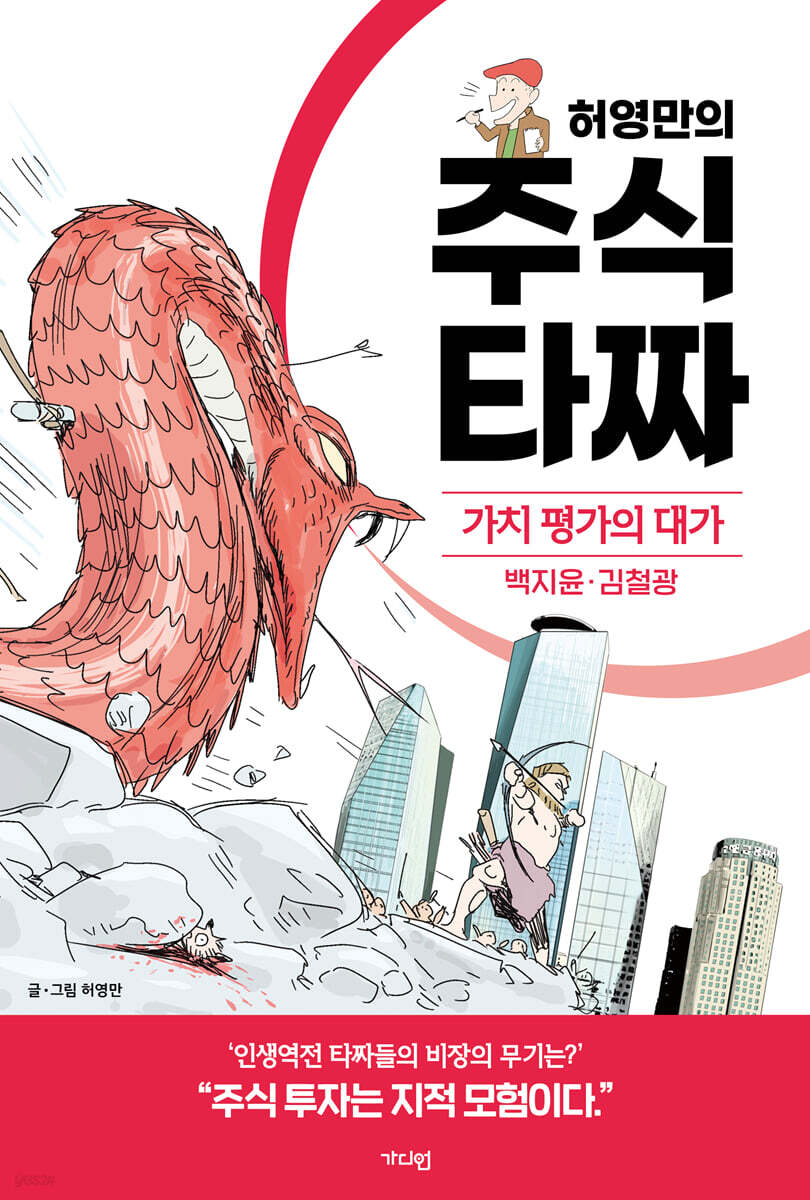

Heo Young-man's Stock Gamble - Baek Ji-yoon and Kim Cheol-gwang, Masters of Valuation

|

Description

Book Introduction

“Stock investment is like a snowball, small and steady.

“After one year, ten years, the company’s value will compensate.”

Baek Ji-yoon and Kim Cheol-gwang, masters of value investing, achieved success by reading each number and indicator of the companies they invested in, based on the philosophy that "stock investment should be like rolling a snowball."

This comic vividly captures their practical experience and strategies in value investing, overcoming numerous failures and frustrations to become successful stock market tycoons.

Baek Ji-yoon is an investor who analyzes financial statements, quarterly reports, corporate disclosures, and even owner mindsets to find opportunities in neglected stocks.

Rather than relying solely on numbers, he achieved a tenfold return in just four years even in a bear market with his three-dimensional analytical ability to read market trends and psychology.

Kim Cheol-gwang, a salaried worker, pursues a stable dividend income that exceeds his annual salary, based on long-term investments in high-dividend, low-growth stocks and thorough corporate analysis.

This approach provides a realistic investment model, especially for working investors.

“Why does it go down when I buy and go up when I sell?”

“Because your stock was bought two weeks ago, and mine was bought a year ago.”

“After one year, ten years, the company’s value will compensate.”

Baek Ji-yoon and Kim Cheol-gwang, masters of value investing, achieved success by reading each number and indicator of the companies they invested in, based on the philosophy that "stock investment should be like rolling a snowball."

This comic vividly captures their practical experience and strategies in value investing, overcoming numerous failures and frustrations to become successful stock market tycoons.

Baek Ji-yoon is an investor who analyzes financial statements, quarterly reports, corporate disclosures, and even owner mindsets to find opportunities in neglected stocks.

Rather than relying solely on numbers, he achieved a tenfold return in just four years even in a bear market with his three-dimensional analytical ability to read market trends and psychology.

Kim Cheol-gwang, a salaried worker, pursues a stable dividend income that exceeds his annual salary, based on long-term investments in high-dividend, low-growth stocks and thorough corporate analysis.

This approach provides a realistic investment model, especially for working investors.

“Why does it go down when I buy and go up when I sell?”

“Because your stock was bought two weeks ago, and mine was bought a year ago.”

- You can preview some of the book's contents.

Preview

index

1.

Baek Ji-yoon, a multi-billionaire with a tenfold return in four years

2.

Kim Cheol-gwang, a high-dividend stock and fund investment expert and office worker

Baek Ji-yoon, a multi-billionaire with a tenfold return in four years

2.

Kim Cheol-gwang, a high-dividend stock and fund investment expert and office worker

Detailed image

.jpg)

Publisher's Review

‘From office worker to stock gambler…’

The story of two masters who overcame failure and frustration to rise to become 'masters of value assessment'!

“I study hard and read investment books to achieve success, but why don’t things work out the way I want?”

“It’s not just information, but because we fail to see the ‘essence of value beyond the numbers.’”

This book is a practical investment comic that helps you develop that 'investment insight'.

The protagonist of this book, Baek Ji-yoon, is the CEO of Blash Asset Management, which has amassed hundreds of billions of won in assets by investing in "companies with sustainable growth" through in-depth study of the company's technology and management's conscience based on market trends, in exchange for a valuation that achieved a tenfold return in just four years.

Kim Cheol-gwang, a professional office worker known by the nickname "Forest of the Wind," is a practical, long-term investor who splits his salary and invests it in high-dividend stocks, REITs, and infrastructure funds, adhering to the principle that "investing can be practiced consistently, just like a job."

One person was an investor who became a wreck after three failures and then became a salaried worker and made a comeback by investing in value stocks with the seed money he had saved. The other person was a novice salaried worker investor who "buys when it goes down and sells when it goes up."

The story vividly depicts the process by which these individuals, through intense study, acquired the ability to discern the "true value" of a company, perfected their own investment philosophy and system, and survived as market leaders.

This is an epic that follows the lives and investment psychology of two gamblers, their mistakes and overcoming them, their choices and their confidence in success, through artist Heo Young-man's characteristically in-depth interviews.

The book contains their well-established investment strategies as follows:

* Baek Ji-yoon's corporate analysis system

: Investment decisions centered on intrinsic value, encompassing financial statements, PER/PBR analysis, industry structure and sales trends, and management ethics assessment.

* Kim Cheol-gwang's salary investment routine

: Utilizing the dividend calendar, securing cash flow through REITs, shipping, and infrastructure funds, and developing a timing strategy for "when to buy and when to sell."

Baek Ji-yoon says.

“Value is hidden beyond numbers.

“How to interpret those numbers is a learning area.”

Kim Cheol-gwang says:

“It’s not that office workers don’t have enough money, it’s that they don’t invest time.”

Both authors go beyond mere rhetoric and, through intense study, demonstrate concrete examples of stocks, buying points, and trading methods, allowing readers to experience firsthand the importance of their own investment vision.

The story of two masters who overcame failure and frustration to rise to become 'masters of value assessment'!

“I study hard and read investment books to achieve success, but why don’t things work out the way I want?”

“It’s not just information, but because we fail to see the ‘essence of value beyond the numbers.’”

This book is a practical investment comic that helps you develop that 'investment insight'.

The protagonist of this book, Baek Ji-yoon, is the CEO of Blash Asset Management, which has amassed hundreds of billions of won in assets by investing in "companies with sustainable growth" through in-depth study of the company's technology and management's conscience based on market trends, in exchange for a valuation that achieved a tenfold return in just four years.

Kim Cheol-gwang, a professional office worker known by the nickname "Forest of the Wind," is a practical, long-term investor who splits his salary and invests it in high-dividend stocks, REITs, and infrastructure funds, adhering to the principle that "investing can be practiced consistently, just like a job."

One person was an investor who became a wreck after three failures and then became a salaried worker and made a comeback by investing in value stocks with the seed money he had saved. The other person was a novice salaried worker investor who "buys when it goes down and sells when it goes up."

The story vividly depicts the process by which these individuals, through intense study, acquired the ability to discern the "true value" of a company, perfected their own investment philosophy and system, and survived as market leaders.

This is an epic that follows the lives and investment psychology of two gamblers, their mistakes and overcoming them, their choices and their confidence in success, through artist Heo Young-man's characteristically in-depth interviews.

The book contains their well-established investment strategies as follows:

* Baek Ji-yoon's corporate analysis system

: Investment decisions centered on intrinsic value, encompassing financial statements, PER/PBR analysis, industry structure and sales trends, and management ethics assessment.

* Kim Cheol-gwang's salary investment routine

: Utilizing the dividend calendar, securing cash flow through REITs, shipping, and infrastructure funds, and developing a timing strategy for "when to buy and when to sell."

Baek Ji-yoon says.

“Value is hidden beyond numbers.

“How to interpret those numbers is a learning area.”

Kim Cheol-gwang says:

“It’s not that office workers don’t have enough money, it’s that they don’t invest time.”

Both authors go beyond mere rhetoric and, through intense study, demonstrate concrete examples of stocks, buying points, and trading methods, allowing readers to experience firsthand the importance of their own investment vision.

GOODS SPECIFICS

- Date of issue: June 20, 2025

- Page count, weight, size: 200 pages | 392g | 152*225*18mm

- ISBN13: 9791167781574

- ISBN10: 1167781570

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)