Betrayal of Investment

|

Description

Book Introduction

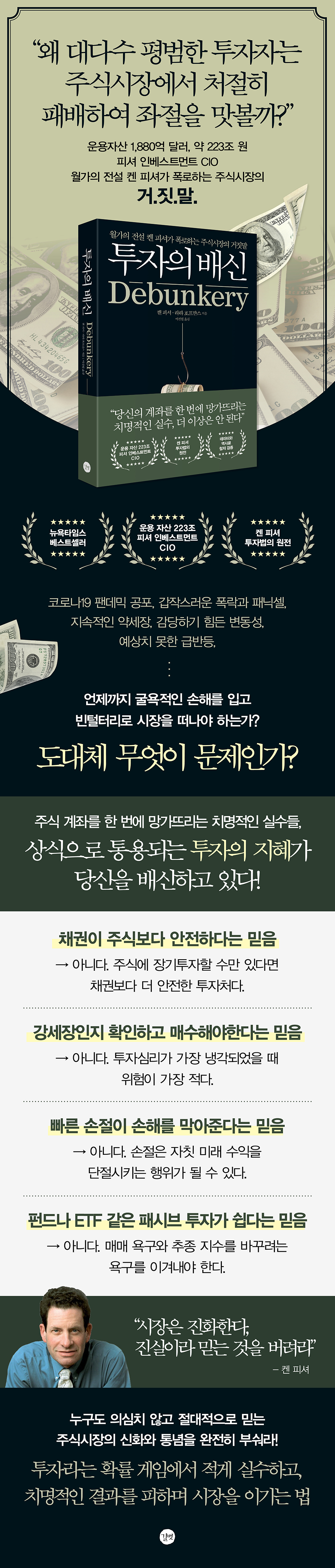

The widely accepted "stock market wisdom" is backfiring on you.

Stock market prediction No. 1 Ken Fisher reveals the lies of the stock market!

New York Times bestseller

An eternal classic for stock investors

Data thoroughly verifies incorrect investment methods believed to be common sense.

Do you believe bonds are safer than stocks? Do you only buy after a bull market is confirmed? Do you expect average returns? Do you believe that cutting losses quickly prevents greater losses? Or do you find ETFs or index investing easier? Do you find price-to-earnings ratios (P/E) or volatility indices helpful in your investment decisions? Do you monitor unemployment rates, oil prices, or other social indicators when making stock investments? Anyone who invests in stocks will undoubtedly answer "yes" to one or two of these questions.

This is because it is the absolute 'wisdom' of the stock market that everyone has believed in for a long time and is also 'investment common sense' that is commonly found in books and on the Internet.

But what if this is actually just a market superstition clouding your judgment? What if you're not experiencing success because you're following the crowd, blindly believing it's safe?

Ken Fisher, author of "The Return of the Investment Man," is a Wall Street legend and the CIO (Chief Investment Officer) of Fisher Investments, which manages $188 billion (approximately 223 trillion won) in assets.

His father, Philip Fisher, is known as the 'Father of Growth Stocks' and has had a profound influence on stock investors around the world, including Warren Buffett.

Ken Fisher emphasizes that we should not immediately accept anything that passes for "truth" in the marketplace.

In this book, he explains why we fail or fail to achieve sufficient investment performance.

The cause is found in the mistake of believing something that is not true as true or not questioning it enough.

So, he says, you need to be able to question what everyone else believes to be true, and look at data and a long-term perspective to become one of the few investors who beat the market.

He shows how he verifies 50 popular stock market myths and challenges readers to put them into practice.

Because the clearer you see the world, the more powerful you become.

If you have the courage and guts to avoid the mistakes most people make and dispel superstitions, you're already well on your way to becoming a successful investor.

Stock market prediction No. 1 Ken Fisher reveals the lies of the stock market!

New York Times bestseller

An eternal classic for stock investors

Data thoroughly verifies incorrect investment methods believed to be common sense.

Do you believe bonds are safer than stocks? Do you only buy after a bull market is confirmed? Do you expect average returns? Do you believe that cutting losses quickly prevents greater losses? Or do you find ETFs or index investing easier? Do you find price-to-earnings ratios (P/E) or volatility indices helpful in your investment decisions? Do you monitor unemployment rates, oil prices, or other social indicators when making stock investments? Anyone who invests in stocks will undoubtedly answer "yes" to one or two of these questions.

This is because it is the absolute 'wisdom' of the stock market that everyone has believed in for a long time and is also 'investment common sense' that is commonly found in books and on the Internet.

But what if this is actually just a market superstition clouding your judgment? What if you're not experiencing success because you're following the crowd, blindly believing it's safe?

Ken Fisher, author of "The Return of the Investment Man," is a Wall Street legend and the CIO (Chief Investment Officer) of Fisher Investments, which manages $188 billion (approximately 223 trillion won) in assets.

His father, Philip Fisher, is known as the 'Father of Growth Stocks' and has had a profound influence on stock investors around the world, including Warren Buffett.

Ken Fisher emphasizes that we should not immediately accept anything that passes for "truth" in the marketplace.

In this book, he explains why we fail or fail to achieve sufficient investment performance.

The cause is found in the mistake of believing something that is not true as true or not questioning it enough.

So, he says, you need to be able to question what everyone else believes to be true, and look at data and a long-term perspective to become one of the few investors who beat the market.

He shows how he verifies 50 popular stock market myths and challenges readers to put them into practice.

Because the clearer you see the world, the more powerful you become.

If you have the courage and guts to avoid the mistakes most people make and dispel superstitions, you're already well on your way to becoming a successful investor.

- You can preview some of the book's contents.

Preview

index

Acknowledgements

Preface: Markets Evolve, Let Go of What You Think is True

Part 1: The Superstitions That Pervade the Market Are Striking You

Betrayal of Investment 01.

Bonds provide more stable returns than stocks.

Betrayal of Investment 02.

If you invest and sleep well, it's a good investment.

Betrayal of Investment 03.

Retirees should invest conservatively.

Betrayal of Investment 04.

Asset allocation should vary depending on age.

Betrayal of Investment 05.

When investing, the market rate of return must be guaranteed.

Betrayal of Investment 06.

You can preserve and grow your assets at the same time.

Betrayal of Investment 07.

Your intuition is always right

Betrayal of Investment 08.

One crash and your investment is over.

Betrayal of Investment 09.

You should enter after confirming that the trend has changed.

Investment Betrayal 10.

Growth stocks always deliver the best returns.

Investment Betrayal 11.

You can't help but fall for a skilled conman.

Part 2: Wall Street Wisdom Targets Your Money

Investment Betrayal 12.

Quick loss cutting prevents big losses

Betrayal of Investment 13.

Covered calls are a good strategy to avoid risk.

Betrayal of Investment 14.

Reduce risk and increase returns with fixed-amount split investments.

Betrayal of Investment 15.

Variable annuities are safe and profitable insurance.

Betrayal of Investment 16.

Index-linked pensions are better than standard pensions.

Betrayal of Investment 17.

Passive investing is easy enough for beginners.

Betrayal of Investment 18.

No-fee funds help boost returns

Betrayal of Investment 19.

The beta coefficient can be used to determine investment risk.

Investment Betrayal 20.

Stock risk premiums make it easy to predict future returns.

Investment Betrayal 21.

Buy when the volatility index is high and sell when it is low.

Betrayal of Investment 22.

The consumer confidence index is an important indicator of the direction of the economy.

Betrayal of Investment 23.

Investors should check the Dow Jones Industrial Average every day.

Part 3: "Investment Sense" Is Ruining Your Account

Betrayal of Investment 24.

January's market determines the stock market for the year.

Betrayal of Investment 25.

Sold in May and bought in fall

Investment Betrayal #26: The lower the PER, the lower the risk.

Investment Betrayal 27.

A strong dollar is good for the stock market.

Betrayal of Investment 28.

Don't fight the Federal Reserve

Betrayal of Investment 29.

Build your retirement savings with interest and dividends for safety.

Investment Betrayal 30.

Buy CDs to secure cash flow

Investment Betrayal 31.

When the baby boomers retire, the stock market will be finished.

Investment Betrayal 32.

Invest intensively to significantly increase your assets.

Part 4: History's Lessons Lead You to Loss

Investment Betrayal 33.

A budget surplus is good for the economy and the stock market.

Investment Betrayal 34.

The recession will end only when the unemployment rate falls.

Investment Betrayal 35.

Gold is always a safe haven asset.

Investment Betrayal 36.

The stock market loves tax cuts.

Investment Betrayal 37.

Oil prices and stock prices move in opposite directions.

Investment Betrayal 38.

The pandemic is making the market sick.

Investment Betrayal 39.

The economy recovers when consumers spend money.

Investment Betrayal 40.

The president's term has nothing to do with the stock market.

Investment Betrayal 41.

Certain political parties are more beneficial to the stock market.

Betrayal of Investment 42.

If it rises too much, it will inevitably fall.

Part 5: The US Stock Market Alone Isn't Enough

Betrayal of Investment 43.

Foreign and U.S. stock markets move separately.

Betrayal of Investment 44.

Diversifying your investments in the US stock market is sufficient.

Betrayal of Investment 45.

The national debt darkens America's future.

Betrayal of Investment 46.

The United States cannot manage its national debt.

Investment Betrayal 47.

China's massive holdings of US Treasury bonds are a weakness.

Investment Betrayal 48.

The trade deficit is a serious negative for the stock market.

Investment Betrayal 49.

The stock market rises only when the economy grows.

Investment Betrayal 50.

Terrorism paralyzes markets

Detailed image

Into the book

In conclusion, if the investment period is long, such as 20 to 30 years, it is unlikely that government bonds will outperform stocks in terms of returns, and even if they do, the difference will not be significant.

Would you go to a Las Vegas casino and bet on a game that offers a 3.7-to-1 payout with a 97 percent chance of winning, or on a game that offers a 1.1-to-1 payout with a 3 percent chance of winning? You'd obviously bet on the former.

But strangely enough, many people have trouble making such easy decisions when investing in stocks.

---「Investment Betrayal 02.

"Investing and sleeping well is a good investment"

I'm not trying to criticize PER as useless.

However, it is not an indicator that can predict the return of the market or stocks.

Like all other commonly used valuation metrics, the P/E ratio lost its predictive power long ago when it became readily available online.

As we've noted before, markets are incredibly efficient at devaluing widely known information.

---From "Investment Betrayal 26. The lower the PER, the lower the risk"

Even popular rumors floating around in the market follow trends.

The popular belief that oil and stock prices move in opposite directions gained popularity in recent years, but died down somewhat in 2010.

However, if oil prices rise quickly or for a long time, it will rear its head again.

People tend to believe that high oil prices are bad news for the stock market.

That is, I believe that an inverse correlation exists, such that when oil prices rise, the stock market falls.

But this belief is nothing more than superstition.

---「Investment Betrayal 37.

From "Oil prices and stock prices move in opposite directions"

People usually don't check foreign or historical sources.

Even though other advanced countries had higher levels of national debt than the United States, they did not go bankrupt.

So, some might ask, what about the Greek crisis of 2008, triggered by excessive national debt?

Of course, excessive national debt can be a problem.

However, I have not been able to find a level of national debt that can be clearly defined as "excessive" for developed countries, including the United States, historically.

---「Investment Betrayal 45.

From "National Debt Darkens America's Future"

From "National Debt Darkens America's Future"

Publisher's Review

“Markets evolve. Let go of what you once believed to be true.”

Completely shatter the myths that are trapping your investments into failure!

Let's recall the stock market crash in March 2020, triggered by fears about the COVID-19 pandemic.

The sudden crash, the resulting panic selling, and the continued bear market completely discouraged stock investors.

When stock prices fall without end, people who cannot afford the high volatility often convert their stocks into cash, suffering huge losses.

(This usually happens when the stock price hits bottom and rebounds sharply.) After that, the market rebounds sharply again, forming a V-shape, and investors, judging that it is a bull market, wait for an opportunity to enter, and then return to the market again, convinced that it is a bull market.

(This usually happens at the end of a bull market.) Doesn't something feel wrong? That's where the problem lies.

Wrong thinking can lead to investment mistakes, and failure to adapt to the rapidly changing market can lead to catastrophic losses that are difficult to recover.

What if, at a time like this, we had known the simple truth: "The stock market always rises more than it falls, and ultimately, it continues to rise over time." At the very least, we wouldn't have felt the excruciating pain of losses, and while the extent of gains may vary from investor to investor, we could have shared in the fruits of the upswing.

Moreover, someone else may have seized the opportunity and embarked on a new investment journey earlier.

Understanding that a single wrong mistake can ruin an entire investment, it's important to identify and examine where your investment mistakes stem from.

Knowing how to "reduce mistakes" in the complex capital and stock markets greatly increases the "probability" of becoming a successful investor.

"Investment Betrayal" clearly shows how 50 common market misconceptions can lead to fatal investment mistakes.

Ken Fisher frees readers from the trap of superstition by providing historical data, logical rebuttals, and objective evidence to unravel the wisdom of the market that no one questions or takes for granted.

By recognizing that widely accepted "investment wisdom" is betraying you, you can gain a new, broader perspective on stock investing and become a successful investor.

To become an investor with a higher probability of success, break free from the comfort of following the crowd!

Learn Ken Fisher's "Market-Beat Eye" and get on the fast track to success.

Bonds are generally believed to be safer than stocks, but if you can invest for the long term, stocks are a safer investment than bonds.

Historically, it has been like that.

There's an adage that says to check if a market is bullish before buying, but in reality, risk is lowest when investor sentiment is at its coldest.

People usually try to predict average returns, but in reality, typical annual returns are extreme.

Even those new to investing believe that cutting losses prevents losses, but it's important to remember that cutting losses incorrectly can cut off future profits.

People who find direct investing difficult often assume passive investing is inherently easy, but they should understand that it's actually easier if you resist the urge to trade or change the index you track.

As such, this book does not present a systematic methodology for generating returns higher than the market.

It doesn't even give you specific details on how to invest.

Ken Fisher simply exposes common misconceptions and myths about investing and teaches readers to critically examine and validate the markets.

Helps you overcome the impulse of intuition.

It awakens us to shake off the impatience to get the timing right.

By viewing the market through the four categories that Ken Fisher discusses, readers can much more easily dispel the "myths" that permeate the market.

Through this training, you can become an investor who beats the market.

Even if something worked at one time, you shouldn't expect it to continue to work.

By breaking free from such complacency and comfort, examining market myths, and striving to reduce mistakes driven by human instinct, we can develop a vision that can overcome the market.

Considering that almost everyone jumps into the stock market without any critique or verification, you're lucky to have come across this book.

Completely shatter the myths that are trapping your investments into failure!

Let's recall the stock market crash in March 2020, triggered by fears about the COVID-19 pandemic.

The sudden crash, the resulting panic selling, and the continued bear market completely discouraged stock investors.

When stock prices fall without end, people who cannot afford the high volatility often convert their stocks into cash, suffering huge losses.

(This usually happens when the stock price hits bottom and rebounds sharply.) After that, the market rebounds sharply again, forming a V-shape, and investors, judging that it is a bull market, wait for an opportunity to enter, and then return to the market again, convinced that it is a bull market.

(This usually happens at the end of a bull market.) Doesn't something feel wrong? That's where the problem lies.

Wrong thinking can lead to investment mistakes, and failure to adapt to the rapidly changing market can lead to catastrophic losses that are difficult to recover.

What if, at a time like this, we had known the simple truth: "The stock market always rises more than it falls, and ultimately, it continues to rise over time." At the very least, we wouldn't have felt the excruciating pain of losses, and while the extent of gains may vary from investor to investor, we could have shared in the fruits of the upswing.

Moreover, someone else may have seized the opportunity and embarked on a new investment journey earlier.

Understanding that a single wrong mistake can ruin an entire investment, it's important to identify and examine where your investment mistakes stem from.

Knowing how to "reduce mistakes" in the complex capital and stock markets greatly increases the "probability" of becoming a successful investor.

"Investment Betrayal" clearly shows how 50 common market misconceptions can lead to fatal investment mistakes.

Ken Fisher frees readers from the trap of superstition by providing historical data, logical rebuttals, and objective evidence to unravel the wisdom of the market that no one questions or takes for granted.

By recognizing that widely accepted "investment wisdom" is betraying you, you can gain a new, broader perspective on stock investing and become a successful investor.

To become an investor with a higher probability of success, break free from the comfort of following the crowd!

Learn Ken Fisher's "Market-Beat Eye" and get on the fast track to success.

Bonds are generally believed to be safer than stocks, but if you can invest for the long term, stocks are a safer investment than bonds.

Historically, it has been like that.

There's an adage that says to check if a market is bullish before buying, but in reality, risk is lowest when investor sentiment is at its coldest.

People usually try to predict average returns, but in reality, typical annual returns are extreme.

Even those new to investing believe that cutting losses prevents losses, but it's important to remember that cutting losses incorrectly can cut off future profits.

People who find direct investing difficult often assume passive investing is inherently easy, but they should understand that it's actually easier if you resist the urge to trade or change the index you track.

As such, this book does not present a systematic methodology for generating returns higher than the market.

It doesn't even give you specific details on how to invest.

Ken Fisher simply exposes common misconceptions and myths about investing and teaches readers to critically examine and validate the markets.

Helps you overcome the impulse of intuition.

It awakens us to shake off the impatience to get the timing right.

By viewing the market through the four categories that Ken Fisher discusses, readers can much more easily dispel the "myths" that permeate the market.

Through this training, you can become an investor who beats the market.

Even if something worked at one time, you shouldn't expect it to continue to work.

By breaking free from such complacency and comfort, examining market myths, and striving to reduce mistakes driven by human instinct, we can develop a vision that can overcome the market.

Considering that almost everyone jumps into the stock market without any critique or verification, you're lucky to have come across this book.

GOODS SPECIFICS

- Publication date: October 27, 2021

- Page count, weight, size: 396 pages | 716g | 152*225*30mm

- ISBN13: 9791165217228

- ISBN10: 1165217228

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)