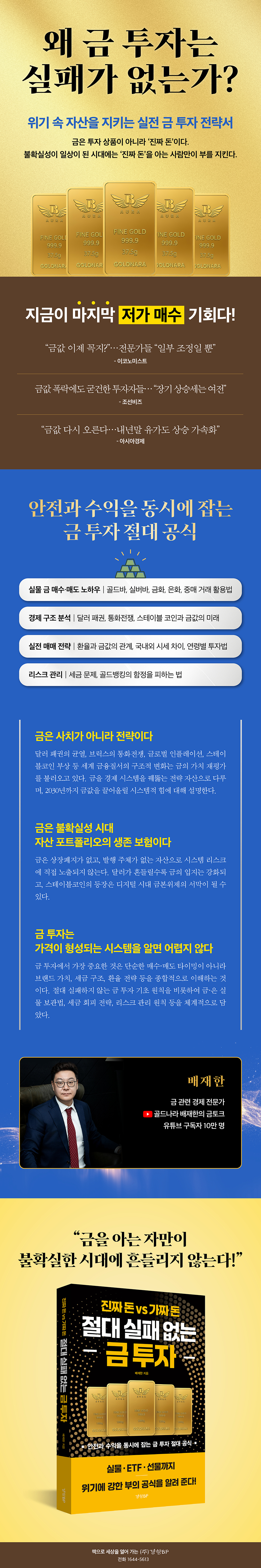

Gold Investments That Never Fail

|

Description

Book Introduction

Gold is not a luxury, it's a strategy.

Gold is an asset that has never lost its value in human history.

Stocks, real estate, and currency have all experienced ups and downs depending on the times and policies, but gold has always been a safe asset.

This is also why central banks around the world accumulate gold as a core part of their foreign exchange reserves.

Even if buying gold doesn't make you rich, it's a surefire way to protect your assets.

Structural changes in the global financial order, such as the cracks in the dollar hegemony, the currency war among the BRICS countries, global inflation, and the rise of stablecoins, are leading to a revaluation of gold.

In times of high volatility, gold is a guarantee of survival and stability.

This book treats gold not simply as a commodity to be bought and sold, but as a strategic asset that permeates the economic system, explaining the systemic forces that will drive up gold prices by 2030.

Gold is survival insurance for asset portfolios in uncertain times.

Gold investment focuses on securing asset survivability in times of crisis rather than short-term profits.

The author analyzes, within a historical and economic context, why gold strengthens during market shocks such as financial crises, wars, and inflation.

Gold and silver are assets that are not subject to delisting and have no issuer, so they are not directly exposed to systemic risk.

As the dollar fluctuates, gold's position strengthens, and the emergence of stablecoins could mark the beginning of a digital gold standard.

This book delves into the essence of "real assets" and provides essential gold investment principles and practical strategies that investors must know.

It clearly presents the essential differences between physical gold and gold ETFs, making them easily understandable even for beginners in gold investment. It also suggests realistic gold investment plans tailored to different age groups and asset situations, from those in their 20s entering the workforce to those in their 50s accumulating assets, retirees, and high-net-worth individuals.

Investing in gold is not difficult if you understand the system by which prices are formed.

The price of gold is determined by distribution structure and trading methods rather than charts or news.

The most important thing in gold investing is not simply timing buys and sells, but a comprehensive understanding of brand value, tax structure, and exchange rate strategies.

This book systematically covers the fundamental principles of gold investment that will never fail, as well as physical gold and silver storage methods, tax avoidance strategies, and risk management principles.

In particular, instead of buying expensively from home shopping channels, department stores, or retail stores, we suggest a strategy of buying cheaper and selling more expensively by utilizing a transparent transaction structure and brokerage transaction platform.

When gold prices rise, silver prices also rise.

Many investors focus on gold, but when gold prices rise, silver prices also move along with them.

In fact, the prices of gold and silver are closely linked in the global precious metals market.

Silver is another real asset, not a shadow of gold.

If gold is 'real money', silver is 'gold's companion and substitute'.

Gold and silver are both strong due to common factors such as global inflation, a weak dollar, and geopolitical crises.

When gold prices surge and investment access becomes difficult, some funds in the market move to silver.

In other words, the rise in gold stimulates the demand for silver.

Silver is very important in terms of popularizing investment because it is a safe asset that even small investors can easily enter because its unit price is lower than that of gold.

This book also explains how to invest in silver, which has been undervalued for a long time.

Gold is an asset that has never lost its value in human history.

Stocks, real estate, and currency have all experienced ups and downs depending on the times and policies, but gold has always been a safe asset.

This is also why central banks around the world accumulate gold as a core part of their foreign exchange reserves.

Even if buying gold doesn't make you rich, it's a surefire way to protect your assets.

Structural changes in the global financial order, such as the cracks in the dollar hegemony, the currency war among the BRICS countries, global inflation, and the rise of stablecoins, are leading to a revaluation of gold.

In times of high volatility, gold is a guarantee of survival and stability.

This book treats gold not simply as a commodity to be bought and sold, but as a strategic asset that permeates the economic system, explaining the systemic forces that will drive up gold prices by 2030.

Gold is survival insurance for asset portfolios in uncertain times.

Gold investment focuses on securing asset survivability in times of crisis rather than short-term profits.

The author analyzes, within a historical and economic context, why gold strengthens during market shocks such as financial crises, wars, and inflation.

Gold and silver are assets that are not subject to delisting and have no issuer, so they are not directly exposed to systemic risk.

As the dollar fluctuates, gold's position strengthens, and the emergence of stablecoins could mark the beginning of a digital gold standard.

This book delves into the essence of "real assets" and provides essential gold investment principles and practical strategies that investors must know.

It clearly presents the essential differences between physical gold and gold ETFs, making them easily understandable even for beginners in gold investment. It also suggests realistic gold investment plans tailored to different age groups and asset situations, from those in their 20s entering the workforce to those in their 50s accumulating assets, retirees, and high-net-worth individuals.

Investing in gold is not difficult if you understand the system by which prices are formed.

The price of gold is determined by distribution structure and trading methods rather than charts or news.

The most important thing in gold investing is not simply timing buys and sells, but a comprehensive understanding of brand value, tax structure, and exchange rate strategies.

This book systematically covers the fundamental principles of gold investment that will never fail, as well as physical gold and silver storage methods, tax avoidance strategies, and risk management principles.

In particular, instead of buying expensively from home shopping channels, department stores, or retail stores, we suggest a strategy of buying cheaper and selling more expensively by utilizing a transparent transaction structure and brokerage transaction platform.

When gold prices rise, silver prices also rise.

Many investors focus on gold, but when gold prices rise, silver prices also move along with them.

In fact, the prices of gold and silver are closely linked in the global precious metals market.

Silver is another real asset, not a shadow of gold.

If gold is 'real money', silver is 'gold's companion and substitute'.

Gold and silver are both strong due to common factors such as global inflation, a weak dollar, and geopolitical crises.

When gold prices surge and investment access becomes difficult, some funds in the market move to silver.

In other words, the rise in gold stimulates the demand for silver.

Silver is very important in terms of popularizing investment because it is a safe asset that even small investors can easily enter because its unit price is lower than that of gold.

This book also explains how to invest in silver, which has been undervalued for a long time.

- You can preview some of the book's contents.

Preview

index

Prologue - Know What "Real Money" Is and Invest It

Chapter 1: The Beginning of a Gold Investment That Never Fails

01 Gold is a strategy, not a luxury.

Why do people seek out gold? ┃If you're looking to invest in gold, start with a safe.

02 Real gold and silver are judged by their details.

Gold Bars: Not All Created the Same ┃Gold isn't just a number; it's a tangible object you can hold in your hand. ┃Physical Gold vs. Gold Futures: Defense vs. Offense

03 Gold becomes stronger in times of crisis.

The Future of the Dollar Hegemony and Gold Prices Amidst the BRICS and Currency Wars: Gold is the Best Safe Asset in a Plunging Financial Market

04 Gold prices are not a lottery, but a barometer of the economy.

Structural Causes of Gold Price Rise┃How is the Gold Price Determined?

05 Gold is an asset that cannot be delisted.

Physical gold will never be delisted. ┃Understand the meaning of real gold and money.

06 Reality is stronger than numbers

Gold and silver aren't bought and sold by looking at charts. How to buy gold with transparent distribution.

07 The system will drive up prices by 2030

The Power of Demand┃The Path to Structural Assets

Chapter 2: Safe Investments That Never Fail

01 Structural changes drive up gold prices.

Cracks in US Monetary Policy and the Dollar System: Limits to Gold Supply and Structural Shifts in Demand

02 As stablecoins rise, gold becomes stronger.

Controlled Currency vs. Uncontrolled Gold: Gold-Backed Stablecoins Are the Gold Standard of the Digital Age

03 In the post-dollar era, the world is turning to gold again.

The Return of Gold Driven by Geopolitical Conflicts: The Intersection of Inflation and Systemic Risk

04 Gold is the survival insurance of your asset portfolio.

Gold is the last resort for protecting assets in times of crisis. ┃Gold is the slowest but strongest asset.

05 Now you can invest in gold with your smartphone.

Investing in Gold Even with Small Amounts: The Potential and Risks of Tokenized Gold

06 Can gold ETFs be an alternative to investing in physical gold?

ETFs are the quickest way to invest in gold without owning the physical gold. ┃The essence of ETFs is liquidity, while the essence of gold is physical.

07 Gold investment strategies vary depending on age and assets.

Gold Investment Strategies for Beginners in Their 20s to Asset Accumulation in Their 50s┃Gold Investment Strategies for Retirees and High-Net-Worth Individuals

Chapter 3: The Fundamentals of Gold Investment That Never Fail

01 It is important to live properly.

Find the right gold investment strategy for you. Don't just buy gold because it's cheap. Buying and selling tips from gold investment experts.

02 Buy cheap, hold smart

How to Buy 10 Don Gold Bars for 500,000 Won Less ┃Why You Should Invest in Physical Gold ┃What You Need to Know to Invest Safely

03 Gold is not a difficult investment.

How to Invest in Gold Wisely | The Misconception That Gold Investing Is Complicated | The Fastest Way to Start

04 Why are the prices different when the weight is the same?

Older products don't lose their content. ┃Unbranded gold bars are difficult to sell for a fair price. ┃Why there's a difference between foreign and domestic gold bars.

05 The rich trade gold differently.

How to Buy Gold Cheaply, a Secret Only the Rich Know: Find a Trustworthy Gold Investment Partner

Chapter 4: A Real-World Gold Investment Strategy That Never Fails

01 Gold investing is a game of timing and psychology.

Investing in gold is easier than you think. The key to investing is how long you can wait. Gold is an asset to stock up on during periods of calm before prices rise.

02 Don't be fooled by the current gold price; read the flow.

Forget the idea of buying a little cheaper. Even if the international price of gold rises sharply, it is not immediately reflected in the domestic price.

03 You can't invest in gold without knowing the exchange rate.

Gold Investment Strategies Based on Exchange Rate Fluctuations┃When Exchange Rates Rise, So Do Gold Prices┃How to Buy Gold Bars Cheaply When Exchange Rates and Gold Prices Surge

04 You can buy gold with dollars in Korea too.

Understanding the Relationship Between Gold and the Dollar | How to Buy Gold Bars with Dollars | Buy Gold with Dollars Without Exchange Fees

05 The structure of the financial system is changing.

Gold is the most anticipated asset when interest rates begin to decline. The cash-based gold trading structure is collapsing. Gold investment strategies to navigate complex economic situations.

Chapter 5: Reading the Gold Price That Never Fails

01 The price of gold is determined by the distribution structure.

The essence of gold investing is understanding price trends and distribution structures. Understand the structure and enter the trading system. Market distribution prices are driven by supply.

02 The price of gold is determined at the actual trading site.

What Matters: Real Transaction Prices, Not News Prices. ┃How Are Gold Prices Determined in Korea? ┃Why aren't gold prices reflected in sales even when they're rising?

03 You must know and sell properly to avoid losses.

Why You Should Avoid Your Local Gold Shop When Selling Gold | Prepare Planfully with Verified Information and Structure | Take Advantage of the Physical Trading Ecosystem

04 A pure gold bracelet is also a valuable investment.

A pure gold bracelet is a real asset that can be liquidated at any time. ┃The price of pure gold jewelry is a choice, but the cost of craftsmanship is a strategy.

Chapter 6: A Never-Fail Method for Storing Physical Gold and Silver

01 The value of an asset is determined by its storage.

How to Store Gold and Silver Bars┃Use a Professional Storage Service for Silver Bars

02 There are hidden opportunities in investing in undervalued silver.

Pay attention to silver bars, a hidden asset. Silver coins are an asset that requires careful management. Invest in premium gold and silver coins.

03 Check the pedigree of real assets.

99.9 and 999.9 are not subtle differences. ┃Serial numbers are not mere engravings. ┃It's wise to invest in guaranteed products.

04 Brands Create the Class of Real Assets

LS Gold Bars aren't just gold; they're branded assets. The value of gold bars varies depending on their brand and appearance. Choose branded gold bars over cast gold.

05 Information and Brands Create Real Value

It's a lie that all gold is created equal. The price of gold varies depending on the brand, trading method, and trading structure. How to avoid being ripped off when buying gold bars.

Chapter 7: Gold Trading Strategies That Never Fail

01 Buy cheaper and sell more through brokerage transactions.

Focus on trading methods rather than gold price predictions. ┃ Actively utilize matchmaking platforms. ┃ You can buy gold much cheaper through matchmaking. ┃ Buy gold bars with brand value through matchmaking. ┃ Actively utilize matchmaking for silver bars as well.

02 Profitability varies by a single point.

Brokerage is beneficial for both buyers and sellers. ┃When buying or selling, use a brokerage, not a goldsmith.

03 Buying gold on home shopping channels is a loss.

Why You Shouldn't Buy Gold on Home Shopping Channels┃Buying gold on home shopping channels is the most expensive option.

04 No matter how urgent it is, don't sell it just anywhere.

Selling gold and silver bars anywhere is a loss. Handle premium products with care.

05 The more you know about physical gold trading, the more you earn.

To sell at a high price, gather information and understand the structure. ┃Gold is also treated like a brand. ┃Investing in gold is not a symbol of wealth, but a way to become rich.

06 Physical gold bars are the forefront of moving money.

When investing in gold, the actual product is more important than the market price. The trend is to find gold that suits your taste rather than cheap gold. Gold bars are not just a commodity; they are a time-tested asset.

Chapter 8: Managing Gold Investment Risks That Never Fail

01 Gold banking eats away at profits.

Gold banking increases taxes and restricts liquidity, not profits. Invest in tax-free physical gold bars.

02 Tax-Free Gold Investment Strategy

Take Advantage of Brokerage Deals┃How to Trade Gold Without VAT

03 Beware of Invisible Powers and Temptations

Invest with a proper understanding of gold and silver futures margins. Be wary of gold investment leading platforms.

04 KRX Premium Signal Light and Increased Proportion of Gold in Foreign Exchange Reserves

The Relationship Between the KRX Gold Market and the Physical Gold Market: Why Should Korea Hold More Gold in Its Foreign Exchange Reserves?

Epilogue - Gold is a real asset for those who understand the value of "real money."

Chapter 1: The Beginning of a Gold Investment That Never Fails

01 Gold is a strategy, not a luxury.

Why do people seek out gold? ┃If you're looking to invest in gold, start with a safe.

02 Real gold and silver are judged by their details.

Gold Bars: Not All Created the Same ┃Gold isn't just a number; it's a tangible object you can hold in your hand. ┃Physical Gold vs. Gold Futures: Defense vs. Offense

03 Gold becomes stronger in times of crisis.

The Future of the Dollar Hegemony and Gold Prices Amidst the BRICS and Currency Wars: Gold is the Best Safe Asset in a Plunging Financial Market

04 Gold prices are not a lottery, but a barometer of the economy.

Structural Causes of Gold Price Rise┃How is the Gold Price Determined?

05 Gold is an asset that cannot be delisted.

Physical gold will never be delisted. ┃Understand the meaning of real gold and money.

06 Reality is stronger than numbers

Gold and silver aren't bought and sold by looking at charts. How to buy gold with transparent distribution.

07 The system will drive up prices by 2030

The Power of Demand┃The Path to Structural Assets

Chapter 2: Safe Investments That Never Fail

01 Structural changes drive up gold prices.

Cracks in US Monetary Policy and the Dollar System: Limits to Gold Supply and Structural Shifts in Demand

02 As stablecoins rise, gold becomes stronger.

Controlled Currency vs. Uncontrolled Gold: Gold-Backed Stablecoins Are the Gold Standard of the Digital Age

03 In the post-dollar era, the world is turning to gold again.

The Return of Gold Driven by Geopolitical Conflicts: The Intersection of Inflation and Systemic Risk

04 Gold is the survival insurance of your asset portfolio.

Gold is the last resort for protecting assets in times of crisis. ┃Gold is the slowest but strongest asset.

05 Now you can invest in gold with your smartphone.

Investing in Gold Even with Small Amounts: The Potential and Risks of Tokenized Gold

06 Can gold ETFs be an alternative to investing in physical gold?

ETFs are the quickest way to invest in gold without owning the physical gold. ┃The essence of ETFs is liquidity, while the essence of gold is physical.

07 Gold investment strategies vary depending on age and assets.

Gold Investment Strategies for Beginners in Their 20s to Asset Accumulation in Their 50s┃Gold Investment Strategies for Retirees and High-Net-Worth Individuals

Chapter 3: The Fundamentals of Gold Investment That Never Fail

01 It is important to live properly.

Find the right gold investment strategy for you. Don't just buy gold because it's cheap. Buying and selling tips from gold investment experts.

02 Buy cheap, hold smart

How to Buy 10 Don Gold Bars for 500,000 Won Less ┃Why You Should Invest in Physical Gold ┃What You Need to Know to Invest Safely

03 Gold is not a difficult investment.

How to Invest in Gold Wisely | The Misconception That Gold Investing Is Complicated | The Fastest Way to Start

04 Why are the prices different when the weight is the same?

Older products don't lose their content. ┃Unbranded gold bars are difficult to sell for a fair price. ┃Why there's a difference between foreign and domestic gold bars.

05 The rich trade gold differently.

How to Buy Gold Cheaply, a Secret Only the Rich Know: Find a Trustworthy Gold Investment Partner

Chapter 4: A Real-World Gold Investment Strategy That Never Fails

01 Gold investing is a game of timing and psychology.

Investing in gold is easier than you think. The key to investing is how long you can wait. Gold is an asset to stock up on during periods of calm before prices rise.

02 Don't be fooled by the current gold price; read the flow.

Forget the idea of buying a little cheaper. Even if the international price of gold rises sharply, it is not immediately reflected in the domestic price.

03 You can't invest in gold without knowing the exchange rate.

Gold Investment Strategies Based on Exchange Rate Fluctuations┃When Exchange Rates Rise, So Do Gold Prices┃How to Buy Gold Bars Cheaply When Exchange Rates and Gold Prices Surge

04 You can buy gold with dollars in Korea too.

Understanding the Relationship Between Gold and the Dollar | How to Buy Gold Bars with Dollars | Buy Gold with Dollars Without Exchange Fees

05 The structure of the financial system is changing.

Gold is the most anticipated asset when interest rates begin to decline. The cash-based gold trading structure is collapsing. Gold investment strategies to navigate complex economic situations.

Chapter 5: Reading the Gold Price That Never Fails

01 The price of gold is determined by the distribution structure.

The essence of gold investing is understanding price trends and distribution structures. Understand the structure and enter the trading system. Market distribution prices are driven by supply.

02 The price of gold is determined at the actual trading site.

What Matters: Real Transaction Prices, Not News Prices. ┃How Are Gold Prices Determined in Korea? ┃Why aren't gold prices reflected in sales even when they're rising?

03 You must know and sell properly to avoid losses.

Why You Should Avoid Your Local Gold Shop When Selling Gold | Prepare Planfully with Verified Information and Structure | Take Advantage of the Physical Trading Ecosystem

04 A pure gold bracelet is also a valuable investment.

A pure gold bracelet is a real asset that can be liquidated at any time. ┃The price of pure gold jewelry is a choice, but the cost of craftsmanship is a strategy.

Chapter 6: A Never-Fail Method for Storing Physical Gold and Silver

01 The value of an asset is determined by its storage.

How to Store Gold and Silver Bars┃Use a Professional Storage Service for Silver Bars

02 There are hidden opportunities in investing in undervalued silver.

Pay attention to silver bars, a hidden asset. Silver coins are an asset that requires careful management. Invest in premium gold and silver coins.

03 Check the pedigree of real assets.

99.9 and 999.9 are not subtle differences. ┃Serial numbers are not mere engravings. ┃It's wise to invest in guaranteed products.

04 Brands Create the Class of Real Assets

LS Gold Bars aren't just gold; they're branded assets. The value of gold bars varies depending on their brand and appearance. Choose branded gold bars over cast gold.

05 Information and Brands Create Real Value

It's a lie that all gold is created equal. The price of gold varies depending on the brand, trading method, and trading structure. How to avoid being ripped off when buying gold bars.

Chapter 7: Gold Trading Strategies That Never Fail

01 Buy cheaper and sell more through brokerage transactions.

Focus on trading methods rather than gold price predictions. ┃ Actively utilize matchmaking platforms. ┃ You can buy gold much cheaper through matchmaking. ┃ Buy gold bars with brand value through matchmaking. ┃ Actively utilize matchmaking for silver bars as well.

02 Profitability varies by a single point.

Brokerage is beneficial for both buyers and sellers. ┃When buying or selling, use a brokerage, not a goldsmith.

03 Buying gold on home shopping channels is a loss.

Why You Shouldn't Buy Gold on Home Shopping Channels┃Buying gold on home shopping channels is the most expensive option.

04 No matter how urgent it is, don't sell it just anywhere.

Selling gold and silver bars anywhere is a loss. Handle premium products with care.

05 The more you know about physical gold trading, the more you earn.

To sell at a high price, gather information and understand the structure. ┃Gold is also treated like a brand. ┃Investing in gold is not a symbol of wealth, but a way to become rich.

06 Physical gold bars are the forefront of moving money.

When investing in gold, the actual product is more important than the market price. The trend is to find gold that suits your taste rather than cheap gold. Gold bars are not just a commodity; they are a time-tested asset.

Chapter 8: Managing Gold Investment Risks That Never Fail

01 Gold banking eats away at profits.

Gold banking increases taxes and restricts liquidity, not profits. Invest in tax-free physical gold bars.

02 Tax-Free Gold Investment Strategy

Take Advantage of Brokerage Deals┃How to Trade Gold Without VAT

03 Beware of Invisible Powers and Temptations

Invest with a proper understanding of gold and silver futures margins. Be wary of gold investment leading platforms.

04 KRX Premium Signal Light and Increased Proportion of Gold in Foreign Exchange Reserves

The Relationship Between the KRX Gold Market and the Physical Gold Market: Why Should Korea Hold More Gold in Its Foreign Exchange Reserves?

Epilogue - Gold is a real asset for those who understand the value of "real money."

Detailed image

GOODS SPECIFICS

- Date of issue: November 12, 2025

- Page count, weight, size: 326 pages | 570g | 152*225*20mm

- ISBN13: 9788969526397

- ISBN10: 8969526390

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)