Principle of Wealth

|

Description

Book Introduction

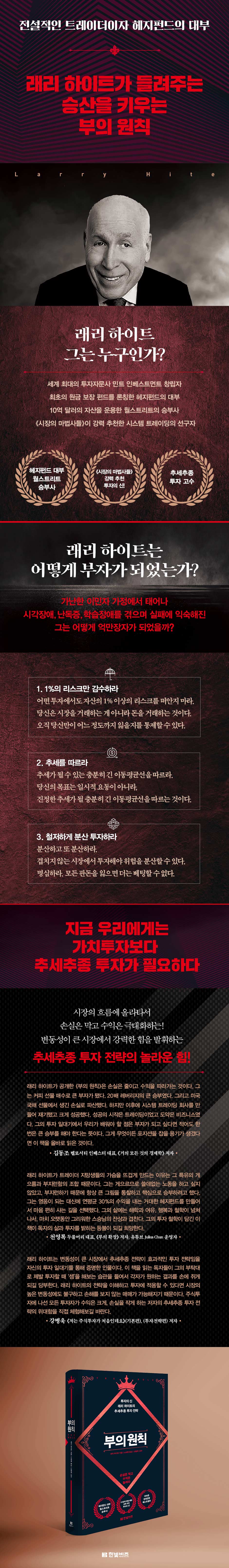

Larry Hite, the god of investment Speaking of the principles of wealth Larry Hite, author of "The Principles of Wealth," is a legendary trader with over 35 years of investment experience and is known as the godfather of hedge funds, having founded Mint Investments and introduced the first principal-guaranteed fund. He has built a wide reputation in the industry as a successful investor and was even featured as a pioneer of systematic trading in Jack Schwager's bestseller, Market Wizards. Despite his impressive resume, he had a difficult childhood due to visual impairment and dyslexia, and he was not a financier who followed an elite path like some of the celebrities on Wall Street. However, even in an unstable environment, he established an attitude toward life that was optimistic about the possibilities of reality and pessimistic about preparing for risks. And that attitude led him to a life of wealth. This book is the essence of his investment philosophy that he leaves to all stock investors. His investment principles are surprisingly concise and shockingly universal. His trend-following investment strategy guided him to wealth in volatile markets and ensured he never fell behind. Thanks to this, he learned how to ride the waves of the stock market, which is full of ups and downs, as if he had pioneered his own life, and was able to continue his voyage of wealth. Through this book, I hope readers will experience the powerful force of trend following that led Larry Hite to wealth. |

- You can preview some of the book's contents.

Preview

index

tribute

Recommendation

If you want to succeed, you have to take a big gamble at least once_ Kim Dong-jo

Larry Hite's Great Investment Principles Applicable to Everyone's Life_Cheon Yeong-rok

Stock Investment Methods for Small Losses and Big Profits_ Kang Byeong-wook

Foreword_ Michael Covel

Opening Remarks_ Jump into the Game

Part 1: Sheepshead, Pork Belly, and Blackjack

1.

Knowing Who You Are: How I Learned from Failure

Know your flaws and get used to failure.

Know what you need and what you want

2.

Find the game you like

: The education I received as a trader

Check the odds

4 bets

3.

Knowing Your Odds: Investment Timeframes and Opportunities

A fool jumps in boldly

Betting on big profits

Increase your chances of dating

4.

Trend Following: Prevent Losses and Increase Profits

statistical rules

But what about holding after buying?

Applying trend following to life

The Correlation Between Trend Following and Love: Keep Betting on the Path to a Happy Marriage

5.

How to Lose Money: How I Lost Millions of Dollars

8 Ways to Lose Money

How I Lost Everything

Part 2: Mint Funds, Market Wizards, and Living by the Rules

6.

Founding Mint

: Know where you are playing

London: A Place Facing Crisis and Opportunity

Asymmetric Leverage and Principal Protection Funds: Our Formula for Success

First component: time

Second component: knowledge

Third component: money (not your own, but someone else's money)

7.

How to Use the Principle of Wealth

: How My Philosophy Can Resonate with You

Where does money begin?

Risk management is everything

Techniques for Finding and Following Trends: Minimize Losses and Increase Profits

Basic knowledge of options and stop-loss

Don't try your luck on bad bets

How to keep increasing your profits

8.

For the next generation: The principles will continue to apply.

next generation

What's your name? How $25 became $2 million.

Managing other people's money again

Identify the worst-case scenario that could occur in any scenario.

9.

A Conversation with a Young Trader

: Sharing the Living, Breathing Principles of Wealth

10.

Make life choices that pay dividends.

What will life be like after success?

Reflections: Theory and Practice of Asymmetric Leverage

(Big returns with small risks)

Closing Remarks_ The Happiness of My Life

Recommendation

If you want to succeed, you have to take a big gamble at least once_ Kim Dong-jo

Larry Hite's Great Investment Principles Applicable to Everyone's Life_Cheon Yeong-rok

Stock Investment Methods for Small Losses and Big Profits_ Kang Byeong-wook

Foreword_ Michael Covel

Opening Remarks_ Jump into the Game

Part 1: Sheepshead, Pork Belly, and Blackjack

1.

Knowing Who You Are: How I Learned from Failure

Know your flaws and get used to failure.

Know what you need and what you want

2.

Find the game you like

: The education I received as a trader

Check the odds

4 bets

3.

Knowing Your Odds: Investment Timeframes and Opportunities

A fool jumps in boldly

Betting on big profits

Increase your chances of dating

4.

Trend Following: Prevent Losses and Increase Profits

statistical rules

But what about holding after buying?

Applying trend following to life

The Correlation Between Trend Following and Love: Keep Betting on the Path to a Happy Marriage

5.

How to Lose Money: How I Lost Millions of Dollars

8 Ways to Lose Money

How I Lost Everything

Part 2: Mint Funds, Market Wizards, and Living by the Rules

6.

Founding Mint

: Know where you are playing

London: A Place Facing Crisis and Opportunity

Asymmetric Leverage and Principal Protection Funds: Our Formula for Success

First component: time

Second component: knowledge

Third component: money (not your own, but someone else's money)

7.

How to Use the Principle of Wealth

: How My Philosophy Can Resonate with You

Where does money begin?

Risk management is everything

Techniques for Finding and Following Trends: Minimize Losses and Increase Profits

Basic knowledge of options and stop-loss

Don't try your luck on bad bets

How to keep increasing your profits

8.

For the next generation: The principles will continue to apply.

next generation

What's your name? How $25 became $2 million.

Managing other people's money again

Identify the worst-case scenario that could occur in any scenario.

9.

A Conversation with a Young Trader

: Sharing the Living, Breathing Principles of Wealth

10.

Make life choices that pay dividends.

What will life be like after success?

Reflections: Theory and Practice of Asymmetric Leverage

(Big returns with small risks)

Closing Remarks_ The Happiness of My Life

Detailed image

Into the book

The first thing you should do

I hope you will follow my life's journey.

I want to share with you my story of becoming a successful trader, a happy husband, father, grandfather, and friend.

My approach to life and investing is non-technical and doesn't require multiple pages of charts.

It's just based on my philosophy.

The key to wealth and success isn't doing things well every time.

Rather, it is a question of how much you earn when you do well and how much you lose when you do wrong.

Sometimes small-minded people make a lot of money.

But if you don't earn enough, you'll only gain the ability to show off at cocktail parties with strangers, and you won't be truly successful.

--- p.40, from "Introduction - Jump into the Game"

4 bets

Most people believe that there are two types of bets: good bets and bad bets.

Through my early experience and research, I have learned that there are actually four types of bets.

There are good bets, bad bets, winning bets and losing bets.

Most people generally assume that if they make a bad bet they lose and if they make a good bet they win.

But this is wrong.

Good bets and bad bets only refer to the odds of winning.

On the other hand, winning and losing bets refer to outcomes.

You can't completely control the outcome.

But there are two things we can definitely control.

It's the odds of winning and the risk you take on.

--- p.101, 「2.

From "Find the game you like"

Asymmetric Leverage and Principal Protection Funds: Our Formula for Success

Asymmetric leverage is unique in that it provides the benefits of traditional leverage without the corresponding risks… .

Mann's acquisition of Mint is a case of asymmetric leverage that benefits both parties.

Mann had over $100 million in assets at the time and was only risking $750,000, a small percentage of his net worth.

They gained a 50 percent stake in Mint, but with less than a 5 percent risk of losing $750,000. (Omitted) These are the same factors that made our principal-guaranteed fund successful.

Thanks to these factors, when we launched our first principal-guaranteed fund, we only had $250,000 of our $2 million in assets under management at risk.

Ultimately, through that fund, we made over $50 million by the end of that year.

This resulted in a return of 40 times our initial investment of $250,000, which was 12.5 percent of our operating capital at the time.

--- p.196, 「6.

From "Establishing Mint"

Where does money begin?

I made a lot of money by calculating interest rates.

In fact, most of my success has come from using debt smartly and calculating the difference between how much I pay on debt and how much I earn with it.

In a college class, when a professor made fun of people who only put up 5 percent of their total trading volume out of their own pocket, the students all burst out laughing.

But I was doing the math, and it turned out that I could trade $10,000 in commodity futures (and make money) with $500.

Always keep track of how much you have, how much you can lose, and how much you can earn.

After doing the math and determining that it is reasonable, invest with appropriate funds.

Please keep this in mind.

Counting is a means of optimized thinking.

--- p.210, 「7.

From “How to Use the Principle of Wealth”

Make life choices that pay dividends.

The market is inefficient.

It is precisely because of such inefficiencies that opportunities arise.

If markets were efficient, people would have no incentive to work or invest.

Inefficiencies motivate people to innovate and create better, faster, and cheaper services and products.

So, what that means is that there will always be a motivation that drives people to work harder, pursue something, and achieve something.

Over time, when an innovation becomes commonplace, its advantage disappears.

But then new opportunities emerge in new markets.

It is up to each individual to find such opportunities at their own time and place.

There is definitely such an opportunity.

To find such opportunities, you just need to know what you want.

What characteristics does the thing you want have?

I hope you will follow my life's journey.

I want to share with you my story of becoming a successful trader, a happy husband, father, grandfather, and friend.

My approach to life and investing is non-technical and doesn't require multiple pages of charts.

It's just based on my philosophy.

The key to wealth and success isn't doing things well every time.

Rather, it is a question of how much you earn when you do well and how much you lose when you do wrong.

Sometimes small-minded people make a lot of money.

But if you don't earn enough, you'll only gain the ability to show off at cocktail parties with strangers, and you won't be truly successful.

--- p.40, from "Introduction - Jump into the Game"

4 bets

Most people believe that there are two types of bets: good bets and bad bets.

Through my early experience and research, I have learned that there are actually four types of bets.

There are good bets, bad bets, winning bets and losing bets.

Most people generally assume that if they make a bad bet they lose and if they make a good bet they win.

But this is wrong.

Good bets and bad bets only refer to the odds of winning.

On the other hand, winning and losing bets refer to outcomes.

You can't completely control the outcome.

But there are two things we can definitely control.

It's the odds of winning and the risk you take on.

--- p.101, 「2.

From "Find the game you like"

Asymmetric Leverage and Principal Protection Funds: Our Formula for Success

Asymmetric leverage is unique in that it provides the benefits of traditional leverage without the corresponding risks… .

Mann's acquisition of Mint is a case of asymmetric leverage that benefits both parties.

Mann had over $100 million in assets at the time and was only risking $750,000, a small percentage of his net worth.

They gained a 50 percent stake in Mint, but with less than a 5 percent risk of losing $750,000. (Omitted) These are the same factors that made our principal-guaranteed fund successful.

Thanks to these factors, when we launched our first principal-guaranteed fund, we only had $250,000 of our $2 million in assets under management at risk.

Ultimately, through that fund, we made over $50 million by the end of that year.

This resulted in a return of 40 times our initial investment of $250,000, which was 12.5 percent of our operating capital at the time.

--- p.196, 「6.

From "Establishing Mint"

Where does money begin?

I made a lot of money by calculating interest rates.

In fact, most of my success has come from using debt smartly and calculating the difference between how much I pay on debt and how much I earn with it.

In a college class, when a professor made fun of people who only put up 5 percent of their total trading volume out of their own pocket, the students all burst out laughing.

But I was doing the math, and it turned out that I could trade $10,000 in commodity futures (and make money) with $500.

Always keep track of how much you have, how much you can lose, and how much you can earn.

After doing the math and determining that it is reasonable, invest with appropriate funds.

Please keep this in mind.

Counting is a means of optimized thinking.

--- p.210, 「7.

From “How to Use the Principle of Wealth”

Make life choices that pay dividends.

The market is inefficient.

It is precisely because of such inefficiencies that opportunities arise.

If markets were efficient, people would have no incentive to work or invest.

Inefficiencies motivate people to innovate and create better, faster, and cheaper services and products.

So, what that means is that there will always be a motivation that drives people to work harder, pursue something, and achieve something.

Over time, when an innovation becomes commonplace, its advantage disappears.

But then new opportunities emerge in new markets.

It is up to each individual to find such opportunities at their own time and place.

There is definitely such an opportunity.

To find such opportunities, you just need to know what you want.

What characteristics does the thing you want have?

--- p.274, 「10.

From “Make life choices that pay dividends”

From “Make life choices that pay dividends”

Publisher's Review

Riding the market flow

Trend-following investment strategy

Larry Hite's trend-following investment method is, in a word, a strategy of riding the wave.

The method is to either ride a wave and then continue following it, or to come down and realize profits.

This strategy is gaining attention in volatile markets like today.

It is because of ‘excellent risk management.’

Larry Hite never lost more than 1% of his total capital in any position.

The first rule that this book emphasizes the most is to 'calculate how much you can lose and determine in advance whether that loss is something you can afford.'

Anticipating the worst-case scenario and structuring your investment to avoid it is the foundation for investors to avoid losing money and achieve wealth.

This book is largely divided into two parts: the first part, which covers the author's growth period in which he established his outlook on life, and the second part, which covers the author's investment journey in which he established an investment advisory firm and continued to pursue trend-following investments.

'Part 1 Sheepshead, Pork Belly and Blackjack' follows Larry Hite's journey of overcoming visual impairment and dyslexia to find his calling.

He explains why he established four principles of life and how he applied them to his own life.

In Part 2, "Mint Funds, Market Wizards, and Living by the Rules," we explore how Larry Hite applied his own life rules to the stock market.

You can explore how the world's largest investment advisory firm, the first to manage $1 billion, came into being, and how trend-following investment strategies, in volatile markets, went through a rigorous process to achieve tremendous success.

If you review "Theory and Practice of Asymmetric Leverage," included as an appendix at the end of this book, you will learn in detail how he was able to establish investment principles that maximize returns with minimal risk.

Larry Hite's comparison of his investment principles to trading and life makes us realize that there is no such thing as a separate attitude toward life and an attitude toward investing.

For example, the advice to break up and follow a better trend rather than suffering for years over a bad marriage, a bad job, or a bad business is completely in line with trend following in investing.

If it's a good trend, you have to stay on it until you see the end.

If you've found a good partner, it's only natural that you should maintain that relationship happily, confidently invest in a successful business, and continue to delegate work to capable people.

The author explains that this is how to enjoy investing and life.

If you want to become rich

Follow the principles of wealth and win.

In Chapter 1 of this book, "Knowing Who You Are," there is a scene where Larry Height is giving a lecture to students in a special education class at a high school.

He honestly describes how he overcame adversity and found success.

'I had to struggle to avoid being thrown into the trash can.

I taught myself how to discipline my mind and set goals.

Having goals simplifies life, and simplifying life is the key to success.'

The "Principles of Wealth" revealed by Larry Hite in this book is to cut losses and follow profits.

Training your mind develops the ability to "assume error" not only in trading but in all decisions in life.

By developing the mental muscle to assume mistakes and assess the probability of being wrong, you increase your chances of making the right big decisions—your "odds."

Larry Hite was able to take on as much risk as he wanted, based on his clear understanding of risk.

I've learned through life and investing that if you don't take risks, nothing happens, and if you take on too much risk, you're out of the game.

He shares his insights about his life and the markets with us.

"You must become a leader of risk, not a slave to it." And if you want to succeed, you must take on a big challenge at least once in your life.

Jump into the game right now.

Trend-following investment strategy

Larry Hite's trend-following investment method is, in a word, a strategy of riding the wave.

The method is to either ride a wave and then continue following it, or to come down and realize profits.

This strategy is gaining attention in volatile markets like today.

It is because of ‘excellent risk management.’

Larry Hite never lost more than 1% of his total capital in any position.

The first rule that this book emphasizes the most is to 'calculate how much you can lose and determine in advance whether that loss is something you can afford.'

Anticipating the worst-case scenario and structuring your investment to avoid it is the foundation for investors to avoid losing money and achieve wealth.

This book is largely divided into two parts: the first part, which covers the author's growth period in which he established his outlook on life, and the second part, which covers the author's investment journey in which he established an investment advisory firm and continued to pursue trend-following investments.

'Part 1 Sheepshead, Pork Belly and Blackjack' follows Larry Hite's journey of overcoming visual impairment and dyslexia to find his calling.

He explains why he established four principles of life and how he applied them to his own life.

In Part 2, "Mint Funds, Market Wizards, and Living by the Rules," we explore how Larry Hite applied his own life rules to the stock market.

You can explore how the world's largest investment advisory firm, the first to manage $1 billion, came into being, and how trend-following investment strategies, in volatile markets, went through a rigorous process to achieve tremendous success.

If you review "Theory and Practice of Asymmetric Leverage," included as an appendix at the end of this book, you will learn in detail how he was able to establish investment principles that maximize returns with minimal risk.

Larry Hite's comparison of his investment principles to trading and life makes us realize that there is no such thing as a separate attitude toward life and an attitude toward investing.

For example, the advice to break up and follow a better trend rather than suffering for years over a bad marriage, a bad job, or a bad business is completely in line with trend following in investing.

If it's a good trend, you have to stay on it until you see the end.

If you've found a good partner, it's only natural that you should maintain that relationship happily, confidently invest in a successful business, and continue to delegate work to capable people.

The author explains that this is how to enjoy investing and life.

If you want to become rich

Follow the principles of wealth and win.

In Chapter 1 of this book, "Knowing Who You Are," there is a scene where Larry Height is giving a lecture to students in a special education class at a high school.

He honestly describes how he overcame adversity and found success.

'I had to struggle to avoid being thrown into the trash can.

I taught myself how to discipline my mind and set goals.

Having goals simplifies life, and simplifying life is the key to success.'

The "Principles of Wealth" revealed by Larry Hite in this book is to cut losses and follow profits.

Training your mind develops the ability to "assume error" not only in trading but in all decisions in life.

By developing the mental muscle to assume mistakes and assess the probability of being wrong, you increase your chances of making the right big decisions—your "odds."

Larry Hite was able to take on as much risk as he wanted, based on his clear understanding of risk.

I've learned through life and investing that if you don't take risks, nothing happens, and if you take on too much risk, you're out of the game.

He shares his insights about his life and the markets with us.

"You must become a leader of risk, not a slave to it." And if you want to succeed, you must take on a big challenge at least once in your life.

Jump into the game right now.

GOODS SPECIFICS

- Date of issue: October 5, 2020

- Page count, weight, size: 312 pages | 596g | 140*210*30mm

- ISBN13: 9791157844487

- ISBN10: 1157844480

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)