Never Invest in Stocks Without Understanding Financial Statements (Part 2)

|

Description

Book Introduction

The best-selling manga, verified by 100,000 investors, is now complete! The secret to reading financial statements: "Investment-tailored" and practical! The financial statement bible made even easier and more fun with comics! With the publication of the latest revised edition in 2020, the book, "Never Invest in Stocks Without Understanding Financial Statements," which has been loved by readers even more, has been perfectly adapted into a comic book. Thanks to the explosive popularity of the first volume of the manga series, "Never Invest in Stocks Without Understanding Financial Statements," a second volume, the final installment, has also been published. This is a comic book lecture format that teaches investors how to read financial statements in an easy-to-understand and fun way, written by a certified public accountant. It includes a "Checkpoint" section that contains essential financial statement knowledge for stock investors, such as capital erosion and depreciation, composition of audit opinions, and the meaning and use of PER, as well as a "Case Study" section where you can practice using real-life examples of company data and disclosures. Financial statements for investment are different from the start. In the second volume of the comic book, "Never Invest in Stocks Without Understanding Financial Statements," the comic book conveys in a more three-dimensional and vivid way the secrets of reading financial statements "just for investors," which can be applied from beginners to real-life situations, to reduce losses in the competitive stock market by reading financial statements, and even to generate profits. For readers who haven't read the original, this book is a good introduction to stock investment. Even for those who have already read the original, it will be a great help in understanding it more easily with a different feel. |

- You can preview some of the book's contents.

Preview

index

Author's Greetings

Character Introduction / How to Use This Book

Part 2 How to Reduce Losses

3.

How to avoid bad news: Avoid the rain and let's see!

Investors panic over sudden capital increase

[Check Point] Capital Erosion and Potatoes

The secret to predicting growth

Can you see it now?

You see as much as you know, and you earn as much as you see.

Protect your wealth by reading just one line of the thank you note!

[Check Point] Composition of Audit Opinion

Misleading articles and misconceptions about audit opinions

Never lose money!

Part 3: How to Make Money

Don't invest in good companies!

There is only one principle in investing!

Methods of Measuring Stock Value

The law of relative value is problematic

[Check Point] The Meaning and Use of PER

The principle of the law of absolute value is not difficult.

[Check Point] Present Value of Perpetual Cash Flows

Why I Don't Prefer DCF

Are analysts' target prices truly the result of their analysis?

2 trillion or 200 billion? Expert opinions differ by a factor of 10.

The point we arrived at after 10 years of thinking

[Case Study] Calculating Equity and ROE in HTS

The best way to calculate fair value

[Check Point] Depreciation

How to predict ROE?

How to Determine the Discount Rate: Theoretical Methods

[Check Point] CAPM

A realistic alternative for stock investment

How long will the company's excess profits last?

How much should I buy it for to get it cheap?

[Case Study] Calculating Target Stock Prices Using S-RIM

Character Introduction / How to Use This Book

Part 2 How to Reduce Losses

3.

How to avoid bad news: Avoid the rain and let's see!

Investors panic over sudden capital increase

[Check Point] Capital Erosion and Potatoes

The secret to predicting growth

Can you see it now?

You see as much as you know, and you earn as much as you see.

Protect your wealth by reading just one line of the thank you note!

[Check Point] Composition of Audit Opinion

Misleading articles and misconceptions about audit opinions

Never lose money!

Part 3: How to Make Money

Don't invest in good companies!

There is only one principle in investing!

Methods of Measuring Stock Value

The law of relative value is problematic

[Check Point] The Meaning and Use of PER

The principle of the law of absolute value is not difficult.

[Check Point] Present Value of Perpetual Cash Flows

Why I Don't Prefer DCF

Are analysts' target prices truly the result of their analysis?

2 trillion or 200 billion? Expert opinions differ by a factor of 10.

The point we arrived at after 10 years of thinking

[Case Study] Calculating Equity and ROE in HTS

The best way to calculate fair value

[Check Point] Depreciation

How to predict ROE?

How to Determine the Discount Rate: Theoretical Methods

[Check Point] CAPM

A realistic alternative for stock investment

How long will the company's excess profits last?

How much should I buy it for to get it cheap?

[Case Study] Calculating Target Stock Prices Using S-RIM

Detailed image

Publisher's Review

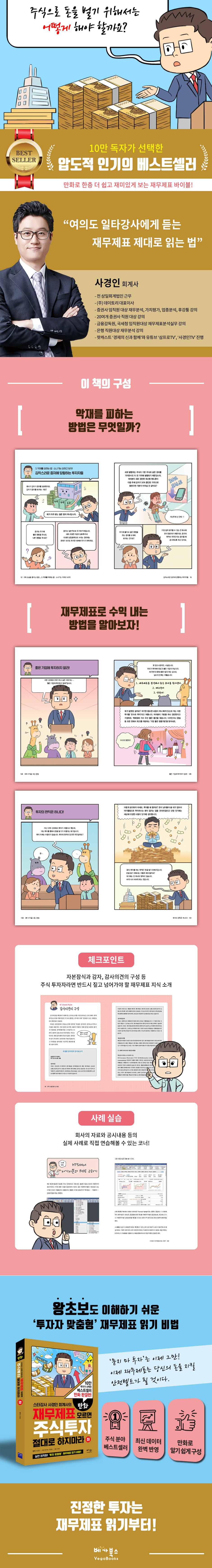

A live lecture by a securities industry daily instructor that you have to wait in line to hear, now in cartoon form!

The author, known as one of the 'Three Greatest Lecturers in the Securities Industry' and consistently loved for his lectures at dozens of securities firms, has perfectly translated his lectures on financial statements into a comic book.

As it is written in the form of a comic book, even novice stock investors can easily approach it, and the vivid and entertaining storytelling will have you reading through to the last page in one sitting.

How to Read Financial Statements: Investors Need to Know

Do accountants know how to properly read financial statements? In fact, accountants' job is to conduct the final review of financial statements prepared by companies.

The author says they are simply checking whether the financial statements are well prepared.

The knowledge required to create financial statements and the knowledge required to read them are completely different.

Building a car and driving it are two completely different things.

Just as you can drive well even if you're not good at welding, you can read financial statements even if you're not good at creating them.

What investors need to know is not 'how to make' but 'how to read'.

This book, based on the author's investment experience and extensive financial knowledge, is a comic book that explains in an easy-to-understand way how to read financial statements, focusing solely on profit and ensuring investment that will not fail, "for investors."

There are no difficult accounting terms or complex calculations, making it easier for beginners to access.

A rich composition with nothing missing

If you think that because it is a cartoon, there will be parts that were in the original work omitted or shortened, you are mistaken.

It contains all the content covered in the original work, “Never Invest in Stocks Without Understanding Financial Statements,” in a way that is consistent with the comics.

The lecture-style comic book explains the original story in more detail, and it includes "Checkpoints" containing essential financial statement knowledge for stock investors, as well as "Case Studies" for practical practice using real-life examples, ensuring that the book is fully structured.

The author, known as one of the 'Three Greatest Lecturers in the Securities Industry' and consistently loved for his lectures at dozens of securities firms, has perfectly translated his lectures on financial statements into a comic book.

As it is written in the form of a comic book, even novice stock investors can easily approach it, and the vivid and entertaining storytelling will have you reading through to the last page in one sitting.

How to Read Financial Statements: Investors Need to Know

Do accountants know how to properly read financial statements? In fact, accountants' job is to conduct the final review of financial statements prepared by companies.

The author says they are simply checking whether the financial statements are well prepared.

The knowledge required to create financial statements and the knowledge required to read them are completely different.

Building a car and driving it are two completely different things.

Just as you can drive well even if you're not good at welding, you can read financial statements even if you're not good at creating them.

What investors need to know is not 'how to make' but 'how to read'.

This book, based on the author's investment experience and extensive financial knowledge, is a comic book that explains in an easy-to-understand way how to read financial statements, focusing solely on profit and ensuring investment that will not fail, "for investors."

There are no difficult accounting terms or complex calculations, making it easier for beginners to access.

A rich composition with nothing missing

If you think that because it is a cartoon, there will be parts that were in the original work omitted or shortened, you are mistaken.

It contains all the content covered in the original work, “Never Invest in Stocks Without Understanding Financial Statements,” in a way that is consistent with the comics.

The lecture-style comic book explains the original story in more detail, and it includes "Checkpoints" containing essential financial statement knowledge for stock investors, as well as "Case Studies" for practical practice using real-life examples, ensuring that the book is fully structured.

GOODS SPECIFICS

- Date of issue: June 4, 2020

- Page count, weight, size: 296 pages | 532g | 152*225*20mm

- ISBN13: 9791190242455

- ISBN10: 1190242451

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)