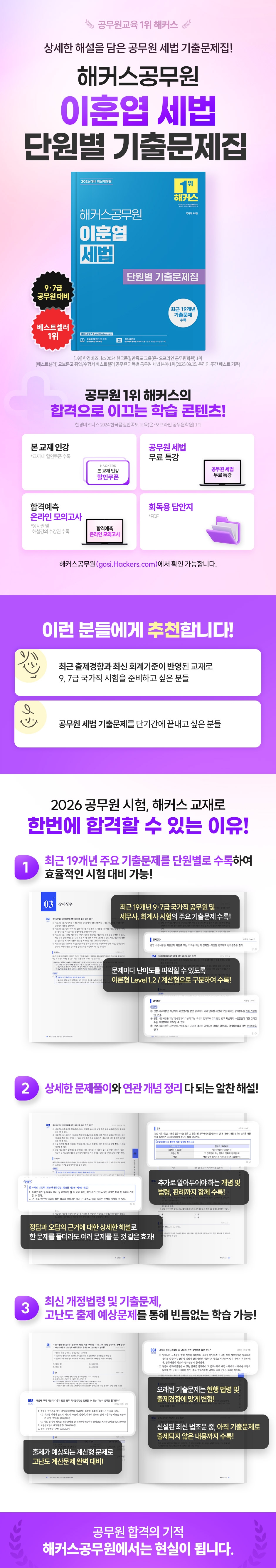

2026 Hackers Civil Servant Lee Hoon-yeop Tax Law Unit-by-Unit Exam Questions

|

Description

Book Introduction

The 2026 Hackers Civil Servant Lee Hoon-yeop Tax Law Unit-by-Unit Past Exam Questions Collection is a problem-solving textbook that helps you familiarize yourself with key points and develop a practical sense of the exam through past civil servant tax law questions and detailed explanations.

1.

A selection of key exam questions from the past 19 years, organized by unit, to enable efficient exam preparation.

2.

A comprehensive explanation that includes detailed problem solving and related concepts.

3.

Complete study through the latest revised laws, past exam questions, and difficult predicted questions.

1.

A selection of key exam questions from the past 19 years, organized by unit, to enable efficient exam preparation.

2.

A comprehensive explanation that includes detailed problem solving and related concepts.

3.

Complete study through the latest revised laws, past exam questions, and difficult predicted questions.

- You can preview some of the book's contents.

Preview

index

Ⅰ National Tax Basic Act

01 General Provisions of the National Tax Basic Act

02 Principles of taxation and application of tax laws

03 Tax obligations

04 Preservation of tax claims

05 Taxation and Refunds

06 Judging and Judging

07 Taxpayer Rights and Provisions

Ⅱ National Tax Collection Act

01 General Provisions of the National Tax Collection Act

02 Reporting and payment, payment notice, etc.

03 Forced collection

Ⅲ Income Tax Act

01 General Provisions of the Income Tax Act

02 Financial Income

03 Business Income

04 Work, Pension, and Other Income

05 Special Cases for Calculating Income Amount

06 Calculation of Comprehensive Income Tax Base

07 Calculation of Comprehensive Income Tax

08 Retirement Income

09 Comprehensive and retirement income tax payment procedures

10. Transfer income

11 Other Matters under the Income Tax Act

Ⅳ Corporate Tax Act

01 General Provisions of the Corporate Tax Act

02 Corporate tax calculation structure

03 Profit

04 Palm

05 Depreciation

06 Reserves and reserves

07 Timing of profit and loss attribution and valuation of assets and liabilities

08 Denial of Unfair Act Calculation

09 Tax base and tax calculation

10 Corporate Tax Payment Procedures

11 Mergers, Divisions, and Consolidations

12 Other corporate taxes

V Value Added Tax Act

01 Basic Theory of Value Added Tax

02 Taxable Transactions

03 Tax rates and exemptions

04 Tax base and sales tax amount

05 Tax invoice and purchase tax amount

06 Concurrent business operator

07 Value-added tax payment procedures

08 Simplified Taxation System

Ⅵ Inheritance Tax and Gift Tax Act

01 Inheritance tax

02 Gift tax

03 Inheritance tax and gift tax payment procedures

04 Valuation of property

01 General Provisions of the National Tax Basic Act

02 Principles of taxation and application of tax laws

03 Tax obligations

04 Preservation of tax claims

05 Taxation and Refunds

06 Judging and Judging

07 Taxpayer Rights and Provisions

Ⅱ National Tax Collection Act

01 General Provisions of the National Tax Collection Act

02 Reporting and payment, payment notice, etc.

03 Forced collection

Ⅲ Income Tax Act

01 General Provisions of the Income Tax Act

02 Financial Income

03 Business Income

04 Work, Pension, and Other Income

05 Special Cases for Calculating Income Amount

06 Calculation of Comprehensive Income Tax Base

07 Calculation of Comprehensive Income Tax

08 Retirement Income

09 Comprehensive and retirement income tax payment procedures

10. Transfer income

11 Other Matters under the Income Tax Act

Ⅳ Corporate Tax Act

01 General Provisions of the Corporate Tax Act

02 Corporate tax calculation structure

03 Profit

04 Palm

05 Depreciation

06 Reserves and reserves

07 Timing of profit and loss attribution and valuation of assets and liabilities

08 Denial of Unfair Act Calculation

09 Tax base and tax calculation

10 Corporate Tax Payment Procedures

11 Mergers, Divisions, and Consolidations

12 Other corporate taxes

V Value Added Tax Act

01 Basic Theory of Value Added Tax

02 Taxable Transactions

03 Tax rates and exemptions

04 Tax base and sales tax amount

05 Tax invoice and purchase tax amount

06 Concurrent business operator

07 Value-added tax payment procedures

08 Simplified Taxation System

Ⅵ Inheritance Tax and Gift Tax Act

01 Inheritance tax

02 Gift tax

03 Inheritance tax and gift tax payment procedures

04 Valuation of property

Detailed image

Publisher's Review

#1 in Civil Service Training

A collection of civil service tax law exam questions with detailed explanations!

[Recommended for]

1.

Those who want to prepare for the 9th and 7th level civil service exams using textbooks that reflect recent exam trends and the latest accounting standards.

2.

Those who want to finish civil service tax law exam questions in a short period of time

[Hacker's Textbook's Unique Features]

1.

A selection of key exam questions from the past 19 years, organized by unit, to enable efficient exam preparation.

1) It includes major past exam questions from the 9th and 7th grade civil service, tax accountant, and public accountant exams over the past 19 years, so you can understand the latest trends in tax law exams and develop problem-solving skills necessary for actual exams.

2) The carefully selected past exam questions are arranged by unit by analyzing the exam trend, and are divided into theory level 1, 2 and calculation type to help you understand the difficulty level (type) of each question.

By solving past exam questions, you can develop problem-solving skills by type and prepare for a variety of problems.

2.

A comprehensive explanation that includes detailed problem solving and related concepts.

1) By providing explanations that clearly explain the correct answer and even thoroughly explain incorrect answers, you can achieve the same effect as solving multiple problems by solving one problem.

2) Since it includes additional concepts, laws, and case law that you need to know in relation to the points of the question, you can learn in detail even the core theories that can be tested on the exam just by reading the explanations.

3.

Complete study through the latest revised laws, past exam questions, and difficult predicted questions.

1) Older exam questions have been modified to reflect current laws and exam trends, and tax law exam questions from up to April 2025 are included, allowing you to learn current, accurate content.

2) You can prepare for the latest legal issues and difficult calculation problems expected to appear on the exam by including the latest legal provisions that have not yet appeared in previous exams and calculation-based problems that are expected to appear on the exam.

A collection of civil service tax law exam questions with detailed explanations!

[Recommended for]

1.

Those who want to prepare for the 9th and 7th level civil service exams using textbooks that reflect recent exam trends and the latest accounting standards.

2.

Those who want to finish civil service tax law exam questions in a short period of time

[Hacker's Textbook's Unique Features]

1.

A selection of key exam questions from the past 19 years, organized by unit, to enable efficient exam preparation.

1) It includes major past exam questions from the 9th and 7th grade civil service, tax accountant, and public accountant exams over the past 19 years, so you can understand the latest trends in tax law exams and develop problem-solving skills necessary for actual exams.

2) The carefully selected past exam questions are arranged by unit by analyzing the exam trend, and are divided into theory level 1, 2 and calculation type to help you understand the difficulty level (type) of each question.

By solving past exam questions, you can develop problem-solving skills by type and prepare for a variety of problems.

2.

A comprehensive explanation that includes detailed problem solving and related concepts.

1) By providing explanations that clearly explain the correct answer and even thoroughly explain incorrect answers, you can achieve the same effect as solving multiple problems by solving one problem.

2) Since it includes additional concepts, laws, and case law that you need to know in relation to the points of the question, you can learn in detail even the core theories that can be tested on the exam just by reading the explanations.

3.

Complete study through the latest revised laws, past exam questions, and difficult predicted questions.

1) Older exam questions have been modified to reflect current laws and exam trends, and tax law exam questions from up to April 2025 are included, allowing you to learn current, accurate content.

2) You can prepare for the latest legal issues and difficult calculation problems expected to appear on the exam by including the latest legal provisions that have not yet appeared in previous exams and calculation-based problems that are expected to appear on the exam.

GOODS SPECIFICS

- Date of issue: September 1, 2025

- Page count, weight, size: 608 pages | 210*280*35mm

- ISBN13: 9791174044365

- ISBN10: 1174044365

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)