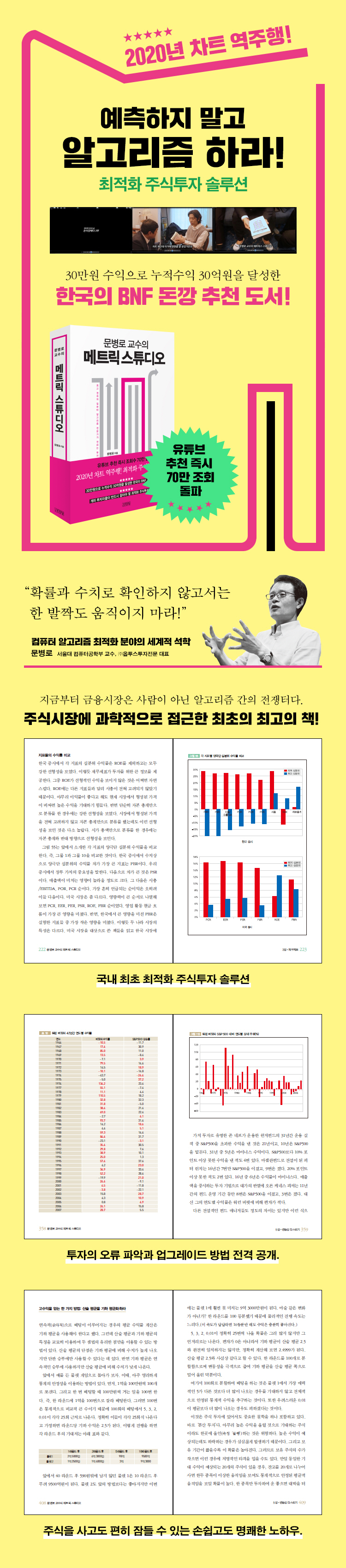

Professor Moon Byeong-ro's Metric Studio

|

Description

Book Introduction

The essence and methods of investing revealed by the world's most authoritative computer algorithm expert.

In a very simple way, you will learn the know-how to easily beat the market.

A numerical and probability-based investment technique guided by Korea's James Simons and world-renowned optimization expert Professor Moon Byung-ro.

It exposes the myths behind what works in the market and what never works.

The key to investing is to cut through the market noise and see the essence of the information.

Don't take a single step without verifying the numbers! If the ultimate height of the market is 10 stories, even the majority of professional players are at the 1st floor.

Professor Moon Byeong-ro's optimization algorithm is at the 5th or 6th floor height.

In fact, the author, who recorded a 222% return on asset management over a five-year period from February 2009, outperforming the KOSPI by 65% by 157 percentage points, has never had a negative return on investment on an annual basis.

The financial market is undergoing a paradigm shift from human-driven investment to computer-driven investment.

The financial markets of the future will become a battleground between machines and algorithms, not people.

Written with both professional and casual investors in mind, this book will help readers build a new level of investment muscle.

You'll discover why you've been losing money in the stock market for so long, why you've consistently failed even when buying good stocks, and what the alternatives are.

A book that guides you through an easy way to buy stocks and sleep soundly.

In a very simple way, you will learn the know-how to easily beat the market!

In a very simple way, you will learn the know-how to easily beat the market.

A numerical and probability-based investment technique guided by Korea's James Simons and world-renowned optimization expert Professor Moon Byung-ro.

It exposes the myths behind what works in the market and what never works.

The key to investing is to cut through the market noise and see the essence of the information.

Don't take a single step without verifying the numbers! If the ultimate height of the market is 10 stories, even the majority of professional players are at the 1st floor.

Professor Moon Byeong-ro's optimization algorithm is at the 5th or 6th floor height.

In fact, the author, who recorded a 222% return on asset management over a five-year period from February 2009, outperforming the KOSPI by 65% by 157 percentage points, has never had a negative return on investment on an annual basis.

The financial market is undergoing a paradigm shift from human-driven investment to computer-driven investment.

The financial markets of the future will become a battleground between machines and algorithms, not people.

Written with both professional and casual investors in mind, this book will help readers build a new level of investment muscle.

You'll discover why you've been losing money in the stock market for so long, why you've consistently failed even when buying good stocks, and what the alternatives are.

A book that guides you through an easy way to buy stocks and sleep soundly.

In a very simple way, you will learn the know-how to easily beat the market!

- You can preview some of the book's contents.

Preview

index

Recommendation

preface

Chapter 1.

Don't go in without measuring the odds in the game.

Investors who don't study

Don't rush into the market without knowing its characteristics.

Extreme Quantitative Investor

If the upper limit is 15%, the lower limit is -13%

The more money you have, the faster it multiplies?

Diversification isn't just about splitting your investments.

Stock Market Myths and Comedy

Get out of the foreigner's trap

Can past data tell the future?

A Scientist's Dilemma: Is the World Full of Guesswork?

The usefulness of approximations

human limitations

The long-run sum of short-term, foolish mass behavior is rational.

Usefulness of Financial Statements

The usefulness of patterns

The importance of operational strategy

The really important information is hidden.

※Stock Stories Investors Should Know: The Importance of Perspective

Chapter 2.

Market observation

Metaphor: Observing the Poker Table

Are you a public investor?

What happens a year after you buy a stock?

How do popular and unpopular stocks move?

Market average data

Does cutting your losses really make sense?

Do small cap stocks generally have higher returns?

The impact of liquidity

Will the strong stocks continue to go up?

The only thing that is certain is past data

※Stock Story for Investors: Victory of the Strangers

Chapter 3.

Financial statements are the most valuable information.

Financial statements and underlying factors

financial statements

Total equity, net income, operating income, operating cash flow

Types of assets and liabilities

Uniqueness of Financial Statements in the Financial Industry

Changes to international standards

Stock prices are reasonable in the long run.

The movement of stock prices and book value

mean regression

The information value of each financial indicator and the results of portfolio investment

preparation

Book value

net profit

Cash flow

operating profit

EBITDA

take

Simple book value

Return on equity

Comparison of returns of indicators

※Stock story that investors should know: When is it appropriate for KOSPI 3000 to come?

Chapter 4.

Do patterns really exist?

Basic characteristics of the market

Excluding the top 5%, most of the profits disappear.

Excluding just the top and bottom 1% would cut returns in half.

Are the patterns that have been passed down really useful?

Breakout above and below the moving average

Do moving averages create trends?

Golden Cross/Dead Cross

Jeong Bae-yeol

Bollinger Bands

Report

The upper limit: pie in the sky or rotten meat

Separation

Be careful, be careful again

Candlestick chart

Korean and US stock markets

obiter dictum

Chapter 5.

Managing Volatility

Are legends without ups and downs?

Real-world examples of fighting volatility

The more money you have, the faster your balance increases?

Arithmetic mean and geometric mean

Volatility and long-term returns

Experimental Example: Where will it fall between the arithmetic mean and the geometric mean?

Shannon's Balance Restoration Portfolio

Kelly Betting

The difference between static leverage and dynamic leverage

One way to get high returns: convert the arithmetic mean to the geometric mean.

Longitudinal and horizontal volatility

Misguided Volatility: Beta and the Comedy of the Century

Be careful using the normal distribution

Timing difficulties

Chapter 6.

The market is always like that

We need a relaxed pace and culture.

Paradigm War

The market is always like that

KOSPI 3000?

Battlefield of Algorithms

Search

preface

Chapter 1.

Don't go in without measuring the odds in the game.

Investors who don't study

Don't rush into the market without knowing its characteristics.

Extreme Quantitative Investor

If the upper limit is 15%, the lower limit is -13%

The more money you have, the faster it multiplies?

Diversification isn't just about splitting your investments.

Stock Market Myths and Comedy

Get out of the foreigner's trap

Can past data tell the future?

A Scientist's Dilemma: Is the World Full of Guesswork?

The usefulness of approximations

human limitations

The long-run sum of short-term, foolish mass behavior is rational.

Usefulness of Financial Statements

The usefulness of patterns

The importance of operational strategy

The really important information is hidden.

※Stock Stories Investors Should Know: The Importance of Perspective

Chapter 2.

Market observation

Metaphor: Observing the Poker Table

Are you a public investor?

What happens a year after you buy a stock?

How do popular and unpopular stocks move?

Market average data

Does cutting your losses really make sense?

Do small cap stocks generally have higher returns?

The impact of liquidity

Will the strong stocks continue to go up?

The only thing that is certain is past data

※Stock Story for Investors: Victory of the Strangers

Chapter 3.

Financial statements are the most valuable information.

Financial statements and underlying factors

financial statements

Total equity, net income, operating income, operating cash flow

Types of assets and liabilities

Uniqueness of Financial Statements in the Financial Industry

Changes to international standards

Stock prices are reasonable in the long run.

The movement of stock prices and book value

mean regression

The information value of each financial indicator and the results of portfolio investment

preparation

Book value

net profit

Cash flow

operating profit

EBITDA

take

Simple book value

Return on equity

Comparison of returns of indicators

※Stock story that investors should know: When is it appropriate for KOSPI 3000 to come?

Chapter 4.

Do patterns really exist?

Basic characteristics of the market

Excluding the top 5%, most of the profits disappear.

Excluding just the top and bottom 1% would cut returns in half.

Are the patterns that have been passed down really useful?

Breakout above and below the moving average

Do moving averages create trends?

Golden Cross/Dead Cross

Jeong Bae-yeol

Bollinger Bands

Report

The upper limit: pie in the sky or rotten meat

Separation

Be careful, be careful again

Candlestick chart

Korean and US stock markets

obiter dictum

Chapter 5.

Managing Volatility

Are legends without ups and downs?

Real-world examples of fighting volatility

The more money you have, the faster your balance increases?

Arithmetic mean and geometric mean

Volatility and long-term returns

Experimental Example: Where will it fall between the arithmetic mean and the geometric mean?

Shannon's Balance Restoration Portfolio

Kelly Betting

The difference between static leverage and dynamic leverage

One way to get high returns: convert the arithmetic mean to the geometric mean.

Longitudinal and horizontal volatility

Misguided Volatility: Beta and the Comedy of the Century

Be careful using the normal distribution

Timing difficulties

Chapter 6.

The market is always like that

We need a relaxed pace and culture.

Paradigm War

The market is always like that

KOSPI 3000?

Battlefield of Algorithms

Search

Detailed image

Into the book

Markets are awash in data, but the primary decision-making process remains largely stuck in the framework of what Keynes called animal instinct 65 years ago.

If we can quantitatively observe the data of the stock market, we can see the universal foolishness of stock market participants.

The more you understand the nature of the probabilistic movements unfolding in the market, the longer your investment horizon will be and the more mentally stable your investments will be.

Page 44

Even in stock investment, people who make money are 'lucky' in making profits.

But here, 'luckily' does not mean 'by chance'.

Could we say "good luck"? If you do it right, you can determine the magnitude of your luck in advance.

The biggest attraction of this field lies in this part.

Page 51

No human can beat an optimization algorithm that searches vast spaces with a computer.

The amount of data and calculations that humans can process is insignificant compared to computers.

Ultimately, from the computer's perspective, only 'very simple' strategies can be found.

The key to investing in stocks is to make educated guesses that give you the highest probability of success in a noisy market.

Individuals without extensive computational power and optimization tools will make 'very rough' estimates, while groups that use computers and optimization techniques will make 'less rough' estimates to match their level of sophistication.

The importance of this type of science that deals with noise is bound to grow in the future.

Page 52

Looking at the results of my portfolio management using an algorithmic investment method over the past five years, I achieved a return of 222%, which is 3.4 times the KOSPI return of 65% over the same period.

With such a difference, wouldn't it seem like it would always outperform the KOSPI? Looking at the monthly returns, that's not the case at all.

Out of 60 months, 37 months were better, and 23 months were worse.

It's almost like a back and forth.

If we break this down into three-month quarters, 16 out of 21 quarters were better, and 5 quarters were worse.

Looking at it in 3-month increments, it looks overwhelmingly good.

If you look at it on a yearly basis, of course, all five years have been better.

Because of this confidence in long-term superiority, I don't feel anxious even if I don't look at my portfolio balance for several weeks.

Even if my return this month is significantly higher than the KOSPI return, this one-month figure is nothing to brag about.

I don't know when another month will come when I can't do it anymore.

What is more encouraging is the long-term result of a 5-year return that is 157 percentage points higher than the KOSPI.

Page 442

An experimental verification using 14 years of Korean stock market data from 1999 revealed that, surprisingly, the 21st-century stock market is rife with mythical beliefs, much like those of Galileo's time.

Most of the predictions that are cited without question in the market, such as moving average breakouts, golden crosses/dead crosses, and Bollinger Bands, do not align with market beliefs.

Sometimes it's even the exact opposite.

Most candlestick patterns that are worshipped in the market have a hit rate of around 50%, which is no different from blindly clicking, and only some patterns are statistically valid.

But these are medicines.

Page 443

As technology advances, it is now an established fact that computers are far superior to humans in data collection and statistical activities.

So, in most investment groups, this is something that is aided by computers.

Algorithmic trading, a rudimentary form of investing that involves implanting human-conceived strategies into computers, is now commonplace.

This paradigm shift is evolving towards extremes.

We are moving from using computers as investment tools to an extreme investment approach where computer algorithms discover algorithms or strategies themselves.

Having specialized in optimization and algorithm research in other fields and branched out into investment, I'm at one extreme of the technical spectrum of engineering investing.

Page 448

In the United States, as early as 2009, algorithmic trading by machines accounted for about three-quarters of all trading.

It was one-third in 2006, so you can imagine the rate of increase.

So how much will this figure change by 2015? Even the most conservative estimate suggests it will be over 90%, and possibly even 95%.

In a market where over 90% of transactions are conducted by machines, is this a battleground for people or machines? An irresistible, massive current is sweeping in.

Just as those who belonged to the old paradigm during the previous paradigm shift, they will only completely surrender when machines completely dominate the market and human investment becomes a fossil.

Page 448

News is noise.

It is not that it has no value as investment information, but it should be considered to be almost non-existent.

Without the noise of news, the irrational greed of investors, and fear, it would be really difficult to make investments that generate above-average returns.

Fortunately, all markets around the world are a noisy feast, to varying degrees.

If you can approach the market probabilistically from a one-year perspective or longer and have the mental strength to settle your investments over a three-year period, this market is virtually unbeatable.

Even without using a computer algorithm like mine, it's not difficult to beat the index by an average of 5 percentage points a year.

Page 451

Algorithms being adopted in advanced markets, with very few exceptions, are not yet at a very high level of abstraction.

By 2015, algorithmic trading will account for at least 90% of trading on New York and London exchanges.

Our country has no choice but to follow this trend.

If we do not prepare for this war in advance, we will inevitably become colonies in the financial war again.

Fortunately, this war is not one in which the expert group that previously dominated Wall Street has any advantage.

The world is now at the beginning of a massive paradigm shift.

Why are we so humble, calling ourselves a financially backward country?

Page 458

If we can quantitatively observe the data of the stock market, we can see the universal foolishness of stock market participants.

The more you understand the nature of the probabilistic movements unfolding in the market, the longer your investment horizon will be and the more mentally stable your investments will be.

Page 44

Even in stock investment, people who make money are 'lucky' in making profits.

But here, 'luckily' does not mean 'by chance'.

Could we say "good luck"? If you do it right, you can determine the magnitude of your luck in advance.

The biggest attraction of this field lies in this part.

Page 51

No human can beat an optimization algorithm that searches vast spaces with a computer.

The amount of data and calculations that humans can process is insignificant compared to computers.

Ultimately, from the computer's perspective, only 'very simple' strategies can be found.

The key to investing in stocks is to make educated guesses that give you the highest probability of success in a noisy market.

Individuals without extensive computational power and optimization tools will make 'very rough' estimates, while groups that use computers and optimization techniques will make 'less rough' estimates to match their level of sophistication.

The importance of this type of science that deals with noise is bound to grow in the future.

Page 52

Looking at the results of my portfolio management using an algorithmic investment method over the past five years, I achieved a return of 222%, which is 3.4 times the KOSPI return of 65% over the same period.

With such a difference, wouldn't it seem like it would always outperform the KOSPI? Looking at the monthly returns, that's not the case at all.

Out of 60 months, 37 months were better, and 23 months were worse.

It's almost like a back and forth.

If we break this down into three-month quarters, 16 out of 21 quarters were better, and 5 quarters were worse.

Looking at it in 3-month increments, it looks overwhelmingly good.

If you look at it on a yearly basis, of course, all five years have been better.

Because of this confidence in long-term superiority, I don't feel anxious even if I don't look at my portfolio balance for several weeks.

Even if my return this month is significantly higher than the KOSPI return, this one-month figure is nothing to brag about.

I don't know when another month will come when I can't do it anymore.

What is more encouraging is the long-term result of a 5-year return that is 157 percentage points higher than the KOSPI.

Page 442

An experimental verification using 14 years of Korean stock market data from 1999 revealed that, surprisingly, the 21st-century stock market is rife with mythical beliefs, much like those of Galileo's time.

Most of the predictions that are cited without question in the market, such as moving average breakouts, golden crosses/dead crosses, and Bollinger Bands, do not align with market beliefs.

Sometimes it's even the exact opposite.

Most candlestick patterns that are worshipped in the market have a hit rate of around 50%, which is no different from blindly clicking, and only some patterns are statistically valid.

But these are medicines.

Page 443

As technology advances, it is now an established fact that computers are far superior to humans in data collection and statistical activities.

So, in most investment groups, this is something that is aided by computers.

Algorithmic trading, a rudimentary form of investing that involves implanting human-conceived strategies into computers, is now commonplace.

This paradigm shift is evolving towards extremes.

We are moving from using computers as investment tools to an extreme investment approach where computer algorithms discover algorithms or strategies themselves.

Having specialized in optimization and algorithm research in other fields and branched out into investment, I'm at one extreme of the technical spectrum of engineering investing.

Page 448

In the United States, as early as 2009, algorithmic trading by machines accounted for about three-quarters of all trading.

It was one-third in 2006, so you can imagine the rate of increase.

So how much will this figure change by 2015? Even the most conservative estimate suggests it will be over 90%, and possibly even 95%.

In a market where over 90% of transactions are conducted by machines, is this a battleground for people or machines? An irresistible, massive current is sweeping in.

Just as those who belonged to the old paradigm during the previous paradigm shift, they will only completely surrender when machines completely dominate the market and human investment becomes a fossil.

Page 448

News is noise.

It is not that it has no value as investment information, but it should be considered to be almost non-existent.

Without the noise of news, the irrational greed of investors, and fear, it would be really difficult to make investments that generate above-average returns.

Fortunately, all markets around the world are a noisy feast, to varying degrees.

If you can approach the market probabilistically from a one-year perspective or longer and have the mental strength to settle your investments over a three-year period, this market is virtually unbeatable.

Even without using a computer algorithm like mine, it's not difficult to beat the index by an average of 5 percentage points a year.

Page 451

Algorithms being adopted in advanced markets, with very few exceptions, are not yet at a very high level of abstraction.

By 2015, algorithmic trading will account for at least 90% of trading on New York and London exchanges.

Our country has no choice but to follow this trend.

If we do not prepare for this war in advance, we will inevitably become colonies in the financial war again.

Fortunately, this war is not one in which the expert group that previously dominated Wall Street has any advantage.

The world is now at the beginning of a massive paradigm shift.

Why are we so humble, calling ourselves a financially backward country?

Page 458

--- From the text

Publisher's Review

1

The essence and techniques of numerical and probability-based investing, guided by Korea's James Simons and Professor Moon Byung-ro, a world-renowned computer algorithm optimization expert.

In a very simple way, you will learn how to beat the market easily.

Professor Moon Byung-ro (Department of Computer Science, Seoul National University), a world-renowned authority in the field of computer algorithm optimization, is a leading authority who has broken numerous world records in his field.

The author, who has conducted research on various algorithm optimization applications, became seriously interested in stock market data in 2000 as an example of the most complex application of optimization theory. After accumulating various research results, he participated in the actual stock market and achieved remarkable operating returns.

The author, who entered the stock market with a completely different background and experience from existing financial experts, is called the 'Korean James Simons.'

James Simons is the founder and chairman of Renaissance Technologies, a leading global hedge fund firm.

Simons, who is not a finance major, has a Ph.D. in mathematics from MIT, served as head of the mathematics department at the State University of New York, and is a mathematical genius who won the Veblen Medal, which is called the Nobel Prize of mathematics.

His Medallion Fund has outperformed Warren Buffett's returns, and he has become a topic of conversation after transforming into a hedge fund manager and earning an annual salary of over 1 trillion won.

The reason Professor Moon Byung-ro, the author of this book, is compared to James Simons is because he developed Korea's first algorithmic trading system based on academic engineering technology, and has achieved remarkable results.

The author, who is not an investment specialist, has become a hot topic in the industry for his unique returns in the stock market, and is also famous for his investment-related columns.

The author achieved a 222% return on asset management over a five-year period from February 2009, outperforming the KOSPI's 65% increase by 157 percentage points.

There has never been a time when the operating profit rate was negative on an annual basis, and it has generated a large excess return compared to the KOSPI every year.

Despite such strong performance, only three quarters out of 20 had negative returns.

On an annual basis, there has never been a time when the operating profit rate was negative, and it has never fallen below the KOSPI.

This is a remarkable result, considering that even Warren Buffett loses to the market about once every three years.

The financial market is undergoing a paradigm shift from human-driven investment to computer-driven investment.

The author argues that the future financial market will become a battleground between machines and algorithms, not people.

The market is much more risky than people generally think.

The optimization algorithms the author introduces and uses are like excellent vehicles for navigating the perilous and infinite multidimensional space of the market.

High returns are based right here.

2.

A book that proves, with figures and diagrams, the fallacy of legendary beliefs that do and do not work in the market.

By properly understanding the nature of the stock market, you will develop a new level of investment mindset and muscle.

The stock market is a typical noisy world.

The key to investing is to cut through the noise and see the main stream of information.

The author uses numbers and probability to debunk the illusions inherent in stock prices, financial statements, various patterns, and market beliefs.

The data clearly reveals the malfunctioning nature of investment methods that have been passed down like legends.

This book quantifies, in detail and with numbers and probabilities, why so many investors have been destined to lose money in the stock market, why they have repeatedly failed despite buying good stocks, and what the alternatives are.

“After verifying 14 years of Korean stock market data since 1999, we discovered that in the 21st century stock market, beliefs that are nothing more than myths, like the geocentric theory of Galileo’s time, are prevalent everywhere.

Most of the predictions cited without question in the market, such as moving average breakouts, golden crosses/dead crosses, and Bollinger Bands, did not match market beliefs.

There were even cases where it was the exact opposite.

“Most candlestick patterns worshipped in the market have a hit rate of around 50%, which is no different from blindly picking patterns, and only a few patterns are statistically valid.” (p. 443)

This book presents a variety of analytical results based on extensive data collected from the Korean stock market and provides in-depth guidance on investment strategies.

In addition, it systematically organizes related Western research and books.

This book is the first in Korea to properly address the "scientific approach to the stock market," and is by far the best book on investment ever published in Korea.

No other book has approached the essence of the stock market this well.

“This is a must-read for everyone, from professionals to individual investors.” (Kim Dong-jin, CEO of Thinkpool)

The author says that if the ultimate level of abstraction in the stock market is 10 levels, most players in the market are at level 1, and his own system is at level 5 or 6.

This book explains concepts and technologies that should be common sense in the market but are not at all, at a level of about two levels.

This book is both an investment guide and a philosophy book.

Written with both general and professional investors in mind, this book will help readers build a new level of investment muscle.

This book provides an easy way to buy stocks and sleep soundly, and is a guide that will help you learn the know-how to easily beat the market in a very simple way.

Never before has a single liberal arts book served as such a comprehensive, in-depth, and friendly investment guide.

3.

In the future, the stock market will become a battleground between machines and algorithms, not people.

Don't take a single step without measuring it with probability and numbers!

No human can beat an optimization algorithm that searches vast spaces with a computer.

This is because the amount of data and calculations that humans can process is insignificant compared to computers.

Humans can only find 'very simple' strategies from a computer's perspective.

“The key to stock investing is to make educated guesses with a high probability of success in a noisy market.

“Individuals without extensive computational power and optimization tools make ‘very rough’ estimates, while groups that use computers and optimization techniques make ‘less rough’ estimates to match their level of skill.” (p. 52)

The importance of this type of science dealing with noise is bound to grow in the future, and market competition is also moving in this direction.

With the development of computers, most data can be accessed even at the individual level.

It's time to invest only in methods that have been empirically proven to work.

In this book, the author advises that it is time to abandon the practice of deciding on an investment strategy without first verifying it yourself or seeing empirically verified results.

One of the author's core principles of investing is that you should never take a single step without quantifying it with probability and numbers.

“In the US, as early as 2009, algorithmic trading by machines accounted for about three-quarters of all trading.

By 2015, even the most conservative estimates suggest it will be over 90%, and possibly even 95%.

In a market where over 90% of transactions are conducted by machines, is this a battleground for people or machines? An irresistible, massive current is sweeping in.

“Just as those who belonged to the old paradigm did during the previous paradigm shift, they will only completely surrender when machines completely dominate the market and human investment becomes a fossil.” (p. 448)

Even the algorithms being adopted in advanced markets, with very few exceptions, are not yet at a very high level of abstraction.

The author predicts that by 2015, algorithmic trading will account for at least 90% of trading on New York and London exchanges.

Our country also has no choice but to follow this trend.

“If we do not prepare for this war, we will inevitably become colonies in another global financial war.

Fortunately, this war is not one in which the expert group that previously dominated Wall Street has any advantage.

The world is now at the beginning of a massive paradigm shift.

“Why are we so humble, calling ourselves a financially backward country?” (458)

It would take a human lifetime to find the optimal solution in a vast space.

Professor Moon Byung-ro's workspace, Metric Studio, uses computers to analyze and calculate statistics, as well as strategies, for infinite data and scenarios inaccessible to humans, thereby deriving the most attractive portfolios and investment strategies.

The goal is to build and analyze a database of hundreds of variables, including financial statement items, macroeconomic indicators, income statements, cash flow and exchange rates, import and export statistics, global stock markets, and individual stock prices, to find optimal patterns.

The author not only applies the optimization techniques that won him international competitions to over 1,700 domestic sports, but also intentionally narrows his focus to his areas of expertise, perfecting his trading system and continually evolving himself. Through optimization techniques, he is building the world's leading algorithmic trading firm.

This book selects the key findings from the author's decades of research, highlighting the essential elements needed to help both the public and experts understand the nature of investment. It summarizes them to the greatest extent possible, within a manageable and accessible scope.

The essence and techniques of numerical and probability-based investing, guided by Korea's James Simons and Professor Moon Byung-ro, a world-renowned computer algorithm optimization expert.

In a very simple way, you will learn how to beat the market easily.

Professor Moon Byung-ro (Department of Computer Science, Seoul National University), a world-renowned authority in the field of computer algorithm optimization, is a leading authority who has broken numerous world records in his field.

The author, who has conducted research on various algorithm optimization applications, became seriously interested in stock market data in 2000 as an example of the most complex application of optimization theory. After accumulating various research results, he participated in the actual stock market and achieved remarkable operating returns.

The author, who entered the stock market with a completely different background and experience from existing financial experts, is called the 'Korean James Simons.'

James Simons is the founder and chairman of Renaissance Technologies, a leading global hedge fund firm.

Simons, who is not a finance major, has a Ph.D. in mathematics from MIT, served as head of the mathematics department at the State University of New York, and is a mathematical genius who won the Veblen Medal, which is called the Nobel Prize of mathematics.

His Medallion Fund has outperformed Warren Buffett's returns, and he has become a topic of conversation after transforming into a hedge fund manager and earning an annual salary of over 1 trillion won.

The reason Professor Moon Byung-ro, the author of this book, is compared to James Simons is because he developed Korea's first algorithmic trading system based on academic engineering technology, and has achieved remarkable results.

The author, who is not an investment specialist, has become a hot topic in the industry for his unique returns in the stock market, and is also famous for his investment-related columns.

The author achieved a 222% return on asset management over a five-year period from February 2009, outperforming the KOSPI's 65% increase by 157 percentage points.

There has never been a time when the operating profit rate was negative on an annual basis, and it has generated a large excess return compared to the KOSPI every year.

Despite such strong performance, only three quarters out of 20 had negative returns.

On an annual basis, there has never been a time when the operating profit rate was negative, and it has never fallen below the KOSPI.

This is a remarkable result, considering that even Warren Buffett loses to the market about once every three years.

The financial market is undergoing a paradigm shift from human-driven investment to computer-driven investment.

The author argues that the future financial market will become a battleground between machines and algorithms, not people.

The market is much more risky than people generally think.

The optimization algorithms the author introduces and uses are like excellent vehicles for navigating the perilous and infinite multidimensional space of the market.

High returns are based right here.

2.

A book that proves, with figures and diagrams, the fallacy of legendary beliefs that do and do not work in the market.

By properly understanding the nature of the stock market, you will develop a new level of investment mindset and muscle.

The stock market is a typical noisy world.

The key to investing is to cut through the noise and see the main stream of information.

The author uses numbers and probability to debunk the illusions inherent in stock prices, financial statements, various patterns, and market beliefs.

The data clearly reveals the malfunctioning nature of investment methods that have been passed down like legends.

This book quantifies, in detail and with numbers and probabilities, why so many investors have been destined to lose money in the stock market, why they have repeatedly failed despite buying good stocks, and what the alternatives are.

“After verifying 14 years of Korean stock market data since 1999, we discovered that in the 21st century stock market, beliefs that are nothing more than myths, like the geocentric theory of Galileo’s time, are prevalent everywhere.

Most of the predictions cited without question in the market, such as moving average breakouts, golden crosses/dead crosses, and Bollinger Bands, did not match market beliefs.

There were even cases where it was the exact opposite.

“Most candlestick patterns worshipped in the market have a hit rate of around 50%, which is no different from blindly picking patterns, and only a few patterns are statistically valid.” (p. 443)

This book presents a variety of analytical results based on extensive data collected from the Korean stock market and provides in-depth guidance on investment strategies.

In addition, it systematically organizes related Western research and books.

This book is the first in Korea to properly address the "scientific approach to the stock market," and is by far the best book on investment ever published in Korea.

No other book has approached the essence of the stock market this well.

“This is a must-read for everyone, from professionals to individual investors.” (Kim Dong-jin, CEO of Thinkpool)

The author says that if the ultimate level of abstraction in the stock market is 10 levels, most players in the market are at level 1, and his own system is at level 5 or 6.

This book explains concepts and technologies that should be common sense in the market but are not at all, at a level of about two levels.

This book is both an investment guide and a philosophy book.

Written with both general and professional investors in mind, this book will help readers build a new level of investment muscle.

This book provides an easy way to buy stocks and sleep soundly, and is a guide that will help you learn the know-how to easily beat the market in a very simple way.

Never before has a single liberal arts book served as such a comprehensive, in-depth, and friendly investment guide.

3.

In the future, the stock market will become a battleground between machines and algorithms, not people.

Don't take a single step without measuring it with probability and numbers!

No human can beat an optimization algorithm that searches vast spaces with a computer.

This is because the amount of data and calculations that humans can process is insignificant compared to computers.

Humans can only find 'very simple' strategies from a computer's perspective.

“The key to stock investing is to make educated guesses with a high probability of success in a noisy market.

“Individuals without extensive computational power and optimization tools make ‘very rough’ estimates, while groups that use computers and optimization techniques make ‘less rough’ estimates to match their level of skill.” (p. 52)

The importance of this type of science dealing with noise is bound to grow in the future, and market competition is also moving in this direction.

With the development of computers, most data can be accessed even at the individual level.

It's time to invest only in methods that have been empirically proven to work.

In this book, the author advises that it is time to abandon the practice of deciding on an investment strategy without first verifying it yourself or seeing empirically verified results.

One of the author's core principles of investing is that you should never take a single step without quantifying it with probability and numbers.

“In the US, as early as 2009, algorithmic trading by machines accounted for about three-quarters of all trading.

By 2015, even the most conservative estimates suggest it will be over 90%, and possibly even 95%.

In a market where over 90% of transactions are conducted by machines, is this a battleground for people or machines? An irresistible, massive current is sweeping in.

“Just as those who belonged to the old paradigm did during the previous paradigm shift, they will only completely surrender when machines completely dominate the market and human investment becomes a fossil.” (p. 448)

Even the algorithms being adopted in advanced markets, with very few exceptions, are not yet at a very high level of abstraction.

The author predicts that by 2015, algorithmic trading will account for at least 90% of trading on New York and London exchanges.

Our country also has no choice but to follow this trend.

“If we do not prepare for this war, we will inevitably become colonies in another global financial war.

Fortunately, this war is not one in which the expert group that previously dominated Wall Street has any advantage.

The world is now at the beginning of a massive paradigm shift.

“Why are we so humble, calling ourselves a financially backward country?” (458)

It would take a human lifetime to find the optimal solution in a vast space.

Professor Moon Byung-ro's workspace, Metric Studio, uses computers to analyze and calculate statistics, as well as strategies, for infinite data and scenarios inaccessible to humans, thereby deriving the most attractive portfolios and investment strategies.

The goal is to build and analyze a database of hundreds of variables, including financial statement items, macroeconomic indicators, income statements, cash flow and exchange rates, import and export statistics, global stock markets, and individual stock prices, to find optimal patterns.

The author not only applies the optimization techniques that won him international competitions to over 1,700 domestic sports, but also intentionally narrows his focus to his areas of expertise, perfecting his trading system and continually evolving himself. Through optimization techniques, he is building the world's leading algorithmic trading firm.

This book selects the key findings from the author's decades of research, highlighting the essential elements needed to help both the public and experts understand the nature of investment. It summarizes them to the greatest extent possible, within a manageable and accessible scope.

GOODS SPECIFICS

- Date of publication: March 7, 2014

- Page count, weight, size: 464 pages | 792g | 152*225*30mm

- ISBN13: 9788934966760

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)