The Big 2 Legendary Pro Traders

|

Description

Book Introduction

"Is this the 'real bottom'? If you want to know, open to Chapter 11."

Trend-following practical know-how, day trading, and options trading strategies.

Technofundamental trading combines the strengths of fundamental and technical analysis.

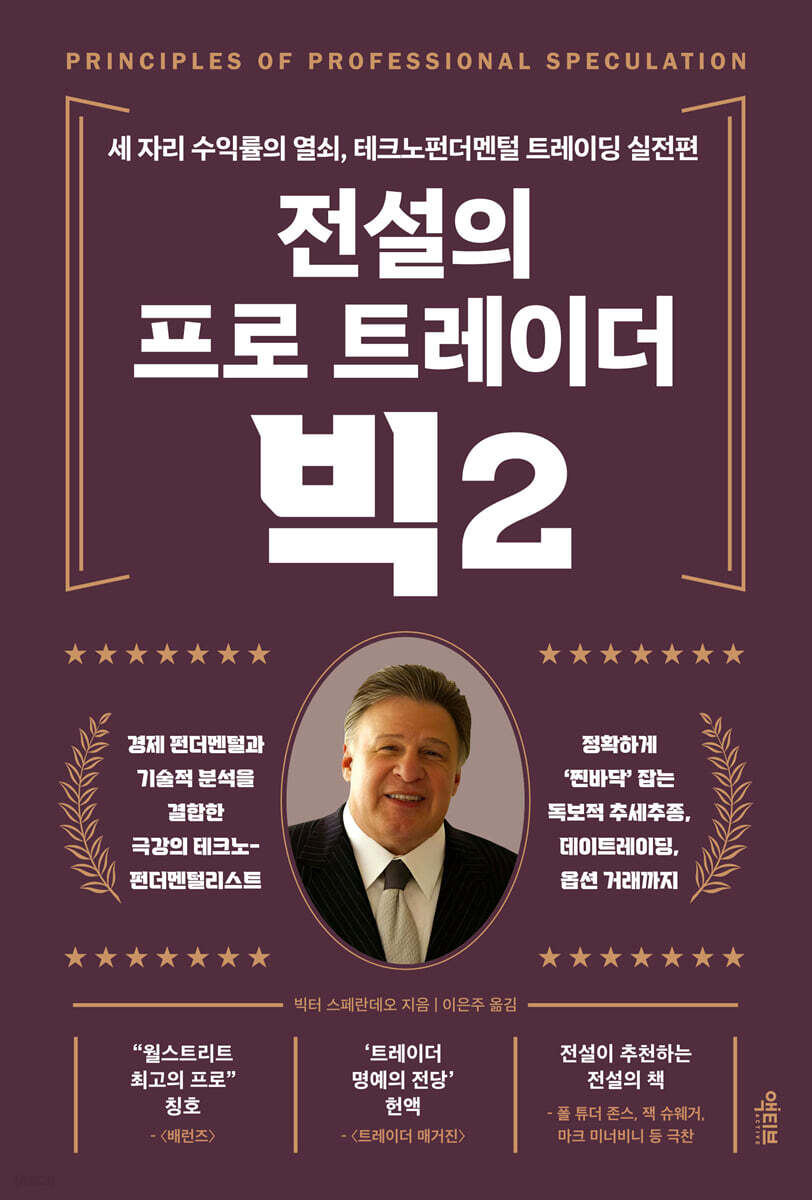

The second book in Victor Sperandeo's "Big: The Legendary Pro Trader," which records an astonishing average annual return of 72% without a single loss for 18 years.

While Volume 1 introduced the fundamental principles of speculative trading, which have yielded remarkable results, Volume 2 focuses on developing the skills to trade with "low risk and high returns" by providing more detailed explanations of market analysis and forecasting tools.

The author, who gained fame as a "Big Trader" on Wall Street, is the original "techno-fundamentalist" who emphasizes macroeconomic trends.

It combines economic fundamentals and technical analysis to identify trends and presents specific methods for leveraging government policies and market sentiment.

Covers the core elements of practical investing, from techniques for seizing opportunities in volatility to options trading and day trading strategies, and even mental management.

As you read, you'll find yourself nodding along to understand why Mark Minervini and Jack Schwager so heavily cite and recommend Victor Sperandeo's techniques in their respective books.

The author emphasizes that a professional trader must be able to "protect the principal investment and generate profits every year."

The book's practical examples, presented with numerous charts, help readers answer any questions they may have.

Let's try probabilistic and scientific trading using the stock market's average life analysis table.

Trend-following practical know-how, day trading, and options trading strategies.

Technofundamental trading combines the strengths of fundamental and technical analysis.

The second book in Victor Sperandeo's "Big: The Legendary Pro Trader," which records an astonishing average annual return of 72% without a single loss for 18 years.

While Volume 1 introduced the fundamental principles of speculative trading, which have yielded remarkable results, Volume 2 focuses on developing the skills to trade with "low risk and high returns" by providing more detailed explanations of market analysis and forecasting tools.

The author, who gained fame as a "Big Trader" on Wall Street, is the original "techno-fundamentalist" who emphasizes macroeconomic trends.

It combines economic fundamentals and technical analysis to identify trends and presents specific methods for leveraging government policies and market sentiment.

Covers the core elements of practical investing, from techniques for seizing opportunities in volatility to options trading and day trading strategies, and even mental management.

As you read, you'll find yourself nodding along to understand why Mark Minervini and Jack Schwager so heavily cite and recommend Victor Sperandeo's techniques in their respective books.

The author emphasizes that a professional trader must be able to "protect the principal investment and generate profits every year."

The book's practical examples, presented with numerous charts, help readers answer any questions they may have.

Let's try probabilistic and scientific trading using the stock market's average life analysis table.

- You can preview some of the book's contents.

Preview

index

Recommendation | Brilliant Insights from 30 Years Ago: What to Take and What to Leave_Yoon Ji-ho

Prologue | Two Frameworks for Market Analysis and Forecasting

Part 1.

Economic Fundamentals: How to Read the Big Economy

Chapter 1.

Basic principles of a sound investment philosophy

Capital preservation | Consistent profits | Pursuit of higher returns | Conclusion

Chapter 2.

Predicting the Market Using Economic Principles

The Definition of Economics | Production as the Top Priority | Savings, Investment, and Technological Innovation | Valuation and Exchange | Seizing the "Soros Opportunity" | Profits Come from Surplus Production | Conclusion

Chapter 3.

The Effects of Monetary Policy on the Business Cycle

The Illusion of a Boom | If There Were No Money | Defining "Natural Interest" | The Three Components of Market Interest Rates | The Nature of the Business Cycle | Government Intervention in Recessions | Conclusion

Chapter 4.

The Effects of Fiscal Policy on the Business Cycle

Why Taxes Matter | The Negative Effects of Capital Gains Tax | The True Meaning of Government Deficit Spending | Conclusion

Chapter 5.

Macroeconomic Analysis and Forecasting

Considering Monetary and Fiscal Policy Together | Forecasting the Future with Historical Data | Conclusion

Chapter 6.

The future of the dollar

The Evolution of the Dollar's Value | Political Scenarios | Conclusion

Part 2.

Technical Analysis: How to Read Trends and Market Sentiment

Chapter 7.

Seizing Opportunity in Volatility

Trading Opportunities and Market Volatility | GNP Volatility and Market Volatility | Conclusion

Chapter 8.

Stock prices are a leading indicator of the economy

Two Economic Forecasting Methods | Correlation Between Stock Prices and the Economy | Definitions | Data from the Last 100 Years | Exceptions | Conclusion

Chapter 9.

Risk and Reward Analysis

A tool for measuring risk and reward | Market life expectancy analysis chart | Focusing on risk | Conclusion

Chapter 10.

Strong technical indicators

Glossary of Terms | Attributes of Trend Reversals | 1-2-3 Rule | 2B Indicator | Other Useful Tools | New Indicators | Conclusion

Chapter 11.

Real-world chart analysis

Case 26: Buy/Sell Signal Detection

Part 3.

Growing Profits with Options Trading: Understanding Options Strategies is Essential Even If You Don't Trade

Chapter 12.

The Magic Key to Triple-Digit Returns

Bet only when the odds are in your favor | Why you should monitor market sentiment | A market dominated by institutional investors | Timing | Market volatility and trend formation | Strategic options trading plan | Conclusion

Chapter 13.

Day Trading Basics and Advanced

Psychological Requirements for Traders | Intellectual Requirements for Traders | Day Trading Fundamentals | Short-Term Trends | Trend Analysis

Part 4.

Trading mind

Chapter 14.

Character training

Finding True Success | Characteristics of Neurotic Traders | Two Personality Types | Qualities of Successful Traders | Lessons from Impulsive Behavior | Conclusion

Epilogue | The Ethics of Wealth

annotation

Search

Prologue | Two Frameworks for Market Analysis and Forecasting

Part 1.

Economic Fundamentals: How to Read the Big Economy

Chapter 1.

Basic principles of a sound investment philosophy

Capital preservation | Consistent profits | Pursuit of higher returns | Conclusion

Chapter 2.

Predicting the Market Using Economic Principles

The Definition of Economics | Production as the Top Priority | Savings, Investment, and Technological Innovation | Valuation and Exchange | Seizing the "Soros Opportunity" | Profits Come from Surplus Production | Conclusion

Chapter 3.

The Effects of Monetary Policy on the Business Cycle

The Illusion of a Boom | If There Were No Money | Defining "Natural Interest" | The Three Components of Market Interest Rates | The Nature of the Business Cycle | Government Intervention in Recessions | Conclusion

Chapter 4.

The Effects of Fiscal Policy on the Business Cycle

Why Taxes Matter | The Negative Effects of Capital Gains Tax | The True Meaning of Government Deficit Spending | Conclusion

Chapter 5.

Macroeconomic Analysis and Forecasting

Considering Monetary and Fiscal Policy Together | Forecasting the Future with Historical Data | Conclusion

Chapter 6.

The future of the dollar

The Evolution of the Dollar's Value | Political Scenarios | Conclusion

Part 2.

Technical Analysis: How to Read Trends and Market Sentiment

Chapter 7.

Seizing Opportunity in Volatility

Trading Opportunities and Market Volatility | GNP Volatility and Market Volatility | Conclusion

Chapter 8.

Stock prices are a leading indicator of the economy

Two Economic Forecasting Methods | Correlation Between Stock Prices and the Economy | Definitions | Data from the Last 100 Years | Exceptions | Conclusion

Chapter 9.

Risk and Reward Analysis

A tool for measuring risk and reward | Market life expectancy analysis chart | Focusing on risk | Conclusion

Chapter 10.

Strong technical indicators

Glossary of Terms | Attributes of Trend Reversals | 1-2-3 Rule | 2B Indicator | Other Useful Tools | New Indicators | Conclusion

Chapter 11.

Real-world chart analysis

Case 26: Buy/Sell Signal Detection

Part 3.

Growing Profits with Options Trading: Understanding Options Strategies is Essential Even If You Don't Trade

Chapter 12.

The Magic Key to Triple-Digit Returns

Bet only when the odds are in your favor | Why you should monitor market sentiment | A market dominated by institutional investors | Timing | Market volatility and trend formation | Strategic options trading plan | Conclusion

Chapter 13.

Day Trading Basics and Advanced

Psychological Requirements for Traders | Intellectual Requirements for Traders | Day Trading Fundamentals | Short-Term Trends | Trend Analysis

Part 4.

Trading mind

Chapter 14.

Character training

Finding True Success | Characteristics of Neurotic Traders | Two Personality Types | Qualities of Successful Traders | Lessons from Impulsive Behavior | Conclusion

Epilogue | The Ethics of Wealth

annotation

Search

Into the book

The discovery of truth is very important.

Because analyzing failure is the foundation for our growth through life's challenges.

Sometimes in the market, the right outcome can come from a wrong cause, and the wrong outcome can come from a high probability of success.

The reason may seem vague, but it is simple.

The point is that the market is not always objective.

Markets are sometimes emotional, subjective and psychological.

--- p.21, from "Prologue"

Most investors use either fundamental analysis or technical analysis when evaluating a trade's potential.

This is quite a wrong approach.

The reason speculation requires the integration of both fundamental and technical analysis into its analytical tools is that it allows for the ability to predict not only future events but also the timing of those events.

By doing this, you increase your chances of trading success.

Furthermore, profits are maximized when the level of research and knowledge required to accurately identify mid-term (weeks to months) market interventions and liquidation points is raised.

--- p.27, from "Prologue"

I would like to note that so far I have not used the words money or credit, but rather general terms related to economics and finance.

From the perspective of basic economic principles, production, savings, investment, capital, profits, losses, etc. have nothing to do with money or credit.

Money and credit are merely technological innovations that make the chains of production and economic growth more efficient, manageable, and measurable.

--- p.60, Chapter 2.

From “Predicting the Market Using Economic Principles”

Typically, during a recession, there are growing calls for the government to "do something" to help the national economy emerge from the doldrums.

But the government is unable to change the reality that a period of adjustment is needed.

All the government can do is stop the wrong fiscal policy of confiscating capital and investing it in the wrong places.

This means cutting both taxes and spending.

But in reality, this rarely happens.

--- p.96, Chapter 3.

From “The Effects of Monetary Policy on the Business Cycle”

How can a capital gains tax cut benefit only the wealthy? If the capital gains tax were nonexistent or the rate were reduced, more and more companies, like Joss, would shed that stigma, branded "unpromising" by investors.

As a result, more resources are used to create new wealth (new products and services).

The result is more jobs, more competitive prices (assuming low inflation), more spending, more profits, more savings, more investment, and a host of other benefits.

--- pp.120~121, 「Chapter 4.

From “The Effects of Fiscal Policy on the Business Cycle”

In 1985, I updated Lea's findings using the Industrial Production Index.

As a result, when targeting the overall bull market, the Dow Jones Industrial Average rose 70.1%, the Dow Transportation Index rose 69.3%, and the Business Index rose 74.6%.

In a bear market, the figures were adjusted to show declines of 57.9%, 53.3%, and 61.76%, respectively.

This numerical data alone makes it clear that the stock market has predictive power.

--- p.184, Chapter 8.

Stock prices are leading indicators of the economy.

Based on the average life analysis table, among all bull markets, the trend size was larger in 53.5% of cases and the trend duration was longer in 67.3% of cases.

In other words, the market was reaching an intermediate level in both dimensions: the magnitude and duration of the trend.

From a statistical standpoint alone, the probability that the market's 'lifespan' would soon end was about 40% on average.

Therefore, if you use this as your sole criterion, your maximum long position in your stock portfolio should not exceed 60%.

--- p.222, Chapter 9.

From “Risk and Reward Analysis”

Technically, the first step in assessing a trend is to draw a trend line.

It seems like a simple task, but just as few people can correctly define a trend, few people can accurately draw trend lines.

The method of drawing trend lines that I want to explain is based on the definitions described above.

However, when I gave only this definition to my 39 trainees and did not explain it further, not a single one of them was able to consistently draw the trend line accurately.

Although it usually follows the trend, it draws trend lines that sometimes give false signals about potential trend reversals.

--- p.243, Chapter 10.

Among the “strong technical indicators”

September oats (Figure 11.1): After a downward trend since December, the price bottomed in February and rebounded and tested in March.

When a new low was formed at 133.0, 2B (new low but no trend progression) appeared.

At this time, you can use 132.75 as the stop loss line and take a buy position at the next day's closing price of 135.25.

Then, you can increase your position size above the March rebound high.

Remember, you should never trade below the March high.

The fact that the March high is broken downwards is itself a very important signal.

--- pp.275~276, 「Chapter 11.

From “Practical Chart Analysis”

Taking smaller options positions reduces the number of trades that must be successful.

By only trading when you have a good chance of winning, setting a risk-to-reward ratio of at least 5x, and using relatively small bet sizes, you can be ahead of the game even if you win just one out of four times.

You can make money just by doing this.

If you make a profit just one out of four times, you are successful.

Even if you succeed just once out of six times, you will have enough capital to continue the game.

Because analyzing failure is the foundation for our growth through life's challenges.

Sometimes in the market, the right outcome can come from a wrong cause, and the wrong outcome can come from a high probability of success.

The reason may seem vague, but it is simple.

The point is that the market is not always objective.

Markets are sometimes emotional, subjective and psychological.

--- p.21, from "Prologue"

Most investors use either fundamental analysis or technical analysis when evaluating a trade's potential.

This is quite a wrong approach.

The reason speculation requires the integration of both fundamental and technical analysis into its analytical tools is that it allows for the ability to predict not only future events but also the timing of those events.

By doing this, you increase your chances of trading success.

Furthermore, profits are maximized when the level of research and knowledge required to accurately identify mid-term (weeks to months) market interventions and liquidation points is raised.

--- p.27, from "Prologue"

I would like to note that so far I have not used the words money or credit, but rather general terms related to economics and finance.

From the perspective of basic economic principles, production, savings, investment, capital, profits, losses, etc. have nothing to do with money or credit.

Money and credit are merely technological innovations that make the chains of production and economic growth more efficient, manageable, and measurable.

--- p.60, Chapter 2.

From “Predicting the Market Using Economic Principles”

Typically, during a recession, there are growing calls for the government to "do something" to help the national economy emerge from the doldrums.

But the government is unable to change the reality that a period of adjustment is needed.

All the government can do is stop the wrong fiscal policy of confiscating capital and investing it in the wrong places.

This means cutting both taxes and spending.

But in reality, this rarely happens.

--- p.96, Chapter 3.

From “The Effects of Monetary Policy on the Business Cycle”

How can a capital gains tax cut benefit only the wealthy? If the capital gains tax were nonexistent or the rate were reduced, more and more companies, like Joss, would shed that stigma, branded "unpromising" by investors.

As a result, more resources are used to create new wealth (new products and services).

The result is more jobs, more competitive prices (assuming low inflation), more spending, more profits, more savings, more investment, and a host of other benefits.

--- pp.120~121, 「Chapter 4.

From “The Effects of Fiscal Policy on the Business Cycle”

In 1985, I updated Lea's findings using the Industrial Production Index.

As a result, when targeting the overall bull market, the Dow Jones Industrial Average rose 70.1%, the Dow Transportation Index rose 69.3%, and the Business Index rose 74.6%.

In a bear market, the figures were adjusted to show declines of 57.9%, 53.3%, and 61.76%, respectively.

This numerical data alone makes it clear that the stock market has predictive power.

--- p.184, Chapter 8.

Stock prices are leading indicators of the economy.

Based on the average life analysis table, among all bull markets, the trend size was larger in 53.5% of cases and the trend duration was longer in 67.3% of cases.

In other words, the market was reaching an intermediate level in both dimensions: the magnitude and duration of the trend.

From a statistical standpoint alone, the probability that the market's 'lifespan' would soon end was about 40% on average.

Therefore, if you use this as your sole criterion, your maximum long position in your stock portfolio should not exceed 60%.

--- p.222, Chapter 9.

From “Risk and Reward Analysis”

Technically, the first step in assessing a trend is to draw a trend line.

It seems like a simple task, but just as few people can correctly define a trend, few people can accurately draw trend lines.

The method of drawing trend lines that I want to explain is based on the definitions described above.

However, when I gave only this definition to my 39 trainees and did not explain it further, not a single one of them was able to consistently draw the trend line accurately.

Although it usually follows the trend, it draws trend lines that sometimes give false signals about potential trend reversals.

--- p.243, Chapter 10.

Among the “strong technical indicators”

September oats (Figure 11.1): After a downward trend since December, the price bottomed in February and rebounded and tested in March.

When a new low was formed at 133.0, 2B (new low but no trend progression) appeared.

At this time, you can use 132.75 as the stop loss line and take a buy position at the next day's closing price of 135.25.

Then, you can increase your position size above the March rebound high.

Remember, you should never trade below the March high.

The fact that the March high is broken downwards is itself a very important signal.

--- pp.275~276, 「Chapter 11.

From “Practical Chart Analysis”

Taking smaller options positions reduces the number of trades that must be successful.

By only trading when you have a good chance of winning, setting a risk-to-reward ratio of at least 5x, and using relatively small bet sizes, you can be ahead of the game even if you win just one out of four times.

You can make money just by doing this.

If you make a profit just one out of four times, you are successful.

Even if you succeed just once out of six times, you will have enough capital to continue the game.

--- p.314, Chapter 12.

From "The Magic Key to Three-Digit Returns"

From "The Magic Key to Three-Digit Returns"

Publisher's Review

Technofundamental trading combines the strengths of fundamental and technical analysis.

The Secrets of Wall Street's Top Traders Revealed

Most investors learn economic analysis and chart analysis, but very few actually apply this knowledge to actual trading.

《Legendary Pro Trader Big 2》 was written to bridge the gap between knowledge and practice.

Trader Big says:

“My ultimate goal in writing this book is to help readers improve their trading skills and make more money.”

To improve your trading skills, you must continually test your judgment and develop the ability to respond flexibly to market conditions.

This book introduces the realistic problems you will face as a trader and how to overcome them.

It covers how to develop trading habits that are unswayed by emotions, learn from failure, and develop consistent strategies.

It also provides practical, practical tips and lessons learned through the author's successes and failures.

Take care of economic fundamentals first.

All trading begins with economic fundamentals.

Trading begins with a deep understanding of economic fundamentals.

Markets are closely linked to political, economic, and social changes, and analysis that takes all these factors into account is essential.

This book explains what data readers should pay attention to and what scenarios can be imagined based on it.

Investing without a proper understanding of economic fundamentals is like setting sail without a compass.

The core approach is to understand economic causality, analyze the impact of political decisions on corporate performance, and interpret market movements based on this.

Two Frameworks for Market Analysis

Harmonizing economic fundamentals and technical analysis

When analyzing the market, two frameworks are needed: economic fundamentals and technical analysis.

Economic fundamental analysis is useful for drawing the big picture of the market, while technical analysis is suitable for pinpointing more precise trading opportunities.

In other words, economic fundamentals tell you what to trade, while technical analysis tells you when to trade.

These two frameworks are complementary and, when used together, can significantly increase your chances of trading success.

The book clearly explains the two frameworks and guides you through how to combine them to systematically analyze the market.

From trend-following to day trading and options trading strategies that capture the "real bottom"

This is the essence of the trend!

Successful trading isn't achieved with just one specific technique.

Economic analysis, trading strategy, and investment mindset must be organically combined.

This book covers, step by step, all the elements a trader must have to succeed in the markets.

Part 1 explains economic fundamentals.

If you want to become an investor, you must first learn the basic principles of market analysis before acquiring advanced trading knowledge.

The market is a series of cause-and-effect relationships, and fundamental analysis is the process of analyzing these basic economic relationships and predicting the future based on them.

The author introduces a useful perspective on economics advocated by Ludwig von Mises.

Part 2 presents several tools for reading the psychology and behavioral patterns of many investors through technical analysis.

It makes sense to analyze all market prices for patterns and trends rather than daily fluctuations.

When market participants move in a certain direction, you should ride the wave, as George Soros said, and get off before the bubble bursts.

The case study highlights how to capture buy and sell signals on various real-world charts, from stock indices to raw materials.

Part 3 presents options trading, the magic key to triple-digit returns.

This is possible only if one can relatively accurately predict future price direction, timing, and trend patterns.

However, if you buy options with even a small portion of your funds, you can make a large profit if your prediction is correct while limiting the risk of loss.

Even if you don't trade options, it's essential to understand options strategies.

Part 4 is a kind of 'trader's stabilizer' due to the stressful nature of trading.

Trading takes place in a whirlwind of emotions.

Market changes are always difficult to predict, and responding to them requires psychological stability and cool-headed judgment.

The author establishes a trading philosophy and, based on this, introduces methods for overcoming tension and stress in the markets.

"Highly recommended for any investor looking to capitalize on trends."

"The essence of chart analysis, applicable to coins and commodities."

Yoon Ji-ho, co-author of "Korean Top-Down Investment Strategy," recommended the book, saying, "The reason why this 30-year-old book is still being recalled is because it is appealing because it contains counterarguments to conventional wisdom throughout and the investment style is unbiased." Hong Jin-chae, CEO of Raccoon Asset Management, said, "I highly recommend this book to all investors who want to understand and utilize trends."

It also received praise such as, “The essence of technical analysis that can be applied not only to stocks but also to coins, commodities, and indices” (Daehyun Kim, author of “Breakthrough Trading Strategy”), and “It is hard to believe that one person wrote the vast amount of content and data that covers economics, politics, technical analysis, psychology, and even wealth ethics” (Seunghoon Ha, operator of “Seunghoon Ha’s Stock Investment TV” on YouTube).

Mark Minervini and Jack Schwager also heavily cited and recommended Victor Sperandeo's techniques in their books, "High-Yield Growth Stocks" and "The New Market Wizards."

"Legendary Pro Trader Big 2" will serve as a guide for all investors who want to arm themselves with their own weapons in the ever-changing market, analyzing and predicting the market to generate profits.

The Secrets of Wall Street's Top Traders Revealed

Most investors learn economic analysis and chart analysis, but very few actually apply this knowledge to actual trading.

《Legendary Pro Trader Big 2》 was written to bridge the gap between knowledge and practice.

Trader Big says:

“My ultimate goal in writing this book is to help readers improve their trading skills and make more money.”

To improve your trading skills, you must continually test your judgment and develop the ability to respond flexibly to market conditions.

This book introduces the realistic problems you will face as a trader and how to overcome them.

It covers how to develop trading habits that are unswayed by emotions, learn from failure, and develop consistent strategies.

It also provides practical, practical tips and lessons learned through the author's successes and failures.

Take care of economic fundamentals first.

All trading begins with economic fundamentals.

Trading begins with a deep understanding of economic fundamentals.

Markets are closely linked to political, economic, and social changes, and analysis that takes all these factors into account is essential.

This book explains what data readers should pay attention to and what scenarios can be imagined based on it.

Investing without a proper understanding of economic fundamentals is like setting sail without a compass.

The core approach is to understand economic causality, analyze the impact of political decisions on corporate performance, and interpret market movements based on this.

Two Frameworks for Market Analysis

Harmonizing economic fundamentals and technical analysis

When analyzing the market, two frameworks are needed: economic fundamentals and technical analysis.

Economic fundamental analysis is useful for drawing the big picture of the market, while technical analysis is suitable for pinpointing more precise trading opportunities.

In other words, economic fundamentals tell you what to trade, while technical analysis tells you when to trade.

These two frameworks are complementary and, when used together, can significantly increase your chances of trading success.

The book clearly explains the two frameworks and guides you through how to combine them to systematically analyze the market.

From trend-following to day trading and options trading strategies that capture the "real bottom"

This is the essence of the trend!

Successful trading isn't achieved with just one specific technique.

Economic analysis, trading strategy, and investment mindset must be organically combined.

This book covers, step by step, all the elements a trader must have to succeed in the markets.

Part 1 explains economic fundamentals.

If you want to become an investor, you must first learn the basic principles of market analysis before acquiring advanced trading knowledge.

The market is a series of cause-and-effect relationships, and fundamental analysis is the process of analyzing these basic economic relationships and predicting the future based on them.

The author introduces a useful perspective on economics advocated by Ludwig von Mises.

Part 2 presents several tools for reading the psychology and behavioral patterns of many investors through technical analysis.

It makes sense to analyze all market prices for patterns and trends rather than daily fluctuations.

When market participants move in a certain direction, you should ride the wave, as George Soros said, and get off before the bubble bursts.

The case study highlights how to capture buy and sell signals on various real-world charts, from stock indices to raw materials.

Part 3 presents options trading, the magic key to triple-digit returns.

This is possible only if one can relatively accurately predict future price direction, timing, and trend patterns.

However, if you buy options with even a small portion of your funds, you can make a large profit if your prediction is correct while limiting the risk of loss.

Even if you don't trade options, it's essential to understand options strategies.

Part 4 is a kind of 'trader's stabilizer' due to the stressful nature of trading.

Trading takes place in a whirlwind of emotions.

Market changes are always difficult to predict, and responding to them requires psychological stability and cool-headed judgment.

The author establishes a trading philosophy and, based on this, introduces methods for overcoming tension and stress in the markets.

"Highly recommended for any investor looking to capitalize on trends."

"The essence of chart analysis, applicable to coins and commodities."

Yoon Ji-ho, co-author of "Korean Top-Down Investment Strategy," recommended the book, saying, "The reason why this 30-year-old book is still being recalled is because it is appealing because it contains counterarguments to conventional wisdom throughout and the investment style is unbiased." Hong Jin-chae, CEO of Raccoon Asset Management, said, "I highly recommend this book to all investors who want to understand and utilize trends."

It also received praise such as, “The essence of technical analysis that can be applied not only to stocks but also to coins, commodities, and indices” (Daehyun Kim, author of “Breakthrough Trading Strategy”), and “It is hard to believe that one person wrote the vast amount of content and data that covers economics, politics, technical analysis, psychology, and even wealth ethics” (Seunghoon Ha, operator of “Seunghoon Ha’s Stock Investment TV” on YouTube).

Mark Minervini and Jack Schwager also heavily cited and recommended Victor Sperandeo's techniques in their books, "High-Yield Growth Stocks" and "The New Market Wizards."

"Legendary Pro Trader Big 2" will serve as a guide for all investors who want to arm themselves with their own weapons in the ever-changing market, analyzing and predicting the market to generate profits.

GOODS SPECIFICS

- Date of issue: February 28, 2025

- Page count, weight, size: 408 pages | 824g | 152*225*23mm

- ISBN13: 9791199150003

- ISBN10: 1199150002

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)