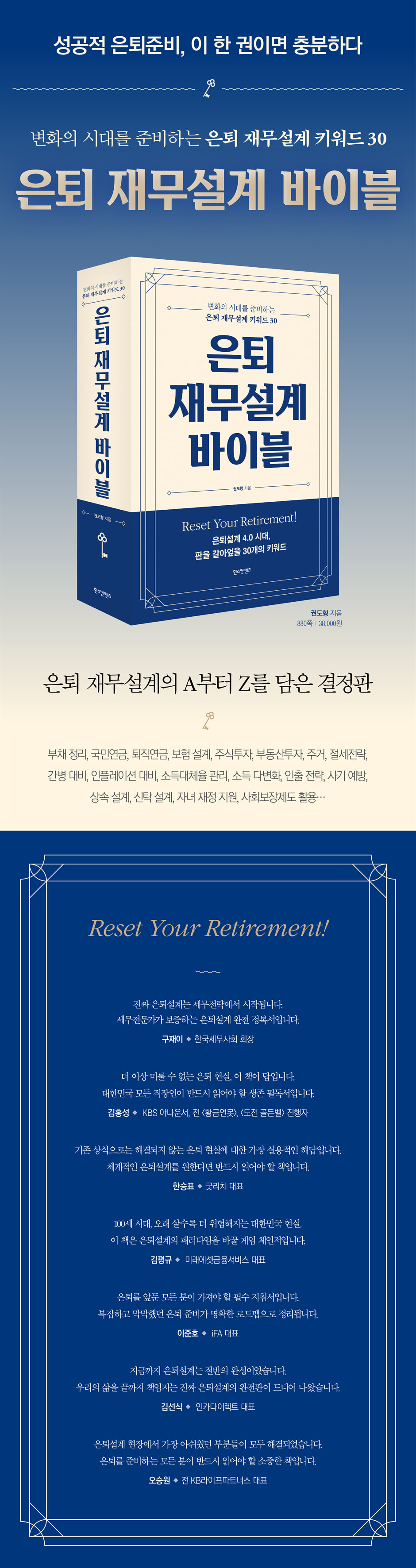

Retirement Financial Planning Bible

|

Description

Book Introduction

Responding to the era of longevity and disease-free life with a new paradigm of retirement planning 4.0 strategy!

"The Retirement Financial Planning Bible" contains all the knowledge and information on retirement financial planning, so that this one book is enough to prepare for retirement.

This voluminous 880-page book introduces retirement financial planning strategies using 30 key keywords, ranging from goal setting and fund management, savings and stock and real estate investment, pension (national pension, retirement pension, private pension) and insurance design, nursing care preparation, inheritance and trusts, income diversification strategies, financial support for children, and fraud prevention.

Through digital innovation and sustainable personal finance strategies, we are approaching retirement planning with greater flexibility and practicality.

It will be a useful guide not only for those preparing for retirement, but also for professionals who consult and help others with retirement planning.

"The Retirement Financial Planning Bible" contains all the knowledge and information on retirement financial planning, so that this one book is enough to prepare for retirement.

This voluminous 880-page book introduces retirement financial planning strategies using 30 key keywords, ranging from goal setting and fund management, savings and stock and real estate investment, pension (national pension, retirement pension, private pension) and insurance design, nursing care preparation, inheritance and trusts, income diversification strategies, financial support for children, and fraud prevention.

Through digital innovation and sustainable personal finance strategies, we are approaching retirement planning with greater flexibility and practicality.

It will be a useful guide not only for those preparing for retirement, but also for professionals who consult and help others with retirement planning.

index

Introduction: Retirement Planning 4.0: Preparing for an Era of Change

Keyword 1.

Life goals after retirement

Keyword 2.

Rational consumption and budget management

Keyword 3.

Debt Management and Liquidation Strategies

Keyword 4.

Management of retirement pensions

Keyword 5.

Savings and investment strategies tailored to your retirement needs

Keyword 6.

Evaluation of all subscribed pensions

Keyword 7.

Evaluation of all insurance policies subscribed

Keyword 8.

Establishing an investment strategy through the essence of stock investment

Keyword 9.

Establishing an investment strategy through the essence of real estate investment

Keyword 10.

Post-retirement housing plans

Keyword 11.

Asset-Liability Statement at the Time of Retirement

Keyword 12.

Pension GAP Analysis and Response Strategies

Keyword 13.

Planning your money needs after retirement

Keyword 14.

National Health Insurance Management Plan

Keyword 15.

Retirement Tax Planning Optimization Plan

Keyword 16.

Long-term care and medical expense planning

Keyword 17.

emergency reserve fund

Keyword 18.

Inflation-prevention strategies

Keyword 19.

Response strategy in case of insurance accident

Keyword 20.

Asset securitization strategy

Keyword 21.

Income replacement rate and regular cash flow management after retirement

Keyword 22.

Post-retirement income diversification strategies

Keyword 23.

Pension withdrawal strategy

Keyword 24.

Response strategies to changes in the value of real estate holdings

Keyword 25.

Fraud Prevention and Response Strategies

Keyword 26.

Inheritance planning

Keyword 27.

Trust design

Keyword 28.

Use a retirement planning expert

Keyword 29.

Utilization of social security systems

Keyword 30.

Child Financial Support Strategies

In conclusion

Acknowledgements

New concepts introduced in this book

Keyword 1.

Life goals after retirement

Keyword 2.

Rational consumption and budget management

Keyword 3.

Debt Management and Liquidation Strategies

Keyword 4.

Management of retirement pensions

Keyword 5.

Savings and investment strategies tailored to your retirement needs

Keyword 6.

Evaluation of all subscribed pensions

Keyword 7.

Evaluation of all insurance policies subscribed

Keyword 8.

Establishing an investment strategy through the essence of stock investment

Keyword 9.

Establishing an investment strategy through the essence of real estate investment

Keyword 10.

Post-retirement housing plans

Keyword 11.

Asset-Liability Statement at the Time of Retirement

Keyword 12.

Pension GAP Analysis and Response Strategies

Keyword 13.

Planning your money needs after retirement

Keyword 14.

National Health Insurance Management Plan

Keyword 15.

Retirement Tax Planning Optimization Plan

Keyword 16.

Long-term care and medical expense planning

Keyword 17.

emergency reserve fund

Keyword 18.

Inflation-prevention strategies

Keyword 19.

Response strategy in case of insurance accident

Keyword 20.

Asset securitization strategy

Keyword 21.

Income replacement rate and regular cash flow management after retirement

Keyword 22.

Post-retirement income diversification strategies

Keyword 23.

Pension withdrawal strategy

Keyword 24.

Response strategies to changes in the value of real estate holdings

Keyword 25.

Fraud Prevention and Response Strategies

Keyword 26.

Inheritance planning

Keyword 27.

Trust design

Keyword 28.

Use a retirement planning expert

Keyword 29.

Utilization of social security systems

Keyword 30.

Child Financial Support Strategies

In conclusion

Acknowledgements

New concepts introduced in this book

Detailed image

Into the book

Now we need to come up with a new life cycle model.

This model includes the transition to retirement and the emergence of long-term care (longevity with illness, longevity without money).

The new lifecycle model includes the following steps:

· Retirement Transition: This is the preparatory stage of several years before retirement, and includes not only financial planning but also mental and social preparation.

· Active retirement: The stage immediately after retirement where people become active and seek new hobbies or jobs.

· Stable retirement: A stage where you can live a more stable life and focus on health and financial management.

· Long-term care period: A stage for preparing for longevity (living with a long-term illness) or longevity without pension (depletion of pension funds).

--- p.39

Here are some reasons why changing insurance products is important during the retirement transition:

First, because financial burden increases as income decreases after retirement.

Before retirement, you have a steady income, but after retirement, you have to rely on pensions or savings.

Therefore, it is necessary to adjust insurance premiums to reduce the financial burden.

Second, after retirement, health problems are likely to occur frequently, which will likely increase the burden of medical expenses.

Therefore, it is important to change to an insurance product that sufficiently covers medical expenses.

Third, existing insurance products may not fit your lifestyle after retirement.

For example, a product that covers living expenses or medical expenses may be more suitable than a product that covers a home loan or children's education expenses.

Finally, new insurance products may offer more favorable terms depending on legal changes and market trends.

Therefore, it is important to reevaluate your insurance products and change them if necessary at the retirement transition point.

--- p.177

After retirement, unexpected taxes may arise.

Among them, it is important to understand the 12 major taxes.

First, retirement income tax is a tax that occurs when you receive retirement benefits.

Second, pension income tax is levied on income generated from national pension, retirement pension, and private pension.

Third, financial income tax is levied on interest and dividend income, and may be subject to comprehensive taxation of financial income.

Fourth, capital gains tax is applied when buying and selling real estate and stocks, and fifth, rental income tax is applied to real estate rental income.

Sixth, miscellaneous income tax is levied on irregular income such as lottery winnings or prize money.

Seventh, property tax and eighth, comprehensive real estate tax are continuously levied on real estate owners.

Ninth, gift tax is imposed when assets are gifted, and tenth, inheritance tax is imposed when assets are inherited.

Eleventh, local health insurance premiums can be adjusted based on retirement income, and twelfth, resident taxes are levied based on income and property taxes.

It is necessary to understand these taxes and plan in advance.

--- p.393

There are many successful cases of tax savings achieved by adjusting pension receipt limits.

One retiree initially faced a high tax burden when receiving both retirement pension and personal pension simultaneously, but adjusted the timing of receipt after receiving expert advice.

As a result, the tax burden was significantly reduced and the sustainability of pension assets was increased in the long term.

These cases show how important it is to set a proper pension receipt limit for tax savings.

By reducing your tax burden, you can keep your pension assets in use longer, which plays a major role in strengthening your financial security in retirement.

When setting pension limits, you should consider not only tax savings but also long-term financial stability.

To achieve this, it is important to regularly review your economic situation, personal health, and changes in living expenses, and adjust your benefit limit if necessary.

--- p.631

After retirement, the financial relationship between parents and children needs to be redefined in a new way.

Japan's 'intergenerational financial sharing model' is a useful example for this.

This model clearly divides financial responsibilities between parents and children, helping parents avoid placing an undue financial burden on their children after retirement.

For example, parents aim to manage their retirement assets, while children aim to live independently and not be dependent on their parents.

This approach helps reduce intergenerational conflict and strengthen trust within families.

A 2023 Japanese survey found that families who adopted this financial sharing model experienced less financial stress in retirement and had a clearer understanding of each other's financial roles.

This model includes the transition to retirement and the emergence of long-term care (longevity with illness, longevity without money).

The new lifecycle model includes the following steps:

· Retirement Transition: This is the preparatory stage of several years before retirement, and includes not only financial planning but also mental and social preparation.

· Active retirement: The stage immediately after retirement where people become active and seek new hobbies or jobs.

· Stable retirement: A stage where you can live a more stable life and focus on health and financial management.

· Long-term care period: A stage for preparing for longevity (living with a long-term illness) or longevity without pension (depletion of pension funds).

--- p.39

Here are some reasons why changing insurance products is important during the retirement transition:

First, because financial burden increases as income decreases after retirement.

Before retirement, you have a steady income, but after retirement, you have to rely on pensions or savings.

Therefore, it is necessary to adjust insurance premiums to reduce the financial burden.

Second, after retirement, health problems are likely to occur frequently, which will likely increase the burden of medical expenses.

Therefore, it is important to change to an insurance product that sufficiently covers medical expenses.

Third, existing insurance products may not fit your lifestyle after retirement.

For example, a product that covers living expenses or medical expenses may be more suitable than a product that covers a home loan or children's education expenses.

Finally, new insurance products may offer more favorable terms depending on legal changes and market trends.

Therefore, it is important to reevaluate your insurance products and change them if necessary at the retirement transition point.

--- p.177

After retirement, unexpected taxes may arise.

Among them, it is important to understand the 12 major taxes.

First, retirement income tax is a tax that occurs when you receive retirement benefits.

Second, pension income tax is levied on income generated from national pension, retirement pension, and private pension.

Third, financial income tax is levied on interest and dividend income, and may be subject to comprehensive taxation of financial income.

Fourth, capital gains tax is applied when buying and selling real estate and stocks, and fifth, rental income tax is applied to real estate rental income.

Sixth, miscellaneous income tax is levied on irregular income such as lottery winnings or prize money.

Seventh, property tax and eighth, comprehensive real estate tax are continuously levied on real estate owners.

Ninth, gift tax is imposed when assets are gifted, and tenth, inheritance tax is imposed when assets are inherited.

Eleventh, local health insurance premiums can be adjusted based on retirement income, and twelfth, resident taxes are levied based on income and property taxes.

It is necessary to understand these taxes and plan in advance.

--- p.393

There are many successful cases of tax savings achieved by adjusting pension receipt limits.

One retiree initially faced a high tax burden when receiving both retirement pension and personal pension simultaneously, but adjusted the timing of receipt after receiving expert advice.

As a result, the tax burden was significantly reduced and the sustainability of pension assets was increased in the long term.

These cases show how important it is to set a proper pension receipt limit for tax savings.

By reducing your tax burden, you can keep your pension assets in use longer, which plays a major role in strengthening your financial security in retirement.

When setting pension limits, you should consider not only tax savings but also long-term financial stability.

To achieve this, it is important to regularly review your economic situation, personal health, and changes in living expenses, and adjust your benefit limit if necessary.

--- p.631

After retirement, the financial relationship between parents and children needs to be redefined in a new way.

Japan's 'intergenerational financial sharing model' is a useful example for this.

This model clearly divides financial responsibilities between parents and children, helping parents avoid placing an undue financial burden on their children after retirement.

For example, parents aim to manage their retirement assets, while children aim to live independently and not be dependent on their parents.

This approach helps reduce intergenerational conflict and strengthen trust within families.

A 2023 Japanese survey found that families who adopted this financial sharing model experienced less financial stress in retirement and had a clearer understanding of each other's financial roles.

--- p.868

Publisher's Review

Retirement planning in Korea can be broadly divided into four generations based on its development process.

The first generation began in earnest with the introduction of the National Pension Service in 1988.

Retirement planning during this period primarily aimed to ensure a basic retirement life centered on national pension and retirement benefits.

However, due to insufficient consideration of population structure changes such as aging and low birth rates, the government has faced limitations in providing sufficient retirement planning with only public pensions and retirement benefits.

Accordingly, awareness has spread that voluntary preparation at the individual level is necessary.

In the second generation, which emerged to overcome these limitations, the importance of personal financial management was highlighted.

There has been active effort to utilize various means of increasing assets, such as personal pensions, stocks, and real estate, and a trend has emerged toward securing multiple sources of income and establishing more proactive financial plans.

However, by focusing too much on increasing assets, I lost balance and failed to plan my entire life.

There have also been frequent instances of losing assets due to investment failures, excessive risk-taking, etc.

Third-generation retirement planning emphasized a balance between financial and non-financial factors.

The Korea Retirement Planning Institute, founded by the author, led this trend.

Beyond simple asset accumulation, we pursued a holistic retirement plan that prioritized quality of life, and incorporated a comprehensive approach that included various non-financial elements such as health, social relationships, time management, career development, and self-realization.

This has led to a trend of seeking a richer and more meaningful direction for life after retirement.

The fourth generation, or "retirement planning 4.0," is defined as a paradigm shift reflecting the new era's changes and crisis situations.

First, unprecedented global risks like the COVID-19 pandemic have had a profound impact on not only the overall economy but also individual lives.

With the global economic downturn and growing uncertainty, many individuals' retirements have not gone as planned, necessitating a comprehensive review of existing financial arrangements.

There is an urgent need to develop a flexible strategy that can actively respond to macroeconomic variables such as inflation.

Moreover, modern society faces the dual risk of old age: 'longevity with illness' and 'longevity without war'.

Although the average life expectancy of Koreans has reached 83 years, long-term survival with chronic diseases is becoming more common than maintaining a healthy old age.

This has led to a continued rise in medical, nursing, and healthcare costs, making them a key factor to consider when developing retirement financial plans.

Additionally, there is a growing number of cases of "bankrupts" who have lost their financial foundation due to factors such as excessive spending, business and investment failures, and fraud without sufficient assets.

The risk of poverty in old age can be exacerbated, especially if you rely too heavily on real estate assets and neglect pension and financial investment preparation.

Moreover, as retirement is no longer understood as a single event as in the past, but rather as a gradual, multi-stage transition process, the existing life cycle hypothesis no longer reflects reality.

The emergence of the 'retirement transition period' is redefining retirement as a continuation of change and transition, rather than a career break.

Meanwhile, women tend to live, on average, about 10 years longer than men, giving them a significantly longer period of time to maintain financial independence after the death of their spouse.

Accordingly, women's preparation for old age is more urgent and requires more detailed and long-term planning.

These realistic challenges and structural changes strongly suggest the need for the 'Era of Retirement Planning 4.0.'

With the digital transformation, more realistic and flexible retirement plans must be developed based on sustainable financial strategies.

"The Retirement Financial Planning Bible" presents new concepts and terminology that reflect these changing times and introduces 30 key keywords for effective retirement planning methodology, contributing to the development of practical retirement strategies suited to modern society.

The first generation began in earnest with the introduction of the National Pension Service in 1988.

Retirement planning during this period primarily aimed to ensure a basic retirement life centered on national pension and retirement benefits.

However, due to insufficient consideration of population structure changes such as aging and low birth rates, the government has faced limitations in providing sufficient retirement planning with only public pensions and retirement benefits.

Accordingly, awareness has spread that voluntary preparation at the individual level is necessary.

In the second generation, which emerged to overcome these limitations, the importance of personal financial management was highlighted.

There has been active effort to utilize various means of increasing assets, such as personal pensions, stocks, and real estate, and a trend has emerged toward securing multiple sources of income and establishing more proactive financial plans.

However, by focusing too much on increasing assets, I lost balance and failed to plan my entire life.

There have also been frequent instances of losing assets due to investment failures, excessive risk-taking, etc.

Third-generation retirement planning emphasized a balance between financial and non-financial factors.

The Korea Retirement Planning Institute, founded by the author, led this trend.

Beyond simple asset accumulation, we pursued a holistic retirement plan that prioritized quality of life, and incorporated a comprehensive approach that included various non-financial elements such as health, social relationships, time management, career development, and self-realization.

This has led to a trend of seeking a richer and more meaningful direction for life after retirement.

The fourth generation, or "retirement planning 4.0," is defined as a paradigm shift reflecting the new era's changes and crisis situations.

First, unprecedented global risks like the COVID-19 pandemic have had a profound impact on not only the overall economy but also individual lives.

With the global economic downturn and growing uncertainty, many individuals' retirements have not gone as planned, necessitating a comprehensive review of existing financial arrangements.

There is an urgent need to develop a flexible strategy that can actively respond to macroeconomic variables such as inflation.

Moreover, modern society faces the dual risk of old age: 'longevity with illness' and 'longevity without war'.

Although the average life expectancy of Koreans has reached 83 years, long-term survival with chronic diseases is becoming more common than maintaining a healthy old age.

This has led to a continued rise in medical, nursing, and healthcare costs, making them a key factor to consider when developing retirement financial plans.

Additionally, there is a growing number of cases of "bankrupts" who have lost their financial foundation due to factors such as excessive spending, business and investment failures, and fraud without sufficient assets.

The risk of poverty in old age can be exacerbated, especially if you rely too heavily on real estate assets and neglect pension and financial investment preparation.

Moreover, as retirement is no longer understood as a single event as in the past, but rather as a gradual, multi-stage transition process, the existing life cycle hypothesis no longer reflects reality.

The emergence of the 'retirement transition period' is redefining retirement as a continuation of change and transition, rather than a career break.

Meanwhile, women tend to live, on average, about 10 years longer than men, giving them a significantly longer period of time to maintain financial independence after the death of their spouse.

Accordingly, women's preparation for old age is more urgent and requires more detailed and long-term planning.

These realistic challenges and structural changes strongly suggest the need for the 'Era of Retirement Planning 4.0.'

With the digital transformation, more realistic and flexible retirement plans must be developed based on sustainable financial strategies.

"The Retirement Financial Planning Bible" presents new concepts and terminology that reflect these changing times and introduces 30 key keywords for effective retirement planning methodology, contributing to the development of practical retirement strategies suited to modern society.

GOODS SPECIFICS

- Date of issue: July 10, 2025

- Page count, weight, size: 880 pages | 152*225*40mm

- ISBN13: 9791191250152

- ISBN10: 1191250156

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)