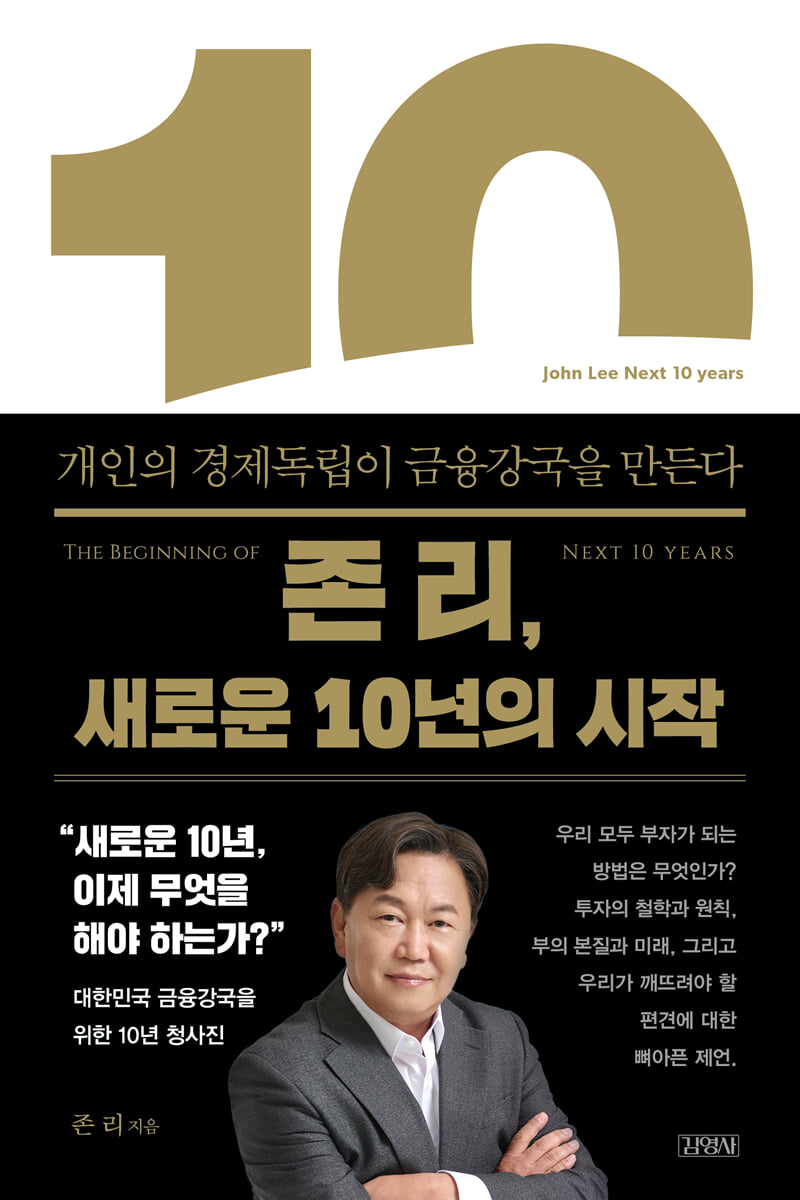

John Lee, the start of a new decade

|

Description

Book Introduction

“A new decade, what should we do now?”

How can we all become rich? The philosophy and principles of investing, the nature and future of wealth,

And a heartbreaking and bitter criticism of the prejudices we must break down, and suggestions for a financial powerhouse.

John Lee, the financial reformer who traveled the country to help the entire nation overcome financial illiteracy, was known as the 'stock investment evangelist,' 'Donghak Ant Mentor,' 'John Bong-jun,' and 'financial expert.'

It is no exaggeration to say that his appearance rewrote the history of investment and finance in our country.

He suddenly left Meritz Asset Management, which he had led for nine years, due to an unexpected situation.

While taking time to rest and recharge, he has continued to provide financial education through 'John Lee Lifestyle Stock' (YouTube) and 'John Lee's Rich School' (camp).

And he published a new book, “John Lee, The Beginning of a New Decade” (published by Kim Young-sa).

He reveals his feelings about ending Act 1 in Korea and his new challenges and plans for Act 2.

How can we all become rich? The philosophy and principles of investing, the nature and future of wealth,

And a heartbreaking and bitter criticism of the prejudices we must break down, and suggestions for a financial powerhouse.

John Lee, the financial reformer who traveled the country to help the entire nation overcome financial illiteracy, was known as the 'stock investment evangelist,' 'Donghak Ant Mentor,' 'John Bong-jun,' and 'financial expert.'

It is no exaggeration to say that his appearance rewrote the history of investment and finance in our country.

He suddenly left Meritz Asset Management, which he had led for nine years, due to an unexpected situation.

While taking time to rest and recharge, he has continued to provide financial education through 'John Lee Lifestyle Stock' (YouTube) and 'John Lee's Rich School' (camp).

And he published a new book, “John Lee, The Beginning of a New Decade” (published by Kim Young-sa).

He reveals his feelings about ending Act 1 in Korea and his new challenges and plans for Act 2.

- You can preview some of the book's contents.

Preview

index

prolog

Chapter 1: Nine Years in Korea: Educating the Importance of Stock Investing

Looking back on nine years as a stock investment evangelist

Scudder, who chose and practiced the first path

Opening the Korea Fund Era

A company where employees can work for a long time

Meeting with Meritz

An asset management company's competitiveness comes from its philosophy.

Meet customers in person

90 percent of the population is my customer.

Chapter 2: Stifling Prejudice and Rigidity

Things that are hindering Korea's growth

The fight against rigidity begins with education.

Children's financial education starts at the dinner table.

obsession with numbers

Can an individual's abilities be evaluated numerically?

The 52-hour workweek should apply to children.

Education should treat children as customers.

The relationship between birth rate and testing

Private education expenses as financial assets

No Pain No Gain

Chapter 3: The Financial Industry Saves South Korea

Finance is the food for the next generation.

K-Finance: If Korea becomes the financial center of Asia

Improvement of corporate governance is urgently needed.

There should be no discrimination against foreign capital.

What's more important than working hours

We need to let go of our obsession with real estate.

The advancement of Korean finance must be driven by asset management.

The executives of financial companies should not have a term of office.

Investing for Retirement: Change Your Perception of Pensions

Chapter 4: The Beginning of a New Decade: What to Do Now

Korea is out of time now

What Should Korea Start Doing Right Now?

Young people dreaming of starting an asset management company

Women in finance are the future.

I want to give hope that anyone can become rich.

Dreaming of Korea becoming a financial powerhouse

Epilogue

Chapter 1: Nine Years in Korea: Educating the Importance of Stock Investing

Looking back on nine years as a stock investment evangelist

Scudder, who chose and practiced the first path

Opening the Korea Fund Era

A company where employees can work for a long time

Meeting with Meritz

An asset management company's competitiveness comes from its philosophy.

Meet customers in person

90 percent of the population is my customer.

Chapter 2: Stifling Prejudice and Rigidity

Things that are hindering Korea's growth

The fight against rigidity begins with education.

Children's financial education starts at the dinner table.

obsession with numbers

Can an individual's abilities be evaluated numerically?

The 52-hour workweek should apply to children.

Education should treat children as customers.

The relationship between birth rate and testing

Private education expenses as financial assets

No Pain No Gain

Chapter 3: The Financial Industry Saves South Korea

Finance is the food for the next generation.

K-Finance: If Korea becomes the financial center of Asia

Improvement of corporate governance is urgently needed.

There should be no discrimination against foreign capital.

What's more important than working hours

We need to let go of our obsession with real estate.

The advancement of Korean finance must be driven by asset management.

The executives of financial companies should not have a term of office.

Investing for Retirement: Change Your Perception of Pensions

Chapter 4: The Beginning of a New Decade: What to Do Now

Korea is out of time now

What Should Korea Start Doing Right Now?

Young people dreaming of starting an asset management company

Women in finance are the future.

I want to give hope that anyone can become rich.

Dreaming of Korea becoming a financial powerhouse

Epilogue

Detailed image

.jpg)

Into the book

Korea must immediately begin a war against stereotypes and prejudice.

Faced with crises such as low birth rates, a super-aging society, and the disappearance of local communities, South Korea no longer has the luxury of waiting for vague, theoretical growth or development.

The destruction of bold ideas, and the movement and practice through them, are needed immediately.

--- p.7

When I came to Korea, the media thought my actions were unconventional and gave me nicknames like 'Don Quixote', 'Alice in Wonderland', and 'Geezy'.

I did think that if you look at it through a rigid lens, my actions could be seen that way.

But if you look at it from a slightly different perspective, things that Korean society had taken for granted might actually seem strange.

--- p.46

First of all, many people looked at me strangely for using public transportation instead of the company-provided car and driver.

Some reporters even went so far as to tail me to check if I really used public transportation.

The reason I use public transportation is very simple.

Because the subway or bus is much faster, more accurate, and cheaper.

--- p.47

What I tried and implemented at Meritz Asset Management is an organizational culture that most foreign financial companies take for granted.

For Korea's financial industry to advance to the next level, companies must be able to boldly break away from existing practices.

--- p.58

For nine years, I worked passionately, almost without weekends or holidays, and thankfully, the response was positive, and I received numerous invitations to speak from people all over the country.

He emphasized and re-emphasized that you must invest in stocks, starting with retirement planning, pension savings funds, and retirement pensions, to the point of talking in your sleep.

He also urged people to never make short-term investments and to make long-term investments.

--- p.70

We need to start education to break down financial prejudices as soon as possible.

The more developed a country's finances are, the more powerful it is in overcoming crises.

--- p.83

Our country has a strong obsession with numbers.

This is a country where people are accustomed to evaluating and ranking their abilities using quantifiable figures from a very young age.

In my view, this too is a fatal practice that hinders the growth of Korean society.

--- p.96

Our children are forced to work almost 80 hours a week.

The labor of learning, which requires competition for grades, is much more severe in terms of both physical and mental pain than simple labor.

The first target group to which the 52-hour system should be introduced are children.

--- p.106

This may be a somewhat radical claim, but I believe that eliminating exams is the most urgent step toward increasing the birth rate.

Unlike advanced countries in other countries, Korea is currently dominated by the omnipotence of examinations.

--- p.118

When the news broke that I was leaving Meritz Asset Management, I saw a media outlet reporting the news and categorically calling it a "dishonorable resignation."

(…) I was aggrieved and angry because of the fake articles that were different from the facts, but after pulling myself together to some extent, I realized that rather than retreating like this, I should fight against the wrong prejudices and rigid culture that dominate Korean society.

(…) Above all, I didn’t want to let the nine years of effort I had put in, body and soul, go to waste.

--- p.194~195

In order to make them think positively about 'stocks' again and recognize the need to prepare for retirement, it took sincere education, that is, a lot of effort and time.

In such a situation, I was worried that the malicious reporting in the newspaper would make them think negatively about investing again.

No matter how much I thought about it, I couldn't leave like this.

--- p.196

Like the United States, our country should also provide institutional support so that many young people with creative investment ideas can start asset management businesses.

If we focus only on risk and strengthen regulations and raise barriers to entry, new and creative ideas will be stifled and eventually disappear like dust.

If we lower the barriers to entry and allow many new, creative asset management businesses to emerge, Korea's growth as a financial powerhouse will accelerate dramatically.

--- p.207

I would like to emphasize this especially to women and parents with daughters.

I would like to say that women should actively enter the financial industry, and above all, the asset management industry.

The number of women currently working in the financial and asset management industries is so low that it is meaningless to even mention it.

But, conversely, this also means that for young Korean women, entering the financial industry is a blue ocean.

--- p.210

With this asset of hope, a 10-year blueprint was drawn up.

Ah, I felt again, deep within me, that this was what I was meant to do.

Just imagining a future where kind and honest wealthy people continue to emerge, making our society beautiful, wealthy, and mutually beneficial, a community where everyone shares and cares, is so exciting that I can't sleep.

I sincerely, earnestly, and fervently hope that South Korea will become a financial powerhouse.

Faced with crises such as low birth rates, a super-aging society, and the disappearance of local communities, South Korea no longer has the luxury of waiting for vague, theoretical growth or development.

The destruction of bold ideas, and the movement and practice through them, are needed immediately.

--- p.7

When I came to Korea, the media thought my actions were unconventional and gave me nicknames like 'Don Quixote', 'Alice in Wonderland', and 'Geezy'.

I did think that if you look at it through a rigid lens, my actions could be seen that way.

But if you look at it from a slightly different perspective, things that Korean society had taken for granted might actually seem strange.

--- p.46

First of all, many people looked at me strangely for using public transportation instead of the company-provided car and driver.

Some reporters even went so far as to tail me to check if I really used public transportation.

The reason I use public transportation is very simple.

Because the subway or bus is much faster, more accurate, and cheaper.

--- p.47

What I tried and implemented at Meritz Asset Management is an organizational culture that most foreign financial companies take for granted.

For Korea's financial industry to advance to the next level, companies must be able to boldly break away from existing practices.

--- p.58

For nine years, I worked passionately, almost without weekends or holidays, and thankfully, the response was positive, and I received numerous invitations to speak from people all over the country.

He emphasized and re-emphasized that you must invest in stocks, starting with retirement planning, pension savings funds, and retirement pensions, to the point of talking in your sleep.

He also urged people to never make short-term investments and to make long-term investments.

--- p.70

We need to start education to break down financial prejudices as soon as possible.

The more developed a country's finances are, the more powerful it is in overcoming crises.

--- p.83

Our country has a strong obsession with numbers.

This is a country where people are accustomed to evaluating and ranking their abilities using quantifiable figures from a very young age.

In my view, this too is a fatal practice that hinders the growth of Korean society.

--- p.96

Our children are forced to work almost 80 hours a week.

The labor of learning, which requires competition for grades, is much more severe in terms of both physical and mental pain than simple labor.

The first target group to which the 52-hour system should be introduced are children.

--- p.106

This may be a somewhat radical claim, but I believe that eliminating exams is the most urgent step toward increasing the birth rate.

Unlike advanced countries in other countries, Korea is currently dominated by the omnipotence of examinations.

--- p.118

When the news broke that I was leaving Meritz Asset Management, I saw a media outlet reporting the news and categorically calling it a "dishonorable resignation."

(…) I was aggrieved and angry because of the fake articles that were different from the facts, but after pulling myself together to some extent, I realized that rather than retreating like this, I should fight against the wrong prejudices and rigid culture that dominate Korean society.

(…) Above all, I didn’t want to let the nine years of effort I had put in, body and soul, go to waste.

--- p.194~195

In order to make them think positively about 'stocks' again and recognize the need to prepare for retirement, it took sincere education, that is, a lot of effort and time.

In such a situation, I was worried that the malicious reporting in the newspaper would make them think negatively about investing again.

No matter how much I thought about it, I couldn't leave like this.

--- p.196

Like the United States, our country should also provide institutional support so that many young people with creative investment ideas can start asset management businesses.

If we focus only on risk and strengthen regulations and raise barriers to entry, new and creative ideas will be stifled and eventually disappear like dust.

If we lower the barriers to entry and allow many new, creative asset management businesses to emerge, Korea's growth as a financial powerhouse will accelerate dramatically.

--- p.207

I would like to emphasize this especially to women and parents with daughters.

I would like to say that women should actively enter the financial industry, and above all, the asset management industry.

The number of women currently working in the financial and asset management industries is so low that it is meaningless to even mention it.

But, conversely, this also means that for young Korean women, entering the financial industry is a blue ocean.

--- p.210

With this asset of hope, a 10-year blueprint was drawn up.

Ah, I felt again, deep within me, that this was what I was meant to do.

Just imagining a future where kind and honest wealthy people continue to emerge, making our society beautiful, wealthy, and mutually beneficial, a community where everyone shares and cares, is so exciting that I can't sleep.

I sincerely, earnestly, and fervently hope that South Korea will become a financial powerhouse.

--- p.222

Publisher's Review

“A new decade, what should we do now?”

How can we all become rich? The philosophy and principles of investing, the nature and future of wealth,

And a painful reminder of the prejudices we need to break.

'Stock investment evangelist,' 'Donghak Ant mentor,' 'John Bong-jun,' 'financial expert'... There are so many words to describe John Lee.

A Wall Street star fund manager who successfully launched the Korea Fund, the first mutual fund to invest in the Korean market; a small giant who elevated Meritz Asset Management to the top of the industry; a financial reformer who traveled the country, including through online and offline broadcasts, to help all citizens overcome financial illiteracy. It is no exaggeration to say that his emergence rewrote the history of investment and finance in Korea.

In June of last year (2022), he left Meritz Asset Management, which he had led for nine years, due to unexpected circumstances.

While taking time to rest and recharge, he has continued to provide financial education through 'John Lee Lifestyle Stock' (YouTube) and 'John Lee's Rich School' (camp).

And, for the first time, he published a new work, 『John Lee, The Beginning of a New Decade』 (published by Kim Young-sa), which contains his feelings about ending the first act in Korea and his new challenges and plans for the second act.

In this book, he summarizes his nine years of experience as CEO of an asset management company and suggests what we need to do now to prepare for the next decade.

“Korea has no time left.

“If we don’t change the paradigm, we could lose a lot of what we have accumulated.”

It emphasizes that the value investing philosophy and investment principles learned through observation, hearing, and experience in advanced financial markets around the world, including Korea, the United States, and elsewhere, remain valid. Above all, it painfully points out the urgent need for productive and creative destruction that transcends the stereotypes and prejudices prevalent throughout Korean society.

And it contains methods and practices for the future of K-finance that can sustain Korea for the next 100 years or more.

“In the future, Asia will become the center of the world economic market.

Among them, Korea must become the economic center and financial core of Asia.” This is because the way for all of us to become rich is to become a financial powerhouse.

John Lee's History of Financial Pioneering: A History of Challenge and Breakthrough

“People who are stuck in their preconceived notions don’t recognize new opportunities.”

Having built a reputation as a star fund manager on Wall Street, he returned to his home country in 2014 to become the CEO of Meritz Asset Management.

After about 10 years, he succeeded in improving the structure of asset management in Korea and changing the flow of the capital market from real estate to 'finance'.

In this book, John Lee honestly and calmly recounts the efforts of a native Korean who went from being a star fund manager on Wall Street to becoming the CEO of a domestic asset management company, and who has taken steps to upgrade Korea's financial industry.

During his nine years of dedicated investment philosophy and financial education to achieve personal financial independence, he had to confront and overcome stereotypes and prejudices at every moment.

He said he was suffocated by the authoritarian culture of obedience to orders, the vertical culture of prioritizing rank, the culture of always comparing oneself to others, and the culture of not asking questions.

I believed that these rigidities and prejudices were hindering Korea's qualitative growth and had a negative impact on corporate growth, so I began to improve the constitution of the company where I was CEO.

Bold attempts were made, such as liberalizing working hours, creating a horizontal organizational culture, and changing the bonus system.

A bitter commentary on prejudices that must be broken for the development of Korean society.

“Korea doesn’t have much time.

“We need to change the paradigm of finance and education right now.”

John Lee says that while Korea has achieved remarkable growth that is recognized worldwide, it lags far behind other countries in terms of its education system and awareness of finance.

I believe that we must improve these two problems to make our children, the next generation, happy and wealthy.

They repeatedly emphasize that if the 'education system' changes, the biggest problems in Korean society, 'low birth rate' and 'poverty among the elderly', can be solved.

As people compete for test scores and admission to good universities, the private education market becomes huge, and people spend more on education than they earn.

As a result, having children becomes a burden, worsening the low birth rate problem. Spending a lot of money on children's education leads to a lack of preparation for old age, which in turn deepens the poverty problem, creating a vicious cycle.

The obsession with numbers is probably due to the fact that Koreans are accustomed to ranking things by first or second place from a young age, and they evaluate everything in numbers.

Performance-based pay and promotion evaluations are conducted based on numerical evaluations of abilities and performance, ignoring the various capabilities of an individual.

If we cannot break free from our obsession with numbers, Korean society will inevitably regress, lacking diversity and inclusiveness.

From suggestions for the growth of the Korean capital market to plans for fostering financial talent.

A new wave of finance envisioned by John Lee, who reimagined the history of finance!

“Many young talents, including women, are entering the investment industry.

In other words, we must embark on a journey of starting an asset management business and explore various avenues with our imagination.”

There are still many Koreans who have prejudices about finance.

Many people are reluctant to talk openly about money.

John Lee believes there are two major misconceptions about the financial industry.

One is that the financial industry is still considered less important than manufacturing, and the other is that money earned through finance (stock investment) is considered "unearned income" as if it were morally problematic.

He says that there is no country with a high level of financial understanding that has weak national competitiveness.

The Jewish people, who make up only 0.2 percent of the world's population, control 20 percent of the world's assets through their strong competitiveness in the financial industry, and the Netherlands' rise to power in the 16th century was also due to the development of the financial industry.

The reason why Britain and the United States are still economic powers is because they have the weapon of finance.

John Lee says that if our country's financial industry takes a leap forward, it can become a stronger country.

Additionally, the cultivation of financial talent and deregulation were cited as essential conditions for the growth of the financial industry.

The argument is that new national wealth must be created through finance in the future, and to do so, a large number of young people must lead the financial industry.

An environment must be created where young people can easily establish asset management companies not only in major cities but also in rural areas.

He also emphasizes that if women boldly and proactively design and launch asset management companies, Korea's capital market can develop further.

Dreaming of Korea becoming a financial powerhouse

“Being rich doesn’t just mean having a lot of money,

“It means being free from money and having hope for happiness and the future.”

He says he dreams of giving hope to the children of our country who are growing up under harsh stress in the bleak reality of endless competition, and of providing them with the happiness of achieving economic independence and a life of wealth.

If individuals and families achieve economic independence, there will be more wealthy people with a positive influence on society.

To this end, we plan to continuously and systematically conduct financial education lectures on stocks for children and provide more specialized financial education for housewives.

I hope that the blueprint for Korea to become a financial powerhouse will be realized.

How can we all become rich? The philosophy and principles of investing, the nature and future of wealth,

And a painful reminder of the prejudices we need to break.

'Stock investment evangelist,' 'Donghak Ant mentor,' 'John Bong-jun,' 'financial expert'... There are so many words to describe John Lee.

A Wall Street star fund manager who successfully launched the Korea Fund, the first mutual fund to invest in the Korean market; a small giant who elevated Meritz Asset Management to the top of the industry; a financial reformer who traveled the country, including through online and offline broadcasts, to help all citizens overcome financial illiteracy. It is no exaggeration to say that his emergence rewrote the history of investment and finance in Korea.

In June of last year (2022), he left Meritz Asset Management, which he had led for nine years, due to unexpected circumstances.

While taking time to rest and recharge, he has continued to provide financial education through 'John Lee Lifestyle Stock' (YouTube) and 'John Lee's Rich School' (camp).

And, for the first time, he published a new work, 『John Lee, The Beginning of a New Decade』 (published by Kim Young-sa), which contains his feelings about ending the first act in Korea and his new challenges and plans for the second act.

In this book, he summarizes his nine years of experience as CEO of an asset management company and suggests what we need to do now to prepare for the next decade.

“Korea has no time left.

“If we don’t change the paradigm, we could lose a lot of what we have accumulated.”

It emphasizes that the value investing philosophy and investment principles learned through observation, hearing, and experience in advanced financial markets around the world, including Korea, the United States, and elsewhere, remain valid. Above all, it painfully points out the urgent need for productive and creative destruction that transcends the stereotypes and prejudices prevalent throughout Korean society.

And it contains methods and practices for the future of K-finance that can sustain Korea for the next 100 years or more.

“In the future, Asia will become the center of the world economic market.

Among them, Korea must become the economic center and financial core of Asia.” This is because the way for all of us to become rich is to become a financial powerhouse.

John Lee's History of Financial Pioneering: A History of Challenge and Breakthrough

“People who are stuck in their preconceived notions don’t recognize new opportunities.”

Having built a reputation as a star fund manager on Wall Street, he returned to his home country in 2014 to become the CEO of Meritz Asset Management.

After about 10 years, he succeeded in improving the structure of asset management in Korea and changing the flow of the capital market from real estate to 'finance'.

In this book, John Lee honestly and calmly recounts the efforts of a native Korean who went from being a star fund manager on Wall Street to becoming the CEO of a domestic asset management company, and who has taken steps to upgrade Korea's financial industry.

During his nine years of dedicated investment philosophy and financial education to achieve personal financial independence, he had to confront and overcome stereotypes and prejudices at every moment.

He said he was suffocated by the authoritarian culture of obedience to orders, the vertical culture of prioritizing rank, the culture of always comparing oneself to others, and the culture of not asking questions.

I believed that these rigidities and prejudices were hindering Korea's qualitative growth and had a negative impact on corporate growth, so I began to improve the constitution of the company where I was CEO.

Bold attempts were made, such as liberalizing working hours, creating a horizontal organizational culture, and changing the bonus system.

A bitter commentary on prejudices that must be broken for the development of Korean society.

“Korea doesn’t have much time.

“We need to change the paradigm of finance and education right now.”

John Lee says that while Korea has achieved remarkable growth that is recognized worldwide, it lags far behind other countries in terms of its education system and awareness of finance.

I believe that we must improve these two problems to make our children, the next generation, happy and wealthy.

They repeatedly emphasize that if the 'education system' changes, the biggest problems in Korean society, 'low birth rate' and 'poverty among the elderly', can be solved.

As people compete for test scores and admission to good universities, the private education market becomes huge, and people spend more on education than they earn.

As a result, having children becomes a burden, worsening the low birth rate problem. Spending a lot of money on children's education leads to a lack of preparation for old age, which in turn deepens the poverty problem, creating a vicious cycle.

The obsession with numbers is probably due to the fact that Koreans are accustomed to ranking things by first or second place from a young age, and they evaluate everything in numbers.

Performance-based pay and promotion evaluations are conducted based on numerical evaluations of abilities and performance, ignoring the various capabilities of an individual.

If we cannot break free from our obsession with numbers, Korean society will inevitably regress, lacking diversity and inclusiveness.

From suggestions for the growth of the Korean capital market to plans for fostering financial talent.

A new wave of finance envisioned by John Lee, who reimagined the history of finance!

“Many young talents, including women, are entering the investment industry.

In other words, we must embark on a journey of starting an asset management business and explore various avenues with our imagination.”

There are still many Koreans who have prejudices about finance.

Many people are reluctant to talk openly about money.

John Lee believes there are two major misconceptions about the financial industry.

One is that the financial industry is still considered less important than manufacturing, and the other is that money earned through finance (stock investment) is considered "unearned income" as if it were morally problematic.

He says that there is no country with a high level of financial understanding that has weak national competitiveness.

The Jewish people, who make up only 0.2 percent of the world's population, control 20 percent of the world's assets through their strong competitiveness in the financial industry, and the Netherlands' rise to power in the 16th century was also due to the development of the financial industry.

The reason why Britain and the United States are still economic powers is because they have the weapon of finance.

John Lee says that if our country's financial industry takes a leap forward, it can become a stronger country.

Additionally, the cultivation of financial talent and deregulation were cited as essential conditions for the growth of the financial industry.

The argument is that new national wealth must be created through finance in the future, and to do so, a large number of young people must lead the financial industry.

An environment must be created where young people can easily establish asset management companies not only in major cities but also in rural areas.

He also emphasizes that if women boldly and proactively design and launch asset management companies, Korea's capital market can develop further.

Dreaming of Korea becoming a financial powerhouse

“Being rich doesn’t just mean having a lot of money,

“It means being free from money and having hope for happiness and the future.”

He says he dreams of giving hope to the children of our country who are growing up under harsh stress in the bleak reality of endless competition, and of providing them with the happiness of achieving economic independence and a life of wealth.

If individuals and families achieve economic independence, there will be more wealthy people with a positive influence on society.

To this end, we plan to continuously and systematically conduct financial education lectures on stocks for children and provide more specialized financial education for housewives.

I hope that the blueprint for Korea to become a financial powerhouse will be realized.

GOODS SPECIFICS

- Date of issue: February 13, 2023

- Page count, weight, size: 228 pages | 350g | 140*210*14mm

- ISBN13: 9788934951025

- ISBN10: 8934951028

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)