The Miracle Routine of Dividend Investment

|

Description

Book Introduction

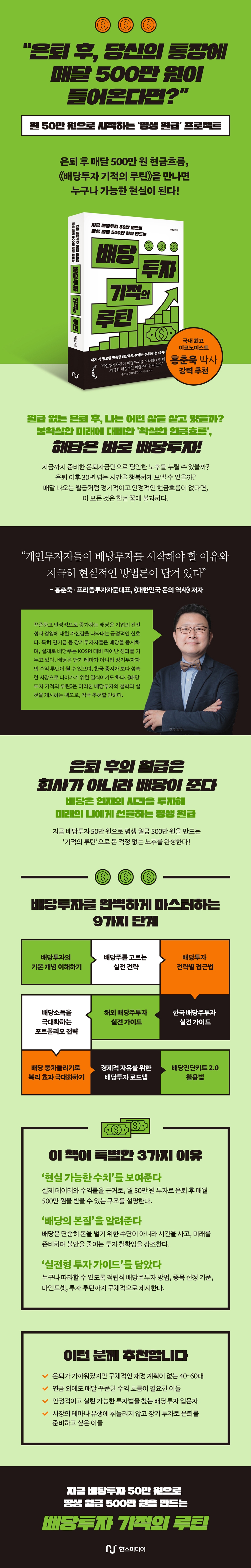

“After retirement, in your bank account

“What if I get 5 million won every month?”

The "Lifetime Salary" Project, Starting at 500,000 Won a Month

Publication of "Dividend Investment Miracle Routine"

Cash flow of 5 million won per month after retirement,

It becomes a reality that anyone can achieve!

What kind of life will I lead after retirement without a salary?

'Sure cash flow' to prepare for an uncertain future,

The answer is dividend investing!

Can you enjoy a peaceful retirement with just the retirement savings you've accumulated so far? Can you truly enjoy the 30 years after retirement? Without a regular and stable cash flow like a monthly paycheck, all of this is nothing more than a dream.

This is why you should start investing in dividends right now.

“Is it really possible to receive 5 million won per month in dividends?”

“Isn’t that something that requires a lot of investment?”

“Can that really happen with a monthly investment of 500,000 won?”

This is entirely possible if you consistently invest in high-quality dividend stocks every month.

Anyone can invest 500,000 won a month in dividend stocks, and based on the long-term stock price increase and dividend accumulation effect, they can create a structure where dividends of 5 million won or more are automatically deposited into their account every month after retirement.

This book goes beyond simply informing readers about "which stocks are promising dividend stocks," and helps readers internalize "why they should invest in dividends," "what mindset they should have," and "what dividends mean."

Dividend investing isn't just a "money-making technique." It's a concrete way to buy a lifetime of time, prepare for the future, and design a life free from anxiety.

“What if I get 5 million won every month?”

The "Lifetime Salary" Project, Starting at 500,000 Won a Month

Publication of "Dividend Investment Miracle Routine"

Cash flow of 5 million won per month after retirement,

It becomes a reality that anyone can achieve!

What kind of life will I lead after retirement without a salary?

'Sure cash flow' to prepare for an uncertain future,

The answer is dividend investing!

Can you enjoy a peaceful retirement with just the retirement savings you've accumulated so far? Can you truly enjoy the 30 years after retirement? Without a regular and stable cash flow like a monthly paycheck, all of this is nothing more than a dream.

This is why you should start investing in dividends right now.

“Is it really possible to receive 5 million won per month in dividends?”

“Isn’t that something that requires a lot of investment?”

“Can that really happen with a monthly investment of 500,000 won?”

This is entirely possible if you consistently invest in high-quality dividend stocks every month.

Anyone can invest 500,000 won a month in dividend stocks, and based on the long-term stock price increase and dividend accumulation effect, they can create a structure where dividends of 5 million won or more are automatically deposited into their account every month after retirement.

This book goes beyond simply informing readers about "which stocks are promising dividend stocks," and helps readers internalize "why they should invest in dividends," "what mindset they should have," and "what dividends mean."

Dividend investing isn't just a "money-making technique." It's a concrete way to buy a lifetime of time, prepare for the future, and design a life free from anxiety.

- You can preview some of the book's contents.

Preview

index

Recommendation: The Allure of Dividend Investing That Grows Over Time (Hong Chun-wook)

Getting Started _ How to Make Money Work for You and Live a Happy Life

Chapter 1: Understanding the Basic Concepts of Dividend Investing

01 What is Dividend Investing? Let's start with the concept.

02 Dividend-Making Structure: Where Does Profit Come From?

03 Differences between Dividend Stocks and Regular Stocks: Immediate Return vs.

Future growth

04 Relationship between Dividend Yield and Total Shareholder Return

05 What investment environment is more advantageous for dividend investing?

06 Growth Stocks vs.

Should I buy both dividend stocks?

Chapter 2: Practical Strategies for Picking Dividend Stocks

07 Five Ways to Choose Profitable Stocks Even Beginners Can Invest With Confidence

08 Find the optimal combination of dividend yield and dividend payout ratio.

09 What the Dividend Growth Rate Means

Infinite confidence in 10 consecutive dividends

11 Dividends: Can They Stay There Long? Dividend Sustainability: A Look at Financial Statements

12 Dividend Cuts: Why Emergency Dividend Reductions and No Dividends Occur

Chapter 3 Dividend Investment Strategies and Approaches

13 The Two Faces of Dividend Investing: Stable Strategies vs.

offensive strategy

14 Companies Age Too: Reading High-Dividend Stocks vs. Investors Through Their Life Cycles

dividend growth stocks

How to Use 15 Monthly Dividend ETFs and High-Dividend ETFs

16. Leveraging Big Tech Covered Call ETFs for a Growth Dividend Portfolio

17 How to Pick the Best Dividend Stocks Based on the Business Cycle

18. Take the dividend and leave. How to use the dividend capture strategy that works in practice.

Chapter 4: A Practical Guide to Investing in Korean Dividend Stocks

19 The allure of dividend investing that generates stable cash flow

20 KOSPI Dividend Stocks vs.

KOSDAQ Dividend Stocks: Differences and Selection Guide

21 Things to Consider When Investing in Korean Dividend Stocks

Analysis of Korea's Top 10 Dividend Stocks

23 How to Use Dividend ETFs in the Korean Market

24 Investment Strategies Before and After the Ex-Dividend Date: Smart Dividend-Aiming Investment Strategies

Chapter 5: A Practical Guide to Overseas Dividend Investing

25 The Era of Global Dividends: Smart Investment in Overseas Dividend Stocks

26. 3 Key Points You Must Know Before Investing in US Dividend Stocks

27 What are the US Dividend Aristocrats? Conquering the Core Stocks

28 Companies Wearing the Dividend Crown: A Look at America's Dividend Kings

29 US High-Dividend ETFs: Stability and Growth Potential

30 Overseas Dividend Investment Strategies to Beat Exchange Rate Risk

Chapter 6 Portfolio Strategies to Maximize Dividend Income

31 Principles for Building a Dividend Portfolio

32 Industry-Specific Diversification for Dividend Stability

33. Increase Cash Flow with a Combination of Dividend Stocks and REITs

34 How to Combine High-Dividend and Growth Stocks: Killing Two Birds: Profitability and Stability

35 You can receive dividends like a pension and create another monthly salary in retirement.

36 Risks and Alternatives to a Dividend-Concentrated Portfolio: A "Long-Giving" Structure Is Better Than a "High-Giving" Structure

Chapter 7: Maximizing Compound Interest with Dividend Windmills

37 What is Dividend Windmilling? Maximize the Effect of Compound Interest

38 How to Smartly Rebalance Your Portfolio with Dividends

39 Dividend Retention Strategy to Protect Compounding Effects

40% dividend reinvestment vs.

Dividend Living Expense Withdrawals: Be Clear About Your Selection Criteria

41 How to Maximize Long-Term Compounding Benefits

42 Is Stop-Loss Necessary in Dividend Stock Investment?

Chapter 8: Dividend Investing Roadmap for Financial Freedom

43 Step-by-Step Plan for Financial Freedom through Dividend Investing

44 Learn about real-life examples of how to make a living from dividend income.

45 Early Retirement (FIRE) Strategies Through Dividend Investing

46 How to Maintain Consistent Dividend Income After Retirement

47 How to Invest in Strong Dividend Stocks in an Inflationary Era

48 How to Effectively Prepare for a Financial Crisis with Dividend Investing

49 A Mindset That Will Build a Lifelong Dividend Investing Continuity

Special Chapter | How to Use Dividend Diagnostic Kit 2.0: I Choose My Own Dividend Stocks

01 So, which dividend stocks should I invest in?

02 Six Key Dividend Investing Variables: Why You Should Pay Attention

03 Creating Dividend Diagnostic Kit 2.0 with 6 Key Variables

04 Dividend Diagnostic Kit 2.0's Top 5 Dividend Growth Stocks

Getting Started _ How to Make Money Work for You and Live a Happy Life

Chapter 1: Understanding the Basic Concepts of Dividend Investing

01 What is Dividend Investing? Let's start with the concept.

02 Dividend-Making Structure: Where Does Profit Come From?

03 Differences between Dividend Stocks and Regular Stocks: Immediate Return vs.

Future growth

04 Relationship between Dividend Yield and Total Shareholder Return

05 What investment environment is more advantageous for dividend investing?

06 Growth Stocks vs.

Should I buy both dividend stocks?

Chapter 2: Practical Strategies for Picking Dividend Stocks

07 Five Ways to Choose Profitable Stocks Even Beginners Can Invest With Confidence

08 Find the optimal combination of dividend yield and dividend payout ratio.

09 What the Dividend Growth Rate Means

Infinite confidence in 10 consecutive dividends

11 Dividends: Can They Stay There Long? Dividend Sustainability: A Look at Financial Statements

12 Dividend Cuts: Why Emergency Dividend Reductions and No Dividends Occur

Chapter 3 Dividend Investment Strategies and Approaches

13 The Two Faces of Dividend Investing: Stable Strategies vs.

offensive strategy

14 Companies Age Too: Reading High-Dividend Stocks vs. Investors Through Their Life Cycles

dividend growth stocks

How to Use 15 Monthly Dividend ETFs and High-Dividend ETFs

16. Leveraging Big Tech Covered Call ETFs for a Growth Dividend Portfolio

17 How to Pick the Best Dividend Stocks Based on the Business Cycle

18. Take the dividend and leave. How to use the dividend capture strategy that works in practice.

Chapter 4: A Practical Guide to Investing in Korean Dividend Stocks

19 The allure of dividend investing that generates stable cash flow

20 KOSPI Dividend Stocks vs.

KOSDAQ Dividend Stocks: Differences and Selection Guide

21 Things to Consider When Investing in Korean Dividend Stocks

Analysis of Korea's Top 10 Dividend Stocks

23 How to Use Dividend ETFs in the Korean Market

24 Investment Strategies Before and After the Ex-Dividend Date: Smart Dividend-Aiming Investment Strategies

Chapter 5: A Practical Guide to Overseas Dividend Investing

25 The Era of Global Dividends: Smart Investment in Overseas Dividend Stocks

26. 3 Key Points You Must Know Before Investing in US Dividend Stocks

27 What are the US Dividend Aristocrats? Conquering the Core Stocks

28 Companies Wearing the Dividend Crown: A Look at America's Dividend Kings

29 US High-Dividend ETFs: Stability and Growth Potential

30 Overseas Dividend Investment Strategies to Beat Exchange Rate Risk

Chapter 6 Portfolio Strategies to Maximize Dividend Income

31 Principles for Building a Dividend Portfolio

32 Industry-Specific Diversification for Dividend Stability

33. Increase Cash Flow with a Combination of Dividend Stocks and REITs

34 How to Combine High-Dividend and Growth Stocks: Killing Two Birds: Profitability and Stability

35 You can receive dividends like a pension and create another monthly salary in retirement.

36 Risks and Alternatives to a Dividend-Concentrated Portfolio: A "Long-Giving" Structure Is Better Than a "High-Giving" Structure

Chapter 7: Maximizing Compound Interest with Dividend Windmills

37 What is Dividend Windmilling? Maximize the Effect of Compound Interest

38 How to Smartly Rebalance Your Portfolio with Dividends

39 Dividend Retention Strategy to Protect Compounding Effects

40% dividend reinvestment vs.

Dividend Living Expense Withdrawals: Be Clear About Your Selection Criteria

41 How to Maximize Long-Term Compounding Benefits

42 Is Stop-Loss Necessary in Dividend Stock Investment?

Chapter 8: Dividend Investing Roadmap for Financial Freedom

43 Step-by-Step Plan for Financial Freedom through Dividend Investing

44 Learn about real-life examples of how to make a living from dividend income.

45 Early Retirement (FIRE) Strategies Through Dividend Investing

46 How to Maintain Consistent Dividend Income After Retirement

47 How to Invest in Strong Dividend Stocks in an Inflationary Era

48 How to Effectively Prepare for a Financial Crisis with Dividend Investing

49 A Mindset That Will Build a Lifelong Dividend Investing Continuity

Special Chapter | How to Use Dividend Diagnostic Kit 2.0: I Choose My Own Dividend Stocks

01 So, which dividend stocks should I invest in?

02 Six Key Dividend Investing Variables: Why You Should Pay Attention

03 Creating Dividend Diagnostic Kit 2.0 with 6 Key Variables

04 Dividend Diagnostic Kit 2.0's Top 5 Dividend Growth Stocks

Detailed image

Into the book

As retirement approaches, people begin to seriously consider how much they can receive each month with the retirement savings they've accumulated.

Now is the era of 100 years.

Even if you retire at 60, you still have 30 to 40 years to live, and without a regular, stable cash flow like a monthly salary, your quality of life will inevitably decline precipitously.

In other words, if there is an investment method that creates a "sure cash flow" to prepare for an uncertain future, it is certainly wisdom we should listen to.

---From "Starting"

Dividend investing is a "kill both the pheasant and the eggs" investment method that pursues active profitability by anchoring in port on stormy days, securing the stability of the investment through the safety margin of dividends, and then going out to sea again on calm days, casting a wide net and even enjoying capital gains.

A typical stock investment involves going out to the open sea and catching a lot of fish during calm times, but returning empty-handed or losing money due to damage to the ship during high waves.

In contrast, dividend investing is a "medium-risk, medium-return" investment that involves going out to the nearby sea, securing a spot where fish are likely to be found, and reaping a stable harvest, and even tying up the boat in port and resting when a storm warning is forecast.

---From "Chapter 1 Understanding the Basic Concepts of Dividend Investment"

A company's dividend is literally a portion of the money the company earns and distributes it to its shareholders.

In other words, cash dividends do not come from profits on the books, but from cash that can actually be held in one's hand.

To put it simply, even if someone's salary seems high, if they have zero money left after paying off credit card bills and loan interest, they wouldn't be able to afford an allowance for their children. Companies are no different.

No matter how much profit is recorded on the income statement, if actual available cash is depleted, cash dividends cannot be paid.

So the most important indicator is free cash flow (FCF).

This is the 'net cash' remaining after deducting necessary investment costs from the cash earned by the company. If the FCF is consistently positive, it can be interpreted that the company has money to pay dividends.

---From "Chapter 2 Practical Strategies for Choosing Dividend Stocks"

A stable dividend investment strategy, as its name suggests, focuses on 'stability.'

A representative target of this strategy is the dividend aristocrats group of stocks described above.

These are companies that have increased their dividends for more than 25 consecutive years, and companies such as J&J (JNJ), Coca-Cola (KO), and Procter & Gamble (P&G, PG) in the United States are representative examples.

What are the characteristics of these companies? They have a solid business model, steady cash flow, and a tendency to be largely unaffected by economic fluctuations.

For example, Coca-Cola still sells even in recessions, and P&G's toothpaste and diapers are necessary products regardless of the economy.

Such companies are capable of steady dividend growth even if their stock price does not rise significantly.

---From "Chapter 3 Dividend Investment Strategy Approaches"

All investments ultimately result in 'cash flow'.

The same goes for stocks, real estate, and bonds.

No matter how much asset prices rise, if I don't have the money in my hands when I actually need it, it's just a pie in the sky.

However, dividend investing actually creates money that is deposited into your account every year (or every month, or every quarter).

This gives investors psychological reassurance.

Even when the market fluctuates, the belief that dividends will still be paid this quarter calms investors' minds.

---From "Chapter 4: Practical Guide to Korean Dividend Investment"

Just 10 to 20 years ago, dividend investments were primarily focused on high-dividend domestic stocks. However, the number of investors now turning their attention to dividend stocks listed in overseas markets such as the U.S., Europe, and Asia is rapidly increasing.

However, overseas dividend stocks are not something you can approach simply because they have a high dividend yield.

Because there are complex, invisible barriers between countries, such as international currency dispersion and tax issues.

So why should we focus on foreign dividend stocks? While Korean companies' dividend payout ratios are steadily improving, they remain low compared to global peers.

The average dividend payout ratio of domestic listed companies over the past 10 years was calculated to be approximately 26%, while the US stock market showed an average dividend payout ratio of 36% over the same period.

Dividend aristocrats in the US and Europe have been increasing their dividends without fail for decades, and their shareholder return policies are generally well-established.

In particular, since there are many global top companies, this can be seen as an opportunity to kill two birds with one stone: stock price increase and dividend growth.

---From "Chapter 5: Practical Guide to Overseas Dividend Investment"

Dividend investing is a core component of a long-term asset management system and the heart of the cash flow asset class for financial freedom.

A good dividend stock is like an orchard.

If you sow the seeds, nurture them, and wait, they will bear fruit every season.

However, when building an orchard, seeds (types), region (currency), and management (life cycle strategies) are important.

These three principles—diversification, life cycle, and global asset allocation—will be the keys to long-term success for dividend investors.

---From "Chapter 6 Portfolio Strategy to Maximize Dividend Income"

Dividend reinvestment is a strategy similar to "windmilling" your savings.

The so-called windmilling of deposits, which is considered essential for domestic financial management, is a method of maximizing the compounding effect by reinvesting the principal and interest in new deposits at maturity.

Likewise, if you reinvest your dividends back into the stock or ETF you receive, you create a structure where dividends generate new dividends, similar to the compounding effect where interest generates more interest.

This method is called the "magic of compound interest," and it has the effect of increasing your assets exponentially over time.

This strategy is particularly useful for long-term investors, as it allows them to generate consistent income through dividends without having to sell assets.

Now is the era of 100 years.

Even if you retire at 60, you still have 30 to 40 years to live, and without a regular, stable cash flow like a monthly salary, your quality of life will inevitably decline precipitously.

In other words, if there is an investment method that creates a "sure cash flow" to prepare for an uncertain future, it is certainly wisdom we should listen to.

---From "Starting"

Dividend investing is a "kill both the pheasant and the eggs" investment method that pursues active profitability by anchoring in port on stormy days, securing the stability of the investment through the safety margin of dividends, and then going out to sea again on calm days, casting a wide net and even enjoying capital gains.

A typical stock investment involves going out to the open sea and catching a lot of fish during calm times, but returning empty-handed or losing money due to damage to the ship during high waves.

In contrast, dividend investing is a "medium-risk, medium-return" investment that involves going out to the nearby sea, securing a spot where fish are likely to be found, and reaping a stable harvest, and even tying up the boat in port and resting when a storm warning is forecast.

---From "Chapter 1 Understanding the Basic Concepts of Dividend Investment"

A company's dividend is literally a portion of the money the company earns and distributes it to its shareholders.

In other words, cash dividends do not come from profits on the books, but from cash that can actually be held in one's hand.

To put it simply, even if someone's salary seems high, if they have zero money left after paying off credit card bills and loan interest, they wouldn't be able to afford an allowance for their children. Companies are no different.

No matter how much profit is recorded on the income statement, if actual available cash is depleted, cash dividends cannot be paid.

So the most important indicator is free cash flow (FCF).

This is the 'net cash' remaining after deducting necessary investment costs from the cash earned by the company. If the FCF is consistently positive, it can be interpreted that the company has money to pay dividends.

---From "Chapter 2 Practical Strategies for Choosing Dividend Stocks"

A stable dividend investment strategy, as its name suggests, focuses on 'stability.'

A representative target of this strategy is the dividend aristocrats group of stocks described above.

These are companies that have increased their dividends for more than 25 consecutive years, and companies such as J&J (JNJ), Coca-Cola (KO), and Procter & Gamble (P&G, PG) in the United States are representative examples.

What are the characteristics of these companies? They have a solid business model, steady cash flow, and a tendency to be largely unaffected by economic fluctuations.

For example, Coca-Cola still sells even in recessions, and P&G's toothpaste and diapers are necessary products regardless of the economy.

Such companies are capable of steady dividend growth even if their stock price does not rise significantly.

---From "Chapter 3 Dividend Investment Strategy Approaches"

All investments ultimately result in 'cash flow'.

The same goes for stocks, real estate, and bonds.

No matter how much asset prices rise, if I don't have the money in my hands when I actually need it, it's just a pie in the sky.

However, dividend investing actually creates money that is deposited into your account every year (or every month, or every quarter).

This gives investors psychological reassurance.

Even when the market fluctuates, the belief that dividends will still be paid this quarter calms investors' minds.

---From "Chapter 4: Practical Guide to Korean Dividend Investment"

Just 10 to 20 years ago, dividend investments were primarily focused on high-dividend domestic stocks. However, the number of investors now turning their attention to dividend stocks listed in overseas markets such as the U.S., Europe, and Asia is rapidly increasing.

However, overseas dividend stocks are not something you can approach simply because they have a high dividend yield.

Because there are complex, invisible barriers between countries, such as international currency dispersion and tax issues.

So why should we focus on foreign dividend stocks? While Korean companies' dividend payout ratios are steadily improving, they remain low compared to global peers.

The average dividend payout ratio of domestic listed companies over the past 10 years was calculated to be approximately 26%, while the US stock market showed an average dividend payout ratio of 36% over the same period.

Dividend aristocrats in the US and Europe have been increasing their dividends without fail for decades, and their shareholder return policies are generally well-established.

In particular, since there are many global top companies, this can be seen as an opportunity to kill two birds with one stone: stock price increase and dividend growth.

---From "Chapter 5: Practical Guide to Overseas Dividend Investment"

Dividend investing is a core component of a long-term asset management system and the heart of the cash flow asset class for financial freedom.

A good dividend stock is like an orchard.

If you sow the seeds, nurture them, and wait, they will bear fruit every season.

However, when building an orchard, seeds (types), region (currency), and management (life cycle strategies) are important.

These three principles—diversification, life cycle, and global asset allocation—will be the keys to long-term success for dividend investors.

---From "Chapter 6 Portfolio Strategy to Maximize Dividend Income"

Dividend reinvestment is a strategy similar to "windmilling" your savings.

The so-called windmilling of deposits, which is considered essential for domestic financial management, is a method of maximizing the compounding effect by reinvesting the principal and interest in new deposits at maturity.

Likewise, if you reinvest your dividends back into the stock or ETF you receive, you create a structure where dividends generate new dividends, similar to the compounding effect where interest generates more interest.

This method is called the "magic of compound interest," and it has the effect of increasing your assets exponentially over time.

This strategy is particularly useful for long-term investors, as it allows them to generate consistent income through dividends without having to sell assets.

---From "Chapter 7 Maximizing Compound Interest with Dividend Windmills"

Publisher's Review

After retirement, your salary comes from dividends, not from the company.

Dividends are a lifetime salary given to your future self by investing your time now.

30 years after retirement, will the assets you have now be enough?

For many people in their 40s and 60s preparing for retirement, life after retirement is still vague.

With rising prices, increasing life expectancy, and insufficient pension benefits, life without a salary is bound to be unstable.

In this era of anxiety, a book has been published suggesting an alternative: 'Start with 500,000 won per month and earn 5 million won per month for life.'

The new book, "Dividend Investment Miracle Routine," goes beyond simply recommending stocks. It introduces a specific investment routine that starts with 500,000 won per month and generates 5 million won in dividends per month after retirement.

This demonstrates that anyone can create a realistic retirement income structure through regular investment in high-quality dividend stocks favored by long-term investors and pension funds.

Dr. Hong Chun-wook, Korea's top economist and renowned author of "The History of Money in Korea," said in his recommendation, "Dividends are not a short-term theme, but can become a long-term investor's profit routine, and are also the key to the Korean stock market moving toward a more mature market.

“The Miracle Routine of Dividend Investment” is a book that presents the philosophy and practice of dividend investment and is highly recommended.

Four Reasons Why This Book Is Special

· Shows 'realistically possible figures'

Based on actual data and returns, we explain a structure that allows you to receive 5 million won per month after retirement with a monthly investment of 500,000 won.

· Explains the 'essence of dividends'

Dividends are not simply a means to make money, but rather an investment philosophy that buys time, prepares for the future, and reduces anxiety.

· Includes a practical investment guide.

It provides detailed information on dividend stock investment methods, stock selection criteria, mindset, and investment routines that anyone can follow.

I recommend this to these people

- People in their 40s to 60s who are nearing retirement but have no concrete financial plan.

- Those who need a steady monthly income stream in addition to their pension

- Beginners in dividend investing looking for a stable and feasible investment method.

- Those who want to prepare for retirement through long-term investment without being swayed by market themes or trends.

Dividends are a lifetime salary given to your future self by investing your time now.

30 years after retirement, will the assets you have now be enough?

For many people in their 40s and 60s preparing for retirement, life after retirement is still vague.

With rising prices, increasing life expectancy, and insufficient pension benefits, life without a salary is bound to be unstable.

In this era of anxiety, a book has been published suggesting an alternative: 'Start with 500,000 won per month and earn 5 million won per month for life.'

The new book, "Dividend Investment Miracle Routine," goes beyond simply recommending stocks. It introduces a specific investment routine that starts with 500,000 won per month and generates 5 million won in dividends per month after retirement.

This demonstrates that anyone can create a realistic retirement income structure through regular investment in high-quality dividend stocks favored by long-term investors and pension funds.

Dr. Hong Chun-wook, Korea's top economist and renowned author of "The History of Money in Korea," said in his recommendation, "Dividends are not a short-term theme, but can become a long-term investor's profit routine, and are also the key to the Korean stock market moving toward a more mature market.

“The Miracle Routine of Dividend Investment” is a book that presents the philosophy and practice of dividend investment and is highly recommended.

Four Reasons Why This Book Is Special

· Shows 'realistically possible figures'

Based on actual data and returns, we explain a structure that allows you to receive 5 million won per month after retirement with a monthly investment of 500,000 won.

· Explains the 'essence of dividends'

Dividends are not simply a means to make money, but rather an investment philosophy that buys time, prepares for the future, and reduces anxiety.

· Includes a practical investment guide.

It provides detailed information on dividend stock investment methods, stock selection criteria, mindset, and investment routines that anyone can follow.

I recommend this to these people

- People in their 40s to 60s who are nearing retirement but have no concrete financial plan.

- Those who need a steady monthly income stream in addition to their pension

- Beginners in dividend investing looking for a stable and feasible investment method.

- Those who want to prepare for retirement through long-term investment without being swayed by market themes or trends.

GOODS SPECIFICS

- Date of issue: July 30, 2025

- Page count, weight, size: 336 pages | 618g | 152*224*21mm

- ISBN13: 9791194777373

- ISBN10: 1194777376

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)