Automated stock trading that no one teaches you

|

Description

Book Introduction

“I increase my stock account balance while working!”

Here's how to set up Yestrader automatic trading (+Kiwoom Securities Catch) in less than an hour, the mecca of automatic trading.

It provides a wealth of information on 7 high-win rate operating strategies, conditional search formulas, and signal searches.

You can learn system trading that increases your stock account balance simply by turning it on before the market starts through 『Stock Automated Trading That No One Teach You』.

Here's how to set up Yestrader automatic trading (+Kiwoom Securities Catch) in less than an hour, the mecca of automatic trading.

It provides a wealth of information on 7 high-win rate operating strategies, conditional search formulas, and signal searches.

You can learn system trading that increases your stock account balance simply by turning it on before the market starts through 『Stock Automated Trading That No One Teach You』.

- You can preview some of the book's contents.

Preview

index

Introduction: Everything About Automated Trading, Incorporated into 10 Years of Research_09

Things you need to know before you start_17

Automated Trading Platform_15 | Elliott Wave Theory_17 | Support and Resistance_19 | Trading Position Setting_22

| Part 1 | Kiwoom Conditional Search Formula and Catch Automated Trading

01 Kiwoom Securities Youngungmun 4 Installation_29

02 Running a conditional search_33

03 Running the Catch Program_57

04 Catch Real-Time Trading Order Setting_72

| Part 2 | Yestrader Automated Trading

01 Yestrader Installation_80

02 Writing Yes Language (#6109)_86

03 Writing a Power Stock Search Formula (#3202)_91

04 Yes Spot (#6132) Editor_98

05 Yes Spot (#6131) Automatic Trading_109

| Part 3 | Shh! The Automated Trading Search Formula I Want to Keep to Myself

_ The trading methods of world masters

01 Larry Williams - Volatility Breakout Strategy_133

Kiwoom Securities Formula Manager Technical Indicator Creation_137 | Kiwoom Securities Formula Manager Signal Search Creation_143 | YesTrader 6109 YesLanguage Creation_148 | YesTrader 3202 Power Stock Search Formula Creation_152

02 Mark Minervini-Sepha Strategy Trend Template_165

Kiwoom Securities Formula Manager Technical Indicator Creation_170 | Kiwoom Securities Formula Manager Signal Search Creation_177 | YesTrader 6109 YesLanguage Creation_182 | YesTrader 3202 Power Stock Search Formula Creation_186

03 Nicholas Davas-Box Theory_190

Kiwoom Securities Formula Manager Technical Indicator Creation_193 | Kiwoom Securities Formula Manager Signal Search Creation_201 | YesTrader 6109 YesLanguage Creation_206 | YesTrader 3202 Power Stock Search Formula Creation_210

| Part 4 | TradingView's Secret Indicators No One Knows About

01 WaveTrend Oscillator_217

Kiwoom Securities Formula Manager Technical Indicator Creation_224 | YesTrader 6109 YesLanguage Creation_233 | YesTrader 3202 Power Stock Search Formula Creation_237

02 AK MACD BB INDICATOR[Algokid]_241

Kiwoom Securities Formula Manager Technical Indicator Creation_244 | YesTrader 6109 YesLanguage Creation_256 | YesTrader 3202 Power Stock Search Formula Creation_260

03 Triple Bollinger Bands [TimeFliesBuy]_264

Kiwoom Securities Formula Manager Technical Indicator Creation_269 | YesTrader 6109 YesLanguage Creation_291 | YesTrader 3202 Power Stock Search Formula Creation_295

Appendix at the end of the book: Conditional search formula for the advanced course 5_299

Things you need to know before you start_17

Automated Trading Platform_15 | Elliott Wave Theory_17 | Support and Resistance_19 | Trading Position Setting_22

| Part 1 | Kiwoom Conditional Search Formula and Catch Automated Trading

01 Kiwoom Securities Youngungmun 4 Installation_29

02 Running a conditional search_33

03 Running the Catch Program_57

04 Catch Real-Time Trading Order Setting_72

| Part 2 | Yestrader Automated Trading

01 Yestrader Installation_80

02 Writing Yes Language (#6109)_86

03 Writing a Power Stock Search Formula (#3202)_91

04 Yes Spot (#6132) Editor_98

05 Yes Spot (#6131) Automatic Trading_109

| Part 3 | Shh! The Automated Trading Search Formula I Want to Keep to Myself

_ The trading methods of world masters

01 Larry Williams - Volatility Breakout Strategy_133

Kiwoom Securities Formula Manager Technical Indicator Creation_137 | Kiwoom Securities Formula Manager Signal Search Creation_143 | YesTrader 6109 YesLanguage Creation_148 | YesTrader 3202 Power Stock Search Formula Creation_152

02 Mark Minervini-Sepha Strategy Trend Template_165

Kiwoom Securities Formula Manager Technical Indicator Creation_170 | Kiwoom Securities Formula Manager Signal Search Creation_177 | YesTrader 6109 YesLanguage Creation_182 | YesTrader 3202 Power Stock Search Formula Creation_186

03 Nicholas Davas-Box Theory_190

Kiwoom Securities Formula Manager Technical Indicator Creation_193 | Kiwoom Securities Formula Manager Signal Search Creation_201 | YesTrader 6109 YesLanguage Creation_206 | YesTrader 3202 Power Stock Search Formula Creation_210

| Part 4 | TradingView's Secret Indicators No One Knows About

01 WaveTrend Oscillator_217

Kiwoom Securities Formula Manager Technical Indicator Creation_224 | YesTrader 6109 YesLanguage Creation_233 | YesTrader 3202 Power Stock Search Formula Creation_237

02 AK MACD BB INDICATOR[Algokid]_241

Kiwoom Securities Formula Manager Technical Indicator Creation_244 | YesTrader 6109 YesLanguage Creation_256 | YesTrader 3202 Power Stock Search Formula Creation_260

03 Triple Bollinger Bands [TimeFliesBuy]_264

Kiwoom Securities Formula Manager Technical Indicator Creation_269 | YesTrader 6109 YesLanguage Creation_291 | YesTrader 3202 Power Stock Search Formula Creation_295

Appendix at the end of the book: Conditional search formula for the advanced course 5_299

Detailed image

Into the book

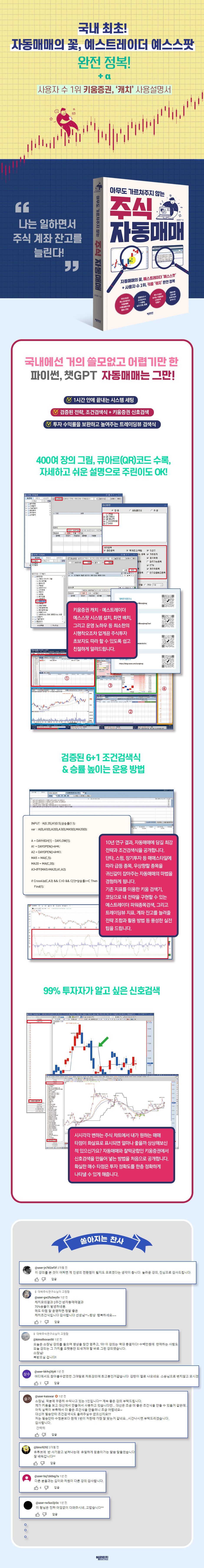

Many retail investors are unfamiliar with the Kiwoom Catch and Yestrader automated trading systems.

In particular, Yestrader can be said to be the definitive version of automatic trading that overcomes the limitations of Kiwoom's 'Catch'.

--- p.10

Again, I want to emphasize that even if your win rate is 40%, you still need to know that even if you lose 6 out of 10 times, you will still be profitable with 4 wins.

Because you can see the profit from maximizing profits while minimizing losses.

--- p.35

Below are the results of actual automated trading.

Automatic purchases were made only between 9 and 10 AM, when volatility is highest.

As you can see, after 10 o'clock, the volatility decreased and I suffered a loss.

The winning percentage was calculated to be 80%.

--- p.67

① v ar timer5 = 2; //2 seconds

You can think of it as pressing the power stock search button every two seconds.

You can do it in 1 second, but it will be very burdensome.

I used to use 1 second and now I use 2 seconds.

--- p.105

If you are trading short-term, it is important to check whether the 5-day moving average is supported by the daily chart on the 6101 chart screen.

--- p.118

Typically, volatility breakout strategies use investment strategies that fix the K value to values such as 0.35, 0.45, and 0.5.

You can improve your investment strategy by dynamically adjusting the K value and calculating the entry price according to market conditions.

--- p.159

I would say that Mark Minervini's technique is more suited to a swing trading style than a short-term one.

Split purchase is the key.

--- p.188

You can see that a point of impact occurs when the wave trend main line (red) breaks through the signal line (blue) or when the main line breaks through -53.

--- p.237

When combining AK MACD BB with other strategies, please use the modified code.

It goes especially well with the Davas Box upper breakout indicator introduced in Chapter 3.

--- p.262

Triple Bollinger Bands is a technical indicator that expands on the traditional Bollinger Band concept by adding three standard deviation bands.

In addition to the basic band (±1σ), additional bands are ‘±2σ and ±3σ’.

This allows for a more in-depth analysis of market volatility and can be used to develop various trading strategies.

In particular, Yestrader can be said to be the definitive version of automatic trading that overcomes the limitations of Kiwoom's 'Catch'.

--- p.10

Again, I want to emphasize that even if your win rate is 40%, you still need to know that even if you lose 6 out of 10 times, you will still be profitable with 4 wins.

Because you can see the profit from maximizing profits while minimizing losses.

--- p.35

Below are the results of actual automated trading.

Automatic purchases were made only between 9 and 10 AM, when volatility is highest.

As you can see, after 10 o'clock, the volatility decreased and I suffered a loss.

The winning percentage was calculated to be 80%.

--- p.67

① v ar timer5 = 2; //2 seconds

You can think of it as pressing the power stock search button every two seconds.

You can do it in 1 second, but it will be very burdensome.

I used to use 1 second and now I use 2 seconds.

--- p.105

If you are trading short-term, it is important to check whether the 5-day moving average is supported by the daily chart on the 6101 chart screen.

--- p.118

Typically, volatility breakout strategies use investment strategies that fix the K value to values such as 0.35, 0.45, and 0.5.

You can improve your investment strategy by dynamically adjusting the K value and calculating the entry price according to market conditions.

--- p.159

I would say that Mark Minervini's technique is more suited to a swing trading style than a short-term one.

Split purchase is the key.

--- p.188

You can see that a point of impact occurs when the wave trend main line (red) breaks through the signal line (blue) or when the main line breaks through -53.

--- p.237

When combining AK MACD BB with other strategies, please use the modified code.

It goes especially well with the Davas Box upper breakout indicator introduced in Chapter 3.

--- p.262

Triple Bollinger Bands is a technical indicator that expands on the traditional Bollinger Band concept by adding three standard deviation bands.

In addition to the basic band (±1σ), additional bands are ‘±2σ and ±3σ’.

This allows for a more in-depth analysis of market volatility and can be used to develop various trading strategies.

--- p.266

Publisher's Review

Korea's first! Yestrader automated trading user manual and winning strategy.

Why wouldn't it be there? I just couldn't find it even when I looked for it.

It's a story about automatic trading.

The point of a surge, the point of a bottom, and the point of a rebound... isn't this the point of hitting the stock market that we amateur ants so desperately desire?

But no matter how much I search after the stock market closes at 3:30, I can't find any stocks like this.

These days, 'robo-advisors' are said to be more profitable than securities fund managers, which makes me wonder if I can take advantage of them.

You must have imagined it at least once.

'If only computers could be more accurate than my eyes and faster than my hands when it comes to buying stocks,' he said.

There are experts who do this.

It is a system trading method that has been kept secret for a long time, not just a day or two ago, and not told to anyone.

So no matter how much I search on Naver, it doesn't come up.

The 'Yestrader' automatic trading system, known as the flower of automatic trading, is one such system, and Kiwoom Securities' 'Catch' is another.

Kiwoom is the most used securities firm by individuals in South Korea.

Of course, Daishin Securities also operates an automatic trading system, but it is somewhat mediocre and the two mentioned above are the core.

This book is a record that discloses and guides the automated trading of Yestrader and Kiwoom Securities, known as the mecca of system trading, to the entire nation.

Yestrader automatic trading is introduced for the first time in Korea.

Yestrader's automated trading platform, 'Yes Place', is composed of coding languages that are not possible with the recently introduced chat GPT or Python.

Any trading strategy can be implemented through coding and connected to automated trading.

That is why it is called the core of automatic trading.

Next is Kiwoom Securities automatic trading.

However, Kiwoom Securities has clear limitations.

You can't create your own strategy through coding like Yestrader.

You can only create conditional searches by combining indicators provided by Kiwoom Securities.

For your information, you can often see 'search engine' advertisements on the internet and social media recently, but 99% of these are created using Kiwoom Securities conditional searches.

This book is largely divided into three parts.

First, the system user manual.

I will introduce how to install and use the Yestrader and Kiwoom Securities automatic trading programs on my computer.

Easy to follow with over 400 pictures included.

Second, it is a trick of operation.

What good is installing a system? You need to know how to operate it.

We provide a comprehensive introduction to strategies and conditional search formulas for automated trading, from basic to applied.

You can run an automated trading system overnight.

Third, it is a condition search engine that complements and maximizes profits.

There are only 7 operational strategies, right?

We'll give you five conditional search engines introduced by the author as a bonus.

1.

Let's go to the new world of automated trading!

1) Kiwoom Automated Trading 'Catch'

With just a PC and this book, you can enter the world of automated trading.

First, create a conditional search formula in Hero's Gate 4 and save it.

Compared to Yestrader's automated trading system, trading strategies cannot be coded and can only be combined using indicators provided by Kiwoom Securities.

There are limits, after all.

There are many combinations of conditional searches, but this book introduces one of the most probable short-term strategies.

Run the 'catch' program.

We will show you how to open 6 windows and use them when trading.

After a sufficient verification period through mock trading, conditions are set for actual trading.

2) Yestrader automatic trading 'Spot'

To enable automatic trading, you must install Yestrader and select a brokerage firm, either NH Nonghyup or Hi Investment & Securities.

Yestrader goes through a four-step process.

Yes Language → Power Stock Search → Yes Spot Editor → Yes Spot Auto Trading.

In Yeslanguage, trading strategies are entered through coding.

This feature is not available at any other securities company, including Kiwoom Securities Catch, and is only available at Yestrader.

Power Stock Search is the step where you combine the strategy created by Yes Language with other indicators.

The stocks that are actually purchased in automated trading are decided here.

Because there are many possible combinations and strategies, study is a prerequisite.

In the YesSpot editor, the last step is to connect the search expression saved in the Power Stock Search to automatic trading, and set the operating time, operating amount, etc.

The last Yes Spot automatic trading function calls up a trading strategy and operates automatic trading.

Open the order book, chart, and sell screens and use them when trading.

3) How to Create the "Signal Search" That 99% of Investors Want

You may have seen stock market experts trading with two or three monitors open.

Even with automated trading, auxiliary tools are needed for more certain profits.

Representative examples include Kiwoom Securities' auxiliary indicator creation and signal search.

This is not possible in Yestrader, but Kiwoom Securities provides a visual representation of this.

By implementing each strategy on a chart, I apply the indicator I created to the stock price of the stock purchased during automatic trading, and I show you at which point to enter with an arrow.

2.

6+1 Best Strategies to Boost Your Account Balance

1) Volatility Breakout Strategy

This is a trading technique created by Larry Williams that achieved the best results ever at the 1987 Robbins Futures Investment Competition.

This is the most commonly used strategy in stock investment by securities firms, so it can be useful to know about it.

The values to be entered in coding are as follows:

① Buy if the stock price exceeds the breakout price today

② Breakout value = Today's opening price + (Previous day's high price - Previous day's low price) × k

③ Sell everything when the market opens the next day.

However, since this is a strategy used in stable markets such as the futures market with low volatility, it must be varied through modification and combination in the stock market with high volatility.

The book introduces a variation strategy that adjusts K values and other factors so that it can be used in practice.

2) Mark Minervini technique

As the founder of the Sepa strategy, he participated in the National Investment Competition in 1997 with $250,000 (about 310 million won) and won with a whopping 155% return.

When the 150-day moving average or 200-day moving average turns from a decline to an increase, the closing price breaks through the 150-day moving average or 200-day moving average or the 25% increase from the 52-week low, whichever is lower.

Mark Minervini's technique is more suited to swing trading than short-term trading, and the book introduces various strategies that can be combined with practical power stock search formulas.

3) Davas Box Breakthrough Strategy

Davas became a famous strategic investor by jumping into the stock market and writing the book, "I Made $2.5 Million in Stocks," and he created the "Box Theory."

Box theory helps determine effective buy and sell positions by analyzing the rising and falling patterns of stock prices.

4) WaveTrend Oscillator

The WaveTrend Oscillator is a useful tool for identifying trend direction and strength.

It was designed to complement the shortcomings of existing oscillators and is known to be particularly effective in highly volatile markets.

The calculation formula is as follows.

Introducing effective combinations in real life.

WT = 100 * (ROC / MA)

ROC: Price change rate over period n

MA: ROC mean over period m

n: usually 14

m: usually 21

5) AK MACD BB INDICATOR[Algokid]

The AK MACD BB INDICATOR is a powerful technical analysis indicator that helps improve trading strategies and increase profitability. It combines two popular indicators, MACD and Bollinger Bands, to help you more effectively identify market trends, volatility, and buy and sell signals.

We introduce effective combinations and modified coding in practice.

6) Triple Bollinger Bands

Triple Bollinger Bands is a technical indicator that expands the existing Bollinger Band concept by adding three standard deviation bands.

In addition to the basic band (±1σ), additional bands are available: ±2σ and ±3σ. These allow for more in-depth analysis of market volatility and can be utilized to develop various trading strategies. We introduce combinations that are effective in practice.

7) Kiwoom Securities' sure-win short-term search engine

We will introduce a short-term search engine that combines indicators provided by Kiwoom Securities.

We provide detailed operational tips for practical use.

3.

5 TradingView Search Formulas for Advanced Users

Here are five amazing stock screeners we found on TradingView.

1) NADARAYA

2) STC INDICATOR

3) KDJ indicator

4) UT BOT ALERTS indicator

5) Support and Resistance Levels with Breaks [LuxAlgo]

Why wouldn't it be there? I just couldn't find it even when I looked for it.

It's a story about automatic trading.

The point of a surge, the point of a bottom, and the point of a rebound... isn't this the point of hitting the stock market that we amateur ants so desperately desire?

But no matter how much I search after the stock market closes at 3:30, I can't find any stocks like this.

These days, 'robo-advisors' are said to be more profitable than securities fund managers, which makes me wonder if I can take advantage of them.

You must have imagined it at least once.

'If only computers could be more accurate than my eyes and faster than my hands when it comes to buying stocks,' he said.

There are experts who do this.

It is a system trading method that has been kept secret for a long time, not just a day or two ago, and not told to anyone.

So no matter how much I search on Naver, it doesn't come up.

The 'Yestrader' automatic trading system, known as the flower of automatic trading, is one such system, and Kiwoom Securities' 'Catch' is another.

Kiwoom is the most used securities firm by individuals in South Korea.

Of course, Daishin Securities also operates an automatic trading system, but it is somewhat mediocre and the two mentioned above are the core.

This book is a record that discloses and guides the automated trading of Yestrader and Kiwoom Securities, known as the mecca of system trading, to the entire nation.

Yestrader automatic trading is introduced for the first time in Korea.

Yestrader's automated trading platform, 'Yes Place', is composed of coding languages that are not possible with the recently introduced chat GPT or Python.

Any trading strategy can be implemented through coding and connected to automated trading.

That is why it is called the core of automatic trading.

Next is Kiwoom Securities automatic trading.

However, Kiwoom Securities has clear limitations.

You can't create your own strategy through coding like Yestrader.

You can only create conditional searches by combining indicators provided by Kiwoom Securities.

For your information, you can often see 'search engine' advertisements on the internet and social media recently, but 99% of these are created using Kiwoom Securities conditional searches.

This book is largely divided into three parts.

First, the system user manual.

I will introduce how to install and use the Yestrader and Kiwoom Securities automatic trading programs on my computer.

Easy to follow with over 400 pictures included.

Second, it is a trick of operation.

What good is installing a system? You need to know how to operate it.

We provide a comprehensive introduction to strategies and conditional search formulas for automated trading, from basic to applied.

You can run an automated trading system overnight.

Third, it is a condition search engine that complements and maximizes profits.

There are only 7 operational strategies, right?

We'll give you five conditional search engines introduced by the author as a bonus.

1.

Let's go to the new world of automated trading!

1) Kiwoom Automated Trading 'Catch'

With just a PC and this book, you can enter the world of automated trading.

First, create a conditional search formula in Hero's Gate 4 and save it.

Compared to Yestrader's automated trading system, trading strategies cannot be coded and can only be combined using indicators provided by Kiwoom Securities.

There are limits, after all.

There are many combinations of conditional searches, but this book introduces one of the most probable short-term strategies.

Run the 'catch' program.

We will show you how to open 6 windows and use them when trading.

After a sufficient verification period through mock trading, conditions are set for actual trading.

2) Yestrader automatic trading 'Spot'

To enable automatic trading, you must install Yestrader and select a brokerage firm, either NH Nonghyup or Hi Investment & Securities.

Yestrader goes through a four-step process.

Yes Language → Power Stock Search → Yes Spot Editor → Yes Spot Auto Trading.

In Yeslanguage, trading strategies are entered through coding.

This feature is not available at any other securities company, including Kiwoom Securities Catch, and is only available at Yestrader.

Power Stock Search is the step where you combine the strategy created by Yes Language with other indicators.

The stocks that are actually purchased in automated trading are decided here.

Because there are many possible combinations and strategies, study is a prerequisite.

In the YesSpot editor, the last step is to connect the search expression saved in the Power Stock Search to automatic trading, and set the operating time, operating amount, etc.

The last Yes Spot automatic trading function calls up a trading strategy and operates automatic trading.

Open the order book, chart, and sell screens and use them when trading.

3) How to Create the "Signal Search" That 99% of Investors Want

You may have seen stock market experts trading with two or three monitors open.

Even with automated trading, auxiliary tools are needed for more certain profits.

Representative examples include Kiwoom Securities' auxiliary indicator creation and signal search.

This is not possible in Yestrader, but Kiwoom Securities provides a visual representation of this.

By implementing each strategy on a chart, I apply the indicator I created to the stock price of the stock purchased during automatic trading, and I show you at which point to enter with an arrow.

2.

6+1 Best Strategies to Boost Your Account Balance

1) Volatility Breakout Strategy

This is a trading technique created by Larry Williams that achieved the best results ever at the 1987 Robbins Futures Investment Competition.

This is the most commonly used strategy in stock investment by securities firms, so it can be useful to know about it.

The values to be entered in coding are as follows:

① Buy if the stock price exceeds the breakout price today

② Breakout value = Today's opening price + (Previous day's high price - Previous day's low price) × k

③ Sell everything when the market opens the next day.

However, since this is a strategy used in stable markets such as the futures market with low volatility, it must be varied through modification and combination in the stock market with high volatility.

The book introduces a variation strategy that adjusts K values and other factors so that it can be used in practice.

2) Mark Minervini technique

As the founder of the Sepa strategy, he participated in the National Investment Competition in 1997 with $250,000 (about 310 million won) and won with a whopping 155% return.

When the 150-day moving average or 200-day moving average turns from a decline to an increase, the closing price breaks through the 150-day moving average or 200-day moving average or the 25% increase from the 52-week low, whichever is lower.

Mark Minervini's technique is more suited to swing trading than short-term trading, and the book introduces various strategies that can be combined with practical power stock search formulas.

3) Davas Box Breakthrough Strategy

Davas became a famous strategic investor by jumping into the stock market and writing the book, "I Made $2.5 Million in Stocks," and he created the "Box Theory."

Box theory helps determine effective buy and sell positions by analyzing the rising and falling patterns of stock prices.

4) WaveTrend Oscillator

The WaveTrend Oscillator is a useful tool for identifying trend direction and strength.

It was designed to complement the shortcomings of existing oscillators and is known to be particularly effective in highly volatile markets.

The calculation formula is as follows.

Introducing effective combinations in real life.

WT = 100 * (ROC / MA)

ROC: Price change rate over period n

MA: ROC mean over period m

n: usually 14

m: usually 21

5) AK MACD BB INDICATOR[Algokid]

The AK MACD BB INDICATOR is a powerful technical analysis indicator that helps improve trading strategies and increase profitability. It combines two popular indicators, MACD and Bollinger Bands, to help you more effectively identify market trends, volatility, and buy and sell signals.

We introduce effective combinations and modified coding in practice.

6) Triple Bollinger Bands

Triple Bollinger Bands is a technical indicator that expands the existing Bollinger Band concept by adding three standard deviation bands.

In addition to the basic band (±1σ), additional bands are available: ±2σ and ±3σ. These allow for more in-depth analysis of market volatility and can be utilized to develop various trading strategies. We introduce combinations that are effective in practice.

7) Kiwoom Securities' sure-win short-term search engine

We will introduce a short-term search engine that combines indicators provided by Kiwoom Securities.

We provide detailed operational tips for practical use.

3.

5 TradingView Search Formulas for Advanced Users

Here are five amazing stock screeners we found on TradingView.

1) NADARAYA

2) STC INDICATOR

3) KDJ indicator

4) UT BOT ALERTS indicator

5) Support and Resistance Levels with Breaks [LuxAlgo]

GOODS SPECIFICS

- Date of issue: June 26, 2024

- Page count, weight, size: 314 pages | 152*225*30mm

- ISBN13: 9791186615669

- ISBN10: 1186615664

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)