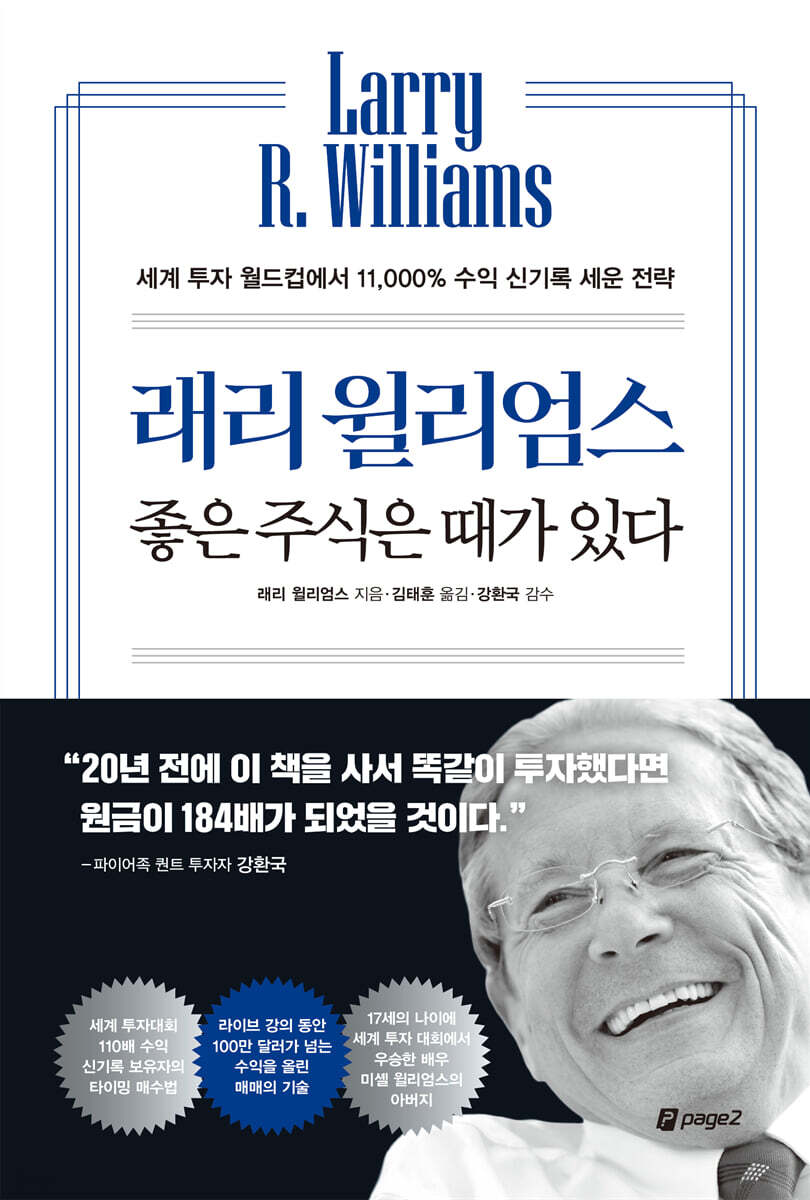

Larry Williams: Good stocks have their time.

|

Description

Book Introduction

- A word from MD

-

Stocks are all about timing!This book presents a method for successful investment by legendary trader Larry Williams.

It's a simple truth to buy 'good stocks' at 'good times', but it provides clear guidelines through various analyses.

This is a must-read for investors who don't want to miss out on upcoming opportunities while waiting for a good time.

September 15, 2023. Economics and Management PD Kim Sang-geun

“If I had bought this book 20 years ago and invested the same way,

“The principal would have increased 184 times.”

The strategy that set a new record of 11,000% returns at the World Investment World Cup.

Would you believe that a book published a full 20 years ago accurately predicted the current situation? It may seem unbelievable, but it's true.

First published in 2003, this book accurately predicted the bottom of the U.S. stock market in October 2022.

The author of this book, Larry Williams, has been a successful investor for 60 years and is considered an investment legend.

He said there are only two ways to succeed in stock investing.

Buying 'good stocks' at 'good times'.

The truth is so simple, but the results are powerful.

If you had invested for 20 years using the method Williams presents in this book, you would have earned 184 times your initial investment.

Let's learn together the simple yet powerful investment secret of buying good stocks at the right time.

“The principal would have increased 184 times.”

The strategy that set a new record of 11,000% returns at the World Investment World Cup.

Would you believe that a book published a full 20 years ago accurately predicted the current situation? It may seem unbelievable, but it's true.

First published in 2003, this book accurately predicted the bottom of the U.S. stock market in October 2022.

The author of this book, Larry Williams, has been a successful investor for 60 years and is considered an investment legend.

He said there are only two ways to succeed in stock investing.

Buying 'good stocks' at 'good times'.

The truth is so simple, but the results are powerful.

If you had invested for 20 years using the method Williams presents in this book, you would have earned 184 times your initial investment.

Let's learn together the simple yet powerful investment secret of buying good stocks at the right time.

- You can preview some of the book's contents.

Preview

index

The Secret Book I Wanted to Keep to Myself: Finally Translated and Published

Introduction · The Essentials of Investing: What to Buy and When

Chapter 1: 10-Year Patterns of the U.S. Stock Market

The Past is the Future | The Path to Successful Investing | An 'Excellent' 5th Year | A 'Sure' 7th Year

Chapter 2, 4-year phenomenon

Overcoming Fear with Charts | Easy enough for a child to understand | The Meaning of the 2002 Buy Point | The Secret to 142 Years of Success | 8 Years of "Straight Line"

Chapter 3: The Amazing October Effect

The Cause of the October Effect | Review and Summary | What to Do Now

Chapter 4: How to Know with Certainty That Now is the Bottom

How to Determine if a Stock is Undervalued | Following the Fed System | Fueling Stock Price Rise | Credit Balances Fueling Rise | Investor Sentiment Is the Secret to Survival | Misjudgments of Investment Advisors | Stock Price Forecasting Using the Bond Market | Stock Trading Timing with Bonds and Volatility Stops | Outlook | Gold Mania: Breaking the Golden Rule

Chapter 5: Why the Next Rise Will Be Huge

Lessons from the Past | The Key to Understanding Investors | Patterns of Disaster | Clues to the Nasdaq's Future

Chapter 6: Purpose of Investment

The Best Investment You Can Make | The Fallacy of Long-Term Investing | The Investment Period is as Important as the Investment Vehicle | Which Stocks Should You Invest in | The Rewards of Consistency

Chapter 7: How to Increase Investment Returns

Build an edge, even if it's a small one | Two of the best investment goals | Find stocks with a distinctly high upside probability.

Chapter 8: The Old Economy is the New Economy

The First Factor in Stock Price Rise: Popularity | The Second Factor in Stock Price Rise: Performance | How to Buy Stocks at a 'Bargain' | Factors Beyond Performance: Debt | Will You Go to That Restaurant? Insider Trading

Chapter 9: Investment Sentiment for Individual Stocks

How Investor Sentiment Affects Individual Stocks | Let the Evidence Speak for Itself 201 | How Traders Use Indicators | What Causes Excessive Optimism and Pessimism? | Insights into Sentimental Indicators | Don't Breathe in the Poison | Factors in Stock Price Fluctuations | My Trading Style | Stock Prices and Seasonality

Chapter 10: The Difficulties of Investing

Investing Success Is About Outperforming the Market | Value Is Key | Three Ways to Control Risk | Seven Measures of Value | More Resources on Value Judgments | Another Way to Outperform the Index | How to Deal with the Madness of Wall Street

Chapter 11: A Complete Guide to Successful Long-Term Investment

When the market bottoms | The truth about dividend yield, cash flow, price-to-sales ratio, and other metrics | About mutual funds | The Williams method that beats Wall Street | Larry Williams' high-yield investment method | Smart fund investment method for lazy people | How to turn $10,000 into $8 million

Chapter 12 Money Management: The Key to Successful Investing

Why Many Investors Take an "All-or-Nothing" Investing Strategy | Different Money Management Approaches: One Will Work for You | The Good, the Bad, and the Ugly of Money Management | A Fresh Perspective on Drawdowns | Fixed-Ratio Trading with Ryan Jones | A Money Management Solution That Improves the Problem

Chapter 13: Non-random Thoughts on Random Markets

Will listed stocks always rise? | Predicting the future with a crystal ball | Pay attention to the raw materials market | The growing potential of the travel and transportation industries | The financial market where money will flow | Entertainment, the future's huge market | As always, opportunities will abound | Additional fuel: the increasing money supply

Acknowledgments · The Best Investment I've Ever Made

Introduction · The Essentials of Investing: What to Buy and When

Chapter 1: 10-Year Patterns of the U.S. Stock Market

The Past is the Future | The Path to Successful Investing | An 'Excellent' 5th Year | A 'Sure' 7th Year

Chapter 2, 4-year phenomenon

Overcoming Fear with Charts | Easy enough for a child to understand | The Meaning of the 2002 Buy Point | The Secret to 142 Years of Success | 8 Years of "Straight Line"

Chapter 3: The Amazing October Effect

The Cause of the October Effect | Review and Summary | What to Do Now

Chapter 4: How to Know with Certainty That Now is the Bottom

How to Determine if a Stock is Undervalued | Following the Fed System | Fueling Stock Price Rise | Credit Balances Fueling Rise | Investor Sentiment Is the Secret to Survival | Misjudgments of Investment Advisors | Stock Price Forecasting Using the Bond Market | Stock Trading Timing with Bonds and Volatility Stops | Outlook | Gold Mania: Breaking the Golden Rule

Chapter 5: Why the Next Rise Will Be Huge

Lessons from the Past | The Key to Understanding Investors | Patterns of Disaster | Clues to the Nasdaq's Future

Chapter 6: Purpose of Investment

The Best Investment You Can Make | The Fallacy of Long-Term Investing | The Investment Period is as Important as the Investment Vehicle | Which Stocks Should You Invest in | The Rewards of Consistency

Chapter 7: How to Increase Investment Returns

Build an edge, even if it's a small one | Two of the best investment goals | Find stocks with a distinctly high upside probability.

Chapter 8: The Old Economy is the New Economy

The First Factor in Stock Price Rise: Popularity | The Second Factor in Stock Price Rise: Performance | How to Buy Stocks at a 'Bargain' | Factors Beyond Performance: Debt | Will You Go to That Restaurant? Insider Trading

Chapter 9: Investment Sentiment for Individual Stocks

How Investor Sentiment Affects Individual Stocks | Let the Evidence Speak for Itself 201 | How Traders Use Indicators | What Causes Excessive Optimism and Pessimism? | Insights into Sentimental Indicators | Don't Breathe in the Poison | Factors in Stock Price Fluctuations | My Trading Style | Stock Prices and Seasonality

Chapter 10: The Difficulties of Investing

Investing Success Is About Outperforming the Market | Value Is Key | Three Ways to Control Risk | Seven Measures of Value | More Resources on Value Judgments | Another Way to Outperform the Index | How to Deal with the Madness of Wall Street

Chapter 11: A Complete Guide to Successful Long-Term Investment

When the market bottoms | The truth about dividend yield, cash flow, price-to-sales ratio, and other metrics | About mutual funds | The Williams method that beats Wall Street | Larry Williams' high-yield investment method | Smart fund investment method for lazy people | How to turn $10,000 into $8 million

Chapter 12 Money Management: The Key to Successful Investing

Why Many Investors Take an "All-or-Nothing" Investing Strategy | Different Money Management Approaches: One Will Work for You | The Good, the Bad, and the Ugly of Money Management | A Fresh Perspective on Drawdowns | Fixed-Ratio Trading with Ryan Jones | A Money Management Solution That Improves the Problem

Chapter 13: Non-random Thoughts on Random Markets

Will listed stocks always rise? | Predicting the future with a crystal ball | Pay attention to the raw materials market | The growing potential of the travel and transportation industries | The financial market where money will flow | Entertainment, the future's huge market | As always, opportunities will abound | Additional fuel: the increasing money supply

Acknowledgments · The Best Investment I've Ever Made

Detailed image

Into the book

We need something more specific.

Ultimately, you need to know not only the exact week or day you should buy or sell stocks, but also the exact time.

While it's impossible to know all of this 100% perfectly, utilizing a variety of tools can help you get much closer to figuring out the best time.

--- p.43

If there's one survival tip in investing, it's understanding that stock market fluctuations are largely a reaction to investor sentiment.

In the long run, stock prices rise.

However, the highs and lows that occur during the process are due to investors being extremely optimistic or pessimistic.

--- p.90

The stock market is a completely different world from the one we live in every day.

Everything is turned upside down there.

What looks good is bad, and what looks bad is very, very good.

--- p.91

The public never buys at the bottom.

They enter the mid-term and buy in bulk at the high point.

I will now show you how to take advantage of this aspect.

--- p.118

The problem with looking only at price trends is that it doesn't focus on earnings, dividends, industry growth, or the company's activities.

Saying that a stock is worth buying because its price is lower than it was in the past cuts off the logical, rational process for making wise investment decisions.

The more fundamental problem is that there are good reasons why stock prices are low.

--- p.136

There is a common saying related to stock investing.

All you have to do is buy good stocks and hold them for a long time.

No, it isn't.

This is a very wrong idea.

--- p.147

People are drawn to the concept of long-term investing because they like the idea of not having to make many decisions, not having to put in a lot of effort, and having their money sitting there for a long time.

The idea of having a long-term plan gives me a sense of comfort.

As if my life was completely planned out.

There is absolutely no straight path to growth in stock investing.

It has been so in the past, and it will be so in the future.

Therefore, the goal of investing should be to enter at the right time and exit at the right time.

--- p.152

To be honest, it is impossible to perfectly time your trades.

But looking at the data, even partial success in the medium term can yield much larger returns than a long-term "buy and pray" strategy.

--- p.153

It is almost impossible for ordinary people like us to consistently find rising stocks.

The overall approach to investing in these stocks, or so-called "good stocks," is basically to focus on the stories and rumors, or to find stocks that have already risen significantly in the hope that they will rise further.

Finding stocks like this can hardly be considered an investment.

It's more like gambling.

You are not buying stocks.

It is buying hope, and a vain hope at that.

--- p.163

There are only two important things to do to beat the market:

The first is to identify stocks that have a high probability of outperforming the stock market and thus rewarding investors.

The second is to identify the right time when these stocks are likely to rise.

--- p.166

In conclusion, it is best to buy when the major market indices are likely to rise.

The old adage that you shouldn't mistake making money in a bull market for being smart also speaks to this point.

A bull market corrects almost every mistake an investor makes.

--- p.167

You can't predict all the ups and downs of the market.

Still, it's generally possible (and reasonable) to buy when the market is most likely to rise over the next 12 months.

Timing makes all the difference.

Long-term analysis shows that perfect timing can almost triple your returns.

--- p.169

Our goal should be to outperform the market.

If you can consistently outperform the market, you will be far ahead of other investors.

--- p.170

Our secret to success is to consistently do the right thing.

If you do it long enough, you're bound to succeed.

Success is inevitable and will definitely happen.

--- p.171

Success in investing usually comes down to doing what other people think you should be doing, and then doing what they're not doing.

--- p.207

There is always plenty of time to invest.

Anytime, any time, any time, any time, any time you hear someone say you need to get in on any stock, right now, that should be a wake-up call.

There is always room in the market.

Time is not our enemy, but our friend.

When it comes to investing, don't rush to judgment.

Ultimately, you need to know not only the exact week or day you should buy or sell stocks, but also the exact time.

While it's impossible to know all of this 100% perfectly, utilizing a variety of tools can help you get much closer to figuring out the best time.

--- p.43

If there's one survival tip in investing, it's understanding that stock market fluctuations are largely a reaction to investor sentiment.

In the long run, stock prices rise.

However, the highs and lows that occur during the process are due to investors being extremely optimistic or pessimistic.

--- p.90

The stock market is a completely different world from the one we live in every day.

Everything is turned upside down there.

What looks good is bad, and what looks bad is very, very good.

--- p.91

The public never buys at the bottom.

They enter the mid-term and buy in bulk at the high point.

I will now show you how to take advantage of this aspect.

--- p.118

The problem with looking only at price trends is that it doesn't focus on earnings, dividends, industry growth, or the company's activities.

Saying that a stock is worth buying because its price is lower than it was in the past cuts off the logical, rational process for making wise investment decisions.

The more fundamental problem is that there are good reasons why stock prices are low.

--- p.136

There is a common saying related to stock investing.

All you have to do is buy good stocks and hold them for a long time.

No, it isn't.

This is a very wrong idea.

--- p.147

People are drawn to the concept of long-term investing because they like the idea of not having to make many decisions, not having to put in a lot of effort, and having their money sitting there for a long time.

The idea of having a long-term plan gives me a sense of comfort.

As if my life was completely planned out.

There is absolutely no straight path to growth in stock investing.

It has been so in the past, and it will be so in the future.

Therefore, the goal of investing should be to enter at the right time and exit at the right time.

--- p.152

To be honest, it is impossible to perfectly time your trades.

But looking at the data, even partial success in the medium term can yield much larger returns than a long-term "buy and pray" strategy.

--- p.153

It is almost impossible for ordinary people like us to consistently find rising stocks.

The overall approach to investing in these stocks, or so-called "good stocks," is basically to focus on the stories and rumors, or to find stocks that have already risen significantly in the hope that they will rise further.

Finding stocks like this can hardly be considered an investment.

It's more like gambling.

You are not buying stocks.

It is buying hope, and a vain hope at that.

--- p.163

There are only two important things to do to beat the market:

The first is to identify stocks that have a high probability of outperforming the stock market and thus rewarding investors.

The second is to identify the right time when these stocks are likely to rise.

--- p.166

In conclusion, it is best to buy when the major market indices are likely to rise.

The old adage that you shouldn't mistake making money in a bull market for being smart also speaks to this point.

A bull market corrects almost every mistake an investor makes.

--- p.167

You can't predict all the ups and downs of the market.

Still, it's generally possible (and reasonable) to buy when the market is most likely to rise over the next 12 months.

Timing makes all the difference.

Long-term analysis shows that perfect timing can almost triple your returns.

--- p.169

Our goal should be to outperform the market.

If you can consistently outperform the market, you will be far ahead of other investors.

--- p.170

Our secret to success is to consistently do the right thing.

If you do it long enough, you're bound to succeed.

Success is inevitable and will definitely happen.

--- p.171

Success in investing usually comes down to doing what other people think you should be doing, and then doing what they're not doing.

--- p.207

There is always plenty of time to invest.

Anytime, any time, any time, any time, any time you hear someone say you need to get in on any stock, right now, that should be a wake-up call.

There is always room in the market.

Time is not our enemy, but our friend.

When it comes to investing, don't rush to judgment.

--- p.243

Publisher's Review

A must-read investment classic for every investor.

Never invest in stocks without reading this book!

★★★ Timing the Buying Method of the World Investment Competition's Record-Breaking 110x Return Holder ★★★

★★★ Trading techniques that generated over $1 million in profits during live lectures ★★★

★★★ Father of actress Michelle Williams, who won a world investment competition at age 17 ★★★

The living history of stock investment,

Who is Larry Williams?

Larry Williams is a living example of stock investing, having successfully invested for 60 years.

He is also a person who holds many great and rare records.

In 1987, he set a new record by turning $10,000 into $1.1 million in 12 months at the Robbins Futures Trading World Cup, a global investment competition.

That record remains unbroken even after 30 years.

What's even more surprising is that exactly 10 years later, his daughter, Michelle Williams, also a Golden Globe-winning actress, won the same investment competition at the age of 17.

This is a record that perfectly supports the 10-year cycle theory that Williams advocates.

He is also famous for successfully completing the 'Larry Williams Million Dollar Challenge'.

The challenge was to make one million dollars through actual trading profits over a total of 21 live lectures, and he successfully completed the challenge, earning $1.25 million (approximately 1.6 billion won).

In the United States, there is a 'Larry Williams Day'.

Because the mayor of San Diego declared October 6, 2002, Larry Williams Day.

October 2022 coincided with the three lows of Larry Williams's 10-year cycle, 4-year cycle, and October, and the U.S. stock market actually bottomed then.

Those who believed his words and started investing on 'Larry Williams Day' were able to achieve success.

He has also received several investment-related awards, including the Futures Masters Award, the Omega Lifetime Achievement Award, and the World Trader of the Year Award, and has been featured in numerous media outlets, including the Wall Street Journal, Forbes, Fortune, CNBC, and Fox News.

“Buy good stocks at good times.

(The Right Stock at the Right Time)”

So what is Larry Williams' principle of investing? Ultimately, it's about buying good stocks at the right time.

He explains these two simple principles very clearly so that anyone can apply them.

What makes a good stock? A stock with excellent PER, PBR, PCR, PSR, dividend yield, ROE, and 12-month growth rate indicators.

When is a good time? It's when these three signals align: the 10-year pattern, the 4-year pattern, and October.

He said it was all 'so easy even a child could do it'.

If you read this book, you will find that this is truly true.

◆ Contents of this book ◆

· How to instantly understand the value of your stock

· Recurring stock market patterns

· The special relationship between seasonality and stock prices

· Factors that shape investment psychology and how to measure it

· How to predict the stock market using the bond market

· Why you should avoid buying popular theme stocks

· Why a consistent focus on values is a smart strategy

How to buy stocks at a discount

· Various money management methods

Industries to watch during market recovery

Entering the bottom of the market

How to Ride the Sure-To-Be Rebound

This book provides readers with clear guidelines on which stocks to buy and when.

All you have to do is pick good stocks as Larry Williams suggests and invest when the odds are in your favor.

We conclude the book introduction with a note from Kang Hwan-guk, a leading Korean quantitative investor and author with a net worth of 6 billion won, who reviewed this book.

“I admit it.

I learned a lot of my investing theories from Larry Williams' books.

It is safe to say that Kang Hwan-guk is someone who applies the contents of this book directly to real life.

If you had bought this book 20 years ago and invested the same amount, your principal would have increased 184 times.

If you just follow Williams' guidelines and leave everything else aside, you will become rich.

What are you waiting for? Read now and start investing! _FIRE Tribe Quant Investor Kang Hwan-guk

Never invest in stocks without reading this book!

★★★ Timing the Buying Method of the World Investment Competition's Record-Breaking 110x Return Holder ★★★

★★★ Trading techniques that generated over $1 million in profits during live lectures ★★★

★★★ Father of actress Michelle Williams, who won a world investment competition at age 17 ★★★

The living history of stock investment,

Who is Larry Williams?

Larry Williams is a living example of stock investing, having successfully invested for 60 years.

He is also a person who holds many great and rare records.

In 1987, he set a new record by turning $10,000 into $1.1 million in 12 months at the Robbins Futures Trading World Cup, a global investment competition.

That record remains unbroken even after 30 years.

What's even more surprising is that exactly 10 years later, his daughter, Michelle Williams, also a Golden Globe-winning actress, won the same investment competition at the age of 17.

This is a record that perfectly supports the 10-year cycle theory that Williams advocates.

He is also famous for successfully completing the 'Larry Williams Million Dollar Challenge'.

The challenge was to make one million dollars through actual trading profits over a total of 21 live lectures, and he successfully completed the challenge, earning $1.25 million (approximately 1.6 billion won).

In the United States, there is a 'Larry Williams Day'.

Because the mayor of San Diego declared October 6, 2002, Larry Williams Day.

October 2022 coincided with the three lows of Larry Williams's 10-year cycle, 4-year cycle, and October, and the U.S. stock market actually bottomed then.

Those who believed his words and started investing on 'Larry Williams Day' were able to achieve success.

He has also received several investment-related awards, including the Futures Masters Award, the Omega Lifetime Achievement Award, and the World Trader of the Year Award, and has been featured in numerous media outlets, including the Wall Street Journal, Forbes, Fortune, CNBC, and Fox News.

“Buy good stocks at good times.

(The Right Stock at the Right Time)”

So what is Larry Williams' principle of investing? Ultimately, it's about buying good stocks at the right time.

He explains these two simple principles very clearly so that anyone can apply them.

What makes a good stock? A stock with excellent PER, PBR, PCR, PSR, dividend yield, ROE, and 12-month growth rate indicators.

When is a good time? It's when these three signals align: the 10-year pattern, the 4-year pattern, and October.

He said it was all 'so easy even a child could do it'.

If you read this book, you will find that this is truly true.

◆ Contents of this book ◆

· How to instantly understand the value of your stock

· Recurring stock market patterns

· The special relationship between seasonality and stock prices

· Factors that shape investment psychology and how to measure it

· How to predict the stock market using the bond market

· Why you should avoid buying popular theme stocks

· Why a consistent focus on values is a smart strategy

How to buy stocks at a discount

· Various money management methods

Industries to watch during market recovery

Entering the bottom of the market

How to Ride the Sure-To-Be Rebound

This book provides readers with clear guidelines on which stocks to buy and when.

All you have to do is pick good stocks as Larry Williams suggests and invest when the odds are in your favor.

We conclude the book introduction with a note from Kang Hwan-guk, a leading Korean quantitative investor and author with a net worth of 6 billion won, who reviewed this book.

“I admit it.

I learned a lot of my investing theories from Larry Williams' books.

It is safe to say that Kang Hwan-guk is someone who applies the contents of this book directly to real life.

If you had bought this book 20 years ago and invested the same amount, your principal would have increased 184 times.

If you just follow Williams' guidelines and leave everything else aside, you will become rich.

What are you waiting for? Read now and start investing! _FIRE Tribe Quant Investor Kang Hwan-guk

GOODS SPECIFICS

- Date of issue: August 30, 2023

- Page count, weight, size: 332 pages | 152*225*19mm

- ISBN13: 9791169850391

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)