How to trade stocks

|

Description

Book Introduction

This is a complete translation of the original text, 『How to Trade in Stocks』, by Jesse Livermore, known as the greatest investor in Wall Street history.

Jesse Livermore's secret notes are also included, giving you a vivid glimpse into his trading.

Through this book, Park Sung-hwan became the first Korean to translate 『How to Trade in Stocks』 and, with rich commentary, introduce and promote the legendary investor Jesse Livermore.

This time, we have revised the translation and reorganized the entire book to create a revised edition.

Jesse Livermore's secret notes are also included, giving you a vivid glimpse into his trading.

Through this book, Park Sung-hwan became the first Korean to translate 『How to Trade in Stocks』 and, with rich commentary, introduce and promote the legendary investor Jesse Livermore.

This time, we have revised the translation and reorganized the entire book to create a revised edition.

- You can preview some of the book's contents.

Preview

index

Jesse Livermore Quotes

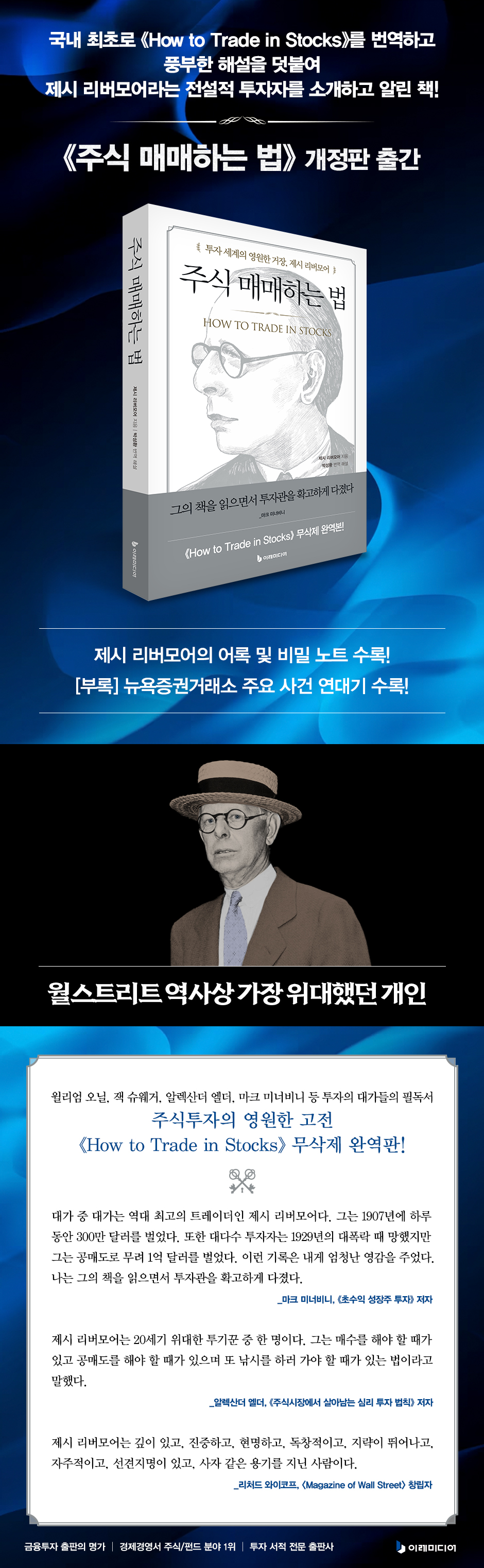

The greatest individual in Wall Street history

Chapter 1: How to Trade Stocks by Jesse Livermore

01 The Challenge of Speculation

02 When does a stock move appropriately?

03 Follow the leader

04 Money in your hand

05 Turning Point

06 The Million Dollar Mistake

$07 3 million profit

08 Jesse Livermore's Secret Notes, Market Key

09 Jesse Livermore's Real Stock Price Chart

Chapter 2: The Life of Jesse Livermore

01 Hogapan Injection

02 The First Transaction, the Birth of a Little Speculator

03 Trading is prohibited

04 First Bankruptcy

05 Second bankruptcy in a bull market

06 Discovery of the Time Element

07 Confidential Information and Stock Investment

08 Evolving Trading Techniques

09 Becoming a Big Hand

10 Chicago Mercantile Exchange

11 The Dangers of Attractive People

12 War and the Stock Market

13 Another lesson: Don't oppose government policy.

14 Completion of Stock Investment Theory

15 Commuting to work by yacht

Standing at the top of the 16th market

Become a Wall Street expert

Chapter 3: Jesse Livermore's Investment Strategy

01 Trading Law

02 The best weapon, patience

03 Pyramiding Strategy

04 The market comes first

05 Pair Trading and the Cycle of Market Leaders

06 Time as an Investment Factor

07 Utilizing the turning point

Chapter 4: Jesse Livermore's Money Management Principles

01 Nothing is perfect

02 Resting is also an investment

03 Cash is your lifeline

04 Short on losses, long on profits, test strategy

05 Diversified Investment

06 Profit Management

Chapter 5: Jesse Livermore's Emotional Control

01 Exploration of Human Nature

02 Four Emotions

03 Mental Traits of Successful Investors

04 The Importance of Independence and Training from Emotions

Chapter 6: The Great Teacher Jesse Livermore

01 Endless Exploration

02 Stock investment is a business

03 The answer lies within me

04 Trend Trading vs. Value Investing

05 From Student to Teacher

Appendix: Chronology of Major Events at the New York Stock Exchange

The greatest individual in Wall Street history

Chapter 1: How to Trade Stocks by Jesse Livermore

01 The Challenge of Speculation

02 When does a stock move appropriately?

03 Follow the leader

04 Money in your hand

05 Turning Point

06 The Million Dollar Mistake

$07 3 million profit

08 Jesse Livermore's Secret Notes, Market Key

09 Jesse Livermore's Real Stock Price Chart

Chapter 2: The Life of Jesse Livermore

01 Hogapan Injection

02 The First Transaction, the Birth of a Little Speculator

03 Trading is prohibited

04 First Bankruptcy

05 Second bankruptcy in a bull market

06 Discovery of the Time Element

07 Confidential Information and Stock Investment

08 Evolving Trading Techniques

09 Becoming a Big Hand

10 Chicago Mercantile Exchange

11 The Dangers of Attractive People

12 War and the Stock Market

13 Another lesson: Don't oppose government policy.

14 Completion of Stock Investment Theory

15 Commuting to work by yacht

Standing at the top of the 16th market

Become a Wall Street expert

Chapter 3: Jesse Livermore's Investment Strategy

01 Trading Law

02 The best weapon, patience

03 Pyramiding Strategy

04 The market comes first

05 Pair Trading and the Cycle of Market Leaders

06 Time as an Investment Factor

07 Utilizing the turning point

Chapter 4: Jesse Livermore's Money Management Principles

01 Nothing is perfect

02 Resting is also an investment

03 Cash is your lifeline

04 Short on losses, long on profits, test strategy

05 Diversified Investment

06 Profit Management

Chapter 5: Jesse Livermore's Emotional Control

01 Exploration of Human Nature

02 Four Emotions

03 Mental Traits of Successful Investors

04 The Importance of Independence and Training from Emotions

Chapter 6: The Great Teacher Jesse Livermore

01 Endless Exploration

02 Stock investment is a business

03 The answer lies within me

04 Trend Trading vs. Value Investing

05 From Student to Teacher

Appendix: Chronology of Major Events at the New York Stock Exchange

Detailed image

Into the book

“Profits accumulate when they are due, but losses never do.” By realizing small initial losses, speculators protect themselves from potentially substantial losses down the road.

This will allow you to keep your account safe and, most importantly, to actively re-enter the market when the market trend allows you to realize profits.

--- p.27

Stocks, like people, have individuality and personality.

Some stocks are very sensitive and volatile, subject to rapid changes, while others are honest, direct, and rational.

Experienced investors learn about individual stocks and pay attention to their individual characteristics.

This allows us to predict the stock's behavior within the context of a changing environment.

There is never a case where the market remains stagnant without changing.

--- p.34

Don't leave managing your excess income to anyone else.

This applies equally whether you're dealing with millions of dollars or thousands of dollars.

Because it is your own money, and you have to protect it yourself to keep it in your possession.

And misbehavior is the surest way to lose that money.

--- p.48

Livermore's losses over the years made him realize that stock investing is not so easy.

But Livermore considered the loss a failure and did not stop trading.

I recorded and tracked my trading history in detail, analyzed the causes of failure, and reflected on them.

This attitude was one of the key characteristics that later led to Livermore's success.

This method of finding the cause of failure later proved to be the best means of learning about the stock market and trading.

--- p.129

Livermore identified four mental traits that successful investors possess: observation, memory, mathematical calculation, and experience.

Successful investors objectively observe market events, remember important events to connect them to future profits, and learn from their experiences to avoid repeating past mistakes and seize opportunities when they arise.

This will allow you to keep your account safe and, most importantly, to actively re-enter the market when the market trend allows you to realize profits.

--- p.27

Stocks, like people, have individuality and personality.

Some stocks are very sensitive and volatile, subject to rapid changes, while others are honest, direct, and rational.

Experienced investors learn about individual stocks and pay attention to their individual characteristics.

This allows us to predict the stock's behavior within the context of a changing environment.

There is never a case where the market remains stagnant without changing.

--- p.34

Don't leave managing your excess income to anyone else.

This applies equally whether you're dealing with millions of dollars or thousands of dollars.

Because it is your own money, and you have to protect it yourself to keep it in your possession.

And misbehavior is the surest way to lose that money.

--- p.48

Livermore's losses over the years made him realize that stock investing is not so easy.

But Livermore considered the loss a failure and did not stop trading.

I recorded and tracked my trading history in detail, analyzed the causes of failure, and reflected on them.

This attitude was one of the key characteristics that later led to Livermore's success.

This method of finding the cause of failure later proved to be the best means of learning about the stock market and trading.

--- p.129

Livermore identified four mental traits that successful investors possess: observation, memory, mathematical calculation, and experience.

Successful investors objectively observe market events, remember important events to connect them to future profits, and learn from their experiences to avoid repeating past mistakes and seize opportunities when they arise.

--- p.172

Publisher's Review

Jesse Livermore's "How to Trade Stocks" (Uncensored)

A timeless classic in stock investing, a must-read for modern stock investors!

A classic does not simply mean an old book, but rather a book that is widely recognized for its value even after time passes.

In this sense, "How to Trade Stocks" is considered a classic for stock investors, and it continues to inspire investment for many people today.

This book is recommended by investment experts such as William O'Neil, Jack Schwager, and Alexander Elder, and is still considered a must-read for fund managers and traders.

"How to Trade in Stocks" is a complete translation of the original work, "How to Trade in Stocks," by Jesse Livermore, known as the greatest investor in Wall Street history.

Jesse Livermore's secret notes are also included, giving you a vivid glimpse into his trading.

The abundant commentary and explanations added by translator Park Seonghwan also help understand the original text, making it easy for anyone to read.

The pleasure of reading "How to Trade Stocks" will be doubled if you examine the trading methods of Jesse Livermore, who became a mentor on Wall Street, and consider the unchanging nature of human investment.

The greatest investor in Wall Street history made $100 million with $5!

Jesse Livermore is a legendary investor who ran away from home at the age of 14 with just $5 and made an astronomical sum of $100 million.

Although he was born the son of a poor farmer, he was a self-made man who reigned as the ruler of Wall Street in New York, and lived as a thoroughgoing individual investor who had never done anything other than investing in stocks.

He started investing in stocks with $5 at the age of 15 and went bankrupt several times, but by 1929 he had made $100 million and had Wall Street at his feet.

JP, who had the greatest influence in the American financial industry in 1907

Even Morgan became such a big player in the market that he asked Jesse Livermore to change his position, which earned him the nickname "The Great Bear of Wall Street."

To modern stock investors, Jesse Livermore is called the "father of trend trading," which focuses on investing in rising stocks, and his book "How to Trade Stocks" is considered a must-read among fund managers and financial experts.

World Investment Guru's Influence on "How to Trade Stocks"

Bill Gross, William O'Neil, Ken Fisher, Jack Schwager, Curtis Pace, Alexander Elder, Mark Minervini, and Dan Zanger are all widely recognized as legends and heroes of the investment world today.

They reveal that they were greatly influenced by Edwin Lefebvre's novel Reminiscences of a Stock Operator, which he wrote based on his personal interview with Jesse Livermore.

Separately, Jesse Livermore compiled modern trading techniques, including trend trading techniques, money management, and psychological control, based on his own stock trading experience in his book, "How to Trade in Stocks," which he wrote himself. This book had such a profound influence on today's trend traders that he is called the "father of trend trading."

Benjamin Graham and Warren Buffett, famous for their value investing, are on a different axis, but no one can deny that Jesse Livermore's trading methods influenced the entire Wall Street.

The timeless classic in stock investing, "How to Trade in Stocks," translated unedited!

"How to Trade Stocks" was planned as a book about "a person who has had a significant impact on today's financial markets."

In particular, it includes an unedited translation of his important book, How to Trade in Stocks, along with secret notes and stock price records he personally wrote.

Through "How to Trade Stocks," readers will learn about the life, spirit, and trading methods of Jesse Livermore, whose influence still continues in our financial markets. They will also learn about the deep interest and concentration he devoted to studying the stock market as a successful individual investor.

Chapter 1 of "How to Trade in Stocks" is significant because it contains a complete translation of the original text of "How to Trade in Stocks," which is the core of this book.

Especially at the end of the chapter, you can see his secret notebook and the actual stock price chart that Jesse Livermore himself designed and used at the time.

Chapter 2 covers Jesse Livermore's life from the time he left home at the age of 14 until his death in 1940.

Chapter 3 details Jesse Livermore's investment strategies, Chapter 4 covers money management principles, and Chapter 5 covers emotional control.

The final chapter offers a glimpse into the investment philosophy and values we can learn from Jesse Livermore's life and trading methods.

Readers will find that "How to Trade Stocks" will be an opportunity to take a step closer to becoming a successful investor.

A timeless classic in stock investing, a must-read for modern stock investors!

A classic does not simply mean an old book, but rather a book that is widely recognized for its value even after time passes.

In this sense, "How to Trade Stocks" is considered a classic for stock investors, and it continues to inspire investment for many people today.

This book is recommended by investment experts such as William O'Neil, Jack Schwager, and Alexander Elder, and is still considered a must-read for fund managers and traders.

"How to Trade in Stocks" is a complete translation of the original work, "How to Trade in Stocks," by Jesse Livermore, known as the greatest investor in Wall Street history.

Jesse Livermore's secret notes are also included, giving you a vivid glimpse into his trading.

The abundant commentary and explanations added by translator Park Seonghwan also help understand the original text, making it easy for anyone to read.

The pleasure of reading "How to Trade Stocks" will be doubled if you examine the trading methods of Jesse Livermore, who became a mentor on Wall Street, and consider the unchanging nature of human investment.

The greatest investor in Wall Street history made $100 million with $5!

Jesse Livermore is a legendary investor who ran away from home at the age of 14 with just $5 and made an astronomical sum of $100 million.

Although he was born the son of a poor farmer, he was a self-made man who reigned as the ruler of Wall Street in New York, and lived as a thoroughgoing individual investor who had never done anything other than investing in stocks.

He started investing in stocks with $5 at the age of 15 and went bankrupt several times, but by 1929 he had made $100 million and had Wall Street at his feet.

JP, who had the greatest influence in the American financial industry in 1907

Even Morgan became such a big player in the market that he asked Jesse Livermore to change his position, which earned him the nickname "The Great Bear of Wall Street."

To modern stock investors, Jesse Livermore is called the "father of trend trading," which focuses on investing in rising stocks, and his book "How to Trade Stocks" is considered a must-read among fund managers and financial experts.

World Investment Guru's Influence on "How to Trade Stocks"

Bill Gross, William O'Neil, Ken Fisher, Jack Schwager, Curtis Pace, Alexander Elder, Mark Minervini, and Dan Zanger are all widely recognized as legends and heroes of the investment world today.

They reveal that they were greatly influenced by Edwin Lefebvre's novel Reminiscences of a Stock Operator, which he wrote based on his personal interview with Jesse Livermore.

Separately, Jesse Livermore compiled modern trading techniques, including trend trading techniques, money management, and psychological control, based on his own stock trading experience in his book, "How to Trade in Stocks," which he wrote himself. This book had such a profound influence on today's trend traders that he is called the "father of trend trading."

Benjamin Graham and Warren Buffett, famous for their value investing, are on a different axis, but no one can deny that Jesse Livermore's trading methods influenced the entire Wall Street.

The timeless classic in stock investing, "How to Trade in Stocks," translated unedited!

"How to Trade Stocks" was planned as a book about "a person who has had a significant impact on today's financial markets."

In particular, it includes an unedited translation of his important book, How to Trade in Stocks, along with secret notes and stock price records he personally wrote.

Through "How to Trade Stocks," readers will learn about the life, spirit, and trading methods of Jesse Livermore, whose influence still continues in our financial markets. They will also learn about the deep interest and concentration he devoted to studying the stock market as a successful individual investor.

Chapter 1 of "How to Trade in Stocks" is significant because it contains a complete translation of the original text of "How to Trade in Stocks," which is the core of this book.

Especially at the end of the chapter, you can see his secret notebook and the actual stock price chart that Jesse Livermore himself designed and used at the time.

Chapter 2 covers Jesse Livermore's life from the time he left home at the age of 14 until his death in 1940.

Chapter 3 details Jesse Livermore's investment strategies, Chapter 4 covers money management principles, and Chapter 5 covers emotional control.

The final chapter offers a glimpse into the investment philosophy and values we can learn from Jesse Livermore's life and trading methods.

Readers will find that "How to Trade Stocks" will be an opportunity to take a step closer to becoming a successful investor.

GOODS SPECIFICS

- Date of issue: December 26, 2023

- Page count, weight, size: 308 pages | 562g | 152*225*20mm

- ISBN13: 9791193394113

- ISBN10: 1193394112

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)