Bitcoin, something I was too embarrassed to ask about

|

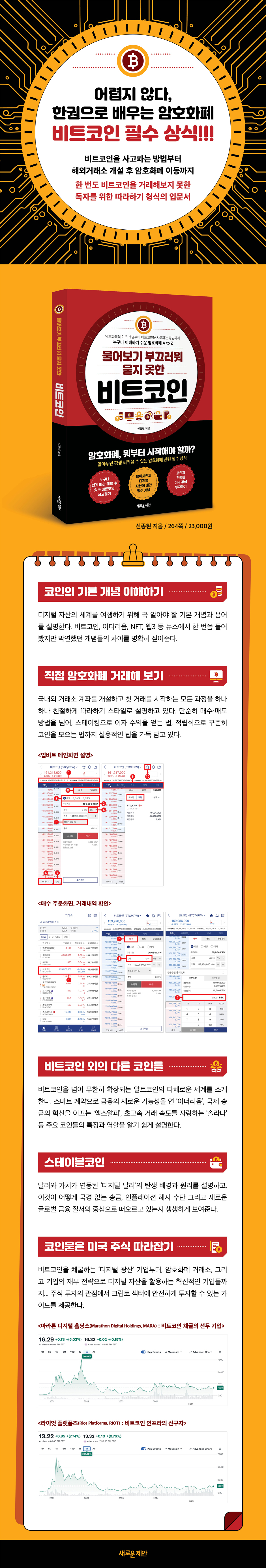

Description

Book Introduction

From how to buy and sell Bitcoin to blockchain and digital assets,

Essential Cryptocurrency Knowledge You'll Use for a Lifetime

Many of the leaps forward in this world that we take for granted today began by transcending the common sense of the time.

Just as quantum mechanics broke the limits of classical physics, transforming our technology and impacting many aspects of our lives, digital assets are also bringing about a fundamental paradigm shift in the existing financial order.

Blockchain and cryptocurrency, concepts that are still unfamiliar or difficult to accept for many, have the potential to become an integral part of our lives in the near future.

Sixteen years after Satoshi Nakamoto published the Bitcoin white paper in 2008, the Trump administration in the United States is moving to incorporate Bitcoin as a national strategic asset.

The empire that owns the world's most powerful dollar is changing its view of Bitcoin.

Therefore, this book is an introductory book on cryptocurrency that approaches concepts like Bitcoin and blockchain from the perspective that, before considering whether they are right or wrong, it is more important to understand the ongoing changes as a larger phenomenon and respond wisely to them.

Rather than trying to persuade the reader, this book is structured with the small goal of encouraging them to think together and understand the changing world from the same perspective, as if a parent were talking to their child, or a middle-aged son to his elderly father.

We avoid using technical terms or formulas as much as possible and explain them in an easy-to-understand way so that many people can gain a more intuitive understanding of concepts such as Bitcoin and blockchain.

Essential Cryptocurrency Knowledge You'll Use for a Lifetime

Many of the leaps forward in this world that we take for granted today began by transcending the common sense of the time.

Just as quantum mechanics broke the limits of classical physics, transforming our technology and impacting many aspects of our lives, digital assets are also bringing about a fundamental paradigm shift in the existing financial order.

Blockchain and cryptocurrency, concepts that are still unfamiliar or difficult to accept for many, have the potential to become an integral part of our lives in the near future.

Sixteen years after Satoshi Nakamoto published the Bitcoin white paper in 2008, the Trump administration in the United States is moving to incorporate Bitcoin as a national strategic asset.

The empire that owns the world's most powerful dollar is changing its view of Bitcoin.

Therefore, this book is an introductory book on cryptocurrency that approaches concepts like Bitcoin and blockchain from the perspective that, before considering whether they are right or wrong, it is more important to understand the ongoing changes as a larger phenomenon and respond wisely to them.

Rather than trying to persuade the reader, this book is structured with the small goal of encouraging them to think together and understand the changing world from the same perspective, as if a parent were talking to their child, or a middle-aged son to his elderly father.

We avoid using technical terms or formulas as much as possible and explain them in an easy-to-understand way so that many people can gain a more intuitive understanding of concepts such as Bitcoin and blockchain.

- You can preview some of the book's contents.

Preview

index

Chapter 1: What is a Coin? Understanding the Basic Concepts

1.

Digital Assets: Cryptocurrencies, Virtual Assets, Coins, Tokens, NFTs, Web 3

Basic concepts and terminology

- Digitalized Assets vs. Digital Assets

- Cryptocurrency

- Blockchain

- Similar but different concepts: Coin and Token 020

- NFT

- Web 3

2.

What is Blockchain?

Understanding Blockchain Concepts: A Shared Ledger System for Apartment Complexes

3.

What is Bitcoin (BTC)?

- Background of Bitcoin's birth

4.

What is the relationship between blockchain and Bitcoin?

Bitcoin, the dawn of the blockchain era

Bitcoin and Energy

Chapter 2: Try Your Hands at Cryptocurrency Trading

5.

From account opening to first transaction

- Register for an exchange and create an account

- Deposit to your exchange account

- Try trading Bitcoin (BTC)

- Exchange Staking Concept and Method

- Collect coins in installments - Little by little, a mountain grows

6.

Opening an overseas exchange (Binance) account and transferring cryptocurrency

- Join an overseas exchange

- Transfer of digital assets between exchanges (domestic exchanges - 〉 foreign exchanges)

- Transfer of digital assets between exchanges (overseas exchanges -> domestic exchanges)

7.

From theory to practice

- What is a cryptocurrency wallet?

- Select an exchange

- What is the Travel Rule?

- The beginning and the end of digital assets: security, security, security!!!

Chapter 3: A Step Further Into the Coin World - Major Cryptocurrencies and Their Ecosystems

08 Cryptocurrencies other than Bitcoin

- What is the difference between Bitcoin (BTC) and Altcoins?

- Bitcoin Dominance (BTC.D)

- A closer look at altcoins

- Ethereum: A platform for smart contracts

- XRP (Ripple, XRP): A coin specialized in international remittances.

- Solana (SOL): Characterized by fast transaction speeds.

- Other cryptocurrencies

Layer 2 solution: a faster and more efficient blockchain.

09 DeFi, the financial heart of the blockchain ecosystem

- The concept of DeFi

- DeFi's main services

10 Tokenization Era

- RWA (Real World Asset): The real world in the blockchain

- STO (Security Token Offering): Stocks are issued as tokens

Chapter 4: Crypto Enters the Real World - Stablecoins

11 What is a Stable Coin?

- Fiat-backed stablecoin

- Real-world asset-backed stablecoins

Cryptocurrency-collateralized stablecoins

- Algorithm-based stablecoin

12 The Beginning of the Stablecoin Era

- Stablecoin Utilization/Application Cases

The Future of Stablecoins

Chapter 5: The Changing Bitcoin Ecosystem in the US: Legal and Social Acceptance

13 Bitcoin as a Strategic Reserve Asset: New Laws

14 Strategies for Accumulating BTC from Different Countries

15 Implications of Bitcoin Spot ETF Approval

- The History of Bitcoin Spot ETF Approvals

- The prelude to altcoin ETFs

16 Wall Street Creating New Opportunities

- Participation of major Wall Street asset management firms

- New business model: Bitcoin holdings by companies such as Strategy (MSTR)

- Expansion of digital asset-related services by financial institutions.

Chapter 6: Crypto-Related US Stocks - Catching Up with Coin-Spirited US Stocks

17 Pure Digital Asset Companies

- Marathon Digital Holdings (MARA):

A leading Bitcoin mining company

Riot Platforms (RIOT): A pioneer in Bitcoin infrastructure.

Cipher Mining (CIFR): A Wall Street-backed sustainable mining company.

CleanSpark (CLSK): An innovative company combining energy technology and mining.

Hut 8 (HUT): A company pursuing the harmony of AI and Bitcoin.

Iris Energy (IREN): An eco-friendly Bitcoin mining company based in Australia.

- Coinbase (COIN): The largest cryptocurrency exchange in the U.S. and a powerhouse in Web3.

Robinhood (HOOD): An exchange dreaming of becoming a super app.

A company dreaming of becoming a whale of digital assets with the 18 DAT (Digital Asset Treasury) strategy.

Strategy (MSTR): The ultimate DAT strategy, the company with the largest Bitcoin holdings.

Strategy

Semler Scientific (SMLR): The medical device company's Bitcoin

Transition to a company

- SharLink Gaming (SBET): Sports betting technology company

Ethereum's meeting

- BitMine Immersion Technologies (BMNR):

A company dreaming of Ethereum's strategy

- DeFi Development Corp (DFDV): Investment in the Solana ecosystem

spearhead company

- Tron Inc. (TRON): From an entertainment company to a Tron financial company

19 Innovators in the Crypto Sector

Galaxy Digital Holdings (GLXY): The Goldman Sachs of Cryptocurrency

Applied Digital (APLD): AI data center innovation company

- Bakkt Holdings (BKKT): A B2B crypto company with a strong parent company.

infrastructure providers

Circle (CRCL): USDC issuer aspiring to be the king of stablecoins.

- Exodus Movement (EXOD): The magnetism of the crypto world

A wallet solution company that protects sovereignty

In conclusion.

A wise response to living in a new world

1.

Digital Assets: Cryptocurrencies, Virtual Assets, Coins, Tokens, NFTs, Web 3

Basic concepts and terminology

- Digitalized Assets vs. Digital Assets

- Cryptocurrency

- Blockchain

- Similar but different concepts: Coin and Token 020

- NFT

- Web 3

2.

What is Blockchain?

Understanding Blockchain Concepts: A Shared Ledger System for Apartment Complexes

3.

What is Bitcoin (BTC)?

- Background of Bitcoin's birth

4.

What is the relationship between blockchain and Bitcoin?

Bitcoin, the dawn of the blockchain era

Bitcoin and Energy

Chapter 2: Try Your Hands at Cryptocurrency Trading

5.

From account opening to first transaction

- Register for an exchange and create an account

- Deposit to your exchange account

- Try trading Bitcoin (BTC)

- Exchange Staking Concept and Method

- Collect coins in installments - Little by little, a mountain grows

6.

Opening an overseas exchange (Binance) account and transferring cryptocurrency

- Join an overseas exchange

- Transfer of digital assets between exchanges (domestic exchanges - 〉 foreign exchanges)

- Transfer of digital assets between exchanges (overseas exchanges -> domestic exchanges)

7.

From theory to practice

- What is a cryptocurrency wallet?

- Select an exchange

- What is the Travel Rule?

- The beginning and the end of digital assets: security, security, security!!!

Chapter 3: A Step Further Into the Coin World - Major Cryptocurrencies and Their Ecosystems

08 Cryptocurrencies other than Bitcoin

- What is the difference between Bitcoin (BTC) and Altcoins?

- Bitcoin Dominance (BTC.D)

- A closer look at altcoins

- Ethereum: A platform for smart contracts

- XRP (Ripple, XRP): A coin specialized in international remittances.

- Solana (SOL): Characterized by fast transaction speeds.

- Other cryptocurrencies

Layer 2 solution: a faster and more efficient blockchain.

09 DeFi, the financial heart of the blockchain ecosystem

- The concept of DeFi

- DeFi's main services

10 Tokenization Era

- RWA (Real World Asset): The real world in the blockchain

- STO (Security Token Offering): Stocks are issued as tokens

Chapter 4: Crypto Enters the Real World - Stablecoins

11 What is a Stable Coin?

- Fiat-backed stablecoin

- Real-world asset-backed stablecoins

Cryptocurrency-collateralized stablecoins

- Algorithm-based stablecoin

12 The Beginning of the Stablecoin Era

- Stablecoin Utilization/Application Cases

The Future of Stablecoins

Chapter 5: The Changing Bitcoin Ecosystem in the US: Legal and Social Acceptance

13 Bitcoin as a Strategic Reserve Asset: New Laws

14 Strategies for Accumulating BTC from Different Countries

15 Implications of Bitcoin Spot ETF Approval

- The History of Bitcoin Spot ETF Approvals

- The prelude to altcoin ETFs

16 Wall Street Creating New Opportunities

- Participation of major Wall Street asset management firms

- New business model: Bitcoin holdings by companies such as Strategy (MSTR)

- Expansion of digital asset-related services by financial institutions.

Chapter 6: Crypto-Related US Stocks - Catching Up with Coin-Spirited US Stocks

17 Pure Digital Asset Companies

- Marathon Digital Holdings (MARA):

A leading Bitcoin mining company

Riot Platforms (RIOT): A pioneer in Bitcoin infrastructure.

Cipher Mining (CIFR): A Wall Street-backed sustainable mining company.

CleanSpark (CLSK): An innovative company combining energy technology and mining.

Hut 8 (HUT): A company pursuing the harmony of AI and Bitcoin.

Iris Energy (IREN): An eco-friendly Bitcoin mining company based in Australia.

- Coinbase (COIN): The largest cryptocurrency exchange in the U.S. and a powerhouse in Web3.

Robinhood (HOOD): An exchange dreaming of becoming a super app.

A company dreaming of becoming a whale of digital assets with the 18 DAT (Digital Asset Treasury) strategy.

Strategy (MSTR): The ultimate DAT strategy, the company with the largest Bitcoin holdings.

Strategy

Semler Scientific (SMLR): The medical device company's Bitcoin

Transition to a company

- SharLink Gaming (SBET): Sports betting technology company

Ethereum's meeting

- BitMine Immersion Technologies (BMNR):

A company dreaming of Ethereum's strategy

- DeFi Development Corp (DFDV): Investment in the Solana ecosystem

spearhead company

- Tron Inc. (TRON): From an entertainment company to a Tron financial company

19 Innovators in the Crypto Sector

Galaxy Digital Holdings (GLXY): The Goldman Sachs of Cryptocurrency

Applied Digital (APLD): AI data center innovation company

- Bakkt Holdings (BKKT): A B2B crypto company with a strong parent company.

infrastructure providers

Circle (CRCL): USDC issuer aspiring to be the king of stablecoins.

- Exodus Movement (EXOD): The magnetism of the crypto world

A wallet solution company that protects sovereignty

In conclusion.

A wise response to living in a new world

Detailed image

Publisher's Review

An introductory book on digital assets, written with the same care and understanding as a parent talking to their children, or a middle-aged son talking to his elderly father.

Chapter 1.

What is a Coin? - Understanding the Basic Concepts

Explains the basic concepts and terminology you need to know to navigate the world of digital assets.

Through the analogy that 'blockchain is like a shared ledger for an apartment complex,' it makes difficult technical principles easy to understand, and clearly points out the differences between vague concepts such as Bitcoin, Ethereum, NFT, and Web3, which we have all heard about in the news.

This chapter will help you learn the language of the crypto world and lay a solid foundation for exploring this new world.

Chapter 2.

Try trading cryptocurrency yourself

Now that you've learned the theory, it's time to move on to practice.

The second chapter explains, step by step, the entire process of opening a domestic or international exchange account and starting your first transaction, just like installing a smartphone banking app for the first time.

Beyond simple buying and selling methods, it's packed with practical tips, including how to earn interest through staking and how to steadily accumulate coins through installment savings.

In particular, it thoroughly explains the security know-how to protect your valuable assets based on the crypto world's iron rule, "If it's not your keys, it's not your coins."

Chapter 3.

A Step Further Into the Coin World - Major Cryptocurrencies and Their Ecosystems

Bitcoin isn't everything.

The third chapter introduces the diverse world of altcoins, which expand infinitely beyond Bitcoin.

We provide an easy-to-understand explanation of the features and roles of major coins, including 'Ethereum', which opened up new possibilities in finance through smart contracts, 'XRP', which is leading the innovation of international remittances, and 'Solana', which boasts ultra-fast transaction speeds.

We also take an in-depth look at the innovative ecosystem that blockchain technology is creating, from DeFi, a financial system without banks, to RWAs and STOs that move real-world assets onto the blockchain.

Chapter 4.

Crypto Enters the Real World - Stablecoins

How can highly volatile cryptocurrencies become a real-world means of payment? The fourth chapter delves into the answer: "stablecoins."

It explains the background and principles behind the creation of the "digital dollar," whose value is linked to the dollar, and vividly demonstrates how it is emerging as a means of borderless remittances, a hedge against inflation, and the center of a new global financial order.

Stablecoins demonstrate how cryptocurrencies are moving beyond mere investment and becoming a part of our lives.

Chapter 5.

The Changing Bitcoin Ecosystem in the US: Legal and Social Acceptance

The biggest change in the crypto market is that Wall Street and the U.S. government are starting to take action.

The fifth chapter examines the significance of the historic approval of a Bitcoin spot ETF and analyzes how it is attracting massive amounts of capital from institutional investors.

We also explore why firms like Strategy (MSTR) are embracing Bitcoin as a core financial asset and how traditional financial powerhouses like JPMorgan are building blockchain technology into the infrastructure of the future of finance.

This will be a key to understanding the massive influx of digital assets into the institutional system.

Chapter 6.

Crypto-Related US Stocks - Catching Up with Coin-Spiked US Stocks

For readers still hesitant to invest directly in digital assets, the final chapter presents a more stable alternative.

This is a method of investing in crypto-related companies listed on the U.S. stock market.

From "digital mining" companies that mine Bitcoin, to cryptocurrency exchanges, to innovative companies leveraging digital assets as part of their corporate financial strategies...

From a familiar stock investment perspective, we provide readers with a guide to safely investing in the crypto sector, a new growth engine.

Chapter 1.

What is a Coin? - Understanding the Basic Concepts

Explains the basic concepts and terminology you need to know to navigate the world of digital assets.

Through the analogy that 'blockchain is like a shared ledger for an apartment complex,' it makes difficult technical principles easy to understand, and clearly points out the differences between vague concepts such as Bitcoin, Ethereum, NFT, and Web3, which we have all heard about in the news.

This chapter will help you learn the language of the crypto world and lay a solid foundation for exploring this new world.

Chapter 2.

Try trading cryptocurrency yourself

Now that you've learned the theory, it's time to move on to practice.

The second chapter explains, step by step, the entire process of opening a domestic or international exchange account and starting your first transaction, just like installing a smartphone banking app for the first time.

Beyond simple buying and selling methods, it's packed with practical tips, including how to earn interest through staking and how to steadily accumulate coins through installment savings.

In particular, it thoroughly explains the security know-how to protect your valuable assets based on the crypto world's iron rule, "If it's not your keys, it's not your coins."

Chapter 3.

A Step Further Into the Coin World - Major Cryptocurrencies and Their Ecosystems

Bitcoin isn't everything.

The third chapter introduces the diverse world of altcoins, which expand infinitely beyond Bitcoin.

We provide an easy-to-understand explanation of the features and roles of major coins, including 'Ethereum', which opened up new possibilities in finance through smart contracts, 'XRP', which is leading the innovation of international remittances, and 'Solana', which boasts ultra-fast transaction speeds.

We also take an in-depth look at the innovative ecosystem that blockchain technology is creating, from DeFi, a financial system without banks, to RWAs and STOs that move real-world assets onto the blockchain.

Chapter 4.

Crypto Enters the Real World - Stablecoins

How can highly volatile cryptocurrencies become a real-world means of payment? The fourth chapter delves into the answer: "stablecoins."

It explains the background and principles behind the creation of the "digital dollar," whose value is linked to the dollar, and vividly demonstrates how it is emerging as a means of borderless remittances, a hedge against inflation, and the center of a new global financial order.

Stablecoins demonstrate how cryptocurrencies are moving beyond mere investment and becoming a part of our lives.

Chapter 5.

The Changing Bitcoin Ecosystem in the US: Legal and Social Acceptance

The biggest change in the crypto market is that Wall Street and the U.S. government are starting to take action.

The fifth chapter examines the significance of the historic approval of a Bitcoin spot ETF and analyzes how it is attracting massive amounts of capital from institutional investors.

We also explore why firms like Strategy (MSTR) are embracing Bitcoin as a core financial asset and how traditional financial powerhouses like JPMorgan are building blockchain technology into the infrastructure of the future of finance.

This will be a key to understanding the massive influx of digital assets into the institutional system.

Chapter 6.

Crypto-Related US Stocks - Catching Up with Coin-Spiked US Stocks

For readers still hesitant to invest directly in digital assets, the final chapter presents a more stable alternative.

This is a method of investing in crypto-related companies listed on the U.S. stock market.

From "digital mining" companies that mine Bitcoin, to cryptocurrency exchanges, to innovative companies leveraging digital assets as part of their corporate financial strategies...

From a familiar stock investment perspective, we provide readers with a guide to safely investing in the crypto sector, a new growth engine.

GOODS SPECIFICS

- Date of issue: December 1, 2025

- Page count, weight, size: 264 pages | 608g | 175*245*15mm

- ISBN13: 9788955336733

- ISBN10: 895533673X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)