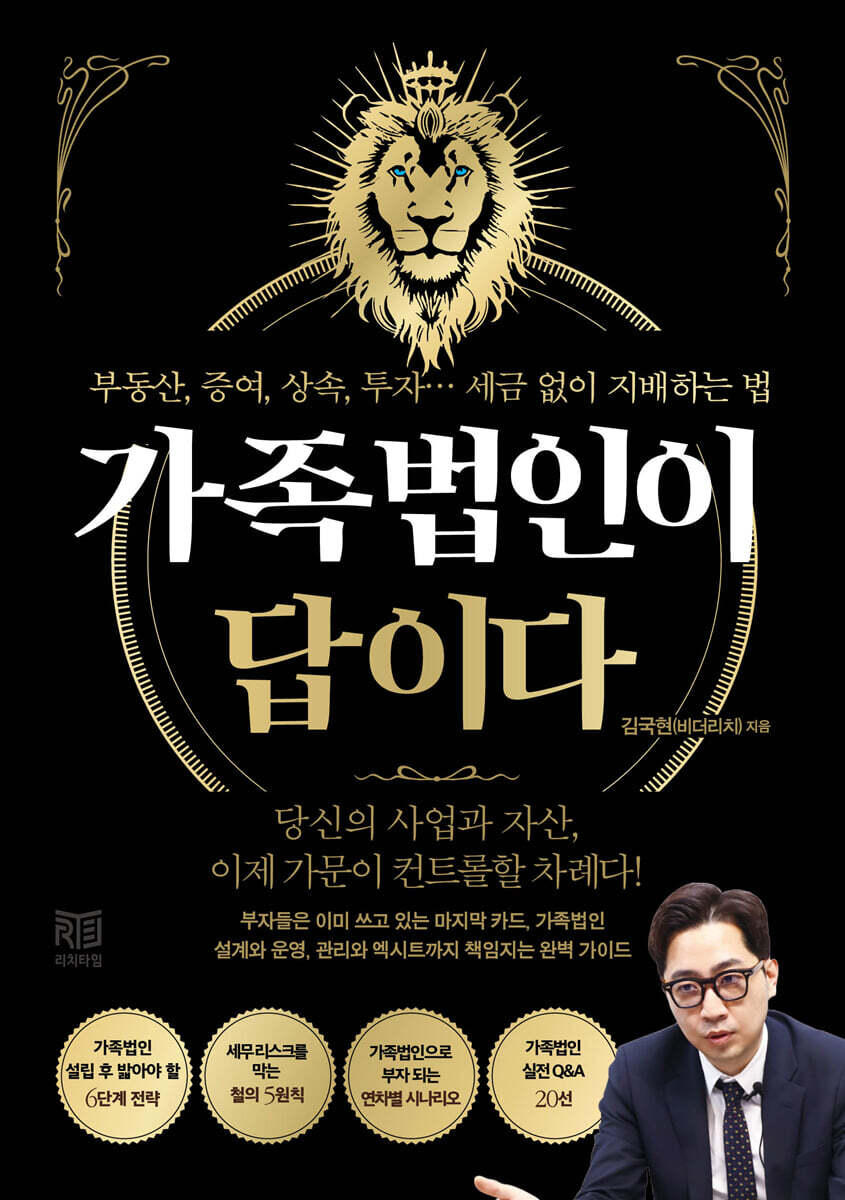

Family corporation is the answer

|

Description

Book Introduction

The concept of a family corporation is explained simply.

We provide strategies for systematically managing assets and passing down wealth through family corporations, along with real-life examples of the wealthy and an implementation roadmap.

We provide strategies for systematically managing assets and passing down wealth through family corporations, along with real-life examples of the wealthy and an implementation roadmap.

- You can preview some of the book's contents.

Preview

index

Prologue: The "Real" Family Corporation Story No One Told You About (Part 4)

Chapter 1: Why Your Assets Are Stagnant: Because You Don't Have a Family Corporation

The Trap of "Just Work Hard and Earn Money": Why Is It Necessary to Form a Family Corporation? 15

What the Rich Enjoy as Family Corporations: 'Family Lineage' and 'Control' 24

30 Things People Who Need a Legal Person Have in Common

39

There's a Different Form of Incorporation for Your Family: 40 Strategies for Designing a Customized Family Incorporation

45

Family Law Firm Design: 3 Preliminary Checklist 47

53

Chapter 2.

The Crossroads Between "Salaryman CEO" and "Wealth Ruler" ─ 6 Essential Strategies for Establishing a Family Corporation

Step 1: Take the First Step to Wealth: Identify the Owners of Your Corporation 61

71

Step 2: Controlling Wealth: Designing Your Stock Structure 74

Step 3: Unlocking the Future of Wealth: Raise Your Children to Be Shareholders from an Early Age (80)

Step 4: Establishing a Center of Wealth: Complete the Internal Power Map with Directors and Auditors (85)

Step 5: Achieving Wealth Freedom: Beyond Paychecks, Escape from Tax Slavery 91

Step 6: Build Your Wealth: Invest in Real Estate and Foreign Stocks (97)

103

Chapter 3.

8 out of 10 are doomed from the start. 90% of family corporations are planned.

Shareholder Structure and Capital: Who Will Hold the Golden Key? 109

You Need a Money-Making Business: Choosing a Purpose-Based Business 116

Every Address Has a Strategy: The Pitfalls and Opportunities of Headquarters Locations 120

99% of delegates don't read 'this document' 126

9-Step Roadmap to Establishing a Successful Family Corporation 132

A Complete Guide to Administrative Procedures You Must Complete After Starting a Business 136

140

Chapter 4.

The Dominant Techniques for Building a Century-Long "Empire of Wealth"—Management is Key for Family Corporations

The real beginning of a corporation is after it is established. 147

Business income vs.

Rental income vs.

Investment Income: Risk and Return by Income Structure 152

Capital? Cash? Expenses?: Control Your Cash Flow 157

How to Kill Two Birds: Severance Pay and Business Succession 163

The "Wealth Peace Scenario" to Prevent Family Conflict 169

174

Tax audits are inevitable: 176 key strategies for eliminating target signals

182

Chapter 5.

The 5-Year Script for Becoming Rich with a Family Corporation - Execute the Year-by-Year Scenarios

Family Corporation Wealth Model: Design → Gift → Dividend → Retirement Benefit 187

Year 1_ Design and Establishment: Structure is 80% 194

Years 2-3_ Asset Transfers and Gifts: Move Money to Your Family 201

Year 5_ Family Completion: Dividends, Retirement Benefits, and the Keys to Inheritance Planning 206

Annual Operational Checklist and Management Manual 211

216

225

Chapter 6.

The ultimate technique of the wealthy, a skill you'll never see again: the family corporation strategy that changes the game of gifting and inheritance.

Tax savings change when a family corporation owns real estate. 229

The Singer's Fund Plan: Zero-Tax Techniques for Injecting and Withdrawing Money into a Corporation 235

A family corporation is the best inheritance tool: safer than a gift.

Whole life insurance should be used while you're alive, not when you're dead. 245

Don't Sell Real Estate: Convert to Stocks to Win 250

Don't Just Save Taxes: Gain Control, Too 255

261

* Things to check before closing the appendix book

#Appendix 1: Can My Family Also Form a Family Corporation? ─ Practical Checklist 9 266

#Appendix 2 Sample Articles of Incorporation 270

#Appendix 3: Example of Business Purpose 272

#Appendix 4: 10 Must-Ask Questions to Your Tax Accountant

Epilogue: Now Your Family Creates "Our Company" 281

Chapter 1: Why Your Assets Are Stagnant: Because You Don't Have a Family Corporation

The Trap of "Just Work Hard and Earn Money": Why Is It Necessary to Form a Family Corporation? 15

What the Rich Enjoy as Family Corporations: 'Family Lineage' and 'Control' 24

30 Things People Who Need a Legal Person Have in Common

39

There's a Different Form of Incorporation for Your Family: 40 Strategies for Designing a Customized Family Incorporation

45

Family Law Firm Design: 3 Preliminary Checklist 47

53

Chapter 2.

The Crossroads Between "Salaryman CEO" and "Wealth Ruler" ─ 6 Essential Strategies for Establishing a Family Corporation

Step 1: Take the First Step to Wealth: Identify the Owners of Your Corporation 61

71

Step 2: Controlling Wealth: Designing Your Stock Structure 74

Step 3: Unlocking the Future of Wealth: Raise Your Children to Be Shareholders from an Early Age (80)

Step 4: Establishing a Center of Wealth: Complete the Internal Power Map with Directors and Auditors (85)

Step 5: Achieving Wealth Freedom: Beyond Paychecks, Escape from Tax Slavery 91

Step 6: Build Your Wealth: Invest in Real Estate and Foreign Stocks (97)

103

Chapter 3.

8 out of 10 are doomed from the start. 90% of family corporations are planned.

Shareholder Structure and Capital: Who Will Hold the Golden Key? 109

You Need a Money-Making Business: Choosing a Purpose-Based Business 116

Every Address Has a Strategy: The Pitfalls and Opportunities of Headquarters Locations 120

99% of delegates don't read 'this document' 126

9-Step Roadmap to Establishing a Successful Family Corporation 132

A Complete Guide to Administrative Procedures You Must Complete After Starting a Business 136

140

Chapter 4.

The Dominant Techniques for Building a Century-Long "Empire of Wealth"—Management is Key for Family Corporations

The real beginning of a corporation is after it is established. 147

Business income vs.

Rental income vs.

Investment Income: Risk and Return by Income Structure 152

Capital? Cash? Expenses?: Control Your Cash Flow 157

How to Kill Two Birds: Severance Pay and Business Succession 163

The "Wealth Peace Scenario" to Prevent Family Conflict 169

174

Tax audits are inevitable: 176 key strategies for eliminating target signals

182

Chapter 5.

The 5-Year Script for Becoming Rich with a Family Corporation - Execute the Year-by-Year Scenarios

Family Corporation Wealth Model: Design → Gift → Dividend → Retirement Benefit 187

Year 1_ Design and Establishment: Structure is 80% 194

Years 2-3_ Asset Transfers and Gifts: Move Money to Your Family 201

Year 5_ Family Completion: Dividends, Retirement Benefits, and the Keys to Inheritance Planning 206

Annual Operational Checklist and Management Manual 211

216

225

Chapter 6.

The ultimate technique of the wealthy, a skill you'll never see again: the family corporation strategy that changes the game of gifting and inheritance.

Tax savings change when a family corporation owns real estate. 229

The Singer's Fund Plan: Zero-Tax Techniques for Injecting and Withdrawing Money into a Corporation 235

A family corporation is the best inheritance tool: safer than a gift.

Whole life insurance should be used while you're alive, not when you're dead. 245

Don't Sell Real Estate: Convert to Stocks to Win 250

Don't Just Save Taxes: Gain Control, Too 255

261

* Things to check before closing the appendix book

#Appendix 1: Can My Family Also Form a Family Corporation? ─ Practical Checklist 9 266

#Appendix 2 Sample Articles of Incorporation 270

#Appendix 3: Example of Business Purpose 272

#Appendix 4: 10 Must-Ask Questions to Your Tax Accountant

Epilogue: Now Your Family Creates "Our Company" 281

Detailed image

Publisher's Review

I am a top-tier tax accountant with proven experience and achievements in the family law field.

These words are not a boast, but rather the 'result' and 'fact' of the work I've done over the years, through tears and laughter, with hundreds of representatives on the ground.

The countless real-world data and invaluable know-how I've gained along the way have now become my most powerful weapons.

I was hesitant at first.

Is it really right to reveal this weapon to the world in a single book?

Is it really right to open up this "map of wealth", which has been enjoyed only by a small number of representatives who have walked alongside me, to everyone?

But the conclusion was clear.

I could no longer turn a blind eye to the unfortunate reality of countless CEOs being swayed by misinformation, hit with a tax bomb based on meager knowledge, and losing the wealth they'd worked for their entire lives in an instant without a single proper blueprint.

So I decided.

Let's start with the 'real' story of family corporations, which no one has ever talked about, but which you absolutely must know.

Some might say:

"A family corporation? Isn't that just something you set up to save some taxes?"

“I know the gist of it.”

“Is there any special story behind it?”

It is precisely these shallow misunderstandings and ignorance that keep countless people hovering on the threshold of wealth their entire lives.

The problem is that most people live under the illusion that they 'know it all'.

But did you know that this knowledge could actually be "fake news" deliberately leaked by someone, or it could be an outdated theory from decades ago?

So why hasn't anyone told this 'real' story until now?

The answer is simple.

Because no one has disclosed it.

The scarcer the information, the more valuable it becomes, and scarce information naturally becomes accessible only to those who can access it.

In other words, limited information creates limited benefits.

And the 'unit price' of that information is getting higher and higher.

A ‘family corporation’ is not simply a tax-saving tool.

It's clear why the truly wealthy create family corporations.

For them, the family corporation is a ‘vessel that holds wealth,’ an ‘iron fortress that protects assets,’ and a ‘system for passing down wealth through generations.’

This book contains the essence and practical strategies of such family corporations.

It is not simply a manual listing tax knowledge or legal provisions.

It is a precise 'wealth blueprint' that can completely change your philosophy on money and redesign your business into a 'wealth-creating system.'

In this book, I will reveal the specific methods and roadmap for how you can protect, nurture, and pass on the wealth you've dedicated your life to to the next generation.

These words are not a boast, but rather the 'result' and 'fact' of the work I've done over the years, through tears and laughter, with hundreds of representatives on the ground.

The countless real-world data and invaluable know-how I've gained along the way have now become my most powerful weapons.

I was hesitant at first.

Is it really right to reveal this weapon to the world in a single book?

Is it really right to open up this "map of wealth", which has been enjoyed only by a small number of representatives who have walked alongside me, to everyone?

But the conclusion was clear.

I could no longer turn a blind eye to the unfortunate reality of countless CEOs being swayed by misinformation, hit with a tax bomb based on meager knowledge, and losing the wealth they'd worked for their entire lives in an instant without a single proper blueprint.

So I decided.

Let's start with the 'real' story of family corporations, which no one has ever talked about, but which you absolutely must know.

Some might say:

"A family corporation? Isn't that just something you set up to save some taxes?"

“I know the gist of it.”

“Is there any special story behind it?”

It is precisely these shallow misunderstandings and ignorance that keep countless people hovering on the threshold of wealth their entire lives.

The problem is that most people live under the illusion that they 'know it all'.

But did you know that this knowledge could actually be "fake news" deliberately leaked by someone, or it could be an outdated theory from decades ago?

So why hasn't anyone told this 'real' story until now?

The answer is simple.

Because no one has disclosed it.

The scarcer the information, the more valuable it becomes, and scarce information naturally becomes accessible only to those who can access it.

In other words, limited information creates limited benefits.

And the 'unit price' of that information is getting higher and higher.

A ‘family corporation’ is not simply a tax-saving tool.

It's clear why the truly wealthy create family corporations.

For them, the family corporation is a ‘vessel that holds wealth,’ an ‘iron fortress that protects assets,’ and a ‘system for passing down wealth through generations.’

This book contains the essence and practical strategies of such family corporations.

It is not simply a manual listing tax knowledge or legal provisions.

It is a precise 'wealth blueprint' that can completely change your philosophy on money and redesign your business into a 'wealth-creating system.'

In this book, I will reveal the specific methods and roadmap for how you can protect, nurture, and pass on the wealth you've dedicated your life to to the next generation.

GOODS SPECIFICS

- Date of issue: November 11, 2025

- Page count, weight, size: 283 pages | 148*210*20mm

- ISBN13: 9791198451934

- ISBN10: 1198451939

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)