Perfect location

|

Description

Book Introduction

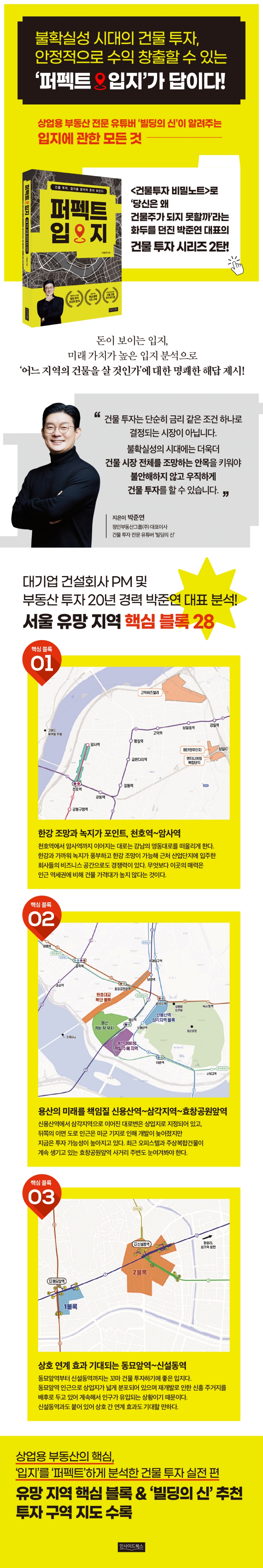

In an era of uncertainty, the answer to building investment is a "perfect location" that generates stable profits! A practical guide to building investment that perfectly analyzes the key "location" of commercial real estate. Includes maps of key blocks in promising areas and recommended investment zones for "Building Gods." The second installment of the building investment series by CEO Park Jun-yeon, who posed the question, "Why can't you become a building owner?" in "Building Investment Secret Notes." "Perfect Location" answers the question most frequently asked by property investors: "Where should I buy a building?" The author, drawing on his 20 years of experience working on-site at a major construction company and his expertise as a real estate investment expert, explored popular investment areas in Seoul and identified suitable building investment locations. Promising areas for building investment are further divided into blocks, and each location's characteristics, development potential, and future value are analyzed to provide direction. The author emphasizes that in times of uncertainty, we must cultivate a perspective that looks at the entire building market, rather than being swayed by fleeting emotions. This book provides answers to questions about building investment, including what location is, what the relationship between commercial districts and location is, and how to determine future value and expandability. |

- You can preview some of the book's contents.

Preview

index

Prologue.

Now is the time to invest in buildings!

Intro.

Building investment is always a work in progress.

CHAPTER 1 Why You Should Pay Attention to Gangdong-gu Now

Core Block 01: Cheonho Station Intersection, Expected to See Dazzling Changes

Core Block 02: Gangdong Station to Gildong Station, Emerging as a Medical Mecca

Core Block 03: Unlimited Expandability! Gildong Station to Gubeundari Station

Core Block 04: Han River views and green space, Cheonho Station to Amsa Station

Point of View.

Can Gangdong-gu become a land of opportunity?

CHAPTER 2 The Myth Continues, Gangnam-gu

Core Block 01 K-Beauty Special Zone, Sinsa Station Intersection

Core Block 02: Shinsa Station and Gangnam Station commercial districts, Nonhyeon Station intersection

Core Block 03: Samseong-dong's Hidden Treasure, Bongeunsa Station~Sports Complex

Core Block 04: MZ Generation Hideout, Apgujeong Rodeo Street and Gangnam Euljiro Hospital Intersection

Core Block 05: Eunma Apartment Intersection, Resilient Even in the Recession

Point of View.

100-year history, Gangnam's status

CHAPTER 3 A gathering place of culture and trends.

Gangnam-daero

Core Block 01 Mecca of Trends, Kyobo Building vs.

Kukkiwon Block

The best scalability in the core block 02 area, Yeongdong Market Food Alley vs.

Banpo-dong

Core Block 03 Samsung Town vs. the Diverging Heebi

Yeoksam Tax Office Block

Key Block 04 Gangnam-daero Promising Bang Bang Intersection, Seocho-dong vs.

Dogok-dong block

Point of View.

Gangnam-daero, is 2 billion won per pyeong possible?

CHAPTER 4 Yongsan, Mapo, and Seongdong Districts Aiming to Become the Next Gangnam

Core Block 01: Hannam-dong and Itaewon-dong Transforming into a New World

Core Block 02: Shinyongsan Station ~ Samgakji Station ~ Hyochang Park Station, responsible for the future of Yongsan

Core Block 03: Mapo-gu's core commercial district, Hapjeong Station area

Focus on the core block 04 Social Venture Valley block, the Seongsu Station area.

Core Block 05: Konkuk University Station Block, divided into Jayang-dong and Hwayang-dong

Point of View.

I like Yongsan, I like Gangnam

CHAPTER 5 Key areas south of the Han River: Seocho, Dongjak, Gwanak, and Yeongdeungpo

Core Block 01: Gyodae Station ~ Seocho Station, shedding its old image

Core Block 02: Bangbae-dong Redevelopment Zone to be Transformed into a Top Residential Area

Sadang Station to Isu Station, emerging as the largest commercial district in the core block 03 area

Core Block 04 Complex yet attractive: Noryangjin Station ~ Sindaebangsamgeori Station ~ Boramae Station

Key Block 05: Sillim Station to Seowon Station, given new life due to redevelopment issues

Core Block 06: A Unique Symbiotic Relationship, Around Yeongdeungpo Station

Point of View.

The attitude of a true investor

CHAPTER 6: The Gangbuk Era Begins! Jongno, Eunpyeong, Dongdaemun, and Nowon Districts

Core Block 01: Wealth Creation Through Generations, Gwanghwamun Station to Jongno 3-ga Station

Bulkwang Station to Yeonsinnae Station, with the opening of Core Block 02 GTX-A imminent

Core Block 03: Dongmyo Station to Sinseoldong Station, where interconnected effects are expected

Core Block 04: Who's First? Nowon Station ~ Ssangmun Station ~ Ssangmun Station

Point of View.

The rise and fall of commercial districts

Point Map.

The best location for building investment is here! 51 investment zones recommended by the "Building God"

Epilogue.

The more you know, the more you see, and the more you get sucked into the real estate investment market.

Now is the time to invest in buildings!

Intro.

Building investment is always a work in progress.

CHAPTER 1 Why You Should Pay Attention to Gangdong-gu Now

Core Block 01: Cheonho Station Intersection, Expected to See Dazzling Changes

Core Block 02: Gangdong Station to Gildong Station, Emerging as a Medical Mecca

Core Block 03: Unlimited Expandability! Gildong Station to Gubeundari Station

Core Block 04: Han River views and green space, Cheonho Station to Amsa Station

Point of View.

Can Gangdong-gu become a land of opportunity?

CHAPTER 2 The Myth Continues, Gangnam-gu

Core Block 01 K-Beauty Special Zone, Sinsa Station Intersection

Core Block 02: Shinsa Station and Gangnam Station commercial districts, Nonhyeon Station intersection

Core Block 03: Samseong-dong's Hidden Treasure, Bongeunsa Station~Sports Complex

Core Block 04: MZ Generation Hideout, Apgujeong Rodeo Street and Gangnam Euljiro Hospital Intersection

Core Block 05: Eunma Apartment Intersection, Resilient Even in the Recession

Point of View.

100-year history, Gangnam's status

CHAPTER 3 A gathering place of culture and trends.

Gangnam-daero

Core Block 01 Mecca of Trends, Kyobo Building vs.

Kukkiwon Block

The best scalability in the core block 02 area, Yeongdong Market Food Alley vs.

Banpo-dong

Core Block 03 Samsung Town vs. the Diverging Heebi

Yeoksam Tax Office Block

Key Block 04 Gangnam-daero Promising Bang Bang Intersection, Seocho-dong vs.

Dogok-dong block

Point of View.

Gangnam-daero, is 2 billion won per pyeong possible?

CHAPTER 4 Yongsan, Mapo, and Seongdong Districts Aiming to Become the Next Gangnam

Core Block 01: Hannam-dong and Itaewon-dong Transforming into a New World

Core Block 02: Shinyongsan Station ~ Samgakji Station ~ Hyochang Park Station, responsible for the future of Yongsan

Core Block 03: Mapo-gu's core commercial district, Hapjeong Station area

Focus on the core block 04 Social Venture Valley block, the Seongsu Station area.

Core Block 05: Konkuk University Station Block, divided into Jayang-dong and Hwayang-dong

Point of View.

I like Yongsan, I like Gangnam

CHAPTER 5 Key areas south of the Han River: Seocho, Dongjak, Gwanak, and Yeongdeungpo

Core Block 01: Gyodae Station ~ Seocho Station, shedding its old image

Core Block 02: Bangbae-dong Redevelopment Zone to be Transformed into a Top Residential Area

Sadang Station to Isu Station, emerging as the largest commercial district in the core block 03 area

Core Block 04 Complex yet attractive: Noryangjin Station ~ Sindaebangsamgeori Station ~ Boramae Station

Key Block 05: Sillim Station to Seowon Station, given new life due to redevelopment issues

Core Block 06: A Unique Symbiotic Relationship, Around Yeongdeungpo Station

Point of View.

The attitude of a true investor

CHAPTER 6: The Gangbuk Era Begins! Jongno, Eunpyeong, Dongdaemun, and Nowon Districts

Core Block 01: Wealth Creation Through Generations, Gwanghwamun Station to Jongno 3-ga Station

Bulkwang Station to Yeonsinnae Station, with the opening of Core Block 02 GTX-A imminent

Core Block 03: Dongmyo Station to Sinseoldong Station, where interconnected effects are expected

Core Block 04: Who's First? Nowon Station ~ Ssangmun Station ~ Ssangmun Station

Point of View.

The rise and fall of commercial districts

Point Map.

The best location for building investment is here! 51 investment zones recommended by the "Building God"

Epilogue.

The more you know, the more you see, and the more you get sucked into the real estate investment market.

Detailed image

Into the book

The subway, known as the flower of public transportation, has at least four lines that have been built or are scheduled to be built in Gangdong-gu alone.

Subway Line 8, which currently runs from Cheonho Station to Amsa Station, will be extended to Byeollae in 2024.

Subway Line 5, which will be connected to Hanam in 2021, is currently being promoted as a direct route, and Line 9 will pass through the Central Veterans Hospital and pass through the core of Gangdong-gu, including the Godeok Gangil District, and is targeted for completion in 2028.

If you use Line 9 from Gangdong-gu, you can reach Gangnam in 15 minutes, and if you use Line 5, you can reach Gwanghwamun and Jongno in 20 to 30 minutes.

If you take Line 8, you can go to Bundang via Songpa in one go.

Additionally, Gangdong-gu is an area that benefits from the opening of the Wirye-Sinsa Line and is also directly affected by the Gangil-Misago Metropolitan Railway.

--- p.034

From the perspective of building investors, it would be better to focus on the area north of Wonhyo Bridge and near Hyochang Park rather than the Yongsan Maintenance Depot site, which is already at its highest price.

Compared to the Yongsan Maintenance Depot site, the land price here is still low and there is endless development potential.

The northern end of Wonhyo Bridge was once a run-down area with many old and dilapidated buildings, including a former ironworks.

But now they are all gone and new buildings are being built one after another.

The street from the intersection of Hyochang Park Station past the northern end of Wonhyo Bridge to Yongsan Health Center and Sookmyung Women's University Station is particularly attractive.

If a building comes up for sale here, you absolutely have to buy it.

--- p.172

Seowon Station and Seoul National University Venture Town Station on the Sillim Line are places that will change completely in the next 3 to 5 years.

The commercial district was already good due to its high population density, but it has gained wings with the addition of the redevelopment issue.

This area, which had been full of weaknesses such as a high population density, no subway, and a commercial district for working-class people, relatively low land prices and prices that did not rise easily, can now expect a 100% increase in land prices in a short period of time.

If you want to invest in a small building with a small amount of money, this is the best place.

If you can afford to buy an apartment, you can challenge the owners of small buildings near Seowon Station and Seoul National University Venture Town Station.

--- p.239

There are many positive factors for Gangbuk redevelopment.

Currently, the Seoul Metropolitan Government is planning to create an eco-friendly walking path from in front of Seoul Station to Yeouido across the Hangang Bridge.

The Jongno and Euljiro areas are dreaming of a new leap forward, including discussions on increasing the floor area ratio.

The full development of Nakwon Shopping Mall and Seun Shopping Mall, which are symbols of Jongno but also a burden, is also under discussion.

In addition, with the relocation of the Blue House, various regulations related to security and safety that had previously been obstacles to development will be relaxed, which could create new beneficiaries.

Subway Line 8, which currently runs from Cheonho Station to Amsa Station, will be extended to Byeollae in 2024.

Subway Line 5, which will be connected to Hanam in 2021, is currently being promoted as a direct route, and Line 9 will pass through the Central Veterans Hospital and pass through the core of Gangdong-gu, including the Godeok Gangil District, and is targeted for completion in 2028.

If you use Line 9 from Gangdong-gu, you can reach Gangnam in 15 minutes, and if you use Line 5, you can reach Gwanghwamun and Jongno in 20 to 30 minutes.

If you take Line 8, you can go to Bundang via Songpa in one go.

Additionally, Gangdong-gu is an area that benefits from the opening of the Wirye-Sinsa Line and is also directly affected by the Gangil-Misago Metropolitan Railway.

--- p.034

From the perspective of building investors, it would be better to focus on the area north of Wonhyo Bridge and near Hyochang Park rather than the Yongsan Maintenance Depot site, which is already at its highest price.

Compared to the Yongsan Maintenance Depot site, the land price here is still low and there is endless development potential.

The northern end of Wonhyo Bridge was once a run-down area with many old and dilapidated buildings, including a former ironworks.

But now they are all gone and new buildings are being built one after another.

The street from the intersection of Hyochang Park Station past the northern end of Wonhyo Bridge to Yongsan Health Center and Sookmyung Women's University Station is particularly attractive.

If a building comes up for sale here, you absolutely have to buy it.

--- p.172

Seowon Station and Seoul National University Venture Town Station on the Sillim Line are places that will change completely in the next 3 to 5 years.

The commercial district was already good due to its high population density, but it has gained wings with the addition of the redevelopment issue.

This area, which had been full of weaknesses such as a high population density, no subway, and a commercial district for working-class people, relatively low land prices and prices that did not rise easily, can now expect a 100% increase in land prices in a short period of time.

If you want to invest in a small building with a small amount of money, this is the best place.

If you can afford to buy an apartment, you can challenge the owners of small buildings near Seowon Station and Seoul National University Venture Town Station.

--- p.239

There are many positive factors for Gangbuk redevelopment.

Currently, the Seoul Metropolitan Government is planning to create an eco-friendly walking path from in front of Seoul Station to Yeouido across the Hangang Bridge.

The Jongno and Euljiro areas are dreaming of a new leap forward, including discussions on increasing the floor area ratio.

The full development of Nakwon Shopping Mall and Seun Shopping Mall, which are symbols of Jongno but also a burden, is also under discussion.

In addition, with the relocation of the Blue House, various regulations related to security and safety that had previously been obstacles to development will be relaxed, which could create new beneficiaries.

--- p.251

Publisher's Review

The building investment market remains unshaken.

As economic instability continues, including prolonged stagnation and inflation, reports have been pouring in that the real estate market is also entering a recession.

Some interpret rising interest rates as a shrinking of the building investment market, but this does not apply to the building investment market.

In fact, even in 2022, when interest rates soared, building prices in Seoul did not fall.

It was different from the sharp drop in apartment prices in Seoul during the same period.

Since the building market is not one where the 'young-kul tribe' can easily enter like apartment investment, it has the basics to cope with most economic fluctuations.

Also, since rental income is generated monthly, there is less burden on bank interest.

Even in new buildings, the rent difference between them and existing buildings is nearly double.

In times like these when the real estate investment environment is volatile, it is important to have the fundamentals down.

If you have a solid foundation, you can develop your own investment philosophy without being swayed by the atmosphere.

Location analysis is one of the most fundamental skills required for a successful real estate investment.

Location depends on whether the commercial area can generate profits.

The first rule of property investment is to generate steady income.

To generate revenue, you need to know the characteristics of the commercial area.

A building that generates consistent and stable investment returns must be located in a location with good commercial districts.

The better the commercial district, the more it must satisfy two conditions: first, it must have the appeal to attract people, and second, it must have the power to maintain that appeal.

The author chose Gangnam Station intersection as a representative area corresponding to this.

A commercial district that accepts new trends and cultures in real time will not decline.

Of course, there are also opposite cases.

Itaewon's Gyeongridan-gil became known as the hippest mecca in Seoul through word of mouth.

Shops and restaurants continued to prosper, leading trends.

However, as land prices and rents soared and profits fell short of expectations, tenants began to leave Gyeongridan-gil.

The streets became deserted as if nothing had happened, and as commercial districts declined, building vacancy rates also increased.

The golden age of business, which was expected to continue, suddenly entered a downward spiral.

It's because even though it had charm, it lacked the power to maintain it.

Knowing the location reveals the building's future value and money.

The author divided Seoul into six chapters, categorized promising areas, and designated key blocks among them to analyze their location characteristics, development potential, and future value.

Among them, the first region to be analyzed in depth was Gangdong-gu.

Gangdong-gu is expected to become the second largest growth engine in Korea with the opening of the Sejong-Pocheon Expressway, which will provide a well-connected transportation network in all directions, and to leap forward as a central city by absorbing surrounding satellite cities.

If we imagine Gangdong-gu a few years from now, a powerful city that is not inferior to Gangnam will unfold before our eyes.

Yongsan also has the advantage of being located in the heart of Seoul, and the relocation of the US military base has made redevelopment, which had been blocked, possible.

The author recommends looking at the area west of the maintenance depot in front of Yongsan Station, from the north end of Wonhyo Bridge behind Yongsan Station toward Seoul Station, as the development of the site is nearing completion.

It is said that the future value is promising as it becomes a complex development site along with the development of an electronic shopping mall.

If you understand the position and draw a picture like this, you will find the answer to your investment.

Comprehensive information on areas benefiting from transportation and redevelopment

How much can we trust the information about development plans pouring out from the news and real estate forums? Is it too late to invest now? For real estate investors grappling with these concerns, the author meticulously and objectively analyzes and identifies areas that will benefit.

There are three areas that will benefit the most from the undergrounding of the 6.8 km/m section of the Gyeongbu Expressway from Hannam to Yangjae IC in Seoul.

The sections are between Bangbang Intersection and Nambu Terminal, between Nonhyeon Station and Banpo Station, and between Gangnam Station and Gyodae Station. Of these, the section between Gangnam Station and Gyodae Station deserves special attention.

However, it is pointed out that caution should be exercised when investing in buildings in Bangbae-dong, where the redevelopment project is being completed with the opening of the Seoripul Tunnel.

As the wind of redevelopment blows, prices rise too much in a short period of time, so even if large apartment complexes are built, the investment returns on buildings may only follow the market rate of return.

As economic instability continues, including prolonged stagnation and inflation, reports have been pouring in that the real estate market is also entering a recession.

Some interpret rising interest rates as a shrinking of the building investment market, but this does not apply to the building investment market.

In fact, even in 2022, when interest rates soared, building prices in Seoul did not fall.

It was different from the sharp drop in apartment prices in Seoul during the same period.

Since the building market is not one where the 'young-kul tribe' can easily enter like apartment investment, it has the basics to cope with most economic fluctuations.

Also, since rental income is generated monthly, there is less burden on bank interest.

Even in new buildings, the rent difference between them and existing buildings is nearly double.

In times like these when the real estate investment environment is volatile, it is important to have the fundamentals down.

If you have a solid foundation, you can develop your own investment philosophy without being swayed by the atmosphere.

Location analysis is one of the most fundamental skills required for a successful real estate investment.

Location depends on whether the commercial area can generate profits.

The first rule of property investment is to generate steady income.

To generate revenue, you need to know the characteristics of the commercial area.

A building that generates consistent and stable investment returns must be located in a location with good commercial districts.

The better the commercial district, the more it must satisfy two conditions: first, it must have the appeal to attract people, and second, it must have the power to maintain that appeal.

The author chose Gangnam Station intersection as a representative area corresponding to this.

A commercial district that accepts new trends and cultures in real time will not decline.

Of course, there are also opposite cases.

Itaewon's Gyeongridan-gil became known as the hippest mecca in Seoul through word of mouth.

Shops and restaurants continued to prosper, leading trends.

However, as land prices and rents soared and profits fell short of expectations, tenants began to leave Gyeongridan-gil.

The streets became deserted as if nothing had happened, and as commercial districts declined, building vacancy rates also increased.

The golden age of business, which was expected to continue, suddenly entered a downward spiral.

It's because even though it had charm, it lacked the power to maintain it.

Knowing the location reveals the building's future value and money.

The author divided Seoul into six chapters, categorized promising areas, and designated key blocks among them to analyze their location characteristics, development potential, and future value.

Among them, the first region to be analyzed in depth was Gangdong-gu.

Gangdong-gu is expected to become the second largest growth engine in Korea with the opening of the Sejong-Pocheon Expressway, which will provide a well-connected transportation network in all directions, and to leap forward as a central city by absorbing surrounding satellite cities.

If we imagine Gangdong-gu a few years from now, a powerful city that is not inferior to Gangnam will unfold before our eyes.

Yongsan also has the advantage of being located in the heart of Seoul, and the relocation of the US military base has made redevelopment, which had been blocked, possible.

The author recommends looking at the area west of the maintenance depot in front of Yongsan Station, from the north end of Wonhyo Bridge behind Yongsan Station toward Seoul Station, as the development of the site is nearing completion.

It is said that the future value is promising as it becomes a complex development site along with the development of an electronic shopping mall.

If you understand the position and draw a picture like this, you will find the answer to your investment.

Comprehensive information on areas benefiting from transportation and redevelopment

How much can we trust the information about development plans pouring out from the news and real estate forums? Is it too late to invest now? For real estate investors grappling with these concerns, the author meticulously and objectively analyzes and identifies areas that will benefit.

There are three areas that will benefit the most from the undergrounding of the 6.8 km/m section of the Gyeongbu Expressway from Hannam to Yangjae IC in Seoul.

The sections are between Bangbang Intersection and Nambu Terminal, between Nonhyeon Station and Banpo Station, and between Gangnam Station and Gyodae Station. Of these, the section between Gangnam Station and Gyodae Station deserves special attention.

However, it is pointed out that caution should be exercised when investing in buildings in Bangbae-dong, where the redevelopment project is being completed with the opening of the Seoripul Tunnel.

As the wind of redevelopment blows, prices rise too much in a short period of time, so even if large apartment complexes are built, the investment returns on buildings may only follow the market rate of return.

GOODS SPECIFICS

- Date of issue: April 17, 2023

- Page count, weight, size: 290 pages | 527g | 153*225*18mm

- ISBN13: 9791197721427

- ISBN10: 1197721428

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)