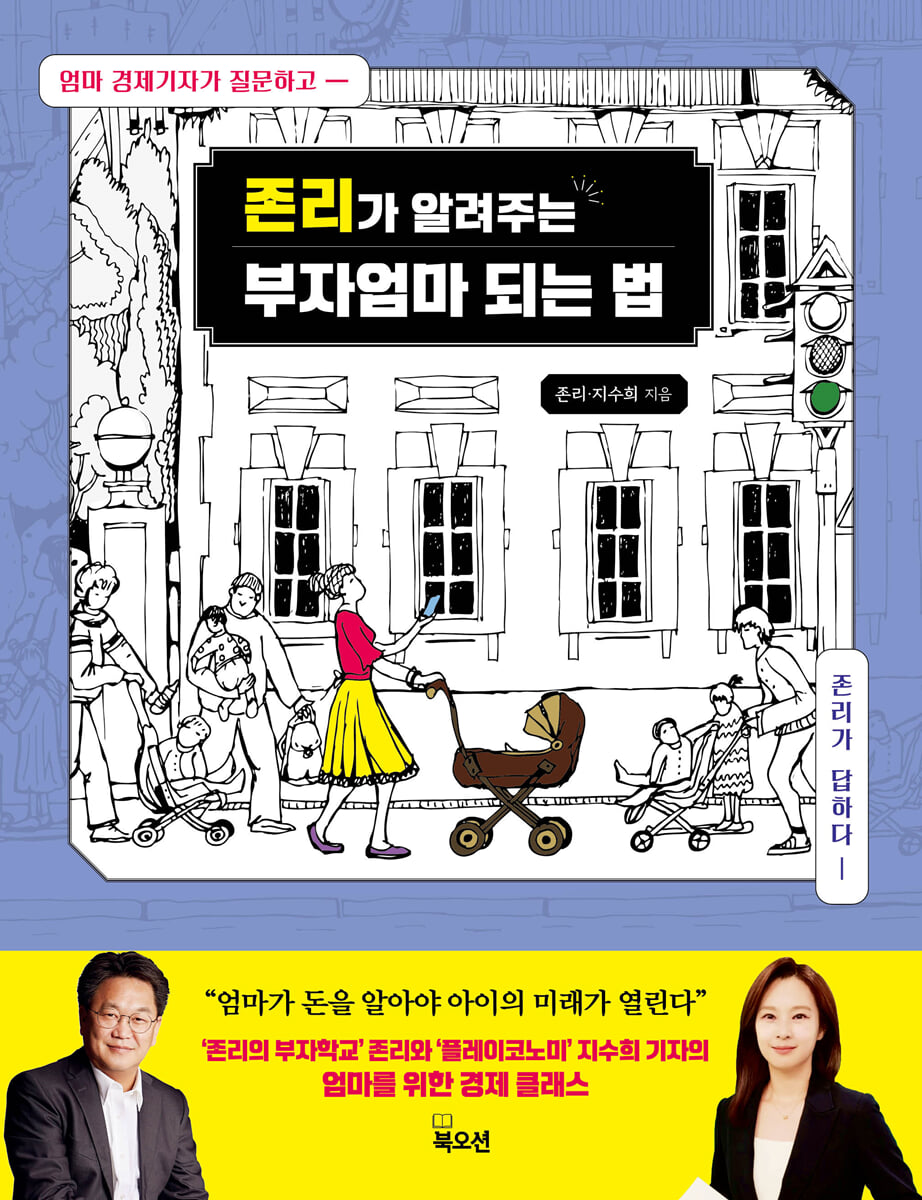

How to Become a Rich Mom, as Told by John Lee

|

Description

Book Introduction

#FinancialMentorJohnLee's Guide to Wealth Education

#Investing that mothers and children start together

#The only way to pass on wealth without inheritance tax

#Investing that starts with just 10,000 won right now

#From how to view the market to preparing for retirement

A mother's change of mindset opens up her child's future.

John Lee's Guide to Raising Your Child to Wealth

John Lee, a mentor to stock investors, financial educator, and investment evangelist, has published a new book, “How to Become a Rich Mom with John Lee,” written for mothers.

This book, written by reporter Jisoohee, who works at Korea Economic TV and runs the economic education program "Play Economy," explains the process of raising a child to be rich in an easy-to-understand manner.

"How to Become a Rich Mom with John Lee" covers not only how to invest, but also why you should invest, how to develop your child's financial sense through investing, and how to prepare for retirement.

This is a must-read for any mother who wants to raise her child to be rich.

#Investing that mothers and children start together

#The only way to pass on wealth without inheritance tax

#Investing that starts with just 10,000 won right now

#From how to view the market to preparing for retirement

A mother's change of mindset opens up her child's future.

John Lee's Guide to Raising Your Child to Wealth

John Lee, a mentor to stock investors, financial educator, and investment evangelist, has published a new book, “How to Become a Rich Mom with John Lee,” written for mothers.

This book, written by reporter Jisoohee, who works at Korea Economic TV and runs the economic education program "Play Economy," explains the process of raising a child to be rich in an easy-to-understand manner.

"How to Become a Rich Mom with John Lee" covers not only how to invest, but also why you should invest, how to develop your child's financial sense through investing, and how to prepare for retirement.

This is a must-read for any mother who wants to raise her child to be rich.

- You can preview some of the book's contents.

Preview

index

Step 1.

Stocks Don't Hurt You - Breaking Down the Boundaries of Stock Investment

〔 Q1 〕 How can I start talking about stocks and money with my children?·20

〔 Q2 〕 Even I am still afraid of stocks.

How to Break Through Fear?·34

〔 Q3 〕 How do you create an 'investment philosophy'?·41

〔 Q4 〕 They say to invest in stocks with spare money, but I don't have any.·50

〔 Q5 〕 I'm saving for my child's savings. Do I really need to invest in stocks?·56

〔 Q6 〕 They say real estate is a no-fail investment. Isn't real estate better than stocks?·66

〔 Q7 〕 I still have a loan.

Shouldn't I pay off the loan first?·70

〔 Q8 〕 When is a good time to start investing in stocks for children?·76

〔 Q9 〕 Individual investors aren't performing very well in the stock market.·84

〔Q10〕 Is this a market where individual investors have a better chance of success than institutions or foreign investors?·91

〔 Q11 〕 Can I become the owner of a company with a small amount of money?·96

Step 2.

10,000 won a day! Starting with the S&P 500—Start investing in funds today.

〔 Q1 〕 When and how do I report a gift?·106

〔 Q2 〕Where should I open an account?·111

〔 Q3 〕 I have multiple accounts.

What kind of account should I create?·117

〔 Q4 〕Why 10,000 won?·125

〔 Q5 〕 Why the S&P 500?·131

〔 Q6 〕 What exactly is an ETF?·138

〔 Q7 〕 What about the KOSPI 200? How do I diversify my investments?·146

〔 Q8 〕What fund is best for my child?·155

〔 Q9 〕 Are there any points to keep in mind when choosing an investment product?·163

Step 3.

Start investing in individual stocks - become the owner of your favorite companies.

〔 Q1 〕 Which company should I choose?·174

〔 Q2 〕 Specifically, what business model is good?·178

〔 Q3 〕 There's so much information out there, I don't know how to choose.·183

〔 Q4 〕What corporate information should beginners keep in mind?·187

〔 Q5 〕 What should I look for when analyzing a company's fair value?·192

〔 Q6 〕 How can I select undervalued companies?·196

〔 Q7 〕 Is there a way to invest without knowing all this information?·200

〔 Q8 〕 Is it okay to consistently buy only Samsung Electronics?·206

〔 Q9 〕 Are there any companies you should not invest in?·210

〔 Q10 〕Which stock is preferred stock? 215

Step 4.

Forget about investing.

But! Except this time—managing investment assets and observing changes in the world.

〔 Q1 〕 What should I do after completing Step 2?·220

〔 Q2 〕 Should I sell when I reach my target rate of return?·224

〔 Q3 〕 Is philosophy necessary for management?·229

〔 Q4 〕 When is the best time to sell?·232

〔 Q5 〕 What if the company I invested in goes bankrupt?·237

〔 Q6 〕 How do you know where and how future value will arise?·240

〔 Q7 〕 When and how will you use the funds you save for your child?·246

Step 5.

Don't Be a Burden to Your Children - Preparing for Retirement, Too

〔 Q1 〕 I'm diligently contributing to the National Pension. Should I prepare more for retirement?·252

〔 Q2 〕 Where should I start?·261

〔 Q3 〕 What's the difference between pension savings, IRPs, and ISAs?·267

〔Q4〕How should I manage my investment portfolio? How will it differ from my child's?·277

〔 Q5 〕 How do you use your funds in retirement?·281

Stocks Don't Hurt You - Breaking Down the Boundaries of Stock Investment

〔 Q1 〕 How can I start talking about stocks and money with my children?·20

〔 Q2 〕 Even I am still afraid of stocks.

How to Break Through Fear?·34

〔 Q3 〕 How do you create an 'investment philosophy'?·41

〔 Q4 〕 They say to invest in stocks with spare money, but I don't have any.·50

〔 Q5 〕 I'm saving for my child's savings. Do I really need to invest in stocks?·56

〔 Q6 〕 They say real estate is a no-fail investment. Isn't real estate better than stocks?·66

〔 Q7 〕 I still have a loan.

Shouldn't I pay off the loan first?·70

〔 Q8 〕 When is a good time to start investing in stocks for children?·76

〔 Q9 〕 Individual investors aren't performing very well in the stock market.·84

〔Q10〕 Is this a market where individual investors have a better chance of success than institutions or foreign investors?·91

〔 Q11 〕 Can I become the owner of a company with a small amount of money?·96

Step 2.

10,000 won a day! Starting with the S&P 500—Start investing in funds today.

〔 Q1 〕 When and how do I report a gift?·106

〔 Q2 〕Where should I open an account?·111

〔 Q3 〕 I have multiple accounts.

What kind of account should I create?·117

〔 Q4 〕Why 10,000 won?·125

〔 Q5 〕 Why the S&P 500?·131

〔 Q6 〕 What exactly is an ETF?·138

〔 Q7 〕 What about the KOSPI 200? How do I diversify my investments?·146

〔 Q8 〕What fund is best for my child?·155

〔 Q9 〕 Are there any points to keep in mind when choosing an investment product?·163

Step 3.

Start investing in individual stocks - become the owner of your favorite companies.

〔 Q1 〕 Which company should I choose?·174

〔 Q2 〕 Specifically, what business model is good?·178

〔 Q3 〕 There's so much information out there, I don't know how to choose.·183

〔 Q4 〕What corporate information should beginners keep in mind?·187

〔 Q5 〕 What should I look for when analyzing a company's fair value?·192

〔 Q6 〕 How can I select undervalued companies?·196

〔 Q7 〕 Is there a way to invest without knowing all this information?·200

〔 Q8 〕 Is it okay to consistently buy only Samsung Electronics?·206

〔 Q9 〕 Are there any companies you should not invest in?·210

〔 Q10 〕Which stock is preferred stock? 215

Step 4.

Forget about investing.

But! Except this time—managing investment assets and observing changes in the world.

〔 Q1 〕 What should I do after completing Step 2?·220

〔 Q2 〕 Should I sell when I reach my target rate of return?·224

〔 Q3 〕 Is philosophy necessary for management?·229

〔 Q4 〕 When is the best time to sell?·232

〔 Q5 〕 What if the company I invested in goes bankrupt?·237

〔 Q6 〕 How do you know where and how future value will arise?·240

〔 Q7 〕 When and how will you use the funds you save for your child?·246

Step 5.

Don't Be a Burden to Your Children - Preparing for Retirement, Too

〔 Q1 〕 I'm diligently contributing to the National Pension. Should I prepare more for retirement?·252

〔 Q2 〕 Where should I start?·261

〔 Q3 〕 What's the difference between pension savings, IRPs, and ISAs?·267

〔Q4〕How should I manage my investment portfolio? How will it differ from my child's?·277

〔 Q5 〕 How do you use your funds in retirement?·281

Into the book

It takes effort from the mother to change her thinking.

We have entered an era where studying hard and graduating from a good university does not lead to wealth.

In this day and age, it is difficult to buy a house in one's lifetime with just one's salary.

In a capitalist society, there are two main types of people.

One is a worker, the other is a capitalist.

Workers offer their labor and skills to capitalists and receive compensation.

Capitalists make money by purchasing labor with capital and making goods or providing services.

The most efficient way to make money in a capitalist society is to become a capitalist.

If you want to become rich, you must work for yourself, not for others.

Salaried workers work for others.

When most people think of 'earning money', the first thing that comes to mind is getting paid for your labor.

But in a capitalist system, wealth accumulation through capital is much faster than wealth accumulation through labor.

For people whose only income is their salary, it is realistically difficult to build wealth.

As we get older, our money goes to more places, but the rate at which our salaries increase doesn't keep pace with the rate at which prices rise.

--- 「Step 1.

From "Stocks Don't Hurt"

When is the best time to invest? This is a question many people ask.

It's right now.

There is no such thing as market timing in stock investing.

The sooner you invest, the more profitable it is.

This applies to both children and adults.

The stock market is always volatile, but in the long run, it can only go up.

So, buy stocks consistently and frequently, regardless of whether the price is high or low.

If your child is 0 years old, you can invest steadily in the U.S. market for 20 years from now until your child becomes an adult.

It's okay if you haven't invested since you were 0.

Start investing now, before it's too late.

If your child is 15 years old, you and your child can invest together for five years until they become adults, and you can continue investing for over 10 years until your child starts working in their late 20s or 30s.

If a child continues to invest on his or her own after earning an income, it is truly a different starting point.

If you wait until your child is an adult instead of starting now, you're missing out on the opportunity to make money work for you.

The best way to invest is to invest now, frequently, and consistently.

--- 「Step 2.

From "10,000 won a day! Starting with the S&P 500"

The important thing is that, whether it's a company, an analyst, or a journalist, you shouldn't just take their analysis at face value, but look at the data and make your own judgments.

They write reports with their own purposes and intentions.

While conveying information is common, the purpose of a company's business is to emphasize that it has done well and will continue to do well, while the purpose of an analyst's business is to increase stock trading in the company through analysis.

And journalists have an underlying goal of making sure their articles are read widely.

In this flood of information, our goal is to find the companies that will make us rich and bring us profit.

Then, we must also develop the ability to select information.

Even if you can't tell right away, you will see it if you look at it for a long time.

--- 「Step 3.

From "Start investing in individual stocks"

These days, we live in an era where people live to be 100 years old.

Even if you're retired from work, you still have plenty of time to spend money.

Even if you retire at 60, you still have to live for another 30 years, as the average life expectancy of Korean women these days is over 90.

What if you're not prepared for retirement? There are plenty of places to spend money, but no places to earn it.

My body isn't what it used to be, so I'm aching here and there and I'm going to have to pay a lot of hospital bills. Imagine what my life would be like if there was no place to make money.

We need to prepare for our life after retirement.

So, if you have the means, you should create a source of income even after retirement and continue investing with that money.

If I spend the money I've saved little by little, I could end up in a tragic situation where I have no money to spend later in life.

The current legal retirement age is 60, but the age at which national pension payments can be received will be delayed from 63 to 65 starting in 2033.

Considering that companies typically retire before reaching the legal retirement age, the gap period can extend to as long as 10 years.

I need to create something that will generate cash flow for me during that time, and that money needs to continue to be invested after I retire.

We have entered an era where studying hard and graduating from a good university does not lead to wealth.

In this day and age, it is difficult to buy a house in one's lifetime with just one's salary.

In a capitalist society, there are two main types of people.

One is a worker, the other is a capitalist.

Workers offer their labor and skills to capitalists and receive compensation.

Capitalists make money by purchasing labor with capital and making goods or providing services.

The most efficient way to make money in a capitalist society is to become a capitalist.

If you want to become rich, you must work for yourself, not for others.

Salaried workers work for others.

When most people think of 'earning money', the first thing that comes to mind is getting paid for your labor.

But in a capitalist system, wealth accumulation through capital is much faster than wealth accumulation through labor.

For people whose only income is their salary, it is realistically difficult to build wealth.

As we get older, our money goes to more places, but the rate at which our salaries increase doesn't keep pace with the rate at which prices rise.

--- 「Step 1.

From "Stocks Don't Hurt"

When is the best time to invest? This is a question many people ask.

It's right now.

There is no such thing as market timing in stock investing.

The sooner you invest, the more profitable it is.

This applies to both children and adults.

The stock market is always volatile, but in the long run, it can only go up.

So, buy stocks consistently and frequently, regardless of whether the price is high or low.

If your child is 0 years old, you can invest steadily in the U.S. market for 20 years from now until your child becomes an adult.

It's okay if you haven't invested since you were 0.

Start investing now, before it's too late.

If your child is 15 years old, you and your child can invest together for five years until they become adults, and you can continue investing for over 10 years until your child starts working in their late 20s or 30s.

If a child continues to invest on his or her own after earning an income, it is truly a different starting point.

If you wait until your child is an adult instead of starting now, you're missing out on the opportunity to make money work for you.

The best way to invest is to invest now, frequently, and consistently.

--- 「Step 2.

From "10,000 won a day! Starting with the S&P 500"

The important thing is that, whether it's a company, an analyst, or a journalist, you shouldn't just take their analysis at face value, but look at the data and make your own judgments.

They write reports with their own purposes and intentions.

While conveying information is common, the purpose of a company's business is to emphasize that it has done well and will continue to do well, while the purpose of an analyst's business is to increase stock trading in the company through analysis.

And journalists have an underlying goal of making sure their articles are read widely.

In this flood of information, our goal is to find the companies that will make us rich and bring us profit.

Then, we must also develop the ability to select information.

Even if you can't tell right away, you will see it if you look at it for a long time.

--- 「Step 3.

From "Start investing in individual stocks"

These days, we live in an era where people live to be 100 years old.

Even if you're retired from work, you still have plenty of time to spend money.

Even if you retire at 60, you still have to live for another 30 years, as the average life expectancy of Korean women these days is over 90.

What if you're not prepared for retirement? There are plenty of places to spend money, but no places to earn it.

My body isn't what it used to be, so I'm aching here and there and I'm going to have to pay a lot of hospital bills. Imagine what my life would be like if there was no place to make money.

We need to prepare for our life after retirement.

So, if you have the means, you should create a source of income even after retirement and continue investing with that money.

If I spend the money I've saved little by little, I could end up in a tragic situation where I have no money to spend later in life.

The current legal retirement age is 60, but the age at which national pension payments can be received will be delayed from 63 to 65 starting in 2033.

Considering that companies typically retire before reaching the legal retirement age, the gap period can extend to as long as 10 years.

I need to create something that will generate cash flow for me during that time, and that money needs to continue to be invested after I retire.

--- 「Step 5.

From “So as not to be a burden to the child”

From “So as not to be a burden to the child”

Publisher's Review

Do you want to raise your child to be a good worker?

Do you want to raise your child to be rich?

Many people believe that the reason there are so many wealthy Jews is because they are taught money from a young age.

However, when it comes to actually raising our children, it is rare to provide them with proper money education.

John Lee, a stock market evangelist who runs 'John Lee's Rich School' after working for Scudder and Meritz, criticizes this state of affairs.

According to John Lee, Korean parents say they want their children to become rich, but they spend a lot of money on private education.

Could there be another investment as inefficient as this one?

So, what should we do to make our children rich?

The book that answers this question, “How to Become a Rich Mom as Told by John Lee,” was published by Book Ocean.

Reporter Ji Soo-hee, who works at Korea Economic TV and is raising a child, poses questions to which John Lee answers in a talk concert format, explaining everything from A to Z to making your child rich in an easy and fun way.

This book covers a wide range of topics, including refreshing your perspective on investing, establishing your own philosophy, developing your child's financial acumen through stocks, avoiding gift tax, selecting investment items, investing in ETFs, and investing in beneficial methods for parents to prepare for their own retirement. This book alone will help both children and parents become wealthy.

This book particularly shines with John Lee's investment philosophy of focusing on value investing with a long-term perspective, without being obsessed with market timing.

Since this is an investment in your child's future, we recommend avoiding buying and selling based on the ups and downs of stock prices and instead choosing a company and market that will grow alongside your child.

As long as capitalism persists and companies around the world grow, investing in stocks remains the surest way to increase wealth.

"How to Become a Rich Mom" by John Lee teaches you the best thing a mother can do for her child.

Do you want to raise your child to be rich?

Many people believe that the reason there are so many wealthy Jews is because they are taught money from a young age.

However, when it comes to actually raising our children, it is rare to provide them with proper money education.

John Lee, a stock market evangelist who runs 'John Lee's Rich School' after working for Scudder and Meritz, criticizes this state of affairs.

According to John Lee, Korean parents say they want their children to become rich, but they spend a lot of money on private education.

Could there be another investment as inefficient as this one?

So, what should we do to make our children rich?

The book that answers this question, “How to Become a Rich Mom as Told by John Lee,” was published by Book Ocean.

Reporter Ji Soo-hee, who works at Korea Economic TV and is raising a child, poses questions to which John Lee answers in a talk concert format, explaining everything from A to Z to making your child rich in an easy and fun way.

This book covers a wide range of topics, including refreshing your perspective on investing, establishing your own philosophy, developing your child's financial acumen through stocks, avoiding gift tax, selecting investment items, investing in ETFs, and investing in beneficial methods for parents to prepare for their own retirement. This book alone will help both children and parents become wealthy.

This book particularly shines with John Lee's investment philosophy of focusing on value investing with a long-term perspective, without being obsessed with market timing.

Since this is an investment in your child's future, we recommend avoiding buying and selling based on the ups and downs of stock prices and instead choosing a company and market that will grow alongside your child.

As long as capitalism persists and companies around the world grow, investing in stocks remains the surest way to increase wealth.

"How to Become a Rich Mom" by John Lee teaches you the best thing a mother can do for her child.

GOODS SPECIFICS

- Date of issue: April 3, 2025

- Page count, weight, size: 288 pages | 547g | 173*225*20mm

- ISBN13: 9788967998745

- ISBN10: 8967998740

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)