying your assets without sufficient information.

As long as you think of your home as a consumer good rather than an asset, and as long as you think you'll save more after you have children or your income rises, the day you own a home will be far away.

GOODS SPECIFICS

- Date of issue: June 30, 2025

- Page count, weight, size: 288 pages | 442g | 146*215*18mm

- ISBN13: 9791173322617

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)