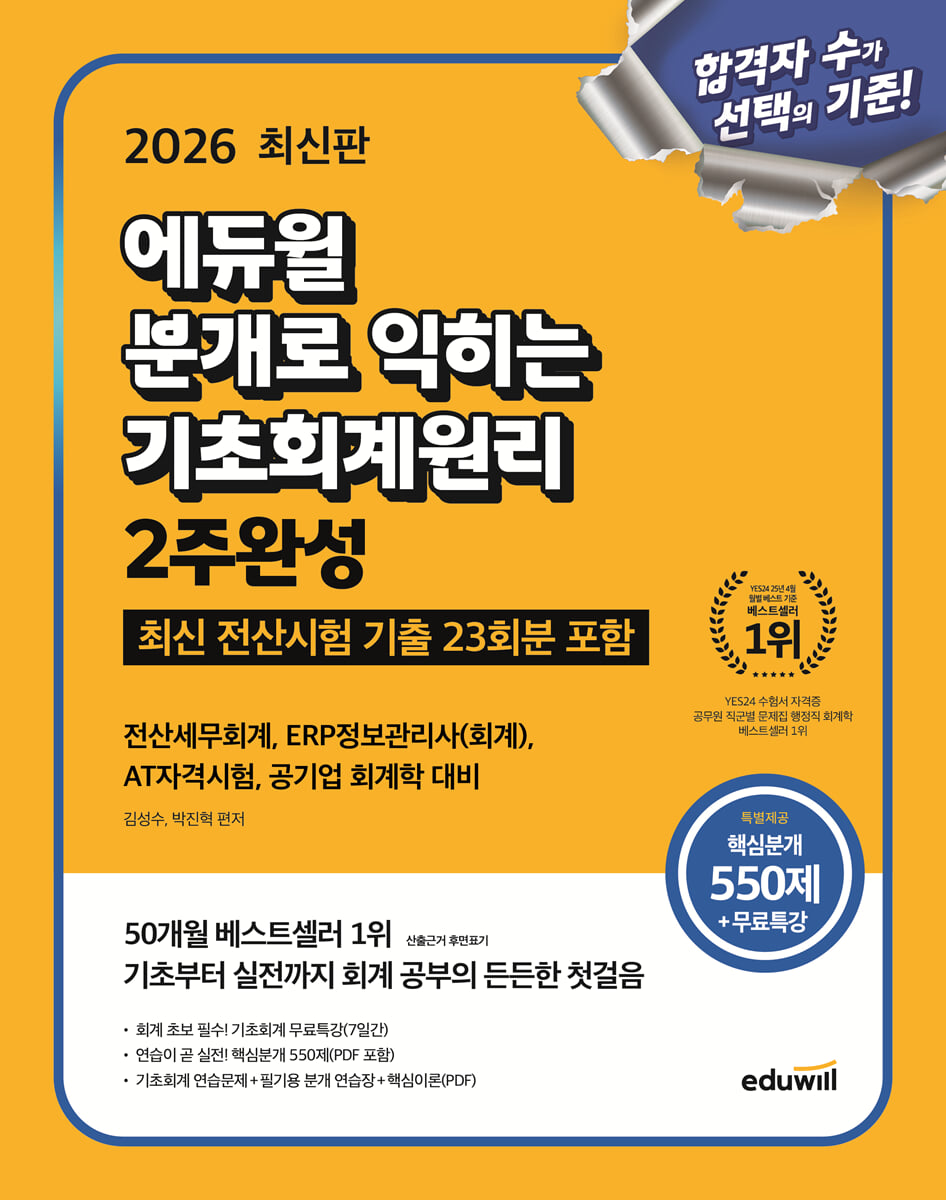

2026 Eduwill Basic Accounting Principles: 2-Week Completion

|

Description

Book Introduction

From accounting fundamentals to practical application! A solid first step toward studying accounting.

[Theory + 23 past exam questions from the latest computer exam + 550 key questions] Complete basic accounting in just two weeks!

- Includes review questions reflecting 23 of the latest computerized exam questions to help you understand the types of questions from previous exams.

- Build your indignation skills with 550 frequently tested core indignation questions and the author's free special lectures.

- Summary of learning content with basic accounting practice problems and key theories (PDF)

[Special benefits offered exclusively by Eduwill for learning basic accounting principles]

Essential for beginners in accounting! Free 7-day basic accounting course.

Practice is the key! 550 core questions (including 50 PDFs) + free special lectures (author's YouTube channel)

- Basic accounting practice problems + written journal entry practice sheet + core theory (PDF) provided

[Theory + 23 past exam questions from the latest computer exam + 550 key questions] Complete basic accounting in just two weeks!

- Includes review questions reflecting 23 of the latest computerized exam questions to help you understand the types of questions from previous exams.

- Build your indignation skills with 550 frequently tested core indignation questions and the author's free special lectures.

- Summary of learning content with basic accounting practice problems and key theories (PDF)

[Special benefits offered exclusively by Eduwill for learning basic accounting principles]

Essential for beginners in accounting! Free 7-day basic accounting course.

Practice is the key! 550 core questions (including 50 PDFs) + free special lectures (author's YouTube channel)

- Basic accounting practice problems + written journal entry practice sheet + core theory (PDF) provided

- You can preview some of the book's contents.

Preview

index

1. PART 01 Fundamentals of Accounting

[CHAPTER 01 Principles of Financial Statements]

Bookkeeping and accounting

financial statements

Income statement

Net income calculation

Previous & Confirmation Questions

[CHAPTER 02 Principles of Double-Entry Bookkeeping]

Objects and methods of accounting records

Electricity and accounting books

The process of accounting cycle

Previous & Confirmation Questions

2. PART 02 Accounting Theory

[CHAPTER 01 Business Activities of the Company]

Basic structure of financial statements

The main business activities of the above company

Previous & Confirmation Questions

[CHAPTER 02 Manufacturing Costs]

Concept and classification of cost

Flow of cost

Previous & Confirmation Questions

[CHAPTER 03 Current Assets and Current Liabilities]

Current Assets and Current Liabilities 1

Current Assets and Current Liabilities 2

Previous & Confirmation Questions

[CHAPTER 04 Non-Current Assets]

Tangible assets

Intangible assets

Investment assets

Other non-current assets

Previous & Confirmation Questions

[CHAPTER 05 Non-Current Liabilities and Provisions]

Bad debt accounting and provisions

non-current liabilities

Previous & Confirmation Questions

[CHAPTER 06 CAPITAL]

The meaning and nature of capital

Accounting for capital

Previous & Confirmation Questions

[CHAPTER 07 Income Statement and Financial Statement Settlement]

Revenue and Expenses and Financial Statement Preparation Standards

The significance of the settlement and year-end revision

Settlement process through comprehensive case studies

Inventory and settlement sheets

Relationships in financial statements

Previous & Confirmation Questions

3.

[Appendix] 550 Key Issues

[CHAPTER 01 Principles of Financial Statements]

Bookkeeping and accounting

financial statements

Income statement

Net income calculation

Previous & Confirmation Questions

[CHAPTER 02 Principles of Double-Entry Bookkeeping]

Objects and methods of accounting records

Electricity and accounting books

The process of accounting cycle

Previous & Confirmation Questions

2. PART 02 Accounting Theory

[CHAPTER 01 Business Activities of the Company]

Basic structure of financial statements

The main business activities of the above company

Previous & Confirmation Questions

[CHAPTER 02 Manufacturing Costs]

Concept and classification of cost

Flow of cost

Previous & Confirmation Questions

[CHAPTER 03 Current Assets and Current Liabilities]

Current Assets and Current Liabilities 1

Current Assets and Current Liabilities 2

Previous & Confirmation Questions

[CHAPTER 04 Non-Current Assets]

Tangible assets

Intangible assets

Investment assets

Other non-current assets

Previous & Confirmation Questions

[CHAPTER 05 Non-Current Liabilities and Provisions]

Bad debt accounting and provisions

non-current liabilities

Previous & Confirmation Questions

[CHAPTER 06 CAPITAL]

The meaning and nature of capital

Accounting for capital

Previous & Confirmation Questions

[CHAPTER 07 Income Statement and Financial Statement Settlement]

Revenue and Expenses and Financial Statement Preparation Standards

The significance of the settlement and year-end revision

Settlement process through comprehensive case studies

Inventory and settlement sheets

Relationships in financial statements

Previous & Confirmation Questions

3.

[Appendix] 550 Key Issues

Detailed image

Publisher's Review

1) Only the theories that will appear on the exam! Core basic accounting theories.

- Provides learning direction by organizing key keywords by chapter

- Quickly identify frequently asked and key theories with 'Important' and 'Highlighter' marks

- Essential theories are summarized once more in the 'auxiliary section' for repeated learning.

- Increase understanding of core theories through case studies and problem types.

2) Understand the exam type with the latest 23 computerized exam questions and confirmation questions.

- Reflects questions from 23 recent computerized exams, including computerized accounting, AT certification, and ERP information management.

- Quickly check the answer and explanation after solving a problem with explanations included on each page.

3) Appendix of 550 core questions and free special lecture by the author

- 550 core questions containing frequently appearing test-related questions (including 50 questions in PDF format)

- Quickly check the correct answer by including the correct answer on each page

- Questions requiring additional explanation can be clearly understood through the author's free special lecture.

- Provides learning direction by organizing key keywords by chapter

- Quickly identify frequently asked and key theories with 'Important' and 'Highlighter' marks

- Essential theories are summarized once more in the 'auxiliary section' for repeated learning.

- Increase understanding of core theories through case studies and problem types.

2) Understand the exam type with the latest 23 computerized exam questions and confirmation questions.

- Reflects questions from 23 recent computerized exams, including computerized accounting, AT certification, and ERP information management.

- Quickly check the answer and explanation after solving a problem with explanations included on each page.

3) Appendix of 550 core questions and free special lecture by the author

- 550 core questions containing frequently appearing test-related questions (including 50 questions in PDF format)

- Quickly check the correct answer by including the correct answer on each page

- Questions requiring additional explanation can be clearly understood through the author's free special lecture.

GOODS SPECIFICS

- Date of issue: July 28, 2025

- Page count, weight, size: 472 pages | 950g | 205*260*30mm

- ISBN13: 9791136038548

- ISBN10: 113603854X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)