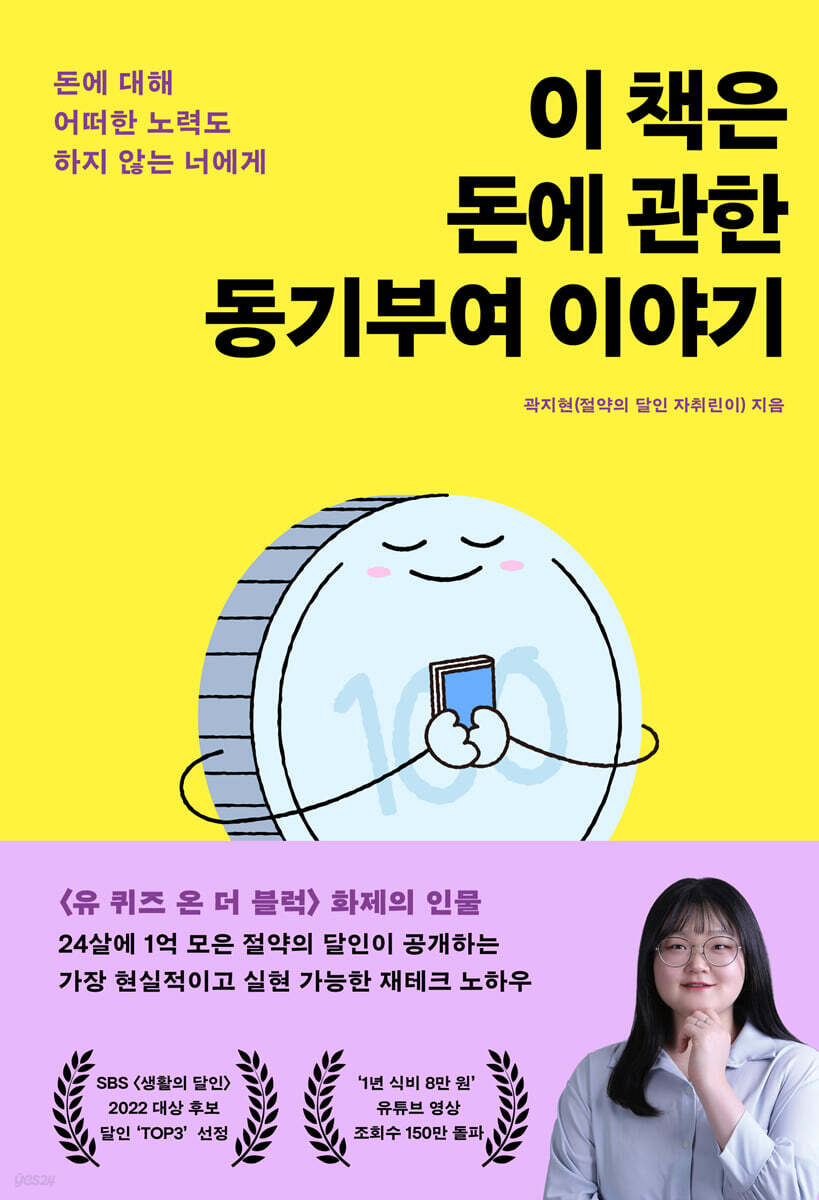

This book is a motivational story about money.

|

Description

Book Introduction

“Let’s re-establish our loose economic concepts,

“A story that will make you reflect deeply!”

With just 'savings' and 'saving' on minimum wage, I earned 100 million won at the age of 24, and another 100 million won in just 2 years!

What the '99-year-old master of savings' says

How to manage your money by spending less and saving more

*** SBS's "Master of Living" 2022 Grand Prize Nominee and Hot Topic

*** From savings to app tech, no spending, experience groups, N-jobs, and more, a wealth of frugal tech know-how is revealed.

*** Highly recommended by PD Kim Dong-hyun of "Master of Life" and Money Trainer Kim Gyeong-pil

The "Master of Savings" has arrived! He earned the minimum wage of 1.41 million won as his first paycheck, and by the age of 24, just four years and two months later, he had saved 100 million won, making him a true master who appeared on SBS's "Master of Living" and garnered much attention.

Less than a month after appearing on TV, she became the youngest person to win an apartment subscription, and earlier this year, at the age of 26, just two years later, she won 100 million won again, and was featured in various media outlets.

He is a protagonist who only elicits exclamations, like the comment, “I gave him a standing ovation for 30 seconds without any hesitation.”

Author Ji-Hyeon Kwak, who is the subject of much discussion, has now taken on the challenge of publishing a book titled “This Book is a Motivational Story About Money.”

This book was not written simply to tell the story of how to save 100 million won.

The purpose is to show the author, who had no secrets, the process of saving 100 million won to take responsibility for his life, and to show that anyone can do it just by 'saving' and 'saving.'

Above all, this book provides inspiration and motivation to those who want to become rich without putting in any effort for money, and encourages them to live a life of independence, free from being led around by money and not restricted by it.

The author, who lived alone on minimum wage but saved 90% of his salary and minimized his spending through app tech, blog experience groups, no-spending challenges, and N jobs, proved that "a little goes a long way" and that even little things add up to a mountain.

And even his mother, who used to nag him, saying, “Don’t live so frugally,” now acknowledges the author’s frugal lifestyle and joins in.

The story of the author, who in his 20s accumulated a tremendous amount of experience in "overcoming" rather than "consumption" experiences such as luxury goods and travel, will serve as an opportunity to correct our lax economic sense and reflect on our consumption habits.

“A story that will make you reflect deeply!”

With just 'savings' and 'saving' on minimum wage, I earned 100 million won at the age of 24, and another 100 million won in just 2 years!

What the '99-year-old master of savings' says

How to manage your money by spending less and saving more

*** SBS's "Master of Living" 2022 Grand Prize Nominee and Hot Topic

*** From savings to app tech, no spending, experience groups, N-jobs, and more, a wealth of frugal tech know-how is revealed.

*** Highly recommended by PD Kim Dong-hyun of "Master of Life" and Money Trainer Kim Gyeong-pil

The "Master of Savings" has arrived! He earned the minimum wage of 1.41 million won as his first paycheck, and by the age of 24, just four years and two months later, he had saved 100 million won, making him a true master who appeared on SBS's "Master of Living" and garnered much attention.

Less than a month after appearing on TV, she became the youngest person to win an apartment subscription, and earlier this year, at the age of 26, just two years later, she won 100 million won again, and was featured in various media outlets.

He is a protagonist who only elicits exclamations, like the comment, “I gave him a standing ovation for 30 seconds without any hesitation.”

Author Ji-Hyeon Kwak, who is the subject of much discussion, has now taken on the challenge of publishing a book titled “This Book is a Motivational Story About Money.”

This book was not written simply to tell the story of how to save 100 million won.

The purpose is to show the author, who had no secrets, the process of saving 100 million won to take responsibility for his life, and to show that anyone can do it just by 'saving' and 'saving.'

Above all, this book provides inspiration and motivation to those who want to become rich without putting in any effort for money, and encourages them to live a life of independence, free from being led around by money and not restricted by it.

The author, who lived alone on minimum wage but saved 90% of his salary and minimized his spending through app tech, blog experience groups, no-spending challenges, and N jobs, proved that "a little goes a long way" and that even little things add up to a mountain.

And even his mother, who used to nag him, saying, “Don’t live so frugally,” now acknowledges the author’s frugal lifestyle and joins in.

The story of the author, who in his 20s accumulated a tremendous amount of experience in "overcoming" rather than "consumption" experiences such as luxury goods and travel, will serve as an opportunity to correct our lax economic sense and reflect on our consumption habits.

- You can preview some of the book's contents.

Preview

index

Recommendation

prolog.

Why I save

Pro Chantaker Test

Chapter 1.

I decided to become rich

I was born with a silver spoon in my mouth, not just a dirt spoon.

No one takes responsibility for my life

1.41 million won, my first salary seemed like a lot to me.

My first pipeline

Savings are the best stress reliever

Save 20 million won a year

Living alone at 22, still a thrifty king

Until I saved 100 million won at the age of 24

Chapter 2.

My spending begins with saving.

If your income is low, you have no choice but to reduce your expenses.

Stop paying credit card installments

Practical tips for reducing food costs

Do you really have nothing to wear?

No more pretty trash

Let's find a replacement

My romanticism about living alone

Even a salty person can date

Chapter 3.

Easy tech tips anyone can use

App Tech: Turn your well-collected points into cash

Receipt Investment: Even Your Own Receipts Can Turn Into Money

Used Gift Certificates: When you want to eat out

Secondhand Market: There are more products than you think.

Recycling: Protect the environment and reap the benefits

Altel Phone: You Can Save on Your Cell Phone Bill, Too

Utility Bills: If you can reduce them by even 100 won

Transportation: No Longer a Fixed Cost

Experience Group: It's Not Just for Influencers

Tap water, not just bottled water: We also tested the water quality.

Donate: Donate and get a tax deduction

Chapter 4.

My small but precious pipeline

YouTube that makes money

A Professional Savings Investor's Investment Challenges

Becoming the youngest apartment subscription winner at 24 years old

Collaboration through personal branding

Writing books and lecturing

Chapter 5.

Things You Must Do to Become Rich

Setting goals

Create a motivation button

Keeping a household account book

Planning a Budget

Take the No Spending Day Challenge

Save first, spend later and split your savings

Going to the forest

Open a subscription account

My mind is also minimalistic

Hang out with people who have the same goals

Epilogue.

Savings are contagious

supplement.

My 10-Year Rich Plan

prolog.

Why I save

Pro Chantaker Test

Chapter 1.

I decided to become rich

I was born with a silver spoon in my mouth, not just a dirt spoon.

No one takes responsibility for my life

1.41 million won, my first salary seemed like a lot to me.

My first pipeline

Savings are the best stress reliever

Save 20 million won a year

Living alone at 22, still a thrifty king

Until I saved 100 million won at the age of 24

Chapter 2.

My spending begins with saving.

If your income is low, you have no choice but to reduce your expenses.

Stop paying credit card installments

Practical tips for reducing food costs

Do you really have nothing to wear?

No more pretty trash

Let's find a replacement

My romanticism about living alone

Even a salty person can date

Chapter 3.

Easy tech tips anyone can use

App Tech: Turn your well-collected points into cash

Receipt Investment: Even Your Own Receipts Can Turn Into Money

Used Gift Certificates: When you want to eat out

Secondhand Market: There are more products than you think.

Recycling: Protect the environment and reap the benefits

Altel Phone: You Can Save on Your Cell Phone Bill, Too

Utility Bills: If you can reduce them by even 100 won

Transportation: No Longer a Fixed Cost

Experience Group: It's Not Just for Influencers

Tap water, not just bottled water: We also tested the water quality.

Donate: Donate and get a tax deduction

Chapter 4.

My small but precious pipeline

YouTube that makes money

A Professional Savings Investor's Investment Challenges

Becoming the youngest apartment subscription winner at 24 years old

Collaboration through personal branding

Writing books and lecturing

Chapter 5.

Things You Must Do to Become Rich

Setting goals

Create a motivation button

Keeping a household account book

Planning a Budget

Take the No Spending Day Challenge

Save first, spend later and split your savings

Going to the forest

Open a subscription account

My mind is also minimalistic

Hang out with people who have the same goals

Epilogue.

Savings are contagious

supplement.

My 10-Year Rich Plan

Detailed image

Into the book

There was another reason why I thought to myself, 'My allowance is 100,000 won a month.'

In fact, there is no limit to consumption.

For office workers, their income is fixed, but not many people set limits on their spending.

I just think that I should spend it within my set income.

But if you live like that, you will only end up taking out the bottom stone to support the top stone, and you will inevitably end up pouring water into a bottomless pit.

In the end, you end up being dragged around by money.

I didn't want to live a life where I was dragged around financially any longer.

To do that, we had to strictly limit our consumption.

Of course, the ideal way is to increase income instead of reducing consumption.

But that was the only way I could do it as a 19-year-old with no special abilities compared to others.

Other people might have thought it was boring, but the more I saved, the more thrilled I felt.

There were even months when I went grocery shopping with my mom with only 100,000 won in monthly allowance, but there were also months when I had about 20,000 won left.

--- p.36

I, too, have had many days when I was physically and mentally exhausted while working and doing part-time jobs to earn money.

There were times when I felt stressed.

At times like that, instead of going out to find a good restaurant or going shopping, I chose to save up for revenge on the world.

The harder it was, the more I clung to savings.

The more you save in revenge, the more money you accumulate.

Just as I was soothing myself by coming home from shopping and taking out the items I had bought, I was also taking revenge on the world by looking at the money piled up in my bank account.

Looking at the numbers on my bankbook relieved my stress and made me want to increase those numbers.

Looking back, it wasn't revenge spending, but savings shopping and revenge savings that were the best stress relievers for me.

--- p.48

The savings I pursue are not necessarily about not eating, not spending, and not buying.

The reason I've been able to consistently save money since the winter of my senior year of high school, when I was 19, is not only because I wanted to escape the harsh reality, but also because I discovered ways to live happily without spending money or spending less.

If you are a little more diligent than others and do your research, you can get food, daily necessities, cosmetics, etc. for free.

It means that I can enjoy what I have enjoyed so far without spending my own money.

If you pay attention, there are many ways to save even as little as 1,000 won.

--- p.126

It takes a lot of self-control to get what you want.

The process of moderation can be fraught with temptations and lack of encouragement or support from those around you.

Every time that happens, you have to be the one who pulls yourself back up.

Let's set our own rules to motivate and reward ourselves.

The reward doesn't have to be grand.

Although a larger reward might seem like it would lead to greater motivation, the duration of motivation after receiving the reward is roughly the same.

Even if it is a small reward, it is enough to motivate you to want to be rewarded again because of the memory of having been rewarded.

To reach the goal, the reward is sufficient as a device to increase momentum.

--- p.266

What changed through collecting 100 million won is not only the increased bank balance.

Everything around me has changed.

I shook off the old ways of filling my empty heart with worthless things and began to surround myself with grateful people who shared the same goals.

My attitude towards people, my attitude towards time, and my attitude towards preparing for the future have all changed.

Relationships, time management, and even my mind have become simple and minimal.

A sum of 100 million won may not be a large sum of money to some people.

However, the experience of saving 100 million won entirely on my own gave me high self-esteem and the confidence to not be swayed by other people's opinions or prejudices.

In fact, there is no limit to consumption.

For office workers, their income is fixed, but not many people set limits on their spending.

I just think that I should spend it within my set income.

But if you live like that, you will only end up taking out the bottom stone to support the top stone, and you will inevitably end up pouring water into a bottomless pit.

In the end, you end up being dragged around by money.

I didn't want to live a life where I was dragged around financially any longer.

To do that, we had to strictly limit our consumption.

Of course, the ideal way is to increase income instead of reducing consumption.

But that was the only way I could do it as a 19-year-old with no special abilities compared to others.

Other people might have thought it was boring, but the more I saved, the more thrilled I felt.

There were even months when I went grocery shopping with my mom with only 100,000 won in monthly allowance, but there were also months when I had about 20,000 won left.

--- p.36

I, too, have had many days when I was physically and mentally exhausted while working and doing part-time jobs to earn money.

There were times when I felt stressed.

At times like that, instead of going out to find a good restaurant or going shopping, I chose to save up for revenge on the world.

The harder it was, the more I clung to savings.

The more you save in revenge, the more money you accumulate.

Just as I was soothing myself by coming home from shopping and taking out the items I had bought, I was also taking revenge on the world by looking at the money piled up in my bank account.

Looking at the numbers on my bankbook relieved my stress and made me want to increase those numbers.

Looking back, it wasn't revenge spending, but savings shopping and revenge savings that were the best stress relievers for me.

--- p.48

The savings I pursue are not necessarily about not eating, not spending, and not buying.

The reason I've been able to consistently save money since the winter of my senior year of high school, when I was 19, is not only because I wanted to escape the harsh reality, but also because I discovered ways to live happily without spending money or spending less.

If you are a little more diligent than others and do your research, you can get food, daily necessities, cosmetics, etc. for free.

It means that I can enjoy what I have enjoyed so far without spending my own money.

If you pay attention, there are many ways to save even as little as 1,000 won.

--- p.126

It takes a lot of self-control to get what you want.

The process of moderation can be fraught with temptations and lack of encouragement or support from those around you.

Every time that happens, you have to be the one who pulls yourself back up.

Let's set our own rules to motivate and reward ourselves.

The reward doesn't have to be grand.

Although a larger reward might seem like it would lead to greater motivation, the duration of motivation after receiving the reward is roughly the same.

Even if it is a small reward, it is enough to motivate you to want to be rewarded again because of the memory of having been rewarded.

To reach the goal, the reward is sufficient as a device to increase momentum.

--- p.266

What changed through collecting 100 million won is not only the increased bank balance.

Everything around me has changed.

I shook off the old ways of filling my empty heart with worthless things and began to surround myself with grateful people who shared the same goals.

My attitude towards people, my attitude towards time, and my attitude towards preparing for the future have all changed.

Relationships, time management, and even my mind have become simple and minimal.

A sum of 100 million won may not be a large sum of money to some people.

However, the experience of saving 100 million won entirely on my own gave me high self-esteem and the confidence to not be swayed by other people's opinions or prejudices.

--- p.310

Publisher's Review

“Money is not something you make, it’s something you save!”

For those whose salary just passes through their bank account

The most realistic advice is to hit the front and back of the head.

After being introduced on YouTube's "Bureadnam TV" with 1.3 million viewers, the author's story has been introduced on many channels, newspapers, YouTube, etc., including SBS's "Master of Life" in 2022, KBS1's "Morning Plaza", "Morning Worth Trying", YTN's "Golden Compass", "Yonhap News TV Special", and most recently KBS2's "High-end Salt Struggler".

The common response I heard each time was, “I was incredibly stimulated and I truly reflect on it.”

This is the reason and purpose for which author Kwak wrote this book.

This book is about money.

However, this book focuses on 'how to save money' rather than 'how to make money'.

If you have to choose between the ability to make money and the ability to save money, the ability to save money is definitely more important to becoming rich.

No matter how much money you earn, you can never become rich if you cannot control your spending.

Many people think that 'even if you save up small amounts of money, it's just small amounts of money.'

People like this will never save money.

To create seed money before starting investment, you must first save small amounts of money.

This is what differentiates this book from other books that teach you how to invest in real estate or stocks.

“If you don’t have money, not spending money should be the basis of your spending habits.

The author's words, "The easiest and simplest way to save money is to spend only within the limits of your means," are a wake-up call to those who focus only on earning money instead of saving it.

Instead of vague goals like "I want to earn a lot and save a lot," the author emphasizes that "spending less and saving more" is the most basic and realistic way to manage money.

“I saved 90% of my salary!”

From savings to app tech, no-spending challenges, experience groups, N-jobs, etc.

Revealing the Ultimate Savvy Tech Know-How to Raise 100 Million Won

How much would you need to save per month to build a seed capital of 100 million won in five years? It's 1.66 million won.

If you save 20 million won a year, you will have 100 million won in 5 years.

In the author's case, after taxes, he doesn't even receive 20 million won a year, so you can put aside the question, "Was this really possible?"

You can quickly understand the know-how of saving 100 million won in just 4 years by reducing fixed costs and saving 90% of your salary through app tech, no-spending challenges, and N-jobs.

There are ways to significantly reduce fixed costs such as food, transportation, and cell phone bills.

As the author says, people “just don’t do it because they don’t want to live in poverty.”

But the author manages to do this.

I save money on food by cooking at home, I never paid more than 5,000 won on my phone bill by using a budget phone, and I minimize fixed costs by finding ways to save on utility bills like gas and electricity and transportation.

As I began to seriously invest in frugal technology, I used app tech and second-hand markets to reduce my spending, and I also made smart use of receipt investment and second-hand gift certificates.

I was happily in a relationship while spending only 25,000 won (not 250,000 won!) on dates a month, and I also increased my extra income through a side job at a hamster shopping mall and a part-time job at a bar after work.

Even with a small salary, I created a steady flow of money, and I was motivated by seeing my bank balance increase every day.

The book is full of useful information for those who are just beginning to take an interest in money, including information on app tech and blog experience groups that the author personally utilized, as well as a YouTube challenge and a story about winning an apartment subscription at the age of 24.

These are the best ways to create seed money through saving and saving alone.

But the author does not say that everyone should live like him.

I don't want to live a miserly and frugal life.

There are many ways for people to gain experience, but he says that through saving and frugality, he has experienced something in life that he has been passionate about and done his best at, and his attitude towards life has changed.

For college students and young professionals who can't even begin to think about studying finance, the author's story will be the most accessible financial management methodology. For salaried workers and middle-aged people, it will be a powerful motivation to start over from the basics.

For those whose salary just passes through their bank account

The most realistic advice is to hit the front and back of the head.

After being introduced on YouTube's "Bureadnam TV" with 1.3 million viewers, the author's story has been introduced on many channels, newspapers, YouTube, etc., including SBS's "Master of Life" in 2022, KBS1's "Morning Plaza", "Morning Worth Trying", YTN's "Golden Compass", "Yonhap News TV Special", and most recently KBS2's "High-end Salt Struggler".

The common response I heard each time was, “I was incredibly stimulated and I truly reflect on it.”

This is the reason and purpose for which author Kwak wrote this book.

This book is about money.

However, this book focuses on 'how to save money' rather than 'how to make money'.

If you have to choose between the ability to make money and the ability to save money, the ability to save money is definitely more important to becoming rich.

No matter how much money you earn, you can never become rich if you cannot control your spending.

Many people think that 'even if you save up small amounts of money, it's just small amounts of money.'

People like this will never save money.

To create seed money before starting investment, you must first save small amounts of money.

This is what differentiates this book from other books that teach you how to invest in real estate or stocks.

“If you don’t have money, not spending money should be the basis of your spending habits.

The author's words, "The easiest and simplest way to save money is to spend only within the limits of your means," are a wake-up call to those who focus only on earning money instead of saving it.

Instead of vague goals like "I want to earn a lot and save a lot," the author emphasizes that "spending less and saving more" is the most basic and realistic way to manage money.

“I saved 90% of my salary!”

From savings to app tech, no-spending challenges, experience groups, N-jobs, etc.

Revealing the Ultimate Savvy Tech Know-How to Raise 100 Million Won

How much would you need to save per month to build a seed capital of 100 million won in five years? It's 1.66 million won.

If you save 20 million won a year, you will have 100 million won in 5 years.

In the author's case, after taxes, he doesn't even receive 20 million won a year, so you can put aside the question, "Was this really possible?"

You can quickly understand the know-how of saving 100 million won in just 4 years by reducing fixed costs and saving 90% of your salary through app tech, no-spending challenges, and N-jobs.

There are ways to significantly reduce fixed costs such as food, transportation, and cell phone bills.

As the author says, people “just don’t do it because they don’t want to live in poverty.”

But the author manages to do this.

I save money on food by cooking at home, I never paid more than 5,000 won on my phone bill by using a budget phone, and I minimize fixed costs by finding ways to save on utility bills like gas and electricity and transportation.

As I began to seriously invest in frugal technology, I used app tech and second-hand markets to reduce my spending, and I also made smart use of receipt investment and second-hand gift certificates.

I was happily in a relationship while spending only 25,000 won (not 250,000 won!) on dates a month, and I also increased my extra income through a side job at a hamster shopping mall and a part-time job at a bar after work.

Even with a small salary, I created a steady flow of money, and I was motivated by seeing my bank balance increase every day.

The book is full of useful information for those who are just beginning to take an interest in money, including information on app tech and blog experience groups that the author personally utilized, as well as a YouTube challenge and a story about winning an apartment subscription at the age of 24.

These are the best ways to create seed money through saving and saving alone.

But the author does not say that everyone should live like him.

I don't want to live a miserly and frugal life.

There are many ways for people to gain experience, but he says that through saving and frugality, he has experienced something in life that he has been passionate about and done his best at, and his attitude towards life has changed.

For college students and young professionals who can't even begin to think about studying finance, the author's story will be the most accessible financial management methodology. For salaried workers and middle-aged people, it will be a powerful motivation to start over from the basics.

GOODS SPECIFICS

- Date of issue: November 1, 2024

- Page count, weight, size: 328 pages | 420g | 140*205*21mm

- ISBN13: 9791187875437

- ISBN10: 1187875430

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)